deposit:

- $10

Trading platform:

- MetaTrader4

- LCG Trader

- SCB

- FCA

- 0%

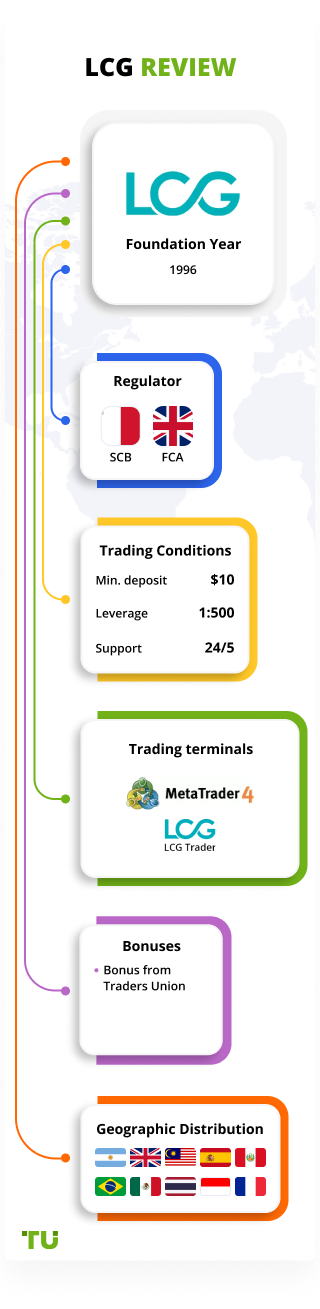

London Capital Group (LCG) Review 2024

deposit:

- $10

Trading platform:

- MetaTrader4

- LCG Trader

- SCB

- FCA

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of LCG Group Trading Company

LCG Group is a broker with higher-than-average risk and the TU Overall Score of 4.86 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by LCG Group clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. LCG Group ranks 130 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

LCG is a broker for beginners and professional traders who prefer trading and managing their own funds independently.

The LCG broker is an international intermediary that started its business in 1996. Traders who have opened an account with LCG have access to 9 groups of trading assets, including: Forex, spot metals, stocks, indices, ETFs, CFDs, stock options, bonds, interest rates, and commodities. The minimum deposit requirements make trading with LCG affordable, and the use of innovations and high-quality service make it comfortable.

| 💰 Account currency: | USD, GBP, EUR, and CHF |

|---|---|

| 🚀 Minimum deposit: | 10$ |

| ⚖️ Leverage: | Dynamic, up to 1:500 |

| 💱 Spread: | From 0 pips |

| 🔧 Instruments: | Currency pairs, indices, spot metals, stocks, commodities, CFDs, exchange traded options, ETFs, bonds and interest rates |

| 💹 Margin Call / Stop Out: | No data |

👍 Advantages of trading with LCG Group:

- Low minimum deposit requirements.

- A wide range of trading instruments.

- An information section with training and analytical materials.

- Round-the-clock support service.

- No commission for funding the deposit and withdrawal of capital.

- The possibility to trade from different devices such as a PC, tablet, or smartphone.

- The presence of Islamic accounts.

👎 Disadvantages of LCG Group:

- The company does not provide offers for passive earnings such as copying services or bonus programs.

- The broker does not serve clients from certain countries.

- Customer support doesn’t work on weekends.

