deposit:

- $25-$250

Trading platform:

- MT4

- MT5

- WebTrader

- MetaTrader Supreme Edition

- FCA

- CySEC

- ASIC

- JSC

- CIPC

- 100%

deposit:

- $25-$250

Trading platform:

- MT4

- MT5

- WebTrader

- MetaTrader Supreme Edition

- FCA

- CySEC

- ASIC

- JSC

- CIPC

- 100%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of Admirals Trading Company

Admirals is a reliable broker with the TU Overall Score of 7.88 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Admirals clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company. Admirals ranks 25 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Admirals is a suitable broker for both beginner traders as well as professional traders.

Admirals was founded in 2001. In more than 20 years of operation, a regional Estonian broker has grown into an international financial group of companies providing access to over-the-counter markets in more than 130 countries, as well as to exchange-traded stock instruments. Following the 2021 rebranding, Admirals became Admirals. The updated platform received new integrated risk management solutions.

The Admirals group of companies comprises:

-

Admirals AU Pty Ltd.

-

Admirals UK Ltd.

-

Admirals Cyprus Ltd.

-

Admirals AS Jordan Ltd.

Regulators of the Admirals group of companies include FCA (UK, 595450), CySEC (Cyprus, 201/13), ASIC (Australia, 410681), JSC (Jordan, 57026), and CIPC (South Africa, 2019 / 620981 / 07).

| 💰 Account currency: | ASIC - AUD, USD. FCA - EUR, USD, GBP, CHF, RUB. CySEC - EUR, USD, GBP, CHF, BGN, RON, PLN, HUF, HRK, CZK. JSC - EUR, USD, JOD, AED, GBP. |

|---|---|

| 🚀 Minimum deposit: | $1 — $100, $250 |

| ⚖️ Leverage: | Up to 1:20-1:30 for retail traders subject to the asset type, up to 1:10-1:500 for professional traders, and up to 1:10-1:500 for all traders with JSC. |

| 💱 Spread: | From 0-0.5 pips. |

| 🔧 Instruments: | stocks, ETFs, as well as CFDs on currency pairs, commodities, stocks, indices, bonds, ETFs, and cryptocurrencies. |

| 💹 Margin Call / Stop Out: | 50% for retail traders and 30% for professional traders. |

👍 Advantages of trading with Admirals:

- 5,000+ trading assets, with stock assets trading on exchange markets available.

- The company’s proprietary social trading platform (copy trading).

- Relatively tight spreads on most assets.

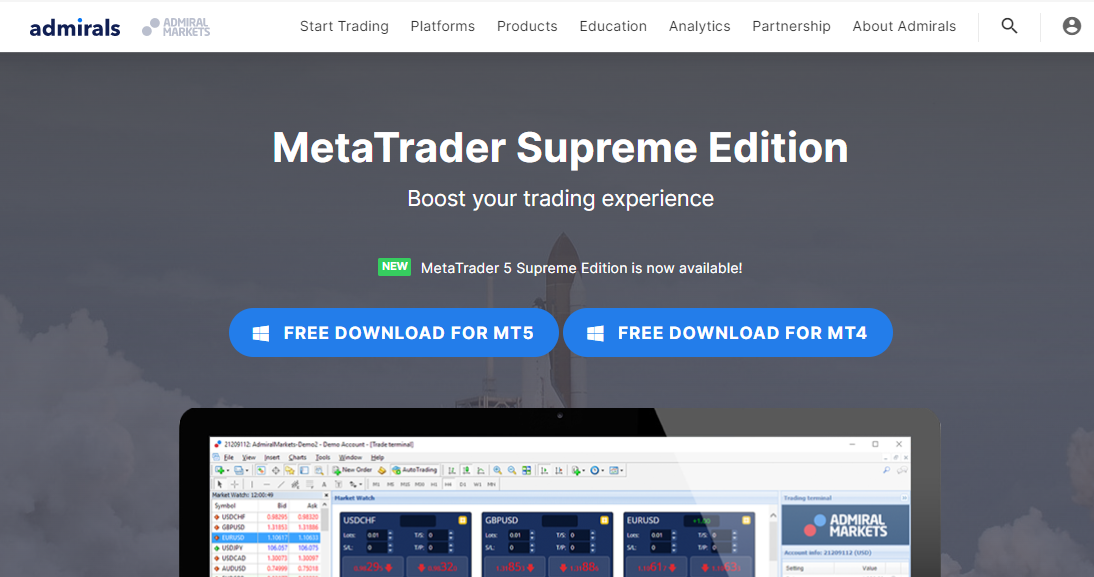

- The company’s own Supreme Edition plug-in for MT4 and MT5, which expands their technical and chart functionality.

- FCA and CySec licenses, which are the most reputable regulators.

- Compensation fund with insurance coverage of up to €20,000 per trader.

- Relatively low initial deposit that provides for opening trades within risk management subject to leverage.

👎 Disadvantages of Admirals:

- Restrictions on leverage for retail traders without the “professional” status as required by regulators.

- Withdrawal fee is charged.

Evaluation of the most influential parameters of Admirals

Trade with this broker, if:

- You need a platform with a low entry threshold. When opening an Invest account, it is sufficient to deposit just $1. This account supports both EUR and USD, with spreads starting from 0 pips and a fee of only $0.02 per share.

