deposit:

- $2000

Trading platform:

- Zacks Trader

- Zacks Trade Pro

- Handy Trader

- Tablet Trader

- Client Portal (Web)

- FINRA

- SIPC

Zacks Trade (ZacksTrade) Review 2024

deposit:

- $2000

Trading platform:

- Zacks Trader

- Zacks Trade Pro

- Handy Trader

- Tablet Trader

- Client Portal (Web)

- Up to 2:1 for overnight trades, up to 4:1 for day trading, up to 6:1 for Portfolio Margin

- Portfolio Margin is available, zero withdrawal fee on the first withdrawal of the month, residents of different countries can open investment accounts

Summary of Zacks Trade Trading Company

Zacks Trade is a moderate-risk broker with the TU Overall Score of 5.26 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Zacks Trade clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Zacks Trade ranks 46 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Zacks Trade is a broker that offers its clients a wide selection of US stocks, funds, options and bonds, and also access to the foreign stock market.

Zacks Trade is a stock broker headquartered in Chicago. The company has been providing investment services and quality analytical research since 1978. It is a division of LBMZ Securities, for which Interactive Brokers provides clearing and execution services. Zacks Trade is regulated by FINRA (CRD#: 7874/SEC#: 8-23266) and SEC, and is a member of SIPC. The broker offers its clients access to trading securities of the USA, Europe and Asia using proprietary platforms with powerful analysis instruments.

| 💰 Account currency: | USD, EUR, AUD, GBP, CAD, CHF, CZK, DKK, HUF, ILS, NOK, PLN, RUB, SEK, ZAR, CNH, HKD, JPY, NZD, SGD, INR, KRW, MXN, TRY |

|---|---|

| 🚀 Minimum deposit: | From USD 2,000 |

| ⚖️ Leverage: | Up to 2:1 for overnight trades, up to 4:1 for day trading, up to 6:1 for Portfolio Margin |

| 💱 Spread: | from $1 |

| 🔧 Instruments: | Stocks (including Penny stocks and OTC stocks), Options, Bonds, ETFs, Mutual Funds, Warrants, IPO |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Zacks Trade:

- The list of countries, the residents of which can open an account, includes 218 states.

- Wide selection of shares of international markets and quoted at the US stock exchanges.

- Reliable regulation by highly respected regulation authorities FINRA and SEC.

- No account service, inactivity or deposit fees.

- Fully digitalized account opening procedure.

- Over 20 base currencies.

- Access to subscription to professional instruments of research from third party providers and specialists of the broker’s own analytical department Zacks Investment Research.

👎 Disadvantages of Zacks Trade:

- At the moment, the broker’s clients cannot trade cryptocurrencies, futures, commodities and Forex instruments. Only shares are available from the securities of foreign exchanges.

- IRA accounts are available only for US tax residents.

- Funds cannot be deposited to the account using debit/credit cards. Also withdrawals to debit/credit cards are not available.

Evaluation of the most influential parameters of Zacks Trade

Geographic Distribution of Zacks Trade Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Zacks Trade

Initially, Zacks Trade (ZacksTrade) was a research and money management company, but later it started to provide investment services as a dealer-broker. Today, thousands investors from all across the world use the analytics of Zacks Investment Research, as the combination of qualitative and fundamental researches is their top priority.

In addition to extensive analysis, the clients of ZacksTrade (Zacks Trade) have access to stock trading of the US and international securities. The broker has developed its proprietary trading platforms that are compatible with PCs, smartphones and tablets. All platforms support the search feature and price alerts. Mobile apps and desktop Zacks Trade Pro feature IBot, a chat bot that can close orders and promptly supply market data required by an investor.

There are practically no educations materials on the website of Zacks Trade, which indicates that experienced investors are the broker’s target audience. Unlike other US brokers, Zacks Trade does not offer zero trading commissions. At that, the commissions on options and mutual funds are higher than those of the competitors.

Dynamics of Zacks Trade’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Zacks Trade clients can invest in shares (including penny and over-the-counter stocks), options, bonds, ETFs, mutual funds, warrants and IPO.

Portfolio Margin — investing with an increased leverage

Using the portfolio margin, Zacks Trade clients can increase the available leverage above the marginal requirements Reg T. Depending on the trading activity, investors get leverage of up to 6:1. Conditions for using Portfolio Margin:

-

To be eligible for Portfolio Margin, a trader must have at least USD 110,000 in net liquidation value (or an equivalent amount in another currency).

-

You need to maintain at least USD 100,000 account balance to be able to trade with an increased leverage.

-

An investor can switch between Portfolio Margin and Reg T, but after requesting the margin the trader cannot switch to Cash Account.

