FP Markets Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- AUD 100

- MT4

- MT5

- IRess

- ASIC

- FSA | Seychelles

- FSC | Mauritius

- MISA

- FSCA | South Africa

- 2005

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- AUD 100

- MT4

- MT5

- IRess

- ASIC

- FSA | Seychelles

- FSC | Mauritius

- MISA

- FSCA | South Africa

- 2005

Our Evaluation of FP Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

FP Markets is a reliable broker with the TU Overall Score of 7.76 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by FP Markets clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company.

FP Markets provides its services worldwide and adjusts its trading conditions subject to the requirements of supervisory authorities.

Brief Look at FP Markets

The FP Markets trademark is managed by FP Markets LLC registered in 2019 in St.Vincent and the Grenadines under number 126 LLC 2019. It is part of FP Markets Group with its head office in Sydney which was opened in 2005. Today, the brokerage holding firm operates using ECN (Electronic Communication Network) and DMA (Direct Market Access) technologies. It is regulated by ASIC, MISA, FSCA | South Africa, FSA | Seychelles, and FSC | Mauritius. FP Markets offers over 10,000 CFDs, MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, Iress, and leverage up to 1:500. The broker doesn’t provide its services to residents of the U.S. and the countries that are on sanction lists.

- Trading accounts in 10 currencies;

- Licenses from 5 jurisdictions;

- Negative balance protection for retail traders;

- Account types with different approaches to trading fee calculation;

- Copy trading, hedging, scalping, and expert advisors are allowed;

- Trading platforms customized for CFD and Forex trading;

- Wide choice of payment systems for making deposits and withdrawals.

- Cent accounts are not available;

- If the broker fails to fulfill its obligations, compensation for losses is available only to traders from the EU;

- Spreads on the Standard account are not the tightest on the market.

TU Expert Advice

Financial expert and analyst at Traders Union

The FP Markets group of companies has more than 18 years of experience in financial markets. It managed to customize its trading conditions for traders with varied experience and strategies. FP Markets received numerous prestigious awards at international Forex events and gained traders’ trust due to its client-oriented approach and compliance with regulatory requirements.

The holding company constantly expands its representative network, opens new offices, and adds new support languages. Live chat is available 24/7 to provide high-quality and timely assistance to both FP Markets clients and the website guests interested in its services. The broker offers profitable partnership programs and bonuses for attracting new traders, broadcasts analytics from reputable sources, and expands the list of trading assets.

FP Markets has developed a proprietary social trading platform and implemented PAMM and MAM systems for professional traders and investors. Its clients can open demo and Islamic accounts, use high leverage, and make instant deposits. FP Markets offers an excellent choice of assets, however, spreads are high for them, and there is no opportunity to trade on cent accounts.

We checked the office of the FP Markets brokerage company in Cyprus, which is located at the following address according to the information on the company’s website:

First Prudential Markets Ltd 109 Griva Digeni, Aigeo Court, 2nd floor, 3101, Limassol, Cyprus

-

The company is located at the stated address

-

We were able to speak to a company representative

-

We were able to visit the office as clients

-

-

Video of the company’s office and an interview with FP Markets (not published due to compliance requirements)

FP Markets Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5, cTrader, and Iress for Australian residents |

|---|---|

| 📊 Accounts: | Demo MT4, Demo MT5, Demo cTrader, Standard, Raw, Islamic Standard, Islamic Raw, and Iress |

| 💰 Account currency: | USD, EUR, AUD, GBP, PLN, SGD, HKD, CAD, CHF, and JPY |

| 💵 Replenishment / Withdrawal: | Bank cards, bank transfers, cryptocurrencies, broker-to-broker transfers, Skrill, SticPay, Neteller, FasaPay, Rupee Payments, Rapyd, Perfect Money, Pagsmile, Rapid Transfer, Google Pay, Apple Pay , and other payment systems |

| 🚀 Minimum deposit: | AUD 100 or equivalent |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: |

Standard — from 1 pips Raw — from 0 pips |

| 🔧 Instruments: | Currency pairs and CFDs on metals, indices, commodities, stocks, ETFs, bonds, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | Commerzbank, HSBC, BNP Paribas, and others |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: |

ECN pricing on MT4, MT5, and cTrader DMA pricing on Iress |

| ⭐ Trading features: | No restrictions on the number of open trades |

| 🎁 Contests and bonuses: | Refer a Friend bonus |

Each FP Markets client can have up to 10 different account types. Maximum trade size depends on the asset class. It is 50 lots for Forex. The broker doesn’t set limits on the number of open orders, including pending. It allows scalping, hedging, automated trading, and other strategies. FP Markets offers the most popular trading platforms and demo accounts for them.

