deposit:

- $250

Trading platform:

- MT4

- CySEC

- 0%

deposit:

- $250

Trading platform:

- MT4

- CySEC

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

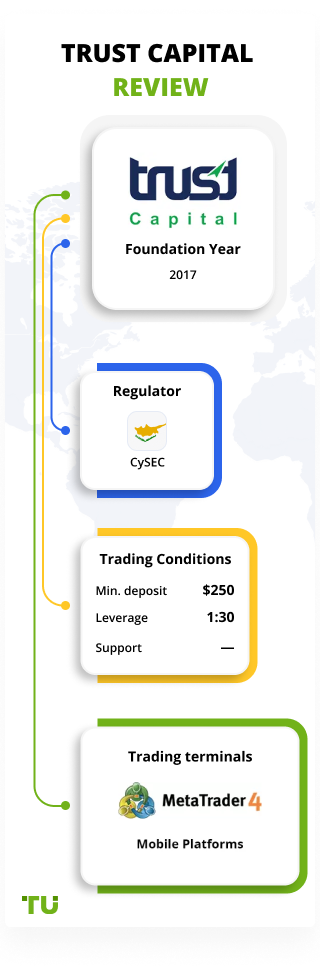

Summary of Trust Capital Trading Company

Trust Capital is a broker with higher-than-average risk and the TU Overall Score of 4.11 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Trust Capital clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Trust Capital ranks 204 among 412 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Trust Capital's CFD trading conditions are generally average. It grants access to hundreds of assets from seven groups, providing a variety of available strategies and portfolio diversification. As trading is conducted through the MT4 platform, traders can customize their workspace. The entry barrier is relatively low, with a free demo available, and a minimum deposit of $250 on a real account. The commission policy is moderately transparent, with no additional markups. The partnership program is beneficial. Unfortunately, there are no options for passive earnings. However, Trust Capital offers an excellent training program for traders of different levels.

Trust Capital is a contract for (price) differences (CFD) broker that offers over 200 assets in the following groups: currencies, cryptocurrencies, stocks, indices, commodities, metals, and energies. It provides a free demo account and two real accounts. The minimum deposit is $250, and the spread starts from 0.9 pips with no trading commission on Solo accounts. Holders of Solo accounts are traders who fully control their accounts and trade independently. The margin call and stop-out levels are 100% and 50%, respectively. The platform supports MetaTrader 4, including its mobile version. There are no trading restrictions, which allow scalping, hedging, and the use of advisors. The broker conducts educational lectures on its website and organizes webinars. It offers basic technical and fundamental analysis tools, such as calculators, newsfeeds, and an economic calendar. Deposits and withdrawals are processed through major channels such as Visa bank cards, PayPal, Neteller, Skrill, e-wallets, and crypto-wallets. Trust Capital offers partnership opportunities to anyone interested, with initial partner earnings starting at $10 per referral but potentially increasing to $300. The company's customer support is available via phone, email, and LiveChat on weekdays.

| 💰 Account currency: | USD, EUR |

|---|---|

| 🚀 Minimum deposit: | $250 |

| ⚖️ Leverage: | Up to 1:30 |

| 💱 Spread: | Floating, from 0.9 or 1.8 pips depending on the account |

| 🔧 Instruments: | CFDs on currencies, cryptocurrencies, stocks, indices, commodities, metals, energies |

| 💹 Margin Call / Stop Out: | 100% / 50% |

👍 Advantages of trading with Trust Capital:

- The free demo account allows exploring the broker's capabilities without risk and practicing trading strategies.

- There are competitive spreads on real accounts, with no trading commission on Solo accounts and market-average commission on Together accounts, which are currency pairs that typically move in the same direction, such as EUR/USD and GBP/USD.

- The company has excellent technical infrastructure, ensuring prompt trade execution, and stable virtual servers.

- Trust Capital uses the versatile MetaTrader 4 trading platform, suitable for both beginner and experienced traders.

- Deposits and withdrawals can be made through various well-known channels, and withdrawal fees are at the competitors’ level.

- The broker provides free educational materials that are highly valued by users and experts.

- The partnership program offers an opportunity for additional earnings from referrals.

👎 Disadvantages of Trust Capital:

- The broker lacks transparency, as traders may not know the commission size on the Together accounts until opening one.

- Apart from the partnership program, there are no other options for additional earnings, such as copy trading and MAM and PAMM accounts.

- The company does not offer services to residents of the United Kingdom, the Czech Republic, Belgium, Iran, and some other countries.

