deposit:

- $30

Trading platform:

- cTrader

- MetaTrader4

- MetaTrader5

- VFSC

- FSC

- 0%

deposit:

- $30

Trading platform:

- cTrader

- MetaTrader4

- MetaTrader5

- VFSC

- FSC

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

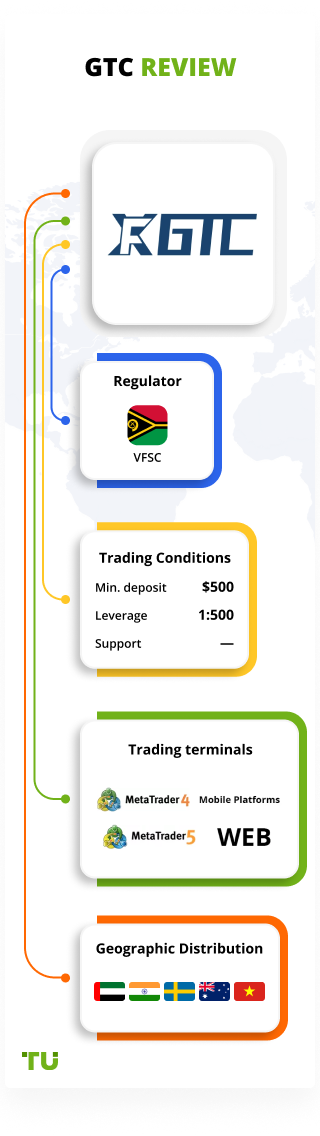

Summary of GTC Trading Company

GTC is a broker with higher-than-average risk and the TU Overall Score of 4.06 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by GTC clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. GTC ranks 209 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

This broker’s trading conditions are a comfortable initial deposit, a wide choice of account types, a large number of trading instruments, and optimal leverage. Its special advantage is the ability to use major trading platforms. Another obvious plus is the availability of several options for passive income. Also, this broker offers tools for technical and fundamental analyses, and training is available in the form of webinars. Unfortunately, GTC Forex has serious regional restrictions.

This broker's clients trade currency pairs and CFDs on stocks, indices, precious metals, and energies through MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. There is a free demo account along with two standard and three professional accounts. Spreads are floating, starting from 0 pips, with no trading fees on most accounts. There are no fees for depositing and withdrawing funds that are available by bank transfers, bank cards, e-wallets, and crypto-wallets. This broker does not limit its clients in trading strategies and methods. Leverage can be increased up to 1:1000. Passive income options include MAM and PAMM accounts and a copy trading service. Also, this broker offers an Introducing Broker (IB) partnership program. The company is licensed by three regulators, is a member of the Financial Dispute Resolution Center (FDRC), and has a compensation fund.

| 💰 Account currency: | USD, AED, NGN, EUR, JPY, AUD, NZD, and PKR |

|---|---|

| 🚀 Minimum deposit: | $30 |

| ⚖️ Leverage: | Up to 1:1000 |

| 💱 Spread: | Floating from 0 pips |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, indices, precious metals, and energies |

| 💹 Margin Call / Stop Out: | 100%/20% |

👍 Advantages of trading with GTC:

- Minimum deposit for standard accounts is only $30, which ensures a low entry threshold;

- Tight spreads from 0 pips and low fees up to $3.5 per lot minimize trading costs;

- Except for the demo account, there are five live account types, that provide for individualizing the offer;

- No trading restrictions combined with high leverage provide high-profit potential;

- Traders work through top-end platforms that are easy to learn and easily customized using plug-ins;

- This broker offers passive income options such as joint accounts and an integrated copy trading service;

- Technical support is multilingual and is available 24/7.

👎 Disadvantages of GTC:

- There are many assets in this broker's pool, but they are only currency pairs and CFDs;

- This broker does not offer a standard referral program for individuals, but only an IB partnership program;

- GTC Forex does not provide its services in Germany, Italy, Belgium, Ireland, Liechtenstein, Norway, and a number of other countries.

Evaluation of the most influential parameters of GTC

Trade with this broker, if:

- You prefer brokers with competitive trading costs. This broker provides tight spreads from 0 pips and low fees up to $3.5 per lot, minimizing your overall trading costs.

- You prefer the MetaTrader 4 platform. GTCFX uses this popular platform known for its features and user-friendly interface.

Do not trade with this broker, if:

- You belong to one of the restricted countries. GTC Forex does not provide its services in Germany, Italy, Belgium, Ireland, Liechtenstein, Norway, and other countries. If you are located in these regions, access to GTCFX might be limited.

