Fusion Markets Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MT4

- MT5

- WebTrader

- cTrader

- TradingView

- ASIC

- VFSC

- FSA

- 2011

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MT4

- MT5

- WebTrader

- cTrader

- TradingView

- ASIC

- VFSC

- FSA

- 2011

Our Evaluation of Fusion Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Fusion Markets is a moderate-risk broker with the TU Overall Score of 6.18 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Fusion Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Fusion Markets is a low-cost broker with low commissions and opportunities to create passive income.

Brief Look at Fusion Markets

Fusion Markets is a young broker from Australia. It was created in November 2017 and began to provide full services in 2019. The company offers to trade in currency pairs and CFDs. Headquartered in Cremorne, Melbourne, Australia, the broker is regulated by ASIC (Australian Securities and Investment Commission, 385620), FSA (Financial Services Authority of Seychelles, SD096) and VFSC (Vanuatu Financial Services Commission, 40256).

- Reliable regulation;

- No non-trading fees;

- Diversity of financial instruments.

- Limited educational opportunities;

- No cent accounts;

- Inability to trade with bonus funds.

TU Expert Advice

Financial expert and analyst at Traders Union

The Fusion Markets broker is an ambitious participant in the brokerage services market, which from the first years of work has confidently earned a place in the low-cost niche due to important advantages like low commissions, fast and friendly support, and ASIC regulation (Australia).

The Fusion Markets brand is owned by Gleneagle Asset Management (GAML), which in turn is a subsidiary of Gleneagle Securities. Founded in 2010, Gleneagle is an institutional participant in the financial markets offering services such as asset management, corporate consulting, and more. With Gleneagle, Fusion Markets clients take advantage of their strong relationships with liquidity providers to trade with low commissions.

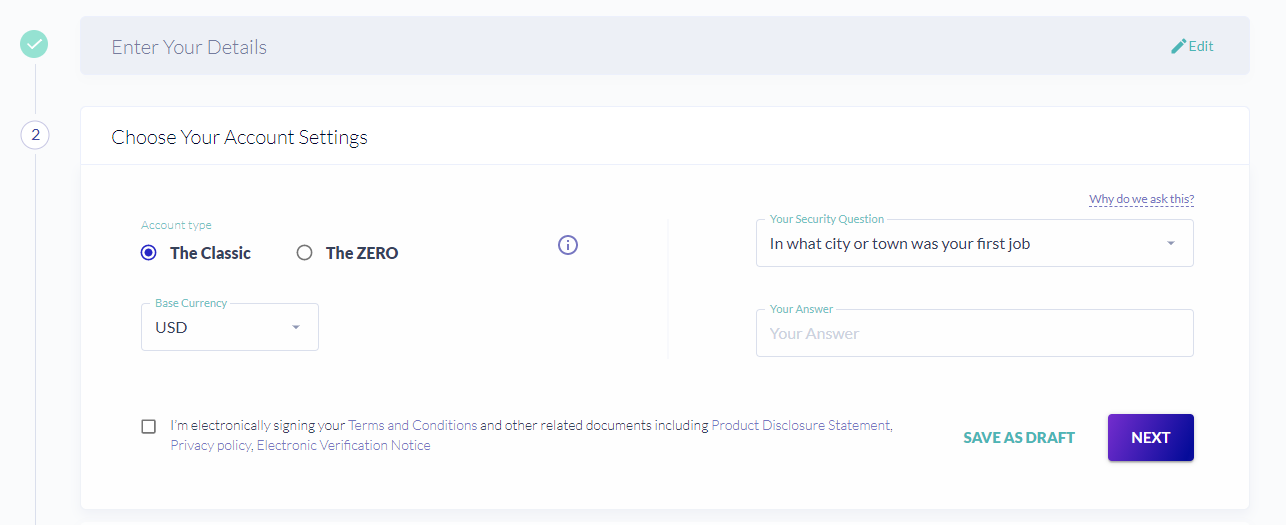

The Fusion Markets brokerage company offers two types of accounts: Classic, Zero and Swap Free. The Zero account’s conditions are more favorable because spreads start at zero and the commission is $4.50 per round (opening and closing a trade). In Classic accounts, the commission is included in the spread, and accordingly, spreads start from 0.9 pips. If your strategy assumes an active trading style, then the Zero account will be preferable.

