deposit:

- $100

Trading platform:

- MetaTrader4

- MetaTrader5

- IFSC

- 0%

Scope Markets Review 2024

deposit:

- $100

Trading platform:

- MetaTrader4

- MetaTrader5

- IFSC

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

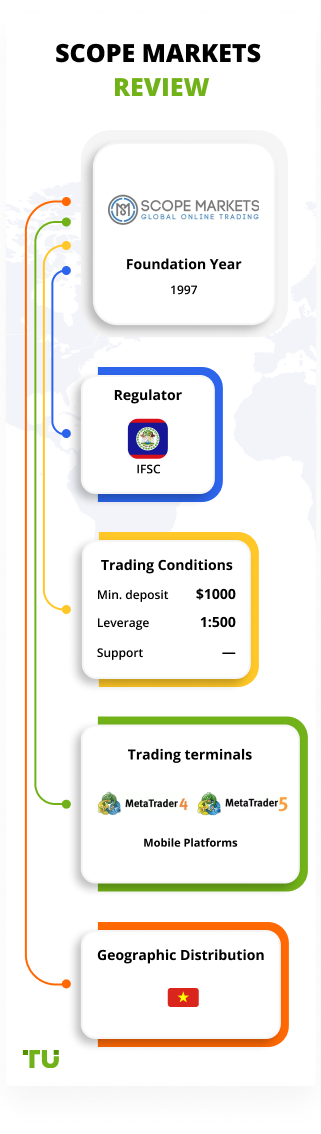

Summary of Scope Markets Trading Company

Scope Markets is a broker with higher-than-average risk and the TU Overall Score of 3.99 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Scope Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Scope Markets ranks 216 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Since Scope Markets uses ECN technology, its clients can expect fast and profitable trading without intermediaries. The minimum spread indicator of 0.9 pips corresponds to the market average, but the absence of trading and withdrawal fees seriously reduces the costs of traders. A large number of assets combined with high leverage increases the profit potential and provides for diversification of trading strategies. Popular trading platforms, make it possible to individualize the work environment. Unfortunately, this broker does not have options for passive income; and technical support works only 12 hours per day on weekdays only, or 12/5.

Scope Markets provides access to CFDs on currency pairs, indices, stocks, commodities, and metals. Its clients can register two account types, namely demo and live. A demo account is free to open; for a live account, you need to deposit $100 minimum. To deposit and withdraw funds, traders can use bank transfers, Skrill, Neteller, and Visa/MasterCard bank cards. Trading conditions look attractive, as there are floating spreads from 0.9 pips, no fees, and leverage up to 1:500. Traders have access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), including their mobile versions. The broker's website contains a large number of educational materials, and each client can participate in webinars if desired. There is a welcome bonus. The broker offers partnerships for individuals and legal entities.

| 💰 Account currency: | USD, EUR, and GBP |

|---|---|

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | Up to 1:500 |

| 💱 Spread: | Floating, from 0.9 pips |

| 🔧 Instruments: | CFDs on currency pairs, indices, stocks, metals, and commodities |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Scope Markets:

- This broker is convenient for novice traders, as the minimum deposit is only $100, there is a 50% welcome bonus, and individual technical support;

- Professional market participants will appreciate the large choice of CFDs, significant leverage, and the absence of trading restrictions;

- Since this broker has only one live account type, its clients do not need to puzzle over which account is optimal for them;

- Scope Markets is an ECN (Electronic Communication Network) broker, which ensures fast execution of trades and no delays in transactions;

- MT4 and MT5 are recognized as easy-to-use and reliable solutions that are easily customized;

- The broker has low spreads, and there are no trading fees, so the trader's costs in the trading process are minimal;

- Clients can withdraw profits for free once a day. A fixed fee is charged for each subsequent withdrawal.

👎 Disadvantages of Scope Markets:

- There are many trading instruments in this broker's pool, but they are all CFDs;

- Analytics is available only for the simplest solutions, and there is no Autochartist and digests;

- The company does not offer passive income options, and there is only the Introducing Broker (IB) program.

Evaluation of the most influential parameters of Scope Markets

Trade with this broker, if:

- You seek Islamic accounts. Scope Markets offers Islamic accounts compliant with Sharia law, catering to the needs of Muslim traders who require Halal trading conditions.

- You value fast execution. As an ECN (Electronic Communication Network) broker, Scope Markets ensures fast execution of trades and no delays in transactions, which can be advantageous for active traders.

Do not trade with this broker, if:

- You seek passive income options as the company does not offer passive income options beyond the Introducing Broker (IB) program. If you're looking for alternative ways to earn income through trading, this may not be suitable.

- You prioritize high regulatory standards. Belize, where Scope Markets is regulated, has less stringent regulations compared to major jurisdictions like the US, UK, or Australia. If you prioritize trading with brokers under stricter regulatory oversight, you may prefer other options.

Table of Contents

Geographic Distribution of Scope Markets Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Scope Markets

Scope Markets Ltd, which owns the brand of the same name, was founded in 2016. It is registered in Belize and therefore is regulated by the Financial Services Commission (FSC). Experts at Traders Union (TU) did not find confirmed facts of non-fulfillment by this broker of its obligations to its clients. The company is reputable, proven, and reliable.

The main feature of its trading conditions is there is only one account type, not counting the demo. Floating spreads from 0.9 pips will not surprise anyone, while the absence of a fee looks like a significant advantage, especially when combined with the absence of a withdrawal fee. More precisely, a fixed fee of $35 is charged only if traders withdraw money more than once a day, so this is a rather rare situation.

Minimum trade is 0.01 lots, maximum leverage is 1:500, and there is a 50% welcome bonus. According to these indicators, Scope Markets does not differ from its leading competitors. Basic technical analysis tools are available, including an economic calendar and a range of calculators. The user account on the website is simple and intuitive, trading is carried out through the top MT4 and MT5 platforms.

The broker’s disadvantages include regional restrictions, the absence of passive income opportunities, and a small number of deposit/withdrawal channels. But these features are not critical disadvantages. After all, this is a CFD broker that uses the ECN system and offers hundreds of assets together with the absence of even minimal trading restrictions.

