deposit:

- $100

Trading platform:

- MetaTrader5

- Fullerton Markets (MT4)

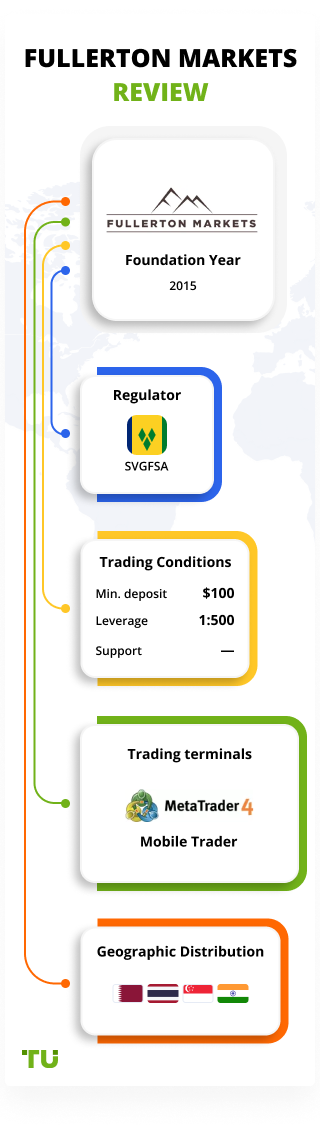

- SVGFSA

- 0%

deposit:

- $100

Trading platform:

- MetaTrader5

- Fullerton Markets (MT4)

- SVGFSA

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of Fullerton Markets Trading Company

Fullerton Markets is a broker with higher-than-average risk and the TU Overall Score of 3.87 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Fullerton Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Fullerton Markets ranks 228 among 412 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Fullerton Markets is a broker for active Forex trading, as well as for passive income generation.

Fullerton Markets is a Forex broker that provides its clients with the possibility to trade currency pairs, metals, oil, and indices. You can also earn passive income through one of its investment programs. The broker primarily works with clients and traders from the Asia-Pacific region. Fullerton Markets received 14 awards over the past 3 years, including Best FX Broker (2019), Best Safety Broker (2019), and Best Social Trading Platform (2020).

| 💰 Account currency: | USD, EUR, SGD |

|---|---|

| 🚀 Minimum deposit: | $100, but when funding account with bank transfers, it is $200 |

| ⚖️ Leverage: | up to 1:500 |

| 💱 Spread: | Floating, ECN-spread, fixed |

| 🔧 Instruments: | Currency pairs, metals, indices, oil |

| 💹 Margin Call / Stop Out: | Determined depending on the settings of the trading account |

👍 Advantages of trading with Fullerton Markets:

- the trading tools on the company’s website are free of charge.

- in most cases, the broker pays the commission for deposits and withdrawals.

- the company offers investment programs.

- there is negative balance protection.

- you can open an Islamic account without swaps.

- support service works round the clock.

👎 Disadvantages of Fullerton Markets:

- The broker is not regulated by third parties.

- Bonus programs are not available for traders who have activated negative balance protection.

- Islamic account holders cannot open MAM accounts.

Evaluation of the most influential parameters of Fullerton Markets

Table of Contents

- Geographic Distribution

- Video Review

- Latest Comments

- Expert Review

- Latest Fullerton Markets News

- Analysis of Fullerton Markets

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Commissions & Fees

- Detailed Review

- Client Area of Fullerton Markets

- User Reviews of Fullerton Markets

- FAQs

- TU Recommends

Geographic Distribution of Fullerton Markets Traders

Popularity in

Video Review of Fullerton Markets i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Fullerton Markets

Fullerton Markets is a broker that offers optimal conditions for independent trading in the market and earning passive income. The company is focused on the Asia-Pacific region and works with clients regardless of their trading experience. Traders can trade Forex assets, oil, indices, and metals.

For comfortable independent trading, Fullerton Markets offers its proprietary trading platforms with advanced functionality and tools necessary for high-quality market analysis. Fast order execution is provided by the STP/ECN system, and liquidity is provided by tier-1 providers. Clients have access to negative balance protection on the trading account. Passive income is possible when using the service of copying transactions or MAM accounts. Fullerton Markets cooperates with both active traders, strategy providers, and account managers. The safety of traders’ funds is ensured by segregated accounts and capital insurance.

