deposit:

- $250

Trading platform:

- MT5

- WebTrader

- CySEC

- ASIC

Trade360 Review 2024

Best alternatives for Trade360

|

Ranking position |

Overall Score |

Broker | Next Step |

|---|---|---|---|

|

1

|

Score

5.6

/10

|

||

|

2

|

Score

5.3

/10

|

||

|

3

|

Score

5.98

/10

|

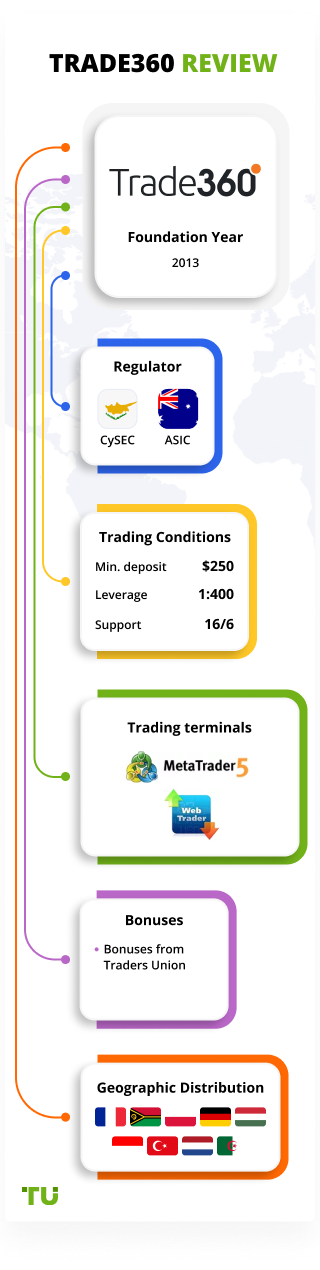

Summary of Trade360 Trading Company

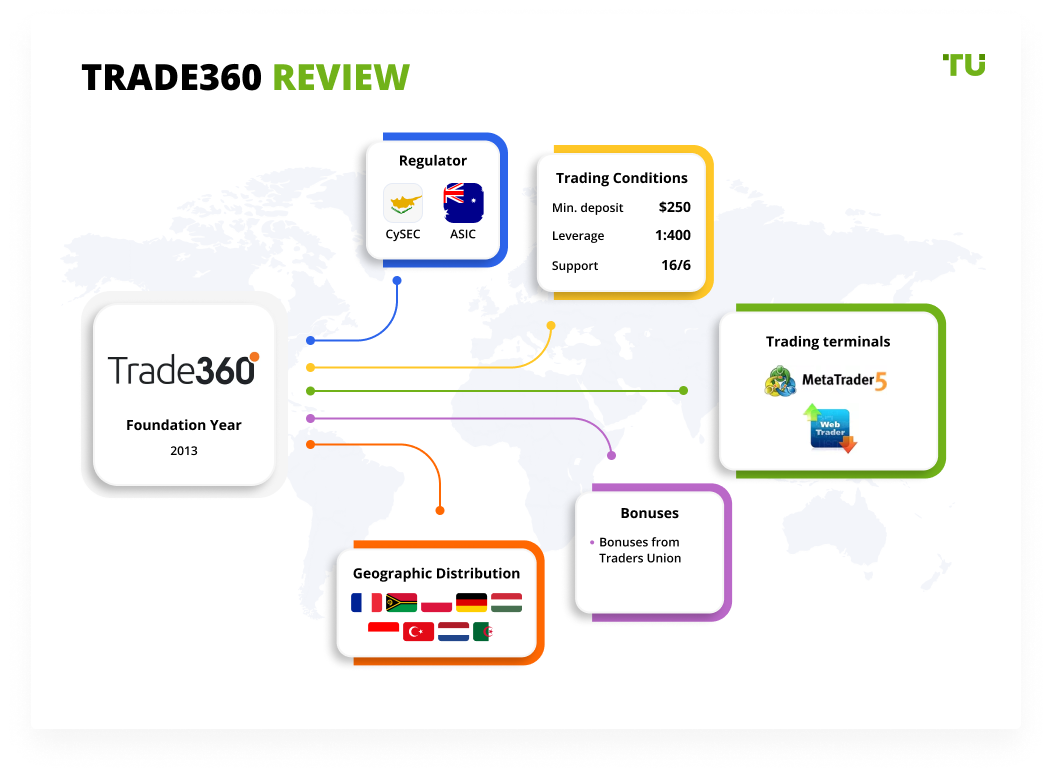

Trade360 is a CFD stockbroker that has been providing services since 2013. The company offers CFD trading in five asset classes - currency pairs, stocks, stock indices, commodities (metals and energy products), and ETFs. Trading in cryptocurrency assets is available only upon special request. Trade360 is a global brand that unites three divisions: CrowdTech Ltd. (Cyprus), Sirius Financial Markets Pty Ltd. (Australia), and ST Services Ltd. (Marshall Islands). The regulators are CySEC 202/13 (Cyprus Securities and Exchange Commission) and ASIC ACN: 142 189 384 (Australian Securities and Investments Commission).

👍 Advantages of trading with Trade360:

- CrowdFeed technology that provides real-time data on market trends.

- Its trading platforms are WebTrader 4 and MetaTrader 5.

- Trading ideas and insights from Trading Central.

- Regulators are in Cyprus and Australia.

- A variety of markets such as foreign exchange, commodity, stock. ETFs and cryptocurrencies are available upon request.

👎 Disadvantages of Trade360:

- High spreads are from 2.0 pips for the EUR/USD pair.

- The minimum deposit is 250 USD.

Geographic Distribution of Trade360 Traders

Popularity in

Video Review of Trade360 i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Investment Programs, Available Markets and Products of the Broker

Broker Trade360 does not provide an opportunity to invest in PAMM or MAM trust accounts or to copy transactions of professional traders to its account through social trading platforms.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Trade360’s affiliate program:

-

Introducing Broker (IB) is a solution for those who want to provide brokerage services. Both a company and an individual can become an affiliate.