- You value strong regulation by major financial authorities. GTCFX might not be suitable if you prioritize regulatory oversight from established authorities like the FCA or SEC.

- You require extensive educational resources and support. While some educational materials exist, they might not be as comprehensive as what other brokers offer, and personalized support might be limited.

Geographic Distribution of GTC Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of GTC

The GTC Forex trademark is owned by Global Trade Capital, which is licensed by regulators of Vanuatu, Mauritius, and the United Arab Emirates. The company has been operating in different regions for several years, providing brokerage services among other things. This broker fulfills its obligations, thus all arising disputes, as a rule, are resolved without involving regulators.

Due to its trading conditions, GTC Forex rightfully occupies one of the top positions in its segment. There are no trading restrictions, the minimum trade volume is 0.01 lots, and there are demo and cent accounts. These conditions don’t differ from those of this broker’s competitors. However, there are parameters that make it unique. For example, the minimum deposit for the Standard account is only $30, which is well below average.

There is a wide choice of account types, and a deep pool of assets, which includes dozens of currency pairs and hundreds of CFDs on stocks, indices, metals, and energies. Leverage of 1:1000 is not exceptional, just like having PAMM accounts. The company offers its proprietary copy trading service and does not use third-party solutions. Functional testing did not reveal any disadvantages of these systems. Thus, traders can successfully earn in many ways.

Analytical tools provided by this broker are standard. Training is provided in the form of webinars that are rated by experts as average in terms of volume and quality. But much more important is that GTC Forex works with MT4, MT5, and cTrader, which gives its clients conceptual advantages of a customized workspace and high functionality.

Indeed, this broker does not have a typical referral program for individuals and there are certain regional restrictions, but these features are not exclusive to the segment. Therefore, taking into account the above advantages, this broker can be recommended for review.

Latest GTC News

Dynamics of GTC’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Most traders come to brokerage companies for active trading. Investment is an absolute plus, but only as an addition, and not the main feature of a broker. Nevertheless, today almost all brokers offer various options for alternative income. These are mainly joint accounts and copy trading. Such opportunities are available with GTC Forex as well. There is also a partnership program.

MAM and PAMM accounts

Joint accounts work the same way with all brokers. Traders can register as managers or investors. Managers partially control investors' sub-accounts along with its own accounts. In particular, they use the funds available on such sub-accounts to execute trades. Investors can limit the balance available to managers. When trades are successful, everyone receives a profit equivalent to their bets, plus managers charge investors a small fee for their services. If a trade fails, everyone loses money.

Copy trading

This service is similar to PAMM accounts, as there are also investors who earn passively. But here signals providers, that investors connect to, do not manage their investors’ funds. Providers trade on their own accounts, and their trades are automatically duplicated on their investors’ accounts. However, investors can set limits, such as the betting threshold (for example, the provider bets $1,000 while the investor duplicates the trade with a bet of $100). With a successful trade, everyone receives a profit according to their bets. Moreover, investors pay providers a fee for their services.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program

GTC Forex does not offer a standard Refer a Friend program. An individual or legal entity can become a partner of the company only as an Introducing Broker. GTC Forex provides its partners with promotional materials for attracting new clients and integrated mechanisms for implementation in ready-made trading solutions. Partner income can be up to $1,850 depending on the region. This broker also has a franchising program and other options.

Trading Conditions for GTC Users

If a broker offers multiple trading account types, the minimum deposit is mostly determined by the account type selected by the trader. To open a standard account with GTC Forex, a minimum deposit of $30 is required; whereas, to open a professional account, you need to deposit $3,000 minimum. Leverage is determined by the traded asset. On all accounts, the highest trading leverage of 1:500 is available for currency pairs. However, a trader can at any time contact technical support and request increased leverage up to 1:1000. Technical support is available 24/7 by phone, email, and live chat.