However, it should be noted that the broker cooperates with many traders, but not from all countries, so before opening an account, you need to clarify that information. Also, Fullerton Markets is not regulated by any independent authority.

Dynamics of Fullerton Markets’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

You don’t need to have experience in Forex trading to make a profit: Fullerton Markets offers its clients programs and services through which they can earn passive income with little or no effort. A client who has opened a real trading account with Fullerton Markets can become a participant in the programs.

CopyPip

This trade copy service allows traders to make profits even if they have no trading experience. The principle of the service is as follows: the client connects to the service and copies the trades of professional traders to his trading account, thus making a profit.

-

The user independently chooses which expert’s trades he wants to copy.

-

Fullerton Markets allows you to set the maximum loss and profit level.

-

The service has a wide selection of risk distribution and trading styles.

-

The client can withdraw funds at any time.

-

The service is suitable not only for those who want to copy trades, but also for traders who can supply trading signals to beginners.

-

Trading strategy providers can withdraw their earnings daily.

-

For using the copy service, traders who copy transactions are charged a commission. The fee is calculated automatically.

To use the services for copying trades, you need to open a CopyPip account in your personal account. There, a trader can apply and become a strategy provider, receiving additional income for his work.

MAM account

MAM account is a way to generate income without any effort. It is suitable for traders who have little experience in trading, as well as those who want to earn passive income without participating in trading.

-

To participate in the program, a trader just needs to fund the account and periodically monitor the profitability.

-

All trading operations are managed by the account manager - a professional trader.

-

The user not only trusts the professional and sees the results, but can also follow his trading actions.

-

The client’s funds are kept in his own account, and not in the manager’s account.

-

If necessary, the user can intervene in the trading process and close trades on his own.

MAM account can be opened separately in the personal account, in the “My Accounts” section. Swap-free account holders cannot benefit from this investment program.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Fullerton Markets’ affiliate program:

-

Introducing Broker (IB). The partner’s task is to manage Fullerton Markets portfolios under the broker’s brand. Program participants receive discounts, commissions, exclusive training, access to marketing materials, and other tools for quality work.

-

Money Manager. The Partner is authorized to manage the accounts of other Fullerton Markets clients. The task of the program participant is to make profitable transactions and contribute to the growth of income, both for himself and for his referrals. The broker provides modern software, and the possibility to receive client funds in one of four currencies, as well as professional reports.

-

White Label. Program participants can develop their own trading business using the services of Fullerton Markets. The broker provides partners with technical support, training, and the possibility to set the size of spreads.

Participants of Fullerton Markets referral programs receive not only the necessary conditions and instruments for work but also additional income. The amount of income depends on the program and trading results and is determined for each user individually.

Trading Conditions for Fullerton Markets Users

Clients have access to one main type of account, however, in the personal account, a trader can choose the desired option: an account with a floating or fixed spread, as well as with the base currency of the account. The trader cannot change the account currency in the future. Also, at the time of registration, the client must indicate the desired leverage, the maximum indicator is 1:500, the minimum is 1:10. The leverage can be changed if necessary. Fullerton Markets offers trading instruments such as currency pairs, indices, metals, and oil. This broker also offers passive methods of income such as MAM accounts and the CopyPip service. To start trading, you need to fund your account with at least 100 USD or an equivalent amount in another currency. Traders can also check the broker’s trading conditions on a demo account.

$100

Minimum

deposit

1:500

Leverage

24/5

Support

| 💻 Trading platform: | Fullerton Markets MetaTrader 4, MetaTrader 5 |

|---|---|

| 📊 Accounts: | Live account, Demo account, MAM account, CopyPip account |

| 💰 Account currency: | USD, EUR, SGD |

| 💵 Replenishment / Withdrawal: | Bank cards of MasterCard, Sticpay, Visa, and MasterCard; electronic payment systems Skrill, Neteller, FasaPay; cryptocurrency; bank transfers; local transfers for clients from Malaysia, Vietnam, Thailand, Indonesia, Philippines, China, Myanmar, Cambodia, Laos, and India |

| 🚀 Minimum deposit: | $100, but when funding account with bank transfers, it is $200 |