The Introducing Broker’s goal is to attract clients to trade under the Trade360 brand on the selected reward model. To do this, he gets access to marketing materials, and Trade360 acts as an intermediary, providing the clients of the IBs with everything they need, including support and a platform with CrowdFeed technology.

-

Affiliates – if you like to trade with Trade360, you can recommend a broker through the affiliate link and get paid for it.

More than 5 million users participate in the affiliate network. In total, the broker paid out over $80 million as customer acquisition rewards. The Affiliates program is only available to active clients. To start earning, you need to select the form of payment in your personal account.

Trading Conditions for Trade360 Users

Trade360 offers clients more than 100 trading instruments, the classic MetaTrader 5 terminal, and the WebTrader terminal with the unique CrowdFeed technology. The CrowdFeed tool constantly measures the volume of purchases and sales and notifies the user about changes in volatility and balance of long-term and short-term positions. ECN accounts are not available and spreads are fixed. Traders receive leverage of up to 1:400, coupled with the useful opportunity within the WebTrader platform to customize the leverage for each specific trade. Potential clients can test the trading conditions on a demo. By making a request of the support team, Muslim traders can get Islamic accounts (no swap charges).

$250

Minimum

deposit

1:400

Leverage

16/6

Support

| 💻 Trading platform: | WebTrader (mobile, web), МТ5 (desktop, mobile) |

|---|---|

| 📊 Accounts: | Demo, Mini, Standard, Gold, Platinum, Diamond, VIP |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Credit and debit cards, wire transfer, Neteller, Skrill |

| 🚀 Minimum deposit: | from 250 USD |

| ⚖️ Leverage: | Up to 1:400 for professionals. For retail clients, it’s up to 1:30. |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 2.0 pips (for type Gold account) |

| 🔧 Instruments: | CFDs for currency pairs (37), shares (450), indices (10), and raw materials (4), ETF (40). Upon request, cryptocurrencies (9) are available |

