deposit:

- $50

Trading platform:

- PRO Trader

- MetaTrader4

- MetaTrader5

- AppTrader

- FSCA

- FSA

- 0%

deposit:

- $50

Trading platform:

- PRO Trader

- MetaTrader4

- MetaTrader5

- AppTrader

- FSCA

- FSA

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

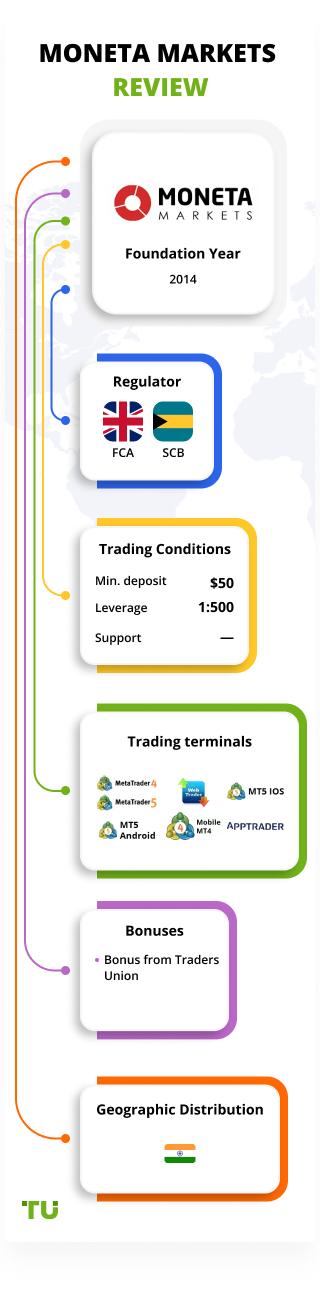

Summary of Moneta Markets Trading Company

Moneta Markets is a broker with higher-than-average risk and the TU Overall Score of 4.53 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Moneta Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Moneta Markets ranks 163 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Moneta Markets offers a large choice of financial instruments and low trading fees by using ECN (Electronic Communication Network) technology.

Moneta Markets has provided its services in financial markets for over 10 years. It offers more than 1,000 trading instruments, including currency pairs, CFDs on stocks, indices, commodities, bonds, and ETFs (exchange-traded funds). This broker is regulated by the Financial Services Conduct Authority of South Africa (FSCA), license number 47490.

| 💰 Account currency: | AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD, and BRL |

|---|---|

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:1000 |

| 💱 Spread: | From 0-1.2 pips subject to the account type |

| 🔧 Instruments: | 45 currency pairs, 635 CFDs on stocks, 15 indices, 15 commodities, 7 bonds, 30 cryptocurrencies, and 50 ETFs |

| 💹 Margin Call / Stop Out: | No/50% |

👍 Advantages of trading with Moneta Markets:

- Minimum deposit is only $50;

- Three account types that are suitable for both novice traders and professionals;

- Demo account for novice traders to test trading conditions and strategies;

- Possibility of passive income by connecting to social trading services;

- Negative balance protection.

👎 Disadvantages of Moneta Markets:

- No PAMM or MAM accounts;

- Small choice of payment methods for depositing and withdrawing funds;

- No cent accounts for trading with reduced risks.

Evaluation of the most influential parameters of Moneta Markets

Table of Contents

Geographic Distribution of Moneta Markets Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Moneta Markets

Moneta Markets has been on the Forex market for more than 10 years and has received many international awards for the quality of its services, client-oriented approach, and introduction of innovative technologies. One of the main advantages of this company, in addition to reduced trading fees, is the use of ECN/STP (straight-through processing) technologies, which provide for getting direct access to liquidity providers with favorable prices and fast order processing for this broker's clients.

Moneta Markets has three standard account types with optimal conditions for novice traders, professionals, and copy traders. The minimum deposit is $50, leverage is up to 1:1000, trading fees are from $0-$3, and spreads are from 0-1.2 pips, subject to the account type. This broker does not prohibit the use of any trading strategies, advisors, or copy trading services.