$30

Minimum

deposit

1:1000

Leverage

24/7

Support

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5, and cTrader |

|---|---|

| 📊 Accounts: | Demo, Standard, Standard Cent, Raw Spread, Zero, and Pro |

| 💰 Account currency: | USD, AED, NGN, EUR, JPY, AUD, NZD, and PKR |

| 💵 Replenishment / Withdrawal: | Bank transfers, bank cards, e-wallets, and crypto-wallets |

| 🚀 Minimum deposit: | $30 |

| ⚖️ Leverage: | Up to 1:1000 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating from 0 pips |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, indices, precious metals, and energies |

| 💹 Margin Call / Stop Out: | 100%/20% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: |

Free demo account; Two standard and three professional account types; Tight spreads and low fees; No withdrawal fees; Several passive income options; Standard set of analytical tools. |

| 🎁 Contests and bonuses: | Welcome bonus and bonuses from Traders Union |

Comparison of GTC with other Brokers

| GTC | RoboForex | Pocket Option | Exness | FreshForex | XM Group | |

| Trading platform |

cTrader, MetaTrader4, MetaTrader5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading | MT4, MT5, MobileTrading, XM App |

| Min deposit | $30 | $10 | $5 | $10 | No | $5 |

| Leverage |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0.6 points |

| Level of margin call / stop out |

No / 50% | 60% / 40% | 30% / 50% | No / 60% | 40% / 20% | 100% / 50% |

| Execution of orders | STP | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | $30 | No |

| Cent accounts | No | Yes | No | No | Yes | Yes |

Broker comparison table of trading instruments

| GTC | RoboForex | Pocket Option | Exness | FreshForex | XM Group | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes | No | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

GTC Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | Standard spread from 3$, no fee | No |

| Standard Cent | Standard spread from 3$, no fee | No |

| Raw Spread | Raw spread from 0$, with a $3.5 fee per lot | No |

| Zero | Standard spread from 0$, with a $0.2 fee per lot | No |

| Pro | Standard spread from 0$, no fee | No |

As can be seen from the table, GTC Forex has no withdrawal fee, which is another important advantage. This fee is not charged under any circumstances, except for withdrawal of bonus funds, since special conditions apply for them. Note that other parties involved in the withdrawal process, such as banks or electronic payment systems, may charge fees, which must be clarified in advance. Since spreads and trading fees are the main costs of a trader, the comparative table below offers the average fees of GTC Forex and two of its competitors. It will help you understand how profitable it is to work with this company.

| Broker | Average commission | Level |

| GTC | $1.5 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed review of GTC Forex

This broker has an extensive infrastructure, uses an advanced technology stack, and provides high security and fast order execution. This is not surprising, since the parent company of the project has been on the market for a long time, is highly experienced, and has sufficient resources. The conceptual advantage is that this broker is licensed by three regulators and is a member of the Financial Dispute Resolution Center. Client funds are insured, and if necessary, all losses will be covered with up to €20,000 per trader. This approach is not common among brokerage companies. This broker’s activities are transparent, all regulatory documents are available on its website, regulators’ licenses can be checked, and there are no hidden or transaction fees. Moreover, any question can be clarified with client support 24/7.

GTC Forex by the numbers:

-

5 live account types (plus demo);

-

Minimum deposit is $30;

-

Maximum fee is $3.5 per lot;

-

15 deposit/withdrawal options;

-

Withdrawal fee is $0.

GTC Forex is a broker for active and passive income

Traders who aim to trade independently have a deep pool of assets at their disposal, which include currency pairs and CFDs on stocks, indices, metals, and energies. A wide range of instruments is an advantage, as it promotes the diversification of investment portfolios and not being limited in choosing a trading strategy. This is especially important, as GTC Forex allows scalping, hedging, trading news, and using expert advisors. For those who want to earn passively, MAM and PAMM accounts and copy trading are available. Both services are implemented at a high-quality level, and have no problems with functionality and performance.

Useful services offered by GTC Forex:

-

Joint accounts. Traders can register as managers or investors. Managers receive additional profit due to fees charged from investors, and investors themselves earn passively with reduced risks;

-

Copy trading. Signals providers trade on their own terms and, when trading successfully, receive some fees from investors who copy their trades. Investors, for their part, can count on income without active trading and a unique experience;

-

Autochartist. It is a comprehensive analytical service that includes a range of automated tools. It scans markets, gives volatility indicators, and provides expert opinions;

-

Signal center. This service examines the newsfeeds and filters them, eliminating the so-called "noise". The result of the analysis allows you to understand how successful this or that strategy can be.

Advantages:

Novice traders can get a low initial deposit and good training;

Work with hundreds of trading instruments without restrictions, top trading platforms, and current analytics;

Competitive spreads, objectively low trading fees, and impressive leverage up to 1:1000;

The company's clients can earn passively using joint accounts and its copy trading service;

Technical support is multilingual and is available 24/7 via all many communication channels, such as phone, mail, and live chat.

