deposit:

- $300

Trading platform:

- MT4

- JForex

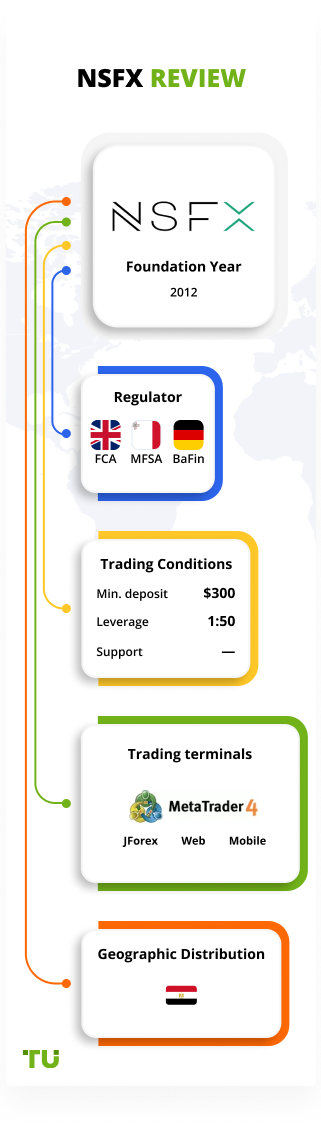

- MFSA

- FCA

- BaFin

- ACP

- Consob

- CNMV

- 0%

deposit:

- $300

Trading platform:

- MT4

- JForex

- MFSA

- FCA

- BaFin

- ACP

- Consob

- CNMV

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of NSFX Trading Company

NSFX is a moderate-risk broker with the TU Overall Score of 5.01 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by NSFX clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. NSFX ranks 117 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

NSFX is a broker for those who appreciate innovation in trading and are ready to develop their trading skills with a reliable European partner.

NSFX (pronounced as nsfx.com) is a brokerage firm that has been operating in the markets of Europe and Asia since 2012. The broker provides access to international financial markets for traders with any level of trading experience. NSFX offers such trading assets as currency pairs, CFDs on gold and silver, energies, and indices. The company is focused primarily on traders from Europe and the CIS countries, therefore it is mainly licensed by such European regulators as MFSA IS/56519 (Malta), BaFin 131055 (Germany), ACP 53102 (France), Consob 3597 (Italy), CNMV 3354 (Spain), and FINANSTILSYNET 9221 (Denmark).

| 💰 Account currency: | USD, EUR, and GBP |

|---|---|

| 🚀 Minimum deposit: | $300 |

| ⚖️ Leverage: | Up to 1:50 |

| 💱 Spread: | from 0.5 pips (five-digit quotes) |

| 🔧 Instruments: | Currency pairs (more than 50), CFDs on indices (more than 7), metals (2), and energies (2) |

| 💹 Margin Call / Stop Out: | 50%/20% |

👍 Advantages of trading with NSFX:

- 6 licenses from European regulators, including a license from one of the most stringent regulatory authorities, BaFin;

- Tight spread is from 0.5-0.6 pips. It is achieved through the aggregation of liquidity from the largest providers, which are international banks operating through Tier-1 operators;

- There are support instruments, such as analytics from Trading Central and the Guardian Angel application for MetaTrader 4 (MT4). It is an add-on that allows traders to control trading risks, duly track spread widening, and receive instant feedback on transactions, avoiding unnecessary market noise;

- Optimal choice of platforms. There is the familiar MT4 platform with the opportunity to add user instruments. Also, there is the professional JForex platform with Depth of Market;

- Full transparency of work. The website provides the offer and terms of cooperation in the public domain. There are neither hidden fees nor brokerage fees for withdrawing profits.

👎 Disadvantages of NSFX:

- Relatively high initial fee. It starts from $300;

- There are limitations in the use of strategies. In particular, scalping is prohibited on the MT4 Fixed account;

- Relatively small selection of assets. The number of currency pairs is just over 50, metals are only gold and silver, 8 indices, and CFDs on oil of two brands.

