Top EV Battery Stocks to Invest

The top 7 EV Battery stocks to invest in 2024 are:

-

FREYR Battery (FREY) - EV battery market leader, strategic partnerships, US expansion

-

Microvast Holdings (MVST) - EV and energy storage, strong partnerships, positive financials

-

Boyd Gaming Corp (BYD) - Dominance in EV market, vertical integration, global expansion

-

QuantumScape (QS) - Revolutionary solid-state batteries, strategic partnerships, upcoming production

-

Albemarle Corporation (ALB) - Lithium market leader, diversified portfolio, sustainable practices

-

Blue Bird Corporation (BLBD) - Electric school bus dominance, diversified product portfolio, improving financials

-

Li Auto Inc. (LI) - China's EV market player, exceptional growth, innovative technology

TU experts are set to discuss promising investment opportunities in the electric vehicle (EV) battery sector for 2024. Key topics on the agenda include market entry strategies, sustainability commitments, financial stability, innovations in battery technology, global expansion initiatives and diversification into essential materials. The conversation will also highlight the significance of market dominance, growth trajectories in the new energy vehicle market, and strategic partnerships as key factors influencing investment decisions. Readers will delve into the nuanced details and essential aspects that make these investments noteworthy in the evolving landscape of electric mobility.

-

What drives the growth of electric vehicle (EV) stocks?

The surge in demand for environmentally friendly transportation and government incentives propel the growth of EV stocks.

-

Are strategic partnerships crucial for EV stocks?

Yes, partnerships with key industry players enhance market position and provide essential resources for EV stock companies.

-

How does sustainability impact EV stock investments?

EV stocks committed to sustainable practices attract investors prioritizing environmental and social responsibility.

-

Why consider diversification in EV stock investments?

Diversification into essential materials and different aspects of electric mobility hedges risks and maximizes opportunities in the EV stock market.

Promising EV Battery stocks for 2024

| Stock Name | Ticker | Market Cap | EPS Next 5Y | Dividend Yield (%) | Forward P/E |

|---|---|---|---|---|---|

FREYR Battery |

FREY |

$234.71M |

N/A |

N/A |

N/A |

Microvast Holdings |

MVST |

$367.19M |

N/A |

N/A |

43.49 |

Boyd Gaming Corp |

BYD |

$6.12B |

5.58% |

1.01% |

10 |

QuantumScape |

QS |

$4.06B |

25.88% |

N/A |

N/A |

Albemarle Corporation |

ALB |

$15.60B |

N/A8.76% |

1.22% |

10.88 |

Blue Bird Corporation |

BLBD |

$805.86M |

N/A |

N/A |

10.76 |

Li Auto Inc. |

LI |

$26.63B |

N/A |

N/A |

18.06 |

FREYR Battery (FREY)

FREYR Battery, listed on the New York Stock Exchange under the ticker symbol FREY, emerges as a compelling prospect for investors in 2024 within the dynamic landscape of the electric vehicle (EV) market. Specializing in advanced battery solutions, FREYR is strategically positioned to capitalize on the soaring demand for electric vehicles, driven by environmental consciousness, governmental incentives, and technological advancements.

| Investment Reasons for FREYR Battery (NYSE: FREY) in 2024 | Description |

|---|---|

1. Growing EV Market |

The surge in demand for electric vehicles (EVs) is expected, driven by environmental concerns and government incentives. As EV popularity rises, the demand for batteries (FREYR's specialization) is likely to grow significantly. |

2. Early Entry into European Market |

FREYR is among the first companies establishing a large-scale battery factory in Europe, gaining a competitive edge in meeting the increasing demand for batteries in the European EV market. |

3. Environmental Sustainability Focus |

Commitment to using renewable energy and recycled materials in battery production aligns with the preference for environmentally conscious companies, appealing to investors prioritizing sustainability (ESG-focused investors). |

4. Recent Move to the US |

The redomiciliation from Luxembourg to the US enhances appeal to American investors and opens up opportunities for potential government incentives, contributing to overall investment attractiveness. |

