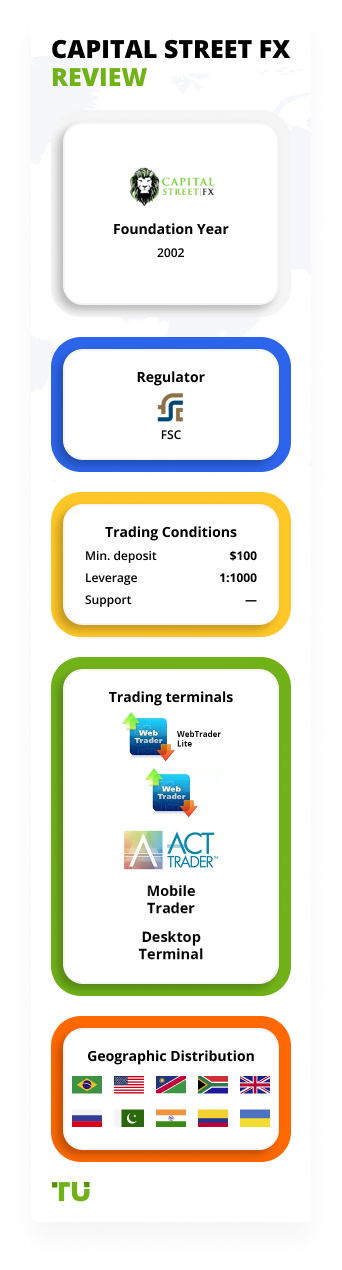

Trading platform:

- WebTrader

- ActTrader

- Desktop Terminal

- WebTrader Lite

- Mobile Trader

- FSC (Mauritius)

- 0%

Trading platform:

- WebTrader

- ActTrader

- Desktop Terminal

- WebTrader Lite

- Mobile Trader

- FSC (Mauritius)

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of Capital Street FX Trading Company

Capital Street FX is a broker with higher-than-average risk and the TU Overall Score of 3.95 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Capital Street FX clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Capital Street FX ranks 220 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Capital Street FX is rather a broker for professional traders, because competitive spreads from 0.1 pips are available only if you deposit USD 10,000 to your account.

The company was established in 2002. Capital Street Intermarkets Limited is authorized and regulated by the Financial Services Commission, Mauritius. The company offers its customers an extensive list of financial services ranging from Capital Market Execution to Private Banking services. Capital Street Intermarkets Limited is duly licensed and fully regulated by FSC Mauritius as a Full Services Investment Dealer (excluding underwriting) with the license No. C112010690. Today, the company is proud to introduce innovations to the field of financial products and services.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | 100 USD |

| ⚖️ Leverage: | 1:1000 |

| 💱 Spread: | from 0,1p |

| 🔧 Instruments: | Forex, CFDs, Futures, ETFs on Currencies, Commodities, Stocks, Bonds, Indices |

| 💹 Margin Call / Stop Out: | 50%/10% |

👍 Advantages of trading with Capital Street FX:

- Wide choice of trading assets. In addition to standard instruments, you can also trade stocks, bonds and cryptocurrencies.

- Flexible bonus programs. Each trader can get a one-time bonus of 150%-900%.

👎 Disadvantages of Capital Street FX:

- Offshore regulation (FSC, Mauritius).

- Proprietary trading platform, which is technically inferior to the classic MT4/MT5 trading platforms.

Evaluation of the most influential parameters of Capital Street FX

Geographic Distribution of Capital Street FX Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Dynamics of Capital Street FX’s popularity among

Traders Union’s traders, according to 2023 data

Investment programs of Capital Street FX

The broker currently does not offer investment programs, although they may be introduced in the future.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Capital Street FX Partnership program

The broker offers a classic type of a partnership program, the Introducing Broker. Both individuals and legal entities can participate in the program. The reward is up to USD 20 per each full lot traded by a referral. Contact the broker’s customer support on details of how to register and earn extra income by referring new clients.

Trading Conditions for Capital Street FX Users

| 💻 Trading platform: | Act Trader, Desktop Terminal, WebTrader, WebTrader Lite, Mobile Trader |

|---|---|

| 📊 Accounts: | Basic, Classic, Professional, VIP, Zero Spread Account, Islamic Account |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank Transfer, Credit Cards,Paypal, Skrill, Neteller, Paypeer, Local deposits |

| 🚀 Minimum deposit: | 100 USD |

| ⚖️ Leverage: | 1:1000 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 0,1p |

| 🔧 Instruments: | Forex, CFDs, Futures, ETFs on Currencies, Commodities, Stocks, Bonds, Indices |

| 💹 Margin Call / Stop Out: | 50%/10% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Mobile Platforms |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market Execution, Instant Execution |

| ⭐ Trading features: | Algo Trading, Expert Advisor |

| 🎁 Contests and bonuses: | YES |

Comparison of Capital Street FX with other Brokers

| Capital Street FX | RoboForex | Pocket Option | Exness | FBS | FXGT.com | |

| Trading platform |

MobileTrading, ActTrader, WebTrader, Desktop Terminal, WebTrader Lite | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading | MetaTrader4, MetaTrader5 |

| Min deposit | $100 | $10 | $5 | $10 | $1 | $5 |

| Leverage |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.1 points | From 0 points | From 1.2 point | From 1 point | From 0.2 points | From 0.5 points |

| Level of margin call / stop out |

50% / 10% | 60% / 40% | 30% / 50% | No / 60% | 40% / 20% | 50% / 20% |

| Execution of orders | Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | $5 | No |

| Cent accounts | No | Yes | No | No | Yes | No |

Broker comparison table of trading instruments

| Capital Street FX | RoboForex | Pocket Option | Exness | FBS | FXGT.com | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | No | Yes | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes | No | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | No | Yes |

| ETF | Yes | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

Capital Street FX Commissions & Fees

The spread below (taken from the broker’s trading conditions) is specified per 1 standard lot.

| Account type | Spread (minimum value) | Withdrawal commission |

| Basic | from USD 25 | yes (on an inactive account) |

| Classic | from USD 20 | yes (on an inactive account) |

| Professional | from USD 10 | yes (on an inactive account) |

| VIP | 1 USD | n/a |

Below is a comparison of the average spread charged by Capital Street FX and its competitors on the EUR/USD pair. STP accounts with a floating spread at the time of high volatility (Capital Street FX charged a fixed spread on this pair in the amount of USD 30) were used for the comparison.

| Broker | Average commission | Level |

| Capital Street FX | $35 | High |

| RoboForex | $1 | Low |

| IC Markets | $1.5 | Medium |

Contacts

| Foundation date | 2010 |

| Registration address | Level 6, GFin Tower, 42 Hotel Street,Cybercity, Ebene 72201,Republic Of Mauritius |

| Regulation |

FSC (Mauritius) Licence number: C112010690 |

| Official site | capitalstreetfx.com |

| Contacts |

Email:

support@capitalstreetfx.com,

Phone: +1-949-335-4314 |

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.