deposit:

- $50

Trading platform:

- MT4

- MT5

- WebTrader

- SCA

- MAS

- CySEC

- ASIC

- AUSTRAC

- BaFin

- FMA

- FSC

- CIMA

- TFG

- VFSC

- 20%

deposit:

- $50

Trading platform:

- MT4

- MT5

- WebTrader

- SCA

- MAS

- CySEC

- ASIC

- AUSTRAC

- BaFin

- FMA

- FSC

- CIMA

- TFG

- VFSC

- 20%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

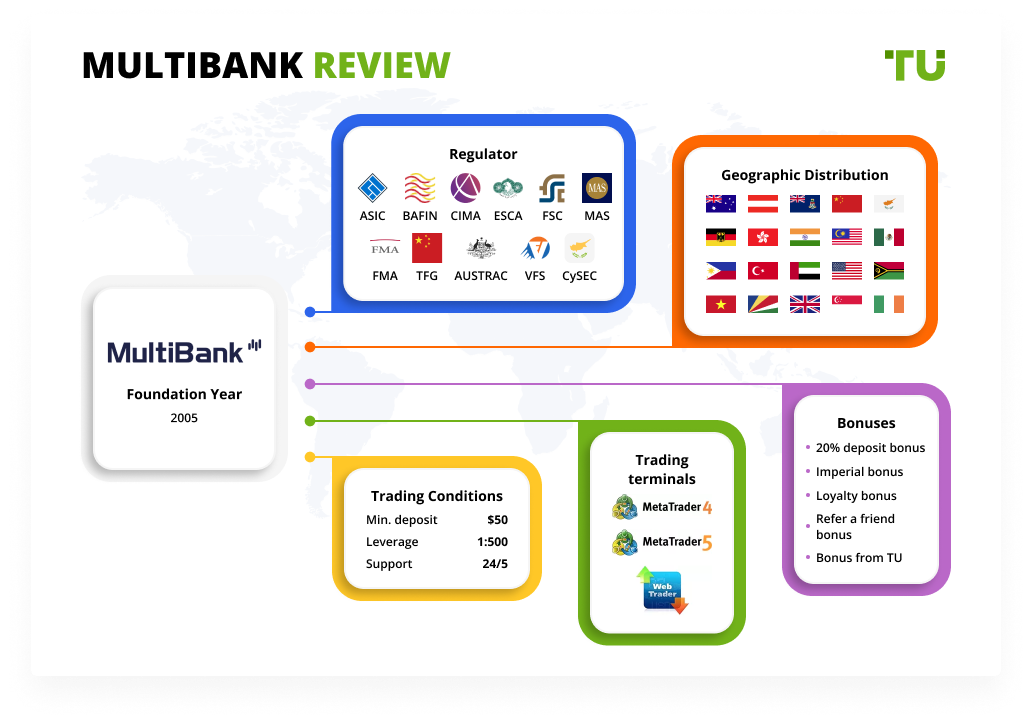

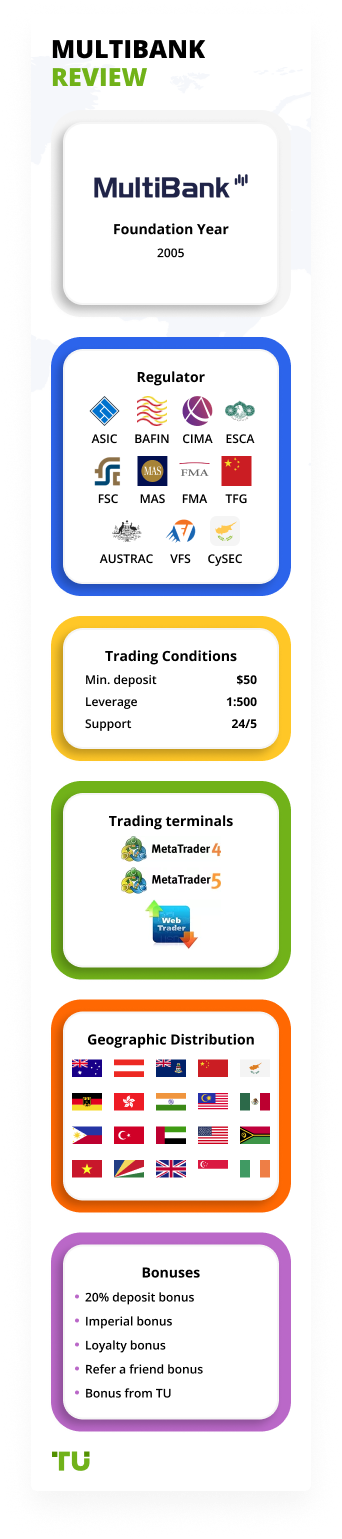

Summary of MultiBank Trading Company

MultiBank is a moderate-risk broker with the TU Overall Score of 5.94 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by MultiBank clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. MultiBank ranks 62 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The MultiBank Group is a broker for active trading and passive investing, the conditions of which are primarily suitable for professional traders.