5. Strategic Partnerships |

Partnerships with key players in the EV industry, such as Koch Minerals and 24M Technologies, provide essential materials and expertise for battery production, strengthening FREYR's market position. |

6. Upcoming Factory in Norway |

Construction of the flagship battery factory in Mo i Rana, Norway, is progressing well. Upon completion, it is expected to have substantial production capacity to meet the increasing demand for batteries. |

7. US Expansion Opportunities |

Redomiciliation to the US makes FREYR more attractive to American investors and opens opportunities for partnerships with US carmakers and potential access to government funding programs, fostering further growth. |

8. Future Growth Potential |

The Mo i Rana factory is set to commence production in 2025, with the company aiming for profitability by 2027-2028, indicating a clear growth trajectory for investors. |

FREYR Battery chart

FREYR Battery (NYSE: FREY) has been going through a consolidation phase where the Bollinger Bands have tightened, suggesting a period of low volatility uncertainty before a potential breakout. Notably, the stock has found support around $1.71 within this consolidation range, indicating that buyers are showing interest at this level.

The tight Bollinger Bands point towards the possibility of a breakout. Traders are keeping a close eye on the stock, as a decisive move could signal a shift from the ongoing consolidation phase, providing potential trading opportunities.

FREYR Battery price forecasts

H3 Microvast Holdings (MVST)

Microvast Holdings (MVST) emerges as a promising investment choice for 2024, driven by its strategic position in the thriving electric vehicle and energy storage sectors. The anticipated surge in the electric vehicle market positions MVST favorably, with the company possessing unique technology and vertical integration capabilities, allowing for potential cost advantages and tailored solutions.

Strengthening its market presence, MVST has secured significant partnerships with industry giants like Volkswagen and PACCAR. Recent positive developments, including analyst upgrades and proactive steps to address delisting risks, contribute to the optimistic outlook. MVST's commitment to sustainable practices aligns with the preferences of environmentally conscious investors, further enhancing its appeal.

Microvast Holdings (MVST) took a proactive step to address concerns related to the Holding Foreign Companies Accountable Act (HFCAA) by filing a Form 20-F with the SEC. This move is seen as a strategic measure to potentially mitigate the risk of delisting.

The latest financial results highlight strong performance, with substantial YoY increases in revenue, gross margin improvement, and a significant backlog, setting the stage for future growth. With a projected break-even in two years and a positive profit outlook for 2025, MVST presents a compelling investment opportunity for those eyeing the dynamic EV and energy storage markets in 2024.

Microvast Holdings chart

Boyd Gaming Corp (BYD)

Although investing in BYD in 2024 offers a compelling opportunity with a number of advantages, it's important to be aware of potential risks.. Here's a breakdown of key reasons supporting an investment decision:

Strong Reasons to Invest

-

Dominance in the EV Market

BYD holds the coveted title of the world's largest electric vehicle (EV) manufacturer by unit sales, outpacing even Tesla in 2023. Their stronghold extends across both passenger cars and commercial vehicles, particularly in China, the globe's largest EV market.

-

Vertical Integration Advantage

An impressive aspect of BYD's strategy is its control over almost every facet of EV production, from batteries and semiconductors to vehicle assembly. This comprehensive vertical integration provides cost advantages and meticulous quality control, setting BYD apart from many competitors.

-

Global Expansion Initiatives

BYD is not limiting itself to its home turf. Actively venturing into new markets such as Europe and Australia, the company diversifies its reach, presenting potential avenues for growth beyond its already significant presence.

-

Solid Financial Performance

Recent financial reports from BYD showcase a robust performance, marked by increasing revenue and profitability. This not only signifies financial stability but also hints at the potential for sustained growth.

-

Government Support in China

Benefiting from favorable Chinese government policies, BYD receives subsidies and tax benefits, providing an additional layer of competitive advantage and support for its continued growth.

Some recent positive news suggesting buying

-

BYD reported record-breaking EV sales in December 2023, exceeding 235,000 units. This underlines their production capacity and growing consumer demand.

