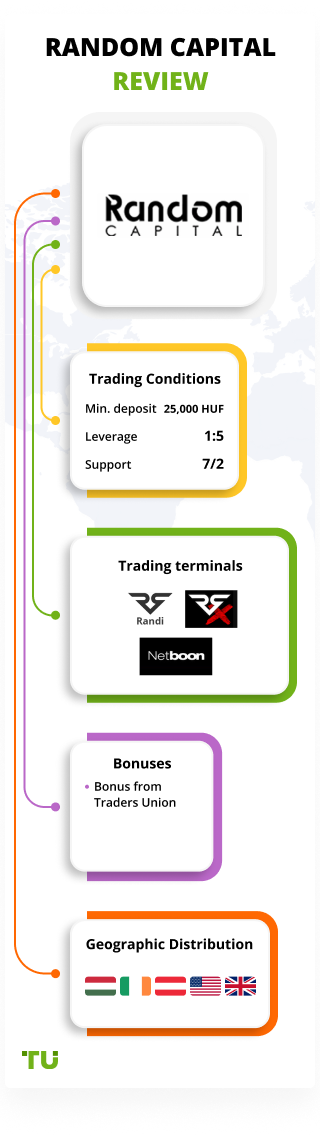

deposit:

- 25,000 HUF

Trading platform:

- Randi (Random Interface)

- Netboon

- Mobil Broker

Random Capital Review 2024

deposit:

- 25,000 HUF

Trading platform:

- Randi (Random Interface)

- Netboon

- Mobil Broker

- Up to 1:5

- Investment instruments in the form of government bonds are available

Summary of Random Capital Trading Company

Random Capital is a broker with higher-than-average risk and the TU Overall Score of 4.3 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Random Capital clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Random Capital ranks 78 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Random Capital is a broker for clients with different needs. The broker offers terms both for investors who choose long-term trading strategies and for traders who prefer intraday trading.

Random Capital is a Hungarian stockbroker that provides services on the local and international markets. The Company has been operating for over 10 years. The main trading instruments of the broker are securities, stocks, ETFs, and futures. The broker's trading terms and capabilities of its trading platforms allow clients to trade intraday, as well as to make transactions using a long-term investment strategy. Since its creation, Random Capital has earned the "Excellent Hungarian Content" (2010), "The Salesman of the Year in the Futures Market” (2010) by Péter Móri", and the "Netboon Home Equity Trading Platform of the Year" (2017) awards.

| 💰 Account currency: | HUF, USD, EUR |

|---|---|

| 🚀 Minimum deposit: | HUF 25,000 |

| ⚖️ Leverage: | Up to 1:5 |

| 💱 Spread: | Fixed |

| 🔧 Instruments: | Stocks, ETFs, futures, investment certificates, securities: bonds, bills |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Random Capital:

- A wide range of trading and investment instruments.

- The broker offers a trading account, as well as a savings and investment account.

- The Random Capital terms are focused on clients with short-term and long-term strategies.

- The company offers a section with useful training materials and webinars.

- The company has an offline office.

- You can trade at Random Capital from any device: starting with your computer to your smartphone.

👎 Disadvantages of Random Capital:

- Only two methods of deposits and withdrawals are available.

- The broker doesn’t provide information about the license or regulation.

- There are no ways to get passive income such as through investments, bonuses, affiliate programs).

Evaluation of the most influential parameters of Random Capital

Table of Contents

Geographic Distribution of Random Capital Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Random Capital

Random Capital is a Hungarian stockbroker which has been providing its services for over 10 years. Any adult Hungarian resident can become a client of the company, residents of other countries should contact the broker's support service to open an account.

Random Capital offers a variety of instruments, including securities in the form of government bonds and bills, as well as stocks, futures, and exchange-traded funds. In total, Random Capital offers about 4,500 trading instruments. It offers its Randi desktop trading platform, its web terminal Netboon, and a Mobil Broker application for smartphone and tablet trading. The commission at Random Capital is fixed, but depends on the time of the trade (intraday or out) and also on the market in which the trade was made — American, European, or Hungarian. Intraday trading and long-term investment opportunities are available at Random Capital.

Users can make trades only by themselves since the platform, including PAMM accounts, other services, copy trades, and trust management are not provided at Random Capital.

Dynamics of Random Capital’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Random Capital is a stockbroker that allows users to profit from price fluctuations intraday, as well as to invest by choosing a longer-term strategy. However, the broker doesn’t provide services for passive income. Copy trades services, managed accounts, PAMM accounts, and other ways to earn without trading are not available at the company. Random Capital is focused on investors and traders who prefer independent money management.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Random Capital’s affiliate program:

The broker doesn’t offer extra income for attracting new users either. There is no referral program at Random Capital, which usually allows traders to get extra funds or reduce commission costs.

Trading Conditions for Random Capital Users

The Random Capital focus is on providing access to domestic (Hungarian) and international stock markets. The broker's clients get the opportunity to buy and sell stocks, bonds, futures, investment certificates, and exchange-traded funds. These instruments are available for both long-term investments and intraday trading. Random Capital provides investors with two types of trading platforms and a mobile app. Leverage at Random Capital doesn’t exceed 1:5. There are three trading accounts in the company such as standard (for active trading), investment, and retirement. Only adult users can open an account. Minors can have an account only if the account came into their possession by will. Hungarian forints, American dollars, and euros are the base currencies of the account. Deposits and withdrawals via e-payment systems are not available. Programs for passive income are not available at Random Capital, nor are affiliate and bonus programs.

25,000 HUF

Minimum

deposit

1:5

Leverage

7/2

Support

| 💻 Trading platform: | Randi (Random Interface), Netboon, Mobil Broker |

|---|---|

| 📊 Accounts: | Real, Long-Term Investment Account (TBSZ); Savings Retirement Account (NYESZ) |

| 💰 Account currency: | HUF, USD, EUR |

| 💵 Replenishment / Withdrawal: | Bank transfer, SWIFT |

| 🚀 Minimum deposit: | HUF 25,000 |

| ⚖️ Leverage: | Up to 1:5 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | Fixed |

| 🔧 Instruments: | Stocks, ETFs, futures, investment certificates, securities: bonds, bills |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Investment instruments in the form of government bonds are available |

| 🎁 Contests and bonuses: | Yes |

Random Capital Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Real | From $2 | From 0.1% per transaction |

| Long Term Investment Account (TBSZ) | From $2 | From 0.1% per transaction |

| Savings Retirement Account (NYESZ) | From $2 | From 0.1% per transaction |

There is no commission for transferring a position to the next trading day, but the level of fees for intraday order closing is slightly lower.

