- CySEC

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

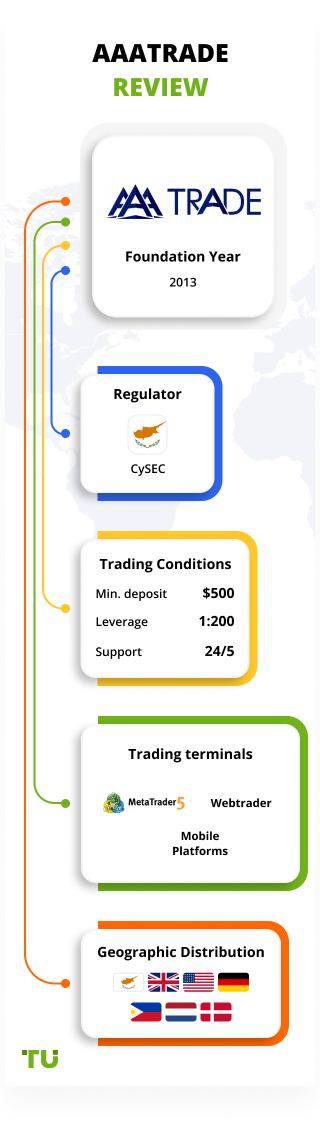

Summary of AAATrade Trading Company

AAATrade is a broker with higher-than-average risk and the TU Overall Score of 4.26 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by AAATrade clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. AAATrade ranks 189 among 412 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

A good broker for stock traders with higher-than-basic experience.

AAATrade is duly authorized and regulated by the CySec (CIF license number 244/14 ). The company’s business activities are governed by MiFID II (Markets in Financial Instruments Directive). Furthermore, AAATrade is regulated by some of the most reliable EU regulatory bodies, for instance, the Federal Financial Supervisory Authority (BaFin) with ref. No. 45052), the Financial Conduct Authority (FCA) with ref. No. 659844, and the Comisión Nacional del Mercado de Valores (CNMV) with reg. No. 3846.

| 💰 Account currency: | USD, EUR, GBP |

|---|---|

| 🚀 Minimum deposit: | no minimum deposit |

| ⚖️ Leverage: | 1:200 |

| 💱 Spread: | from 0,0 p |

| 🔧 Instruments: | CFDs, Shares, Forex, Commodities, Indices, ETFs, Futures, Cryptocurrencies. |

| 💹 Margin Call / Stop Out: | 70/50% |

👍 Advantages of trading with AAATrade:

- No minimum deposit requirement.

- Access to more than 16,000 assets, including cryptocurrencies.

- Proprietary platform for trading cryptocurrencies in the stock market.

👎 Disadvantages of AAATrade:

- The MT4 platform that features many indicators and EAs is not available.

- Withdrawal fee.

Evaluation of the most influential parameters of AAATrade

Trade with this broker, if:

- You want a broker with no minimum deposit requirement. AAATrade does not impose a minimum deposit, offering flexibility for traders with various budget sizes.

- You want access to a wide range of assets, including cryptocurrencies. AAATrade provides access to more than 16,000 assets, providing a diverse selection for trading.

Do not trade with this broker, if:

- Regulation is crucial for you. AAATrade is regulated by the International Financial Services Commission of Belize (IFSC), which is considered less stringent than regulatory bodies like the FCA or CySEC.

- You are looking for Shariah-compliant trading options. AAATrade currently does not specifically cater to Islamic finance principles, which may be a concern if adherence to these principles is a key consideration for your trading.

Geographic Distribution of AAATrade Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Dynamics of AAATrade’s popularity among

Traders Union’s traders, according to 2023 data

Investment programs of AAATrade

The broker’s investment programs feature several money management models. Investors can transfer the money into trust management by a professional manager of the broker or invest in ready-made portfolios.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

AAATrade Partnership program

The broker offers the following partnership options:

Pаrtners. This is a classic model for private partners. The reward amount depends on the region of the referral, their trading volume and number of referrals.

Affiliates. This is a model of attracting new clients through building a chain of subsidiaries. There are four models of accrual of rewards.

Banks & Institutional. This is an offer for large institutional players in the financial markets. The broker provides CRM, a database of liquidity providers, Smart Order Routing system, etc.

White Label. This option implies provision of ready-made technologies and solutions for launching a brokerage business and is suitable for legal entities.

Regardless of the chosen program type, each partner gets a user account with instruments for analysis of statistics on referred clients, and marketing instruments (referral link, logo, templates,, banners, widgets, etc.).

Trading Conditions for AAATrade Users

| 💻 Trading platform: | MT5, Webtrader, Mobile Platforms, AAATrader |

|---|---|

| 📊 Accounts: | Novice, Experienced, CryptoExchange |

| 💰 Account currency: | USD, EUR, GBP |

| 💵 Replenishment / Withdrawal: | Bank transfer, Credit/debit card, Crypto Wallet ("Virtual Wallet"), QIWI, Neteller, FasaPay, Skrill, Union Pay. |

| 🚀 Minimum deposit: | no minimum deposit |

| ⚖️ Leverage: | 1:200 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 0,0 p |

| 🔧 Instruments: | CFDs, Shares, Forex, Commodities, Indices, ETFs, Futures, Cryptocurrencies. |

| 💹 Margin Call / Stop Out: | 70/50% |

| 🏛 Liquidity provider: | Yes |

| 📱 Mobile trading: | Mobile Platforms |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market Execution |

| ⭐ Trading features: | Trading Signals and Chart Analysis, FIX API 4.4 connectivity |

| 🎁 Contests and bonuses: | No |

Comparison of AAATrade with other Brokers

| AAATrade | RoboForex | Eightcap | Exness | Gerchik&Co | NPBFX | |

| Trading platform |

MT5, WebTrader, Mobile trading platform, AAATrader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | MT4 |

| Min deposit | No | $10 | $100 | $10 | $100 | $10 |

| Leverage |

From 1:1 to 1:200 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:100 |

From 1:1 to 1:1000 |

| Trust management | Yes | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 1 point | From 0 points | From 0.4 points |

| Level of margin call / stop out |

70% / 50% | 60% / 40% | 80% / 50% | No / 60% | 100% / 50% | No / 30% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| AAATrade | RoboForex | Eightcap | Exness | Gerchik&Co | NPBFX | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | Yes | Yes | No | No | Yes | Yes |

| Options | No | No | No | No | No | No |

AAATrade Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Novice | from USD 2 | from EUR 10 or from 1.5% |

| Experienced | from USD 2 | from EUR 10 or from 1.5% |

TU experts also performed a comparative analysts of the spread on the EUR/USD pair charged by AAATrade and other brokers.

| Broker | Average commission | Level |

| AAATrade | $2.5 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Contacts

| Foundation date | 2012 |

| Registration address | Victory House, Arch. Makarios III Avenue 205, Limassol 3030, Cyprus |

| Regulation |

CySEC Licence number: 244/14 |

| Official site | aaatrade.com |

| Contacts |

Email:

cs@aaatrade.com,

Phone: +442037692245 |

Disclaimer:

Your capital is at risk. 72.58% of retail investor accounts lose money when trading CFDs with this provider. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

Do reviews by traders influence the AAATrade rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about AAATrade you need to go to the broker's profile.

How to leave a review about AAATrade on the Traders Union website?

To leave a review about AAATrade, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about AAATrade on a non-Traders Union client?

Anyone can leave feedback about AAATrade on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.