- You are a novice and want to gain practical knowledge about trading. In fact, Admirals educational materials will be beneficial even to professionals. The website includes articles, guides, video tutorials, and regular webinars conducted by the broker's experts. There are also two specialized courses, basic and advanced.

Do not trade with this broker, if:

- You are not interested in contracts for difference. Admirals UK is a CFD broker, meaning that all assets, including currency pairs, stocks, indices, bonds, cryptocurrencies, and more, are available only in this format.

NOTE!

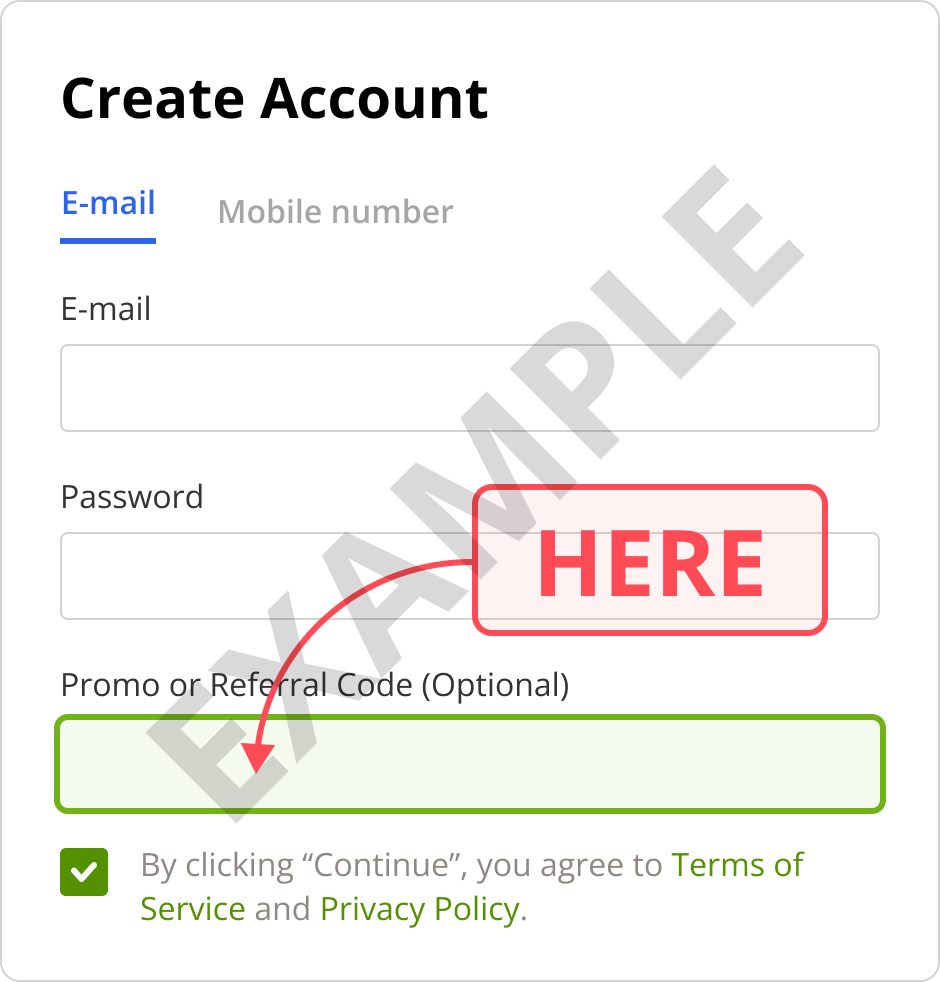

Do not miss a chance to get additional monthly bonuses and payouts for trading at Admirals.

Enter the referral code when you register on the website or Admirals app.

6144

*TU may receive partnership reward for registration of the client on the company’s website on a referral link.

Geographic Distribution of Admirals Traders

Popularity in

Video Review of Admirals i

Formerly Admiral Markets, Admirals Trading Company sails diverse financial waters, offering trading and investing in Forex, stocks, ETFs, commodities, indices, and even cryptocurrencies. Regulated by multiple top-tier authorities like the FCA and ASIC, it boasts a clean track record for safe sailing.

Admirals equips traders with multiple seafaring vessels: MT4, MT5, and their own web platform, all packed with tools and charts. To chart your course, their comprehensive education and analytics section acts as your lighthouse. For cost-conscious voyagers, a zero commission account and a cashback program sweeten the deal.

However, uncharted waters lurk ahead. The product portfolio, while broad, leans heavily on CFDs, with real stocks and ETFs only accessible to some. Inactivity and conversion fees can be hidden reefs, and some reviews whisper of occasional customer service storms, platform glitches, and choppy order execution.

Therefore, Admirals suits experienced traders looking for platform diversity, commission-free options, and rewards for activity. Beginners or those seeking wider asset offerings and absolute transparency might need a different captain. Be mindful of the fee structure and potential service hiccups before setting sail.