-

The unveiling of BYD's Blade Battery 3.0 technology, while claiming improved energy density and safety, prompts cautious optimism among analysts about its real-world performance and market reception.

-

Unconfirmed reports suggest BYD is in talks with Tesla for potential collaboration on battery production and supply. Although speculative, this news generates excitement among investors about possible synergies between the two EV giants.

| Metrics | Performance |

|---|---|

Record Revenue |

RMB 76.4 billion (110% YoY increase, 16% QoQ increase) |

EV Sales |

186,352 units (209% YoY increase, 26% QoQ increase) |

Net Profit |

RMB 5.2 billion (93% YoY increase, 23% QoQ increase) |

QuantumScape Corporation (QS)

Investing in QuantumScape in 2024 presents a unique opportunity driven by its revolutionary solid-state lithium-ion battery technology. QuantumScape's breakthroughs in EV batteries offer a compelling alternative to conventional lithium-ion batteries, promising faster charging, a longer range, enhanced safety, and potentially lower costs. The disruptive nature of their solid-state batteries positions QuantumScape as a frontrunner in transforming the electric vehicle (EV) market, where innovation is crucial for sustainable and efficient transportation.

Crucially, the company has established strategic partnerships with automotive giants like Volkswagen and Ford, indicating industry validation and potential future collaborations. These partnerships not only lend credibility to QuantumScape's technology but also pave the way for widespread adoption as EV demand continues to surge.

Recent positive developments, including prototype tests exceeding performance targets, have bolstered investor confidence in QuantumScape's viability. The company's ability to achieve over 1,000 charge cycles with more than 95% energy retention, surpassing their commercial target, underscores the tangible progress in their technology.

QuantumScape is making strides in its solid-state battery journey, with plans to kick off limited production in 2024 and aiming to launch its first-generation batteries at scale by 2025. The company, headquartered in San Jose, California, is gearing up its QS-0 pre-pilot line, set to be operational in early 2024. This facility will craft small batches of solid-state batteries for crucial testing and validation.

QuantumScape's confidence in its technology's potential to revolutionize the electric vehicle industry adds a compelling dimension to its progress. These developments signify a tangible roadmap for QuantumScape, bringing its innovative solid-state batteries closer to widespread commercial use in the near future.

While QuantumScape is currently in a pre-revenue stage, its focus on scaling up production, securing additional partnerships, and targeting commercialization by 2025 signals a clear roadmap for future growth.