Fusion Markets Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | МТ4 (desktop, mobile, web), МТ5 (desktop, mobile), WebTrader, TradingView, cTrader |

|---|---|

| 📊 Accounts: | Demo, Classic, Zero, Swap Free |

| 💰 Account currency: | USD, EUR, GBP, AUD, CAD, JPY, SGD, THB |

| 💵 Replenishment / Withdrawal: | Visa / Mastercard, bank transfer, Skrill, Neteller, Fasapay, Jeton Wallet, Perfect Money, PayPal (not available for all countries) |

| 🚀 Minimum deposit: | From USD 1 |

| ⚖️ Leverage: | Up to 1:30 (for ASIC-regulated retail accounts), up to 1:500 (for VFSC and Fusion Pro ASIC-regulated accounts) |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.9 pips (Classic), from 0 pips (Zero) |

| 🔧 Instruments: | Currency pairs (90+), CFDs on stocks (100), indices (12), metals (14), energy (3), cryptocurrencies (5) |

| 💹 Margin Call / Stop Out: | 90% / 20% |

| 🏛 Liquidity provider: | Unidentified partners of parent company Gleneagle Securities |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market Execution |

| ⭐ Trading features: | There is no inactivity fee on the account; Remove the 30-day restriction on using a demo account; Convenient client cabinet. |

| 🎁 Contests and bonuses: | Bonus for attracting a client |

The Fusion Markets broker does not offer clients the widest range of tools for trading through the classic MetaTrader terminals. Traders receive leverage from 1:30 (for Australian regulated accounts) to 1:500 (for Vanuatu regulated accounts). To check the quality of the broker's services, clients can open a demo account. Unfortunately, work on Islamic accounts (without charging for swaps) is not available for Muslim traders, but the broker promises to notify those interested as soon as this opportunity is implemented.

