Which Platform Is Best For Leverage Trading Cryptocurrencies?

Best crypto leverage trading platform - ByBit

Top crypto leverage trading platforms are:

-

ByBit - offers margin trading with up to 100x leverage

-

Binance - provides competitive fees and up to 125x leverage for highly profitable tradingenvironment

-

OKX - features diverse leverage options, extending up to 100x for futures

-

Kraken - ensures secure leverage trading with up to 5x on margin accounts and 50x for futures

-

HTX (Huobi) - offers up to 5x leverage in margin trading

-

Coinbase - platform with up to 10x leverage, ideal for traders in the US

-

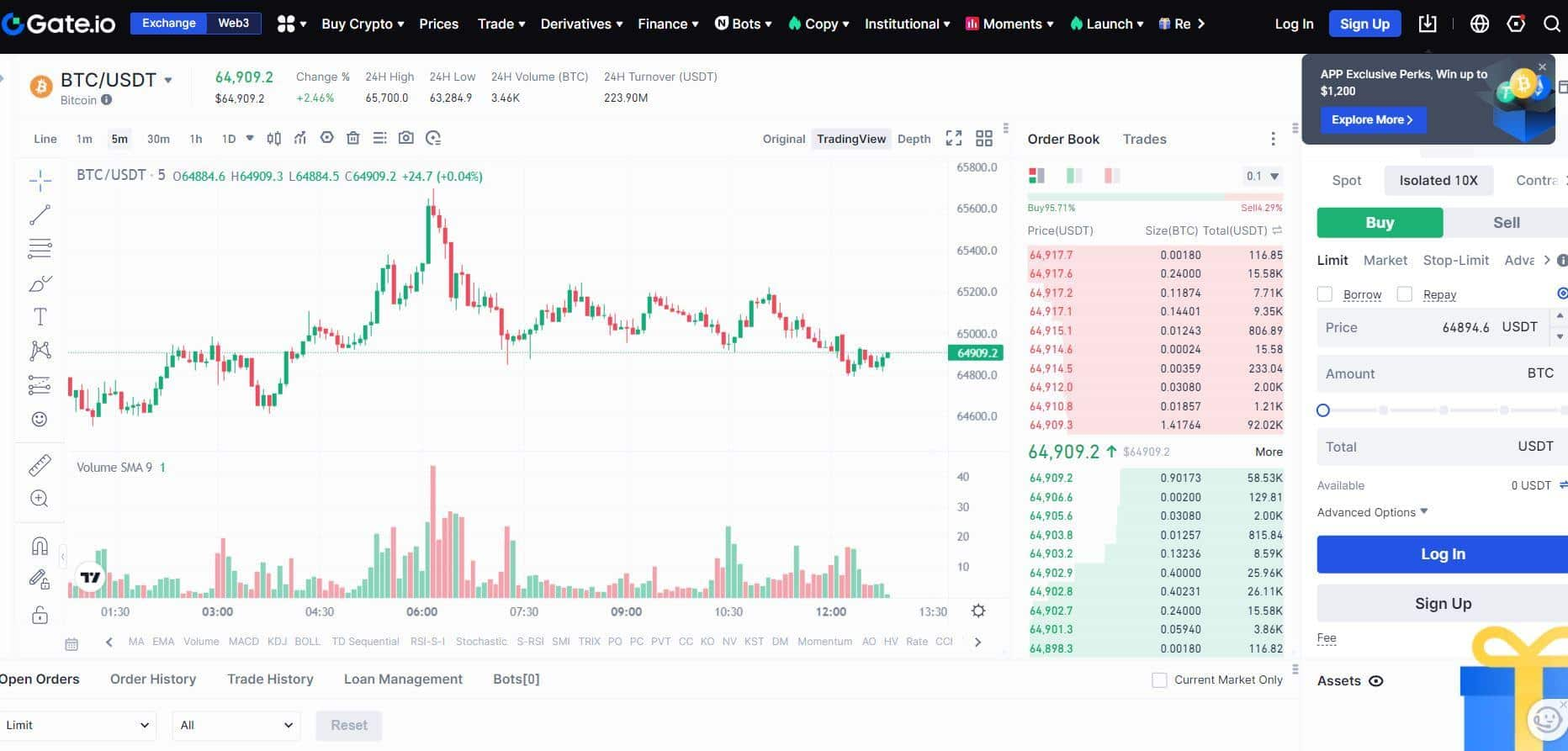

Gate.io - presents an extensive leverage trading suite with up to 100x leverage

I’ve spent considerable time using and analyzing many of these crypto platforms, each with its unique selling points and functionalities. From user-friendly interfaces to high-leverage opportunities, robust security measures to diverse asset offerings, these platforms cater to a range of trader needs. Curious to know which one could be your doorway to optimized crypto trading? Let’s move forward and dissect their distinct features and benefits.

What is the best site to margin trade crypto?

Let’s turn our attention to the top 7 platforms for crypto margin trading:

-

ByBit: A platform known for its user-friendly interface and advanced trading features. It offers up to 100x leverage but lacks a wide range of altcoins for trading.

-

Binance: One of the largest cryptocurrency exchanges in the world, offering margin trading with leverage up to 125x. However, its complex interface may be overwhelming for beginners.

-

OKX: Known for its robust security measures and a wide range of trading pairs. It offers leverage up to 100x and has competitive trading fees.

-

Kraken: A well-established platform with a strong reputation for security. It offers leverage up to 5x (50x for futures) and a wide range of cryptocurrency assets for margin trading.

-

HTX (Huobi): Known for its liquidity and competitive trading fees. It offers leverage up to 125x but may lack some advanced trading features compared to other platforms.

-

Coinbase: A popular choice for beginners due to its user-friendly interface. It offers leverage up to 10x but has a limited selection of cryptocurrencies available for margin trading. Also, it has higher fees than many alternatives.

-

Gate.io: Known for its wide range of altcoins available for trading. It offers leverage up to 100x and has competitive trading fees.

I’ll provide a detailed review of each, considering key aspects such as unique features, pros, and cons of their leverage trading offerings.

