Space Stocks to Invest in 2024

The best space stocks to invest in 2024 are:

-

Rocket Lab (RKLB): Government contract stability, financial performance, market potential.

-

AST & Science (ASTS): Revolutionary technology, market potential, first-mover advantage.

-

Spire Global (SPIR): Nanosatellite constellation, data-driven insights, strong financial performance.

-

Planet Labs (PL): Global imagery dominance, data accessibility, strategic partnerships.

-

Virgin Galactic (SPCE): First-mover advantage, experienced leadership, technological innovation.

-

Leidos Holdings Inc. (LDOS): Market leadership in government services, diversified revenue streams, strong cash generation.

-

Howmet Aerospace (HWM): Robust financials, market leadership in aerospace, growth strategies.

In this article TU experts will discuss investment opportunities in the space industry for 2024, focusing on government contracts, innovative technologies, and financial performances. They'll delve into recent achievements, growth prospects, and market positions of companies in satellite technology, space tourism, and aerospace applications.

The discussion will touch on themes like space-based technologies, satellite constellations, and advancements in aerospace and defense. Additionally, experts will highlight strategic partnerships, revenue diversification, and market dynamics influencing investment decisions.

The article aims to guide readers through the factors that make space stocks attractive, emphasizing potential growth in a trillion-dollar industry. The experts will also address the risks associated with investing in space stocks, such as market volatility, technological challenges, and dependency on government contracts.

-

Why consider investing in space stocks in 2024?

Investing in space stocks presents an opportunity to capitalize on the booming space industry, driven by technological advancements and increasing demand for space-related services.

-

What factors make space stocks attractive for investment?

Space stocks are appealing due to factors like government contracts, innovative technologies, and the potential for substantial growth in a trillion-dollar industry.

-

How do space stocks contribute to the global economy?

Space stocks play a crucial role in contributing to economic growth by participating in sectors such as satellite communications, Earth observability, and aerospace applications.

-

What are the risks associated with investing in space stocks?

Risks include market volatility, technological challenges, and dependency on government contracts, which can impact the financial performance of space-related companies.

Best space stocks to invest in 2024

| Stock Name | Ticker | Market Cap | EPS Next Year | Dividend % |

|---|---|---|---|---|

Rocket Lab (RKL.B) |

RKL.B |

$2.36B |

-8.48% |

- |

AST & Science (ASTS) |

ASTS |

$372.20M |

-10.18% |

- |

Spire Global (SPIR) |

SPIR |

$138.86M |

51.65% |

- |

Planet Labs (PL) |

PL |

$591.32M |

20.62% |

- |

Virgin Galactic (SPCE) |

SPCE |

$775.44M |

34.89% |

- |

Leidos Holdings Inc. (LDOS) |

LDOS |

$15.09B |

7.78% |

1.34% |

Howmet Aerospace (HWM) |

HWM |

$22.72B |

21.56% |

0.31% |

Rocket Lab (RKLB)

Investing in Rocket Lab USA (NASDAQ: RKLB) in 2024 presents a compelling opportunity for several reasons. The company's recent achievements and strategic positioning in the booming space industry make it an attractive prospect for investors looking for long-term growth. Here are key factors supporting the investment thesis:

Government Contract Stability

-

Rocket Lab secured a substantial $515 million government contract, covering the manufacturing of 18 space vehicles with long-term maintenance.

-

Contract duration extends through 2030, with a potential extension to 2033, providing a solid revenue stream and ensuring short-term viability.

Financial Performance

-

The company marked significant milestones in 2023, including its 42nd Electron rocket launch and a record-setting 10 launches in a single year.

-

Despite a previous flight failure that impacted shares, Rocket Lab's resilient performance and the lucrative government contract contributed to a strong finish in 2023.

Market Potential

-

The global space industry is projected to reach $1 trillion by 2030, offering substantial growth prospects for Rocket Lab.

-

The company's diversified revenue streams, including space systems solutions, satellites, and spacecraft structures, position it to capitalize on the expanding space market.

Competitive Advantages

| Aspect | Strength |

|---|---|

Cost-effective Launch Services |

Electron's lower launch costs attract budget-conscious customers. |

Electron Flexibility |

Capability to launch multiple satellites per mission aligns with the demand for constellation deployments. |

Rapid Innovation |

Proven track record of rapid iteration and development, ensuring a competitive edge in technology. |

Latest Contract and Future Prospects

-

Rocket Lab's latest contract involves a HASTE mission for the Defense Innovation Unit (DIU) to deploy a scramjet-powered suborbital payload.

-

Launch scheduled from Q1, 2025, indicating a continuous influx of contracts and projects that contribute to the company's growth.

