deposit:

- $100

Trading platform:

- MetaTrader4

- MetaTrader5

- Markets.com

- CySEC

- FCA

- ASIC

- FSCA

- BVI FSC

- 0%

deposit:

- $100

Trading platform:

- MetaTrader4

- MetaTrader5

- Markets.com

- CySEC

- FCA

- ASIC

- FSCA

- BVI FSC

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of Markets.com Trading Company

Markets.com is a moderate-risk broker with the TU Overall Score of 5.13 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Markets.com clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Markets.com ranks 105 among 412 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Markets.com is a licensed active and passive trading broker that is more suitable for experienced traders with capital stock.

Established in 2009, Markets.com has grown to become one of the most trustworthy Forex&CFD brokers. Markets.com is fully regulated by the FCA (507880), ASIC (424008), FSCA (46860), CySEC (092/08), and the BVI FSC (SIBA/L/14/1067). The company accepts customers globally and offers every customer unmatched smooth trading services. With Markets.com, one can trade with more than 2,200 trading tools, and use multiple technical and analytical tools on an innovative Investment platform.

| 💰 Account currency: | EUR, USD, GBP, SEK, DKK, ZAR, NOK, PLN, AUD, AED, CZK |

|---|---|

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | Up to 1:300 |

| 💱 Spread: | From 0.6 pips |

| 🔧 Instruments: | Currencies, cryptocurrencies, stocks, ETFs, indices, bonds, commodities, precious metals, blends |

| 💹 Margin Call / Stop Out: | 50% |

👍 Advantages of trading with Markets.com:

- licensed and monitored by four reputable regulators;

- a wide range of Forex and CFD trading instruments;

- no restrictions on the use of trading strategies.

👎 Disadvantages of Markets.com:

- minimum deposit of $100;

- availability of swaps for moving a position to the next day;

- complex site navigation.

Evaluation of the most influential parameters of Markets.com

Trade with this broker, if:

- You're skill-conscious, as in you're new to trading or have some experience, because their user-friendly platforms (WebTrader, MT4, MT5) and educational resources are tailored to your level, providing a supportive environment for learning and growth.

- You want diverse asset choices as they offer a wide range of CFDs on forex, shares, commodities, indices, ETFs, and cryptocurrencies, giving you ample opportunities to diversify your investment portfolio and explore different markets.

- You value transparent pricing as they offer commission-free trading with spreads built into the price, ensuring transparency in pricing and eliminating hidden fees or charges.

Do not trade with this broker, if:

- You prioritize tightest spreads as while their spreads are transparent, they might not offer the tightest spreads compared to some rivals. If getting the absolute lowest spreads is your priority, you may want to consider other brokers with narrower spreads.

- You reside in an unsupported jurisdiction as they don't accept clients from certain countries, like the US and Canada.

Table of Contents

Geographic Distribution of Markets.com Traders

Popularity in

Video Review of Markets.com i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Markets.com

The international Forex company Markets.com has been providing a wide range of brokerage services in the CFD and Forex markets for over twelve years. The licensed broker has its own educational and information centers, which are constantly being updated. The company provides technical and fundamental analysis, provides clients with the latest news, as well as the opportunity to participate in webinars and watch training videos.

Trading conditions at Markets.com are more suitable for professionals and traders with minimal experience. The novice traders can learn the basics of Forex trading with a free demo account. However, the broker does not have cent accounts, and the minimum deposit is $100, which does not allow traders to evaluate its service with minimal risks. Clients can work with floating spreads.

The navigation system is complex and does not allow you to quickly find the information you need. The site and support are available in 7 languages (English, French, Spanish, Italian, Arabic, German, Bulgarian).

Dynamics of Markets.com’s popularity among

Traders Union’s traders, according to 2023 data

Markets.com affiliate program

-

“The Parent-Partner Program” is a three-tier affiliate program. The amount of remuneration depends on the country of registration of the trading account.

-

“Spread Share” represents the accrual of a percentage of the total spread obtained as a result of the attracted trader’s trading activity and is only available under certain jurisdictions.

Participation in affiliate programs allows the broker's clients to receive additional income for attracting new active traders. The higher the number of connected referrals, the higher the Markets.com partner's reward.

Trading Conditions for Markets.com Users

Markets.com’s trading conditions are not suitable for every trader. The minimum deposit starts at $100 and the leverage does not exceed 1:300. The broker offers accounts with floating spreads. The minimum trade volume is 0.01 lot.