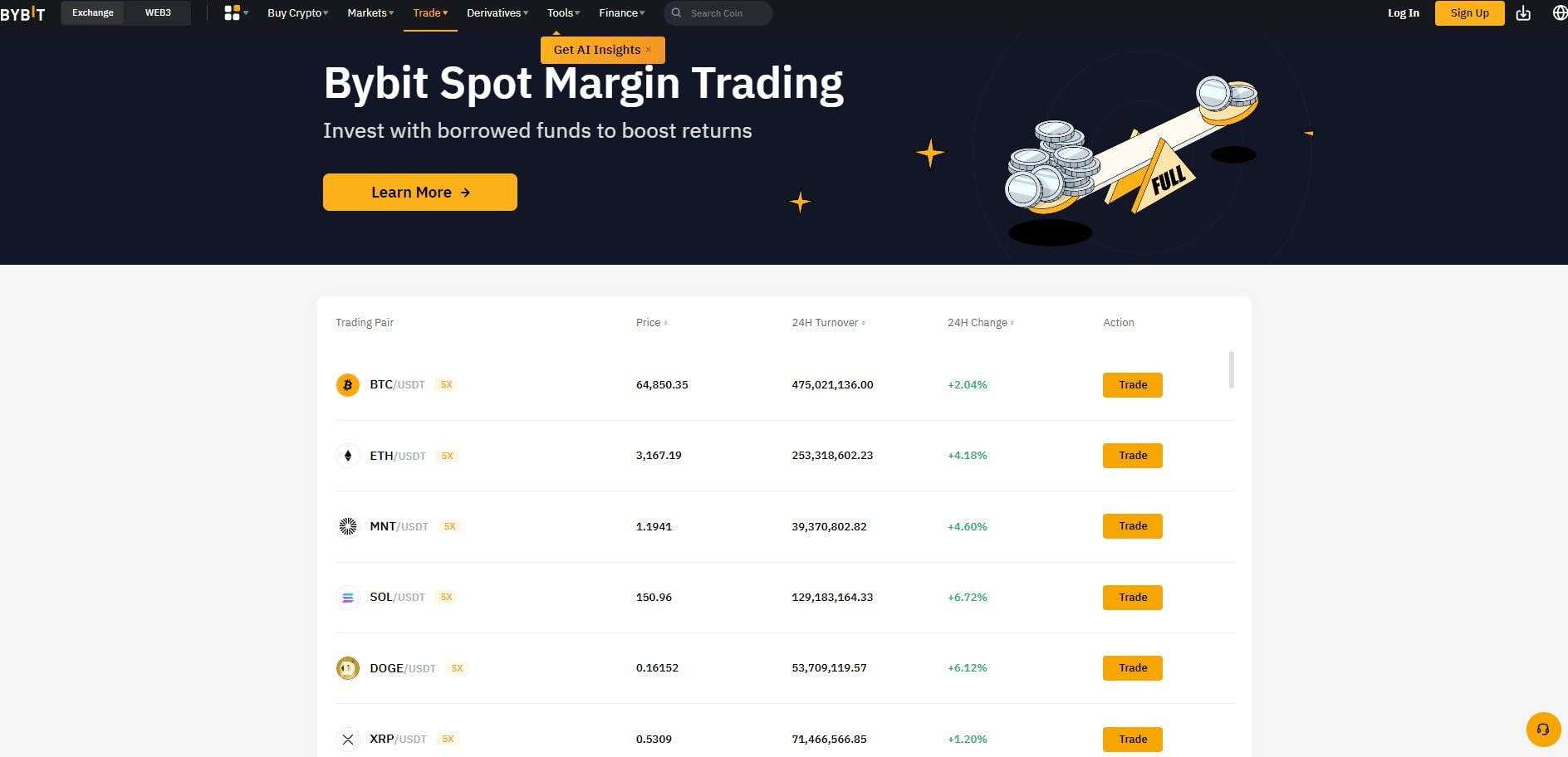

Bybit

With a user-friendly interface and robust security measures, ByBit is a go-to for many traders. It’s not one of the oldest platforms, being founded in 2018, but it’s quickly built a reputation for its innovative features and a very high leverage offered, up to 100x.

Bybit Margin Trading

Features:

-

Leverage Options: Bybit offers leveraged trading for both spot and futures markets, giving traders the chance to amplify their positions.

-

High Trading Volume: Thanks to its high trading volume, Bybit ensures liquidity, making it easier for traders to enter and exit positions.

-

Crypto Variety: The platform supports various cryptocurrencies, appealing to a broad spectrum of traders.

-

Risk Management: Bybit’s leverage trading tools allow for potential high profits with strategic risk management.

| PROS | CONS |

|---|---|

Innovative features that often lead the market. |

Could be daunting for beginners due to its advanced features. |

|

Deep liquidity pool ensuring smooth trade execution. |

Not as widely regulated as some competitors, which can be a double-edged sword. |

|

Exceptional system stability that’s a rarity in the high-stakes world of crypto trading. |

Relatively new compared to some other entries on the list, so it hasn’t had to weather as many crypto storms as some of its competitors |

|

High leverage (up to 100x) |

Verdict / Best for

For the seasoned trader who thrives on the cutting edge of cryptocurrency trading, ByBit stands tall as the colossus best suited to their needs. However, considering it’s relatively new and not as regulated as some, it might not be the safest platform out there.