Evaluation of the most influential parameters of LCG Group

Geographic Distribution of LCG Group Traders

Popularity in

Video Review of LCG Group i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

shanthan

shanthan  GB London

GB London

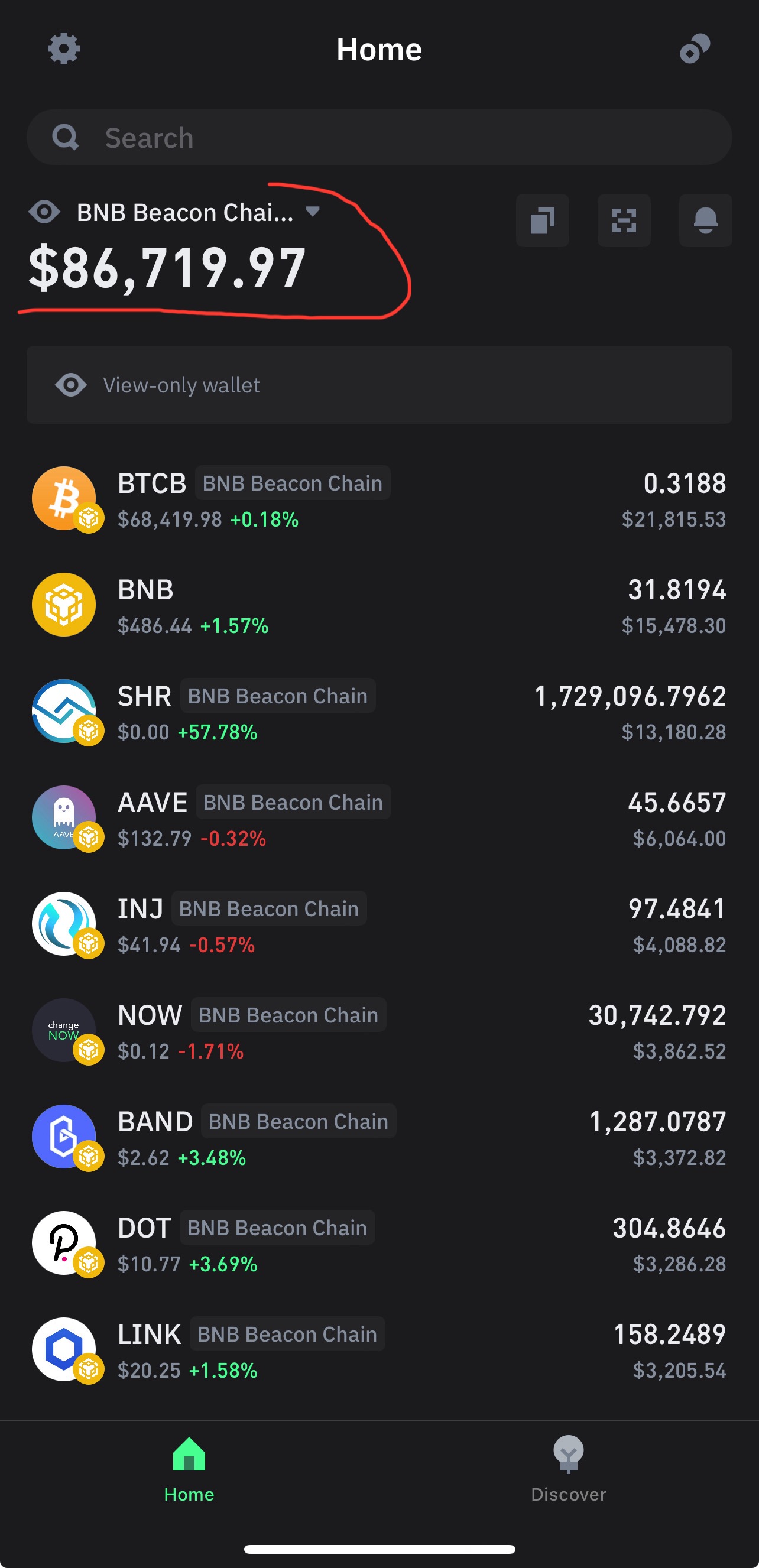

I MADE OVER $80,000 IN LESS THAN 1 MONTH

I loving everything about the company

Expert Review of LCG Group

The LCG is an international broker that started operating in 1996. The company’s list of trading instruments includes a variety of assets, from standard currency pairs to stock options, bonds, commodities, and interest rates. In total, LCG has more than 7,000 trading instruments.