$100

Minimum

deposit

1:300

Leverage

24/5

Support

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5, Markets.com platform |

|---|---|

| 📊 Accounts: | Demo, Standard |

| 💰 Account currency: | EUR, USD, GBP, SEK, DKK, ZAR, NOK, PLN, AUD, AED, CZK |

| 💵 Replenishment / Withdrawal: | Bank transfer, bank cards Visa/Mastercard, Neteller, Skrill, PayPal |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | Up to 1:300 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.6 pips |

| 🔧 Instruments: | Currencies, cryptocurrencies, stocks, ETFs, indices, bonds, commodities, precious metals, blends |

| 💹 Margin Call / Stop Out: | 50% |

| 🏛 Liquidity provider: | Not listed on the site |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant execution, Market execution |

| ⭐ Trading features: | Markets.com proprietary platform |

| 🎁 Contests and bonuses: | No |

Comparison of Markets.com with other Brokers

| Markets.com | RoboForex | Eightcap | Exness | FxPro | Gerchik&Co | |

| Trading platform |

MT4, MT5, Mobile, Markets.com | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5, cTrader, FxPro Edge | MetaTrader4, MetaTrader5 |

| Min deposit | $100 | $10 | $100 | $10 | $100 | $100 |

| Leverage |

From 1:1 to 1:300 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:100 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

No / 50% | 60% / 40% | 80% / 50% | No / 60% | 25% / 20% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| Markets.com | RoboForex | Eightcap | Exness | FxPro | Gerchik&Co | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | Yes | Yes | No | No | No | Yes |

| Options | No | No | No | No | No | No |

Markets.com Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | From $6 | No |

There are swaps (commission for moving a position to the next day). We also compared the size of trading commissions in Markets.com with similarly situated competitors. In the comparative table for this criterion, brokers are placed depending on the assigned level of low, medium, and high.

| Broker | Average commission | Level |

| Markets.com | $6 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of Markets.com

Markets.com is a subsidiary of the Safecap Investment Ltd group, which is part of Playtech PLC investment holdings. It is listed on the London Stock Exchange under the symbol "PTEC" and is also listed on the FTSE 250. Through the implementation of innovative solutions, the broker provides its clients with the opportunity to trade on the global financial markets online. However, accounts with Markets.com cannot be opened by citizens of Japan, Canada, Belgium, or the United States.

A few figures about Markets.com that will be of interest to traders who are in the process of choosing a broker:

-

more than 2,200 trading instruments;

-

5 licenses from reputable regulators - CySEC, FCA, ASIC, FSCA and BVI FSC;

-

more than 12 years in the international Forex market.

Markets.com is a broker for experienced traders

Markets.com is a reliable broker that provides quality service and favorable conditions for traders with a certain amount of trading knowledge. The company's clients trade from standard and premium accounts with instant execution and market execution. For the safety of its clients, Markets.com uses the SSL protocol, which protects its servers from unauthorized access. Also, the broker cooperates only with international payment systems with PCI level certificates. The company's servers are located in data centers certified in accordance with SAS 70, which is the standard for storing confidential information that was developed by the AICPA Institute.

Clients trade through the broker's own Markets.com platform, as well as MetaTrader 4 and MetaTrader 5. The company provides a web terminal and makes it possible to work through mobile devices based on the Android and iOS operating systems. Connecting to a multi-terminal platform allows you to parallel trade from multiple accounts.

Useful Markets.com Services:

-

Advanced Charts allow you to track positions, view forecasts, and compare assets, which can be customized;

-

Economic calendar displays important events such as central bank notifications, PMIs, inflation reports, etc .;

-

XRay Streaming Service displays comments from renowned Forex financiers and experts. The XRay content is broadcast in real-time and is recorded for display at a later time for the user.

Advantages:

high reliability of the broker because it is monitored by several international regulators;

customer funds are held in segregated accounts that are not linked to company accounts;

8 types of trading assets, the total number of which exceeds 2200 instruments;

the ability to choose accounts with fixed and floating spreads;

availability of mobile terminals and a web platform;

advisors are allowed.

Traders who have opened an account with a broker can use any trading strategies, including hedging, locking, and scalping.

How to Start Making Profits — Guide for Traders

Markets.com offers its clients one main account type. Trading accounts differ in the type and size of the spread, as well as the amount of the minimum deposit. There are no micro (cent) accounts, and the minimum deposit of $100 is more geared toward professional traders.

Account types:

The broker provides a free demo account with $10,000 of virtual funds so that traders can test the platform before depositing their own funds.

Markets.com is suitable for both beginners and experienced traders. The broker provides clients with a knowledge center where beginner traders can familiarize themselves with trading terminology as well as the different trading tools offered.

