Please note that your capital is at risk.

Pepperstone Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- cTrader

- MetaTrader4

- MetaTrader5

- TradingView

- ASIC

- FCA

- DFSA

- BaFin

- CMA

- SCB

- CySec

- 2010

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- cTrader

- MetaTrader4

- MetaTrader5

- TradingView

- ASIC

- FCA

- DFSA

- BaFin

- CMA

- SCB

- CySec

- 2010

Our Evaluation of Pepperstone

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Pepperstone is one of the top brokers in the financial market with the TU Overall Score of 8.42 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Pepperstone clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews prove that the broker’s clients are fully satisfied with the company.

Pepperstone is particularly suitable for novice market participants as well as more seasoned trading professionals. In general, the Pepperstone platform offers everything novice traders need for comfortable trading such as favorable conditions, reliability, a wide selection of trading options, along with an assortment of first rate educational materials.

Brief Look at Pepperstone

Pepperstone (Pepperstone.com) was founded in 2010 in Melbourne, Australia,

by professional traders who were not satisfied with the quality of services provided by most brokers. The founders

decided to avoid many of the disadvantages of competitors, including high commissions, delayed execution of orders,

etc. The founders therefore focused on improving the technical component. The company has set itself the goal of

changing the “rules of the game” and setting the bar high for online trading.

Today, Pepperstone offers clients all over the world some of the best technological solutions and favorable trading

conditions. The company also provides professional tools that help traders not only master the fine art of trading,

but also significantly increase trading efficiencies. In addition, Pepperstone’s platform is scrutinized by seven

regulatory authorities, including ASIC (Australian Securities and

Investments Commission, AFSL No.414530), FCA (UK Financial

Conduct Authority, 684312), DFSA

(F004356), BaFin (151148), CMA (128), SCB

(SIA-F217), and CySec (388/20). Moreover,

with Pepperstone, clients' assets are maintained in aggregated accounts with several major, global banking

institutions. These facts confirm the reliability of the company and guarantee the safety of the client's capital.

- Attractive trading conditions;

- Fast order execution - 30 ms on average;

- 1,200+ trading instruments;

- Low fees; and

- No inactivity fee.

- Support service works only 24/5;

- No cent account;

- Not available to US clients;

- Limited passive trading opportunities;

- Limited analytical materials available on the site. The only way to resolve this issue is to connect to trading signals;

- No news section; and

- Demo accounts can only trade for free for one month only.

TU Expert Advice

Contributor

Pepperstone is a notable trading company that caters to both beginners and seasoned traders, providing a robust platform for a seamless trading experience. For beginners, the user-friendly interface and comprehensive educational resources make it an ideal choice to embark on the trading journey. The availability of a demo account enables novices to practice strategies without real financial risk, fostering skill development.

One of the standout features of Pepperstone is its commitment to regulation, holding licenses from reputable authorities like the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA). This regulatory adherence instills a sense of trust and security among potential traders, emphasizing the company's dedication to maintaining high industry standards.

Pepperstone's diverse range of tradable instruments, including Forex, commodities, and cryptocurrencies, provides ample opportunities for traders at various levels. The competitive spreads and efficient order execution contribute to the appeal of the platform for both beginners and professionals.

Moreover, the broker's commitment to customer support is evident through various channels, ensuring that traders have assistance when needed. However, potential traders should be mindful of associated fees, and it's advisable to review the terms and conditions thoroughly. In summary, Pepperstone emerges as a reliable and feature-rich trading platform suitable for both beginners and experienced traders, offering a blend of user-friendly interfaces and professional-grade tools.

We checked the office of the Pepperstone brokerage company in Cyprus, which is located at the following address according to the information on the company’s website:

Arch. Makariou ΙΙΙ, 195, Neocleous House, 3030, Limassol, Cyprus

-

The company is located at the stated address

-

We were able to speak to a company representative

-

We were able to visit the office as clients

-

Video of the company’s office

Pepperstone Summary

Your capital is at risk. Please note that your capital is at risk. Also note that between 74-89 % of retail investor accounts lose money when trading CFDs. Therefore, it is extremely important that you understand how CFDs work and whether you can afford to take the high risk of losing your invested capital.

| 💻 Trading platform: | cTrader, TradingView, MetaTrader 4 and MetaTrader 5 |

|---|---|

| 📊 Accounts: | Razor, Standard |

| 💰 Account currency: | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD and HKD |

| 💵 Replenishment / Withdrawal: | Visa, Mastercard, bank accounts, PayPal, Neteller, Skrill, BPay, Union Pay, EMPESA |

| 🚀 Minimum deposit: | $1 |

| ⚖️ Leverage: | Up to $400:1 retail, 500:1 Pro |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 lot |

| 💱 Spread: | from 0.0 pips |

| 🔧 Instruments: | CFDs on Forex, Index, Stocks, Currency Indices, Commodities, ETFs, Crypto |

| 💹 Margin Call / Stop Out: | 90% / 20% |

| 🏛 Liquidity provider: | Barclays, HSBC |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant (30 ms) |

| ⭐ Trading features: | Trading using advisors; Auto copying; Scalping; Hedging; Trading on the news are allowed. |

| 🎁 Contests and bonuses: | No |

Pepperstone is distinguished by favorable trading conditions. The minimum trade volume is 0.01 lots, and spreads start at 0.0 pips. Also, Pepperstone offers over 1,200 different trading instruments where trade orders are executed quite quickly - within 30 ms on average. The ability to auto copy trades is also provided.