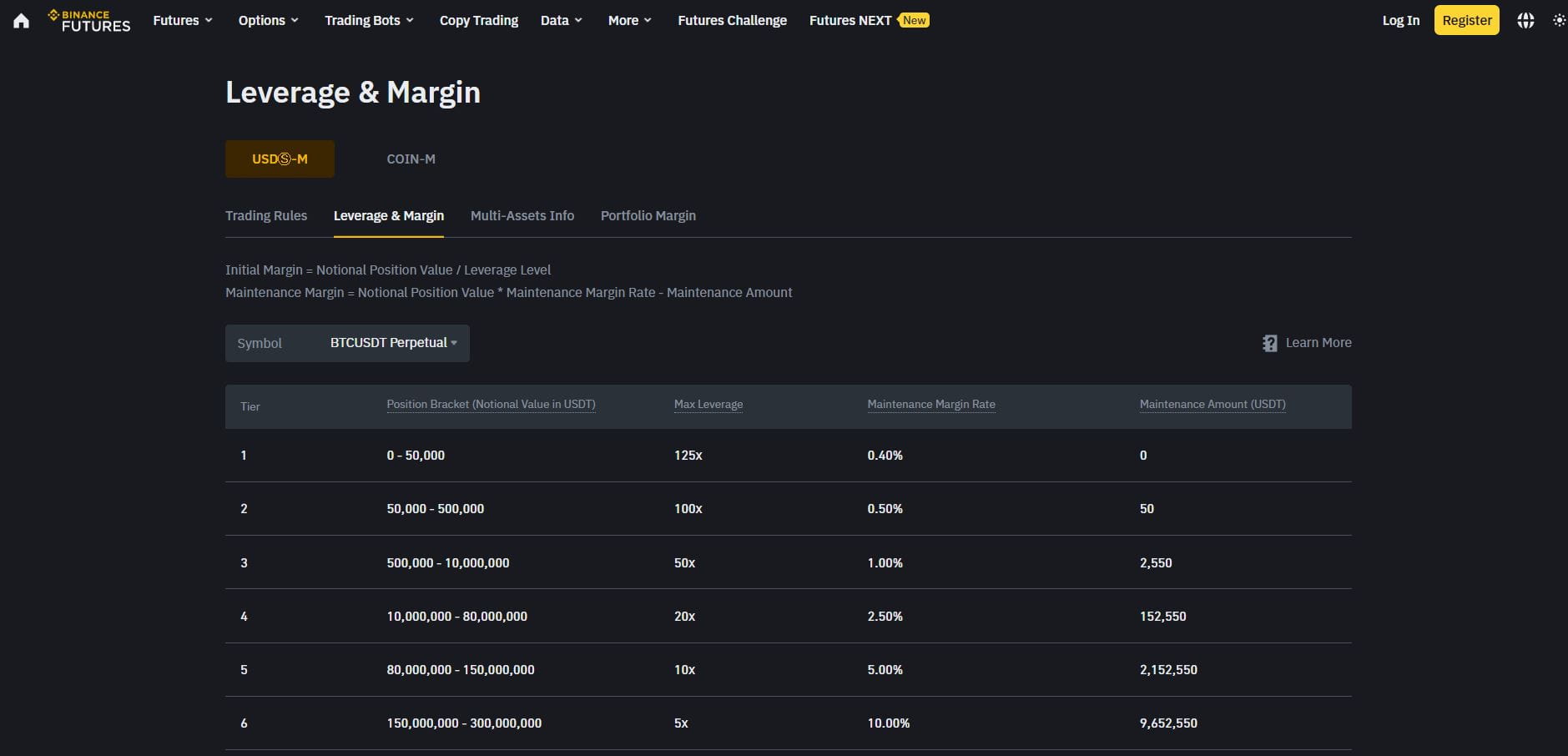

Binance

While Bybit stands as a strong contender in the crypto leverage trading arena, another platform that equally commands attention is Binance, renowned for its diverse trading options and robust leverage features. Founded in 2017, Binance has become one of the most well known crypto platforms and a staple in the crypto community.

Binance Leverage and Margin Trading

Features:

-

Huge selection of different cryptocurrencies + advanced trading features

-

Very high trading volume, i.e. constant liquidity

-

Up to 125x leverage on futures contracts

-

One of, if not the most reputable crypto platform

-

Considered very secure as far as centralized crypto platforms go

| PROS | CONS |

|---|---|

400+ cryptocurrencies available |

Complex for beginners |

|

Very high leverage limits (up to 125x) |

Variable fee structure that might not be to everyone’s preference |

|

Binance Earn opportunities for passive income |

Not fully available in the US |

|

Secure and dependable with a robust security systems in place |

Recent regulatory scrutiny |

Verdict / Best for

Binance is best for experienced traders looking for a wide range of trading options, high leverage limits, and advanced trading features. It is particularly suitable for those interested in perpetual futures and leveraged options. However, beginners may find the platform overwhelming, and the variable fee structure may be a disadvantage for some users.

OKX

OKX was founded in 2017, same as Binance, and has become a fairly popular choice for leverage trading.. Arguably the best platform for leverage trading options, it’s designed to service the diverse demands of its users with a formidable selection of over 300 cryptocurrencies.