Guide on how traders can start earning profits

The account type is of great importance. The Standard Cent account is aimed specifically at novice traders so that they can gain experience by trading on the real market, but without significant risks, as trading is executed in micro lots. Standard is a universal account, suitable for most users, and it has fairly tight spreads and no fees. Raw Spread offers a raw spread (i.e., the lowest) and a fixed fee per lot. On the Zero account, spreads are higher than on Raw Spread, but fees are lower. Both accounts are professional, as they require an increased initial deposit of $3,000, while on Standard Cent and Standard accounts, you need only $30. Finally, the Pro account has a rather small spread and no fee and is aimed at experienced traders. Except for the account type, trading platforms are also important. MT4, MT5, and cTrader are quite different, although they are all convenient, easy to learn, and perfectly customizable.

Account types:

As a rule, if traders have never worked with a broker, they first open a demo account. Conditions on the demo correspond to those of a live account, thus users get access to real quotes but work with virtual currency. This helps novice traders to get used to the platform, and study its advantages and features. Moreover, a demo account provides for testing a particular strategy without risk. If traders are satisfied with everything on the demo, they open one of the live account types in accordance with their available budget and trading preferences.

Investment Education Online

A solid theoretical background, along with active trading, is very important for trader success. Traders can improve their knowledge by reading special literature, communicating with colleagues, attending webinars held by experts, etc. Brokers understand this and provide training materials to their clients. Considering that many users come to brokerage companies with no experience at all, training is most often aimed specifically at them, that is, it provides only basic information. With GTC Forex, traders cannot count on full-fledged training courses and structured programs. However, this broker constantly holds webinars, which are available online or traders can download the content as a text file with infographics. At webinars, this broker's experts review a variety of issues ranging from the basics of technical analysis to specific strategies and methods using their own life hacks.

Thus, training webinars of GTC Forex are really useful for traders of any level. However, in-depth candlestick analysis techniques, for example, are more aimed at experienced traders, and novice market participants should return to it later. And the basics of technical and fundamental analyses are unlikely to bring much benefit to a professional, but they will be of interest to a novice trader. The nuisance is that webinars are held in the corresponding section in a continuous stream, which is constantly growing. Therefore, it is quite difficult to find a specific topic.

Security (Protection for Investors)

Brokerage companies must act officially within the laws of the country where it is headquartered. Registration as a financial institution is mandatory, otherwise this is a fraudulent project aimed at stealing trader funds. However, registration alone is not enough, and control by an international regulator is necessary. A regulator license means that a broker works transparently, constantly reports to a controlling authority, and fulfills its legal and ethical obligations. If the obligations are not fulfilled, traders have the right to apply to a regulator to resolve the issue. GTC Forex is registered in Vanuatu and its activities are controlled by three regulators: the Vanuatu Financial Services Commission (VFSC, 40354), the Department of Economic Development of Dubai (DED), and the Financial Services Commission (FSC, GB22200292 Mauritius). This potentially indicates a high level of broker reliability.

👍 Advantages

- Clients can address this broker’s technical support

- Traders can apply to VFSC, DED, and FSC

- Contact Traders Union’s legal department for a free consultation and representation. It protects its members’ rights without charge.

👎 Disadvantages

- This broker’s clients cannot address any financial control agency outside Vanuatu

- Traders cannot address international regulators that do not monitor activities of this broker

Withdrawal Options and Fees

-

When trading on a live account and being successful, this broker’s clients receive income;

-

Traders can withdraw their profits at will using the appropriate option of their user accounts on the website;

-

Withdrawals are available to bank accounts, bank cards, and e-wallets;

-

This broker does not charge a withdrawal fee, regardless of the withdrawal channel, amount, and other factors;

-

The fee will be charged only when withdrawing profits earned using bonus funds (under the “Welcome Bonus” promotion);

-

For most channels, withdrawals take 24 hours, while for some it takes 1-5 days;

-

Note that only certain currencies are available for some channels (for example, only USD and EUR can be withdrawn to Visa and Mastercard).

Customer Support Service

Technical support is crucial for any company. Brokers need it because traders sooner or later face trading-related situations that they cannot resolve on their own. Which means they need help. If technical support is not fast or competent enough, clients may well become disappointed with a broker and leave for a competitor. GTC Forex understands this perfectly, so this broker's technical support works 24/7. All major communication channels such as phone, email, live chat, and social media profiles are available. Thus, clients have no complaints about support.

👍 Advantages

- Non-clients of this broker can contact technical support

- Support is available 24/7

👎 Disadvantages

- Responses via email are not prompt

Whether you are this broker’s client or just intend to become one, do not hesitate to contact its technical support if you have any trade-related questions. Use the following channels to get in touch with experts:

-

call center;

-

email;

-

tickets on the website;

-

live chat on the website and in the user account.