Accordingly, this broker is recommended for review. Moreover, the demo account is free for 14 days, and the minimum deposit on a live account is only $100.

Latest Scope Markets News

Dynamics of Scope Markets’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Most traders come to brokerage companies to trade on their own. Therefore, due to the minimum demand, alternative income options are not available everywhere. There are platforms where you can buy dividend stocks or invest in cryptocurrency staking. Although most often those are joint accounts, copy trading services, or referral programs. Scope Markets does not offer any of these options.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership with this broker

Any individual or legal entity can become this broker’s partner. For example, this can be a socially active trader, a marketing expert, a lead generator, an investment manager, a private trading firm, or a fintech company. Depending on the investments, the number of invited traders, and the volume of their trading, this broker's partner receives various benefits, such as trading discounts, participation in drawings, etc. The discount per conversion (CPA model) includes 4 levels and can be up to $1,000. Scope Markets offers its partners modern marketing tools and transparent statistics. However, this program is more suitable for businesses, rather than individuals as partners.

Trading Conditions for Scope Markets Users

If a broker offers multiple live account types, the minimum deposit usually depends on the type chosen by a trader. But Scope Markets has only one account type, so the minimum deposit is $100 under any circumstances. Leverage is determined by the asset, and it is always the highest for CFDs on currency pairs. Its indicator of 1:500 corresponds to the average trading leverage among the top CFD brokers. Technical support can be contacted via call center, email, and live chat. Unfortunately, managers are only available 12/5.

$100

Minimum

deposit

1:500

Leverage

12/5

Support

| 💻 Trading platform: | MetaTrader 4 and MetaTrader 5 |

|---|---|

| 📊 Accounts: | Demo and Standard |

| 💰 Account currency: | USD, EUR, and GBP |

| 💵 Replenishment / Withdrawal: | Bank transfer, Visa and MasterCard bank cards, Skrill, and Neteller |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating, from 0.9 pips |

| 🔧 Instruments: | CFDs on currency pairs, indices, stocks, metals, and commodities |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | From 30 ms |

| ⭐ Trading features: |

Demo account is free; One live account type; Low entry threshold; Many CFDs from five groups; No trading fees and no fees for the first withdrawal per day; Tight spreads; No passive income options. |

| 🎁 Contests and bonuses: | Yes: welcome bonus, rebates from Traders Union, and competitions for partners |

Comparison of Scope Markets with other Brokers

| Scope Markets | RoboForex | Eightcap | Exness | Octa | TeleTrade | |

| Trading platform |

MT4, MT5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | MT4, MT5 |

| Min deposit | $500 | $10 | $100 | $10 | $25 | $1 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:10 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 1 point | From 0.6 points | From 0.8 points |

| Level of margin call / stop out |

50% / 10% | 60% / 40% | 80% / 50% | No / 60% | 25% / 15% | 70% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| Scope Markets | RoboForex | Eightcap | Exness | Octa | TeleTrade | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | No | Yes |

| Options | No | No | No | No | No | No |

Scope Markets Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | Floating spread from $9, no fee | No fee for the first withdrawal per day, $35 is charged for subsequent withdrawals |

There are many brokers that charge withdrawal fees. The fee can be fixed or floating (i.e., a percentage of the withdrawn amount), and it usually depends on the withdrawal channel. But there are also companies that cover their own expenses for traders’ withdrawals. Scope Markets is in the middle position because there is no fee only for the first withdrawal per day. Since the vast majority of traders do not withdraw profits more than once, it is possible to say that this broker’s clients do not have additional expenses. The comparative table below shows the average trading fees for Scope Markets and its closest competitors.

| Broker | Average commission | Level |

| Scope Markets | $9 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed review of Scope Markets

Scope Markets has an up-to-date technology stack. In particular, the company uses the ECN system for executing trades in order to provide traders with the most favorable trading conditions. It also uses virtual servers, which ensures its stable operation and high performance. The conceptual advantage is the use of MetaTrader. These trading platforms are intuitive, have many useful features, and can be easily customized using integrated plug-ins. TU’s retrospective analysis did not reveal situations when this broker had problems with hacking accounts or a drop in the efficiency of order execution. This speaks in favor of the technical reliability of this broker and traders’ security.

Scope Markets by the numbers:

-

1 live account type plus demo;

-

Minimum deposit is $100;

-

Minimum spread is 0.9 pips;

-

Maximum leverage is 1:500;

-

5 groups of trading instruments.

Scope Markets is a CFD broker for fast and comfortable trading

Speed is important for any trader. The broker offers execution of orders at the level of 30 ms, which is achieved, among other things, through the ECN protocols. The second important point is the asset pool. The more of them, the wider traders’ strategic opportunities. Scope Markets provides access to hundreds of trading instruments, and there are CFDs on currency pairs, indices, stocks, commodities, and metals. Yet, this broker does not set restrictions on trading, so its clients work freely. A large number of instruments provides for forming diversified portfolios, in which the negative trend of one asset is compensated by the stable and progressive positions of others. Another aspect of working with Scope Markets is the possibility of customizing the working environment through plug-ins for MetaTrader platforms. Thus, a trader of any level will feel comfortable.

Useful services offered by Scope Markets:

-

Economic calendar. This is a basic technical analysis tool. It displays events from the world of politics and economics that can affect quotes. Also, it provides for making forecasts;

-

Profit calculator. This tool provides for calculating profit on a trade, taking into account all expenses. Traders choose the instrument, currency, position volume, and other parameters, and get a precise result;

-

Pips calculator. This is another technical tool that automates basic calculations. By choosing an asset, currency, and trade volume, traders will find out the value of a pips.

Advantages:

Registration and verification take a minimum of time; and a trader can immediately open a free demo account;

To open a live account, a deposit of $100 is required; also, there are no trading restrictions, and top MT4 and MT5 platforms are available;

The broker’s pool has hundreds of CFDs from five groups with leverage up to 1:500;

The company has a powerful technological base, which guarantees stable operation of the site and fast execution of trades;

Technical support is highly evaluated by users and independent experts.