OKX Margin Trading

Features:

-

Spot and Futures: OKX is not one to play it safe. It offers both spot and futures, catering to the immediate and the forward-thinking traders alike.

-

Daily Volume: The liquidity here is a constant flow, providing a high daily volume that ensures your trades aren't just wishes but immediate realities.

-

Range and Resources: A smorgasbord of trading pairs, coupled with advanced features and rich educational resources, OKX gears you up for a strategic trading endeavor.

| PROS | CONS |

|---|---|

350+ cryptocurrencies available |

The fee structure can feel a bit confusing |

|

Leverage limits that soar to the skies, providing ample room for calculated audacity. |

Beginners may find themselves in a labyrinth of complexity. |

|

Trading fees that whisper sweet numbers, reaching just 0.03% per transaction. |

The eyes of regulators have been keen and scrutinous, a factor to be wary of. |

|

The OKX Earn program, a passive income stream in a volatile market |

Doesn’t accept US clients, leverage isn’t available to UK clients |

|

OKX Wallet ensures asset management is a breeze, not a chore. |

Verdict / Best for

OKX is a decent choice for the experienced trader who seeks depth, variety, and the thrill of high stakes.. Yet, for the neophyte, it demands patience and a steep learning curve. Its OKX Wallet and Earn program are great, but the fact that it’s not available to the US clients and that it has been hacked throughout history knocks it down a peg.

Kraken

Kraken was Coinbase before Coinbase became Coinbase. What I mean by this is - Kraken was the exchange that beginners would often flock to, due to its smooth UI and friendly user experience. Does Kraken still hold a claim as one of the top crypto exchanges, particularly in terms of leverage trading? Yes, yes it does.

Kraken Margin Trading

Features:

-

Kraken has never been hacked, which is a huge deal in the crypto world, especially considering it’s been around ever since 2011.

-

Spot and Futures: Whether it's the immediacy of spot trading or the foresight of futures, Kraken serves both on a silver platter.

-

Daily Volume: High trading volume here speaks volumes about the liquidity that Kraken prides itself on - a strong choice margin traders seeking stable grounds.

-

Security and Accessibility: With a laudable reputation for security and the convenience of accepting various fiat currencies, Kraken casts a wide net, drawing traders from over 190 countries.

| PROS | CONS |

|---|---|

A secure and reputable exchange, weathering the crypto storms since 2011. |

The leverage fees are on the higher end. |

|

Leverage on margin accounts up to 5x—accessible for both bullish and bearish bets. |

Rollover fees every four hours. |

|

Futures trading that elevates leverage limits to 50x. |

Not the highest leverage available |

|

A truly global platform, serving traders in more than 190 countries. |

Verdict / Best for

Best for security-conscious traders with a tactical edge. It doesn’t offer as many cryptocurrencies as Binance or as high a leverage as many other platforms on this list, but Kraken is a stable, secure exchange and a solid choice.

HTX (Huobi)

HTX (Huobi) was established in 2013 in China, but moved to the Republic of Seychelles due to China’s ban on crypto exchanges. In the meantime, HTX (Huobi) has become one of the most active crypto exchanges worldwide, and although it’s available in the majority of the world, several countries, such as the United States or Japan aren’t able to use it.

HTX (Huobi) Margin Trading

Features:

-

Spot, Futures, and Beyond: Huobi's leverage trading is an extensive playground, with spot, margin, futures, and options all up for grabs.

-

Daily Volume and Leverage Options: The platform's high daily volume speaks to its liquidity and dynamism, but the maximum leverage it offers is 5x, significantly less than some other entries on our list.

-

Tiered Fee Structure: With an innovative tiered fee structure tailored to both normal and professional traders, HTX (Huobi) optimizes the trading experience to your volume, interest rates, and even your holdings in its native token, HT.

| PROS | CONS |

|---|---|

A straightforward interface that welcomes beginners with open arms. |

Leverage maxes out at 5x for margin trades—a limitation for leverage aficionados. |

|

An impressive roster of tokens and coins at your disposal. |

Higher interest rates for those at the lower end of the user tiers can be a deterrent. |

|

Round-the-clock customer support that stands vigilant for your every query. |

The tiered fee structure, while innovative, can be intricate to navigate for newcomers. |

Verdict / Best for

In some respects, Huobi Global resembles other major players in the sector, like Binance or Coinbase. While it may not boast the top-tier safety record of Kraken, the polished design of Coinbase, or the vast scale of Binance (though it is certainly a large cryptocurrency exchange in its own right), it nonetheless fulfills nearly all the basic requirements of a reliable digital asset exchange.