Fusion Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

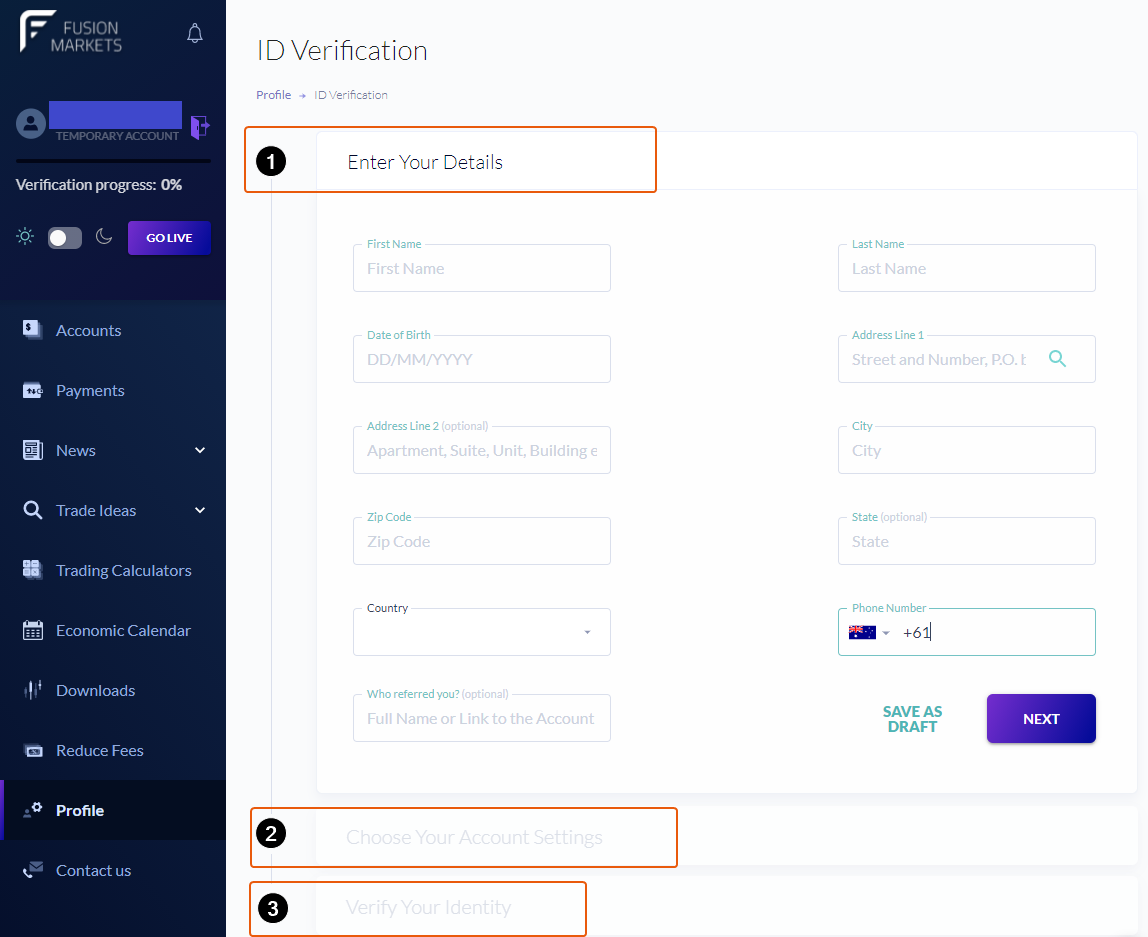

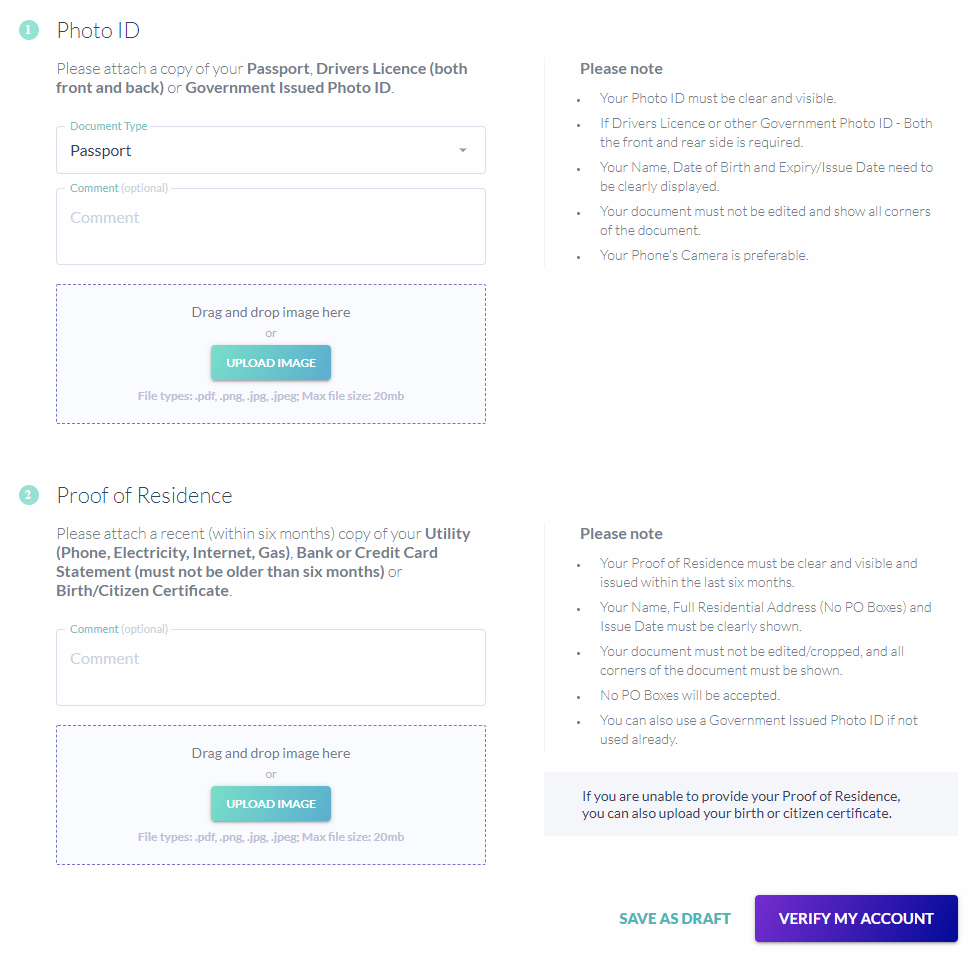

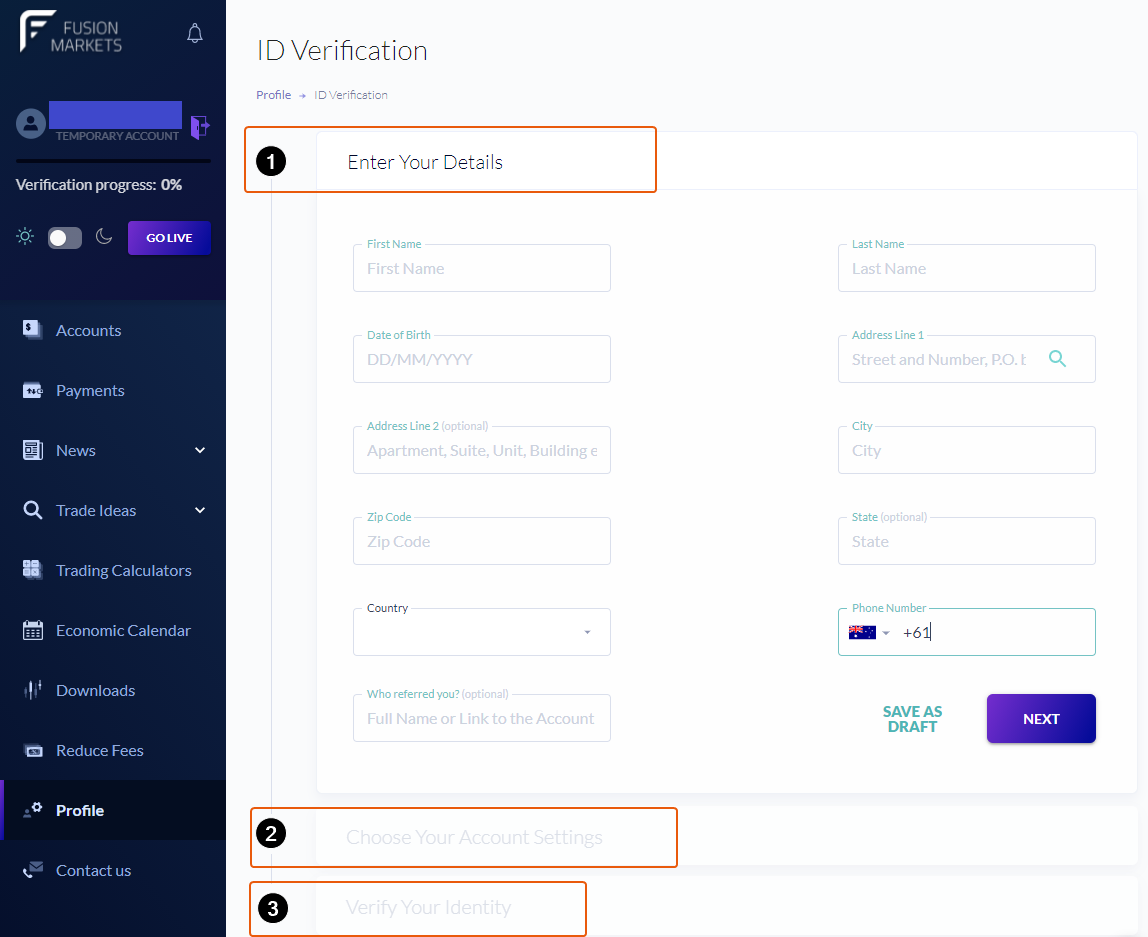

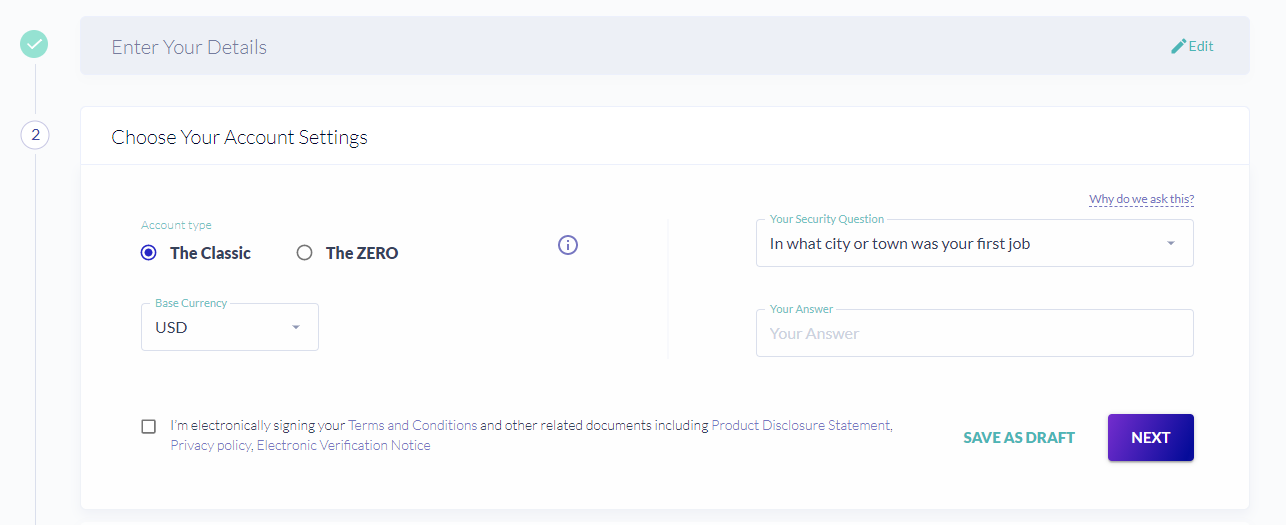

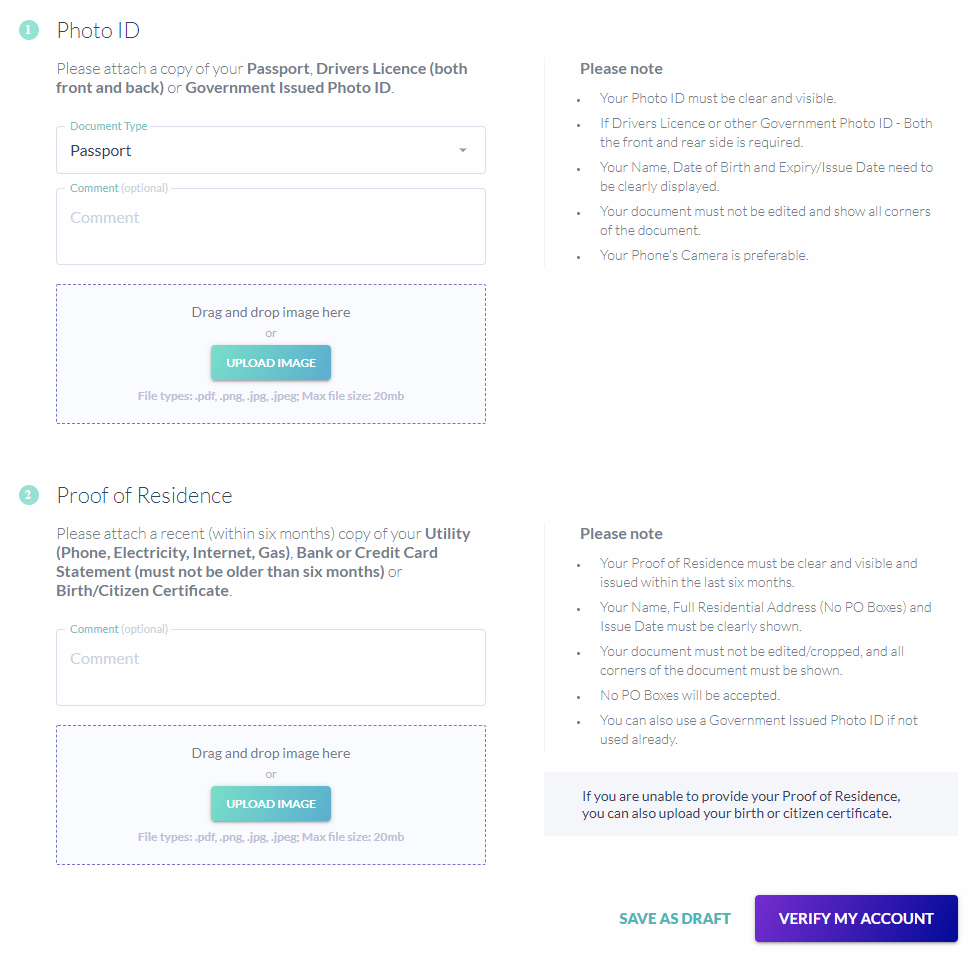

Trading Account Opening

It is very easy to create a personal account on the Fusion Markets website.

Click on the Create An Account button on any page of the site. After that, the system will offer to fill out a simple form that can be found when registering on many resources. Note the availability of the function of registration through a Google account. In this case, your account will be created with 1 click.

After this simple registration, you will get access to the account, where you can create a demo account, learn the Trading Central analytics (access to all sections of the cabinet is in the left vertical menu). But in order to use the full functionality of the account, including the ability to open a real account, and replenish and withdraw funds, you need to go through a simple ID verification process.

For an account in the jurisdiction of Vanuatu, verification consists of 3 simple steps:

After clicking on the Verify My Account button, the application will be sent to the broker. The answer is usually received within 1 business day.