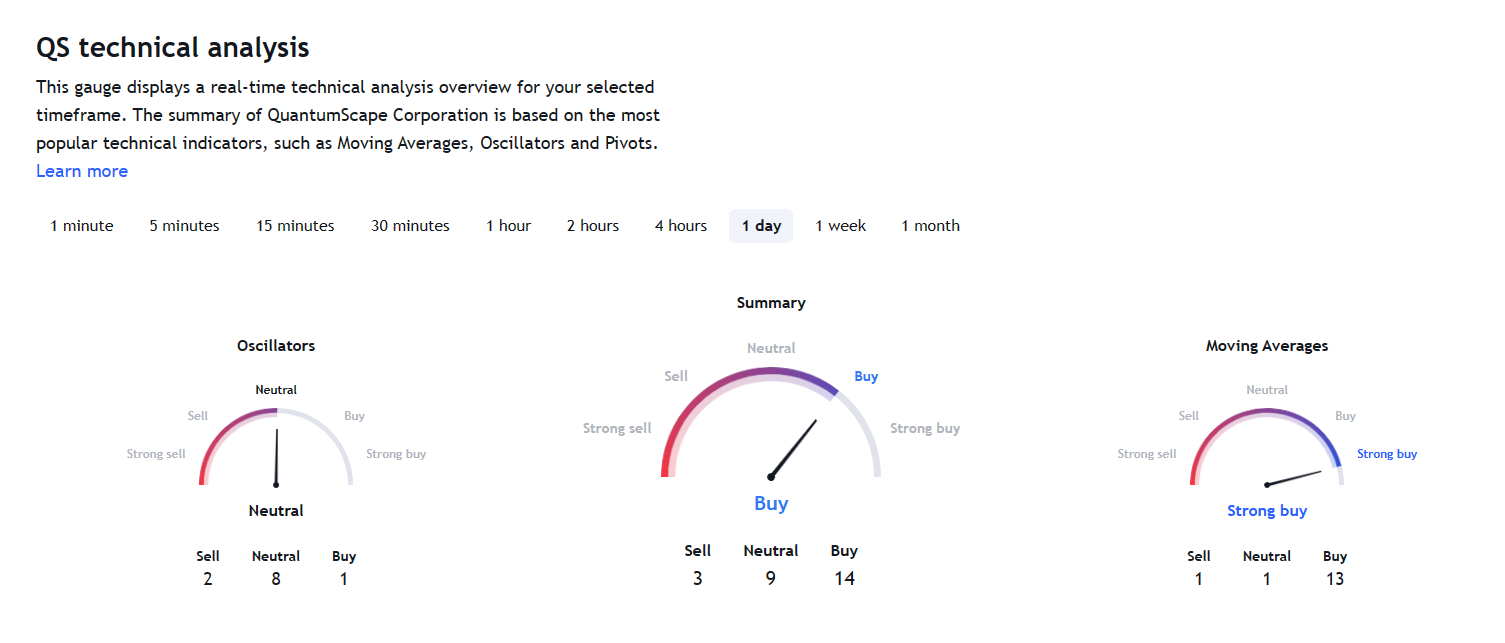

QS technical analysis

Albemarle Corporation (ALB)

Due to a number of factors that place Albemarle Corporation at the forefront of the electric vehicle (EV) revolution, it becomes an attractive investment opportunity in 2024. Here's a breakdown of the reasons to consider investing in ALB, along with key considerations:

| Factors | Investment Appeal |

|---|---|

Booming EV Market |

Explosive growth in global EV sales, fueling demand for lithium in batteries. |

Albemarle's Dominating Position |

World's largest producer of lithium hydroxide, strategically positioned in the heart of the lithium market. |

Expanding Production |

Aggressive capacity expansion through investments in new brine projects in Chile and Argentina, ensuring market leadership. |

Diversification Beyond Lithium |

Venturing into nickel and cobalt diversifies the company's portfolio, reducing reliance on a single commodity. |

Strong Financial Performance |

Consistent revenue and profit growth, supported by a robust balance sheet and low debt levels, instilling investor confidence. |

Sustainable Practices |

Prioritizing environmental sustainability throughout operations attracts environmentally conscious investors. |

Attractive Valuation |

Trading at a moderate valuation compared to peers, offering potential for future price appreciation. |

ALB's recent partnership with Paccar, a major truck manufacturer, to supply lithium-ion battery packs for electric trucks further strengthens its position in the high-growth commercial EV market.

The recent upgrade by Bank of America to a neutral rating highlights that the stock is currently undervalued. As of the latest check, ALB is trading at less than 10 times expected earnings, 1.7 times sales, and nearly half of its growth potential. This suggests that ALB offers solid growth potential at an attractive valuation, making it an appealing investment.

Despite a slump in 2023 due to slower EV demand growth impacting lithium prices, ALB's outlook is positive. The Australian government's forecast of strong growth in lithium production and demand aligns with ALB's position in the market. The company's stock price has seen a decline to $136, presenting a market cap of $16 billion. However, with a focus on tripling lithium conversion capacity between 2022 and 2027, ALB is strategically preparing for robust revenue growth in the coming years.

While there are considerations such as commodity price volatility and geopolitical risks, ALB's proactive measures and continuous growth initiatives make it a promising player in the evolving landscape of clean energy and electric mobility.

Blue Bird Corporation (BLBD)

Blue Bird Corporation (BLBD) is a prominent player in the school bus manufacturing industry, recognized for its commitment to safety, reliability, and innovation since its establishment in 1927. The company has evolved into a technology leader, particularly in the electric school bus (ESB) segment, where it holds a substantial market share and leads in the deployment of electric buses across the United States.

