- CySEC

- FCA

- DFSA

- CMA

- FSC

- FSA

- JSC

- 0%

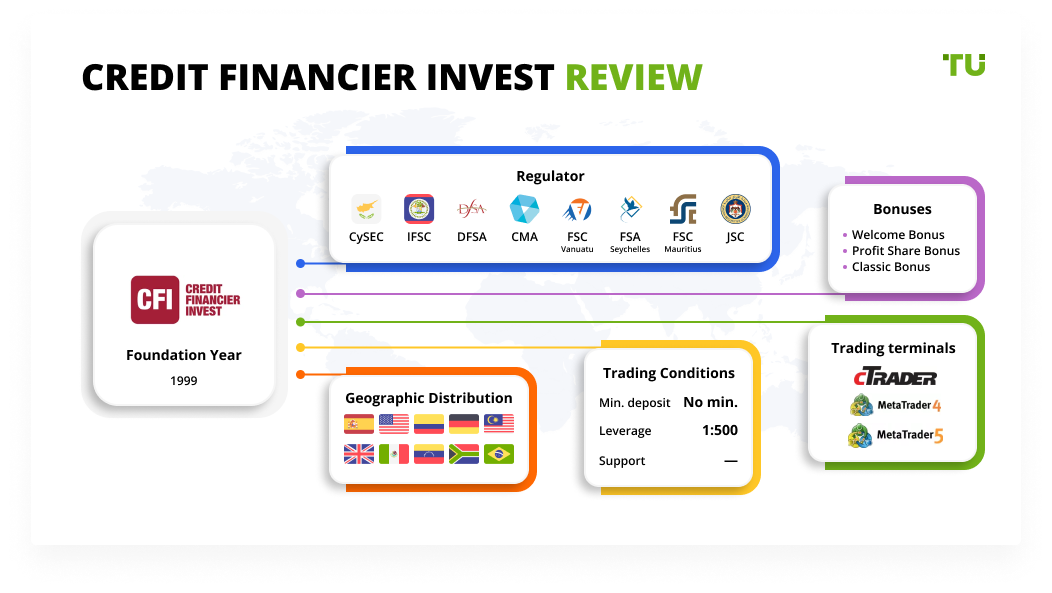

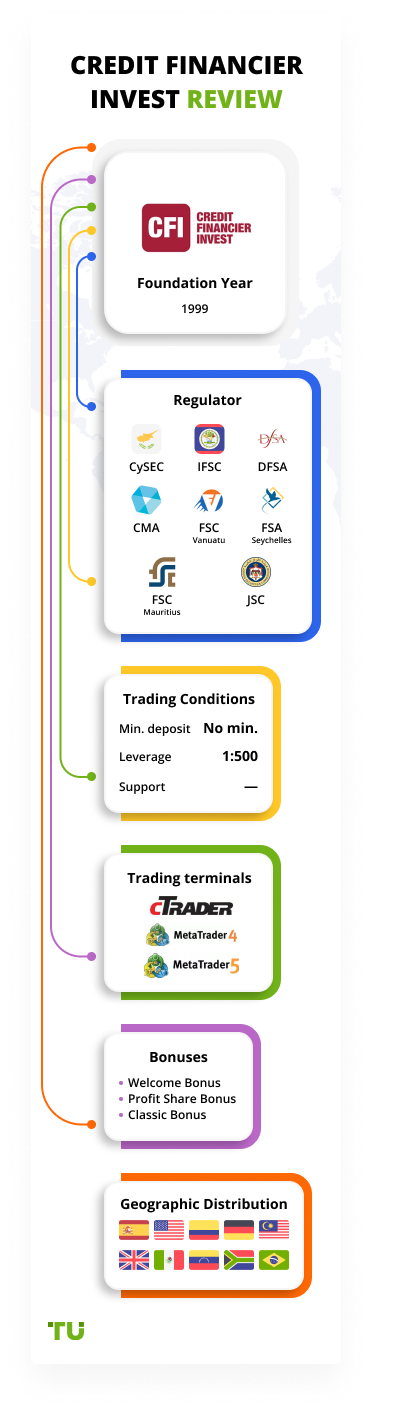

CFI Trade (CFI Markets) Review 2024

- CySEC

- FCA

- DFSA

- CMA

- FSC

- FSA

- JSC

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of CFI Financial Group Holding Limited

Credit Financier Invest (CFI) Ltd is a moderate-risk broker with the TU Overall Score of 5.04 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Credit Financier Invest (CFI) Ltd clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Credit Financier Invest (CFI) Ltd ranks 114 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Credit Financier Invest is a universal broker for all categories of traders.

CFI Financial Group has long earned its good name with more than two decades of experience and service provided in multiple regions and cities throughout more than 100 countries of the world. CFI offers its customers professional client support, skilled account managers, daily technical analysis, free webinars, and friendly trading environment. Here one can trade Stocks, Forex, Commodities, Indices, ETFs, and Cryptocurrencies from 19 markets globally and take advantage of minimum spreads starting as low as 0 pips, no additional commissions, lightning-fast order execution, and no minimum deposit limits.

| 💰 Account currency: | USD, EUR, GBP & Other |

|---|---|

| 🚀 Minimum deposit: | No minimum deposit |

| ⚖️ Leverage: | 1:500 |

| 💱 Spread: | from 0,0 p |

| 🔧 Instruments: | Forex, Indices, Metals, Commodities, CFDs on Equities, ETFs, Stocks, CFDs on Crypto |

| 💹 Margin Call / Stop Out: | Professional Clients: 50/10%, Retail Clients: 100/50% |

👍 Advantages of trading with Credit Financier Invest (CFI) Ltd:

- No minimum deposit requirements.