FP Markets Key Parameters Evaluation

Trading Account Opening

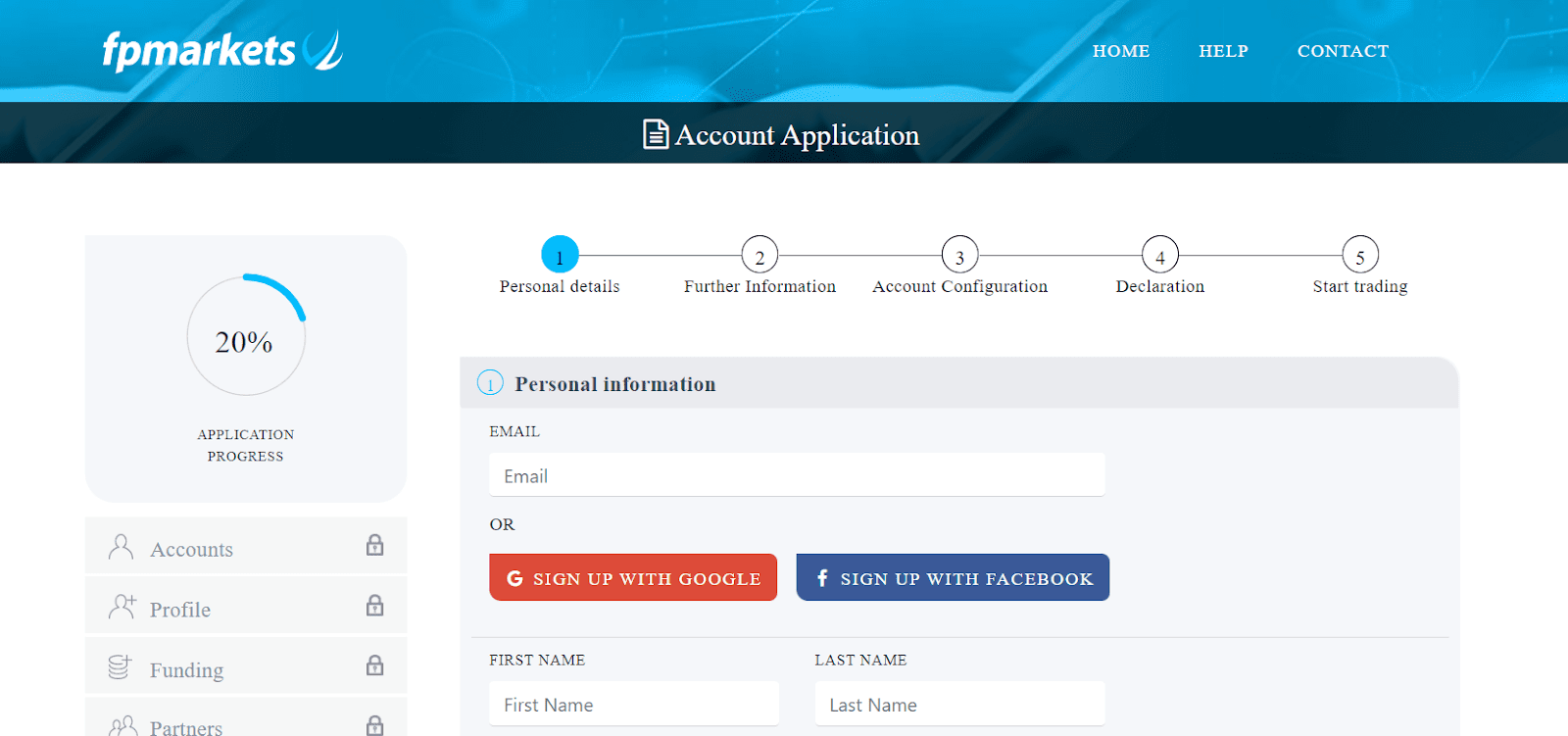

To start trading with FP Markets, open an account and make a deposit. These actions are performed in the user account on the broker’s official website. Registration is standard:

Click “Start Trading” or “Open Live” buttons to fill in the registration form.

The registration process consists of 5 stages. Each of them requires certain data, including personal information, source of income, trading experience, etc. Also, enter your password to access your user account. You can make the password yourself or generate it automatically.

The user account allows you to:

-

Set parameters of your trading account, such as currency type, platform, account type, and leverage.

-

Upload scans of documents to confirm your personal data and the country of residence.

Additional features of the user account that allow you to:

-

Download desktop platforms or go to their web versions;

-

Make deposits or withdraw profits;

-

Connect to the social trading platform;

-

Use traders’ tools;

-

Go to the partner portal;

-

Generate a referral link;

-

Quickly contact technical support.