Blue Bird's product portfolio extends beyond ESBs to include propane and natural gas buses, showcasing a diversified approach to meet the diverse needs of school districts. The company's focus on innovation is evident through its investments in cutting-edge technologies, such as autonomous driving and advanced safety features, positioning Blue Bird at the forefront of the evolving school bus market.

Investing in Blue Bird Corporation (NASDAQ: BLBD) can be considered for several reasons, as outlined below:

Dominance in Electric School Buses (ESBs)

-

Blue Bird is a key player in the electric school bus market, holding a significant market share and boasting the most deployed electric buses in the United States.

-

With the growing support for electric school buses from the government, BLBD is well-positioned to benefit from this trend.

Diversified Product Portfolio

-

While focusing on electric school buses, Blue Bird also offers propane and natural gas buses, providing a diversified product portfolio.

-

This diversification allows Blue Bird to cater to the varied needs of different school districts, enhancing its market presence.

Financial Performance Improvement

-

Blue Bird has demonstrated improved financial performance, reporting increasing revenue and profitability.

-

After facing challenges in previous years, the recent positive financial results indicate a potential turnaround and suggest future growth prospects.

Strong Partnerships

-

Collaborations with key partners, such as Generate Capital for fleet electrification and Caterpillar for engine supply, provide stability and growth opportunities.

Focus on Innovation

-

Blue Bird invests significantly in developing new technologies, including autonomous driving and advanced safety features for its buses.

Increased Electric Bus Orders

-

Blue Bird has announced several new electric bus orders, including a substantial order from California, indicating sustained demand for their electric school buses.

Improving Financials

-

The company's positive financial results for Q3 2023, with revenue growth and improved profitability, suggest progress towards financial stability.

The trend of improving financials is crucial for investor confidence and reflects the company's ability to execute its business strategy effectively.

| Metric | FY2023 | Change from FY2022 |

|---|---|---|

Revenue |

$1.13 billion |

41% |

Net Income |

$23.8 million |

Positive turnaround |

Adjusted EBITDA |

$87.9 million |

102.70% |

Earnings per Share |

$1.74 |

Positive growth |

| Operational Metric | FY2023 | Change from FY2022 |

|---|---|---|

Total Buses Sold |

8,514 buses |

25% |

Electric Bus Sales Growth |

+253% YoY |

Substantial increase |

Full-Year Electric Bus Orders |

Nearly 600 orders |

Reflecting strong demand |

Full-Year Electric Bus Backlog |

12% mix in backlog |

Demonstrates sustained growth |

Guidance and Outlook

-

BLBD has raised its FY2024 adjusted EBITDA guidance to $115 million, indicating confidence in sustained profitable growth.

-

Long-term outlook remains positive, targeting ~$2 billion in revenues and adjusted EBITDA margins of 12%+.