Also in the personal account, the trader has access to:

-

Contact form with a broker's representative.

-

Form for changing personal data.

-

Information about accounts, movement of funds on them, statistics of withdrawals and replenishments.

-

Trading ideas, current news background.

-

Economic calendar, trading calculator, download links for trading platforms.

Regulation and Safety

Fusion Markets has two representative offices, each of which operates under the requirements of the regulators of the country of its jurisdiction. Fusion Markets is an ASIC regulated entity of Gleneagle Asset Management Limited (ABN 29 103 162 278) and operates under Australian Financial Services License No. 385620. Gleneagle Securities Pty Limited, which provides services under the name Fusion Markets EN, is a registered company in Vanuatu (company number 40256) and is regulated by the VFSC, is a registered company in Seychelles, (license number SD096) and is regulated by the FSA.

Fusion Markets cannot accept clients from Iran, Japan, New Zealand, North Korea, or the United States. For all non-Australian customers, Vanuatu is the default location.

Advantages

- Client funds are segregated from Fusion Markets capital and held in segregated bank accounts

- Moderate choice of electronic payment systems for making deposits and withdrawals of money

- In case of violation by the broker of the obligations prescribed in the offer, the client can file a complaint with the regulator

Disadvantages

- To open an account in the Australian jurisdiction, you must provide detailed financial information and fill out a form

- Without verification, you cannot make a deposit or withdraw funds

- No negative balance protection

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Zero | 4,5$ | No |

| Classic | 9$ | No |

| Swap Free | 0$ | No |

Swaps (commission for transferring a position to the next day) are available. Their size is set by liquidity providers and is independent of Fusion Markets. The Union also compared the average trading fees of Fusion Markets, RoboForex, and Pocket Option. The comparative results are presented in the form of a table.

| Broker | Average commission | Level |

|---|---|---|

|

$4.5 | |

|

$1 | |

|

$8.5 |

Account Types

Fusion Markets offers two types of accounts - Classic, Zero and Swap Free. If desired, the client can change the type of account by writing a request to the support service.