This broker has its profiles on Facebook, Twitter, YouTube, LinkedIn, and Instagram. You can contact managers through any of these platforms. It is also recommended to subscribe to any of the company's profiles so as not to miss its latest news.

Contacts

| Foundation date | 2017 |

| Registration address | First-floor B&P House, Kumul Highway Port Vila, Vanuatu |

| Regulation |

VFSC, FSC |

| Official site | https://gtcfx.com/ |

| Contacts |

Email:

support@gtcup.com,

Phone: 800 667788 |

Review of the Personal Cabinet of GTC Forex

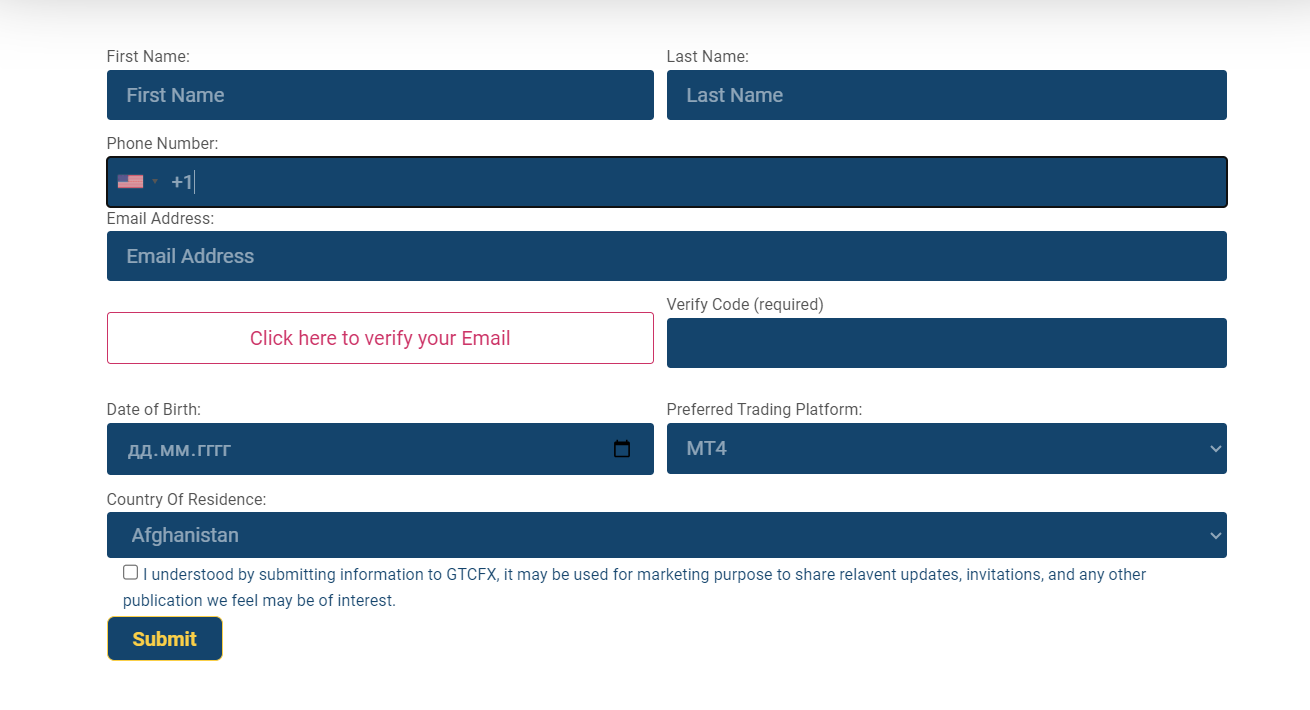

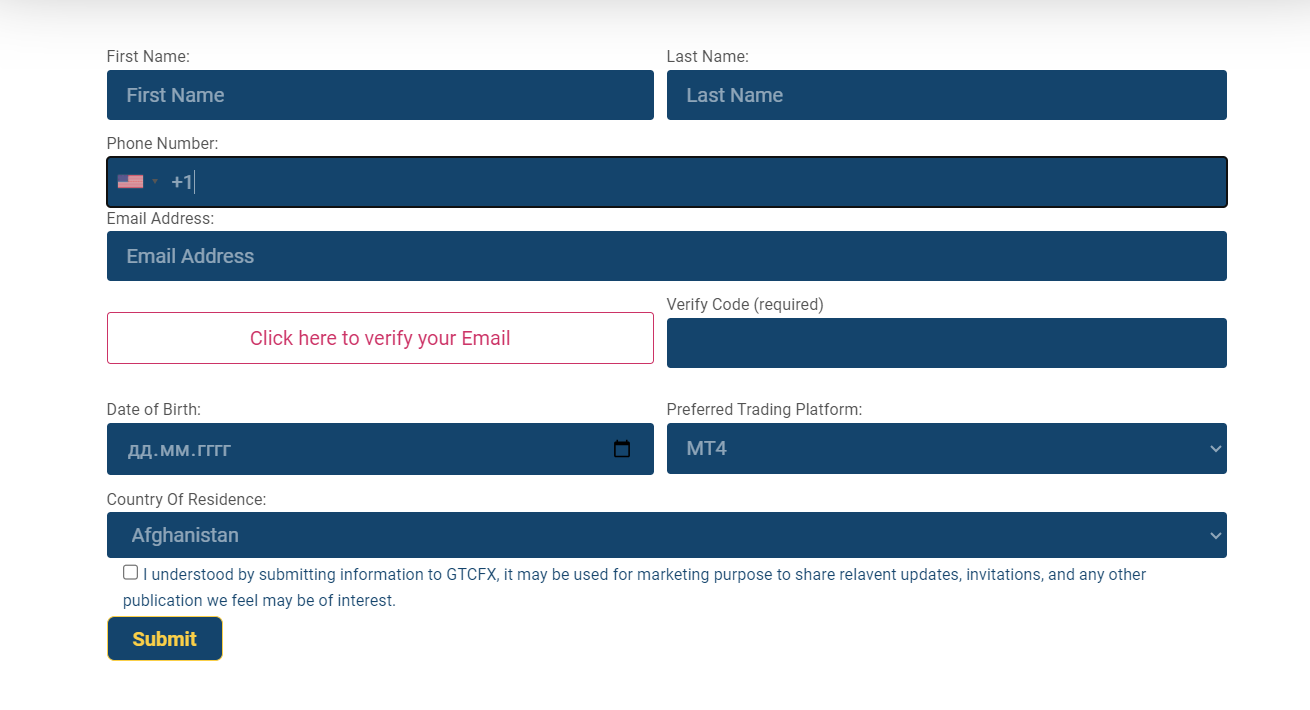

To start working with this broker, register on its official website. Registration does not take much time. Verification, which is confirmation of your personal data, is also required. After that, traders open a demo or live account, download the trading platform, make a minimum deposit, and start trading. User accounts also provide access to joint accounts and the copy trading service. TU experts have prepared the below step-by-step guide on registration and features of the user account.

Go to this broker's website. Select the interface language in the upper right corner, and click the “Open Live Account” button in the below block.

Enter your first and last names, email address, and contact phone number. Specify your preferred account type, and select the preferred trading platform. After that, select your country of residence, agree to the terms of service by ticking the box, and click the “Next” button.

Enter your nationality and date of birth. Then enter your full registration address with the postal code. Answer a few questions about your occupation and click the “Next” button.

In the next block, answer a few questions about your trading experience. The answers will allow this broker to provide you with a more personalized offer. If you have never traded in the Forex and stock markets before, simply answer “No” and you won't have to fill out anything. In any case, click the “Next” button.

Now tell this broker about your financial capabilities, which is also necessary to individualize the offer. Unfortunately, you cannot skip this step, and have to consistently answer all the indicated questions. Once finished, click the “Next” button.

Answer a few more questions and provide scans or photos of the required documents for verification. At the bottom of the block, check each field, having previously studied the documents using the links. At the end, click the “Confirm” button.

A confirmation link will be sent to your email. Click it to activate your account and go to your user account. In your user account, you can download the trading platform and make a deposit (to do this, go to the appropriate section, select the deposit channel, and follow the instructions on the screen). After that, start trading.

Features of the user account:

Traders receive detailed information about their active accounts, also they can open and close accounts here;

Deposits, withdrawals and internal transfers are available here;

Users can correct their personal information and change security settings;

Copy trading and joint accounts services are available in the user account;

Also here is the training section and distributions of trading platforms;

Tools for technical and fundamental analyses are also provided here.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

Do reviews by traders influence the GTC rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about GTC you need to go to the broker's profile.

How to leave a review about GTC on the Traders Union website?

To leave a review about GTC, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about GTC on a non-Traders Union client?

Anyone can leave feedback about GTC on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.