This brokerage company focuses on the transparency of its trading conditions, so all information about assets is available in the “Spreads and Commissions” section. Moneta Markets has a fairly informative educational and news section, where both novice traders and professionals can find many useful materials. This broker offers profitable partnership programs with rewards for conversions and fees for the trading volume of attracted clients.

Dynamics of Moneta Markets’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Moneta Markets is focused on active trading; therefore, it does not offer diversified portfolios, PAMM accounts, or other tools for passive income. This company's clients can, however, use the MQL4 copy trading service. To earn without trading skills on financial markets, it is enough to connect MetaTrader 4 to the signals of successful traders. You can also connect to such social trading platforms as ZuluTrade and DupliTrade to copy trades of professionals.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program from Moneta Markets:

Introducing Broker (IB). It is a multi-level partnership program with fees received based on the trading volume of attracted traders. The program has 20 levels with the possibility to track statistics on referrals and partner fees on the IB portal. This broker provides promotional materials, such as banners and whole pages, to attract new clients;

CPA (Cost Per Action). This program provides for earning up to $1,200 per conversion with high-quality traffic. This company provides partners with a variety of marketing tools in 13 languages. The reward depends on the tariff plan. To accrue partner reward, the attracted client must deposit $1,000 minimum and sell at least two Forex lots;

Hybrid Partner is a three-level partnership program that combines CPA and IB. That is, you can earn on conversions up to $480 and receive a percentage of the referrals' trading volume, provided that they fund their accounts with $500 or more and close two Forex lots.

IB fees can be withdrawn daily, while CPA rewards can be withdrawn once every two weeks. The Hybrid Partner program implies the monthly accrual of a bonus to partners, whose deposits are 2.5 times higher than their CPA rewards per month.