The company strives to provide its clients with quality services and make sure that trading is affordable. So, to open an account, the user will need only 10 USD. You can understand that broker focuses on traders with different professional experiences since it has a section with useful training and analytical materials. Execution of orders depends on the type of account (ECN or market execution), and swap-free accounts are available for Muslim clients.

It is worth mentioning that LCG is aimed at working with active traders, therefore there are no programs and services for generating passive income. The company doesn’t have contests and bonus programs either. Please note that the broker does not cooperate with certain countries. Therefore, residents of Australia, Belgium, Singapore, Canada, New Zealand, and the USA cannot open a trading account with LCG.

Latest LCG Group News

Dynamics of LCG Group’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

The LCG broker aims to cooperate with active traders and those who use their own trading experience and funds when making transactions. The broker provides optimal conditions for independent trading, including instruments in which you can invest. However, there are no special programs for copying trades, receiving trading signals, or PAMM or MAM accounts in LCG.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

LCG’s affiliate program:

-

Affiliates. The broker’s clients can earn additional income by referring new users to LCG. The company provides program participants with personal referral links and marketing materials, and you can track the activity of invited users from your personal account. The maximum payout is 800 USD.

-

Introducing Broker. This program is suitable for business owners. The principle of operation is the same as with the affiliates program: the LCG client opens a trading account, discusses with the manager participation in the affiliate program, its conditions, and then receives an individual referral link. The user gets income from the trading commission of the invited clients.

-

Institutional. The affiliate program is intended for those who have their own finance company. Clients of the program participant can access the LCG trading conditions, that is, the company will take on all the organizational and technical tasks. The income of the member of such an affiliate program will also consist of commissions payments.

The participants of all programs will discuss with the managers the amount of payments, the type of commission, and other issues on an individual basis, before receiving a personal referral link.

Trading Conditions for LCG Group Users

The LCG broker gives traders the possibility to trade instruments from 9 groups: Forex, stocks, indices, CFDs, commodities, ETFs, exchange-traded options (ETOs), interest rates, and bonds. There are two trading platforms available at LCG: MetaTrader 4 and the LCG Trader. A user with any trading experience can open a trading account with the company, and the minimum deposit of 10 USD makes opening an account even more affordable. Leverage in LCG is dynamic: it directly depends on the trading volume. As the volume increases, the leverage automatically decreases. The maximum leverage is 1:500, the minimum is 1:5. There are no programs for automatic trading, copying trades, or generating passive income at LCG.

$10

Minimum

deposit

1:500

Leverage

24/5

Support

| 💻 Trading platform: | MetaTrader 4, LCG Trader |

|---|---|

| 📊 Accounts: | Classic, ECN, demo |

| 💰 Account currency: | USD, GBP, EUR, and CHF |

| 💵 Replenishment / Withdrawal: | Visa and MasterCard; Union Pay, Southeast Asian Nations Payment System, Skrill, and Neteller |

| 🚀 Minimum deposit: | 10$ |

| ⚖️ Leverage: | Dynamic, up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 lot |

| 💱 Spread: | From 0 pips |

| 🔧 Instruments: | Currency pairs, indices, spot metals, stocks, commodities, CFDs, exchange traded options, ETFs, bonds and interest rates |

| 💹 Margin Call / Stop Out: | No data |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution, ECN |

| ⭐ Trading features: | VIP clients have access to special trading conditions |

| 🎁 Contests and bonuses: | Yes, bonuses from the Traders Union |

Comparison of LCG Group with other Brokers

| LCG Group | RoboForex | Eightcap | Exness | Pepperstone | Libertex | |

| Trading platform |

MT4, LCG Trader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, WebTrader, cTrader, MT5, TradingView | Libertex, MT5, MT4 |

| Min deposit | $10 | $10 | $100 | $10 | $1 | 100 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:400 |

