deposit:

- $50

Trading platform:

- Proprietary platform

- CySEC

- FCA

- ASIC

- 0%

deposit:

- $50

Trading platform:

- Proprietary platform

- CySEC

- FCA

- ASIC

- 0%

Summary of eToro Trading Company

eToro is a moderate-risk broker with the TU Overall Score of 5.6 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by eToro clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. eToro ranks 79 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The eToro broker is a non-standard broker that focuses exclusively on social trading.

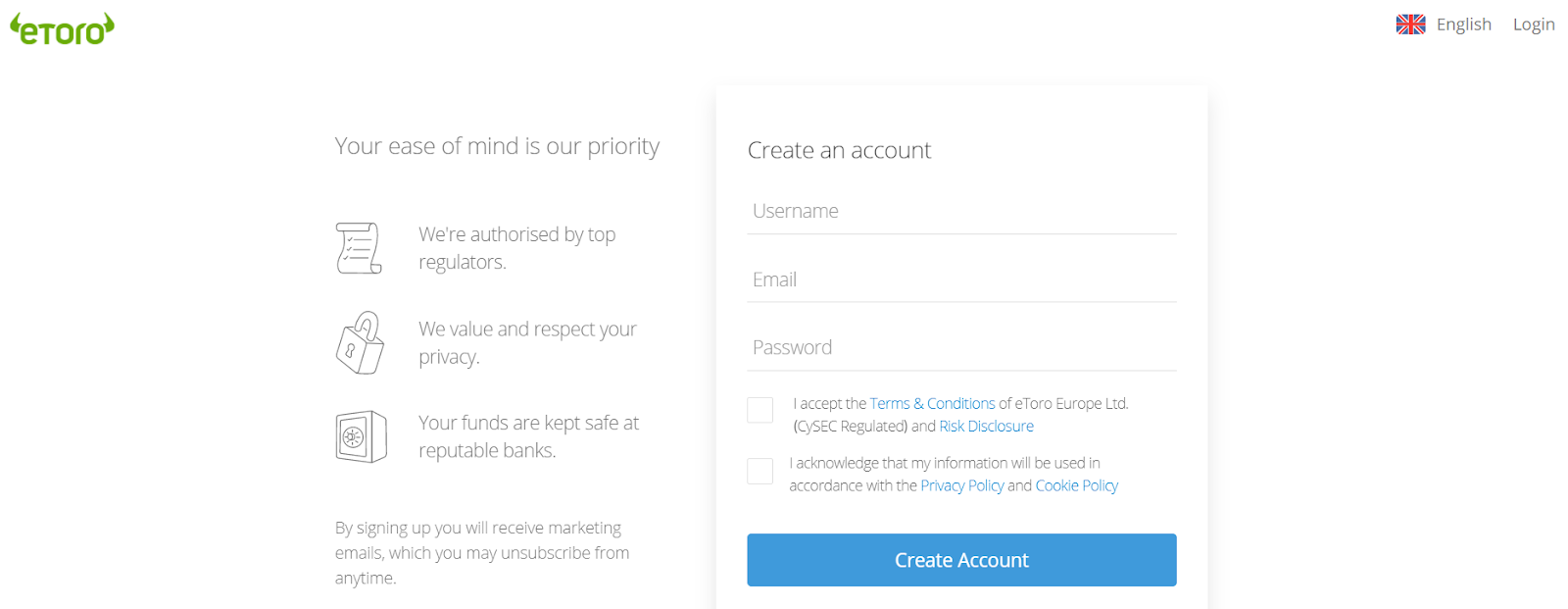

The eToro broker was founded in 2007. The company promotes itself as a social trading platform working with traders from over 140 countries. The broker has several divisions operating under different jurisdictions and licensed by different regulators. For example, eToro (Europe) is licensed by the Cypriot regulator CySEC (109/10) and eToro (UK) is licensed by the British regulator FCA (583263). The broker also has a representative office in Australia and the USA. eToro Profile Details

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | 50$ |

| ⚖️ Leverage: | 1:1-1:30 |

| 💱 Spread: | From 0.1 pips |

| 🔧 Instruments: | Currencies, assets of stock and commodity markets, cryptocurrencies |

| 💹 Margin Call / Stop Out: | n/a |

👍 Advantages of trading with eToro:

- the minimum transaction amount for copying is $1;

- handy functionality for passive investing;

- regulated by independent monitors;

- it is possible to purchase contracts for fractional shares (that is, to invest amounts less than the cost of one share);

- it is possible to buy shares at once (not CFDs) on the US stock exchanges.