| ⚖️ Leverage: | up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 lot |

| 💱 Spread: | Floating, ECN-spread, fixed |

| 🔧 Instruments: | Currency pairs, metals, indices, oil |

| 💹 Margin Call / Stop Out: | Determined depending on the settings of the trading account |

| 🏛 Liquidity provider: | Tier-1 liquidity providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | STP, ECN |

| ⭐ Trading features: | Investment programs; Free training materials. |

| 🎁 Contests and bonuses: | Yes |

Comparison of Fullerton Markets with other Brokers

| Fullerton Markets | RoboForex | Eightcap | Exness | TeleTrade | XM Group | |

| Trading platform |

MT4, Mobile platforms | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MT4, MT5, MobileTrading, XM App |

| Min deposit | $100 | $10 | $100 | $10 | $1 | $5 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:10 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.3 points | From 0 points | From 0 points | From 1 point | From 0.8 points | From 0.6 points |

| Level of margin call / stop out |

50% / 30% | 60% / 40% | 80% / 50% | No / 60% | 70% / 20% | 100% / 50% |

| Execution of orders | STP | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Broker comparison table of trading instruments

| Fullerton Markets | RoboForex | Eightcap | Exness | TeleTrade | XM Group | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes | Yes | Yes |

| CFD | No | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | No | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | Yes | No |

| Options | No | No | No | No | No | No |

Fullerton Markets Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Live account | from 1.3$ | Withdrawal commissions are paid by Fullerton Markets. The exception is bank transfer (the commission is charged by the bank), as well as funding with cryptocurrency (the commission is 2–4% of the amount) |

The company has established swaps (commissions for transferring a trading position to the next trading day). Clients of the Islamic religion can open a swap-free account upon request.

The experts at the Traders Union compared the size of the trading commission set in Fullerton Markets with the indicators of other Forex brokers such as RoboForex and Forex4you. As a result of the analysis, each company was assigned low, medium, or high commission levels.

| Broker | Average commission | Level |

| Fullerton Markets | $1.3 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of Fullerton Markets

Fullerton Markets offers its clients a comfortable trading environment on the Forex market. The main task of a broker is to ensure fast execution of transactions, a safe trading environment, and high liquidity of assets. Fullerton Markets offers currency pairs, indices, metals, and oil as instruments. In addition, the company has available ways to generate passive income like a MAM account and the CopyPip transaction copying service.

Fullerton Markets by the numbers:

-

Fullerton Markets trading is available 24/5.

-

The minimum leverage is 1:10 and the maximum is 1:500.

-

The minimum lot size is 0.01.

-

The broker offers 2 types of spreads: floating and fixed.

-

Fullerton Markets uses 3 base currencies: USD, EUR, and SGD.

Fullerton Markets is a broker for active and passive trading

This broker makes sure that traders get the best trading conditions at an affordable price. Fullerton Markets uses STP/ECN order processing, which increases the speed of each transaction, and also cooperates with Tier 1 liquidity providers, which has a beneficial effect on the trading results. For trading with Fullerton Markets, one main account is provided, and in the personal account, the client can choose an account for independent trading, investing in a MAM account, and the CopyPip service. Opening a swap-free account for those clients who profess Islam is also available.

The broker offers two options as a trading platform: proprietary terminals based on MetaTrader 4 and MetaTrader 5. Terminals differ in functionality, number of timeframes, strategy testers, order execution, etc. Trading via a mobile application is also available. You can download the required terminal in your personal account, in the “Trading” section.

Fullerton Markets’ useful services:

-

Support. Clients of the broker can get answers to their questions in the FAQs section or contact support directly.

-

Education. There are some useful materials that traders can use to improve their professionalism. More materials are available to registered traders.

Advantages:

Fullerton Markets offers investment programs.

The company has free training materials.

The broker offers a bonus program in which bonuses are awarded for each replenishment.

Withdrawal fees are paid by Fullerton Markets in most cases.

The company has convenient ways to fund the deposit and withdraw funds.

The broker periodically holds contests among traders. Information about current offers and conditions of contests is available in the Promotions section.

How to Start Making Profits — Guide for Traders

Fullerton Markets offers traders one type of trading account from which trades can be made in real market conditions. The company does not work with customers from Cuba, Iran, Sudan, Syria, North Korea, Hong Kong, Singapore, Japan, and the United Kingdom.

Account types:

Before opening a real account, Fullerton Markets clients can test their knowledge on a demo account, which mimics the conditions on a real account.