Pepperstone Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Frimps Logan

Frimps Logan  NG Port Harcourt

NG Port Harcourt

Great

None

Kendy Peter

Kendy Peter  NG

NG

Pepperstone Autochartist is simple to use

No

Trading Account Opening

You can start trading via the Pepperstone platform by using your personal account. To do so, you will need to do the following:

You can enter your Pepperstone personal account from the main page of the company's website. Once you navigate to this main page, simply click "Personal Account" in the upper right corner of the screen.

You can then log in using your email address and password. Alternatively, you can use your Google, Facebook or Linkedin accounts for authorization.

If an account has not yet been opened, then you must click on the "Open an account" link appearing in the upper right corner of the site page. Linking to Google and Facebook will be available for individuals. The registration procedure is relatively straightforward : you must indicate the type of account, country, email address, and enter a password. In addition, you will need to confirm your password by re-entering it. Once these steps are completed, you will need to go through identity verification.

After the identity verification is completed, you can deposit your funds into your account. Then, you can start trading by choosing any trading terminal and financial instrument from those available.

In addition, in your personal Pepperstone.com account, you can:

-

trade statistics;

-

use statistics to assess the effectiveness and profitability of affiliate programs;

-

take advantage of educational information;

-

review the history of trading operations and the deposit and withdrawal of funds;

-

use support services for professional advice;

-

balance funds by way of replenishments;

-

withdraw funds; and

-

access the economic calendar.

Regulation and Safety

Pepperstone is regulated by ASIC and the FCA. This ensures the transparency of the platform.

Pepperstone conducts financial activities strictly according to its own regulations and regulatory requirements. It is a guarantee of clearly defined rights and obligations, as well as the safety of assets.

Advantages

- Client assets are held in segregated accounts with major banks

- Provides negative balance protection

- Dispute resolution is carried out with via an independent and neutral party

- If the Pepperstone platform, due to circumstances, is unable to provide additional financial services, traders will receive compensation

Disadvantages

- Regulators do not consider claims for moral damages

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Razor | From $0 | No |

| Standard | From $1 | No |

We also performed a comparative analysis of Pepperstone’s trading commissions with those of its peers. Based on this comparison, each brokerage company was assigned a level for this criterion: low, medium, or high. Note that Peppersone’s commissions ranked the lowest among these peers.

| Broker | Average commission | Level |

|---|---|---|

|

$0.5 | |

|

$1 | |

|

$8.5 |

Account Types

Pepperstone offers 2 types of accounts. Account replenishments are available in currencies such as AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, and HKD. Regardless of the selected account type, the minimum order size is 0.01 lot.

Account types:

In addition to real accounts, Pepperstone offers traders a demo version of a trading account. With such an account, there is no need to replenish the deposit on the demo account. This demo version provides active traders with an opportunity to master the software, learn the process of making trades, and test trading strategies.

Pepperstone provides traders with MT4 and MT5, TradingView terminals as well as cTrader. A trader can trade using the desktop version of the software. Mobile versions for Android and iOS are also available.

Deposit and Withdrawal

-

Traders have the option to withdraw funds to Visa and Mastercard bank cards, as well as bank accounts. These withdrawals are available to electronic wallets, such as PayPal, Neteller, Skrill, Union Pay, BPay, MPESA, and POLi.

-

The processing time of the user account application can vary depending on when the application is submitted.For example, if the application is submitted before 21:00 (GMT), then it will be accepted the next day. If the application was submitted before 07:00 (AEST), then it is considered on the same day.

-

Funds can only be withdrawn to bank accounts opened in the same name as the trading account with the Pepperstone.

-

Pepperstone does not charge a withdrawal fee, but banks may charge such a fee. The average commission is AUD 20.

-

Funds withdrawn to a bank account take 3-5 business days to clear. If traders want access to their withdrawn funds earlier, they can process these withdrawals to bank cards or e-wallets.

-

These withdrawal times are approximate and may be increased.

Investment Options

Pepperstone is a great option for those who want to combine active manual trading and trading with expert advisors. Unfortunately, Pepperstone does not offer any types of investment programs such as trust management. However, social trading is provided, allowing traders to receive trading signals from experienced market participants and auto-copy trades.