From 1:1 to 1:30 for retail clients |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.1 points | From 0 points | From 0 points | From 1 point | From 0 points | From 0.1 points |

| Level of margin call / stop out |

No / 50% | 60% / 40% | 80% / 50% | No / 60% | 90% / 20% | 50% / 50% |

| Execution of orders | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Instant Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| LCG Group | RoboForex | Eightcap | Exness | Pepperstone | Libertex | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes (as CFDs) |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes (as CFDs) |

| Crypto | No | No | Yes | Yes | Yes | Yes (as CFDs) |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes (as CFDs) |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes (tradable CFDs or Stocks for investment) |

| ETF | Yes | Yes | No | No | Yes | Yes (as CFDs) |

| Options | Yes | No | No | No | No | Yes (as CFDs) |

LCG Group Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Classic | From $8 | No |

| ECN | From $0 | No |

For the transfer of a trading position to the next day, LCG charges a swap fee. Customers living under Sharia law can contact customer service and open an Islamic account.

The Traders Union’s specialists compared the trading commission level in LCG with the indicators of its competitors — RoboForex and FXPro. Comparison of the spread on Forex assets allows you to objectively assess the level of commissions. You can find the results below.

| Broker | Average commission | Level |

| LCG Group | $4 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of LCG

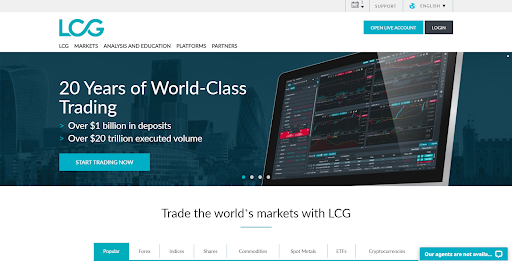

LCG has been a financial services company for 25 years. The broker cooperates with professional and novice traders and provides comfortable trading conditions. The four principles that LCG is based on are quality customer service, high-tech trading platforms, favorable trading conditions, and the use of innovative technologies.

LCG’s success by the numbers:

-

The company has been providing financial services for over 25 years.

-

LCG clients have access to 9 asset classes and over 7,000 trading instruments.

-

The minimum deposit in the company is 10 USD/GBP/EUR.

-

The total amount of deposits of all LCG clients is over $1 billion.

-

The support service is available 24/5.

LCG is a broker for novice and professional traders

LCG has created optimal conditions for independent trading. The broker offers a wide range of working instruments, including currency pairs, commodities, stocks, indices, spot metals, stock options, ETFs, CFDs, bonds, and interest rates. The trading conditions are comfortable for day trading, however, the transfer of positions to the next day is also available. But there are no services and programs for generating income without participating in trading in LCG, such as services for copying transactions, PAMM, MAM, and LAMM accounts, and trading signals are not provided by the company.

LCG offers two trading platforms: classic MetaTrader 4 and their proprietary terminal LCG Trader. Both platforms are available as mobile apps. You can install terminals directly from the broker’s website, just go to the “Platforms” section and select a suitable trading platform.

LCG’s useful services:

-

Market Holidays. Here the trader will find the timetable for various markets, including a calendar for weekends and holidays. This information will help you adjust your trading strategy and work schedule.

-

FAQs. This section contains answers to frequently asked questions from traders and potential clients of the company.

Advantages:

Low level of the minimum deposit.

Wide range of trading assets.

Voluminous training section with many analytical materials.

Fast and convenient payment options.

No commission for funding the deposit or withdrawal of funds.

The LCG affiliate program offers favorable terms of cooperation for individuals and legal entities.

Registration with the LCG website is carried out in a few minutes, and verification of documents on average takes up to 2 hours.

How to Start Making Profits — Guide for Traders

There are two main types of accounts at LCG. Clients from Muslim countries can write to the support team to open an Islamic trading account (swap-free account).

Account types:

To test their knowledge and master new trading strategies, traders can use a free demo account; for CFD trading, the broker offers a CFD trading account.

LCG does not cooperate with residents from the following countries: Singapore, Canada, Belgium, USA, Australia, or New Zealand.

Bonuses Paid by the Broker

LCG does not provide its clients with the opportunity to receive bonuses for trading actions or funding a trading account.