Evaluation of the most influential parameters of Trust Capital

Table of Contents

Geographic Distribution of Trust Capital Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Trust Capital

The Trust Capital brokerage company has been in existence for quite a long time, is registered in Cyprus and the UAE, and has physical offices there. It is regulated by CySEC 369/18 (The Cyprus Securities and Exchange Commission), and its license number has been confirmed. It always fulfills its obligations to clients, and there are no documented conflicts that have occurred due to the broker's fault. Considering this, TU experts can conclude that the company is reliable for trading in the modern market of brokerage services. All documents are freely available and can be verified. In addition, Trust Capital has responsive customer support that provides all the necessary clarifications.

The broker's trading conditions are assessed as average for the market. The minimum deposit is $250, with over 200 assets from 7 groups, spreads from 0.9 pips, and integration with MetaTrader 4. These are competitive conditions, but not outstanding indicators. Trust Capital clearly surpasses most competitors in individual aspects, but when considering the overall factors, the platform cannot be determined as top tier. There are many brokers with lower spreads and commissions. Additionally, there are platforms with copy trading, MAM and PAMM accounts, and special bonuses, but Trust Capital does not offer these features.

However, for a CFD broker, the conditions are quite acceptable. There are no trading commissions on the Solo account, which is a significant advantage. Clients of the company can create diverse portfolios to mitigate trading risks. A conceptual advantage is its comprehensive education program, which includes articles and newsfeeds. Also, the broker conducts seminars and webinars, and as an additional service, clients can connect with a professional manager or an experienced market participant who will train the trader and provide advice.

Dynamics of Trust Capital’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Many brokers offer their clients alternative earning options besides active trading. Although most traders come to trade independently using their Solo accounts, additional opportunities are unlikely to be considered a drawback of the platform. However, these features are not mandatory, and if a broker does not provide an integrated copy trading service or PAMM accounts, it does not mean that it is uncomfortable or disadvantageous to collaborate with them. Trust Capital is an example of such a broker. It is competitive in terms of trading conditions, but the company does not offer investment programs. It only has a referral (partner) program, which cannot be considered an investment solution or even a source of passive income. To earn a decent profit from it, one needs to show maximum activity online. Otherwise, a trader will not be able to have a wide reach for their unique referral link.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Trust Capital affiliate program:

Anyone can participate in the partner program by joining it through their user account. Then, it is necessary to promote the broker's services online. The company provides a list of ready-made promotional materials that include partner links. The partner program follows standard protocols. If a user visits the broker's website, for example, by clicking on an advertisement banner, they automatically become a referee of the person who placed that banner. The referee will bring a bonus amount to the owner of the link if they register with the broker and make a deposit. The bonus amount depends on various factors, including the user's activity. The more referees they bring to the platform, the higher their payouts. The initial bonus amount is $10, and the maximum amount is $300. If a trader wants to work on individual terms, they can contact customer support with their proposal. Trust Capital collaborates with both individuals and legal entities.

Trading Conditions for Trust Capital Users

In the case of a demo account, it is sufficient to complete registration and verification; no deposit is required. For the Solo account, a minimum deposit of $250 is required, while for the Together account, a minimum deposit of $1000 is required. This is a standard practice where brokers offer multiple account types with varying minimum deposit requirements. Traders can deposit more than the specified amount but not less; otherwise, they will not be able to engage in trading. The broker provides a modest trading leverage of up to 1:30, which is the same for all account types. Trust Capital's technical support operates on weekdays from 9:00 to 23:00 Pacific Time. Support is not available during nights and weekends. Contacting support can be done via telephone (two numbers), email, LiveChat on the website, and within the user account. The broker also has profiles on social platforms, through which one can reach out to the managers. However, it should be noted that currently, the company is focused on its website and does not actively develop some of its social media pages. For example, this applies to YouTube, where the broker's account has undergone several restarts, so the latest videos were released three years ago.

$250

Minimum

deposit

1:30

Leverage

14/5

Support

| 💻 Trading platform: | MT4 |

|---|---|

| 📊 Accounts: | Demo, Solo, Together |

| 💰 Account currency: | USD, EUR |

| 💵 Replenishment / Withdrawal: | Visa, Skrill, Neteller, bank transfer, PayPal, Swift, Crypto |

| 🚀 Minimum deposit: | $250 |

| ⚖️ Leverage: | Up to 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating, from 0.9 or 1.8 pips depending on the account |

| 🔧 Instruments: | CFDs on currencies, cryptocurrencies, stocks, indices, commodities, metals, energies |

| 💹 Margin Call / Stop Out: | 100% / 50% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: |

Demo account, two real accounts, all assets are CFDs; Over 200 trading instruments from 7 groups; Average market spread, no trading commissions on Solo accounts; Small withdrawal fees, multiple deposit/withdrawal options; Clients trade through the MT4 trading platform; No copy trading or PAMM. |

| 🎁 Contests and bonuses: | Yes. There are bonuses in the form of rebates from Traders Union |