The lack of options for investing capital to obtain passive income in their more familiar format for many PAMM accounts is compensated by a variety of trading assets. So, traders can trade currency pairs as well as futures.

Besides, Pepperstone offers lucrative affiliate programs that allow most traders to pursue their preferred trading style.

Pepperstone affiliate program

The Pepperston affiliate program is a customer acquisition based program that we have found most suitable for internet marketers, SEO professionals, large web resource owners, or bloggers. For more general information regarding this affiliate program, please contact Pepperstone directly.

Pepperstone also offers a unique program that they call Introducing Broker (IB). This unique program provides a reward of up to 55% back to participating traders. The program offers participating traders access to a unique system that allows real-time tracking of conversion and trade volume. The partner receives the support of a professional conversion team. The term for calculating remuneration in the form of a commission for clients is unlimited.

Pepperstone also offers a program of professional fund managers. This program is particularly geared for qualified professionals having at least three years of trading experience. Note that having a regulatory license is a condition precedent for applying to this affiliate program and conducting business.

Due to the variety of affiliate program options, everyone can choose the best option for themselves and that matches their skill set. The programs allow you to make a profit from trading even without performing trading operations yourself.

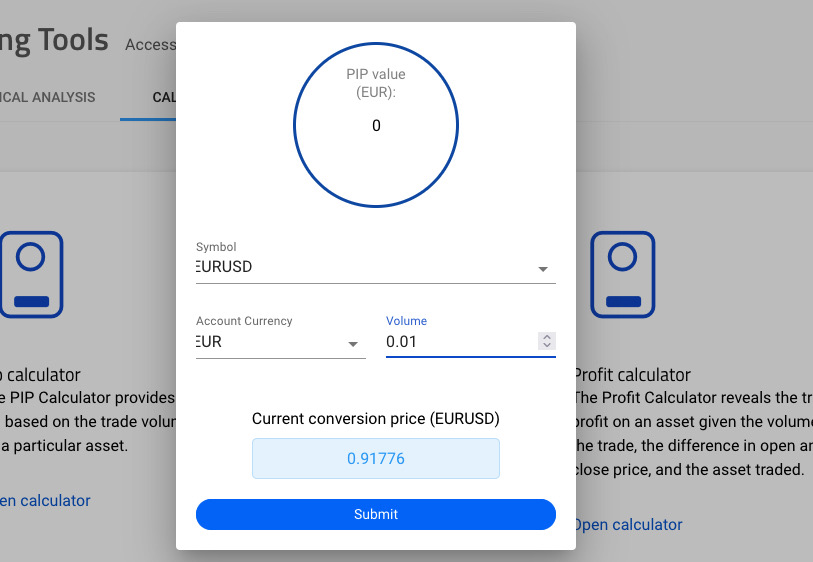

Additional Trading Tools

-

Smart Trader Tools for MetaTrader.

With Smart Trader Tools for MetaTrader, traders can create fully automated trading systems. Each trader can make their trading system with just a few clicks and without special programming knowledge. Using the R StocksTrader tool, manual trading systems can be converted into automated Expert Advisors.

-

API trading.

The API trading system helps traders automate their trading process. This tool was created for traders who prefer to use automated trading systems developed independently, according to individual parameters and requirements.

-

cTrader Automate.

With the cTrader Automate tool, traders can test and optimize their trading systems. Trading systems are optimized through the use of automatic trading robots. The cTrader API system and the C# programming language are used to achieve these goals. Previously, this tool was called cAlgo. cTrader Automate is integrated into the cTrader trading platform and is available with other functions and tools.

-

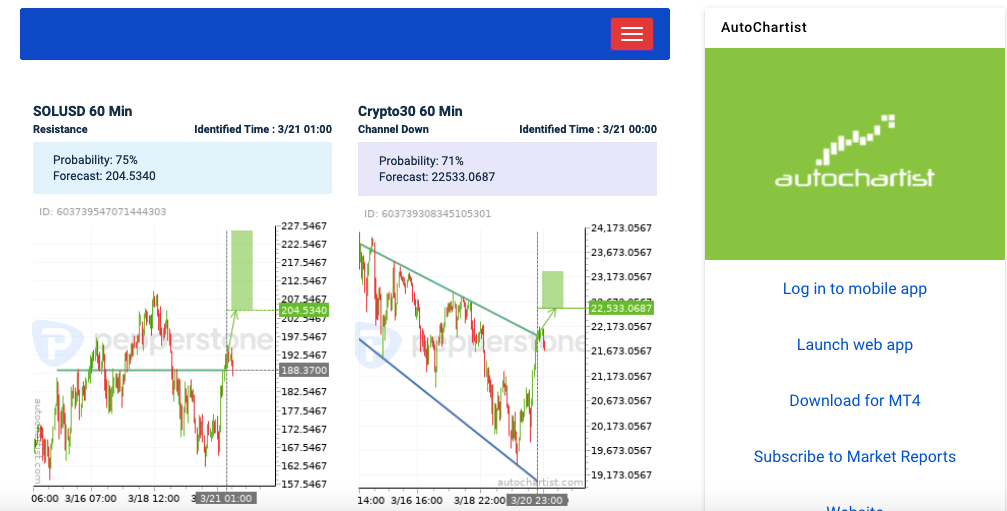

Autochartist.