-

Checking and approval of a Portfolio Margin account takes 24-48 working hours.

Margin portfolio is not available for the US commodity futures, futures options, bonds, mutual funds and currency positions. If the net liquidation value of the portfolio drops below $100,000, the broker does not allow the investor to perform any trades with increased leverage.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Zacks Trade’s affiliate program

At the moment, the broker does not offer its clients partnership programs.

Trading Conditions for Zacks Trade Users

The minimum deposit for Cash Account is $2,500. On the IRA account, the initial investment amount is not set, but it cannot be more than $6,500 per year. Marginal trading is available with an account balance at $2,000. For day trading (more than four intraday trades during five working days), a trader must have $25,000 on their account. The leverage depends on the types of trades. By default, all trading platforms support data streaming with a 15-minute delay. For execution during extended trading sessions – Pre-Market and After-Market, only trigger orders Limit or Stop Limit can be introduced.

$2000

Minimum

deposit

1:6

Leverage

8/5

Support

| 💻 Trading platform: | Client Portal (web platform), Zacks Trader, Zacks Trade Pro, Handy Trader (application for smartphones), Tablet Trader (application for tablets) |

|---|---|

| 📊 Accounts: | Zacks Trade Pro Demo, Margin Account, Cash Account, Traditional IRA, Roth IRA, Rollover IRA, SEP IRA |

| 💰 Account currency: | USD, EUR, AUD, GBP, CAD, CHF, CZK, DKK, HUF, ILS, NOK, PLN, RUB, SEK, ZAR, CNH, HKD, JPY, NZD, SGD, INR, KRW, MXN, TRY |

| 💵 Replenishment / Withdrawal: | Wire transfer, ACH payments, request for a cheque, transfer of assets from another broker (Automated Client Account Transfer) |

| 🚀 Minimum deposit: | From USD 2,000 |

| ⚖️ Leverage: | Up to 2:1 for overnight trades, up to 4:1 for day trading, up to 6:1 for Portfolio Margin |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | from $1 |

| 🔧 Instruments: | Stocks (including Penny stocks and OTC stocks), Options, Bonds, ETFs, Mutual Funds, Warrants, IPO |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Portfolio Margin is available, zero withdrawal fee on the first withdrawal of the month, residents of different countries can open investment accounts |

| 🎁 Contests and bonuses: | No |

Zacks Trade Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Cash Account | from $1 | Charged on the second and following withdrawals within one month |

| Margin Account | from $1 | Charged on the second and following withdrawals within one month |

| Portfolio Margin Account | from $1 | Charged on the second and following withdrawals within one month |

Trades with broker’s involvement are not charged with an additional fee. The company also does not charge inactivity fee and account servicing fee, including IRA.

Traders Union analysts compared trading commissions on options charged by ZacksTrade, Ally and Charles Schwab. The calculation was made based on 10 contracts. All three brokers don’t charge a commission per trade, but charge commission per each contract.

| Broker | Average commission | Level |

| Zacks Trade | $1 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of Zacks Trade

Zacks Trade offers access to investors to trading shares, options, bonds, warrants, IPO, ETFs and mutual funds. Through the broker, the traders can invest in securities of the USA, Asia, Europe, Australia, Canada and Mexico. The company’s clients get free access to professional trading platforms and quality analytics from third party market data providers. The company does not prohibit intraday trading (provided certain conditions are met) and provides a possibility to invest with leverage.

Zacks Trade in figures:

-

Manages assets worth over $5 billion.

-

Services clients from 218 countries.

-

Offers access to trading at 91 exchanges in 19 countries.

-

Provides access to 20 free news and research resources and 80 paid premium-class subscriptions.

Zacks Trade is a broker with a wide range of research instruments

Zacks Trade is targeted at experienced investors, who use professional analytical instruments. The company’s own division titled Zacks Investment Research is the top provider of independent investment research and instruments, such as Zacks Rank, a ranking system. Zacks Investment Research provides information to the clients through several types of free and paid subscriptions. Individual investors have access to Dow Jones and Benzinga Professional news, Morningstar research, Seeking Alpha and Thomson Reuters articles.

The broker’s clients can perform trades via Client Portal, a simple platform Zacks Trader, and Zacks Trade Pro, an advanced and customizable platform with direct access to account management. Access to platforms is granted only after the client makes a deposit. The company also offers applications for iOS, BlackBerry and Android devices: Handy Trader for smartphones and Tablet Trader for tablets. Only trading stocks, ETFs, options and warrants is available on mobile platforms. All platforms support Limit, Market, Relative, Stop, Trailing Stop, Stop Limit market orders.