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Admirals

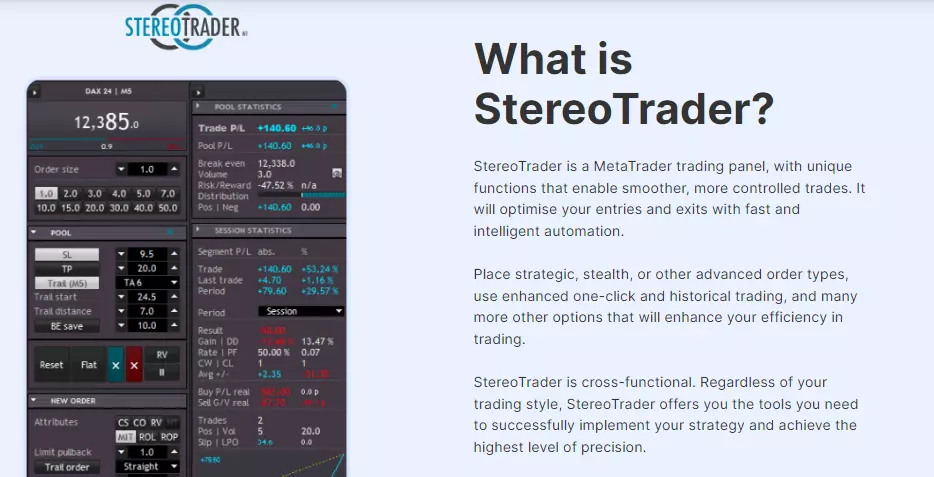

Admirals is a universal broker for over-the-counter Forex trading and exchange trading of stocks with tools for both active trading and passive investing. Following the rebranding in 2021, the company focused on the development of its technical functionality. Traders can use the StereoTrader trading panel with smart automation of executing trades, Trading Central technical analysis tools, volatility protection tools, the Supreme Edition plug-in, and other applications for free.

More than 3,000 CFDs are available for trading almost all types of assets, including ETFs, bonds, cryptocurrencies, and more than 4,500 stocks on 15+ stock exchanges globally. Average spread starts from 0.3-0.6 pips subject to the asset and account type, which is a relatively good indicator for a CFD broker. Although cent accounts are not provided, Admirals offers a good scope of educational materials. Step-by-step usage of acquired knowledge on a demo account allows novice traders to approach the “professional” status.

Recently, the broker's technical product line has been expanded with a social trading platform. Now Admirals’ clients can earn extra profit by delivering signals or, on the contrary, subscribe to trades of successful traders and copy them to their accounts. When you first discover the functionality of the broker and its security guarantees, you get a positive impression of Admirals, because the company is included in the TU Top 10 every month.

Dynamics of Admirals’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

The broker offers two copy trading services as passive investment options: a proprietary copy trading platform and copy trading from the MQL5.Community. Both services have their own individual benefits.

Important! The Copy Trading service is available only to clients of Admiral Markets Cyprus Ltd.

Admirals social trading service

Admirals offers a proprietary social trading platform you can use to earn money by automatically copying trades of other Admirals’ clients. This is how it works:

-

You register and complete verification with the broker. After verification, you can open an account with a minimum allowable deposit.

-

In the Copy Trading section of the user account you will find a list of traders with trading statistics for each of them, including profitability for the period, risk level, maximum drawdown, account lifetime, equity, etc.

-

Profiles of each trader have terms of cooperation, such as a monthly fee, which depends on the investor’s amount involved in copying. The subscription amount is paid per each month, regardless of the number of trades and their effectiveness. If investors unsubscribe from a trader's account, payment is only charged for the subscription period.

As of subscription, all trades opened by a trader are copied to the investor's account automatically in accordance with the specified parameters (copying proportion, trade volumes, etc.).

Learn More About MT4 Copy Trading

The other option is copying trades directly from MT4 or MT5. The MQL5.Community is a community of traders based on the MQL5 website. To start copying trades, you need to:

-

Register on the MQL5 website and make a deposit (not to be confused with replenishment of the broker's account).

-

Link the MT4 or MT5 platform to your community account. To do this, go to “Service/Settings/Community” and provide registration information in the community (login and password).

-

In the “Platform” window (or in a window with similar functionality), select the “Signals” tab.

In this tab you will find a list of traders with a detailed review of their trading and subscription fees. Advantages of copying trades via MT4/MT5 are detailed statistics with backtest and strict requirements for getting into the MQL5 rating.

Important!

If you are a large investor and plan on investments over $ 10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Admirals affiliate programs:

-

Introducing Broker is a standard partnership program, which provides for a partner to receive a part of the fee paid by a referee to the broker. The higher the trading volume of the referee, the bigger the payout to the partner. The amount of remuneration is up to 25% of spread and fee.

-

Media partner is a program for those who can generate user traffic and redirect it to the broker’s website. It is suitable for owners of websites and blogs. The remuneration depends on the referees’ deposits and their jurisdictions.

-

“Refer a friend” (available for traders working with Admirals AU Pty Ltd regulated by ASIC). The offer is valid for every trader who opens the Invest.MT5 account. Reward is up to $750 per friend invited through a referral link.

-

White Label is designed for investment companies, banks, and other financial institutions.

Each client of the platform can access the network of the participants involved and to determine who will carry out the trading operations. The main purpose of having referrals is to get part of the commission from a broker.

Trading Conditions for Admirals Users

Admirals trading conditions are suitable for any category of traders, regardless of their trading experience. There are 5 account types which differ in platforms, spread/fee, and asset type. Trade and Zero accounts with a minimum deposit of $25/$100/$250, subject to the regulator, are opened on MT4 and MT5 and are intended for trading CFDs on any type of assets. The Invest account with a minimum deposit of $1 is only available on MT5. This account type is intended for trading stocks and ETFs on the stock market.