| 💹 Margin Call / Stop Out: | 50%/25% |

| 🏛 Liquidity provider: | Several partner brokers |

| 📱 Mobile trading: | Available |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant execution, Market execution |

| ⭐ Trading features: | Payment for an inactive account – 100 USD once per each 45 day period |

| 🎁 Contests and bonuses: | unavailable |

Trade360 Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Mini | from $40 | No |

| Standard | from $30 | No |

| Gold | from $20 | No |

| Platinum | from $20 | No |

| Diamond | from $20 | No |

There are swaps (commission for moving a position to the next day). Their sizes depend on the trading instrument, the direction of the existing position, and volatility.

Analysts at Traders Union also compared the size of the average trading commission of Trade360, Admiral Markets, and FXPro. The results of the comparison are presented in this table.

| Broker | Average commission | Level |

| Trade360 | $30 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed Review of Trade360

The Broker Trade360 bases its work on three principles: technological effectiveness, a variety of trading instruments, and fast client support. Clients can conduct automated trading on the MT5 platform, monitor the behavior of other market participants on the WebTrader platform, and use free analytics from the Trading Central experts. Islamic accounts are available to traders upon request.

Trade360 in numbers:

-

More than 500 available trading instruments.

-

More than 8 years in brokerage services.

-

More than $80 million paid according to the affiliates program.

Trade360 is a broker for trading in harmony with market trends

The company’s clients can trade CFDs on currency pairs, stock indices, stocks, metals, energy products, ETFs, and cryptocurrencies (upon request).

Trade360’s clients trade via the MetaTrader 5 desktop and mobile terminals, as well as using the broker’s proprietary web platform. One-click trading is available to traders. Automated advisors, scripts, and signals received through the MQL market are allowed on MT5.

Trade360’s useful services:

-

CrowdFeed. With the WebTrader platform, the user can monitor the updated balance of open long-term/short-term positions to discover market trends and make trading decisions based on this information.

-

Analytics from Trading Central. Daily forecasts for price movements are right inside the platform.

-

Display of market data. Traders have access to an economic calendar, can search for trading instruments by ticker, form watch lists, and sort through trading instruments according to various criteria.

-

Alerts are triggered when specified conditions are met.

Advantages:

There are five asset classes available for trading, such as currency pairs, stocks, stock indices, commodities (metals and energy products), and ETFs.

Its regulators are located in the EU and Australia.

To ensure the safety of clients’ funds, the company stores them in segregated accounts.

Protection of investors from the European Compensation Fund for up to €20,000.

Clients have access to information about the actions of other market participants thanks to the award-winning CrowdTrading technology.

The broker provides free analytics and online materials to improve the quality of trading.

All clients, regardless of the size of the deposit, have access to Islamic accounts. It is possible to open a demo account.

How to Start Making Profits — Guide for Traders

Trade360 offers six types of accounts for retail traders; there is a separate account for professionals. The WebTrader platform is available for all account types. MetaTrader 5 is available starting with a Standard account. The maximum leverage for retail clients is 1:30 (depending on the jurisdiction), and for professionals, it’s 1:400.

Account types:

Demo accounts are available for all terminals.

Trade360 is a CFD broker that provides trading with integrated CrowdTrading technology.

Bonuses Paid by the Broker

Currently, the Trade360 broker does not provide bonuses to its clients. Traders who have opened an account here may only use their personal funds to trade.

Investment Education Online

The Trade360 website has a separate section with training information, but it is poorly supplied. The materials are aimed at those who are starting to trade from scratch.

The broker does not have cent accounts, so the only way to apply the knowledge gained is to practice on a demo account.

Security (Protection for Investors)

Trade360 is an international brand with three divisions. Each division operates under the requirements of the regulators of the country of its jurisdiction.

CrowdTech Ltd. operates under a license from the Cyprus Securities and Exchange Commission (CySEC), license number 202/13. Under the Markets in Financial Instruments Directive (MiFID II), the company is allowed to provide brokerage services in the European Economic Area. A division of Sirius Financial Markets Pty Ltd. authorized and regulated by ASIC, the Australian Securities and Investments Commission, license number 439907.