Useful services offered by Zacks Trade:

-

Market Scanners. Using this service, based on the specified criteria an investor can quickly scan the markets and select the stocks, options, mutual funds and bonds.

-

Algos. These are Zacks Trade Pro Stock algorithms, including the arrival price, volume-based percentage strategy, TWAP and VWAP.

-

Probability Lab. This is an option analysis service without complex mathematical calculations.

-

Basket Trader is a professional instrument of Zacks Trade Pro platform for importing the basket of orders on stocks and their quick execution.

-

Rebalance Portfolio. This feature allows the investors to rebalance their portfolio quickly and easily to meet their investment goals and admissible risk level.

-

SpreadTrader. This instrument is designed for creation of complex option orders and managing them, and also for easy closure or change of any positions of the brokerage commission.

-

Options Strategy Lab. This feature allows to form a list of potentially profitable strategies based on the price forecast and underlying share volatility.

-

Volatility Lab features an extended set of instruments for determining volatility taking into account the past and future indicators.

Advantages:

The broker’s clients can trade OTC and Penny stocks.

Automatic transfer of the client’s account from another broker and transfer of assets with no commission charged from Zacks Trade to another company are available.

Trading is possible from all devices (desktop and mobile). There is also a web platform, which is accessed via the Personal Account.

Intraday trading and trading with a leverage of up to 6:1 are available.

The company’s website features an online chat, the operators of which quickly respond to questions.

The broker is suitable for traders and investors, who need complex instruments of research and a wide selection of the investment assets of the US markets.

How to Start Making Profits — Guide for Traders

At Zacks, traders can open an investment account (cash or marginal) or retirement account. Investing in US securities and securities of international markets is available for all accounts.

Account types:

The broker offers a demo account with pre-loaded paper trading funds worth USD 1 million for a period of 90 days. The demo account is available only on the Zacks Trade Pro platform and can be requested via email.

Zacks Trade is a stock broker for experienced and professional investors, who are prepared to invest a minimum of $2,500 into trading securities.

Bonuses Paid by the Broker

At the moment, the broker does not offer bonuses to its clients.

Investment Education Online

ZacksTrade website does not feature a separate Education section. The future investors can find useful information in the Support section (the button is in the lower part of the home page of the website). It features the answers to frequently asked questions and video tutorials on how to set up an account, work with platforms, make a deposit and withdraw funds from the accounts.

Trading on a demo account allows you to test and learn about the trading platform, learn to open orders and use built-in technical analysis indicators.

Security (Protection for Investors)

Zacks Trade is a member of FINRA and is registered with the Securities and Exchange as a broker/dealer. The company is a division of LBMZ Securities, for which Interactive Brokers LLC provides clearing and execution services.

The accounts of Zacks Trade clients are protected by the Securities Investor Protection Corporation (SIPC). The maximum coverage is $500,000, but the cash limit is $250,000. SIPC compensation is paid in case Zacks Trade files for bankruptcy.

👍 Advantages

- The broker’s operation is regulated by FINRA and SEC

- SIPC insurance coverage is available

- The broker accurately fulfils the obligations envisaged by the agreement

👎 Disadvantages

- Tax documents must be provided for opening an account

- SEC limits the choice of assets for which increase leverage is available

- Payment transactions using debit/credit cards and electronic wallets are not supported