How to buy/sell on AdmiralsStrict adherence to regulatory requirements is the reason for restrictions on leverage. For retail clients, maximum leverage is 1:20-1:30. Upon confirmation of the “professional trader” status, it increases to 1:500. For the JSC regulated broker, leverage for all traders is up to 1:500. Spreads depend on the account type. On the Trade account on both platforms it is from 0.5 pips, on the Zero account it is from 0 pips with an additional fee per lot of $1.8-$3 for currency pairs and metals. Both account types also have a fixed fee for trading stocks and ETFs.

There are no restrictions on use of strategies and tools: scalping, hedging, algorithmic trading, arbitrage, and carry trade are allowed. Hedging is only prohibited on the Invest account. Also, there is no negative balance protection on the Invest account.

Admirals AI-based analytical research terminal provides traders with advanced tools to enhance their trading experience. It is free for all clients, providing powerful analytical features to inform investment decisions based on news, sentiment, and price movements. The terminal is powered by Acuity's AI technology and seamlessly integrates with the MT4 and MT5 platforms. Key features of this new terminal include:

-

Corporate calendar tool that helps stock traders stay ahead of upcoming corporate events.

-

Economic calendar to help traders navigate macroeconomic events and market volatility.

-

NewsIQ tool that detects trading opportunities by combining news data with other datasets.

-

Integration with Dow Jones for financial news and insights.

$25-$250

Minimum

deposit

1:10-1:500

Leverage

24/7

Support

| 💻 Trading platform: | МТ4, MT5, MetaTrader Supreme Edition, WebTrader |

|---|---|

| 📊 Accounts: | ASIC - AUD and USD. FCA - EUR, USD, GBP, CHF, and RUB. CySEC - EUR, USD, GBP, CHF, BGN, RON, PLN, HUF, HRK, and CZK. JSC - EUR, USD, JOD, AED, and GBP |

| 💰 Account currency: | ASIC - AUD, USD. FCA - EUR, USD, GBP, CHF, RUB. CySEC - EUR, USD, GBP, CHF, BGN, RON, PLN, HUF, HRK, CZK. JSC - EUR, USD, JOD, AED, GBP. |