👍 Advantages

- Client funds are segregated from Trade360 capital and held in segregated bank accounts

- Investor funds are protected by the European Compensation Fund up to €20,000

- In case the broker violates the obligations prescribed in the offer, the client can file a complaint with the regulators

👎 Disadvantages

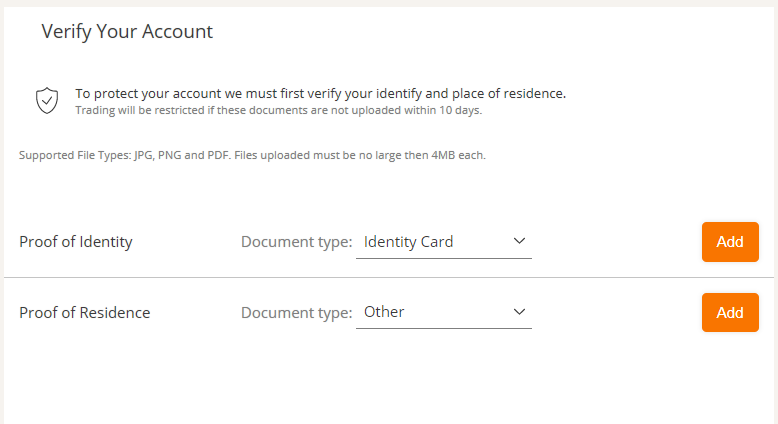

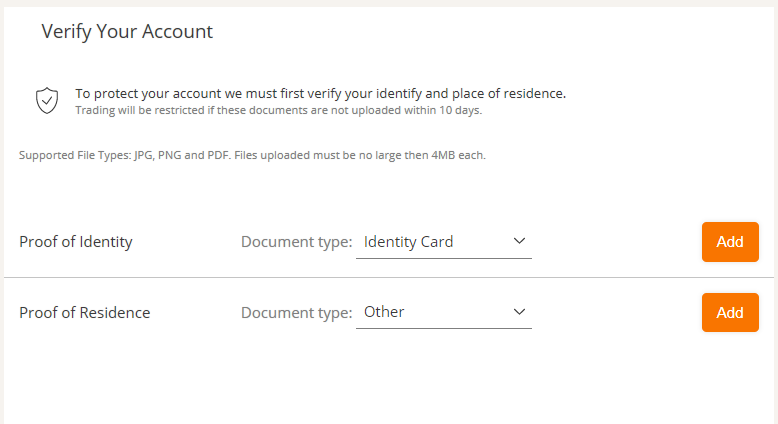

- To open an account, you must provide detailed financial information

- Without verification, you cannot make a deposit and withdraw funds

Withdrawal Options and Fees

-

The broker processes withdrawal requests within three business days. The total wait time between sending a withdrawal request and receiving funds depends on the selected payment method and can take up to 14 business days.

-

Withdrawals must be made using the same payment method that the client used when placing the deposit: Visa and Mastercard (debit and credit), via bank transfer, electronic payment systems Neteller and Skrill, etc.

-

To be able to withdraw funds, the broker may request three documents: an identity document (driver’s license, passport), a document confirming the place of residence, and proof of card ownership.

Customer Support Service

The support team is available six days a week. Sunday – from 6:00 am GMT to 1:00 pm GMT. Monday through Thursday – from 4:00 am GMT to 8:00 pm GMT. Friday – from 4:00 am GMT to 12:00 pm GMT.

👍 Advantages

- In the online chat, you can ask a question without being a client of the company

- Quick replies

👎 Disadvantages

- One language support only

Available communication channels with customer support specialists include:

-

telephone;

-

email;

-

online chat on the website and via the personal account;

-

the feedback form on the Contact Us page.

Not only can a registered client ask a question to a support employee in the chat, but also a site visitor without an active account can do so.