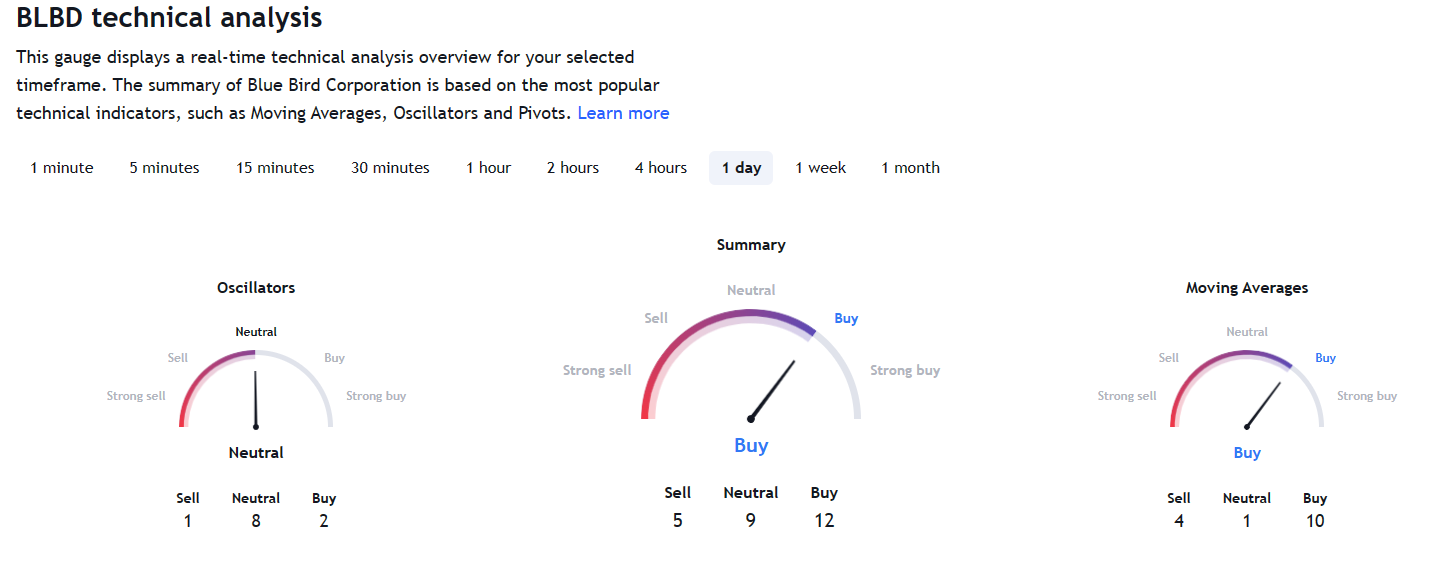

BLBD technical analysis

Li Auto Inc. (LI)

Li Auto Inc. (LI) stands out as a prominent player in China's new energy vehicle market, making a mark with its luxury electric vehicles. The company has exhibited substantial growth, particularly evident in its Q3 2023 results, where it reported an impressive 271% year-over-year revenue surge and a notable 196% increase in annual vehicle deliveries. This positive trajectory is set to continue with the upcoming launch of its high-tech flagship family MPV, Li MEGA, scheduled for March 1, 2024.

With a unique focus on extended-range electric vehicles (EREVs) and a direct-to-consumer sales model, Li Auto presents a compelling investment opportunity in the evolving landscape of the electric vehicle (EV) market. The company's strong financial performance, innovative technology, and strategic partnerships position it for sustained growth in 2024 and beyond.

Reasons to Consider Investing in Li Auto Inc. (LI) in 2024

-

Exceptional Growth Trajectory

Li Auto experienced outstanding growth in Q3 2023, marked by a 271% YoY revenue surge and a 196% increase in annual vehicle deliveries, showcasing its ability to capitalize on the expanding EV market.

-

Upcoming Model Launches

The introduction of Li MEGA, the high-tech flagship family MPV, in March 2024, has garnered significant market interest with over 10,000 pre-orders. This expansion of Li Auto's product line is expected to contribute to increased sales.

-

Favorable Chinese EV Market Outlook

With the Chinese EV market projected to continue rapid growth in 2024, Li Auto is strategically positioned to capture a substantial share of this expanding market, presenting a favorable outlook for investors.

-

Robust Financial Performance

Li Auto demonstrated financial strength in Q3 2023, generating $1.8 billion in free cash flow. This indicates a healthy financial position, providing the company with the means to fund future growth initiatives.

-

Innovative Technology

Li Auto's focus on extended-range electric vehicles addresses range anxiety concerns, potentially offering a competitive edge over pure EVs in specific market segments.

-

Direct-to-Consumer Model

The company's direct sales model eliminates dealership markups, providing greater control over branding and the customer experience, which could positively impact sales and brand loyalty.

-

Strategic Partnerships

Li Auto's recent partnership with Nvidia is expected to enhance its technological capabilities and contribute to increased sales as consumers leverage advancements in artificial intelligence (AI).

-

Differentiation from Competitors

While Tesla dominates the global EV market, Li Auto distinguishes itself by focusing on the premium family market within China, potentially reducing direct competition and appealing to a specific consumer segment.

Best Stock brokers

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

3

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

4

Diversification

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

-

5

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.