deposit:

- $0

Trading platform:

- MT4

- WebTrader

- Stocks Trading Platform

- SCA

- 0%

Noor Capital Review 2024

deposit:

- $0

Trading platform:

- MT4

- WebTrader

- Stocks Trading Platform

- SCA

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of Noor Capital Trading Company

Noor Capital is a broker with higher-than-average risk and the TU Overall Score of 3.15 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Noor Capital clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Noor Capital ranks 300 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Noor Capital suits both professional and novice traders, investors, and those interested in earning through partnership programs.

Noor Capital is a company providing brokerage services since 2005, regulated by the UAE Securities and Commodities Authority (SCA). The broker is licensed for financial services across five categories, including Forex trading. It offers various trading instruments such as currencies, indices, stocks, metals, and energy resources.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | From $0 |

| ⚖️ Leverage: | Up to 1:400 |

| 💱 Spread: | From 2 pips |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, indices, metals, energy |

| 💹 Margin Call / Stop Out: | Depends on the deposit and traded instruments (set individually and specified in the individual agreement) |

👍 Advantages of trading with Noor Capital:

- Provision of services under a brokerage license;

- No limits on deposit amounts;

- Availability of PAMM and MAM accounts for passive income;

- No fees for depositing or withdrawing funds;

- Accessible partnership programs for earning through referrals and establishing own branches using the company's infrastructure.

👎 Disadvantages of Noor Capital:

- Limited choice of payment methods for deposits and withdrawals;

- Absence of cent accounts for low-risk trading;

- Prohibition on scalping (orders must be closed no sooner than three minutes after opening).

Evaluation of the most influential parameters of Noor Capital

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Noor Capital

Noor Capital has been in the brokerage market since 2005 and has earned a reputation as a reliable and client-centric entity over the years. The broker has received several prestigious awards in the Middle East and North Africa (MENA) region and Persian Gulf countries. Trading options include currency pairs, indices, stocks, metals, and energy resources. Noor Capital offers the classic MT4 trading platform and a proprietary platform known as the Stocks Trading Platform.

For clients, Noor Capital provides standard accounts for both individual and corporate clients. The maximum leverage is 1:400, orders are executed via market execution, and there are no specific deposit requirements. Forex spreads start from 2 pips. Margin requirements are set individually for each client based on their deposit size and the financial assets they trade.

All necessary information regarding regulators, licenses, and legal documentation is available on the company's website. Clients have access to analytics, newsfeeds, and various useful online tools. The Noor Academy caters to beginners by providing educational resources. To gain free access to the educational course modules, clients need to fund their accounts with a minimum of $1,500.

Dynamics of Noor Capital’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Noor Capital offers active trading instruments and various avenues for passive earnings. The company allows investing in PAMM- and MAM-managed accounts. Additionally, one can earn from the signals of market experts via their social trading platforms. By selecting a successful trader and subscribing to their signals, one can profit from their trading activity. Moreover, the broker provides several partnership programs for earning from referred traders.

PAMM and MAM accounts cater to investors and managers

Noor Capital offers free opening of master accounts and competitive spreads for professional traders. The broker also provides PAMM and MAM accounts, enabling investors to earn without manually trading while managers can profit by trading with client funds. Both account types are accessible via the MetaTrader 4 trading platform. For managers, the company offers favorable conditions and necessary technical support:

-

No fee for opening managed accounts;

-

Managers of PAMM and MAM accounts trade with lower fees;

-

In the manager's account, access to investor statistics connected to their account is available;

-

Unlimited investors can connect to master accounts.

Only professional traders with confirmed experience and knowledge can become managers. All financial instruments provided by the company are available for trading within managed accounts. Any client can become an investor by joining a master account and funding its balance.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Noor Capital's partnership program

-

Introducing Broker — a program with fee payouts for the trading volume of referred clients. Personal managers are assigned to assist and provide guidance to all partners;

-

White Label — an opportunity to establish one's own business on Noor Capital's ready-made infrastructure. The broker offers all necessary functions and access to financial markets.

Noor Capital offers comprehensive support and assistance to its partners, providing the necessary tools and advertising materials. The White Label program is an opportunity to access top-tier liquidity providers, best quotes, and instant trade execution through FIX API.