Contacts

| Foundation date | 2013 |

| Registration address | 116 Gladstonos, M. Kyprianou House, 3rd & 4th Floors, 3032, Limassol, Cyprus. |

| Regulation |

CySEC, ASIC Licence number: 202/13, 439907 |

| Official site | https://www.trade360.com/ |

| Contacts |

Email:

support@trade360.com,

Phone: +357-25-030-622 |

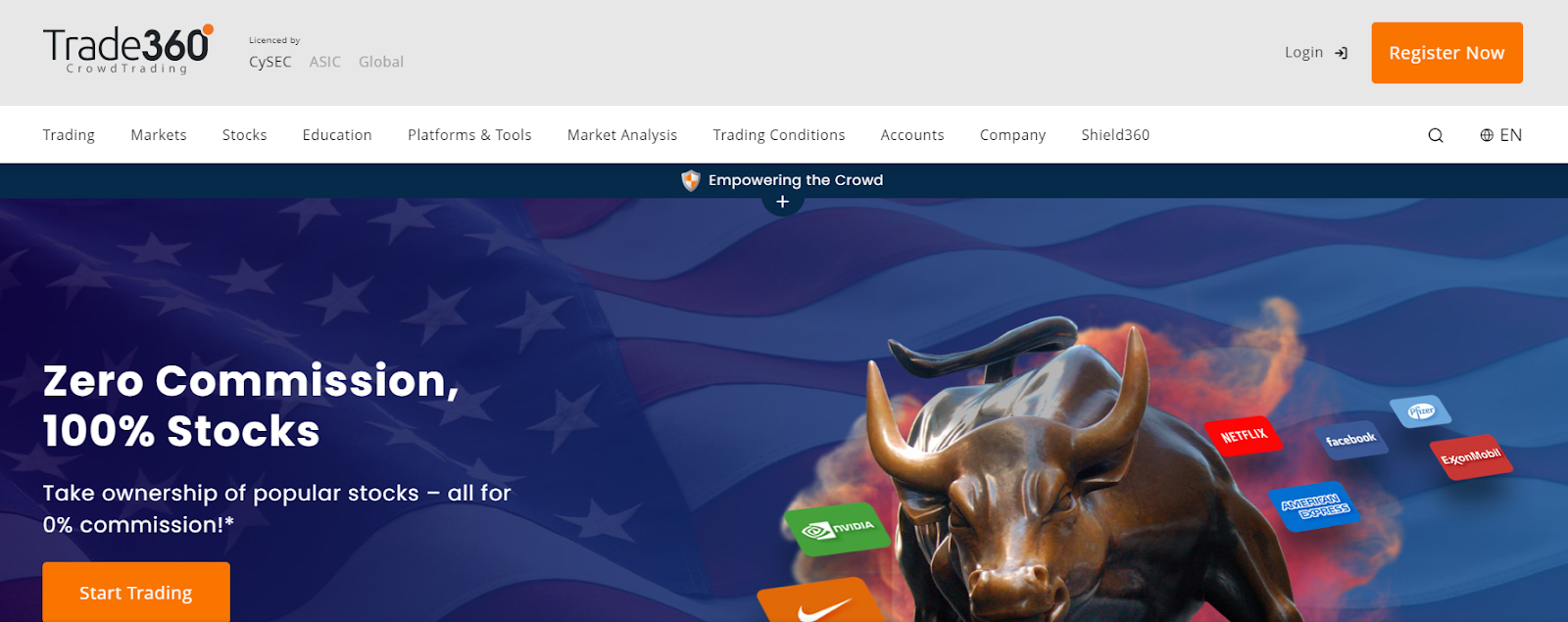

Review of the Personal Cabinet of Trade360

To start trading with Trade360, you need to become a client of the broker by opening a trading account. Brief instruction for opening an account in the European jurisdiction looks like this:

On the trade360.com website, click Trading (the first item of the main menu). After that, the system will open the WebTrader trading platform, in which you need to click Sign Up.