Investment Education Online

The lcg.com website has a section that contains information useful for traders such as training materials, analytics, and videos. Videos on how to use the trading platforms can be found in the “Platforms” section.

A demo account is available to the broker’s clients, where they can test different trading strategies, styles, and their skills in trading without financial risks.

Security (Protection for Investors)

The LCG broker is licensed and supervised by the SCB (Securities Commission of the Bahamas), license number: SIA-F194. The country of incorporation is the Commonwealth of the Bahamas, registration number 200271. LCG’s subsidiaries are also registered and licensed. LCG Limited is regulated by the FCA (UK Financial Conduct Authority), license number 182110. LCG Limited is also regulated by the FCA, and the registration countries are England and Wales, registration number 3218125.

The finances of the broker’s clients are kept in accounts with European financial institutions, therefore, in case of unforeseen circumstances, LCG clients can recover their funds because the broker does not have access to them and cannot use this money for personal purposes.

👍 Advantages

- The broker uses segregated accounts to store clients’ funds

- The company’s activities are licensed and regulated

👎 Disadvantages

- LCG does not cooperate with independent bodies to resolve disputes between the company and its clients

Withdrawal Options and Fees

-

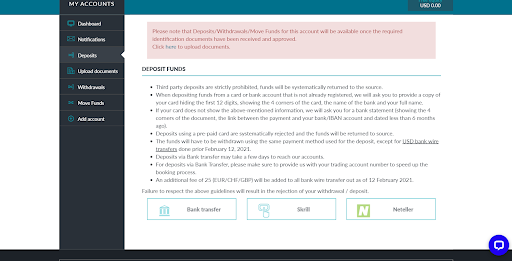

To fund a deposit and withdraw funds from a trading account to a personal one, LCG offers the following payment systems: Visa and MasterCard bank cards; Union Pay, Southeast Asian Nations Payment System, Skrill, and Neteller.

-

The processing of the application depends on the type of transaction. The application for funding the deposit is processed within half an hour; whereas, the application for withdrawal of funds is processed within 1 business day.

-

There is no withdrawal fee. When funding a deposit, there are also no fees, except for bank credit cards, in which case the user pays a commission in the amount of 2% of the deposit amount.

-

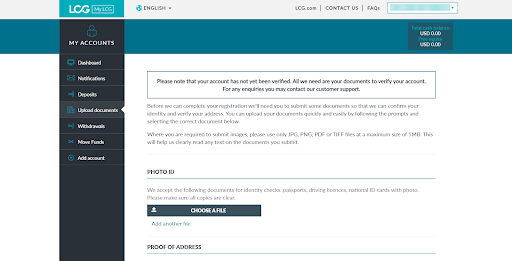

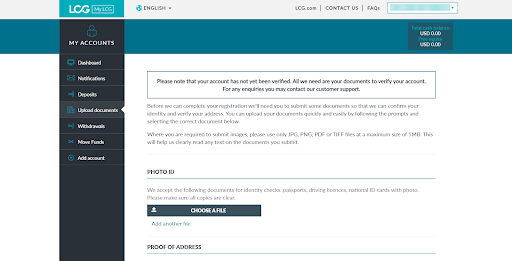

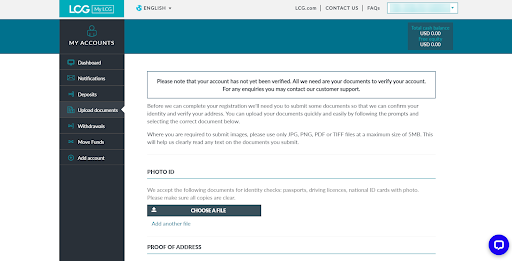

To carry out financial transactions, a trader needs to verify his account. To do this, you must upload the documents specified by the broker and wait for approval and confirmation.

Customer Support Service

The client support service is responsible for solving transaction-related problems and providing answers to trade-related questions. The support team works around the clock and is available 5 days a week. Saturday and Sunday are their off days.