Analysts at the Traders Union compared Random Capital with other popular brokers according to the "size of trading fees". The results of the comparison are below.

| Broker | Average commission | Level |

| Random Capital | $2 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of Random Capital

Random Capital is a European stockbroker, which is mainly focused on cooperation with investors and traders from Hungary. However, residents of other countries can also open a trading account with the broker upon contacting client support. The company specializes in providing access to the Hungarian, American, and European stock markets.

Random Capital by the numbers:

-

The company has been providing financial services for over 10 years.

-

Investors have access to 3 basic account currencies.

-

The minimum deposit with a broker is 25,000 HUF.

-

Account maintenance, terminal usage, and deposit fees are 0 HUF.

-

Any Random Capital account can have only one owner.

Random Capital is a broker for active trading and long-term investments

Random Capital offers securities (bills, bonds), investment certificates, local and international equities, ETFs, and futures as trading instruments. All of these instruments are available to the user, regardless of the type of account. Trading and money management shall be made solely by the owner of the account: Random Capital doesn’t offer an account management service. The broker's terms are designed for active investors and traders who are ready to trade on their own. Services for passive income are not provided in the company; but educational materials are provided for novice investors to help them master the basics of trading on the stock market.

Trading operations are carried out on Random Capital's proprietary platforms: Randi (Random Interface) and Netboon. The terminals are offered as a web version and desktop application. Tools for market analysis are built into the platforms, and there is no charge for their use. Trading from mobile devices is possible via its Mobil Broker application, which is available for Android, Windows, and iOS.

Useful services of Random Capital:

-

RandomReggeli. This is a daily morning mailing service that allows investors to stay informed about events and news in the stock market. You can unsubscribe if you wish.

-

GYIK (FAQs). The section contains answers to frequently asked questions about account opening, deposits, withdrawals, and the specifics of each type of account, etc.

-

Elemzesek. This section provides technical analysis of shares of different markets such as Hungarian, American, and European.

Advantages:

You can open an account both online and offline.

The broker allows for trading and investment, plus pension savings.

The company offers both local instruments and international instruments.

Random Capital provides two trading platforms to choose from and a mobile app is also available.

Investors' funds are safe because the broker cooperates with the Investor Protection Fund.

The broker provides information for learning the basics of the stock market.

The trading terms at Random Capital are designed for both day traders and investors who prefer long-term strategies.

How to Start Making Profits — Guide for Traders

Random Capital is a Hungarian broker and the main target audience is investors and traders from that country. However, residents of other countries can also open a trading account with the company.

Account types:

There are no demo accounts for account management at Random Capital. But the broker allows you to enter the platform in demo mode, so the investor can see the dynamics of trading with a delay of 15 minutes. The data is delivered without delay when logging in from a real trading account.

If you are not a resident of Hungary, please contact the broker's support service to open a trading account.

Bonuses Paid by the Broker

Random Capital is a stockbroker that allows investors for capital growth, high-quality tools, and a convenient trading platform. However, the company doesn’t provide bonuses for registration, deposit, and other non-trading operations. Investors can rely only on their own capital, and, if necessary, use leverage.

Investment Education Online

Random Capital provides its users with information for self-education. In particular, the broker's website has several webinars on basic topics that investors need to know. However, there are not many materials at Random Capital, and many of them were published 2-3 years ago, which can affect the relevance of the data.

The Random Capital broker doesn’t provide a demo account for trading but allows users to enter the trading platform in demo mode to follow the dynamics of trading on the Budapest Stock Exchange. Data will be made available with a 15-minute delay. The broker's clients who have opened an account will have access to the data in real-time.

Security (Protection for Investors)

The company has been providing financial services for over 10 years. The broker is a member of the Investor Protection Fund, which means that funds up to €100,000 are protected. There is no information about the license of the broker and the regulatory bodies of Random Capital.

To protect personal data, a two-factor authentication procedure is required. To log into the account, confirm the login using a code sent to your phone by SMS. Login confirmation is required only once a day.

👍 Advantages

- The broker is a member of the Investor Protection Fund

- Customers' personal data are protected by two-factor authentication

- There is a section on the broker's website with documents regarding its complaint policy, dispute resolution, etc.

👎 Disadvantages

- Broker doesn’t provide data on licensing and regulatory authorities.

- Random Capital doesn’t use segregated accounts

Withdrawal Options and Fees

-

You can deposit money at Random Capital in the following ways: bank wire transfer (for transactions in HUF), SWIFT-transfer (for transactions in USD and EUR).

-

The crediting funds period depends on the payment system workload. As a rule, bank transfers are credited to the account within a day.

-

Users of Random Capital can transfer not only fiat currencies but also securities to their accounts.

-

The broker doesn’t charge for deposit replenishment. There is a fixed fee for the withdrawal: from 0.1% to 0.2%. The fee varies depending on the currency and account to which the transaction is made.

-

To work with a broker verification is required, so all transactions (both deposit and withdrawal) are made only after the confirmation of the client’s personal data.

Customer Support Service

The broker’s support service is a reliable way to quickly and efficiently solve clients' problems and answer their questions. Users of Random Capital can ask for help from the broker's support online or visit the office, the reception is held every week on Tuesday and Thursday, from 9 AM to 4 PM. Before visiting the office, please clarify with the support the exact time of the meeting.

👍 Advantages

- The broker offers different ways to communicate

- There is an opportunity to visit the office of Random Capital

- Help is available to both clients of the broker, as well as visitors to the website who do not yet have an account with the company

- The website offers a FAQs section.

👎 Disadvantages

- No data on support service opening hours

- There is no online chat.

There are several ways to contact client support specialists:

-

by writing an email;

-

by a phone call;

-

by sending a fax;

Investors and clients who wish to open an account at Random Capital can also visit the broker's offline office.