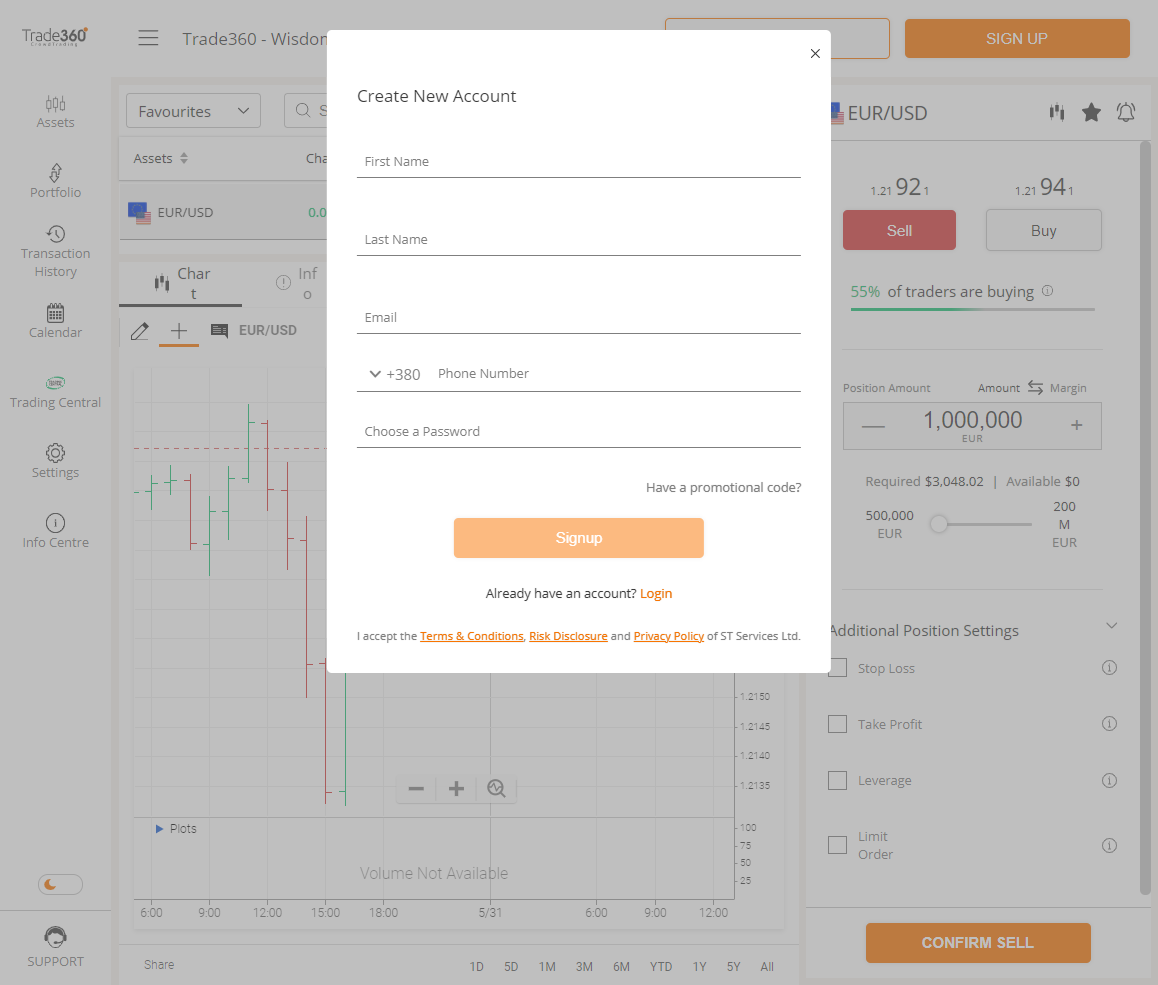

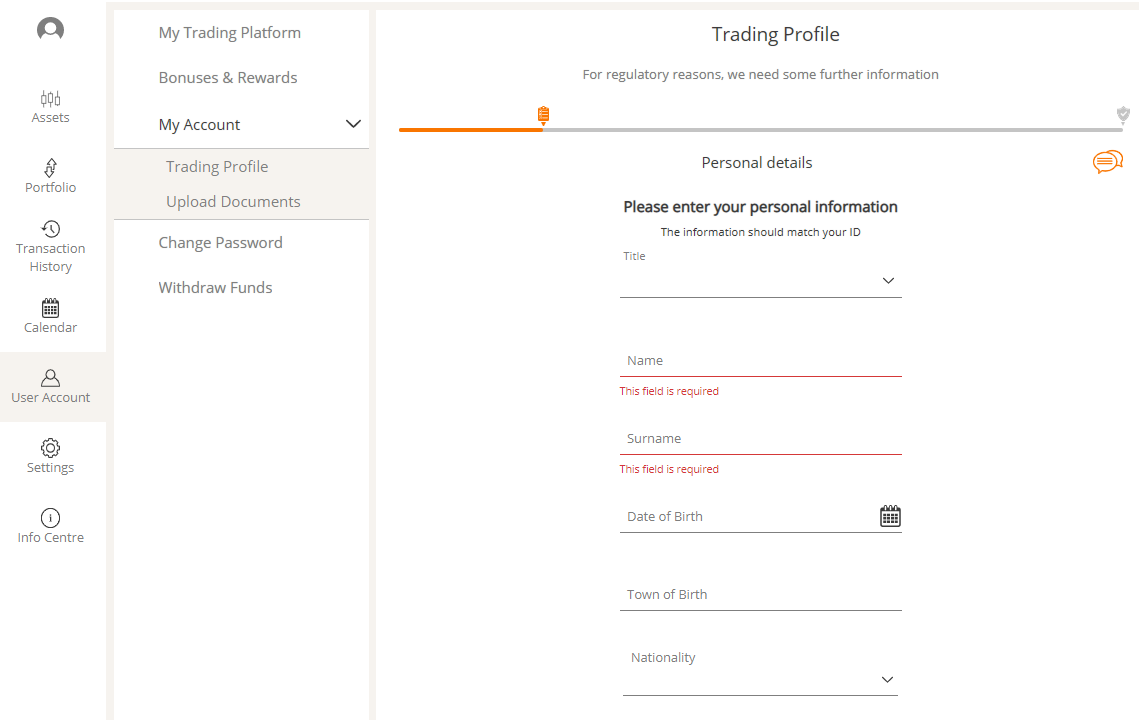

Fill out the registration form. The broker asks you to indicate your name, surname, email, phone number, password. After that, the personal account will be registered. To start trading, you need to open a new account in your client space after passing the verification.

The Trade360 personal account is integrated into the WebTrader platform.

The functionality of the Trade360 personal account:

1. Opening a new trading account:

2. Making a deposit will be available after passing the verification (uploading documents) and filling out the application form (trading experience, financial situation, and other information). Customer details are required by the KYC policy in force in Europe.

1. Opening a new trading account:

2. Making a deposit will be available after passing the verification (uploading documents) and filling out the application form (trading experience, financial situation, and other information). Customer details are required by the KYC policy in force in Europe.