Regulation and Safety

FP Markets is a global company with many entities that are licensed by:

-

ASIC (Australian Securities and Investments Commission) under number AFS № 286354;

-

MISA (Mwali International Services Authority) under number T2023412;

-

FSCA (Financial Sector Conduct Authority | South Africa) under number FSP 50926;

-

FSA (Financial Services Authority | Seychelles) under number SD130;

-

FSC (Financial Services Commission | Mauritius) under number GB21026264.

Additionally, the broker is registered by FSA (Financial Services Authority | St.Vincent and the Grenadines) under number 126 LLC 2019.

The availability of numerous licenses, including ASIC and FSCA, provides a proper security level. Supervisory authorities control the broker’s financial performance and require that it comply with conditions of client funds protection.

Advantages

- The broker provides its services in strict compliance with the agreement

- Traders can file complaints with regulators

- Client funds and the company’s capital are segregated

Disadvantages

- The €20,000 compensation is available only to EU traders

- Leverage is reduced to 1:30 for retail traders from the EU and Australia

- No professional liability insurance

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard | $10 | Fees of payment systems and banks |

| Raw | $0 | Fees of payment systems and banks |

The broker withholds swaps for transferring positions overnight. On Wednesday night, triple swaps are charged.

TU experts have compared FP Markets’ fees to those of other brokers. The results are shown in the comparative table below.

| Broker | Average commission | Level |

|---|---|---|

|

$5 | |

|

$1 | |

|

$8.5 |

Account Types

The choice of account types at FP Markets depends on the trader’s country. Muslims can work on Islamic accounts without swaps, while Australian residents can open accounts on Iress. For other countries, Standard and Raw accounts for MT4, MT5, and cTrader are available. To activate the account, pass verification and make a minimum deposit of AUD 10.

Account types:

Before opening live accounts, traders can open a demo account to check the broker’s trading conditions with virtual funds.

FP Markets has customized its trading conditions for traders from different regions and maximized the choice of platforms to satisfy clients with varied experience.

Deposit and Withdrawal

-

The broker doesn’t charge withdrawal fees. However, traders pay fees of third-party payment providers. When withdrawing cryptocurrencies, traders pay blockchain fees. Fees for other methods are 0.5%-5% of the amount.

-

FP Markets offers instant withdrawals. On average, the process takes 1-2 days, however, withdrawals to bank cards are made within 2-10 business days.

-

If traders reside in Australia and request to withdraw AUD, the money is credited to their bank accounts within 1 business day. International bank transfers take up to 5 days.

-

Both the withdrawal amount and the payment method must match the deposit. After the deposit is withdrawn in full, traders can withdraw profits through any of the available methods.

Investment Options

FP Markets offers a wide range of copy trading services that help novice and experienced traders automate the trading process and save time on market analysis. Also, its clients can invest in managed accounts and earn from partnership programs and trading bots.

Investment solutions from FP Markets

The broker’s clients can reduce their trading activity to almost zero and still receive profits on financial markets. FP Markets offers the following passive income solutions:

-

Copy trading. Traders can use both standard copy trading options on MetaTrader and cTrader platforms, and alternative services. The latter include the proprietary FP Markets Social Trading platform and Signal Start from a third-party provider.

-

Algorithmic trading. It is implemented using special programs and apps, called Expert Advisors (EAs). They can be connected on any of the platforms available with the broker, however, there are some restrictions, such as: not more than 5,000 actions, including trade opening and closing, should be made within 24 hours.

-

PAMM and MAM accounts. Trust management accounts allow traders to invest their capital when trading with experienced traders. Profits and losses are split proportionately according to the investments of all participants in PAMM and MAM accounts.

Not only investors can register with FP Markets. The company offers profitable conditions to account managers and trading signal providers.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership programs from FP Markets:

-

Affiliate program. It provides a one-time fee for attracting a new active client who makes a deposit and starts trading. Rewards can be up to $800 and depend on the CPA (Cost Per Action) level.

-

Introducing Broker (IB). This is a reward program for active trading of referred traders. The fee is paid according to lots traded by the referrals. IBs receive $5 for each lot closed on the Standard account and $2 for lots closed on the Raw account.

Also, FP Markets welcomes White Label partnerships, Regional partnerships, and professional account managers. All partners are provided with 24/5 support, ready-made marketing tools in numerous languages, and convenient user accounts to monitor conversions.

Additional Trading Tools

-

VPS.

VPS provides high network stability, protection against power outages, and low execution latency. Traders use VPS to run automated algorithmic strategies, including Expert Advisors (EAS) and algorithmic trading strategies. VPS trading allows you to avoid requotes and slippages, which can lead to significant capital losses in the long term.

-

Traders Toolbox.

Trading Toolbox combines a robust trading infrastructure with market information and apps to help you trade. Trader Tools Alarm Manager simplifies risk management by allowing you to set automatic actions to lock in profits and minimize losses. Traders Toolbox provides access to real-time price activity and trend direction and trading support tools to gauge market volatility.