Contacts

| Foundation date | 2018 |

| Registration address | 1138 Budapest, Népfürdő u. 24-26 |

| Official site | https://randomcapital.hu/ |

| Contacts |

Email:

info@randomcapital.hu,

Phone: 06-1-501-3300 |

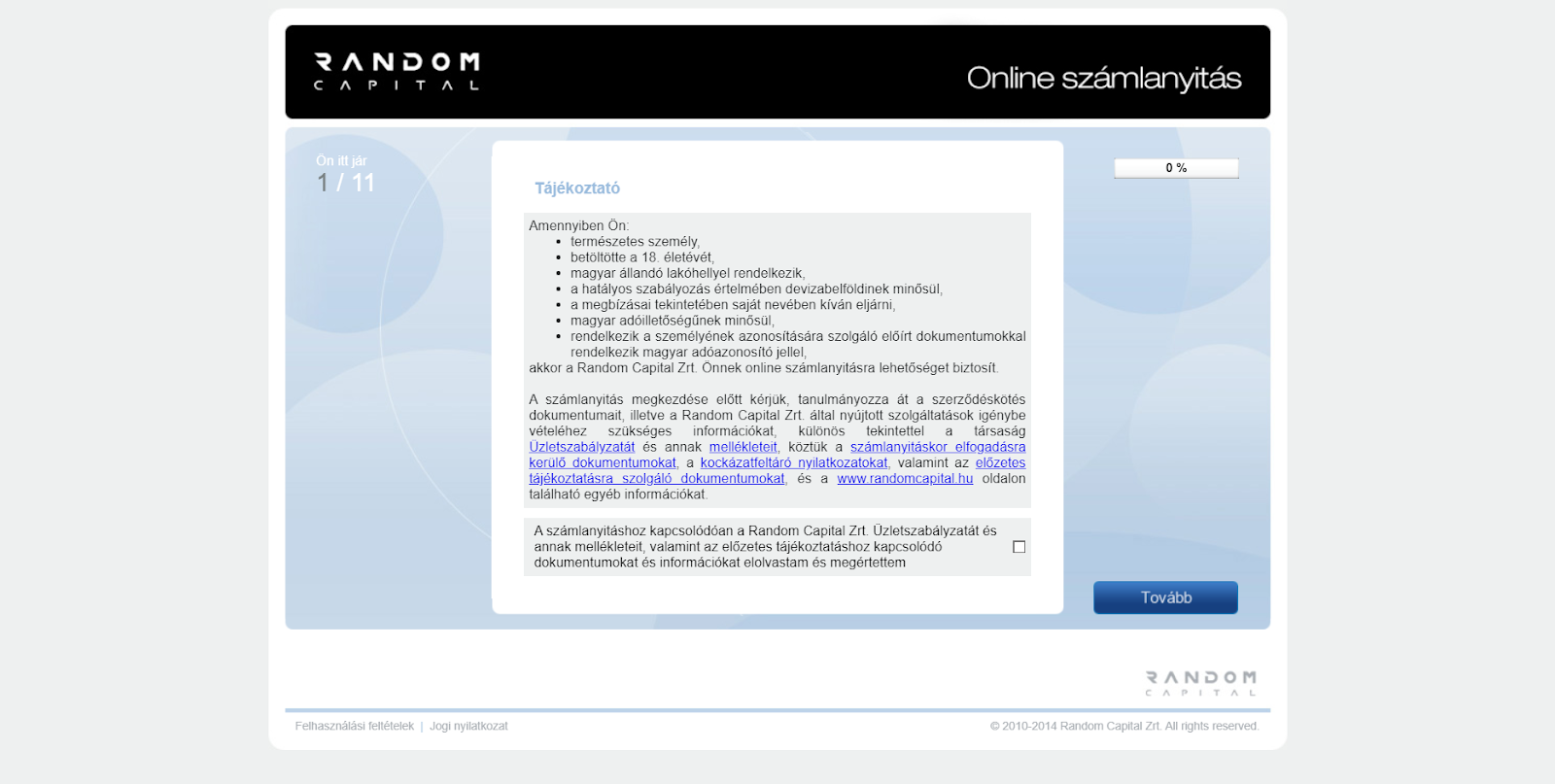

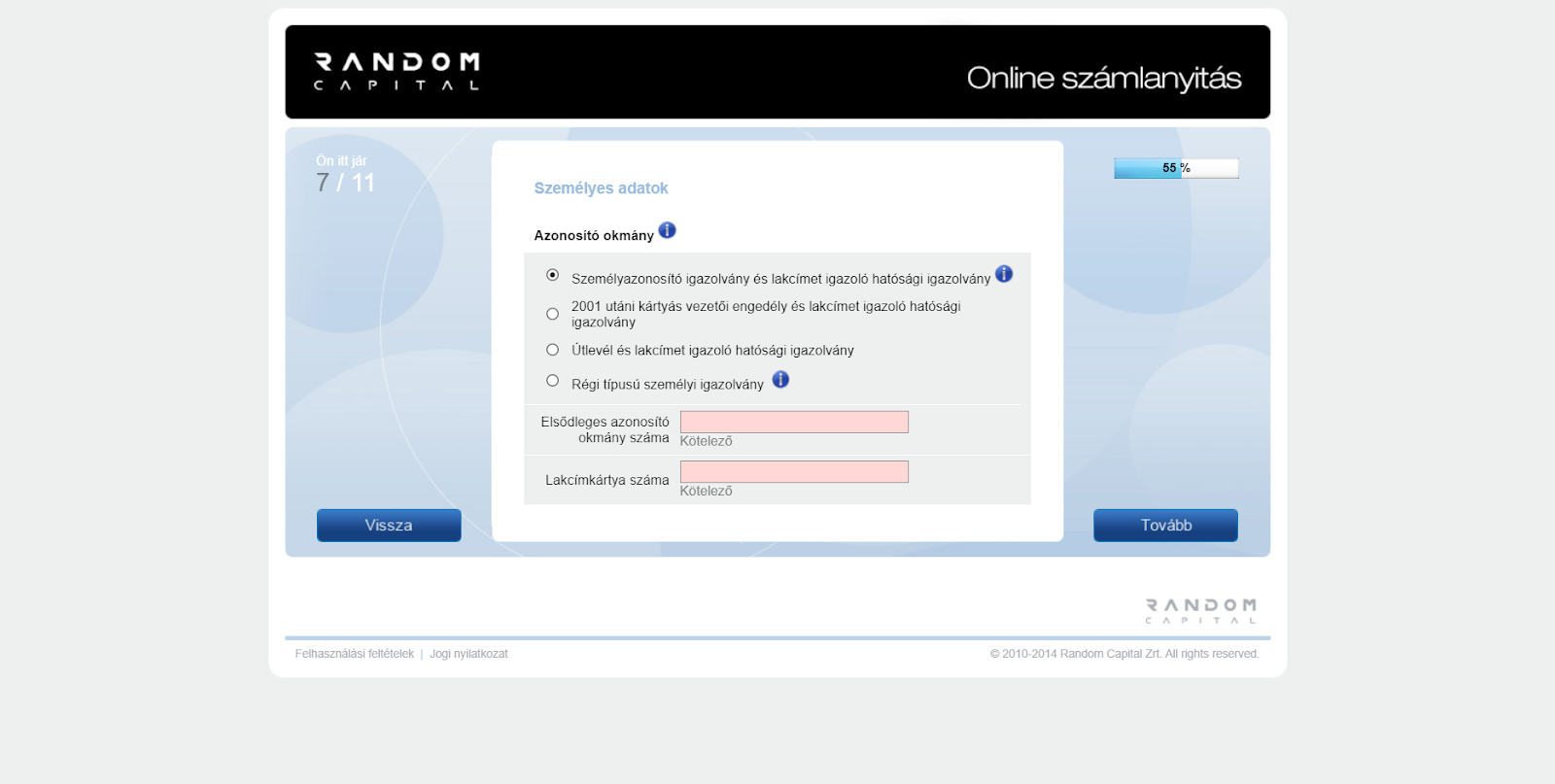

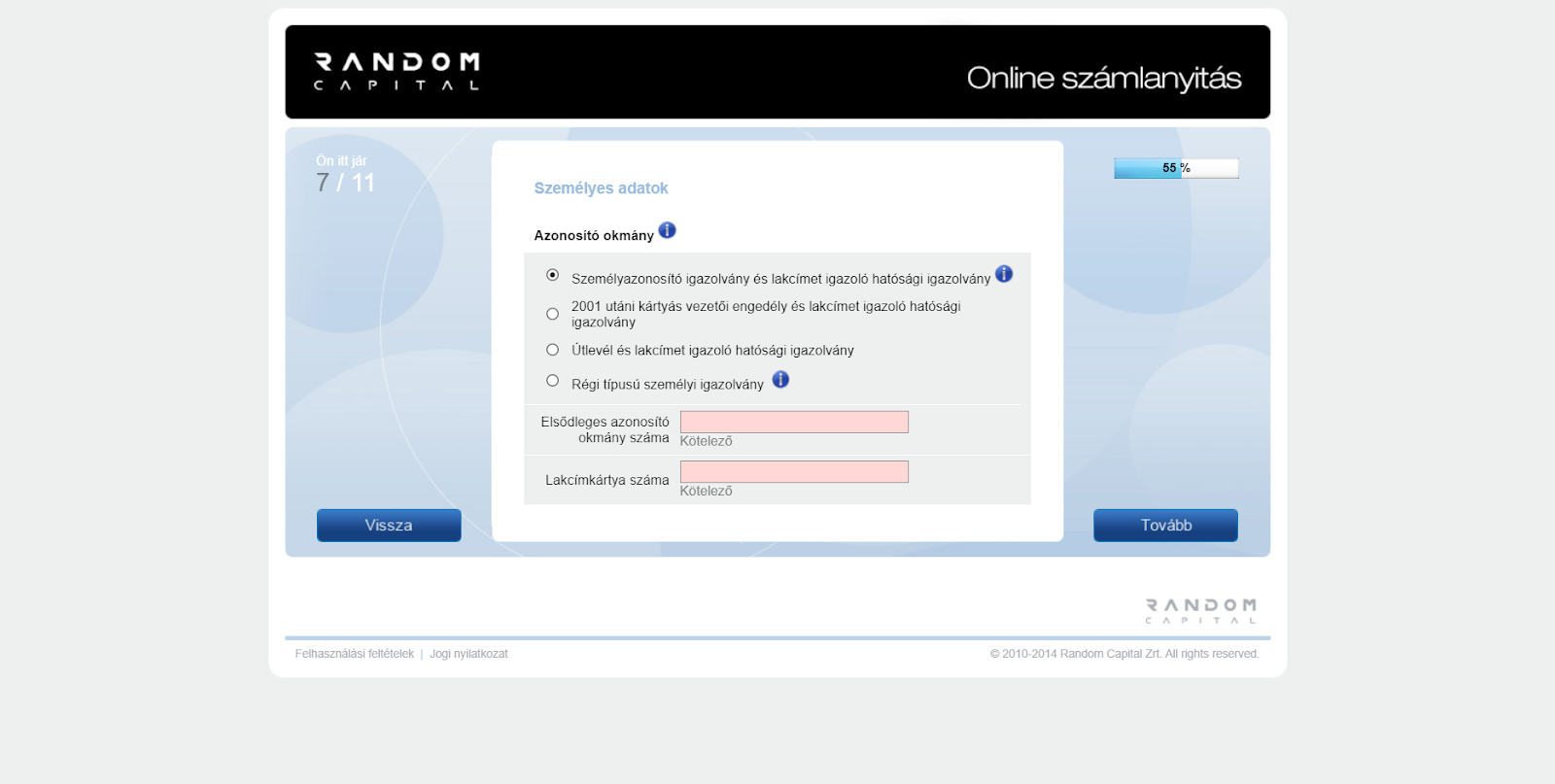

Review of the Personal Cabinet of Random Capital

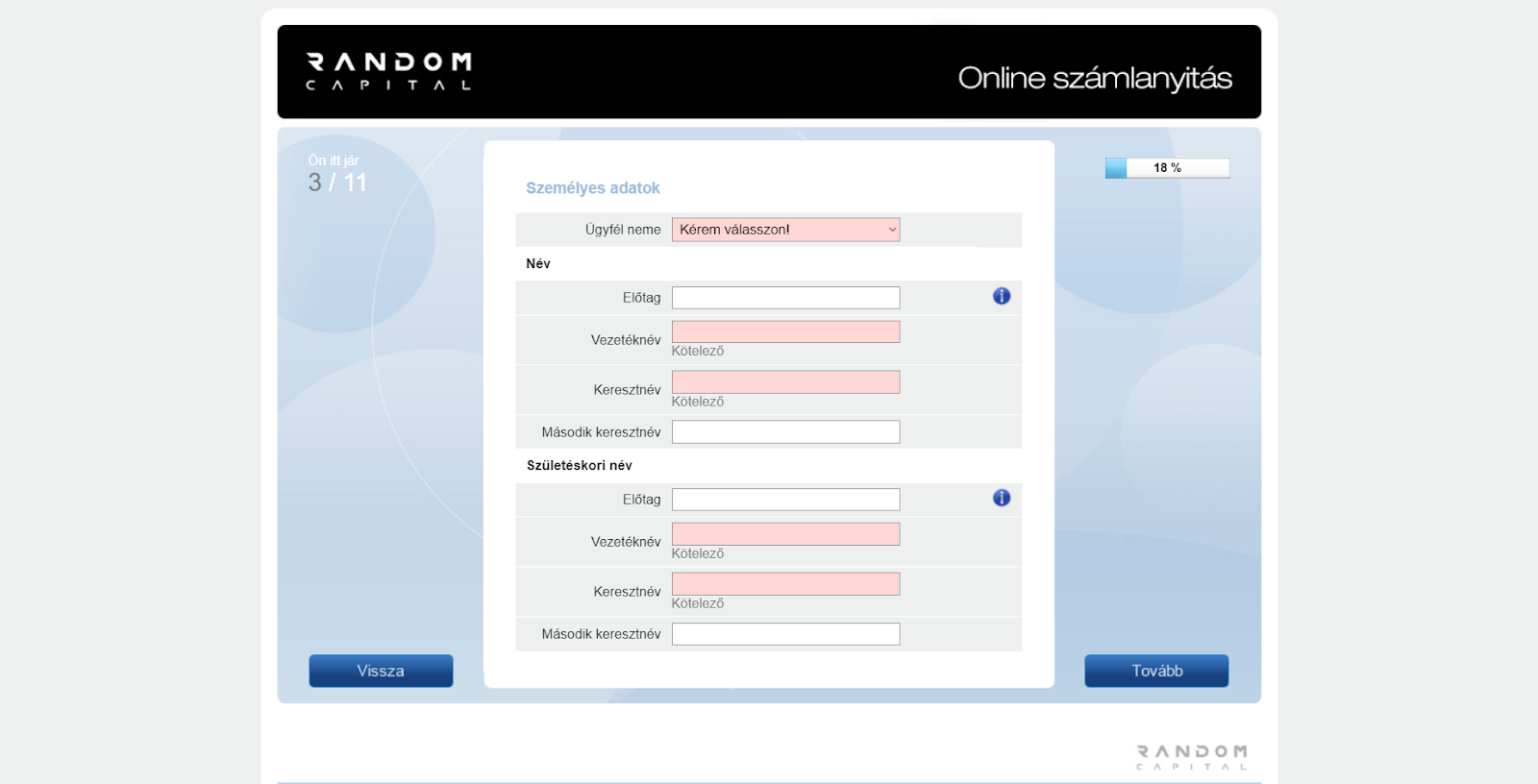