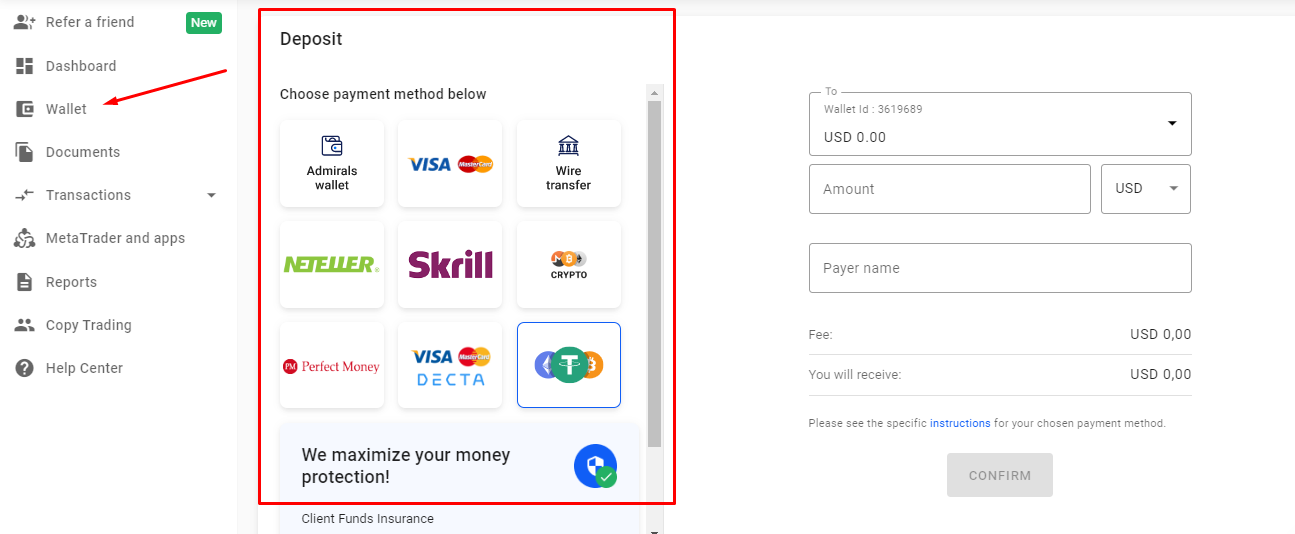

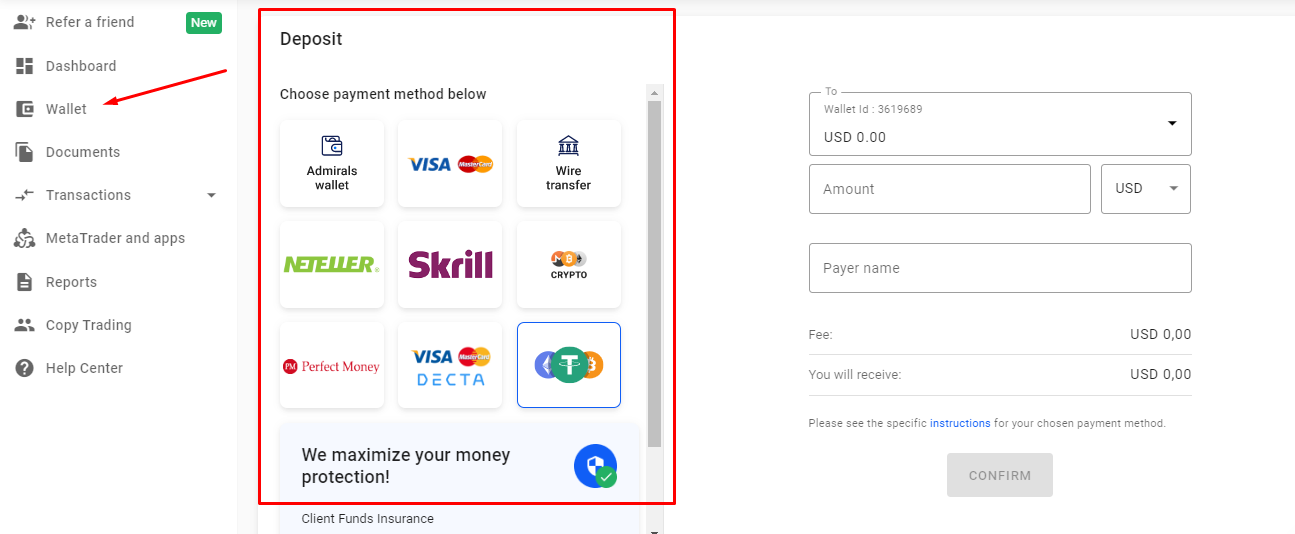

| 💵 Replenishment / Withdrawal: | Bank transfer, Visa and MasterCard bank cards (deposits only), Skrill, and Neteller for the ASIC regulated broker. Bank transfer, Visa and MasterCard bank cards, Skrill, Neteller, Klarna (deposits only), PayPal, and iBank&BankLink for the FCA regulated broker. Bank transfer, Visa and MasterCard bank cards, Skrill, and Klarna (deposits only) for the CySec regulated broker. Bank transfer, Visa and MasterCard bank cards (deposits only), and Perfect Money for the JSC regulated broker. |

| 🚀 Minimum deposit: | $1 — $100, $250 |

| ⚖️ Leverage: | Up to 1:20-1:30 for retail traders subject to the asset type, up to 1:10-1:500 for professional traders, and up to 1:10-1:500 for all traders with JSC. |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 (step — 0.01) — 100 |

| 💱 Spread: | From 0-0.5 pips. |

| 🔧 Instruments: | stocks, ETFs, as well as CFDs on currency pairs, commodities, stocks, indices, bonds, ETFs, and cryptocurrencies. |

| 💹 Margin Call / Stop Out: | 50% for retail traders and 30% for professional traders. |

| 🏛 Liquidity provider: | Institutional banks from different countries, such as Citibank, Goldman Sachs, UBS, and Deutsche Bank. |

| 📱 Mobile trading: | Mobile version available |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market and exchange execution for the Invest account |

| ⭐ Trading features: | Available options for protection against volatility; One-click trading. There is a copy trading platform (available with CySec) |

| 🎁 Contests and bonuses: | No |

Comparison of Admirals with other Brokers

| Admirals | RoboForex | Eightcap | Exness | TeleTrade | FxGlory | |

| Trading platform |

MT4, MT5, WebTrader, Mobile platforms | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MT4, MobileTrading, MT5 |

| Min deposit | $250 | $10 | $100 | $10 | $1 | $1 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:10 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | 8.00% |

| Spread | From 0.5 points | From 0 points | From 0 points | From 1 point | From 0.8 points | From 2 points |

| Level of margin call / stop out |

50% / No | 60% / 40% | 80% / 50% | No / 60% | 70% / 20% | 20% / 10% |

| Execution of orders | Exchange execution, Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| Admirals | RoboForex | Eightcap | Exness | TeleTrade | FxGlory | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | No |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | No |

| Stock | Yes | Yes | Yes | Yes | Yes | No |

| ETF | Yes | Yes | No | No | Yes | No |

| Options | No | No | No | No | No | No |

Admirals Commissions & Fees

-

Spreads and fees are not subject to the broker. It means that liquidity providers are the same for the entire group.

-

The Zero MT4/MT5 account has a fixed fee per 1 full standard lot. Forex and metals are charged with a fee ranging from $1.8 to $3 per 1 lot. Energies are charged with a $1 fee per lot. The fee is indicated per one transaction, thus it is doubled when closing a trade.

-

There is a $0.02 fee per transaction for trading stocks and ETFs.

-

There is a withdrawal fee which is subject to the payment system and the broker. Its minimum ranges from $1 to $15. All withdrawal fees are discussed in detail in the following blocks.

| Account type | Spread (minimum value) | Withdrawal commission |

| Trade MT4/MT5 | from $5 | Yes |

| Zero MT4/MT5 | from $0 | Yes |

| Zero MT4/MT5 | from $0 | Yes |

Also, TU experts have compared Admirals’ spreads with those of its main competitors. Spread (expressed in USD) for the EUR/USD pair on a standard account per 1 full lot was taken as the basis.

| Broker | Average commission | Level |

| Admirals | $5 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of Admirals

Admirals was founded in 2001. Over more than 20 years, it has grown into a group of companies operating in more than 130 countries worldwide. During this time, the broker has become a high-tech platform that operates in both over-the-counter and stock exchange markets. Through direct access to institutional liquidity providers, Admirals offers traders the best spreads and guarantees almost no requotes and slippages when trading CFDs. The broker’s separate technological solution is the Invest account, which provides for trading stocks and ETFs with a minimum deposit of $1.