Guide on how traders can start earning profits

If a broker offers several account types, the first step is to carefully select the type that is best for him. At Scope Markets, the user immediately gets access to one live account with universal trading conditions upon registration and verification. The choice of a trading platform is of conceptual importance. MT4 and MT5 are similar, but they have a lot of differences in terms of functions and customization options. TU experts recommend trying both solutions if you haven't worked with them before. As for the IB program, everyone is eligible to participate in it. An ordinary trader who does not have serious resources to attract clients to this broker is unlikely to be able to gain significant benefits.

Account types:

The usual practice is to open a demo account first, and then a live one. The demo promotes learning the site and its capabilities without the risk of financial losses. Moreover, by trading virtual currency in real markets, traders get a chance to test and improve their strategy without the risk of losing money. When they are convinced of the comfort of the conditions and are ready to trade for real, they can open a live account. Scope Markets offers only one account type, so traders don’t have to puzzle over which to choose.

Investment Education Online

It is not enough for a trader to practice constantly. Theoretical education, such as watching webinars, reading specialized literature, and researching analytical calculations is required also. Only in this way can he successfully follow the market and earn. Many start trading with almost no real knowledge of the financial markets. Brokers are well aware of this, so some websites have educational programs for novice traders and intermediate users. Scope Markets offers a series of eBooks that explain the basics of trading as well as in-depth topics. Moreover, this broker constantly updates its collection of video tutorials and regularly holds open webinars.

It is a mistake to assume that absolutely all the information that is available on this broker's website in the “Education” section will be of interest only to novice traders. First, repetition is the key to learning. Second, there is also a lot of useful information for mid-level players, such as specific trading methods and strategies. At the same time, regular webinars conducted by the company's experts are of particular value to everyone without exception.

Security (Protection for Investors)

Security of user funds and data can only be ensured if a broker is officially registered and regulated. Registration indicates that the company operates within the laws. Regulation confirms its transparency and honesty. The Scope Markets brand is owned by Scope Markets Ltd, which is registered in Belize and has a physical office there. Scope Markets Ltd is regulated by the Belize Financial Services Commission (FSC), under license numbers 000274/393 and 000274/394.

👍 Advantages

- Traders can contact client support of Scope Markets Ltd

- The broker’s clients can apply to FSC

- Contact Traders Union’s legal department for a free consultation and representation. It protects its members’ rights without charge.

👎 Disadvantages

- No opportunity to address financial authorities at the traders’ place of residence (unless they reside in Belize)

- No opportunity to contact any other regulator except for FSC

Withdrawal Options and Fees

-

If traders work on a demo account, they do not use real money, therefore they do not receive real profit;

-

As soon as this broker's clients switch to a live account, they start executing real trades and make income;

-

Funds are accumulated on the account balance, and withdrawals are carried out upon request;

-

Withdrawal requests are submitted through the relevant option in the trader's user account on the Scope Markets website;

-

Traders can use such withdrawal channels as bank transfers, Visa and MasterCard bank cards, Skrill, and Neteller;

-

Minimum withdrawal amount is $50/€50/£50;

-

The broker does not charge a fee if this is the first withdrawal of the day, for the second and subsequent withdrawals the fee is $35;

-

Traders need to remember that fees may also be charged by third parties involved in the withdrawal process;

-

Withdrawal requests are processed within 1-2 business days, transfers take 3-5 days, and international transfers take up to 3-8 days.

Customer Support Service

Any trader sooner or later faces situations that their experience and qualifications cannot resolve. This may be, for example, ambiguities in trading or difficulties in withdrawing funds. If a broker's clients receive timely and competent assistance, they continue to work with it. But if client support does not satisfy traders in terms of efficiency or competence, they may be disappointed and leave for a competitor. Scope Markets offers technical support that is highly evaluated by users and experts. It is available by such standard communication channels as phone, email, and live chat. Unfortunately, managers do not work at night or on weekends.

👍 Advantages

- Non-clients of this broker can contact technical support

- During the daytime, support responds promptly via all communication channels

- Each client is provided with a personal manager

👎 Disadvantages

- Support is not available at night or on weekends

Whether you are this broker’s client or just intend to be, do not hesitate to contact client support for any questions via the following communication channels:

-

call center;

-

email (English);

-

email (German);

-

live chat on this broker's website and in the user account.

The broker has its profiles on such social platforms as LinkedIn, Twitter, Facebook, Instagram, and YouTube. There, you can also contact technical support. Subscribe to at least one profile in order to quickly track the company’s news.

Contacts

| Foundation date | 2013 |

| Registration address | 6160, Park Avenue, Buttonwood Bay, Lower Flat Office Space Front, Belize City, Belize |

| Regulation |

IFSC Licence number: IFSC/60/373/TS/20 |

| Official site | www.scopemarkets.com |

| Contacts |

Email:

customerservice@scopemarkets.com,

Phone: +44 2030 51695 |

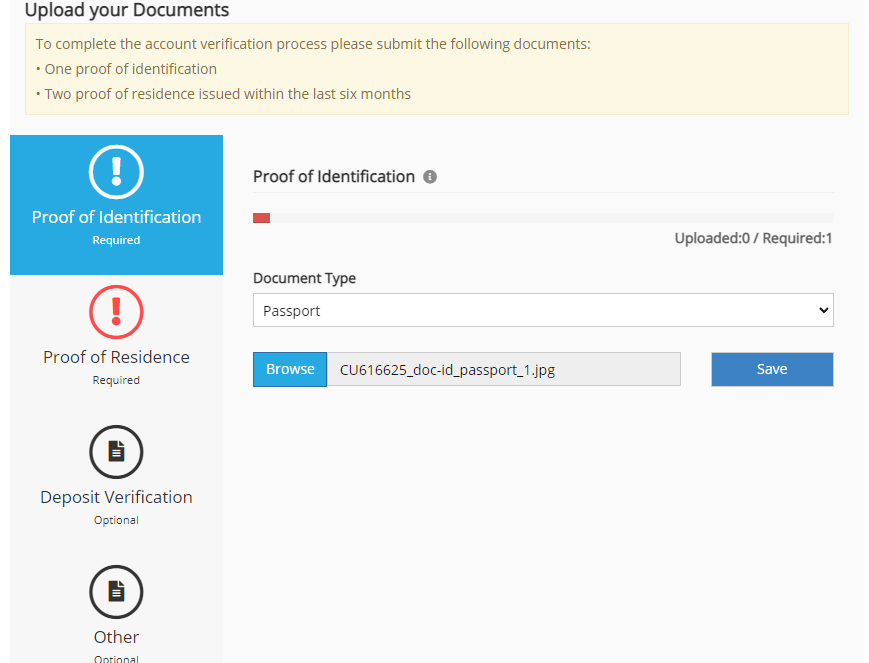

Review of the Personal Cabinet of Scope Markets

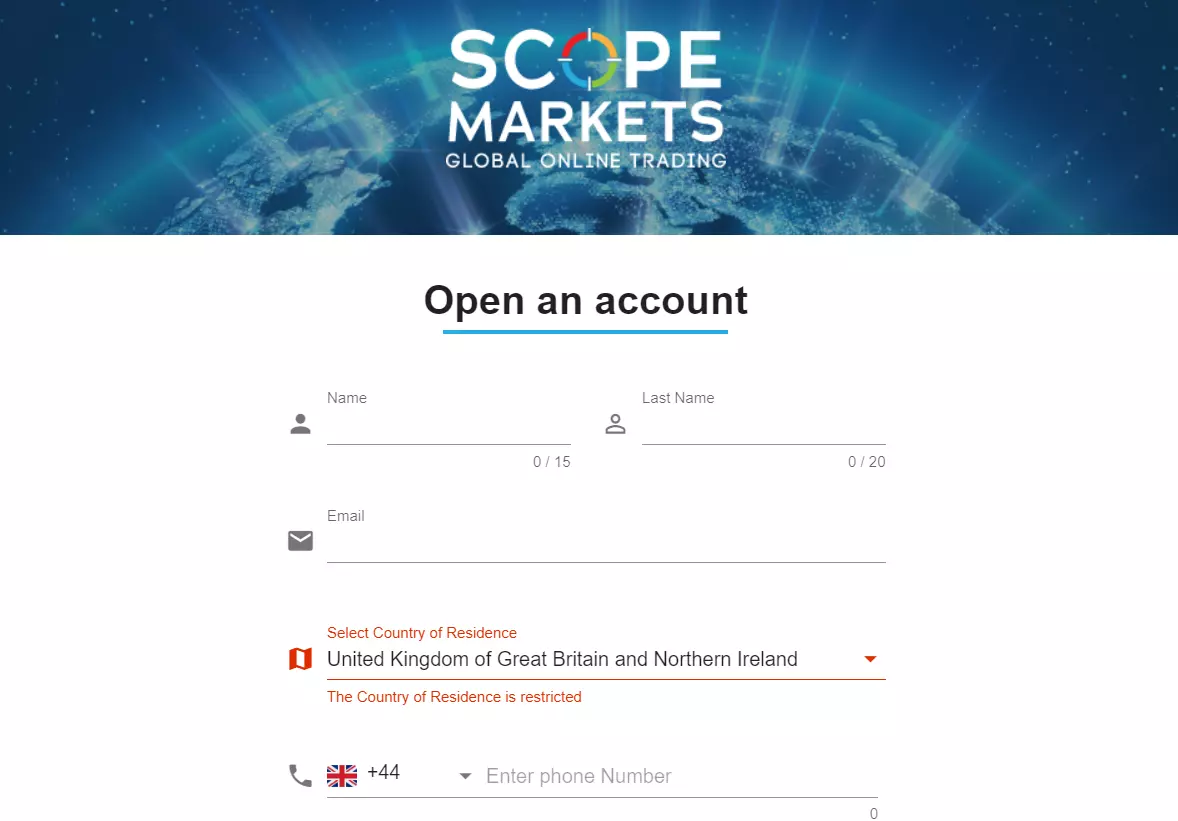

To start working with Scope Markets, register on its official website, complete verification, and make a deposit not less than the minimum. TU experts have prepared a step-by-step guide on registration and the possibilities of the user account.

Go to this broker's website. Select the interface language from the top menu and click the “Start Trading Now” button.