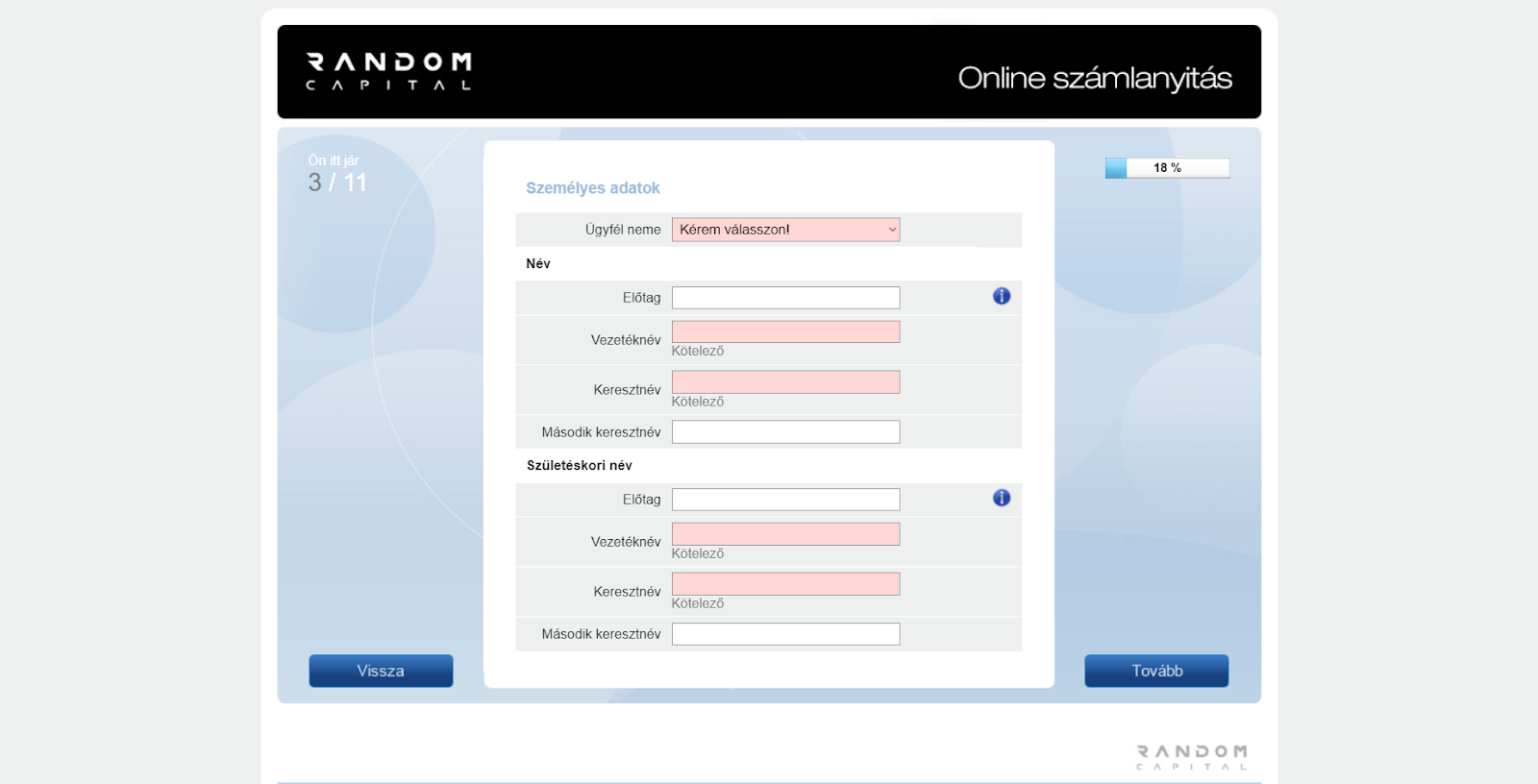

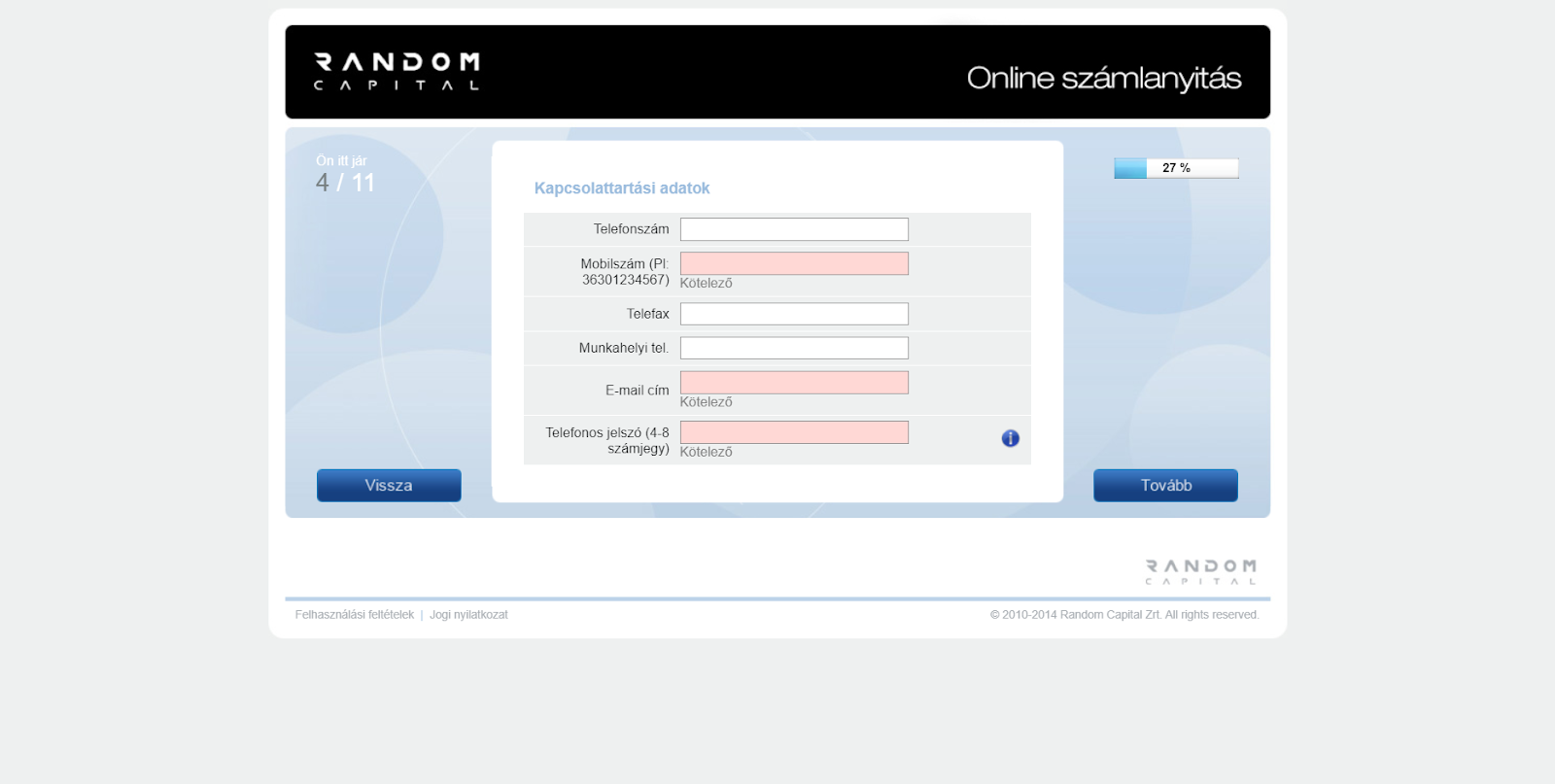

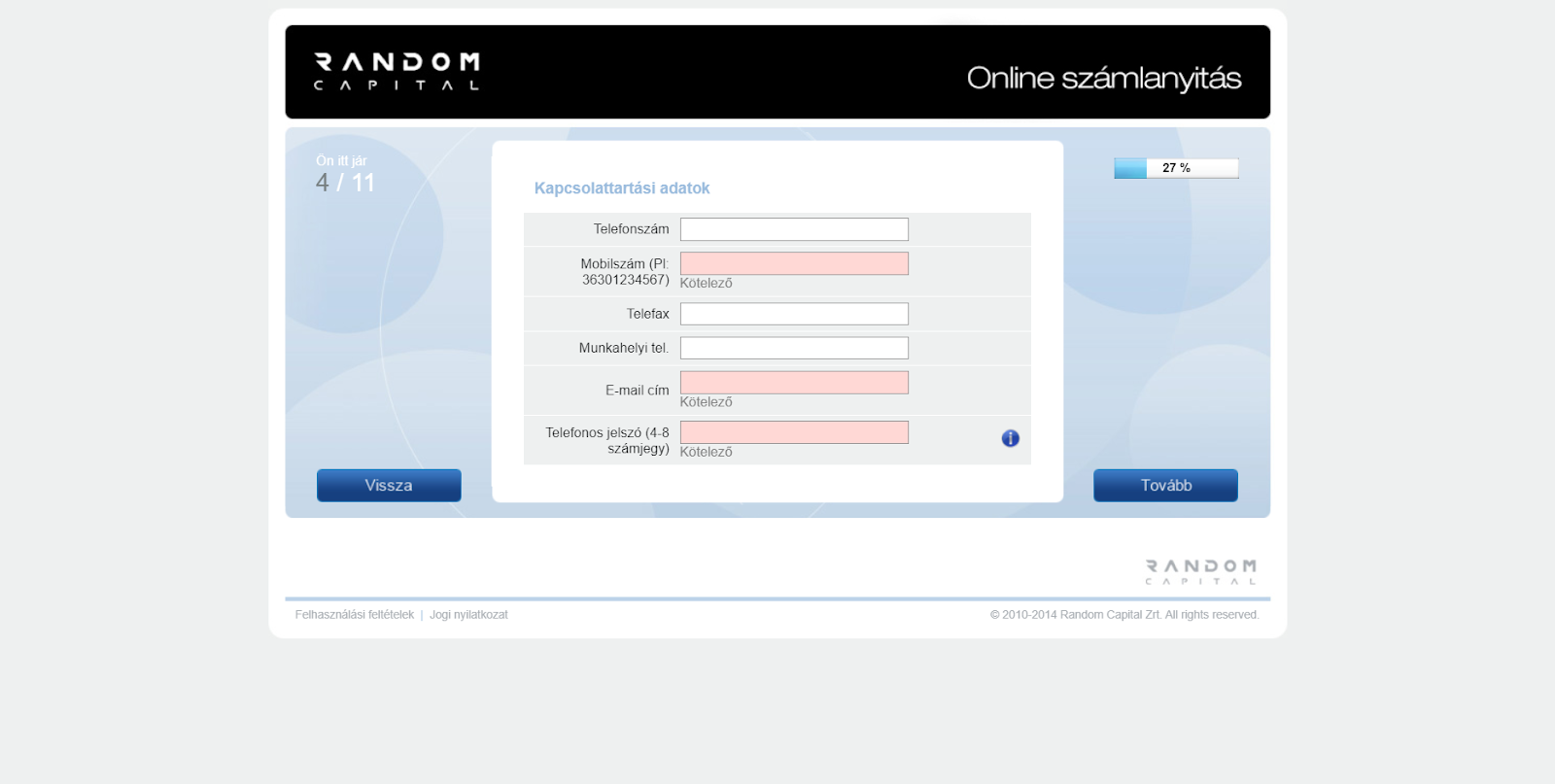

Access to trading instruments is only available after opening a trading account at Random Capital. The broker offers customers two ways to open an account: in the office of the company or online. Since the broker's office is open for a limited number of hours, below is a step-by-step instruction to open an account online.