👎 Disadvantages of eToro:

- high spreads;

- periodic technical failures in order execution;

- lack of the most popular platforms such as MetaTrader 4 and MetaTrader 5 in Europe and the CIS;

- no access to ECN systems, orders are processed only according to the STP (straight-through processing) scheme with access to specific liquidity providers;

- there is a commission for withdrawing funds;

- impolite support staff;

- inconvenient website.

Evaluation of the most influential parameters of eToro

We checked the office of the eToro brokerage company in Cyprus, which is located at the following address according to the information on the company’s website:

st. Profiti Ilias, 4, business center "Kanika", 7th floor, Yermasogeia, 4046, Limassol, Cyprus

-

The company is located at the stated address

-

We were able to speak to a company representative

-

We were able to visit the office as clients

-

-

Video of the company’s office

-

Geographic Distribution of eToro Traders

Popularity in

Video Review of eToro i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of eToro

The broker eToro has been operating in the over the counter (OTC) financial markets for over 10 years, but there are still questions remaining to fulfill its obligations. First of all, it is worth noting the inconvenient website design. To learn about account types with detailed trading conditions you have to first register on the site.

Trading conditions for investors in comparison with similar conditions of social trading of other brokers can hardly be called attractive. First of all, there is a $5 fee for withdrawing funds. Yes, it seems symbolic, but then its reason is more unclear. Secondly, the number of traders copied is limited to 100. The reason for such restrictions are also unclear.

The broker eToro is rather a platform possessing a specific niche for social trading, with its own advantages and disadvantages. Nevertheless, its longevity suggests that the company confidently maintains an average level in its segment. The broker eToro also occupies an average position in the Traders Union rating of Forex brokers.

Latest eToro News

Dynamics of eToro’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

The broker eToro as compared to other platforms in Forex is characterized by its socially-oriented approach and online trading services. The broker casts itself as an online social trading platform with a unique proprietary platform, the CopyTrader system, CopyPortfolios investment strategies, and auto-follow functionalities. Learn more about eToro Dividends here.

CopyTrader and CopyPortfolios are unique offers of the eToro broker

CopyTrader is a system for transactions copying, allowing to duplicate the actions of other traders in real-time. Technically, the key-point of social trading is classic:

-

the trader is trading. The more effective it is, the best positions he gets in the rating;

-

the investor evaluates the strategies, risks, and performance of traders, selects one or more (no more than 100), links to the account;

-

all transactions are copied online to the investor's account and the trader gets a commission. The commission is both fixed and a percentage of the amount of income depending on the type of asset.

The most popular traders can earn additional income by participating in the Popular Investor program and eToro ESG Investing. Popular Investors can receive up to 1.5% payment based on average AUC. For example, if a trader is copied by 1,000 people with a total amount of 10 million dollars, then the additional income will be 200 thousand dollars per year.

CopyPortfolios is another unique eToro product, which is a ready-made investment strategy formed according to certain criteria. This is a ready-to-use investment formula with a diversified set of assets and optimized risk. It is possible to copy thematic portfolios, conservative portfolios, portfolios of successful traders, and portfolios of the world's leading financial institutions.

Important!

If you are a large investor and plan on investments over $ 10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

eToro affiliate program

The eToro affiliate program provides for a single or multi-level referral network that will bring passive income to the trader (the remuneration amount is not indicated on the website). After registering as a partner, each trader gets unique and effective banners, landing pages, and widgets for free. The personal account displays detailed statistics on partner payments.