Comparison of Trust Capital with other Brokers

| Trust Capital | RoboForex | Eightcap | Exness | NPBFX | Libertex | |

| Trading platform |

MetaTrader4, Mobile platforms | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4 | Libertex, MT5, MT4 |

| Min deposit | $250 | $10 | $100 | $10 | $10 | 100 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:30 for retail clients |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.4 points | From 0 points | From 0 points | From 1 point | From 0.4 points | From 0.1 points |

| Level of margin call / stop out |

No / 50% | 60% / 40% | 80% / 50% | No / 60% | No / 30% | 50% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Instant Execution, Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| Trust Capital | RoboForex | Eightcap | Exness | NPBFX | Libertex | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes (as CFDs) |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes (as CFDs) |

| Crypto | Yes | No | Yes | Yes | Yes | Yes (as CFDs) |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes (as CFDs) |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes (tradable CFDs or Stocks for investment) |

| ETF | No | Yes | No | No | Yes | Yes (as CFDs) |

| Options | No | No | No | No | No | Yes (as CFDs) |

Trust Capital Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Solo | From 9$, floating, and no commission | Yes, in most cases |

| Together | From 1.8$ pips, floating, and with commission | Yes, in most cases |

Some brokers do not charge a withdrawal fee. However, in such cases, they compensate for their transaction service costs through other means (e.g., higher spreads). Trust Capital expressly states that there is a withdrawal fee, and it depends on the withdrawal channel. For example, for Visa cards, the fee is 0.50 euros per transfer. For Skrill, the fee is 1%, and if a trader uses PayPal, there are no additional charges. However, it is important to note that third parties in the withdrawal process such as Skrill, may impose their own fees. It is necessary to clarify this aspect in advance to avoid confusion. The table below presents data on the average trading fees at Trust Capital and those of its closest competitors. A simple comparison will help to better understand the benefits of working with this broker.

| Broker | Average commission | Level |

| Trust Capital | $5.4 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed review of Trust Capital

The Trust Capital broker is well-known in the global market. It offers over 200 assets, all of which are contracts for difference (CFDs). Since the spread is floating and corresponds to the market average, collaborating with the company is economically beneficial. Especially considering that there is no trading commission on Solo accounts, and the withdrawal fees are generally low, with PayPal being free. Trust Capital uses the MetaTrader 4 trading platform, which attracts more users. After all, MT4 is the most versatile platform due to its extensive customization options. It also includes a mobile version which frees you from a desk. Little is known about the company's technological stack, but the high execution speed and platform stability indicate that Trust Capital employs innovative solutions that meet modern standards.

Trust Capital by the numbers:

-

The minimum deposit is $250.

-

Over 200 CFDs are available.

-

The minimum spread is 0.9 pips.

-

Commission on Solo accounts is $0.

-

Referral program payout is up to $300 per partner.

Trust Capital is a convenient CFD broker

Companies that offer only CFDs do not differ significantly in terms of basic trading conditions. For a trader, it is important to have CFDs represented in as many assets as possible and preferably in multiple groups. With Trust Capital offering over 200 assets in its pool, this issue is resolved. There are CFDs on currencies, cryptocurrencies, stocks, indices, commodities, metals, and energies. This means that for the company's clients, it is not difficult to form a diversified portfolio that allows them to offset negative trends in one instrument with stable and growing positions in others. In addition, the variety of assets allows for the use of various trading strategies. Considering the favorable commission policy, quality education, and integration with MT4, Trust Capital's conditions can indeed be characterized as comfortable.

Trust Capital’s analytical services:

-

Calculator. A comprehensive service that includes four calculators: profit and loss calculation, pips calculation, Fibonacci calculation, and pivot calculation. These calculators are useful for simplifying the search for entry points in trades and calculating costs.

-

Economic calendar. This is one of the simplest and most effective tools for fundamental analysis. The service displays the most significant events that can impact quotes, along with the changes in projected trends.

-

Market news. An intelligent newsfeed where relevant events affecting selected assets are published. Users can filter posts based on arbitrary timeframes.

Advantages:

The broker is loyal to new clients, offering a demo account and a low minimum deposit of only $250 for a Solo account. All assets from the platform's pool are immediately accessible.

Since traders work through the MT4 trading platform, they can trade with maximum convenience on a computer, tablet, or smartphone; plus there are hundreds of plugins available for MT4.

The basic technical and fundamental analysis tools offered by the broker significantly simplify the lives of its clients, allowing them to trade more successfully.