Coinbase

Coinbase has etched its name into the bedrock of crypto exchanges. Founded in 2012, I've watched Coinbase grow into a behemoth, wielding the influence of over 100 million customers. It’s the exchange that crypto newbies often flock to when first getting their feet wet in crypto markets. Every grandma, uncle and cousin who suddenly wants to get into crypto - most likely is making a Coinbase account.

Coinbase Margin Trading

Features:

-

Spot and Futures: Leverage trading on Coinbase is a calculated dance, with up to 10x leverage for the spot market and 3x for futures.

-

Daily Volume: A hub of activity, Coinbase's trading volume is a testament to its vast user base and the deep liquidity it offers, essential for leverage trading.

-

Variety and Education: With an arsenal of over 260 digital assets, Coinbase is a veritable candy store for traders. Coupled with educational resources, it's as much a learning center as it is a trading platform.

-

Probably the best user interface, user experience and design, which makes it very friendly for beginners.

| PROS | CONS |

|---|---|

A diverse selection of over 260 cryptos at your fingertips. |

Leverage caps at 10x, which might not satisfy the appetite of high-risk traders. |

|

FDIC-insured - a shield in the volatile world of crypto. |

A fee structure that could chip away at profits, especially for smaller trades. |

|

Publicly traded, ensuring a layer of accountability and transparency. |

Its simplicity, while a boon for beginners, might stifle the seasoned trader's need for advanced features. |

|

"Coinbase Earn" and staking options offer innovative ways to grow your portfolio passively. |

|

|

Very beginner friendly |

Verdict / Best for

Coinbase is a go to for new people in crypto. Its user-friendly interface, educational resources, and steadfast compliance with regulatory standards make it the ideal starting point for new traders In addition, it is one of the most transparent platforms out there. If you’re a highly experienced trader however, Coinbase may not be the right choice since they don’t offer the highest leverage and their fee structure is on the higher end.

Gate.io

Founded in 2013 and located in Cayman Islands, Gate offers 1400 cryptocurrencies to choose from, a ludicrously high number by any standard. It's best known for spot trading, but it does offer some solid margin trading opportunities.

Gate Margin Trading

Features:

-

Spot, Futures, and Options: Whether it's the classic spot trading, the forward-looking futures, or the strategic options market, Gate.io has it all, with leverage peaking at 100x.

-

Daily Volume: The platform’s daily volume is indicative of a bustling marketplace, where liquidity is abundant and opportunities are ripe.

-

Leveraged Tokens and Passive Income: Traders can dabble in leveraged tokens with up to 5x leverage, and even earn passive income through funding futures loans - an ingenious feature.

-

By far the highest number of cryptocurrencies available - over 1400. Many of those include some of the more fringe altcoins.

| PROS | CONS |

|---|---|

An expansive futures market, offering a rich tapestry for trading. |

Leverage limits may scale down on less liquid altcoins, which might dampen the spirits of altcoin enthusiasts. |

|

A ceiling of 100x leverage |

The promise of lower commissions is gated behind a lofty monthly trading volume requirement of $60,000. |

|

Options trading on major cryptocurrencies, adding a layer of sophistication to your strategies. |

Very low rating on TrustPilot of only 1.8 / 5 |

|

1400+ cryptocurrencies offered - the largest pool to choose from |

Customer support isn’t touted as great |

|

Passive income opportunities |

Verdict / Best for

I personally often use Gate simply for the sheer amount of altcoins offered. The platform does have some cool features that allows for more advanced trading, as well as opportunities for passive income. With that said, its poor reviews and less than stellar customer support are a concern. My advice is, use Gate to play around with some smaller altcoins you’d have a hard time finding elsewhere - but never have a huge amount of assets or a significant part of your portfolio on the platform. Better safe than sorry.

How to select the best cryptocurrency leverage trading platform?