Trading Conditions for eToro Users

The eToro broker's trading conditions can be considered relatively attractive due to the specifics of the service provided. eToro requires a first-time deposit of $200 USD, after the first deposit; there is a minimum deposit amount of $50 USD and the amount required to copy another trader is $200, also minimum Copy position size from $1 to $2. Leverage is set by the requirements of the European regulators. Learn more about eToro Forex and CFD Assets.

$50

Minimum

deposit

1:30

Leverage

24/5

Support

| 💻 Trading platform: | a proprietary unified platform |

|---|---|

| 📊 Accounts: | Standard and demo |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank transfer, Neteller, Skrill, Webmoney, GiroPay |

| 🚀 Minimum deposit: | 50$ |

| ⚖️ Leverage: | 1:1-1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | $1 (when copying transactions) |

| 💱 Spread: | From 0.1 pips |

| 🔧 Instruments: | Currencies, assets of stock and commodity markets, cryptocurrencies |

| 💹 Margin Call / Stop Out: | n/a |

| 🏛 Liquidity provider: | n/a |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Cryptocurrency trade; Structural investment portfolios; Copy Portfolios; Trading Central. |

| 🎁 Contests and bonuses: | No |

Comparison of eToro with other Brokers

| eToro | RoboForex | Eightcap | Exness | Gerchik&Co | Libertex | |

| Trading platform |

MobileTrading, WebTrader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | Libertex, MT5, MT4 |

| Min deposit | $100 | $10 | $100 | $10 | $100 | 100 |

| Leverage |

From 1:2 to 1:30 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:100 |

From 1:1 to 1:30 for retail clients |

| Trust management | No | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 2 points | From 0 points | From 0 points | From 1 point | From 0 points | From 0.1 points |

| Level of margin call / stop out |

No | 60% / 40% | 80% / 50% | No / 60% | 100% / 50% | 50% / 50% |

| Execution of orders | Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| eToro | RoboForex | Eightcap | Exness | Gerchik&Co | Libertex | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes (as CFDs) |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes (as CFDs) |

| Crypto | Yes | No | Yes | Yes | Yes | Yes (as CFDs) |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes (as CFDs) |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes (tradable CFDs or Stocks for investment) |

| ETF | Yes | Yes | No | No | Yes | Yes (as CFDs) |

| Options | No | No | No | No | No | Yes (as CFDs) |

eToro Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | From $1.1 | Yes |

There is a swap (commission for shifting transactions to the next day). We also compared eToro's trading commissions with those of competitors. A ranking was carried out based on the analysis, and according to it each broker was assigned its own level.

| Broker | Average commission | Level |

| eToro | $1.1 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of eToro

The broker eToro is a fully-featured transactions-copying platform. It is a highly specialized company that has chosen the social trading sector as its main niche. This makes the platform suitable for use by trading beginners. For over 10 years, eToro managed to develop and offer innovative technologies in the field of online trading and auto-following, such as instant copying of transactions with the ability to constantly monitor the actions of a trader in a web terminal.

A few figures about eToro that may be of interest to traders when choosing a company for trading:

-

over 2,000 assets available, including CFDs, stocks: Nvidia stock, Apple stock, Google stock, Tesla stock etc. , and cryptocurrencies;

-

over 6 million customers;

-

over 140 countries.

How to copying transactions on eToro

The broker eToro is focused on providing transactions copying services. In 2007, the company offered the Visual FX social trading platform, which in 2009 was developed into a web version and got the name WebTrader. In 2010, another OpenBook platform was developed and it was powered by the innovative CopyTrader technology. In 2015, the two platforms were merged.

Another unique eToro service is access to the US stock market , where each trader can become a real shareholder (in most cases, other brokers offer to trade only CFDs on shares), and eToro, in this case, acts as a sub-broker.

Can You Trade Options At eToro?

Other eToro useful services:

-

Copy Portfolios. Thematic investment tool for long-term investors. It is a range of investment portfolios with different structures and risk levels, the management of which involves the use of machine learning technology. The minimum investment amount is $200;

-

Trading Central. Conditions apply and eToro provides its clients with free access to restricted exclusive materials of the information and analytical platform;

-

analyst at the Financial Times. Traders/investors can get free access to analytical materials and research results from one of the best information providers;

-

a calendar of the release of reports on the profit of companies.