Admirals by the numbers:

-

5,000+ assets from exchange and over-the-counter markets.

-

More than 6 licenses from regulators and insurance of client money of up to $100,000, regardless of the trader’s jurisdiction.

-

1,000,000+ users worldwide.

Admirals is a broker for regular investment and active trading

The broker offers two most popular platforms for over-the-counter trading which are MT4 and MT5. MT5 also has additional functions for trading stocks. The broker’s unique features include plug-ins, add-ons, and trading panels for platforms. They expand the MetaTrader technical and graphical tools for speeding up and automating charts analysis, and making trading decisions.

For novice traders there is an educational section, which helps them become traders with a confident medium level of knowledge. The Admirals website has articles on all analysis types, risk management, visual webinars, etc.

Useful services offered by Admirals:

-

Constantly updated data on technical and fundamental analysis.

-

VPS. It is necessary for uninterrupted trading in case of the internet and electricity shutdown, or disconnection from the server. It is free with deposits from $5,000/€5,000.

-

Premium Analytics. It includes market news, technical analysis, and fundamental analysis on data taken from over a thousand sources of financial news. All data is provided by such financial companies as Dow Jones, Trading Central и Acuity.

Advantages:

rapid account opening;

possibilities of rapid deposit and withdrawal;

many European currencies are available for trading;

several types of analytics that allow you to decide on the next steps;

minimum spread.

You can use proven trading strategies to increase the efficiency of your work on the Admirals website.

How to Start Making Profits — Guide for Traders

You can open the following account types with Admirals:

Leverage is from 1:10 to 1:500. Its maximum is subject to the asset, the “Retail” or “Professional” statuses, and the trader’s jurisdiction.

Admirals - How to open, deposit and verify a trading account | Firsthand experience of TU

Useful Tools

In addition to the main trading instruments, Admirals offers free auxiliary tools for simplifying search of signals and speeding up market analysis.

-

Supreme Edition. It is a free add-on for MT4 and MT5, which can be used on demo accounts as well. It has built-in signals by Trading Central, combined indicators, widgets, built-in calculator, etc.

-

StereoTrader trading panel. It is an add-on for MT4 and MT5, expanding functions of the platform. It is intended for scalping and intraday strategies. Its features include placement of strategic group of orders with several clicks, advanced order types, and risk management system.

-

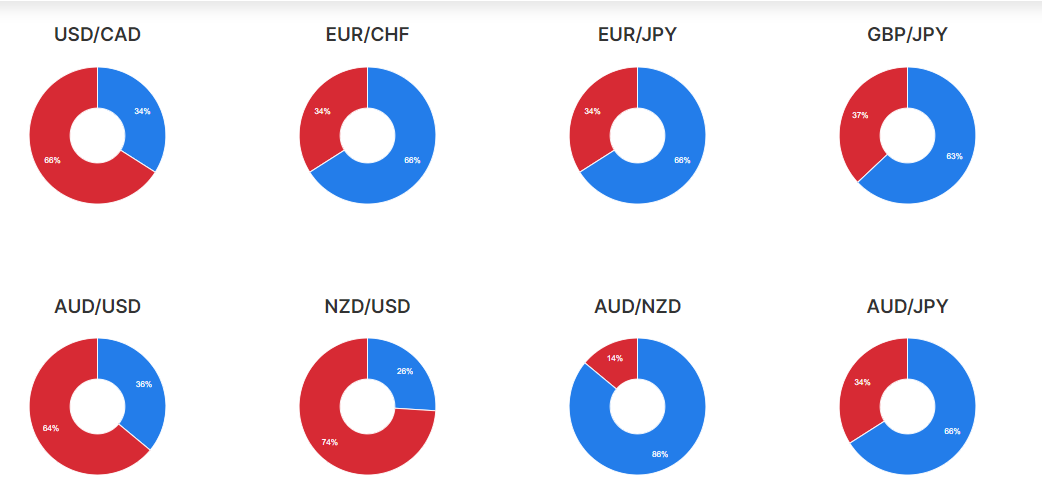

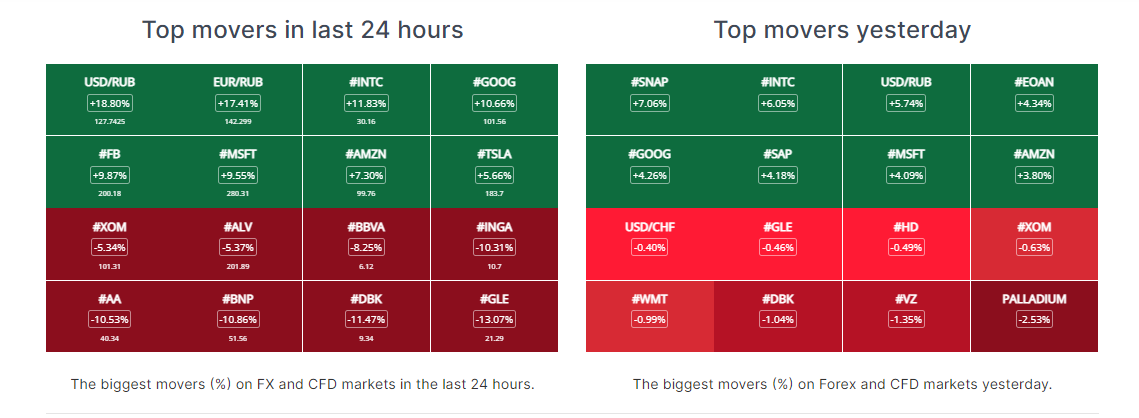

Market sentiments. These are indicator diagrams on main assets, showing current prevalence of buyers and sellers. Data is provided by FxBlue.