Autochartist is a unique tool that scans the market and removes excess market noise. This tool allows traders to focus on crucial trading events and make more targeted and successful trades on dedicated trading pairs. Autochartist provides traders with statistical data that helps them identify significant market events and asset price levels.

Customer Support

The company's support service is ready to answer customer’s questions and help traders 24/5.

Advantages

- Many options for communication

- Multilingual support

- The site has a FAQs section with answers to the most popular questions

- You can ask a question without being a client of a broker

Disadvantages

- Customer support not available on weekends

There are several ways to contact support:

Directly by the phone numbers indicated on the website

By email

In the online chat on the broker's website

Support is available from the Pepperstone website and from your personal account

Contacts

| Foundation date | 2010 |

|---|---|

| Registration address | 1300 033 375 Level 16, Tower One, 727 Collins Street Melbourne, VIC Australia 3008 |

| Regulation | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec |

| Official site | pepperstone.com |

| Contacts |

+613 9020 0155

|

Education

The Pepperstone.com website includes a tutorial section that contains the basic information necessary to understand the trading platform. Also, the trader can learn the basic terms and the fundamentals of market analysis. This will help you quickly get used to trading, as well as increase the efficiency and profitability of your trades.

For the practical application of the theoretical knowledge gained on the Pepperstone website, the company's specialists recommend opening a demo account. And after training on a demo account, you can start trading in the real market.

Comparison of Pepperstone with other Brokers

| Pepperstone | RoboForex | Eightcap | Exness | FXGT.com | Libertex | |

| Trading platform |

MT4, MobileTrading, WebTrader, cTrader, MT5, TradingView | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | Libertex, MT5, MT4 |

| Min deposit | $1 | $10 | $100 | $10 | $5 | 100 |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:30 for retail clients |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 1 point | From 0.5 points | From 0.1 points |

| Level of margin call / stop out |

90% / 20% | 60% / 40% | 80% / 50% | No / 60% | 50% / 20% | 50% / 50% |

| Execution of orders | Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed Review of Pepperstone

The Pepperstone trading platform provides its clients with the popular MetaTrader 4 and 5, and TradingView platforms. Traders can also use a terminal called cTrader. The cTrader is used for trading robots, creating personal advisors, and technical indicators.

The company is regulated by the Australian Securities and Investments Commission and the UK Financial Conduct Authority. This fact confirms that Pepperstone is reliable. Therefore, a trader who cooperates (i.e., works) with this broker will find it beneficial and safe to do so.

Pepperstone is structured to support both novice and experienced traders

Traders who make a deposit immediately receive access to trading operations with a variety of assets, the number of which exceeds 1,200.

Pepperstone also allows traders to pursue various strategic trading models. Such trading models include: scalping, news, medium- and long-term, and intraday trading. Traders can also trade manually or autotrade using robots. Pepperstone’s platform also provides the ability to copy trades automatically. This allows traders to generate passive income. When auto copying, traders need to select an experienced trader and subscribe to this trader’s trading activities. The trading positions opened and closed by the selected experienced trader will be automatically carried out on the subscriber's trading account.

Trading with Pepperstone is lightning fast. For example, the order execution time is 30 ms on average. Traders can also trade from anywhere, because the Pepperstone terminals offer a mobile app that is adapted for devices based on iOS and Android.

Pepperstone offers limited analytical tools. Pepperstone does, however, offer an economic calendar which makes it possible to track news affecting the volatility of certain financial instruments. Pepperstone’s trading platform also enables traders to set indicators for technical analysis of certain market situations. Traders can also subscribe to trading signals.

Pepperstone provides the following useful services:

-

Autochartist - This feature removes certain market noise. It displays currency pairs, as well as data intervals and indicators related to important market events.

-

VPS hosting - This feature allows trading around the clock and without interruption, regardless of the quality of the internet connection.

Advantages:

controlled by seven regulators;

attractive trading conditions;

more than 1,200 trading instruments: trading in Forex and CFDs on stocks;

protection against negative balance (gap) - will not allow the trader to drain the deposit;

you can trade with advisors; making it possible to use all the advantages of automatic trading systems;

hedging is allowed, reducing risks;

scalping is allowed;

social trading is available; and

trading on the news is allowed.

User Satisfaction