Evaluation of the most influential parameters of NSFX

Geographic Distribution of NSFX Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of NSFX

NSFX is a mid-tier broker that confidently occupies a leading position in its segment. The company does not have any unique products. The broker is primarily focused on the technological development of its own platform and improving the quality of services provided. The order execution speed is about 30-50 ms, which is one of the best results in the market. The spread is from 0.5 pips. Types of accounts are suitable for all major categories of traders. The MT4 STP account with fixed spread is for novice traders with manual intraday strategies, the MT4 ECN account with floating spread is for scalping and algorithmic trading, and the ECN account on the JForex platform is for professional trading.

The advantage of this company is that it is licensed by 6 European regulators. The broker is constantly under independent cross-audit that monitors the financial condition, compliance with the principle of account segregation, and the ability to fulfill its obligations to the clients.

Trading platforms are MT4 and JForex. General trading conditions for assets are on the website, but you will find detailed specifications for individual contracts only on the platforms. Deposit and withdrawal options for accounts are the Neteller and Skrill payment systems. Withdrawal of profits takes up to 2 business days. Support can always be contacted by email, but it is better not to rely on live chat.

Dynamics of NSFX’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

NSFX develops the direction of providing active trading services and improves order processing and data transfer technologies. It has not provided its own investment programs yet.

Copy trading from MetaQuotes

MetaQuotes is the developer of the MT4 trading platform and the owner of the MQL5 freelance platform, which is a community that brings together traders and developers worldwide. One of the features of the MQL5 community is to provide all MT4 users with signals from professional traders. Clients can copy their trades automatically or can select individual signals and transfer them to their accounts manually. This is how it works:

A trader opens an account at nsfx.com, downloads MT4, and links an open account to the platform;

Then a trader registers on the MQL5.com website and chooses his status. Each person can be both a signal provider and a subscriber. Subscription to most of the signals is paid. To become a signal provider, you need to successfully trade for more than 1 month and have your account appear in the rating;

A trader subscribes to the provider's signals from the MQL5.com website or from MT4 in the "Signals" tab of the "Platform" window.

Before subscribing, check with NSFX support about the possibility of copying third-party signals. Depending on the type of account, there may be some peculiarities.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program from NSFX:

The broker attracts clients by improving technologies, introducing innovative solutions, and expanding the product line and trading instruments. Attracting clients through partnership programs is not provided yet.

Trading Conditions for NSFX Users

NSFX offers a standard set of trading instruments, including more than 50 currency pairs, CFDs on gold and silver, Brent and WTI oil, and 8 stock indices. Leverage in accordance with the requirements of European regulators is up to 1:50. It can be reduced for individual instruments (see the contract specifications). There is a demo account for training and testing.

$300

Minimum

deposit

1:50

Leverage

24/5

Support

| 💻 Trading platform: | MT4 and JForex |

|---|---|

| 📊 Accounts: | Demo, МТ4 Fixed, MT4 ECN, and JForex |

| 💰 Account currency: | USD, EUR, and GBP |

| 💵 Replenishment / Withdrawal: | Bank cards, bank transfers, Neteller, and Skrill |

| 🚀 Minimum deposit: | $300 |

| ⚖️ Leverage: | Up to 1:50 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 0.5 pips (five-digit quotes) |

| 🔧 Instruments: | Currency pairs (more than 50), CFDs on indices (more than 7), metals (2), and energies (2) |

| 💹 Margin Call / Stop Out: | 50%/20% |

| 🏛 Liquidity provider: | Barclays, CitiFX Pro, UBS, Dukascopy Bank SA, Currenex, Credit Suisse, and PrimeXM |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Instant execution and market execution |