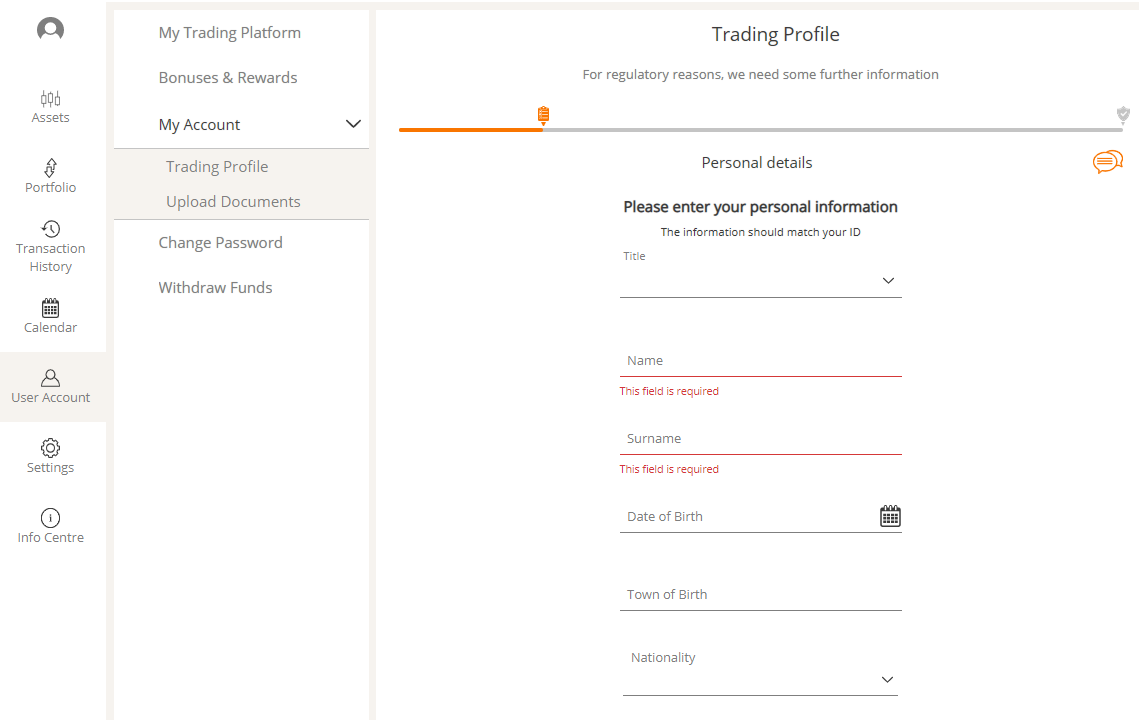

Also in the personal account, the trader has access to:

-

Info Center – a collection of reference materials on broker services.

-

Chat button with a customer service representative.

-

Data on the movement of funds on the client’s account.

-

Data from Trading Central: market analysis and a quick overview of daily news.

-

Economic calendar.

-

Functionality for switching to the demo account mode, choosing the MetaTrader 5 platform.

We constantly monitor the Internet for the emergence of new fraudulent schemes to deceive traders. We have been collecting data about scam brokers for more than 10 years and we think we know every dishonest company in the market. Below we have collected for you the information about the scammers from the List of SCAM Brokers.

Articles that may help you

FAQs

Why has Trade360 been placed on the Forex Broker Blacklist?

Possible reasons:

• multiple complaints have been filed against Trade360 by traders claiming the broker failed to fulfil its obligations, including process withdrawals;

• the website of Trade360 is down, not updated or operates with clear errors and some features are not available;

• Trade360 has been blacklisted by the regulatory authority, and a warning has been published on the regulator’s website.

What should I do if Trade360 got blacklisted and I still have money in my account?

Don’t panic right away. First, try to find out the reason why Trade360 got blacklisted. The situation may be temporary. Contact Traders Union client service for details. If the situation is critical, try to withdraw money. The best way to do it in parts, so that the broker does not suspect that you want to withdraw your entire balance and close the account.

What should I do if I cannot withdraw my money from Trade360?

If your broker refuses to process withdrawals under various pretexts, your algorithm of actions is as follows:

• Get a clear response from the broker’s Support Service with reference to the clauses of the Terms of Use (User Agreement). Save your correspondence and download the transaction history from your account.

• With a full package of documents, appeal to the following organizations: the broker’s regulator or corresponding law enforcement agencies. If you make your deposit with a bank transfer, try to initiate a chargeback request.

• Share your situation on traders’ forums, add the broker to blacklists of various websites, as it will help others avoid the mistake.

Is there any chance to recover my money if Trade360 is a scam?

On rare occasions, yes, for example, if the broker was a member of a compensation fund, or upon a court’s ruling.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.