Valuation Considerations

-

Rocket Lab's current valuation, with a market cap of $2.69 billion and a trading multiple of over 11x sales, reflects investor confidence in substantial future growth.

-

While the valuation is steep, the recent government contract significantly enhances the company's long-term potential.

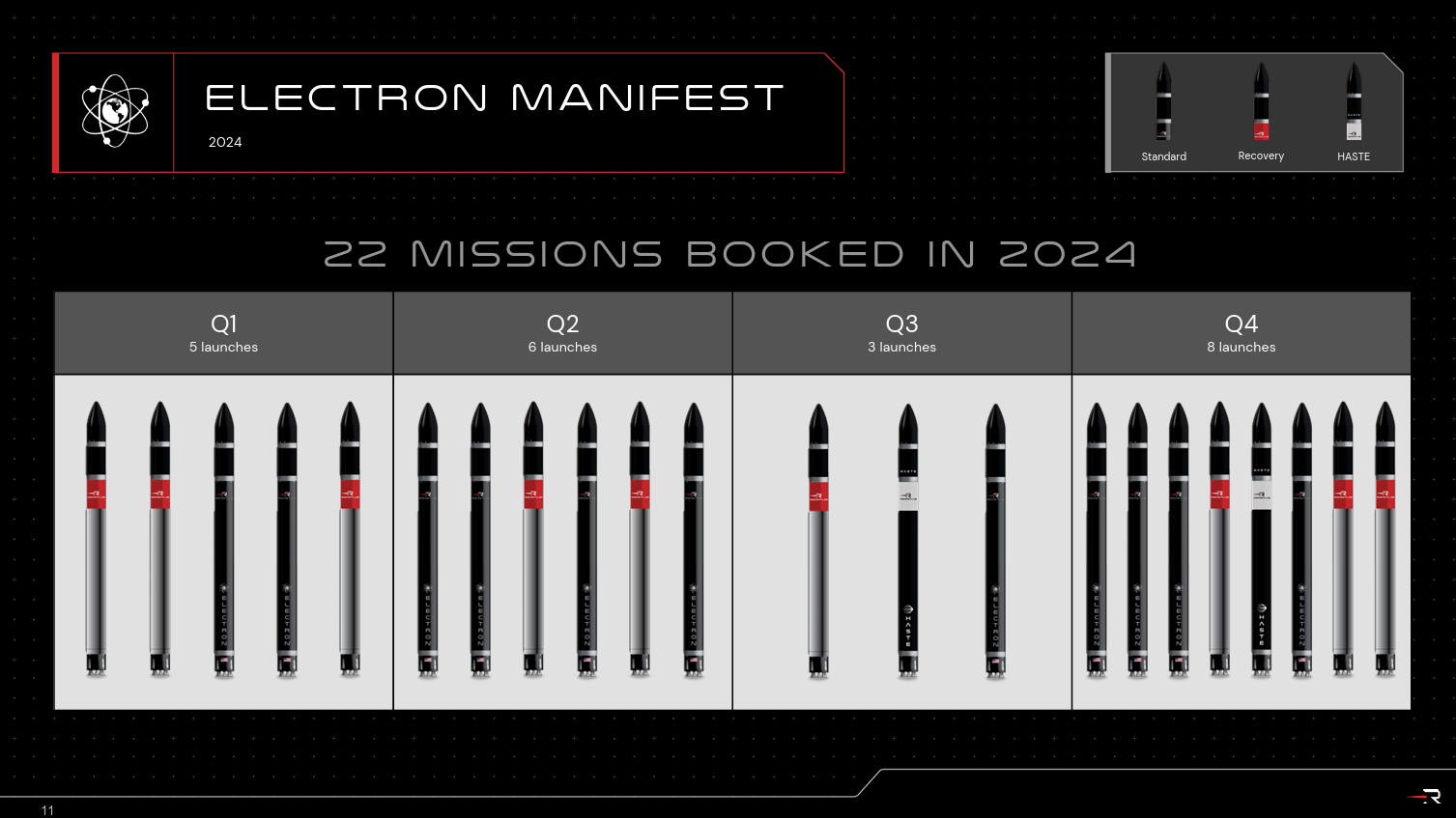

Electron manifest

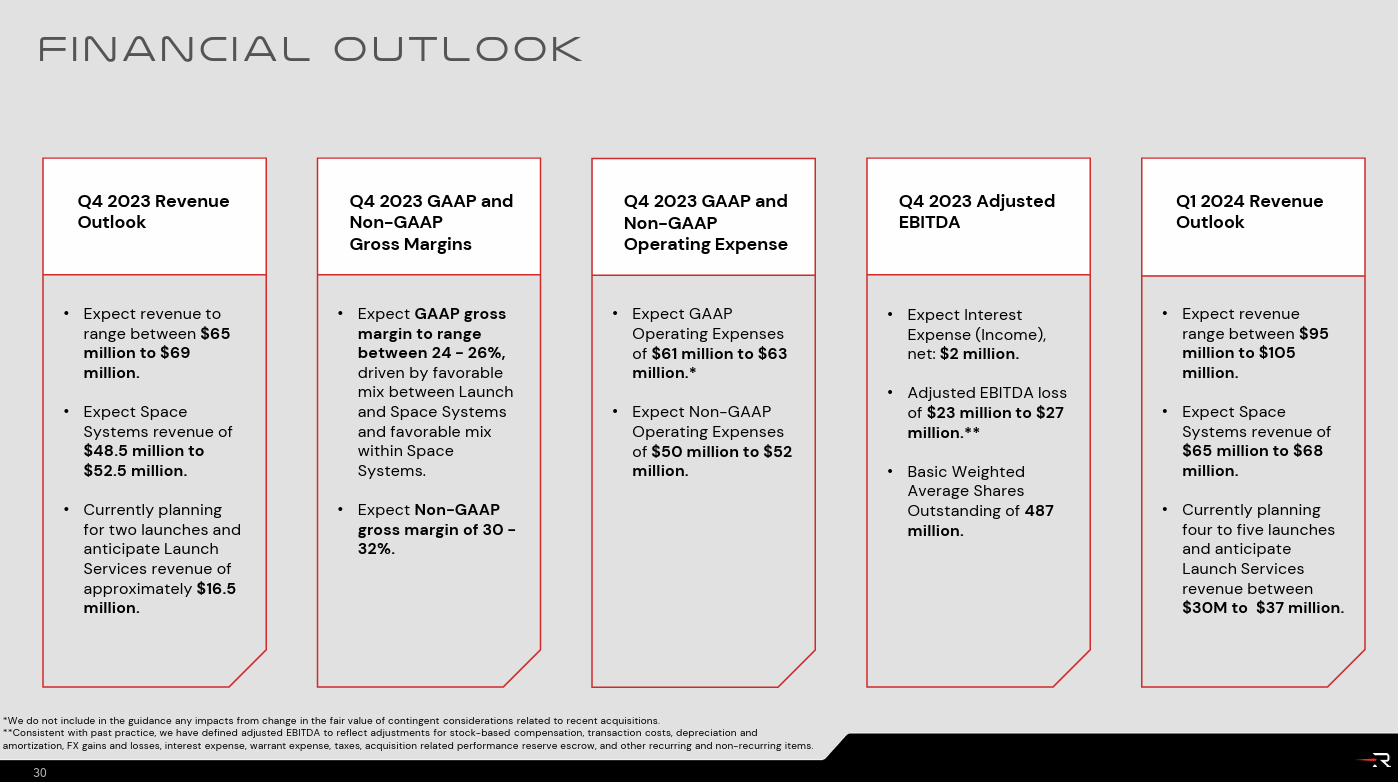

Financial outlook

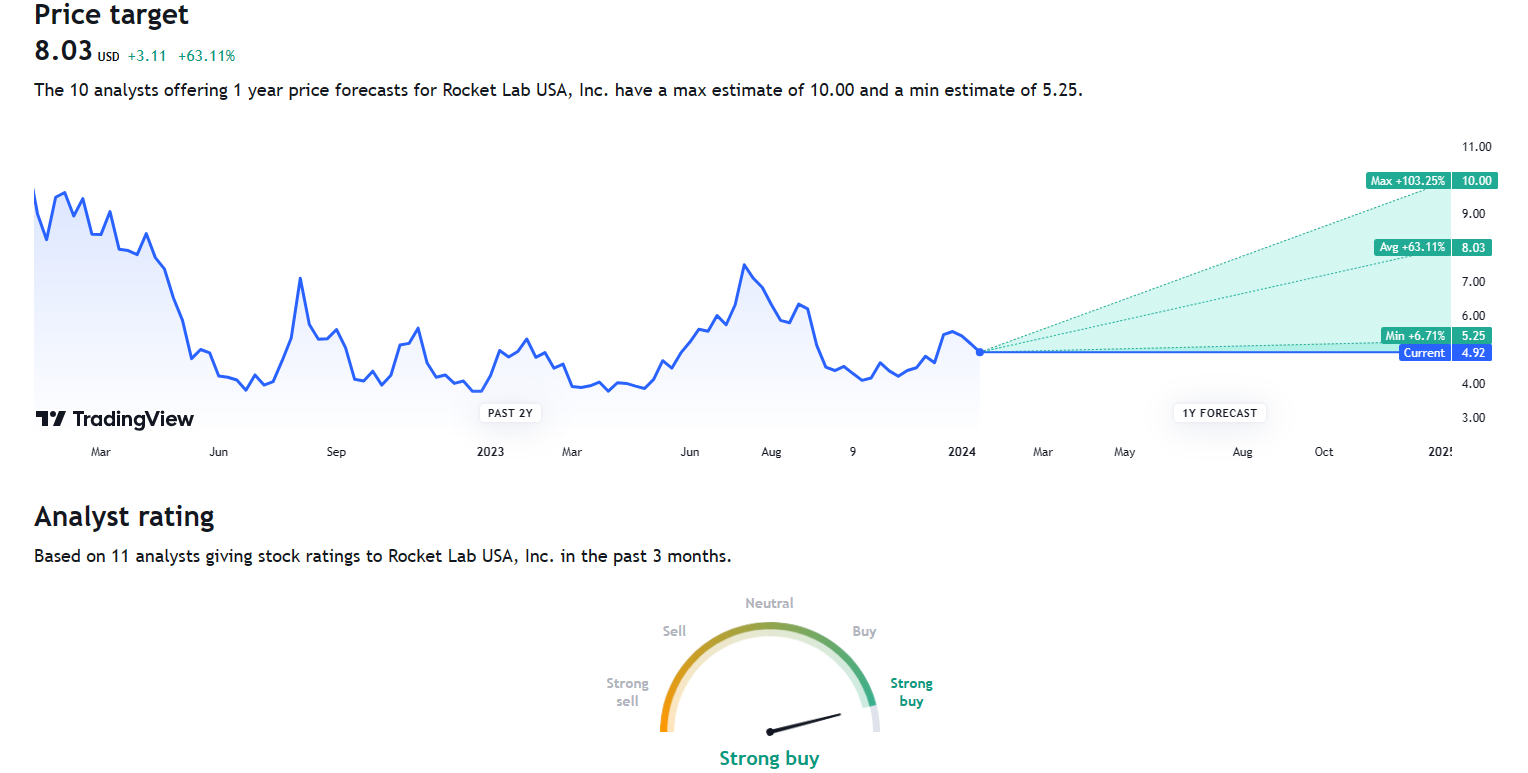

Rocket Lab chart

Rocket Lab price forecasts

AST & Science (ASTS)

Experts have highlighted in the below table reasons to invest in this stock in 2024

| Investment Factors | Reasons |

|---|---|

Revolutionary Technology |

ASTS utilizes low-earth satellites for global 5G cell service, demonstrating groundbreaking technology. |

Successful 5G satellite call in 2023 sets the stage for commercialization in 2024. |

|

Market Potential |

Targets underserved global population without mobile broadband, presenting a vast and untapped market. |

Billions of people without connectivity offer substantial growth opportunities. |

|

First-Mover Advantage |

First company to develop a network of satellites at a lower altitude, enjoying a competitive edge. |

Pioneering position enhances ASTS' role in the emerging market of satellite-based mobile broadband. |

|

Financial Projections |

Projects $9 billion in revenue for 2023 and an ambitious $15 billion in 2024. |

Ambitious projections, coupled with a unique value proposition, suggest positive growth potential. |

|

Recent Achievements |

Successful launch of BlueWalker 3 prototype showcases commitment to advancing technology. |

Secured $400 million in funding, demonstrating investor confidence and providing capital for development. |

|

Strategic Partnerships |

Ongoing talks with potential customers, including mobile operators and governments, indicate strong interest. |

Expected partnerships in 2024 can significantly boost market presence and revenue streams. |

|

Updated Cost Structure |

Adjusted operating expenses of $25-30 million per quarter from Q1 2024 suggest prudent financial management. |