| ⭐ Trading features: | Scalping is prohibited on the MT4 Fixed account |

| 🎁 Contests and bonuses: | No |

Comparison of NSFX with other Brokers

| NSFX | RoboForex | Eightcap | Exness | FBS | AMarkets | |

| Trading platform |

JForex, MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading | MT4, MT5, AMarkets App |

| Min deposit | $300 | $10 | $100 | $10 | $1 | $100 |

| Leverage |

From 1:1 to 1:50 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:3000 |

| Trust management | Yes | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.5 points | From 0 points | From 0 points | From 1 point | From 0.2 points | From 0 points |

| Level of margin call / stop out |

50% / 20% | 60% / 40% | 80% / 50% | No / 60% | 40% / 20% | 50% / 20% |

| Execution of orders | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | $5 | No |

| Cent accounts | No | Yes | No | No | Yes | No |

Broker comparison table of trading instruments

| NSFX | RoboForex | Eightcap | Exness | FBS | AMarkets | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | No | Yes | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes | No | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | No | Yes |

| ETF | No | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

NSFX Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| МТ4 Fixed | $5 | No |

| MT4 ECN | From $5 | No |

| JForex | From $5 | No |

A swap fee is charged. The date and order of charging are stated in the specifications. Also, analysts of Traders Union compared the fees of NSFX to similar spreads of its competitors. The fee for contracts for stock indices and shares was taken as a basis. The comparative table below shows the result.

| Broker | Average commission | Level |

| NSFX | $5 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed review of NSFX

NSFX is a broker operating on a combined STP/ECN model. The STP (Straight Through Processing) model allows you to keep a fixed spread without widening even when volatility is abnormal and there is a deficit of liquidity, which is supplied by Barclays, UBS, Dukascopy, and Credit Suisse banks. The broker's markup is already included in the fixed spread. The ECN (Electronic Communication Network) model offers the best minimum floating spread. Users' trades are entered through the end-to-end method into the Currenex network, which unites millions of traders and market makers. The Depth of Market built into the JForex platform allows you to see the volume of the market at individual price levels and trade at the best prices.

NSFX by the numbers:

-

Floating spread for the EUR/USD pair is from 0.5 pips (five-digit quotes). Spreads for exotic pairs and cross-rates are from 1.1-1.3 pips;

-

90% compensation of up to €20,000, which is how much traders will receive in case of force majeure from the insurance fund of the Malta regulator.

NSFX is a reliable broker for calm trading

The mission of NSFX is based on three prongs, which are: success in the financial markets depends on the implementation of innovative solutions, the development of new trading instruments, and the provision of quality services. Taking into account the almost complete absence of negative reviews, the company manages to cope with the task.

In addition to the classic MT4 platform, NSFX offers the JForex platform with the possibility of opening an ECN account with floating spreads. Its language is Java, which can be used to write users’ indicators and expert advisors. The platform works with Linux OS. It has more than 200 built-in basic indicators and graphical instruments, a tester for algorithmic trading systems, and more than 5 chart types. Also, non-standard market and pending order types have been added.

Useful services offered by NSFX:

-

Guardian Angel. The Guardian Angel system is a support add-on for MT4. Its task is to simplify user control over individual trading processes, such as changes in volatility, deposit and margin levels, changes in trading performance, and spread widening;

-

Economic calendar. It provides information about major future market events;

-

Fundamental analysis from NSFX experts. It is a brief overview and daily forecast for the main trading instruments.

Advantages:

Account types for different trading styles with fixed and floating spreads.

Hedging and trading using algorithmic systems is allowed;

Relatively small spreads and fees;

Transparent trading conditions;

Order execution speed is up to 50 ms.

A daily free analysis of the main trading instruments subject to the market mood is available.

Guide on how traders can start earning profits

NSFX offers 3 account types. MT4 provides two account types. They are STP with a fixed spread account and ECN with a floating spread account. JForex provides 1 floating spread account. The maximum leverage for all accounts is 1:50.