-

Forex Calculator.

FP Markets offers its clients an additional trading tool: a Forex Calculator. This tool allows traders to calculate points, margins, swaps, and profits and uses a convenient currency converter.

-

Autochartist.

The tool provides performance and volatility analysis of chart patterns over the last six months. The study includes information about the times of day when markets are most volatile and the corresponding exit levels. FP Markets offers the software as a bonus feature but does not guarantee the information's completeness, accuracy, or timeliness.

-

Trading Central.

Trading Central combines AI analysis and data from industry experts to make investment decisions. Market participants can anticipate and act on market-moving events, view key value investment metrics, and receive trusted investment ideas. Trading Central works with a user-friendly platform and provides actionable insights through its various offerings. The software provides invaluable data and offers an in-depth understanding of the market's direction with real-time economic data.

Customer Support

FP Markets wants to provide high-quality support on all relevant questions, therefore it offers various communication channels. Technical support is available 24/7. Telephone support is provided round the clock on weekdays and from 8:00 to 16:00 (GMT+2) on weekends.

Advantages

- Telephone numbers to contact the broker in 18 countries are available

- Prompt responses in a live chat

Disadvantages

- Chat operators don’t always give detailed answers

- Popular instant messengers are not available

To seek assistance from FP Markets, use the following channels:

-

Call back in the Help menu of the website;

-

Live chat on the website or in the user account;

-

Email;

-

Visit an office in your region, where available.

Support in the live chat is available in 42 languages.

Contacts

| Foundation date | 2005 |

|---|---|

| Registration address | FP Markets LLC, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines |

| Regulation |

ASIC, FSA | Seychelles, FSC | Mauritius, MISA, FSCA | South Africa

Licence number: 371/18, 286354 |

| Official site | www.fpmarkets.com |

| Contacts |

+44 28 2544 7780

|

Education

FP Markets offers educational materials, as well as market analytics and research that are necessary for novice and experienced traders to develop a successful trading strategy.

FP Markets offers podcasts and holds educational webinars that are free for its clients. The broker offers demo accounts for qualitative training without the risk of losing real funds.

Comparison of FP Markets with other Brokers

| FP Markets | RoboForex | Eightcap | Exness | FxPro | XM Group | |

| Trading platform |

MT4, MT5, WebTrader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5, cTrader, FxPro Edge | MT4, MT5, MobileTrading, XM App |

| Min deposit | $100 | $10 | $100 | $10 | $100 | $5 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 1 point | From 0 points | From 0.6 points |

| Level of margin call / stop out |

No | 60% / 40% | 80% / 50% | No / 60% | 25% / 20% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed review of FP Markets

FP Markets is an ECN broker which means that it doesn’t interfere with trading of its clients and broadcasts prices directly from major liquidity providers. Client funds are held on accounts with AA-rated Australian banks and are segregated from the broker’s capital. User accounts on the FP Markets website offer Two-Factor Authentication (2FA), negative balance protection, and SSL encryption.

FP Markets by the numbers:

-

25+ payment systems;

-

10 base account currencies;

-

40+ awards for premium services and the best execution speeds;

-

24 seconds is the average response time in a live chat;

-

Client support is available in over 40 languages.

FP Markets is a broker with fast execution and a wide choice of trading instruments

The range of available assets depends on the trading platform. MT4 allows you to trade CFDs on Forex and commodities, including metals, indices, and cryptocurrencies. MT5 and cTrader offer a wider choice of assets, including CFDs on stocks of the U.S., Australia, Hong Kong, the UK, and Europe, as well as ETFs traded on the NYSE and Nasdaq exchanges. FP Markets clients get the fastest possible execution speeds due to servers located in NY4 Equinix (New York).

If traders close over 10 lots on the Standard account or over 20 lots on the Raw account, the broker provides them with free access to VPS from Liquidity Connect. This is especially important for algorithmic traders who need 24/7 uninterrupted operation.

Useful services offered by FP Markets:

-

Market schedule and trading hours on holidays;

-

Fundamental data and market technical analysis;

-

Call back option;

-

Calculators for pips, swaps, profits, and margin;

-

Currency converter;

-

Advanced tools for MT4 and MT5;

-

Daily reports on Forex and stock markets;

-

Podcasts and webinars held by professional traders.

Advantages:

Clients are not required to confirm their bank cards before making a deposit;

Access to analytics from Autochartist and Trading Central, economic calendars, and Traders Toolbox;

The broker doesn’t charge inactivity fees, but it archives accounts with the possibility to unblock them at any time;

During high market volatility, leverage reduces automatically to protect traders from big losses;

Traders can work from any device without installing special software.

FP Markets offers numerous tools to improve trading quality, access to a large number of markets, and leading trading platforms.