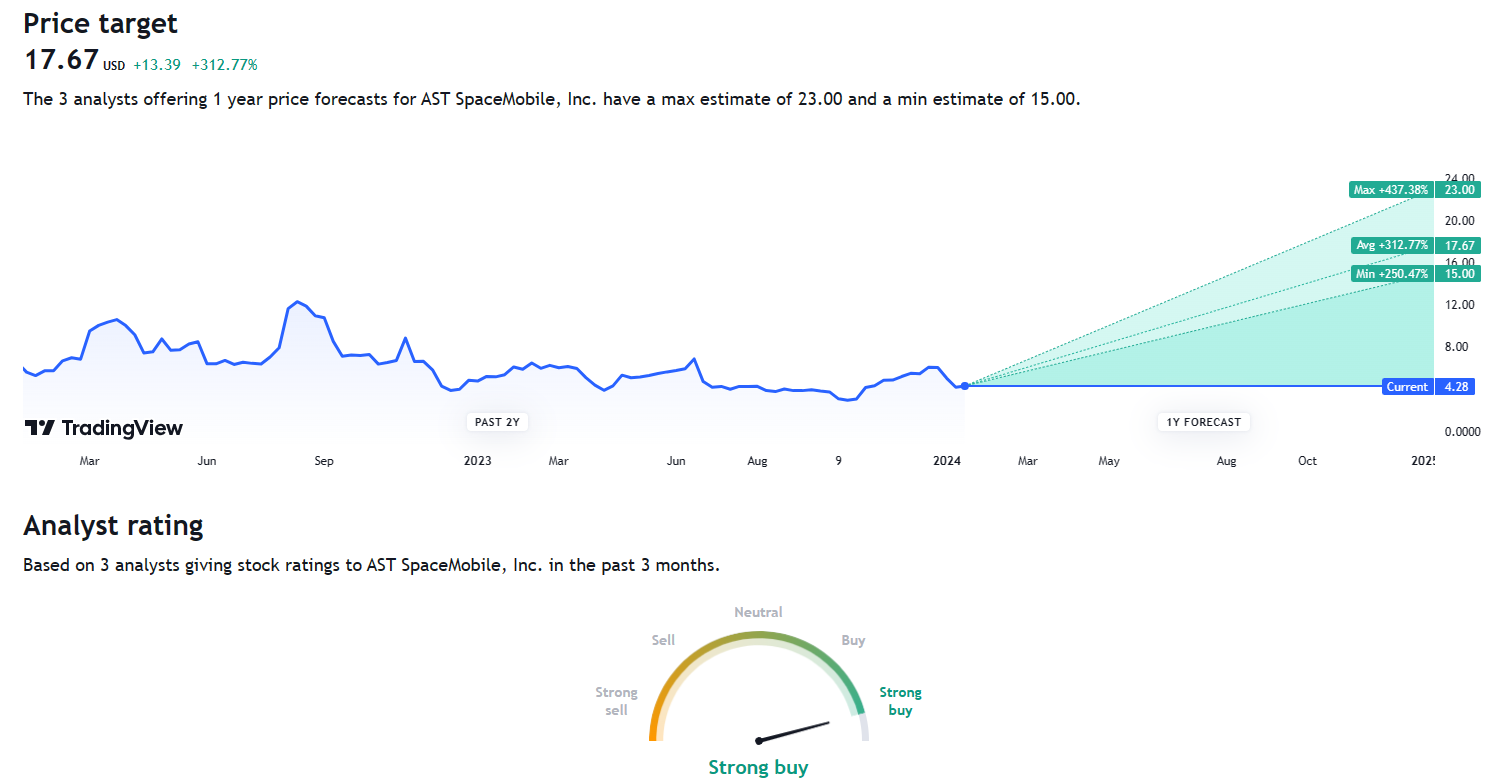

ASTS chart

ASTS price forecasts

Spire Global (SPIR)

Investing in Spire Global (NYSE: SPIR) in 2024 presents a strategic opportunity for several reasons.

| Aspect | Reasoning |

|---|---|

Unique Nanosatellite Constellation |

Spire has one of the world's largest nanosatellite constellations, providing valuable data on weather, maritime traffic, and global flight tracking. |

Data-Driven Insights and Analytics |

Spire transforms collected data into actionable insights through its advanced analytics platform, aiding clients in optimizing operations and making informed decisions. |

Strong Financial Performance |

Demonstrated impressive financial growth with a 34% YoY revenue increase and a 15% jump in gross margins to 65%, indicating a healthy and expanding business model. |

Diversified Client Base |

Serves a diverse range of clients across various industries, reducing dependence on any single sector and spreading risk. |

Strategic Partnerships and Contracts |

Secured lucrative contracts with major players like NASA and NOAA, indicating growing recognition and potential in the industry. |

Opportunities

| Aspect | Reasoning |

|---|---|

Growing Space Economy |

- The space industry is projected to reach $1 trillion by 2040, providing a significant growth opportunity for Spire to capitalize on the expanding market. |

Expansion into New Markets |

- Ongoing exploration of new markets, such as the partnership with AST & Science for space-based cellular connectivity, opens up additional revenue streams and applications. |

Latest news and announcements

| Date | Announcement |

|---|---|

January 9, 2024 |

Partnership with NorthStar Earth & Space for the first commercial space situational awareness satellite constellation. |

January 8, 2024 |

Awarded a $9.4 million contract by NOAA for satellite weather data, reinforcing its role in global weather forecasting. |

December 12, 2023 |

Multi-million euro contract with EUMETSAT for satellite weather data, expanding reach in the European market. |

Other Developments |

Successful launch of 11 satellites on SpaceX's Transporter-9 mission, ongoing technological advancements, and active participation in industry events. |

Recent contract awards by NOAA and EUMETSAT, as well as partnerships for commercial space situational awareness, demonstrate the growing demand for Spire's services and reinforce its market position.