Account types at NSFX:

To gain experience and test strategies, a demo account with free registration without verification is provided.

NSFX is a broker that combines STP and ECN order execution technologies. It is recommended for all strategy types including scalping, swing trading, and long-term investing.

Investment Education Online

The NSFX website provides a separate section with training materials and analytics. There are answers to the most frequently asked questions, a trading base, courses, and eBooks.

It is possible to apply the acquired knowledge on a demo account. Registration is free and takes up to 10 minutes; verification is not required.

Security (Protection for Investors)

NSFX is focused on traders from Europe, the CIS countries, and the Asian region. The company is licensed by 6 European regulators: MFSA (Malta), BaFin (Germany), ACP (France), Consob (Italy), CNMV (Spain), and FINANSTILSYNET (Denmark). These licenses indicate that the broker is constantly checked by an independent audit and regulators for compliance with local laws, financial reporting standards, and for the fulfillment of its obligations to its clients. NSFX operates in accordance with the European MiFID directives (Markets in Financial Instruments Directive) I and II. The purpose of the directive is to ensure transparency, competitiveness of companies, reduce and diversify clients’ risks, and protect the interests of traders.

👍 Advantages

- Cross-checks by multiple regulators with different requirements

- NSFX is licensed by BaFin (the Federal Financial Supervisory Authority), a regulator that is considered the second after FCA (the Financial Conduct Authority) (UK) in terms of rigidity of requirements for brokers and freedom of authority

👎 Disadvantages

- Difficulty in filing a complaint by a private investor. Regulators consider collective complaints, while private complaints can be referred to an ombudsman

Withdrawal Options and Fees

-

NSFX withdraws funds at the request of a trader without any restrictions on the withdrawing amount and the number of applications;

-

Currency for deposit and withdrawal of funds is USD, EUR, and GBP. If deposit currency differs from the account currency, conversion is possible at the broker's internal rate;

-

There are no fees for funding accounts or for withdrawal of profits to bank cards. The fee for withdrawing to Skrill and Neteller is 2.9%. Check with the broker's support service whether this payment is a fee of the payment system;

-

Funding of accounts is instant, regardless of the payment system. Bank transfer takes up to 10 days;

-

Withdrawal of profits takes up to 2 business days.

Customer Support Service

You can contact the broker’s support team at any time except for days off and holidays.

👍 Advantages

- None

👎 Disadvantages

- No response from support in a live chat

The broker provides the following communication channels:

-

email;

-

live chat on the broker's website;

-

phone numbers listed on the website.

It is better to contact a personal manager after verification, but not the support without registration.

Contacts

| Foundation date | 2010 |

| Registration address | 168 St Christopher Street, Valletta VLT 1467, MALTA |

| Regulation |

MFSA, FCA, BaFin, ACP, Consob, CNMV Licence number: IS/56519, 595195, 131055, 74397, 3597, 3354 |

| Official site | nsfx.com |

| Contacts |

Email:

support@nsfx.com,

Phone: (+44) 330 8080 098, (+34) 9 3220 0491, (+49) 696 4350 0009 |

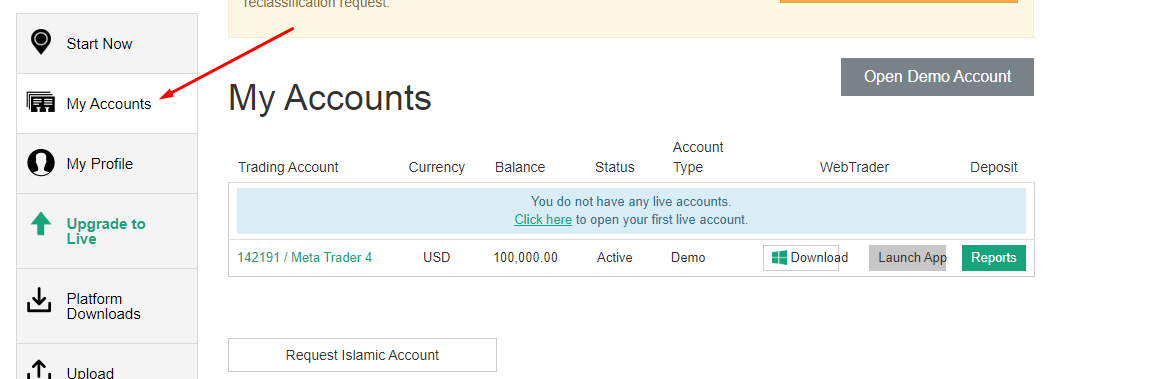

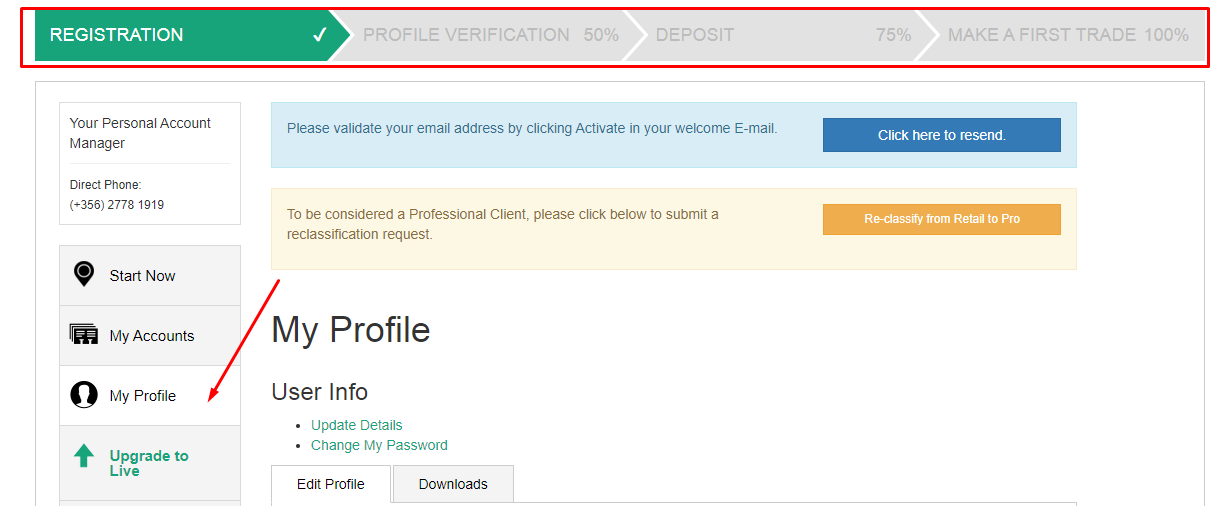

Review of the Personal Cabinet of NSFX

To start trading with NSFX register on Traders Union’s website, where you will find a referral link. Follow it to the broker's website. It is free and will allow you to save on trading expenses in the future by receiving partial reimbursements for expenses.