Account types:

The demo is only available for a period of 30 days. To use a demo account without time limits, you need to fund your real account with $10.

Fusion Markets is a low-cost broker that provides favorable trading conditions for traders in the main markets.

Deposit and Withdrawal

-

The first withdrawal of funds is possible only in the way in which they were credited to the account. It is prohibited to withdraw funds to third-party accounts.

-

Withdrawals are available via wire transfer, credit or debit card, Skrill, and Neteller.

-

All payments received by 11:00 am AEDT on a business day are processed on the same day. If the broker receives a request after 11:00 AEDT, it will be processed on the next business day. Customers usually receive their funds within 1-5 business days for credit and debit cards (depending on the card provider) and within 2-5 business days for bank transfers.

-

Money can be withdrawn to Visa and Mastercard (debit and credit), bank transfer, using the electronic payment system Neteller.

-

Fusion Markets does not charge withdrawal fees, but your bank may use an intermediary where fees range from $15 to $25. This is why the broker has a minimum withdrawal amount of $30 via wire transfer (not for Australian residents). Withdrawals to credit and debit cards are commission-free through a refund process. Withdrawals via Skrill and Neteller are also commission-free.

-

To be able to make a deposit, you must complete verification.

How to withdraw money from your Fusion Markets account | Firsthand experience of TU experts

Investment Programs, Available Markets and Products of the Broker

The Fusion Markets broker provides an opportunity to earn money not only for those who trade on their own, but clients can also open a Multi-Account Manager (MAM/PAMM) account. This option is suitable for experienced traders who are ready to manage their accounts and investors’ accounts and receive a percentage of the trades. For beginners, the main option is to set up your account to copy trades from the accounts of professional traders.

A Multi-Account Manager (MAM/PAMM) is the solution for professional managers

For professional fund managers who have their own client base and are looking for the best conditions to trade on multiple accounts, Fusion Markets offers special terms. To clarify the details, you need to contact the broker's management and discuss everything individually.

It is known that to apply for a MAM account, managers must:

-

Make a minimum deposit of $5,000. The amount on the account cannot fall below this size.

-

Have at least three months of statistics confirming the profitability of the system.

-

Have at least three clients.

-

The manager must be licensed for this type of activity if required in his country.

Copy-trading: A method to generate additional income

The Fusion Markets broker cooperates with two copy-trading services that allow automatic copying of trades of successful traders. These are well-known platforms like Myfxbook, AutoTrade, and DupliTrade.

Both services have very strict criteria for selecting professional traders from whose accounts you can copy signals. Applicants' strategies must have proven statistics for several months, establishing the profitability of the strategy with acceptable drawdowns.

Copying trades to your account is a rational way to create passive income, even for those who have no experience in real Forex trading.

Advantages:

-

You choose which strategy will be copied to your account.

-

Real-time account tracking is available.

-

You can connect to several strategies, thereby reducing risks.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Fusion Markets’ affiliate program:

The broker has several affiliate programs targeting different categories of potential partners.

-

IB Partner – The Introducing Broker (IB) option is intended for those companies who want to receive recurring commissions for clients they refer to Fusion Markets. To participate, you need to obtain broker approval. As soon as the referral places his first trade, the partner will start earning.

-

Invite a friend. The ideal referrals for traders looking to recommend a broker to friends, family, or other interested parties. As soon as your friend registers and starts trading, the broker will deposit $50 to the account of each member of the affiliate program which includes the referral and the partner who attracted him.

-

Fusion Affiliates program - will be interesting for trading sites, popular Youtube channels, bloggers, arbitrageurs, email marketers, media, as well as those who have a lot of subscribers in social networks. The essence of the Fusion Affiliates program is that each partner receives a reward for the client they refer. To help, the broker provides a variety of marketing materials, as well as the technical ability to track the sources of attracting new customers. To obtain the current conditions of this program, you need to apply by filling out a form.

Additional Trading Tools

-

TradingView platform. Fusion Markets offers its clients the following tools and resources, including TradingView. This platform is designed for analyzing financial markets, creating and viewing price charts, conducting technical analysis, and exchanging ideas with other traders and investors. It supports 15 types of charts, 90+ drawing tools, 100,000+ custom indicators, various types of price alerts, and direct trading from the charts.