Spire Global chart

Spire Global price forecasts

Planet Labs (PL)

Investing in Planet Labs (NYSE: PL) in 2024 presents a compelling opportunity driven by its leadership in Earth observability and promising market dynamics.

| Strengths | Description |

|---|---|

Global Imagery Dominance |

Boasting the largest satellite constellation, Planet Labs captures daily images of 90% of Earth's landmass, offering unparalleled insights for agriculture, forestry, environmental monitoring, and disaster response. |

Data Accessibility |

Planet Labs employs user-friendly platforms with flexible pricing, democratizing access to its data. This approach expands its market and fosters increased adoption across diverse user segments. |

Strategic Partnerships |

Partnerships with major players like Airbus, NASA, and NOAA enhance market reach and credibility, unlocking new applications and revenue streams. |

Technological Innovation |

Continuous investment in satellite technologies and data analysis tools ensures a competitive edge and enables the expansion of data offerings. |

Financial Momentum |

Despite being unprofitable, Planet Labs exhibits consistent revenue growth, exceeding $214 million in 2023, with a healthy cash flow and active operational scaling. |

Opportunities for Planet labs

Growing Demand for Earth Observation Data

-

Rising demand driven by climate change, food security concerns, and urban development.

-

Positions Planet Labs for substantial growth in providing real-time earth observation data.

Expansion into New Markets

-

Active exploration of markets like renewable energy, finance, and insurance.

-

Opens avenues for valuable insights in risk assessment and decision-making.

Space-Based Data Fusion

-

Integration of Planet Labs' imagery with other data sources like weather or radar.

-

Generates more powerful insights, unlocking new applications and revenue streams.

Potential Profitability

-

Analysts project a gradual decline in net loss.

-

Expected break even profitability around FY2027.

-

Supported by strong revenue growth, reaching 27.33% in FY2025.

These opportunities highlight Planet Labs' strategic positioning to capitalize on emerging trends in the Earth observability sector. The company's proactive approach in exploring new markets and integrating data sources demonstrates a commitment to innovation and diversification.

Virgin Galactic (SPCE)

Investing in Virgin Galactic (SPCE) in 2024 presents compelling opportunities for investors.

First Mover Advantage

Virgin Galactic holds the prestigious position of being the first company to offer commercial space tourism. This unique status establishes a distinctive brand and competitive edge, potentially fostering strong customer loyalty and global brand recognition.

Experienced Leadership

Richard Branson's leadership brings a wealth of entrepreneurial experience and success. His visionary approach has not only garnered significant media attention but also positions the company as a trailblazer in the space tourism sector. Branson's track record adds credibility and enhances the public appeal of Virgin Galactic.

Technological Innovation

Virgin Galactic has demonstrated a commitment to technological innovation with the development of its SpaceShipTwo vehicle and mothership carrier aircraft. These innovations not only contribute to the company's unique offerings but could also provide cost advantages over potential future competitors, strengthening its market position.

Growing Space Tourism Market

The expanding space tourism market offers a vast growth opportunity. Virgin Galactic's early entry into this market positions it well to capture a significant share of the increasing demand for commercial space travel, potentially translating into substantial revenue growth.

Diversification Potential

Beyond space tourism, Virgin Galactic has the potential to diversify its services. Exploring scientific research flights, satellite launches, and cargo transportation opens avenues for additional revenue streams. This diversification strategy could enhance the company's financial sustainability and broaden its market presence.

Technological Advancements and Collaborations

Continued investment in technological advancements provides Virgin Galactic with the potential for cost efficiencies and staying at the forefront of space travel capabilities. Collaborations with space agencies, research institutions, and tech companies could further accelerate the company's development and expand its reach.

Recent Successes

The successful launch of the BlueWalker 3 test satellite in December 2023 represents a positive step towards diversification. This achievement not only demonstrates the company's ability to expand its capabilities beyond space tourism but also opens doors to new revenue streams.

Virgin Galactic chart

Virgin Galactic's financial highlights from Q3 2023 reflect a strong cash position, increased revenue, and improved financial performance compared to the same period in 2022. The company's strategic focus on reducing operating expenses and generating additional capital through stock issuance contributes to its financial stability. Additionally, the upcoming “Galactic 06” mission scheduled for January 26, 2024, signifies continued progress in the company's spaceflight operations.