👍 Advantages

- Support service is available 24/5

- The broker offers several options for communicating with its employees

👎 Disadvantages

- There is no possibility to contact support on the weekend

- There is no callback function

This broker provides the following communication channels for its clients:

-

write a message to the broker’s online chat;

-

call the phone number indicated in the “Contact Us” section;

-

write an email to LCG.

LCG representatives are also present on social networks, such as LinkedIn, Facebook, Twitter, Instagram, and YouTube.

Contacts

| Foundation date | 1996 |

| Registration address | 5 North Buckner Square, Olde Towne Sandyport, Sandyport Marina Village, West Bay Street, Nassau, Bahamas |

| Regulation |

SCB, FCA |

| Official site | https://www.lcg.com/ |

| Contacts |

Email:

customerservices.bhs@lcg.com,

Phone: +442 (0) 7456 7505 |

Review of the Personal Cabinet of LCG

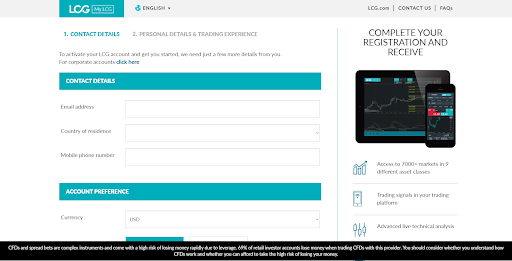

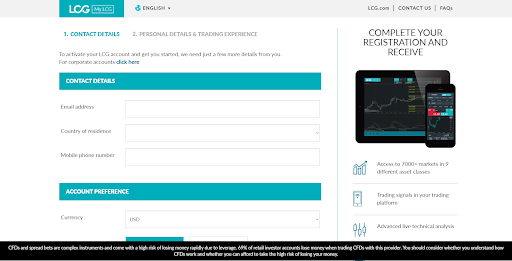

The first step to trading with LCG is registering with the broker’s website and opening a trading account there. You can do this by following the step-by-step instructions below:

First, open the LCG official website in your browser at. To open a new account on the main page, click on the “Open Live Account” button which is located in the upper right corner.

In the window that opens, enter your email address, country of residence, and phone number. Select the base currency of your trading account, preferred trading terminal, create a password, confirm it by re-entering it, and click on the “Next” button to continue registration.

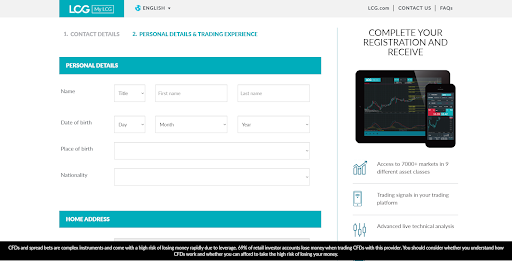

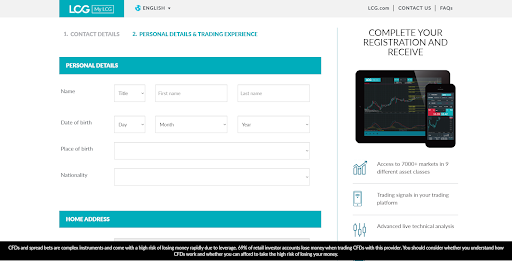

Enter your personal information such as first name, last name, date of birth, place of birth, nationality, home address, employment, and financial experience. Indicate if you have professional experience in trading.