Trading Conditions for Moneta Markets Users

- Support is active 24/5

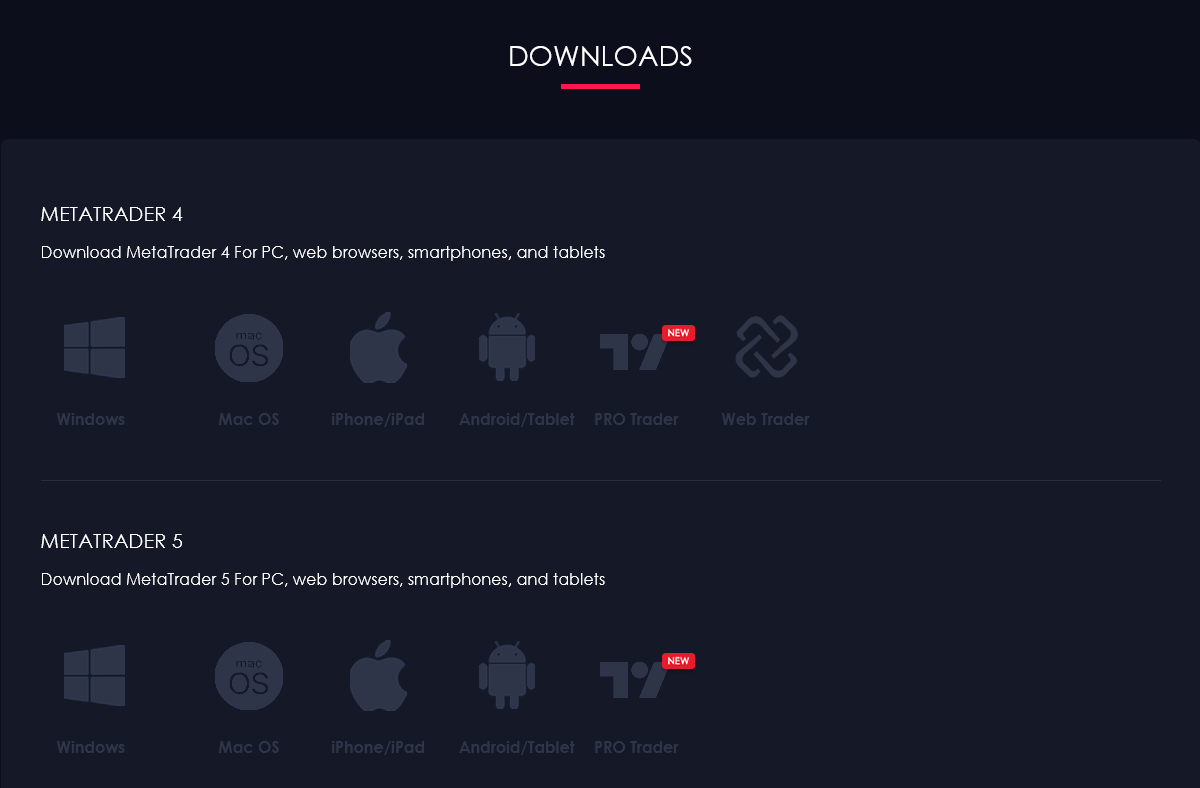

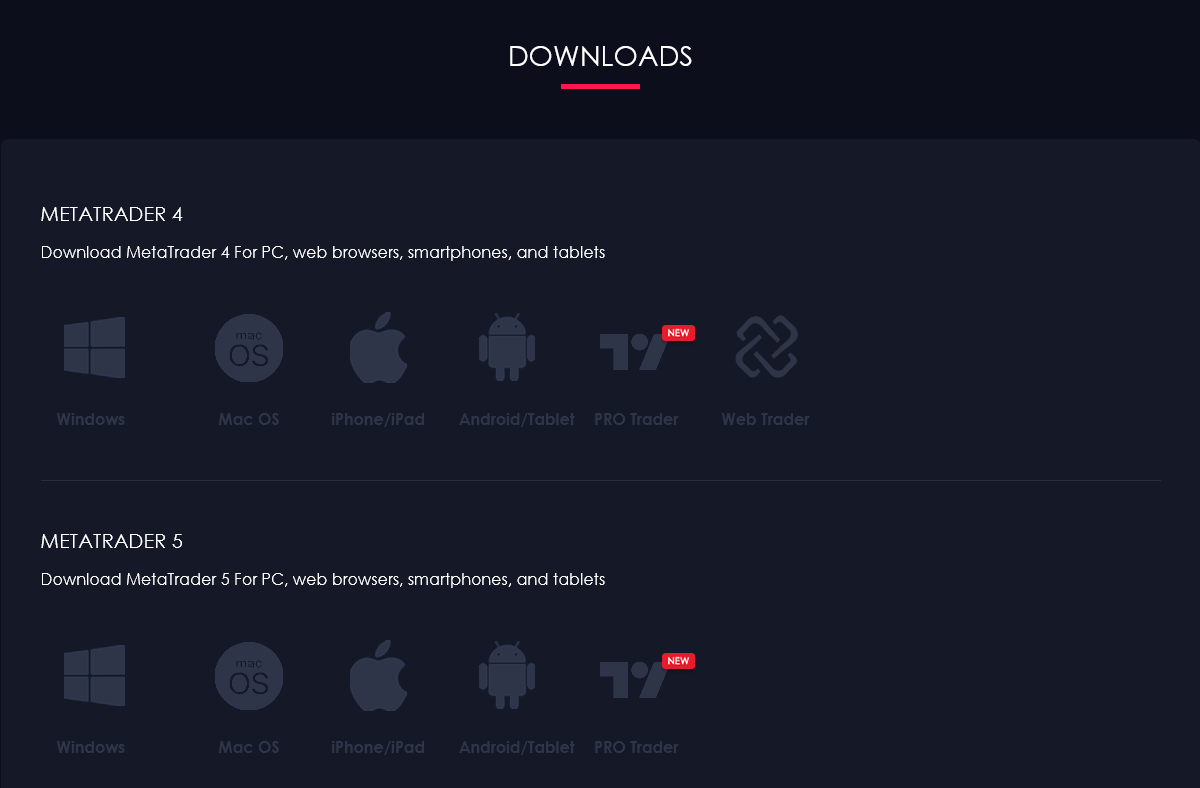

Moneta Markets offers such popular trading platforms as MetaTrader 4 and MetaTrader 5, ProTrader, and AppTrader for working on PCs and mobile devices. This company has three standard account types and a variety of financial instruments with different trading fees and spreads. The maximum leverage for all account types is 1:1000. The minimum deposit is $50.