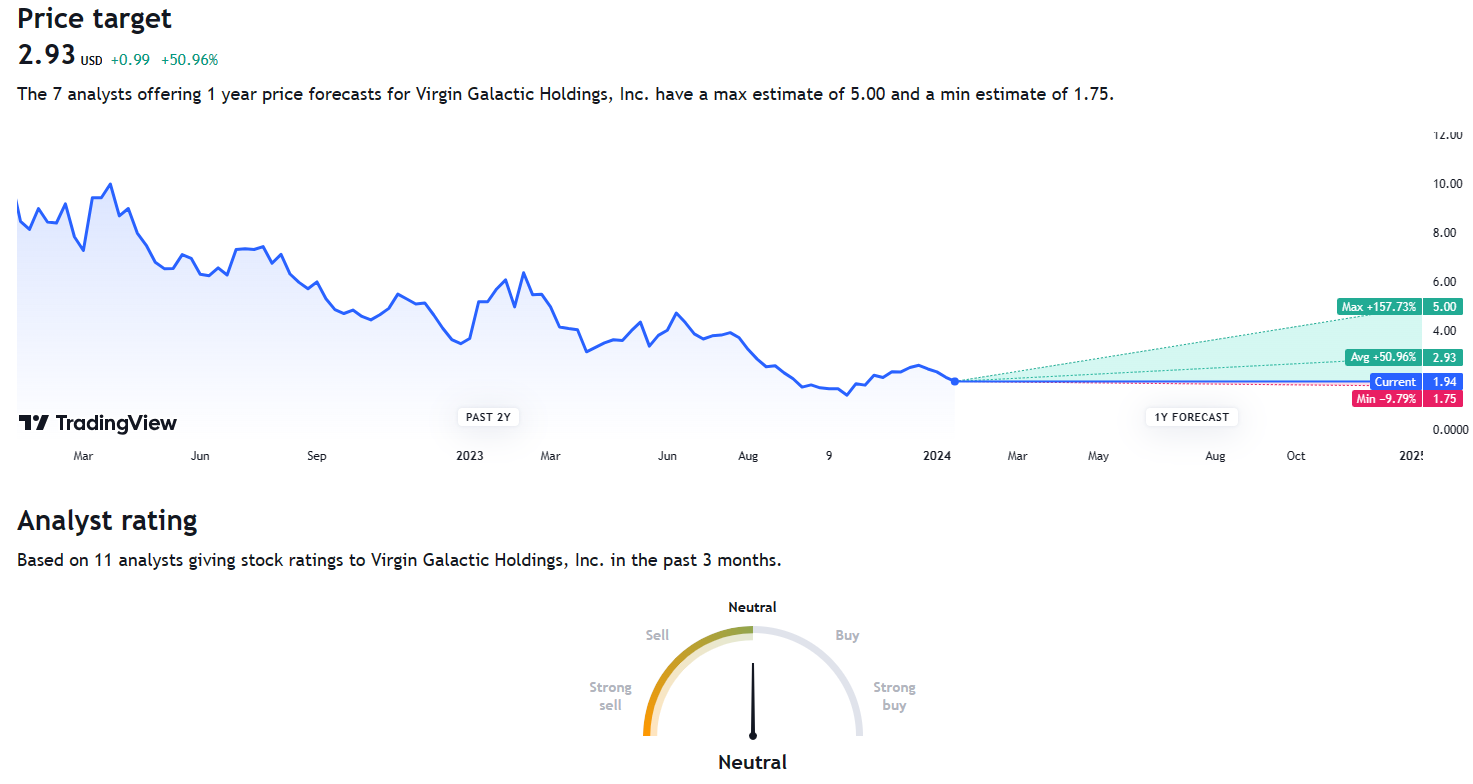

Virgin Galactic price forecasts

Leidos Holdings Inc. (LDOS)

Investing in Leidos Holdings Inc. (LDOS) in 2024 is supported by a combination of strong fundamentals, a leading position in key sectors, and favorable industry trends. Here's a detailed breakdown of reasons to consider LDOS as an investment

Market Leadership in Government Services

-

LDOS holds a prominent position in the U.S. government contracting space, with a focus on defense, intelligence, civil, and health markets.

-

Strong relationships across these sectors provide LDOS with a consistent revenue stream and a track record of winning significant projects.

Diversified Revenue Streams

-

Unlike many government contractors, LDOS exhibits revenue diversification across multiple sectors.

-

Defense Solutions (57%): Provides advanced technology and services for defense departments, ensuring a stable base.

-

Civil (24%): Offers environmental, homeland security, and IT solutions, diversifying beyond defense reliance.

-

Health (19%): Delivers IT and engineering solutions for healthcare agencies, tapping into a dynamic market.

Strong Cash Generation

-

Operates under a capital-light business model, generating significant cash flow.

-

Consistent cash flow enables LDOS to make strategic acquisitions, pay dividends, and reinvest in growth opportunities.

Solid Track Record

-

Boasts a history of steady revenue and earnings growth, instilling investor confidence.