Investment Education Online

Information

The broker's website contains a training section called "Knowledge Center" with information and education materials on Forex trading and investment principles. There are also subsections with analytics, online news, and answers to popular questions.

The theoretical knowledge gained can be tested on a virtual demo account.

Security (Protection for Investors)

Information

Markets.com is regulated by CySEC (Cyprus Securities and Exchange Commission) license 092/08, FCA (Financial Conduct Authority) license 607305, ASIC (Australian Securities and Investments Commission) license 424008 and BVI FSC (Financial Services Commission) license SIBA/L/14/1067.

In order not to lose its licenses, the broker must work within the established rules of its regulators. Thus, regulators require Markets.com to provide financial statements to confirm its compliance with the established norms of the capital structure and to segregate its clients’ accounts into a separate account.

👍 Advantages

- Availability of segregated accounts as required by its regulators

- Negative balance protection

- Availability of insurance fund up to 20,000 euros per claim

👎 Disadvantages

- Most regulators do not consider claims of insignificant amounts by private traders

Withdrawal Options and Fees

-

It takes one business day for Markets.com to process a withdrawal request. There is no limit on the number of requests. The size of the withdrawal fee depends on the chosen payment system (bank cards, etc.).

-

You can withdraw funds via bank transfer, Visa/Mastercard, Neteller, Skrill, PayPal, or e-wallets.

-

Instant withdrawals are not available. Crediting to e-wallets takes from 1 to 24 hours, to cards and bank accounts may take up to seven business days.

-

Withdrawal currencies: EUR, USD, GBP, SEK, DKK, ZAR, NOK, PLN, AED, CZK and AUD. For withdrawals in other currencies, a conversion fee is charged.

-

Minimum withdrawals: credit/debit cards are $10 for USD, EUR, GBP; Skrill, Neteller $5 for EUR, GBP; bank transfer is 100 EUR, GBP, and 20 Euros within the EU.

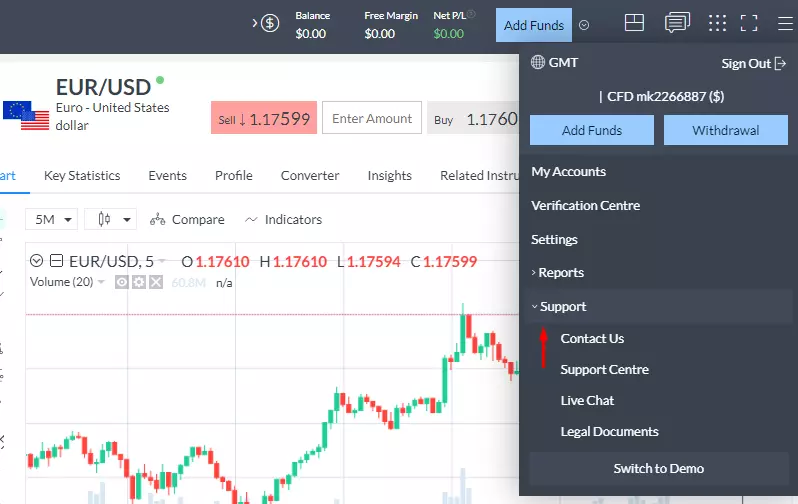

Customer Support Service

Information

The broker's support service is open from 22:00 Sunday to 21:00 Friday (GMT + 00).

👍 Advantages

- There are online chat and telephone support

- Multilingual support

👎 Disadvantages

- Closed on weekends

There are several ways to contact Customer support:

-

by phone, as specified in the contact section;

-

by email;

-

in the online chat on the broker's website.

Support is available from the broker's website and from your Personal Account.

Contacts

| Foundation date | 2006 |

| Registration address | 148 Strovolos Avenue, 2048, Strovolos, P.O.Box 28132, Nicosia, Cyprus. |

| Regulation |

CySEC, FCA, ASIC, FSCA, BVI FSC |

| Official site | markets.com |

| Contacts |

Email:

privacy@markets.com,

Phone: +442031500380 |

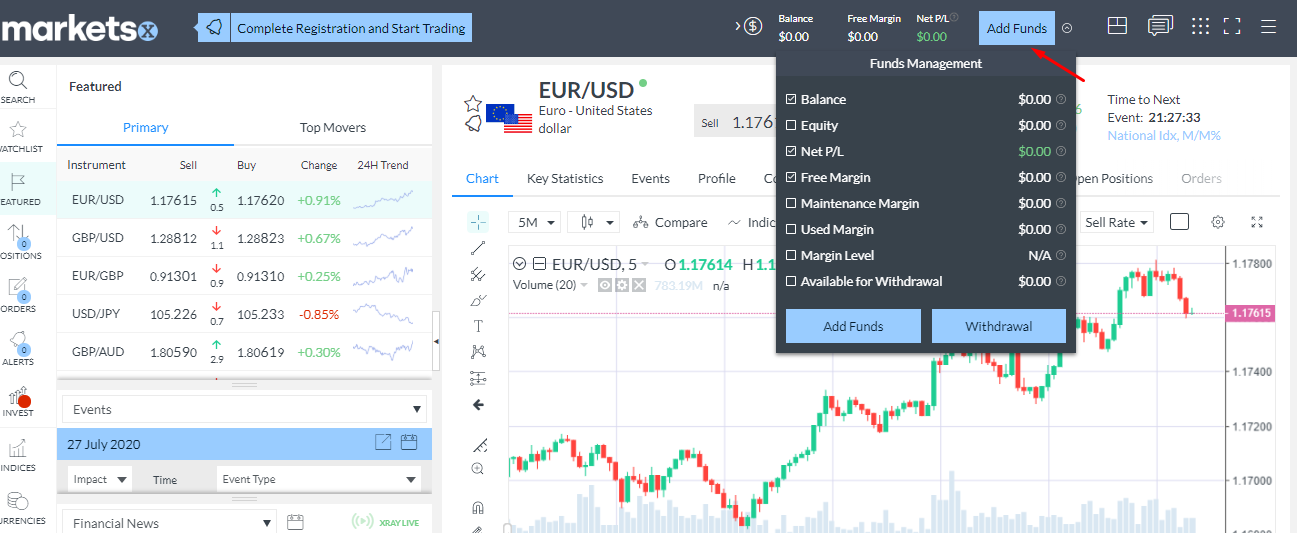

Review of the Personal Cabinet of Markets.com

To start trading with Markets.com and receive spread compensation from Traders Union, you need to follow these steps:

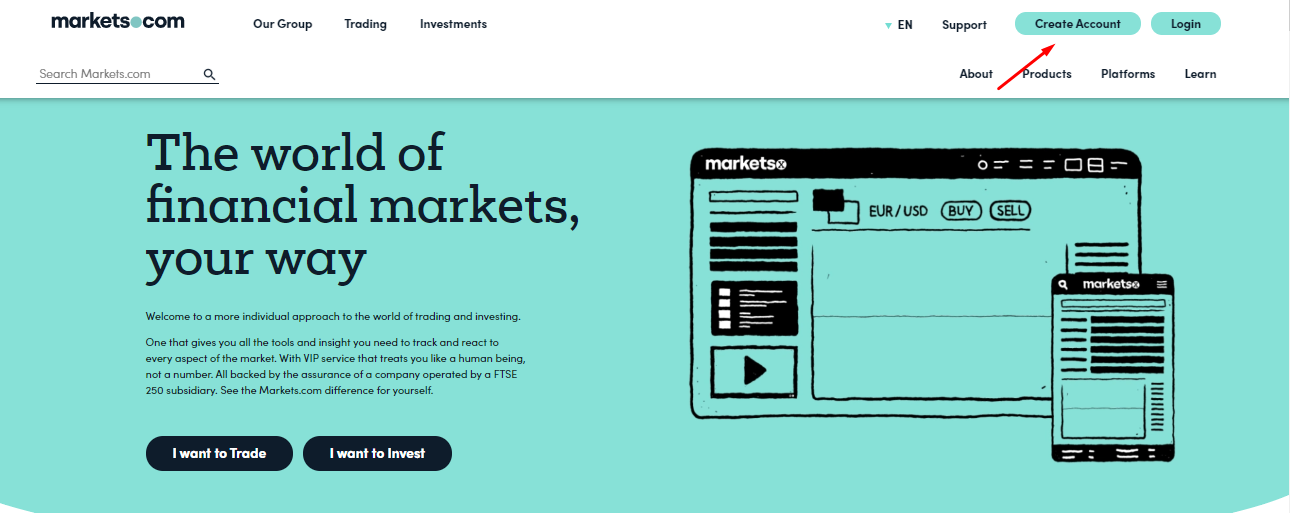

Register on the Traders Union website, and using the referral link, go to the broker's official website. On the main page, click the "Create Account" button.

You can register in several ways - through your personal Google, Facebook, and Apple accounts, or by filling out a dedicated form. In the latter case, you need to provide an email address, a password, and select the currency for the account. Then you should indicate your personal information: name, surname, telephone number, residence address, and citizenship, as well as financial data, trading experience, and level of financial knowledge.