Fullerton Markets is the choice for traders who do not want to choose between independent trading and passive investing.

Bonuses Paid by the Broker

Infinity Credit Bonus

The broker credits traders with a bonus every time a trading account is funded. The amount of the bonus depends on the level that the client has reached in the bonus program. There are 6 levels in total: for the first $10,000, users receive a 10% bonus; for the second $10,000, it's 25%; for the third, it's 20%; for the fourth, it's15%, and for the fifth, it's10%. At the sixth level, the size of the bonus reaches 8%. Upon an initial deposit of $100,000, the trader will receive a $12,000 bonus. When the deposit is withdrawn, the amount of bonuses will be proportionally reduced. Bonuses can only be used for trading, and the leverage should not exceed 1:200.

Investment Education Online

The broker’s website has a training section with materials that will be useful to both beginners and experienced market participants.

Traders can check their trading skills and Fullerton Market’s trading conditions on a free demo account.

Security (Protection for Investors)

The broker is registered under Law 149 in force in Saint Vincent of the Grenadines, and Fullerton Markets’ registration number is 24426. The company is also FSA (Financial Services Authority) compliant.

Fullerton Markets uses segregated accounts to store clients’ funds. The broker does not have access to them and cannot use them for personal purposes. In addition, Fullerton Markets provides clients with insurance in case the client incurs losses due to inappropriate advice from the broker’s employees or as a result of fraud.

👍 Advantages

- Traders’ money is kept separate from the broker's funds

- Fullerton Markets provides insurance services to traders

👎 Disadvantages

- The company’s activities are not regulated by independent authorities

Withdrawal Options and Fees

-

Fullerton Markets offers the following methods of depositing and withdrawing funds: MasterCard, Sticpay, Visa, and MasterCard bank cards; electronic payment systems such as Skrill, Neteller, FasaPay; cryptocurrency; bank transfers; local transfers for clients from Malaysia, Vietnam, Thailand, Indonesia, the Philippines, China, Myanmar, Cambodia, Laos, and India.

-

Withdrawal requests are processed by Fullerton Markets’ staff within 1 business day, and funds are transferred within 2-4 days.

-

When withdrawing funds through local transfers, cryptocurrency wallets, and bank transfers, a limit is set on the minimum and maximum withdrawal amounts.

-

Funding of a trading account (except by bank transfer) is carried out within 1 business day. Funding by bank transfer may take 2-5 business days.

-

Deposit and withdrawal fees are paid by Fullerton Markets. There are only three exceptions when the trader pays the commission: bank transfer, cryptocurrency funding (2-4% fee), and transactions via Neteller (2%), but only if the client is from Zimbabwe, India, Indonesia, Mexico, Nigeria, Venezuela, Vietnam, Pakistan, South Korea, France or Germany.

-

To carry out financial transactions, a trader needs to verify the account by uploading identity documents.

Customer Support Service

The broker’s customer support team takes care of the broker’s customer support so that Fullerton Markets traders can always resolve relevant issues. Users can contact support at any time of the day from Monday to Friday.

👍 Advantages

- Support service is available around the clock

- The broker offers different methods to communicate

👎 Disadvantages

- No callback function

This broker provides the following communication channels for its clients:

-

fill out the feedback form on the website;

-

send an email;

-

call the specified phone number;

-

write a message to the online chat.

Fullerton Markets clients can also visit the broker’s offline office or contact the company's representatives on social networks via Facebook, Twitter, Instagram, LinkedIn.

Contacts

| Foundation date | 2012 |

| Registration address | First Floor, First St. Vincent Bank Ltd Building James Street, P.O. Box 1574 Kingstown, VC0100 |

| Regulation |

SVGFSA Licence number: 24426 IBC 2017 |

| Official site | https://www.fullertonmarkets.com/ |

| Contacts |

Email:

support@fullertonmarkets.com,

Phone: +44 20 3808 8261 |

Review of the Personal Cabinet of Fullerton Markets

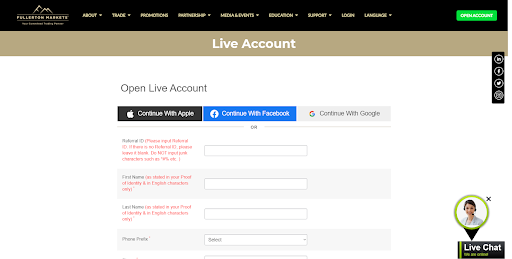

Trading with Fullerton Markets will only become available after the user has registered. You can find step-by-step instructions for opening an account below:

Open the broker’s website. On the main page, to open a new trading account, click on the “Open Account” button.