Additional Trading Tools of Fusion Markets - TradingView platform -

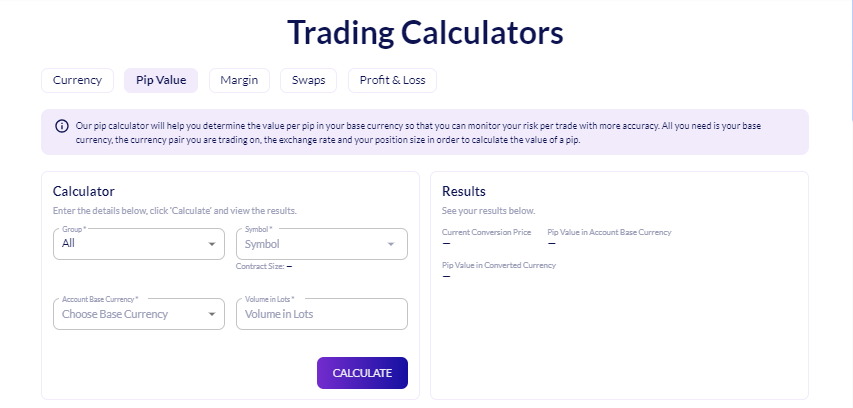

Trading calculators. The broker's website features online tools for calculating currency exchange rates, pip value, swap size for overnight positions. Additionally, traders can determine the margin and potential profit/loss for a specific trade.

Additional Trading Tools of Fusion Markets - Trading calculators -

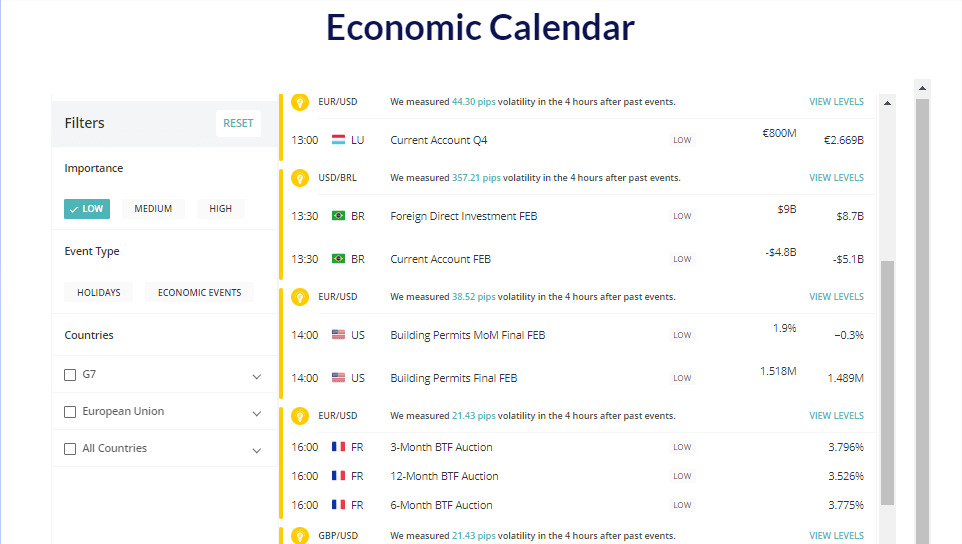

Economic calendar. This tool provides information about upcoming events and news that may impact financial markets. It features various economic indicators such as employment reports, inflation, GDP, central bank interest rates, retail sales data, etc.

Additional Trading Tools of Fusion Markets - Economic calendar -

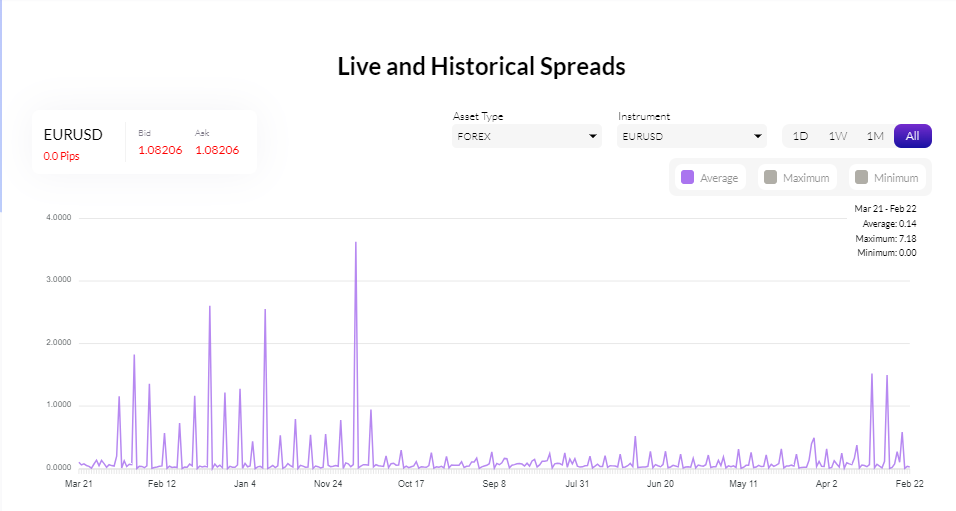

Tools to enhance trading efficiency include analyst opinions, technical analysis, Market Buzz information, real-time spread broadcasts on the broker's website, as well as historical spreads with timeframes ranging from 1 hour to 1 month.