-

Consistent financial performance reflects management's ability to navigate challenges and capitalize on opportunities.

Promising Long-Term Trends

-

Positioned to benefit from future trends in government spending.

-

Increased focus on cybersecurity and national security amid geopolitical tensions.

-

Adoption of new technologies (AI, machine learning, big data) by government agencies.

Latest News and Performance

-

Positive Q3 2023 results: LDOS exceeded analyst expectations with adjusted EPS of $1.76 and reaffirmed its full-year guidance.

-

Strong bookings momentum: Record bookings in Q3 indicate potential for future revenue growth.

-

Upgraded analyst ratings: Several analysts have recently upgraded LDOS to "Buy" or "Overweight" based on its positive outlook.

-

Strategic acquisitions: LDOS continues to make strategic acquisitions, expanding its capabilities and market reach.

Space Industry Opportunities

-

Unique positioning in space technology with NASA contracts and involvement in cutting-edge space tech projects.

-

Diversification across space-related activities, from AI-powered satellites to autonomous lunar rovers, mitigates risk and ensures consistent growth.

Industry Recognition and Resilience

-

Industry recognition for navigating challenges well, improving competitive positioning, and demonstrating resilience.

Leidos Holdings Inc. chart

Howmet Aerospace (HWM)

Howmet Aerospace, a key player in aerospace and defense applications, emerges as an enticing investment opportunity for 2024, supported by robust financials, market leadership, and industry trends. In Q3, the company showcased a commendable 16% YoY revenue growth, reaching $1.66 billion, propelled by a remarkable 23% YoY surge in the commercial aerospace category. This positive momentum extended to the bottom line, with earnings per share (EPS) witnessing a notable 28% YoY increase, reaching $0.46.

Financial Performance Highlights

| Financial Metrics | Q3 2024 | YoY Change |

|---|---|---|

Revenue |

$1.66 billion |

16% |

EPS |

$0.46 |

28% |

Aerospace stands out as HWM's largest and fastest-growing market, where the company has strategically positioned itself to capitalize on the burgeoning global aircraft demand. A notable achievement is Howmet's production of over 90% of structural and rotating aero-engine components, coupled with its invention of 90% of all aluminum alloys that have flown. This solidifies Howmet's capabilities and positions it for sustained growth.

| Market Position | Growth Strategies |

|---|---|

Leading provider in aerospace |

Increased production of aero engines and airframe structures. |

Key contributions to aero-engine components |

Capturing market share in titanium processing. |

Pioneering aluminum alloys |

Proving capability for innovation and future growth. |

Furthermore, recent news from December 2023, reinforces Howmet's strong standing in the aerospace and defense industry. According to analysts at Morgan Stanley, Howmet is positioned as the top stock pick for 2024 in the aerospace and defense sector. The company's potential to expand its valuation multiple, coupled with its operation in the aftermarket for parts and maintenance services, adds to its attractiveness.

Howmet Aerospace chart

The stock is currently on an upward trajectory, supported by bullish momentum as indicated by the Relative Strength Index (RSI). Read also: How to buy SpaceX stock in the TU article.

Best Stock brokers

Pros and cons of investing in space stocks in 2024

👍 Pros of Investing in Space Stocks (2024)

• High-Growth Potential: Emerging industry with substantial growth prospects.

• Diversification: Adds diversity to your portfolio, potentially reducing overall risk.

• Innovation: Supports groundbreaking technologies and scientific advancements.

• Government Support: Increased government investment in space exploration may benefit the industry.

👎 Cons of Investing in Space Stocks (2024)

• High Volatility: Subject to significant price swings due to various factors.

• Speculative Nature: Many space companies are unprofitable and in early development.

• Long-Term Horizon: Returns may take years as the space industry is a long-term play.

• Limited Information: Difficulty in finding reliable information, especially for smaller companies.

Factors to consider before investing in space stocks in 2024

| Industry Analysis | Company Evaluation | Investment Considerations |

|---|---|---|

Growth Potential: $1 trillion by 2040. |

Business Model and Technology: Assess core business model, competitive advantage, and technology. |

Risk Tolerance: Acknowledge high-risk nature; assess personal comfort with volatility. |

Risks and Regulations: Inherent risks and evolving regulations. |

Financial Performance: Evaluate financial health, profitability, revenue streams, and debt levels. |

Investment Horizon: Understand the long-term commitment required for potential returns. |

Government Support: Assess impact of government programs on industry growth. |

Management Team: Evaluate leadership expertise and track record in the space industry. |

Portfolio Diversification: Consider adding space stocks for diversity and risk reduction. |

Additional Resources: Stay informed with industry news, financial tools, and seek professional advice. |

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Diversification

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

-

4

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

5

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.