Fill out a short form: enter the Referral ID (if any), your first name, last name, phone number, email address, and password. Select the desired interface language, then click on the “Register” button. You can also register with Fullerton Markets through your Apple, Facebook, or Google account.

After filling in the required fields, you can download the Fullerton Markets mobile app.

To confirm registration, check the specified email. The broker will send a letter. Open it and follow the link.

To get into your personal account, you need to re-enter your login details.

Re-enter your email address and enter your password, then click the Sign In button.

Now you need to confirm your phone number: once again enter the country code and your number, click on the “Proceed” button. Check if your number is correct, then click on “Confirm”.

Fullerton Markets will send an SMS with a code to the number you specified. Enter the received code in the special field, click on the “Proceed” button.

After completing all the steps, the user enters his personal account, where he needs to select the type of trading account and upload documents to activate the account.

Functions of Fullerton Markets’ personal account:

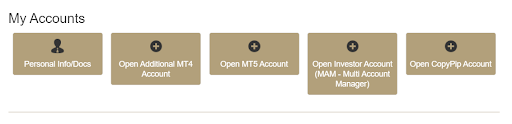

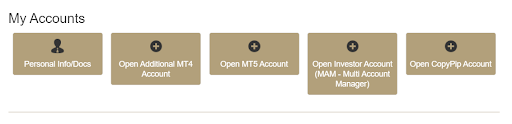

1. My Accounts. Here you can select the required type of account or open several accounts for trading on MT4 or MT5, the MAM, or CopyPip accounts.

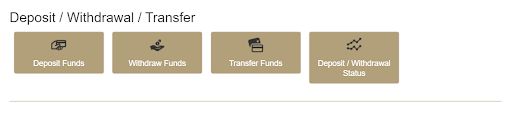

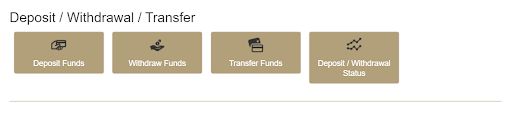

2. In this section, you can fund your trading account, make a withdrawal, as well as transfer funds from one account to another, and check the status of the transaction.

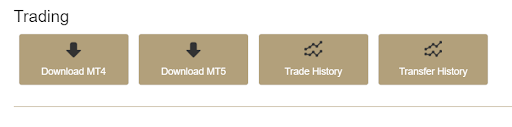

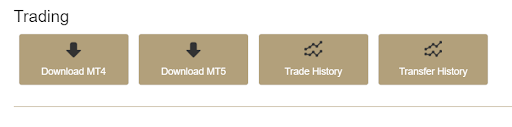

3. Here you can download the Fullerton Markets trading platforms, view the history of completed deals and transactions.

1. My Accounts. Here you can select the required type of account or open several accounts for trading on MT4 or MT5, the MAM, or CopyPip accounts.

2. In this section, you can fund your trading account, make a withdrawal, as well as transfer funds from one account to another, and check the status of the transaction.

3. Here you can download the Fullerton Markets trading platforms, view the history of completed deals and transactions.

Also in the personal account, the trader has access to:

-

the “Becoming a Partner” function where clients can become a Fullerton Markets partner and choose the option of cooperation that suits them.

-

Selecting the interface language.

-

personal account settings: change personal data (first name, last name, country of residence, email, and phone number).

-

Security settings such as changing the password for entering the personal account.

-

Inbox. In this section, the trader can read messages from the broker regarding their trading activity, warnings, explanations, etc.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Find out how Fullerton Markets stacks up against other brokers.

Articles that may help you

FAQs

Do reviews by traders influence the Fullerton Markets rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Fullerton Markets you need to go to the broker's profile.

How to leave a review about Fullerton Markets on the Traders Union website?

To leave a review about Fullerton Markets, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Fullerton Markets on a non-Traders Union client?

Anyone can leave feedback about Fullerton Markets on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.