Additional Trading Tools of Fusion Markets - Trading tools

Customer Support

Support operators are available 24 hours a day (06:00 AM AEDT Monday to 07:00 Saturday) when Forex trading is open.

Advantages

- In the online chat, you can ask a question without being a client of the company

- Quick response

Disadvantages

- Works 24/5

- English support only

Available communication channels with customer support specialists include:

-

phone +61 3 8376 2706;

-

email: help@fusionmarkets.com;

-

online chat on the site (recommended);

-

feedback form (on the Contact Us page and inside the personal account).

Not only a registered client but also a trader without an active account can ask a broker's representative a question.

Contacts

| Foundation date | 2011 |

|---|---|

| Registration address | Level 10, 627 Chapel St South Yarra VIC 3141 Australia |

| Regulation |

ASIC, VFSC, FSA

Licence number: 40256, 385620, SD096 |

| Official site | https://fusionmarkets.com/ |

| Contacts |

+61 3 8376 2706

|

Education

There is no separate training section on the Fusion Markets website. This broker's website cannot be called informative because of its lack of training courses. Blog articles are published on average once a month, and information about trading instruments may not correspond to reality. So, for example, at the time of this writing, the site did not have conditions for trading CFDs on Share, although there is such an opportunity, as you can see from the list of available MetaTrader tools.

The most informative source of educational information from a broker is the Youtube channel.

The broker does not have cent accounts, so the only way to consolidate the knowledge gained in practice will be training on a demo account.

Comparison of Fusion Markets with other Brokers

| Fusion Markets | RoboForex | Pocket Option | Exness | FBS | FxPro | |

| Trading platform |

MT4, MobileTrading, WebTrader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading | MT4, MobileTrading, MT5, cTrader, FxPro Edge |

| Min deposit | No | $10 | $5 | $10 | $1 | $100 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0.2 points | From 0 points |

| Level of margin call / stop out |

90% / 20% | 60% / 40% | 30% / 50% | No / 60% | 40% / 20% | 25% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | $5 | No |

| Cent accounts | No | Yes | No | No | Yes | No |

Detailed Review of Fusion Markets

The Fusion Markets broker has three core values: providing the best prices, the ability to apply any trading strategy, and providing responsive support. Client orders are executed according to the Market execution type, the broker does not prohibit automated trading. Trading ideas from the Trading Central service are available in the client area for free.

Fusion Markets in figures:

-

Spreads from 0 pips.

-

250+ assets for trading.

-

Commissions are 36% lower than those of its closest competitors.

Fusion Markets is a low-cost active trading and passive investing broker

Fusion Markets has direct ties to Gleneagle Securities, a private and corporate financial services firm that manages over USD 273 million. By taking advantage of Gleneagle Securities' partnerships with liquidity providers, Fusion Markets is able to offer clients trading with minimal spreads/commissions. The broker's clients can trade currency pairs, as well as CFDs on stocks, indices, cryptocurrencies, metals, and energies.

For those who wish to create passive income or increase profits from their professional strategies, the broker offers social trading services through two services: DupliTrade and MyFxBook Autotrade. Fusion Markets clients trade through MetaTrader 4/5 desktop and mobile terminals. This is a well-known product for traders, where one-click trading is available. It is possible to connect and write your own advisors and scripts.

Useful services of Fusion Markets investment:

-

VPS. Hosting for the trading platform allows you to run smoothly around the clock using automated strategies.

-

Sentiment and Market Buzz - data on market sentiments are available as metrics in the client's cabinet.

-

Trading calculators. They allow you to calculate the size of profit and loss, margin, swaps.

-

Economic calendar. Allows you to keep track of important statistics.

-

Trading ideas from the team of professionals at Trading Central.

Advantages:

There are six asset classes available for trading: currencies, metals, energy resources, stock indices, and stocks.

To ensure the safety of client funds, the company stores them in segregated accounts. This is a strict requirement of the Australian ASIC regulator.

Low commissions and spreads, no costs on the part of the broker when depositing or withdrawing funds.

For automatic copying, investors have access to strategies from DupliTrade and MyFxBook Autotrade.

Convenient client cabinet.

All clients, regardless of the size of the deposit, have access to VPS, algorithmic trading, and access to analytical data inside the office.

User Satisfaction