Follow the official website of the broker. To get started, click on the "Open an account" button in the upper right corner of the screen, highlighted in orange.

Confirm that you are a resident of Hungary, are at least 18 years old, and have all the documents necessary to register with Random Capital.

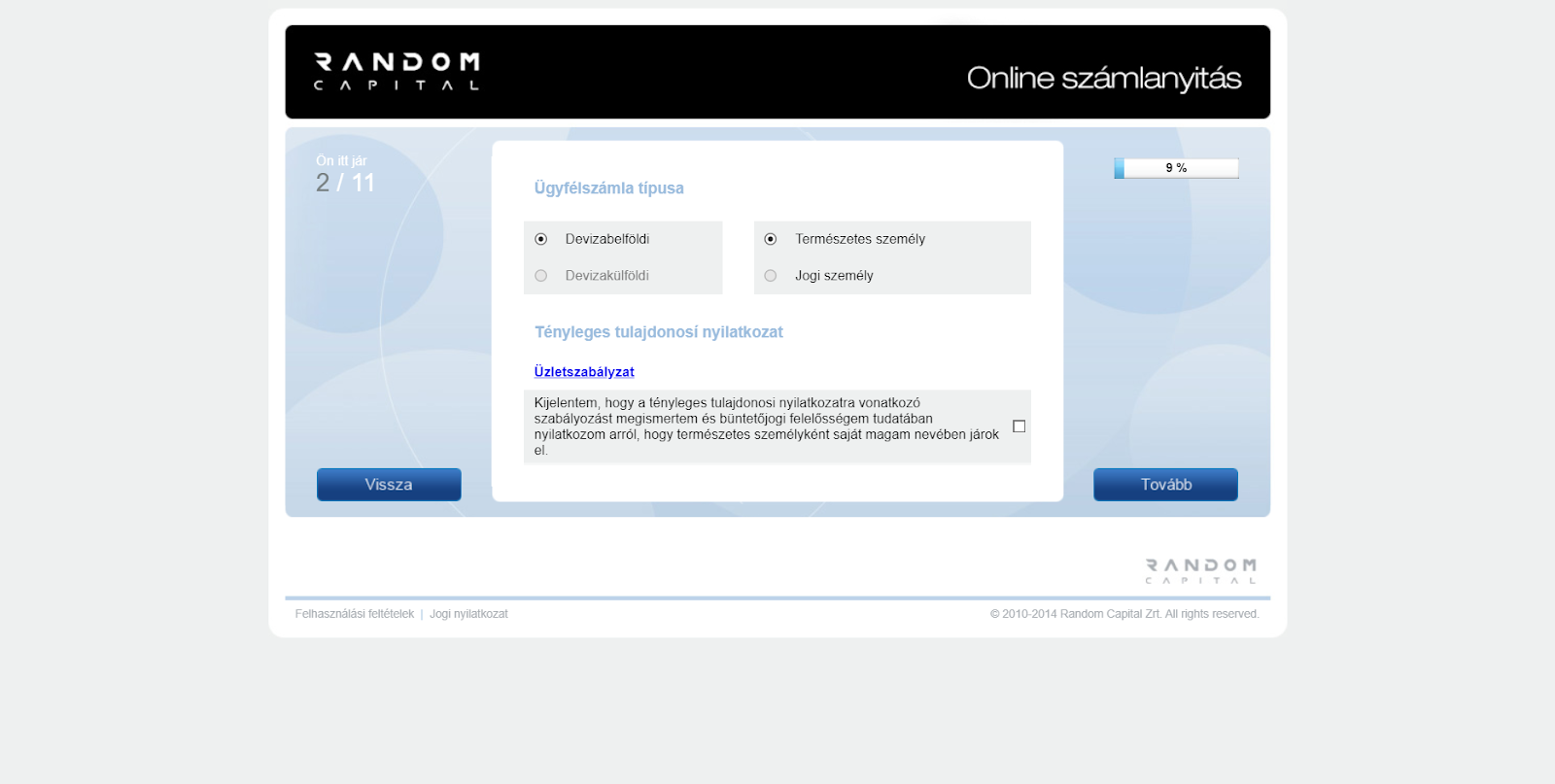

Select the type of account, read the declaration of ownership policy, and confirm that you are acting as a responsible individual.

Enter personal information: full name and sex. The fields marked in red are required.

Provide your contact information: phone number, fax number, office phone number, email address, password.