Established in 2005, MultiBank Group has successfully stamped its authority in the world of trading. It has a valid impact in the foreign exchange industry with providing exemplary products, services, and trading platforms. With a paid-up capital of over $322 million, MultiBank Group is recognized as one of the largest only financial derivatives providers worldwide.

-

The Group is closely supervised by 11 financial regulators worldwide across various jurisdictions, what ensures investor protection. Entities regulated by SCA (20200000045), MAS (CMS101174), CySEC (430/23), ASIC (416279), AUSTRAC (100724469), BaFin (HRB 73406), FMA (491129z), FSC (SIBA/L/14/1068), CIMA (1811316), TFG, VFSC (700443).

-

20,000+ CFD Products across six asset classes including Forex, Metals, Commodities, Indices and Cryptocurrencies

-

Lowest spreads, starting from 0.0* pips on Forex, and $0.07 on Gold.

-

Multi-lingual Expert Customer support 24/7

-

Guaranteed funds withdrawals within 24 hours

-

Zero commission trading and negative balance protection

| 💰 Account currency: | USD, GBP, EUR, CHF, AUD, AED, NZD, CAD |

|---|---|

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:500 |

| 💱 Spread: | from 0.0 pips |

| 🔧 Instruments: | Forex, Metals, Shares, Indices, Commodities, Cryptocurrencies |

| 💹 Margin Call / Stop Out: | 50% |

👍 Advantages of trading with MultiBank:

- the ability to trade from professional ECN accounts with floating spreads from 0.1 pips;

- popular trading platforms MT4 and MT5, mobile applications and web terminals compatible with various OS and browsers;

- several options for passive earnings including a service for copying trades, PAMM accounts, free MAM, EA, VPS, API and an affiliate program.

- ECN start from 0 pips.

👎 Disadvantages of MultiBank:

- lack of micro (cent) accounts;

- trading restrictions on scalping;

Evaluation of the most influential parameters of MultiBank

Trade with this broker, if:

- You require honest spreads without additional expenses. MultiBank's standard account offers spreads starting from 1.5 pips, while on the Pro account, they begin at 0.8 pips, and there is no trading fee in either case. On the ECN account, spreads are zero, but a fee is charged.

- You are accustomed to creating diversified portfolios from various types of assets. The broker's pool includes over 20,000 financial instruments, including currency pairs, stocks, indices, metals, commodities, and cryptocurrencies.

Do not trade with this broker, if:

- You dislike MT solutions. MultiBank clients can only trade through MetaTrader 4 and MetaTrader 5 platforms. The platform does not support cTrader, RTrader, or any other alternative software.

- You do not accept trading restrictions. Traders working with the company can’t use certain common strategies, such as scalping.

Geographic Distribution of MultiBank Traders

Popularity in

Video Review of MultiBank i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of MultiBank

On first acquaintance with MultiBank Group, I got a feeling that it wasn’t like the other trading firms I dealt with. The trading terms were clear and obvious: information on the funds’ withdrawal, specifications for contracts for all trading assets and more. Also, the trading terms are very favorable compared to other brokers in the market. They offer spreads below the market average with a minimum deposit of only $50. At Multibank Group, they value their partners and offer competitive packages and rebates for IBs.

The technical part is also very clear and transparent. According to traders, it is easy to add custom indicators or Expert Advisors created in the standard MQL code to them. On the other hand, the social trading platform is a little harder to understand, but with their dedicated customer service support, everyone can understand and use it thoroughly.

Clients might seem a little skeptical at first because of the 1:500 leverage provided but the fact that it is licensed from over 10 regulators around the world assures you that there is nothing unclear or misleading about it.

Latest MultiBank News

Dynamics of MultiBank’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

MultiBank Group services an extensive client base of over 320,000 clients across the globe. The Group provides an extensive range of 20,000+ financial products across various asset classes including Forex, Metals, Commodities, Indices, Shares and Cryptocurrencies. In addition, MultiBank Group offers opportunities for clients who are seeking additional income by its Partnership Programs.

The Group provides an excellent opportunity for traders to join and trade via a social network and profit from the knowledge of trading experts. They can earn passive income by copying transactions of successful traders or, conversely, become a signal provider.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

MultiBank Groups affiliate program

-

“Introducing Broker Program”, this IB program is dedicated to benefit a community of 30,000+ IBs with one of the highest rebates and offers in the industry.