$50

Minimum

deposit

1:1000

Leverage

24/5

Support

| 💻 Trading platform: | МetaТrader 4/5 (desktop, mobile, and web versions), ProTrader, and AppTrader |

|---|---|

| 📊 Accounts: | Demo, Ultra, Prime, and Direct |

| 💰 Account currency: | AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD, and BRL |

| 💵 Replenishment / Withdrawal: | Wire transfers, bank cards, FasaPay, JCB, and STICPAY |

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:1000 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0-1.2 pips subject to the account type |

| 🔧 Instruments: | 45 currency pairs, 635 CFDs on stocks, 15 indices, 15 commodities, 7 bonds, 30 cryptocurrencies, and 50 ETFs |

| 💹 Margin Call / Stop Out: | No/50% |

| 🏛 Liquidity provider: | Own liquidity providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | STP and ECN |

| ⭐ Trading features: | Copy trading and hedging are allowed |

| 🎁 Contests and bonuses: | 25% Rescue Bonus and recurring bonuses in the form of rebates from TU |

Comparison of Moneta Markets with other Brokers

| Moneta Markets | RoboForex | Eightcap | Exness | Octa | Gerchik&Co | |

| Trading platform |

AppTrader, MetaTrader4, MetaTrader5, PRO Trader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | MetaTrader4, MetaTrader5 |

| Min deposit | $50 | $10 | $100 | $10 | $25 | $100 |

| Leverage |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:100 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 1 point | From 0.6 points | From 0 points |

| Level of margin call / stop out |

No / 50% | 60% / 40% | 80% / 50% | No / 60% | 25% / 15% | 100% / 50% |

| Execution of orders | STP, ECN | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| Moneta Markets | RoboForex | Eightcap | Exness | Octa | Gerchik&Co | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | Yes | Yes | No | No | No | Yes |

| Options | No | No | No | No | No | No |

Moneta Markets Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Direct | $12 | No |

| Prime | $0 | No |

| Ultra | $0 | No |

Moneta Markets has swaps for transferring positions overnight. The comparative table below, compiled by TU’s analysts, shows the average spreads of Moneta Markets and its competitors.

| Broker | Average commission | Level |

| Moneta Markets | $4 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed review of Moneta Markets

Moneta Markets positions itself as a reliable service provider with a large choice of financial instruments. This company has received numerous international awards, including the Best Client Support Award, the Best Forex Broker Award, the Most Advanced CFD Trading Platform Award, etc. This broker allows the use of any trading strategies and social platforms. Three standard account types and Islamic and demo accounts are available to its clients. This company also has many useful tools and a finance news section.

Moneta Markets by the numbers:

-

10+ years of successful Forex work;

-

70,000+ open client accounts;

-

Monthly trading volume is $100+ billion;

-

1,500,000+ transactions monthly.

Moneta Markets is a broker for active and social trading

Moneta Markets provides three account types with ECN/STP order execution. This execution model allows private traders to trade directly with liquidity providers rather than through dealers, which is advantageous due to extremely low spreads. This company offers a wide range of trading instruments, such as currency pairs, CFDs on stocks, bonds, indices, commodities, cryptocurrencies, and ETFs. This broker allows the use of MQL4’s ZuluTrade and DupliTrade for passive income. Investors can copy the trading signals of top traders, cancel trades that seem unprofitable, and deposit and withdraw funds at any time.

Moneta Markets provides several platforms that are suitable for mobile, desktop, and web trading. Also, this broker does not prohibit the use of trading advisors or other strategies.

Useful services offered by Moneta Markets:

-

VPS hosting. The use of a private dedicated server ensures smooth trading even when there are problems with internet and electricity;

-

Economic calendar. It publishes important events that may affect the market situation and prices;

-

Forex trading calculators are tools for calculating the profitability of a potential trade;

-

Support via TeamViewer. If necessary, this company's specialists will help set up this trading platform and resolve other issues by connecting to the client's PC;

-

Moneta TV. It broadcasts TV finance news daily;

-

Trading hours. This tool provides information about market schedules subject to the asset;

-

Spreads and commissions. This is a section with detailed information on spreads and trading fees for available financial instruments.