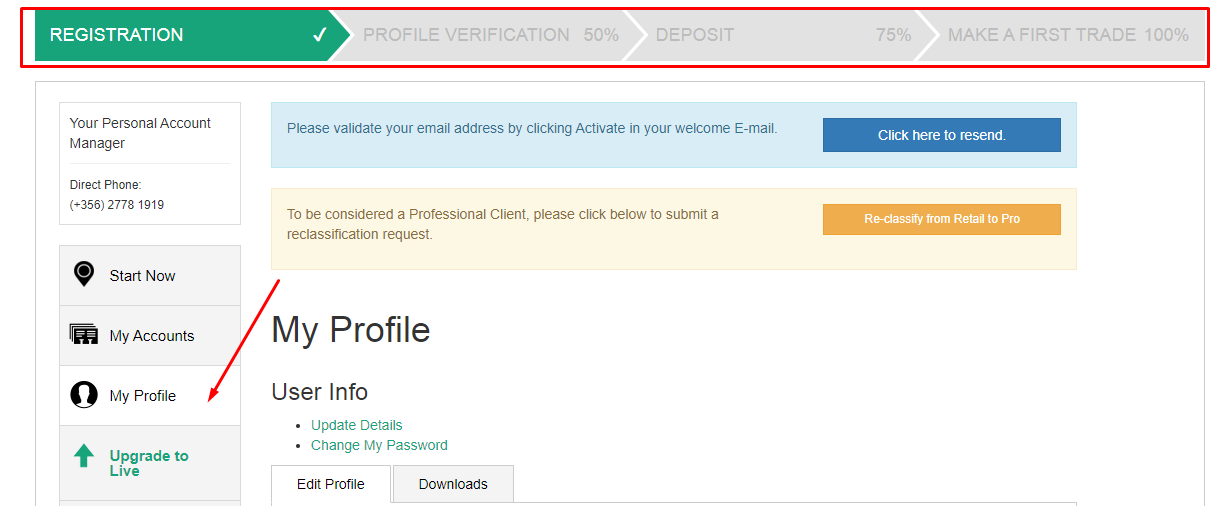

The procedure of opening an account with NSFX:

On the main page of the NSFX website, click the Open Live Account or the Open Demo Account buttons. These options are also available on other pages.

Fill out the registration form with your first and last names, email address, and phone number. Also, select the account type and currency. If you open a live account, enter reliable data only, this way you will avoid problems with subsequent verification.

Services of the NSFX user account:

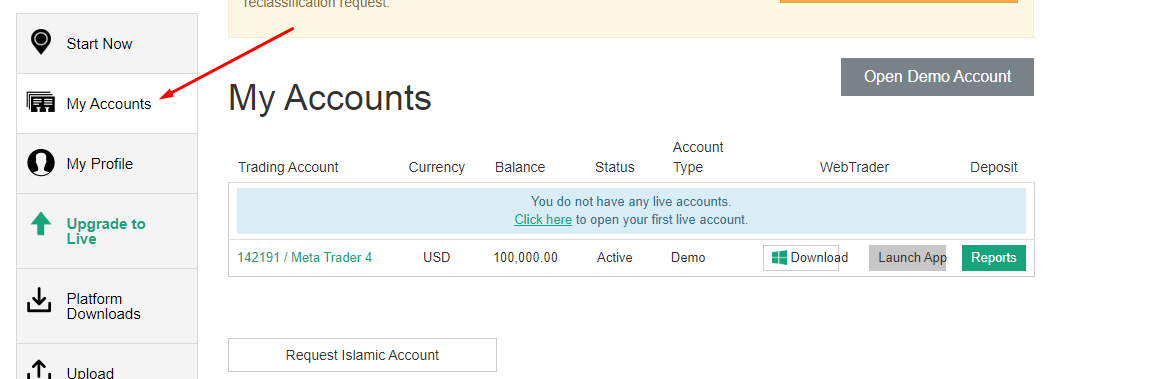

1. Account management. You can open and close accounts, and view the history of invoices:

2. Profile management. You can change your personal data, upload files, and get verified:

1. Account management. You can open and close accounts, and view the history of invoices:

2. Profile management. You can change your personal data, upload files, and get verified:

Available opportunities in the user account:

-

Download platforms for any OS, mobile, and stationary devices;

-

Access to the Academy training section;

-

Access to Trading Central analytics and the economic calendar;

-

Deposit management: withdrawal of profits, review of statistics, and internal transfers.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

Do reviews by traders influence the NSFX rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about NSFX you need to go to the broker's profile.

How to leave a review about NSFX on the Traders Union website?

To leave a review about NSFX, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about NSFX on a non-Traders Union client?

Anyone can leave feedback about NSFX on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.