Trading Conditions for Noor Capital Users

At Noor Capital, trading is available for currency pairs, metals, oil, gas, and indices, as well as stocks of major companies. Clients can use the following platforms: MT4, WebTrader, and Stocks Trading Platform. The maximum permissible leverage is 1:400. For testing trading conditions, the broker provides a demo account.

$0

Minimum

deposit

1:400

Leverage

24/6

Support

| 💻 Trading platform: | MT4, Stocks Trading Platform, WebTrader |

|---|---|

| 📊 Accounts: | Demo, Standard |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Visa, Mastercard, bank transfer |

| 🚀 Minimum deposit: | From $0 |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 2 pips |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, indices, metals, energy |

| 💹 Margin Call / Stop Out: | Depends on the deposit and traded instruments (set individually and specified in the individual agreement) |

| 🏛 Liquidity provider: | Own providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market |

| ⭐ Trading features: | Scalping (trades opened for less than three minutes) is prohibited |

| 🎁 Contests and bonuses: | Yes, from Traders Union |

Comparison of Noor Capital with other Brokers

| Noor Capital | RoboForex | Eightcap | Exness | FreshForex | IC Markets | |

| Trading platform |

MT4, Stocks Trading Platform, WebTrader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading | MT4, cTrader, MT5, TradingView |

| Min deposit | No | $10 | $100 | $10 | No | $200 |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 2 points | From 0 points | From 0 points | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

No | 60% / 40% | 80% / 50% | No / 60% | 40% / 20% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | $30 | No |

| Cent accounts | No | Yes | No | No | Yes | No |

Broker comparison table of trading instruments

| Noor Capital | RoboForex | Eightcap | Exness | FreshForex | IC Markets | |

| Forex | No | Yes | Yes | Yes | Yes | Yes |

| Metalls | No | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | No | Yes |

| CFD | No | Yes | Yes | Yes | Yes | Yes |

| Indexes | No | Yes | Yes | Yes | Yes | Yes |

| Stock | No | Yes | Yes | Yes | Yes | Yes |

| ETF | Yes | Yes | No | No | No | No |

| Options | Yes | No | No | No | No | No |

Noor Capital Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | From $20 | No |

Noor Capital charges a swap fee for carrying over open orders to the next trading day.

TU specialists compared the average spread sizes of Noor Capital, RoboForex, and Pocket Option. The analysis used spreads for the EUR/USD currency pair obtained on the MT4 platform after opening a demo account.

| Broker | Average commission | Level |

| Noor Capital | $20 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed review of Noor Capital

Noor Capital stands as one of the leading brokerage firms in the Gulf Cooperation Council (GCC) countries (comprising Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates) as it strives for capital growth and innovation. The broker collaborates with tier-1 banks, ensuring clients access to the best quotes and rapid order execution. The Noor Capital website hosts a plethora of tools for effective trading, alongside an extensive educational section offering valuable insights for both beginners and professionals.

Noor Capital by the numbers:

-

Technical support operates 6 days a week;

-

Over 18 years of experience in the financial markets;

-

The company boasts $200 million in investment capital.

Noor Capital caters to active traders, investors, and partners.

It offers standard trading accounts and promises advantageous quotes and swift responses to traders' commands, facilitated by cooperating with top-tier liquidity providers. Trading options include currencies, metals, energy resources, indices, and stocks. Investors can access PAMM and MAM accounts managed by professional market participants. Additionally, for passive income, there's the option to use social trading platforms by subscribing to successful traders' signals that will be replicated in the trading platform.

Noor Capital provides clients with the classic MetaTrader 4 platform alongside its proprietary trading platform for stock trading. Before employing scripts, advisors, or various trading strategies, it's recommended to confirm with support that the brokerage complies with its own rules.

Useful functions of Noor Capital:

-

Technical analysis helps plan trading strategies by incorporating price movements into its forecasts of financial markets;

-

Economic calendar details crucial global political and economic events that might impact quotes;

-

Live streaming offers traders online newsfeeds about price changes in assets, financial forecasts, and other relevant information;

-

Daily economic reports aid in making precise and timely decisions based on key financial sector news.