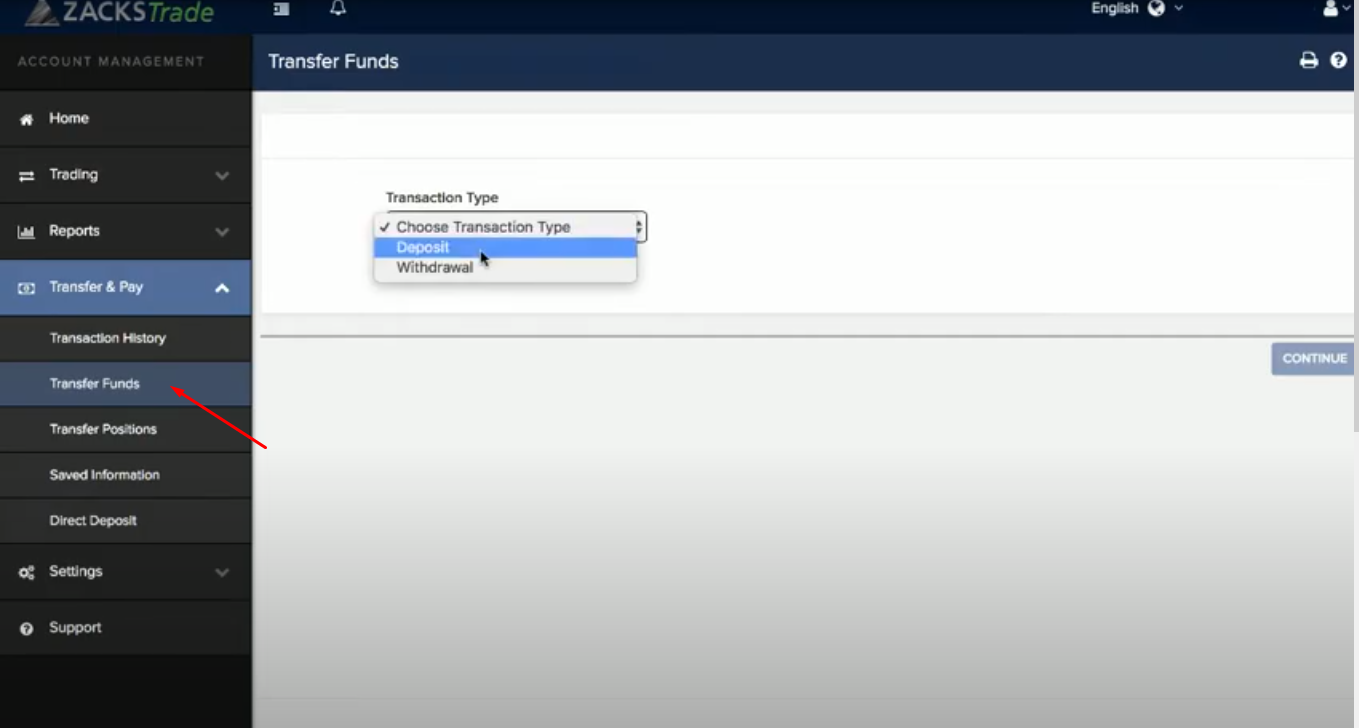

Withdrawal Options and Fees

-

For withdrawal of funds from the accounts on Zacks Trade, ACH transfers, cheque requests or wire transfers are available.

-

The first withdrawal of the month is not charged with a fee regardless of the withdrawal method. For every other withdrawal within the same month, the broker charges a withdrawal fee: $1 for ACH transfer, $4 – cheque, $10 – wire transfer.

-

When ACH transfer is used, the money can be withdrawn four working days after the deposit is made, for wire transfers and cheques – three working days. If the money is transferred to a bank via the ACH, which is a different bank from the sender bank, the broker may hold the funds on the investment account for a period of 44 working days.

Customer Support Service

The company representatives can be contacted from Monday till Friday, from 9:00 am until 6:00 pm (ET), except for public holidays.

👍 Advantages

- There is an online chat on the website

- Toll-free number is available

- Chat operators respond within several minutes

👎 Disadvantages

- Customer support operates 5 days a week

- No 24h support

- No callback feature

- Facebook and Twitter profiles are currently inactive

The broker provides the following methods of contacting customer support:

-

Online chat;

-

Phone;

-

Email.

The operators of the online chat respond to questions not only of the clients with active accounts, but also of the unregistered users.

Contacts

| Foundation date | 1978 |

| Registration address | 10 S. Riverside Plaza, Suite 1600, Chicago, IL 60606 |

| Regulation |

FINRA, SIPC |

| Official site | https://www.zackstrade.com/ |

| Contacts |

Email:

support@zackstrade.com,

|

Review of the Personal Cabinet of Zacks Trade

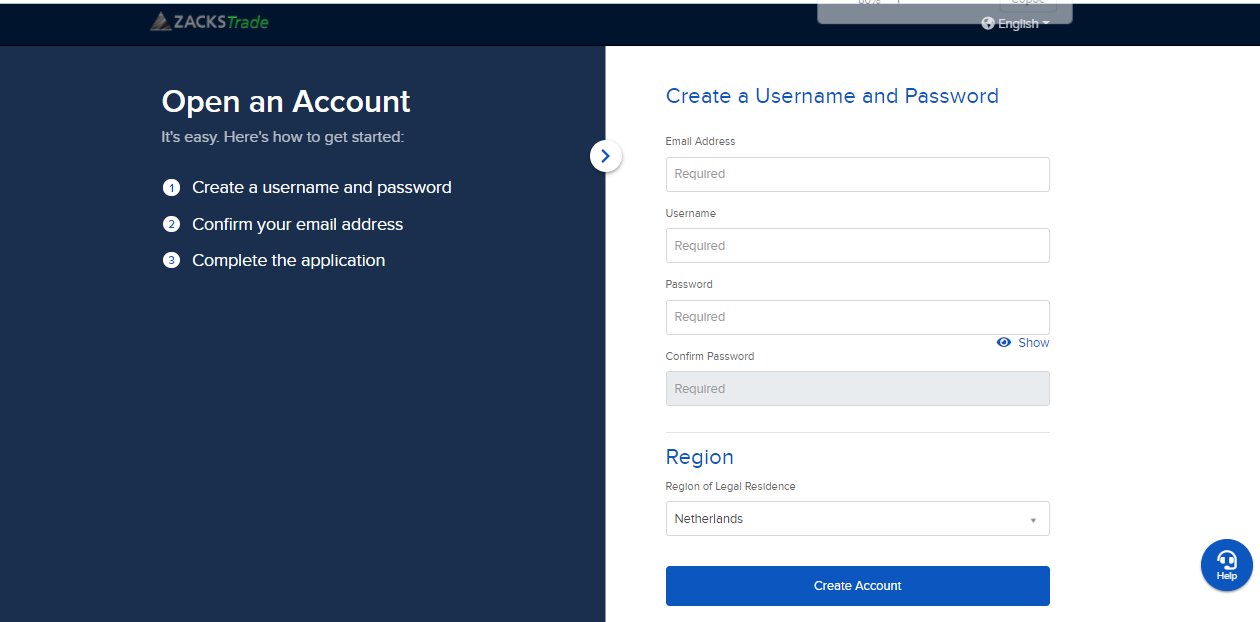

In order to open a Personal Account on Zacks Trade, you need to become a broker’s client. For this, take the following steps:

On the Home Page of the broker’s website, click on OPEN AN ACCOUNT.

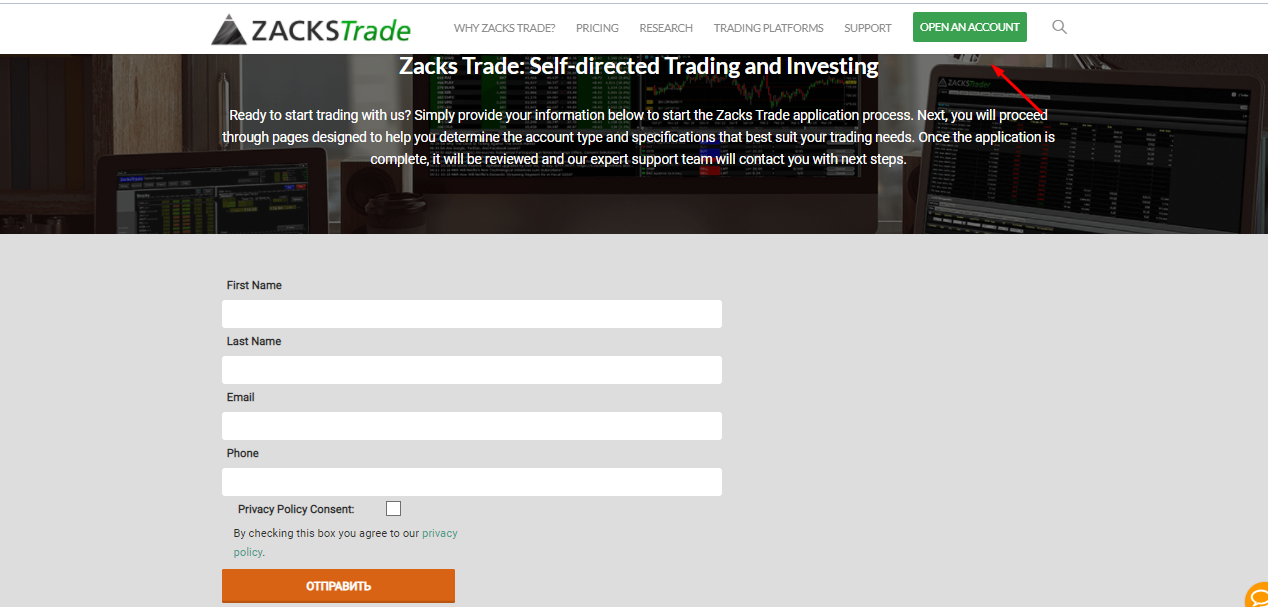

Fill out the registration form that will open once you click on the Open An Account button. Specify your first name, last name, phone number and email.