When selecting the best cryptocurrency leverage trading platform, weigh a variety of factors such as:

-

Maximum leverage limits offered;

-

The platform’s safety and reputation;

-

The range of tradable cryptocurrencies;

-

Associated trading fees;

-

User experience;

-

Legal compliance;

-

Security.

How do I start leverage trading crypto?

To begin leverage trading in crypto, understanding key concepts such as margin and margin calls is crucial.

Next, knowing about the different types of accounts available for crypto leverage trading and the starting capital required can help you make more informed decisions.

Above all, risk management strategies are essential to safeguard your investments in this volatile and high-risk market.

Let’s explain each of those.

What is margin and margin call?

Margin is the amount of funds you need to have in your account to open and maintain a leveraged position. It’s essentially your skin in the game.

A margin call occurs when your account balance falls below the required maintenance margin, and you’re prompted to add more funds or face the risk of your position being liquidated.

Types of accounts for leverage trading crypto

There are 2 main account types available to you, namely - margin accounts and isolated margin accounts.

| Account Type | Description | Associated Risk |

|---|---|---|

|

Margin Accounts |

Allows borrowing based on existing assets |

Higher risk as potentially all assets can be liquidated |

|

Isolated Margin Accounts |

Limits the amount at risk per trade |

Lower risk as only isolated assets are at stake |

Risk management

Make sure to take into account the steps I’m outlining below:

-

First, you need to grasp the concept of leverage trading, this multiplies your trading position in the crypto market.

-

Next, you should establish clear risk management strategies. This includes setting stop-loss orders and proper position sizing, which are crucial in protecting your capital.

-

Begin with small leverage ratios and gradually increase them as your confidence and trading skills grow.

-

Lastly, always stay updated with market trends and news. This ensures you can make informed decisions when trading.

How much to start with?

For those keen to venture into crypto leverage trading, a modest initial deposit - often as low as $10 to $100 depending on the platform and the specific cryptocurrency - can get you started. Your starting amount can vary widely depending on numerous factors, including the platform you choose and the specific crypto you plan to trade.

I’d recommend starting conservatively to minimize risks and gain vital experience in managing leveraged positions. Learn how to start with small amounts and make it work to your benefit in our guide How To Trade Crypto With A $100: Beginner's Guide.

Expert opinion

In crypto leverage trading, always remember that with great power comes great responsibility. Use leverage wisely - it can multiply your gains, but it can also magnify your losses. Discipline is your anchor in the volatile tides of the market.

Conclusion

Trading with leverage in the cryptocurrency market can be appealing because it offers the potential to magnify returns. Don’t forget that this comes with greater risks however, particularly because of the high volatility inherent in cryptocurrencies. Beginners should tread carefully, focus on learning, and implement sound risk management strategies.

Methodology for compiling our ratings

Traders Union applies a rigorous methodology to evaluate brokers using over 100 both quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

-

User reviews. Client reviews and feedback are analyzed to determine customer satisfaction levels. Reviews are fact-checked and verified.

-

Trading instruments. Brokers are evaluated on the breadth and depth of assets/markets available to trade.

-

Fees and commissions. A comprehensive analysis is done of all trading costs to analyze overall cost to clients.

-

Trading platforms. Brokers are assessed based on the variety, quality and features of platforms offered to clients.

-

Extra services. Unique value propositions and useful features that provide traders with more choices for yield generation.

-

Other factors like brand popularity, customer support, education resources are also evaluated

FAQs

What is crypto leverage trading?

Crypto leverage trading is the practice of using borrowed funds to increase the potential return on investment in cryptocurrency markets.

Is crypto leverage trading legal?

Yes, crypto leverage trading is legal in many jurisdictions around the world, but regulations can vary significantly from one country to another.

What is the best leverage for crypto?

The best leverage for crypto varies depending on the individual trader's experience level, risk tolerance, and trading strategy, but it's generally recommended to use lower leverage to manage risks effectively.

Is crypto leverage trading profitable?

Crypto leverage trading can be profitable, offering the potential for amplified gains; however, it also comes with a higher risk of significant losses, especially for those who do not have a sound risk management strategy in place.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Leverage

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

-

3

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

4

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

5

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).