-

“Trading Bonuses”, traders can benefit from various trading bonuses including the 20% deposit bonus whereby traders can earn a bonus up to $40,000.

-

“CPA Affiliate Program”, this CPA program allows digital marketers such as portal websites, media buyers, email marketers, affiliate networks, bloggers, and influencers of the forex or financial services community to earn a commission for every active trader they introduce to MultiBank Group.

Trading Conditions for MultiBank Users

MultiBank Group’s trading conditions will vary according to the trading account or platform used. Orders will be executed in accordance with trading conditions or spreads at the time. MultiBank Group provides stop-out level, where trading platforms are set to automatically close positions whenever such level is reached. With a low minimum deposit and a leverage of up to 1:500, clients can implement a high number of trading strategies to multiply their profits. According to trading conditions, the minimum spread starts at 0.0* pips on FX.

$50

Minimum

deposit

1:500

Leverage

24/7

Support

| 💻 Trading platform: | MT4, MT5, WebTrader, Mobile app |

|---|---|

| 📊 Accounts: | Pro, ECN, Standard, Demo |

| 💰 Account currency: | USD, GBP, EUR, CHF, AUD, AED, NZD, CAD |

| 💵 Replenishment / Withdrawal: | Bank transfer, Debit/Credit card, Electronic wallet, Cryptocurrency |

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 0.0 pips |

| 🔧 Instruments: | Forex, Metals, Shares, Indices, Commodities, Cryptocurrencies |

| 💹 Margin Call / Stop Out: | 50% |

| 🏛 Liquidity provider: | Yes |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market Execution |

| ⭐ Trading features: | Allows crypto CFD trading; Social Trading; Trading Bonuses; Trust management; Accrual of % on the balance. |

| 🎁 Contests and bonuses: | 20% bonus |

Comparison of MultiBank with other Brokers

| MultiBank | RoboForex | Eightcap | Exness | Pepperstone | IC Markets | |

| Trading platform |

ECN Pro, MultiBank Pro (MT4), Maximus | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, WebTrader, cTrader, MT5, TradingView | MT4, cTrader, MT5, TradingView |

| Min deposit | $50 | $10 | $100 | $10 | $1 | $200 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:400 |

From 1:1 to 1:500 |

| Trust management | Yes | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 80% / 50% | No / 60% | 90% / 20% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Instant Execution | Market Execution |

| No deposit bonus | $1 | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| MultiBank | RoboForex | Eightcap | Exness | Pepperstone | IC Markets | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | Yes | No |

| Options | No | No | No | No | No | No |

MultiBank Commissions & Fees

Multibank beats its nearest competitors when it comes to trading costs for EURUSD and EURCHF pairs. Fees for other popular pairs such as GBPUSD or AUDUSD are closer to the market average but still competitive.

| Broker | Average commission | Level |

| MultiBank | $3 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of MultiBank Group

MultiBank Group is a multi-regulated ECN broker that provides over 20,000 CFD products in Forex, Metals, Indices, Stocks, Commodities and Cryptocurrencies. Clients can place their trades on the MT4 and MT5 platforms, which are available for desktop, web, and mobile services. They also offer social trading platforms, MAM and PAMM accounts, and free VPS.

The following are some facts and figures about MultiBank Group that might be of interest to traders:

-

Established in 2005

-

Regulated by 11 financial regulators across the globe

-

More than 320,000 clients worldwide

-

They have won over 40 awards from distinguished financial institutions

-

Unbeatable Introducing Broker Program

MultiBank Group is a broker for professional trading in the Forex exchange and OTC markets

MultiBank Group positions itself as a pure ECN, Non-Dealing Desk broker that works directly with liquidity providers, offering optimal spreads and commissions. They are globally recognized for its Introducing Broker’s Program, with a network of over 30,000 IBs. They value their partners and guarantee the best market prices for order execution without slippage.

Clients can choose from the MT4 and MT5 platforms, where they can access flexible charting variations for each market. You can open a maximum of 5 live accounts under the same account holder’s name.

MultiBank Group’s useful services:

-

MAM and PAMM accounts: the Multi Account Manager software is provided by MultiBank Group for its asset managers who manage several accounts at the same time. A user-friendly software that supports a variety of trading technologies, including the use of Expert Advisors (EAs). The asset manager will be able to trade multiple accounts simultaneously from the Master account. The set-up is quick and simple

-

VPS: a free virtual private server (VPS) provided by MultiBank Group to all clients who fill in the VPS request form. VPS provides low latency with a reliable and steady connection to trading servers. It is often used by traders who use EAs or other trading systems. VPS runs trading platforms 24/7 without the need of switching your computer on

-

Social Trading: Traders can become signal providers and allow other traders to copy their trades automatically while they earn a profitable commission. Signal providers set up their payout intervals and commissions charged for their service

Advantages:

the Company has 11 international licenses;

has average market spreads for popular currency pairs;

access for trading using the most popular trading platforms - MT4 and MT5;

negative balance protection;

the existence of several types of affiliate programs;

website and support in 9 languages.