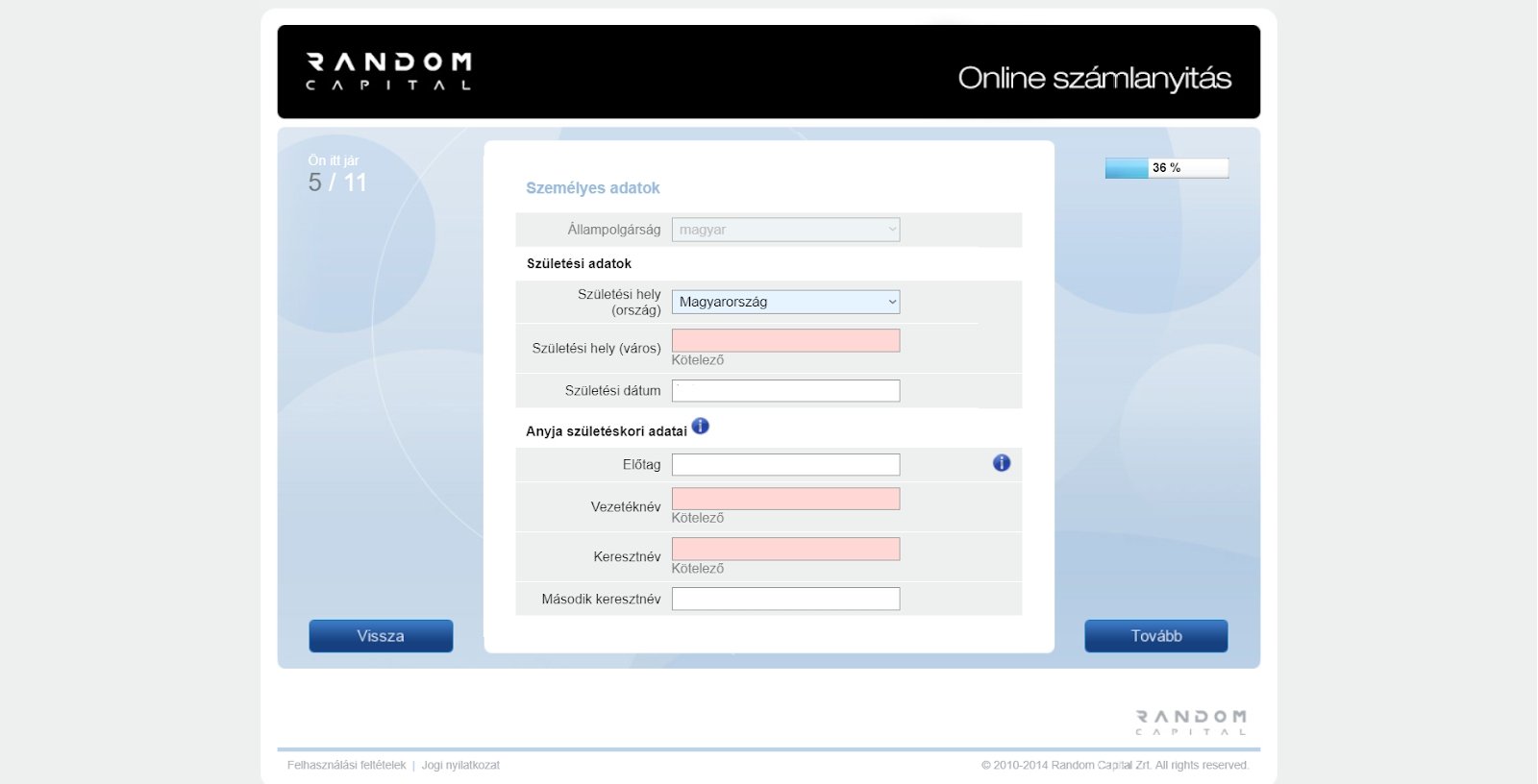

Fill in the questionnaire with extended personal data: specify your nationality, country, city, and date of birth. Enter your mother's full name.

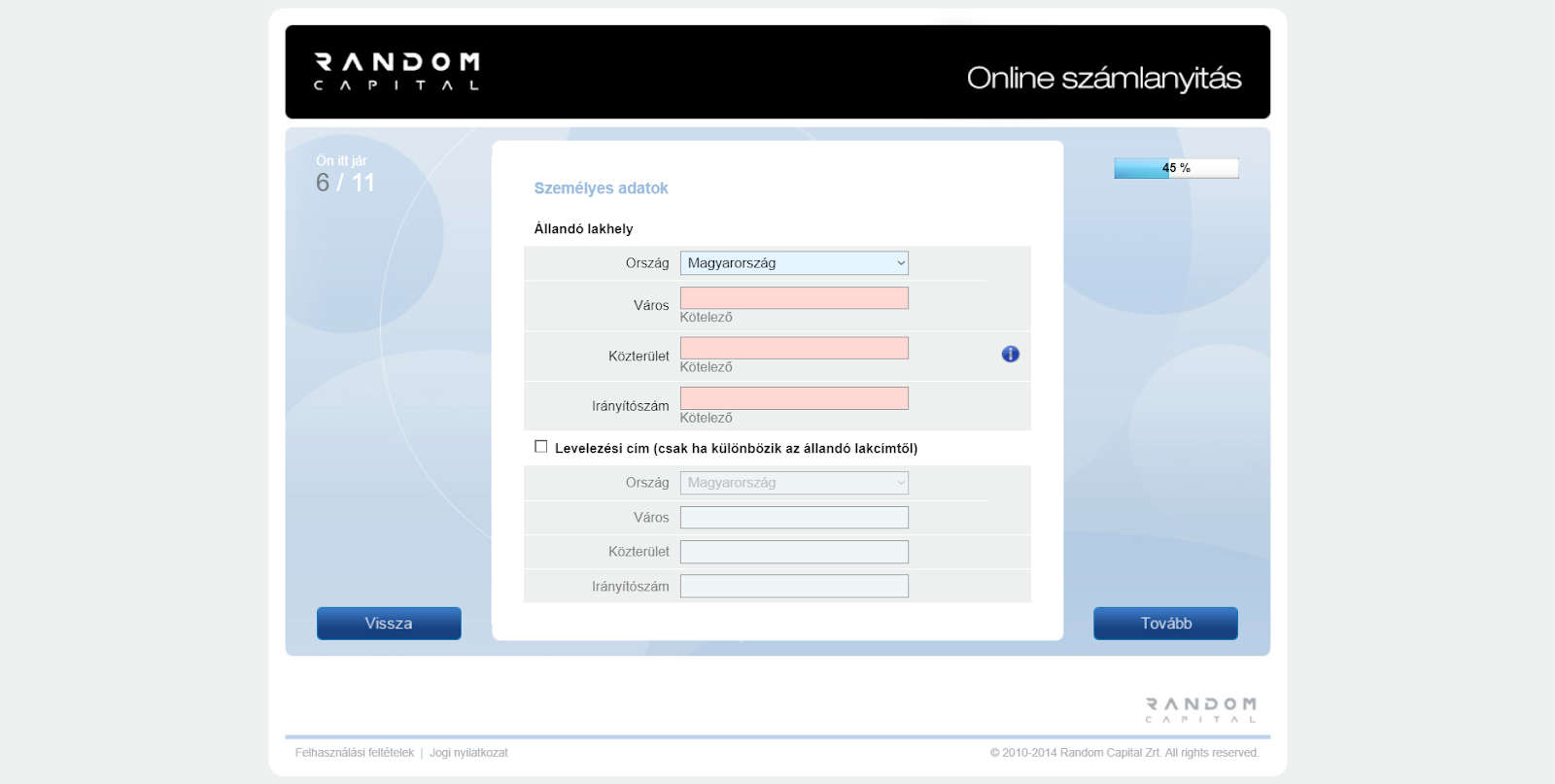

Provide detailed information about your place of residence: enter your country, city, residential address including street, house and apartment number, and zip code. If you don’t reside in Hungary, please contact the support team. Opening an account online is only available for residents of Hungary.

Provide information about your identity documents. Select the appropriate type of document and indicate its number.

In your user account on the site of Random Capital you will have access to these sections:

-

Financial history and statistics.

-

Personal information and verification.

-

Trading accounts and trading history.

-

Training section.

-

Customer service.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Random Capital rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Random Capital you need to go to the broker's profile.

How to leave a review about Random Capital on the Traders Union website?

To leave a review about Random Capital, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Random Capital on a non-Traders Union client?

Anyone can leave feedback about Random Capital on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.