Advantages:

1,000+ financial instruments are available for trading;

Client funds are segregated from this company's capital and held on accounts with a tier-1 custodial bank;

This company provides useful tools and services to improve trading efficiency;

For partners, there are three programs of passive income on conversions and referral trading volumes;

Multilingual technical support.

All clients can connect to top liquidity providers using oneZero, which is a new mechanism to close trades as quickly as possible.

Guide on how traders can start earning profits

Moneta Markets offers three standard account types and a demo account. The maximum trading leverage on all accounts is 1:1000. The minimum deposit, fees, and spreads depend on the account type. The minimum trading volume is 0.01 lots.

Account types:

Demo accounts will automatically deactivate if not used for 30 days.

Moneta Markets is a broker with reduced spreads and trading fees, which is achieved by working directly with liquidity providers using ECN and STP technologies.

Rescue Bonus of 25%

This is a reusable bonus for this broker’s clients who have deposited $1,000 or more and lost 75% or more when trading. To receive compensation, fill out a special form on the bonus program page.

Investment Education Online

The Moneta Markets website has an informative educational section that will help novice traders quickly get used to the world of financial markets.

This company's clients do not have the opportunity to trade on cent accounts, so it is recommended to open a demo account for trading virtual currency without risking real money.

Security (Protection for Investors)

Moneta Markets is registered with two regulators, namely FSCA and SVGFSA (Saint Vincent and the Grenadines Financial Services Authority). Moneta Markets Ltd is regulated by the Seychelles FSA, license number SD144. MMonexia Ltd is registered in Cyprus under the number HE436544. This broker is an authorized representative of the Australian company AGC Capital Securities Pty Ltd, which allows it to give general recommendations regarding financial assets.

👍 Advantages

- Client funds are segregated from this broker’s capital and are held in accounts of reliable banks

- In case of a dispute, traders can file a complaint to this broker’s email to investigate and resolve the problem

- Negative balance protection

👎 Disadvantages

- To fund the account, the provision of detailed information and user account verification is mandatory

- This broker has the right to refuse to restore the neutral balance if it decides that traders abuse the position size and leverage

- When submitting the first withdrawal request, this broker may require information about the account holder and a document with bank details

Withdrawal Options and Fees

-

You can withdraw funds only after passing the verification procedure;

-

Moneta Markets processes withdrawal requests within 24 hours;

-

Subject to the payment method selected, withdrawals may take from 1 to 7 days;

-

Money can be withdrawn by bank transfer, to bank cards, via FasaPay, JCB, and STICPAY;

-

Funds can be withdrawn only to the account used to make the deposit;

-

Withdrawal requests are not processed on weekends;

-

This broker does not charge withdrawal fees, but banks and payment systems do. For example, a $25 fee is charged for bank transfers.

Customer Support Service

Support managers are available 24/5.

👍 Advantages

- Non-clients of this broker can contact support via live chat

- Client support is available in 13 languages

👎 Disadvantages

- Feedback form is not available

- Support works 24/5

This broker provides the following communication channels:

-

telephone;

-

live chat;

-

email.

This broker has its profiles on Instagram, Facebook, YouTube, LinkedIn, and X, where you can also find a lot of useful information and ask questions.

Contacts

| Foundation date | 2006 |

| Registration address | Moneta Markets South Africa (Pty) Ltd, 1 Hood Avenue, Rosebank, Johannesburg, Gauteng 2196, South Africa |

| Regulation |

FSCA, FSA Licence number: 47490 , SD144 |

| Official site | https://www.monetamarkets.com/ |

| Contacts |

Email:

support@monetamarkets.com,

Phone: +61 2 8330 1233 |

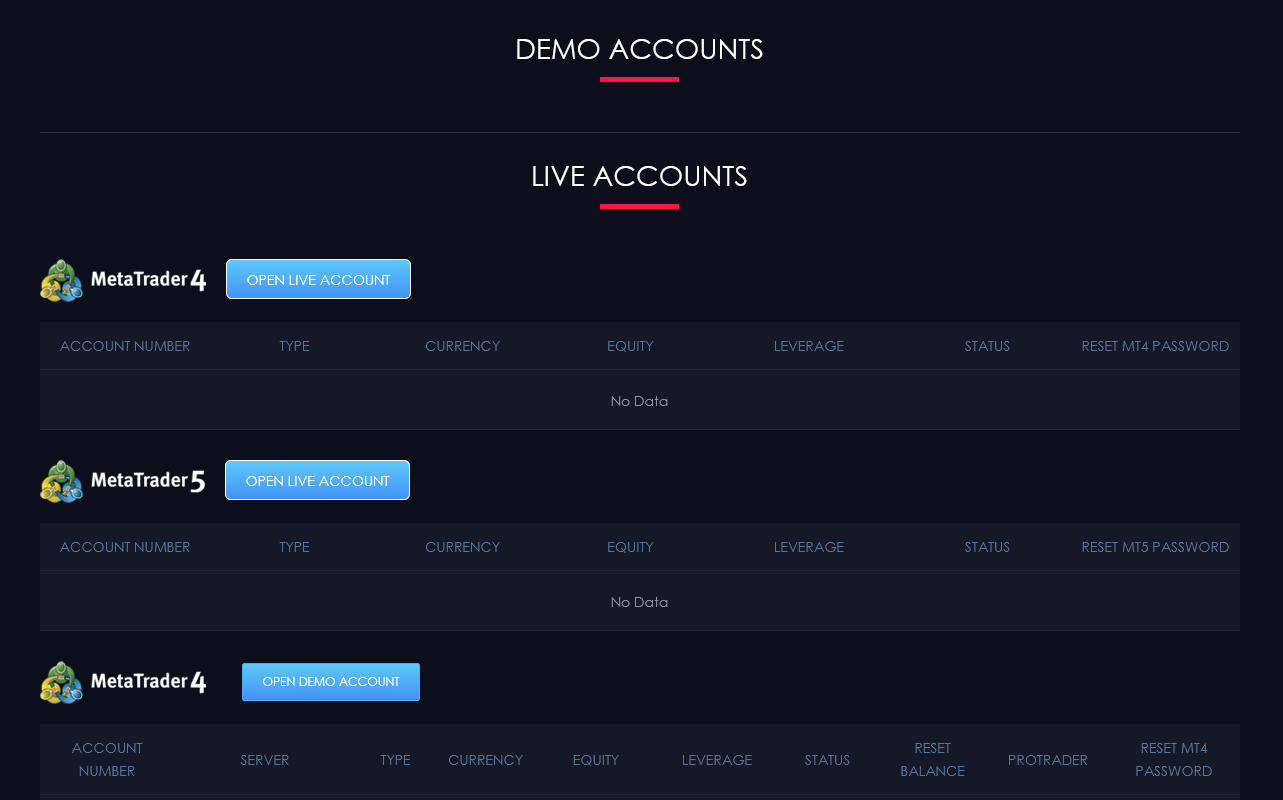

Review of the Personal Cabinet of Moneta Markets

To trade through Moneta Markets, register on its website and open a trading account. Below are the instructions for registration and the user account:

On the Moneta Markets website, click the “Sign Up” button.

Select your country, an individual or corporate account type, enter your first and last names, email, and phone number, then click the “Next” button. Learn important information about this broker’s regulator and click the “Continue” button.

Options available in Moneta Markets’ user account:

Additional features of the user account:

Professional trading tools;

History of financial transactions;

Contact technical support;

Information about open accounts;

Deposits and withdrawals;

Technical analysis;

Language selection.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Find out how Moneta Markets stacks up against other brokers.

Articles that may help you

FAQs

Do reviews by traders influence the Moneta Markets rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Moneta Markets you need to go to the broker's profile.

How to leave a review about Moneta Markets on the Traders Union website?

To leave a review about Moneta Markets, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Moneta Markets on a non-Traders Union client?

Anyone can leave feedback about Moneta Markets on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.