- Licensed by CySEC 179/12 (Cyprus). It is a respected offshore regulatory authority, as it strictly complies with the European financial law.

- No limitations on strategies.

- 24/7 support.

👎 Disadvantages of Credit Financier Invest (CFI) Ltd:

- No МТ4. МТ5 is considered less convenient, albeit more technologically advanced.

- Withdrawal fee.

Evaluation of the most influential parameters of Credit Financier Invest (CFI) Ltd

Trade with this broker, if:

- You are seeking a Cypriot investment firm regulated by CySEC. CFI Ltd holds authorization and regulation from the Cyprus Securities and Exchange Commission (CySEC) under license number 376/15, providing a higher level of security and investor protection compared to unregulated brokers.

- You are looking for competitive spreads and fees. CFI Ltd offers competitive pricing on their instruments, potentially resulting in lower trading costs for you.

Do not trade with this broker, if:

- You are a beginner with minimal trading experience. The complexity of some instruments and the limited educational resources provided by CFI Ltd might not be suitable for those new to trading.

- You prioritize advanced trading features and tools. CFI Ltd's platform may lack some of the advanced features and analysis tools offered by other brokers, which may be a consideration for traders seeking more sophisticated tools.

Geographic Distribution of Credit Financier Invest (CFI) Ltd Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Investment programs of Credit Financier Invest

At the moment, the broker does not offer investment programs, but in the future, investment solutions could be added to the instruments of acting trading. As an alternative, traders can use the copy trading service built into the MT5 trading platform. Once you register on the MQL5 website, you can connect to any trader community through MT5.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Credit Financier Invest Partnership program

Types of partnership programs:

Liquidity Solutions. The broker offers access to several liquidity providers for brokerage business of partners.

White Label Solutions. The broker is ready to transfer technologies to help a new business occupy its niche in the financial markets.

All partnership solutions are for legal entities only.

Trading Conditions for Credit Financier Invest (CFI) Ltd Users

| 💻 Trading platform: | MetaTrader5, MetaTrader4, CTrader |

|---|---|

| 📊 Accounts: | Dynamic, Zero Commission |

| 💰 Account currency: | USD, EUR, GBP & Other |

| 💵 Replenishment / Withdrawal: | Wire Transfer, Credit Cards, Skrill, Neteller |

| 🚀 Minimum deposit: | No minimum deposit |

| ⚖️ Leverage: | 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 Lots |

| 💱 Spread: | from 0,0 p |

| 🔧 Instruments: | Forex, Indices, Metals, Commodities, CFDs on Equities, ETFs, Stocks, CFDs on Crypto |

| 💹 Margin Call / Stop Out: | Professional Clients: 50/10%, Retail Clients: 100/50% |

| 🏛 Liquidity provider: | Yes |

| 📱 Mobile trading: | Mobile Platforms |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market Execution |

| ⭐ Trading features: | Yes |

| 🎁 Contests and bonuses: | No |

Comparison of Credit Financier Invest (CFI) Ltd with other Brokers

| Credit Financier Invest (CFI) Ltd | RoboForex | Eightcap | Exness | Octa | FxPro | |

| Trading platform |

cTrader, MT5, MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | MT4, MobileTrading, MT5, cTrader, FxPro Edge |

| Min deposit | No | $10 | $100 | $10 | $25 | $100 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

| Trust management | Yes | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 1 point | From 0.6 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 80% / 50% | No / 60% | 25% / 15% | 25% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| Credit Financier Invest (CFI) Ltd | RoboForex | Eightcap | Exness | Octa | FxPro | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | Yes | Yes | No | No | No | No |

| Options | Yes | No | No | No | No | No |

Credit Financier Invest (CFI) Ltd Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Zero Commission | USD 6-15 | yes |

| Dynamic Trader | from USD 0 | yes |

The experts also compared Credit Financier Invest spread with spreads charged by other brokers. The spread on the EUR/USD pair for 1 full standard lot was used for the comparison.

| Broker | Average commission | Level |

| Credit Financier Invest (CFI) Ltd | $8 | High |

| RoboForex | $1 | Low |

| IC Markets | $1.5 | Medium |

Contacts

| Foundation date | 2009 |

| Registration address | Grigori Afxentiou 10 Avenue, Livadiotis Court 5, 6023 – Larnaca, Cyprus |

| Regulation |

CySEC, FCA, DFSA, CMA, FSC, FSA, JSC Licence number: 179/12, 828955, F003933, 40, C118023104, SD107, 49631 |

| Official site | www.cfifinancial.com |

| Contacts |

Email:

global@cfifinancial.com,

Phone: +230 460 82 66 |

Articles that may help you

FAQs

Do reviews by traders influence the Credit Financier Invest (CFI) Ltd rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Credit Financier Invest (CFI) Ltd you need to go to the broker's profile.

How to leave a review about Credit Financier Invest (CFI) Ltd on the Traders Union website?

To leave a review about Credit Financier Invest (CFI) Ltd, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Credit Financier Invest (CFI) Ltd on a non-Traders Union client?

Anyone can leave feedback about Credit Financier Invest (CFI) Ltd on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.