Advantages:

detailed statistics for each trader are available in the personal account;

there are ready-made structural investment portfolios;

the minimum amount for copying is $1.

There are no restrictions on choosing a strategy when copying transactions.

Guide for Traders

The eToro broker has only two accounts: a demo account and a standard trading account. Both are designed for direct trading and copying transactions. In some cases, a separate account may be opened in shares (when working with the US stock exchanges).

The eToro broker is an interesting company for those who prefer passive investing, who understand approaches to the formation and management of investment portfolios.

Investment Education Online

Information

There is a separate "Training" section to help novice traders. It describes the key points of social trading, the scheme for copying transactions, and the principle of choosing a trader by an investor.

Each of these tools can be useful when creating an investment portfolio.

Security (Protection for Investors)

Information

The eToro broker is geographically divided into three companies located in different jurisdictions: eToro (Europe) — the CySEC regulator (Cyprus, license No. 109/10); eToro (UK) — FCA regulator (Great Britain, license FRN583263); and eToro (AUS) — ASIC regulator (Australia, license No. 491139). Brokerage is carried out under the European MiFID directive. eToro has individual insurance policies to protect your finances.

👍 Advantages

- FCA licensed. The regulator is considered one of the strictest in the world

- Protection from negative balance

- There is access to the US stock market

👎 Disadvantages

- Difficulty filing an application in the event of a conflict of interest for an individual trader

Withdrawal Options and Fees

-

eToro carries out withdrawal of money at the first request of the client without restrictions on the number of requests. Commission and withdrawal time depend on the chosen payment system.

-

There are several options for money replenishment or withdrawal: eToro Money, WebMoney, Neteller, Skrill, GiroPay, and transfer.

-

Processing the application and depositing to the account may take from 2 to 8 days, depending on the selected withdrawal method.

-

Withdrawal and replenishment of currencies occur in USD only.

-

The broker’s commission is $5 per each transaction regardless of the withdrawal amount. There are also commissions of payment systems.

-

The minimum withdrawal amount is from $30 ($500 for bank transfer).

Customers’ Support

Information

The broker's customer service is available for each trader twenty-four five.

👍 Advantages

- Live chat

👎 Disadvantages

- Does not work on weekends

There are several ways to contact customer support:

-

via feedback form;

-

via social networks.

Support is available on the broker's website and in a personal account.

Contacts

| Foundation date | 2007 |

| Registration address | eToro (UK) Ltd., 24th floor, One Canada Square, Canary Wharf London, E14 5AB, United Kingdom |

| Regulation |

CySEC, FCA, ASIC |

| Official site | etoro.com |

Review of the Personal Cabinet of eToro

Cooperation with a broker starts with the registration of a personal account. First, register on the Traders Union website and go to the eToro website using the partner link to save on the spread. To register:

Click the "Register" button on the top panel regardless of which page of the site you are on.

Go through authorization by specifying the following data: email address, name, account password. This data is sufficient to gain access to the personal account.

The following is available in the eToro personal account:

-

Current analytics for major assets with Market Sentiment Indicator;

-

Rating of traders with open statistics and different groups.

Other features of the personal account:

-

investment portfolio statistics;

-

news feed;

-

CopyPortfolios structural portfolios;

-

statistics on accrued bonuses for invited friends;

-

withdrawal of funds;

Disclaimer:

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

eToro - How to open, deposit and verify a trading account | Firsthand experience of Traders Union

Disclaimer:

Your capital is at risk. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. Via eToro's secure website.

Find out how eToro stacks up against other brokers.

Articles that may help you

FAQs

Do reviews by traders influence the eToro rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about eToro you need to go to the broker's profile.

How to leave a review about eToro on the Traders Union website?

To leave a review about eToro, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about eToro on a non-Traders Union client?

Anyone can leave feedback about eToro on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.