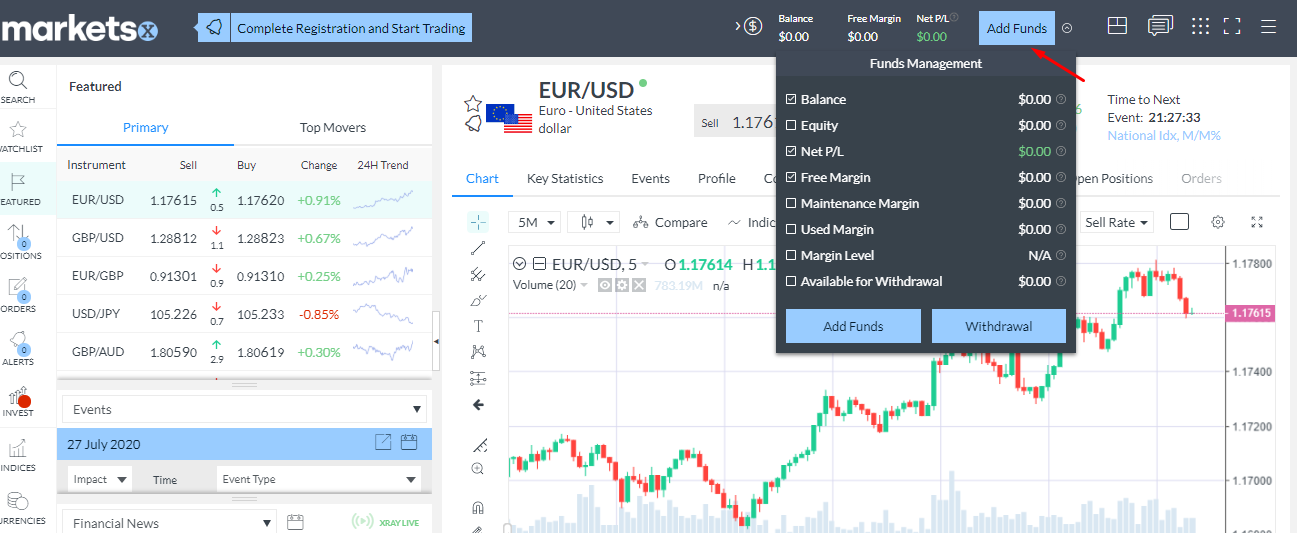

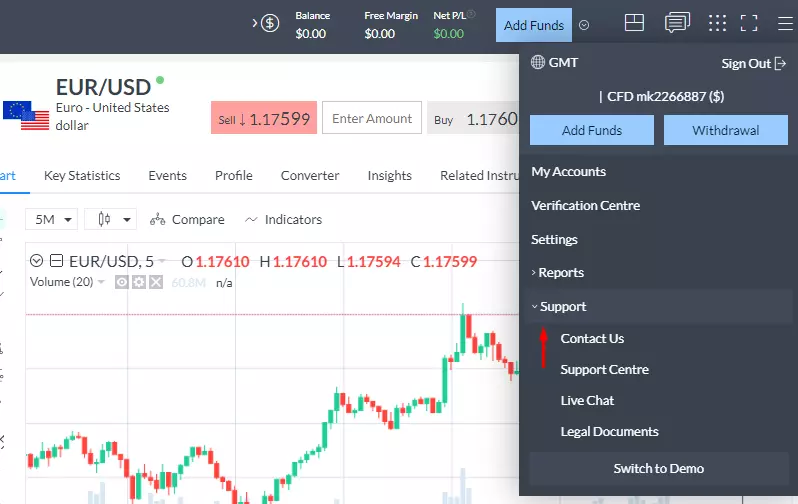

The following functions are available in the Personal account of Markets.com:

1. Financial operations:

2. Communication with support specialists:

1. Financial operations:

2. Communication with support specialists:

The following data is also displayed in the Trader's Personal account:

-

latest economic news, as well as the news archive;

-

an economic calendar with dates and work schedules of various financial exchanges that are relevant to traders;

-

currency quotes that are updated in real-time;

-

information about open and closed orders for a certain period.

Disclaimer:

Your capital is at risk. 79,9% of retail investor accounts lose money when trading CFDs with this provider. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

Do reviews by traders influence the Markets.com rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Markets.com you need to go to the broker's profile.

How to leave a review about Markets.com on the Traders Union website?

To leave a review about Markets.com, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Markets.com on a non-Traders Union client?

Anyone can leave feedback about Markets.com on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.