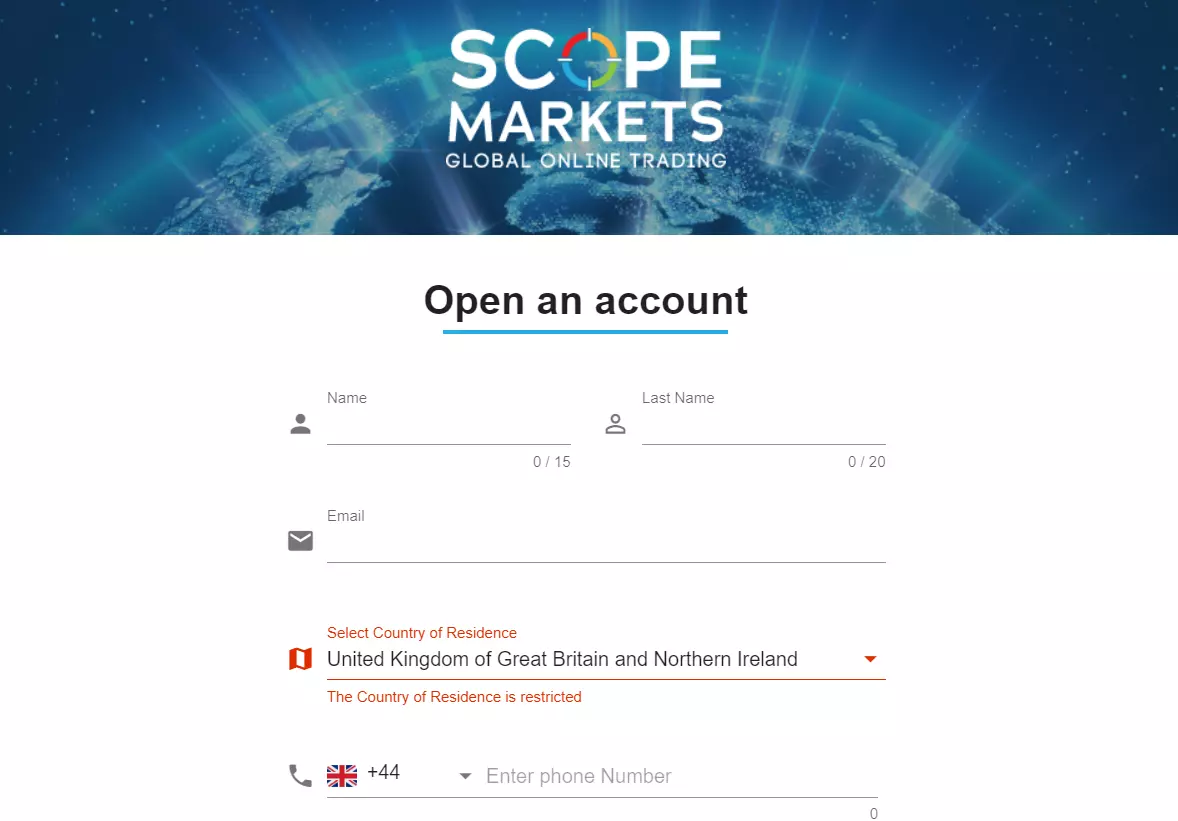

Enter your first and last names, email, phone number, and your country of residence. Create a password, agree to the terms of service by ticking the box, and click the “Submit” button.

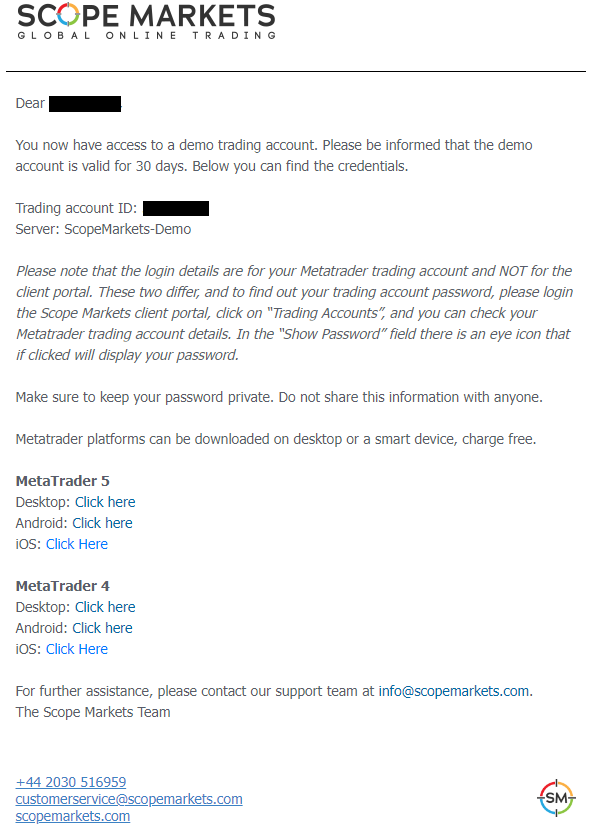

A letter with the identifier of the demo account will be sent to the specified email. Also, in the letter there will be links to the MT4 and MT5 distributions.

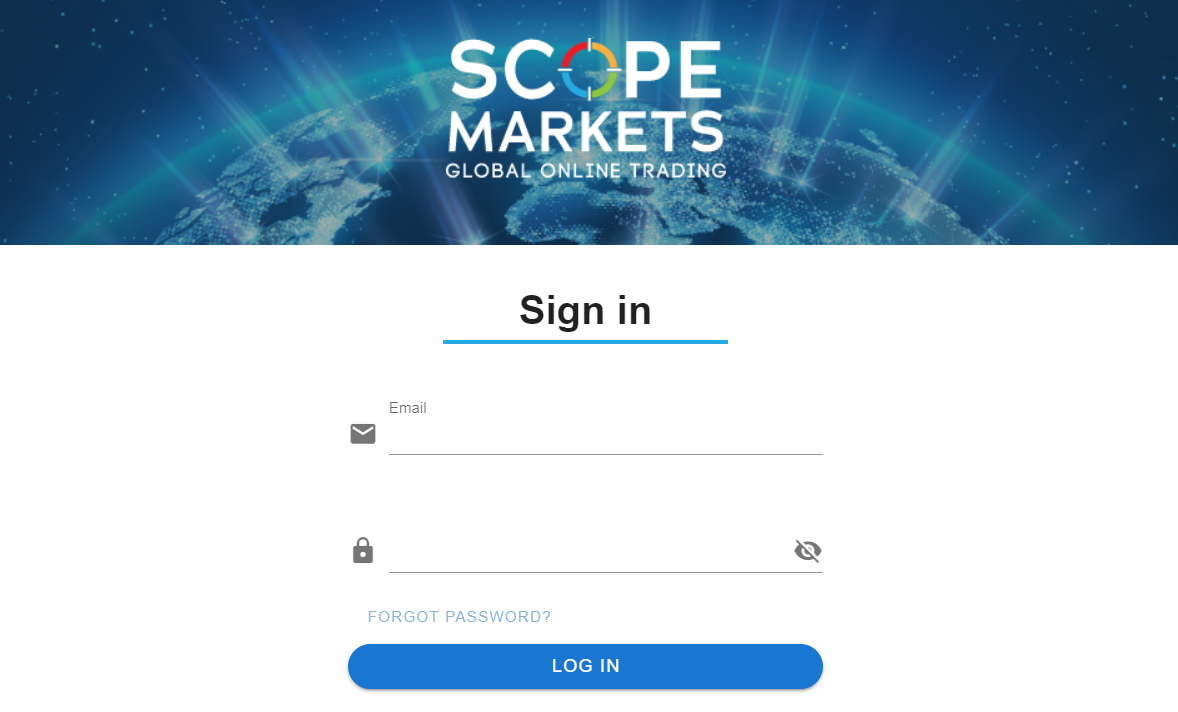

Return to this broker's website and click the “Login” button in the top right corner. Enter your email and password.