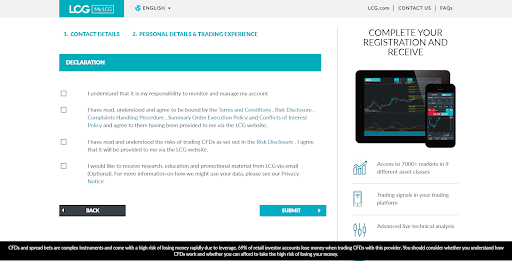

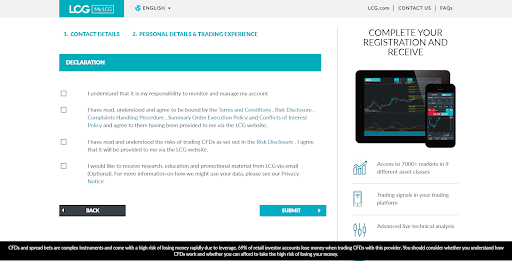

The next step is to sign the user agreement. The page contains hyperlinks to a complete list of obligations on the part of the trader and the broker. After you agree to the terms of use of LCG services, click on the “Submit” button.

After completing all the above points, you will be taken to your personal account.

The functionality of the personal account:

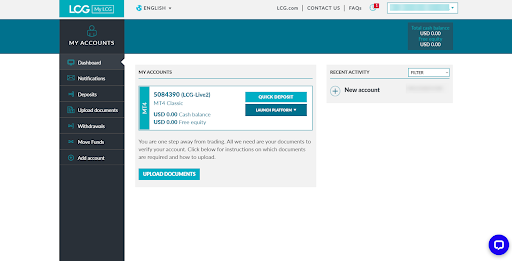

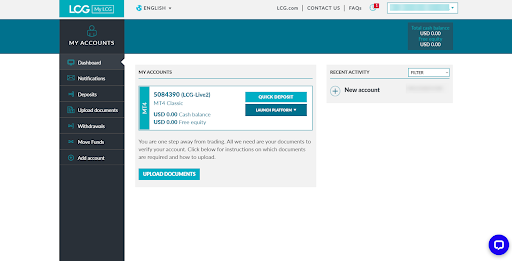

1. Dashboard. This section contains information about the trader’s open trading account(s) and the amount of the deposit in each.

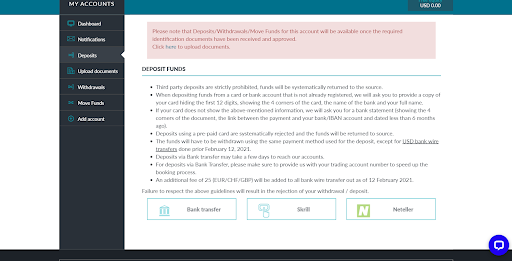

2. Deposits. To start trading, a trader needs to fund the trading account. This can be done in the specified section. Select a payment method, specify the amount, etc. This section becomes available after account verification.

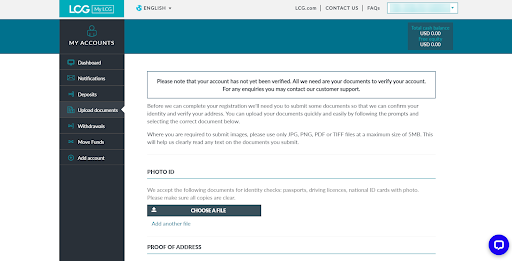

3. Upload documents. In this section, the trader needs to upload copies of personal documents to verify the data and gain access to the full functionality of the personal account.

1. Dashboard. This section contains information about the trader’s open trading account(s) and the amount of the deposit in each.

Overview of LCG’s personal account — Dashboard"

Overview of LCG’s personal account — Dashboard"

2. Deposits. To start trading, a trader needs to fund the trading account. This can be done in the specified section. Select a payment method, specify the amount, etc. This section becomes available after account verification.

3. Upload documents. In this section, the trader needs to upload copies of personal documents to verify the data and gain access to the full functionality of the personal account.

Also in the personal account, the trader has access to:

-

Notifications from the broker.

-

Withdrawal of funds.

-

Other financial transactions.

-

Adding another trading account.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

Do reviews by traders influence the LCG Group rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about LCG Group you need to go to the broker's profile.

How to leave a review about LCG Group on the Traders Union website?

To leave a review about LCG Group, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about LCG Group on a non-Traders Union client?

Anyone can leave feedback about LCG Group on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.