-

Market statistics. It provides general visual information on assets with price performance.

-

Economic Calendar. The calendar provides a list of the most important news by countries, categories, and industries.

Investment Education Online

Information

Educational resources covering topics in trading are available on the Admiral Markets website. They are useful for both the beginner trader and for professional traders.

If you have any questions, use the additional FAQ section, and contact technical support if there is no answer.

Security (Protection for Investors)

Information

The Admirals group comprises several companies operating in different jurisdictions. This separation allows the broker to provide its services in more than 130 countries without violating local laws. The group regulators and corresponding security measures are:

-

FCA (UK). The broker operates in compliance with the European MiFID directive, which defines the rules of providing financial services. In the event of the bank’s bankruptcy where clients' money is held, the Financial Services Compensation Scheme (FSCS) is provided for traders with an insurance coverage of up to GBP 85,000 per client.

-

CySEC (Cyprus). The broker operates in compliance with the MiFID Directive. Clients' money is held separately from the broker's money in European banks. The broker is a member of the IFC Compensation Fund with coverage of up to €20,000. Professional clients are insured against a negative balance in the amount of up to €50,000.

-

ASIC (Australia). Segregation: Clients' money is held by Westpac Banking Corporation. The broker annually undergoes an external audit and is a member of the Australian Financial Complaints Authority (AFCA).

-

JSC (Jordan) and CIPC (South Africa). Availability of licenses means that brokers are controlled by local regulators.

👍 Advantages

- Licenses of some of the most reputable regulators in the world

- Regular external audit

- Availability of the compensation fund

👎 Disadvantages

- It is difficult for private traders to file a complaint. Regulators generally consider only collective claims. Complaints from private traders can be ignored

Options and Fees

-

Payment methods: bank transfer, Visa and MasterCard bank cards (deposits only), Skrill, and Neteller for the ASIC regulated broker. bank transfer, Visa and MasterCard bank cards, Skrill, Neteller, Klarna (deposits only), PayPal, and iBank&BankLink for the FCA regulated broker. Bank transfer, Visa and MasterCard bank cards, Skrill, and Klarna (deposits only) for the CySec regulated broker. Bank transfer, Visa and MasterCard bank cards (deposits only), and Perfect Money for the JSC regulated broker.

-

Deposits: No fee regardless of the payment method and regulator.

-

Withdrawals: One withdrawal request per month is fee-free regardless of the payment method and regulator. Fees are subject to the payment method. Most payment systems charge a 1% fee regardless of the regulator. Bank transfer costs €1 with CySec and $10 with ASIC, FCA, and JSC per each request.

Customers’ Support

Information

Admirals support service is available to contact you at any time 24/7. The advantage of Admirals is multi-language support depending on the version you are using.

👍 Advantages

- Opportunity to get help in different languages

- The prompt response through any form of communication

👍 Disadvantages

- No

Clients can use the following communication methods:

-

Phone (subject to traders’ country);

-

Email (subject to traders’ country);

-

Live chat;

-

Social media and instant messengers.

Contacts

| Foundation date | 2007 |

| Registration address |

Admirals UK Ltd: 37th Floor, One Canada Square, Canary Wharf, London, E14 5AB, United Kingdom. Admirals Cyprus Ltd: Dramas 2, 1st floor, 1077 Nicosia, Cyprus Admirals AU Pty Ltd: Level 1, 17 Castlereagh Street, Sydney, NSW 2000, Australia. Admirals AS Jordan Ltd: первый этаж Time Centre Building, Eritrea Street, Um Uthaina, Amman, Jordan. Admirals SA (Pty) Ltd: Dock Road Junction, CNR Dock Road and Stanley Street, V&A Waterfront, Cape Town, Western Cape, 8001, South Africa. |

| Regulation |

FCA, CySEC, ASIC, JSC, CIPC |

| Official site | admiralmarkets.com |

| Contacts |

Email:

global@admiralmarkets.com,

Phone: +44 20 8157 7344 |

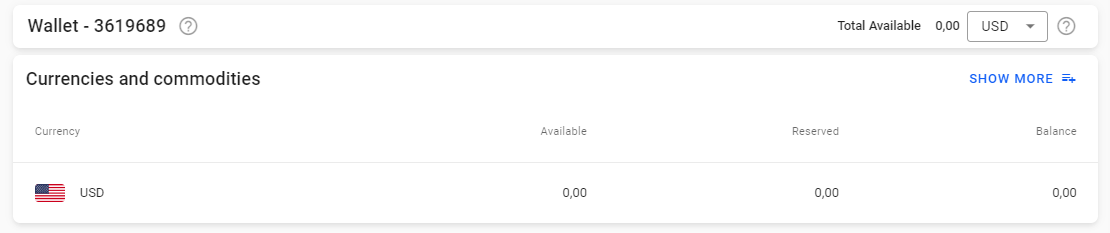

Review of the Personal Cabinet of Admirals

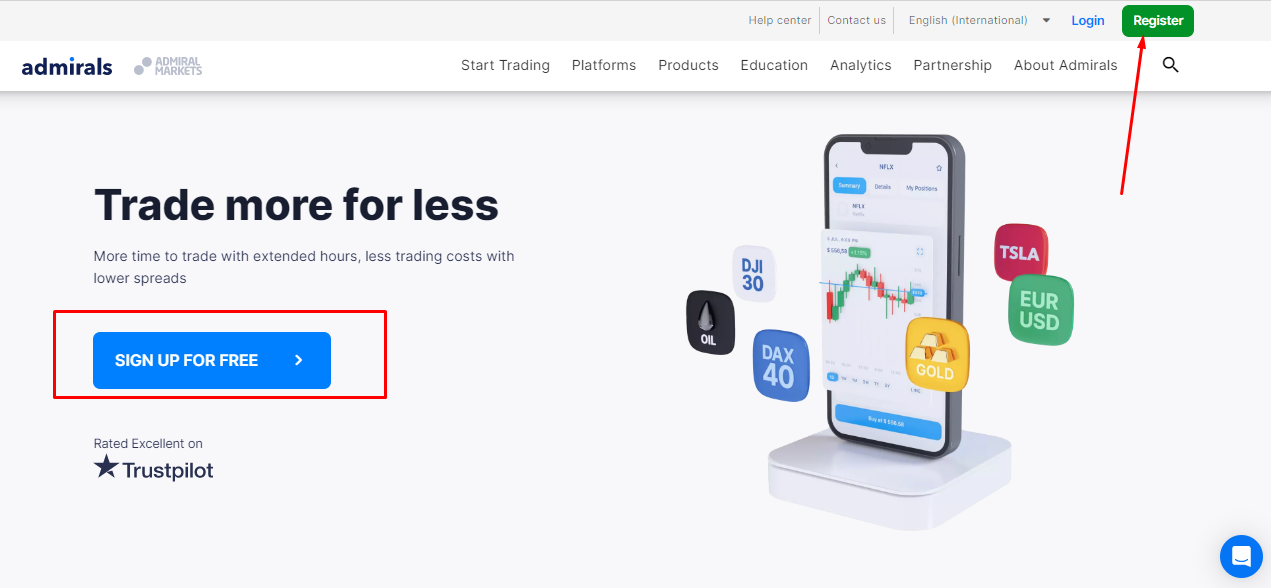

Follow these steps to start earning money with the Admirals brokerage company and receive funds for trading using Traders Union:

Register on the website of the Traders Union. Follow the affiliate link to the official website of Admirals and click the “Start Trading” button.

Enter your first name, last name, email address. Follow the instructions in the email to complete the profile creation on Admirals.

The following is available in the personal account of Admirals:

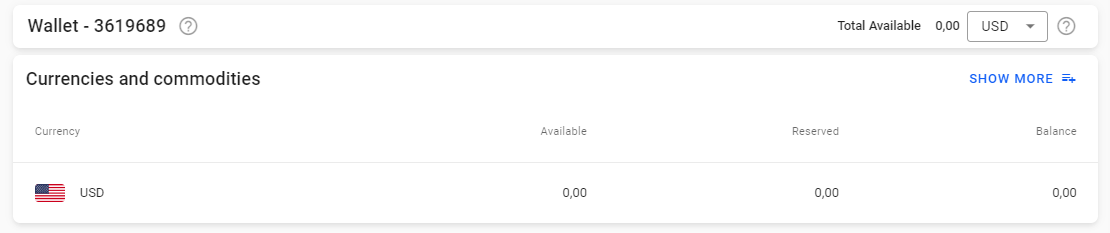

1. Account replenishment and cash withdrawals.

2. View transaction history and open a real

trading account.

1. Account replenishment and cash withdrawals.

2. View transaction history and open a real trading

account.

In the broker's account, you will find many other useful functions and features such as:

-

the global analytical portal is a novelty from Admirals;

-

the option to subscribe to notifications of deposit/withdrawal of funds, about margin call and current market news;

-

access to downloading broker software for any type of device — PC, tablet, smartphone;

-

customer support portal with contact details.

Alternatively, you can use the reference materials that are always at hand if there are difficulties at the start of trading. It is also possible to contact the Admirals technical support in case of problems with the resource.

Articles that may help you

FAQs

Is Admirals a good broker?

Every broker has its advantages. Admirals is ranked in the TU Top 10 Brokers. To understand if the broker is good for you, download a free trading platform, open a demo account, and try to open several trades.

How do I withdraw money from Admirals?

Payment methods are subject to the broker’s jurisdiction. The complete list of available payment systems is provided in the review on this page.

What is the minimum deposit for trading with Admirals?

Minimum deposit is subject to the broker’s jurisdiction and is $25/$100/$250. The Invest account has a minimum deposit of $1 regardless of the jurisdiction.

How does Admirals work?

Admirals is a broker providing intermediary services on the stock and over-the-counter markets. To work with the broker, download the trading platform, open any account, make a deposit, and open trades.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.