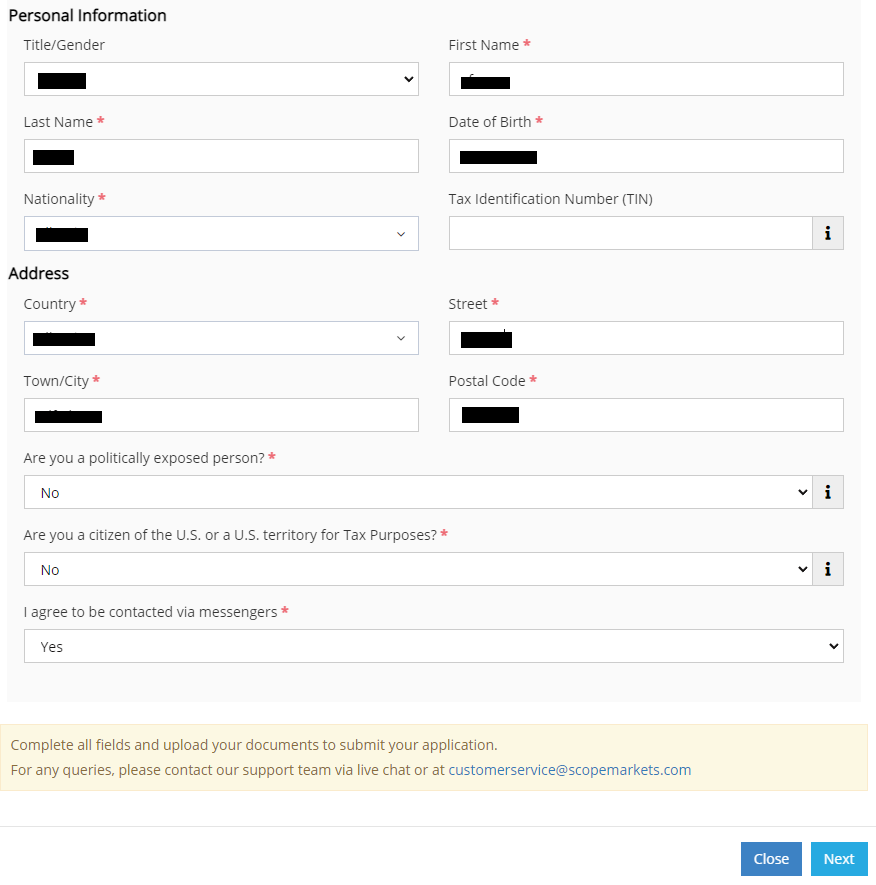

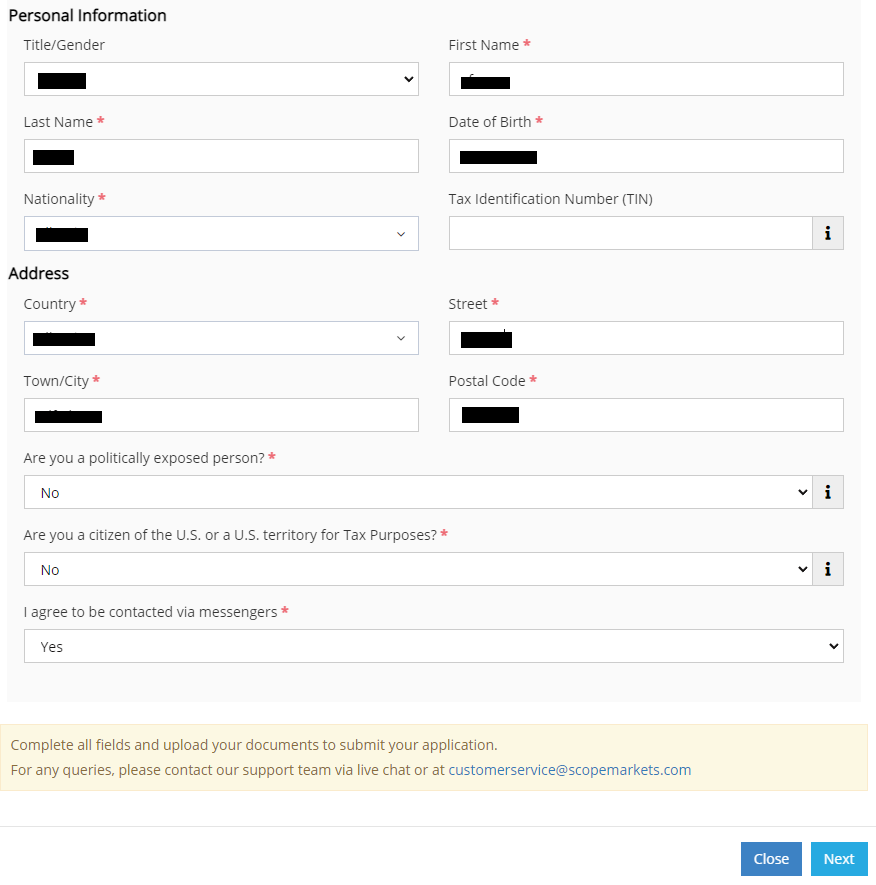

Enter your full registration address with the post code and your date of birth. Answer a few questions and click the “Next” button.