On all platforms, the broker prohibits the use of scalping and high-frequency strategies, in which the opening/closing of trades occurs within 10 seconds.

How to Start Making Profits — Guide for Traders

MultiBank Group offers 3 live account types and Demo account.

Clients can open a maximum of 5 accounts under the same account holder’s name.

Bonuses Paid by the Broker

MultiBank Group provide its clients with high quality services. They currently offer 4 different Bonuses:

20% DEPOSIT BONUS

up to $40,000 deposit bonus on top of your investment that you can redeem for real cash rewards

IMPERIAL BONUS

up to $5,000 bonus on first-time deposits

LOYALTY BONUS

long-term clients can earn up to $3,500 bonus

REFER A FRIEND BONUS

for every successful referral, clients can earn up to $400 bonus

Investment Education Online

MultiBank Group does not provide training materials, trading academy, training videos or learning resources.

Security (Protection for Investors)

MultiBank Group is a heavily regulated broker, verified by 11 financial regulators worldwide. Their latest entity, MEX Atlantic, is taking their success a step further by offering an insurance policy with Lloyd’s of London, that protects clients’ funds up to 1 million USD per account. To secure client funds further, MultiBank Group provides their clients with:

-

Segregated accounts

-

Tier 1 Banking

-

Paid up capital of $322 million USD

Withdrawal Options and Fees

Withdrawing money from MultiBank account is free of charge. Clients can use the same options for withdrawal as for deposit (Bank transfer, Credit/debit card, electronic wallets, and cryptocurrency).

Clients can only withdraw money to the same name as the account holder.

Withdrawals take up to 24 hours to be processed. Clients will need to follow the next steps:

-

Log into MyMultiBank

-

Go to 'Withdrawal'

-

Select trading account

-

Give the reason for the withdrawal

-

Enter withdrawal amount

-

Select withdrawal method

-

Initiate withdrawal

Customer Support Service

MultiBank Group’s multilingual 24/7 client support service is ready to assist clients around the clock.

There are several ways to contact support:

-

Live chat: Can be found on their website. It can be very useful as the questions are answered quickly and efficiently.

-

Phone support: Extremely helpful with guidance and approach to solving greater issues. Clients can reach phone support in several languages via local phone numbers

-

Email: Also, very efficient. All emails are answered effectively within 24 hours

Contacts

| Foundation date | 1985 |

| Registration address | 200 Gloucester Road, Wan Chai, Hong Kong |

| Regulation |

SCA, MAS, CySEC, ASIC, AUSTRAC, BaFin, FMA, FSC, CIMA, TFG, VFSC Licence number: 20200000031, CMS101174, 430/23, 416279, 100724469, HRB 73406, 491129z, SIBA/L/14/1068, 1811316, 120000400121019, 700443 |

| Official site | multibankfx.com |

| Contacts |

Email:

cs@multibankfx.com,

Phone: +1 213 992 4748, +34 931220671, +39 0230578823, +62 02129264151 |

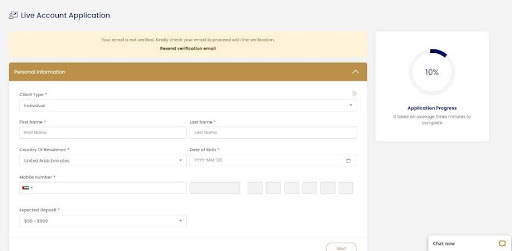

Opening an account with MultiBank Group

Opening an account with MultiBank Group is easy and straightforward. They accept clients from all over the world, however, there are some exceptions such as the USA or Hong Kong. The required minimum deposit varies between $50 and $5000 depending on the account type.

Clients will only need to register their email, fill in the required forms and scan and submit the required documents in around 20 minutes.

Clients will have to follow the next steps to open a live account with MultiBank Group:

Select the regulator.

Choose account type.

Add personal information, email address and country of residence.

Complete Trading Assessment.

Verify your identity and residency.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Find out how MultiBank stacks up against other brokers.

See related articles in our country selection:

Articles that may help you

FAQs

Do reviews by traders influence the MultiBank rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about MultiBank you need to go to the broker's profile.

How to leave a review about MultiBank on the Traders Union website?

To leave a review about MultiBank, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about MultiBank on a non-Traders Union client?

Anyone can leave feedback about MultiBank on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.