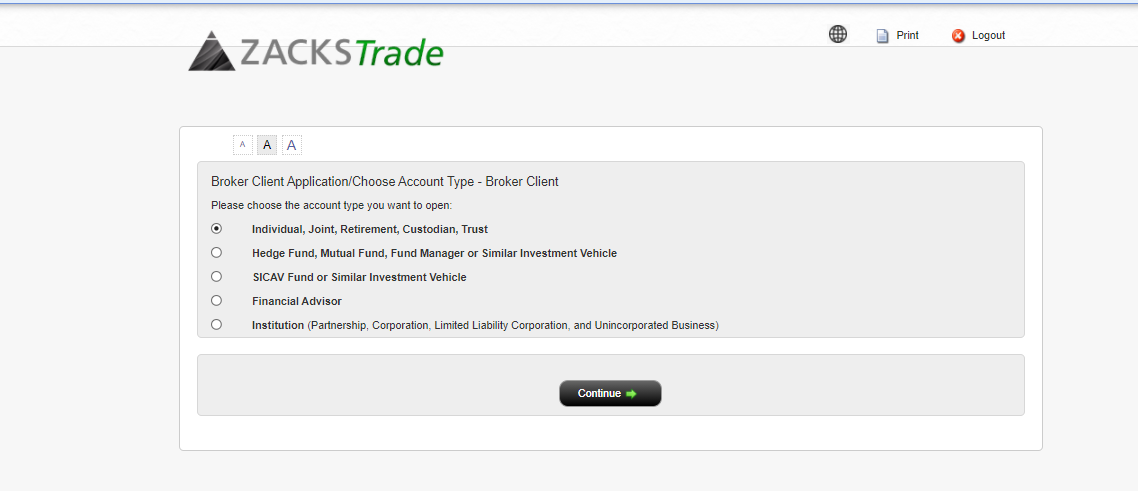

Choose the account type:

Fill out the account opening form, specifying your email, country of residence and also come up with a username and password:

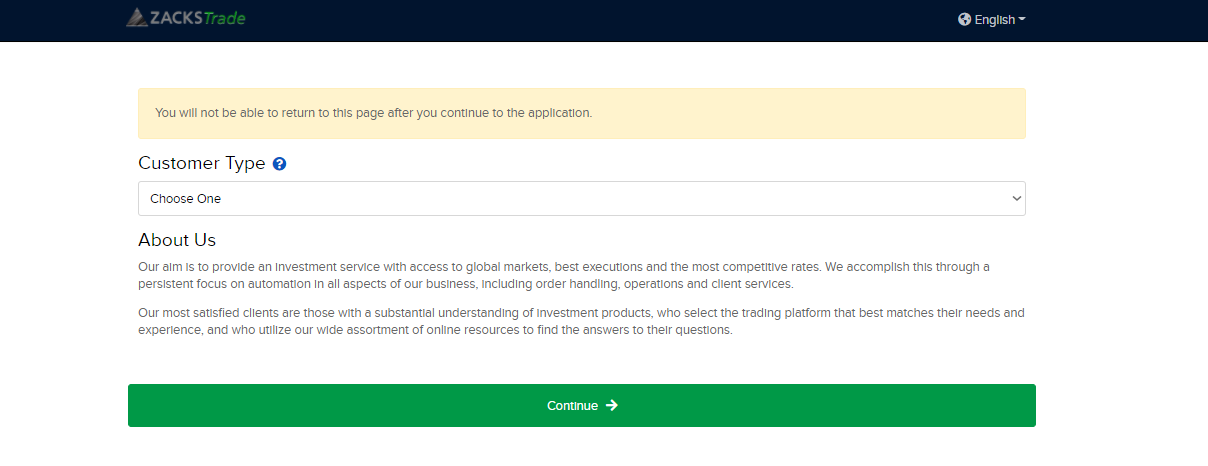

Choose the customer type (individual, joint, retirement, trust):

Next, provide personal data (exactly as they are written in your passport), date of birth, taxpayer ID number. If you do not have a TIN, you need to provide your social security number or employer’s ID number. Non-residents of the US need to additionally provide passport number and scanned copies of its pages, where the nationality, residency and country of issuance are specified. Also, it is necessary to fill out the IRS W-8 form in order to confirm the country of tax residency.

In the Personal Account on Zacks Trade, users can do the following:

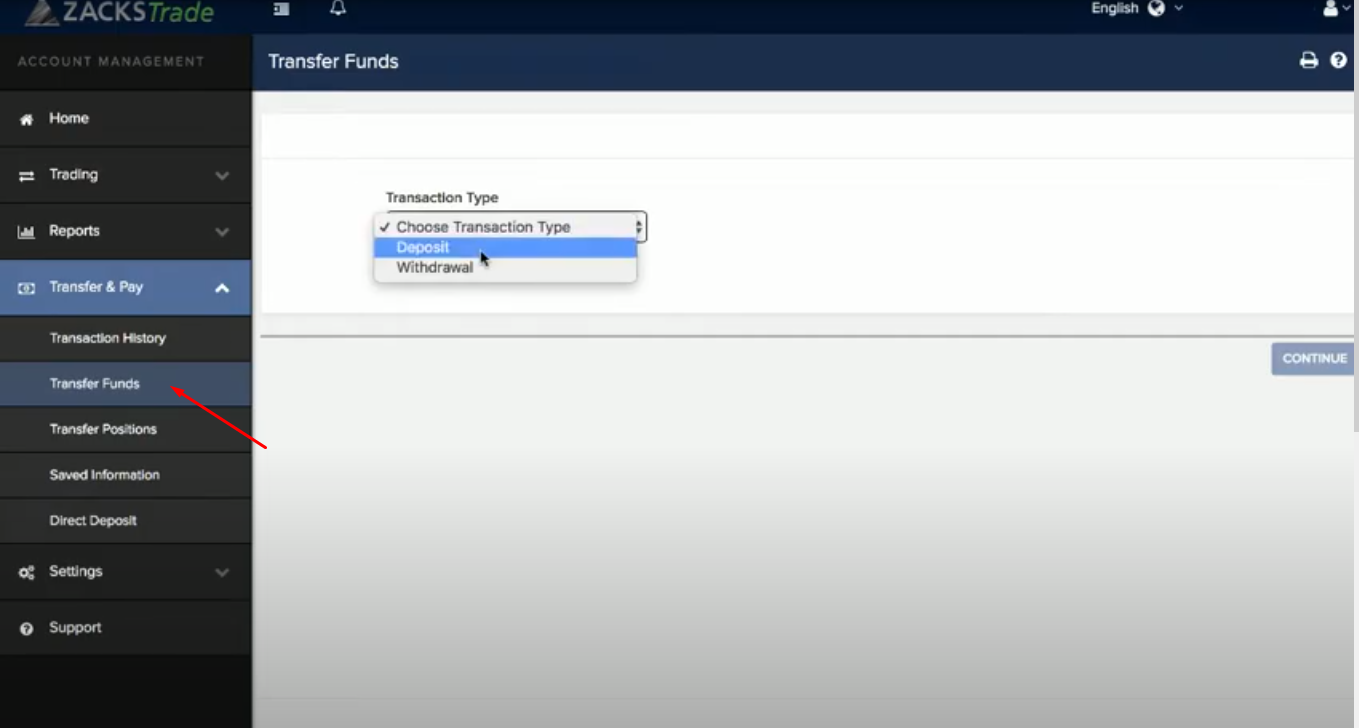

1. Make a deposit:

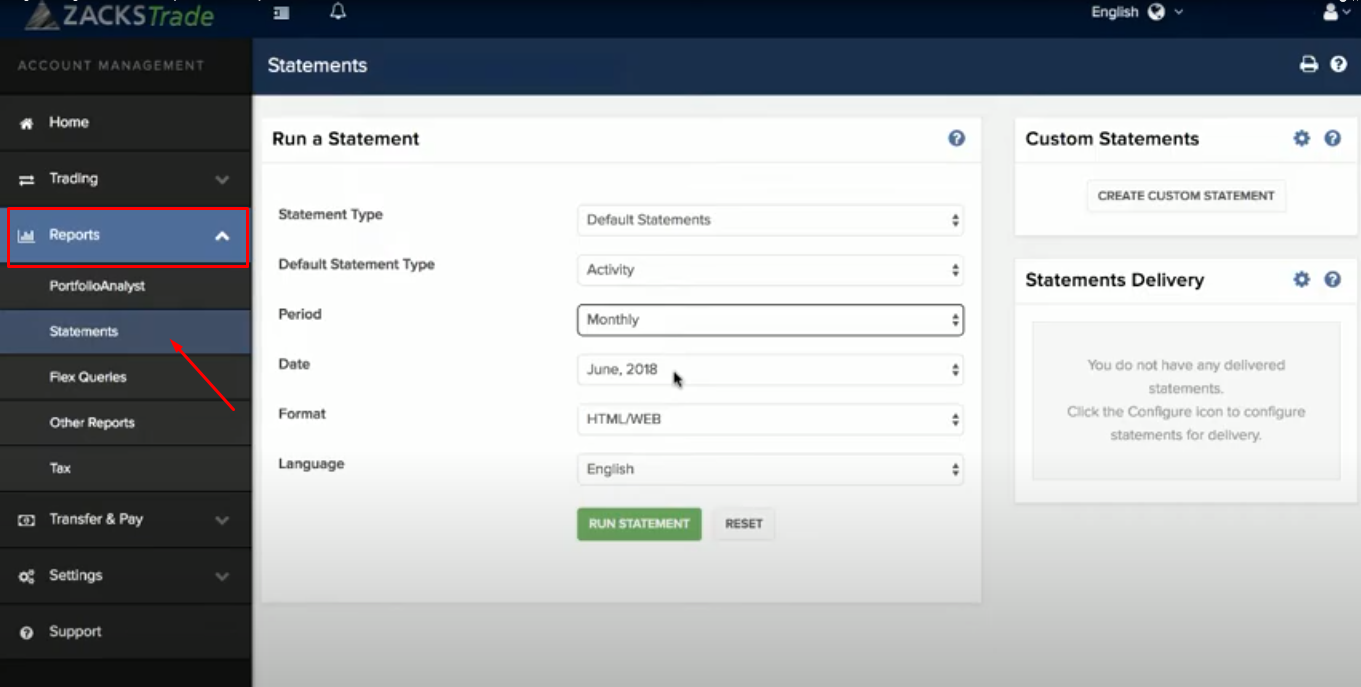

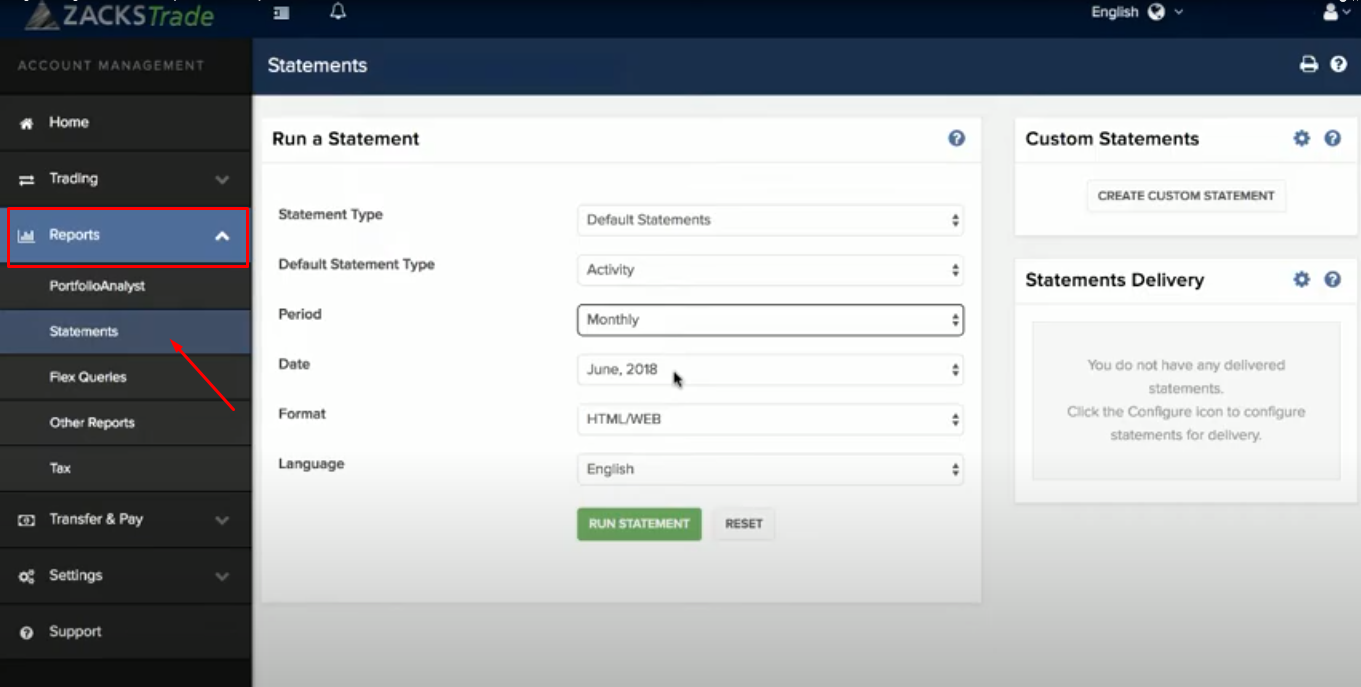

2. View statements:

1. Make a deposit:

2. View statements:

Personal Account also features the following tabs:

-

Trading – for performing transactions on the web platform.

-

Financing — for requesting money withdrawal.

-

Trading configuration — for cancelling third-party paid subscriptions for market data and research.

-

Transaction History — form monitoring the status of the deposit.

-

Reports — for viewing the list of closed trades over a chosen period of time.

-

Portfolio — for forming trading statistics on profits, losses and commissions charged by the broker.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Zacks Trade rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Zacks Trade you need to go to the broker's profile.

How to leave a review about Zacks Trade on the Traders Union website?

To leave a review about Zacks Trade, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Zacks Trade on a non-Traders Union client?

Anyone can leave feedback about Zacks Trade on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.