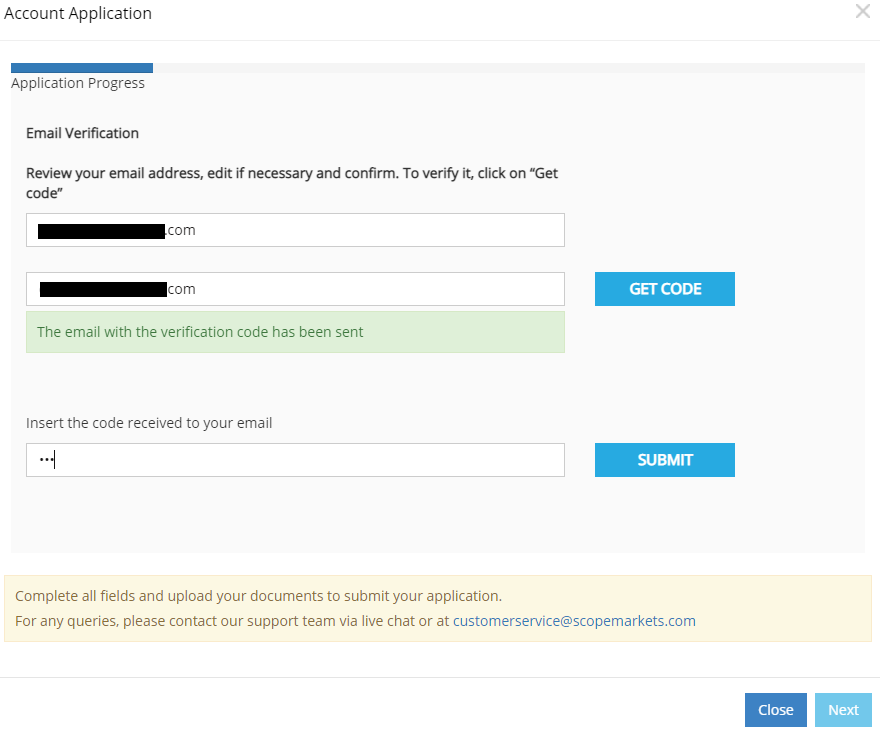

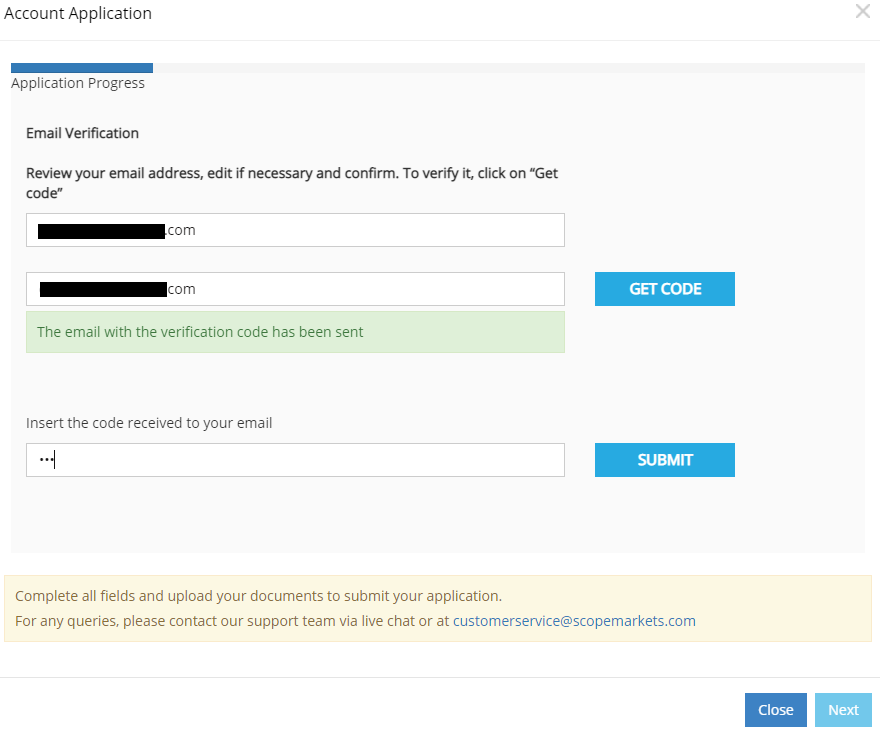

A three-digit code will be sent to your email. If for some reason it did not arrive, click the “Get Code” button. Enter it in the appropriate field to confirm the email and click the “Next” button.