Advantages:

The company has received numerous prestigious awards;

Trading covers six classes of financial assets;

Client funds are held in segregated accounts with major banks;

Analytics, newsfeeds, forecasts, and online tools are available for traders;

The broker provides its own platform designed specifically for stock trading;

Novice traders have access to an academy consisting of two educational modules;

No registration, form filling, or document uploading is required to open a demo account.

Guide on how traders can start earning profits

Noor Capital provides standard accounts for private and corporate clients. There are no minimum deposit requirements across all accounts, and the available leverage goes up to 1:400. Trading can be conducted in the browser, MetaTrader 4 desktop, and Noor Capital's proprietary platform — Stocks Trading Platform — for mobile devices and web trading.

Account Types:

Demo accounts can be opened on all trading platforms provided by the company. Noor Capital offers various trading instruments, competitive trading conditions, and the opportunity for passive income through investment accounts.

Bonuses from Noor Capital

At the moment, the broker doesn't conduct any promotions or offer bonuses to new clients. Traders can only trade with their own funds after opening an account with this company.

Traders Union bonuses

TU bonuses provide an opportunity to save on brokerage fees after meeting the participation conditions. On TU’s website, you can use the broker ratings to choose a reliable and beneficial option. Register through the specific broker's referral link to receive bonuses in the form of partial rebates of broker’s fees for spreads from Traders Union after you start trading. Bonus funds are credited to your account within your TU profile and can be withdrawn at any time. Existing clients of brokerage firms may need to re-register their accounts. More details about this procedure can be found .

Investment Education Online

The broker's website hosts an extensive section with useful information, FAQs, and the Noor Academy, offering opportunities to learn trading from professionals. Free access to the academy is granted to clients who have deposited $1,500 or more.

Noor Capital doesn't offer cent accounts, so it's recommended to first solidify the acquired theoretical knowledge on a demo account before transitioning to a standard account.

Security (Protection for Investors)

Noor Capital PSC has its main office in Abu Dhabi and a branch in Dubai. The broker's operations are regulated by the Department of Economic Development in Abu Dhabi. Additionally, the company is regulated by the SCA — Securities and Commodities Authority | UAE. Noor Capital operates under license No. 608023.

👍 Advantages

- Trader funds are held in accounts with top-tier banks, separate from the company's capital

- The activity is regulated by two authorities

- If the company violates the obligations and rules, clients can send a complaint to the regulator

👎 Disadvantages

- To register a trading account, it is necessary to upload copies of documents and provide detailed personal and tax information

- You cannot open a user account without going through the verification procedure

- The broker has the right to cancel transactions and block clients' accounts if it suspects them of actions contrary to its own rules

Withdrawal Options and Fees

-

Funds can be withdrawn via bank transfer, as well as debit and credit cards;

-

Transaction times and fees depend on the internal regulations of the banking institution where the funds are being withdrawn;

-

To enable the withdrawal option, one must undergo the verification process;

-

If a client has open orders, Noor Capital reserves the right to suspend the processing of a withdrawal request until the positions are closed;

-

Withdrawals can only be made using the method used for depositing funds.

Customer Support

Support operators are available around the clock from Sunday to Friday.

👍 Advantages

- Traders who are not registered clients can ask questions via the online chat

- The online chat responds promptly and provides necessary information, including details about trading conditions

👎 Disadvantages

- Support is not available on Saturdays

- There is no option for requesting a callback

You can reach out to support representatives through these communication channels:

-

phone;

-

feedback form;

-

email;

-

online chat.

You can also seek advice by messaging the company directly on their social media pages on X, Instagram, and Facebook.

Contacts

| Registration address | Noor Capital PSC, office 203/204, Second Floor, Al-Montazah Tower B, Zayed the First Street, Khalidiyah |

| Regulation |

SCA |

| Official site | https://noorcapital.ae/ |

| Contacts |

Email:

info@noorcapital.ae,

cs@noorcapital.ae,

onboarding@noorcapital.ae,

Phone: +97142795400, +97142795400 |

Review of the Personal Cabinet of Noor Capital

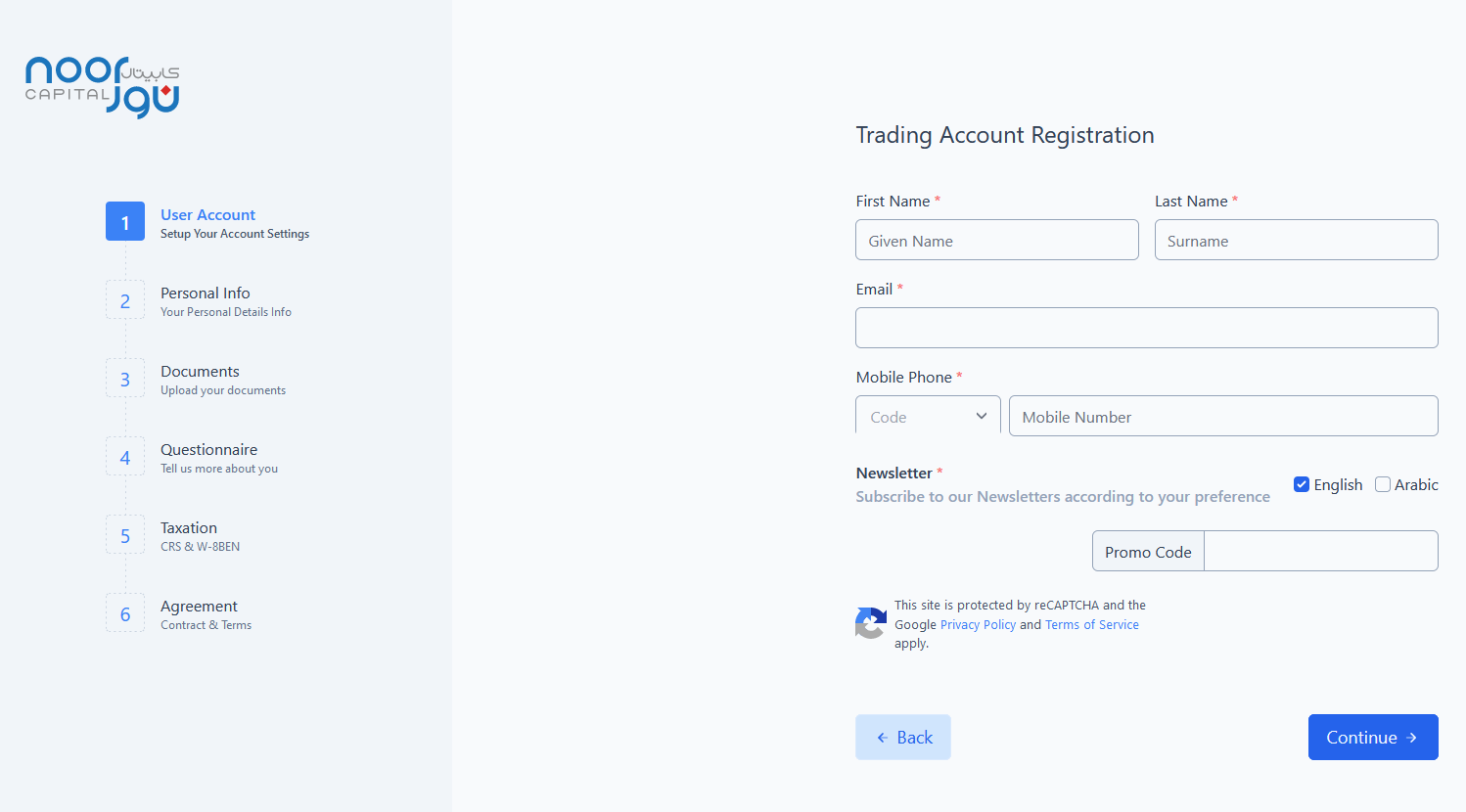

To trade with Noor Capital, one needs to become a client of the broker. The registration and account opening procedures are as follows:

Click on "Register user account." Choose the trading instruments and the account type: individual or corporate.

Fill out the registration form: name, surname, email, and phone number. Complete a questionnaire with personal information, upload documents for verification, provide tax details, and agree to the company's terms and conditions.

Disclaimer:

Your capital is at risk. Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Noor Capital and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

Articles that may help you

FAQs

Do reviews by traders influence the Noor Capital rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Noor Capital you need to go to the broker's profile.

How to leave a review about Noor Capital on the Traders Union website?

To leave a review about Noor Capital, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Noor Capital on a non-Traders Union client?

Anyone can leave feedback about Noor Capital on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.