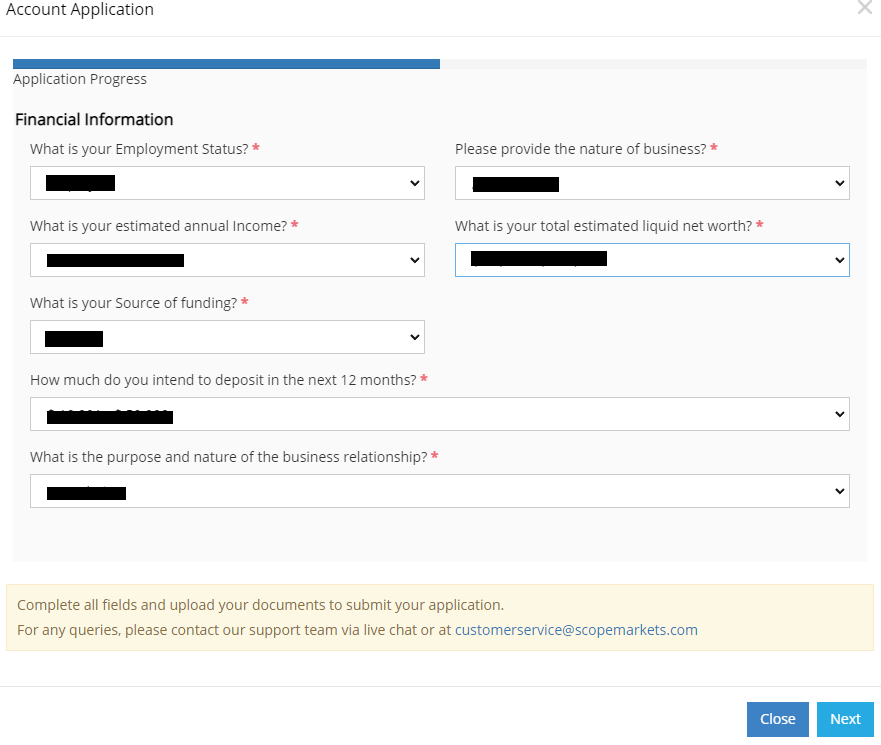

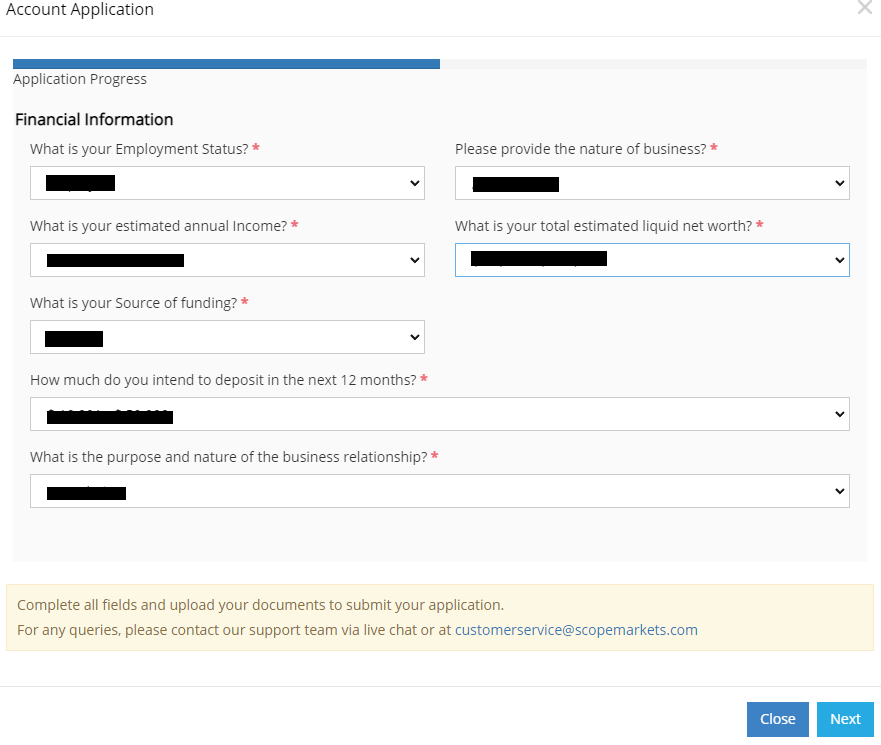

Answer a few questions about your income and trading experience. Click the “Next” button after completing each block.

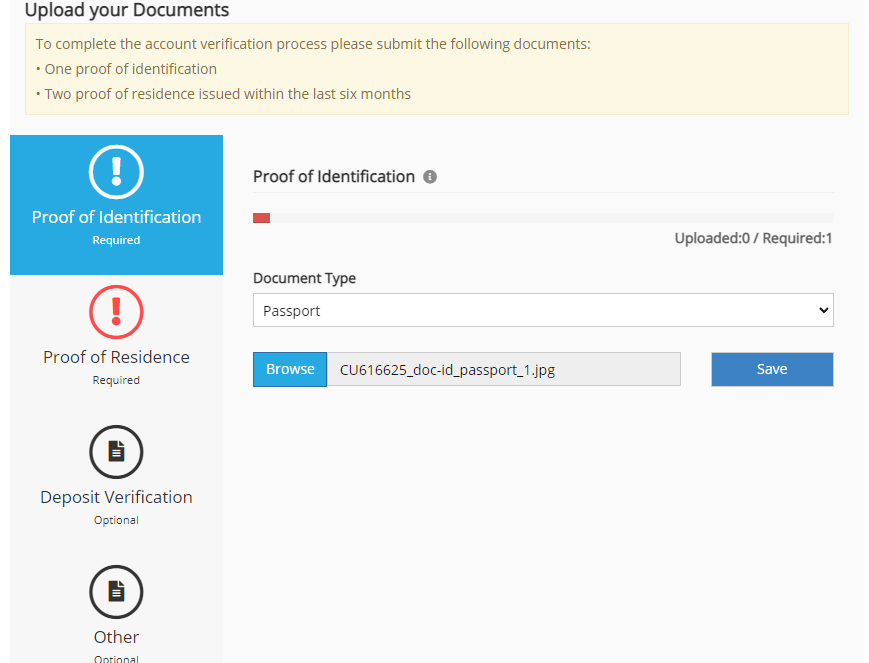

Upload scans/photos of documents confirming your identity. Read the comments on the screen and follow the instructions carefully. Note that there are four sections in the verification block and you need to fill in each of them.

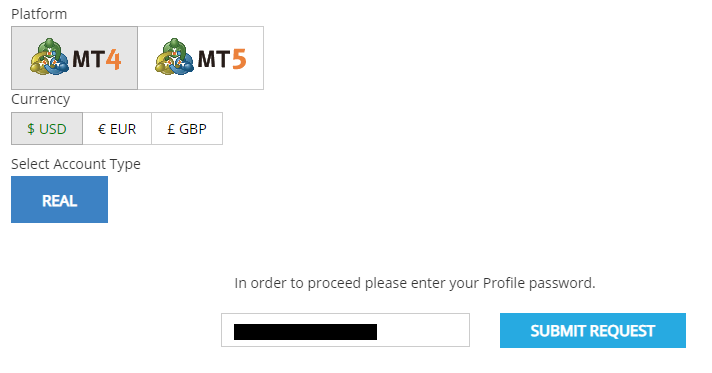

Click the “Open Account” button. Select a live account type, specify the platform, and basic currency. You will receive an account number and a password to enter the trading platform. Now make a deposit, download MT4 or MT5, and start trading.

Features of the user account:

In the dashboard, traders can see detailed information about their accounts, including open and closed trades;

Deposits and withdrawals are carried out through the appropriate options;

In the profile settings, the user adjusts personal data and security settings;

There is a live chat with technical support and an email button;

Access to training materials and analytical tools is provided through this broker's website.

Articles that may help you

FAQs

Do reviews by traders influence the Scope Markets rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Scope Markets you need to go to the broker's profile.

How to leave a review about Scope Markets on the Traders Union website?

To leave a review about Scope Markets, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Scope Markets on a non-Traders Union client?

Anyone can leave feedback about Scope Markets on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.