Traders can see the broker's fee amount before executing a trade, with no hidden charges.

The affiliate program allows anyone interested to earn additional income for referring clients, with a maximum referral payout of $300.

Guide on how traders can start earning profits

The account type is of paramount importance. With Trust Capital, it is quite simple as they offer two real accounts plus a demo account. The Solo option is versatile, with a reduced initial deposit and spread, and no commission. The Together option differs with an increased initial deposit ($1000) and higher spreads, starting from 1.8 pips, plus a trading commission. However, Together provides priority technical support, expanded education options, and a personal manager. The training process also differs, as it is more personalized. Essentially, Together accounts are designed for users with substantial capital who are willing to invest significant amounts in CFDs, thus requiring an elite approach from the broker. Otherwise, the accounts do not have any differences: both offer market order execution, a minimum trade size of 0.01 lots, and margin call and stop-out requirements at 100% and 50%, respectively.

Account types:

As a rule, traders prefer to start with a demo account. These accounts allow them to familiarize themselves with the platform, assess its advantages and disadvantages, and quickly test various strategies without risking financial losses. If a trader is satisfied with the performance on the demo account, they can make a deposit according to the requirements of the chosen real account. When selecting an account type, users typically consider their experience, financial capabilities, and ambitions.

Investment Education Online

Traders can only be successful if they constantly strive for improvement. This includes regular trading and theoretical preparation. The latter involves studying e-books, specialized forums, relevant webinars, and more. Recognizing the importance of knowledge, some brokers seek to enhance the skills of their clients by providing them with learning and self-education opportunities. Trust Capital is precisely such a company; its clients can attend seminars at company offices and participate in real-time webinars. They have access to newsfeeds, analytics, articles on various topics, and a trading glossary. It's a substantial amount of data that is regularly updated and replenished, and the materials are interesting for both beginners and experienced market participants. However, priority is given to teaching the basics of trading.

Although part of the educational course is only available to traders using premium accounts, there is more than enough material for beginner and intermediate-level players. The information is well-structured and easy to filter. It focuses less on money management and trading psychology, but Trust Capital provides up-to-date and practical information even on these challenging topics.

Security (Protection for Investors)

Brokerage companies can guarantee the fulfillment of their obligations to its clients through two means. The first is official registration. Being registered indicates that the company operates legally. However, registration alone is not enough to address guarantees. Therefore, brokers also obtain licenses from international regulators, which are authorized organizations responsible for overseeing the operations of financial platforms. Trust Capital is both registered and regulated. Trust Capital TC Ltd is registered in Cyprus and has a representative office in the UAE. It is regulated and holds a confirmed license from the Cyprus Securities and Exchange Commission (CySEC). In other words, the broker possesses a complete set of documents that confirm the legitimacy and transparency of its operations. Nevertheless, experts recommend additionally studying reviews about the broker on independent platforms. For example, on the Traders' Union website, where all posts are verified, moderators filter out false, fake, and promotional comments.

👍 Where can you go for help?

- To the customer support of Trust Capital TC Ltd company.

- To the Cyprus Securities and Exchange Commission.

- Contact Traders Union’s legal department for free consultation and representation. It protects its members’ rights without charge.

👎 There is no point in contacting

- A regulator that does not monitor the activities of this broker.

- Governmental financial control authorities outside Cyprus and the UAE.

Withdrawal Options and Fees

-

After a trader opens a real account and makes a deposit, they earn profits if their trades are successful.

-

Funds can be withdrawn at any time by submitting a request through the corresponding option in the user account.

-

The following channels are currently available for fund withdrawals: Visa, Skrill, Neteller, bank transfer, PayPal, Swift, and Crypto.

-

There is a commission for withdrawals through most channels, and its amount is indicated on the website in the relevant section.

-

If a trader withdraws funds using the PayPal system, there are no additional charges.

-

Any questions regarding fund withdrawals can be clarified with the broker's technical support.

Customer Support Service

Technical support is crucial for a broker because all traders, regardless of their experience and skills, inevitably will encounter situations they cannot resolve on their own. If they do not receive prompt and competent assistance, they may become disappointed with the broker and switch to its competitors. Trust Capital's customer support is highly appreciated by its users. Responses to inquiries are quick, specific, and comprehensive. Managers can be contacted via phone, email, or LiveChat. The only thing to note is that support operates for 14 hours a day and only on weekdays. It is not available during nights and weekends.

👍 Advantages

- You can contact support even if you are not a client of the broker.

- Managers work without breaks during the daytime and on weekdays.

- All standard communication options are available.

👎 Disadvantages

- Working hours are 14/5.

You can clarify any questions related to trading, deposits/withdrawals, or other matters with the support team of Trust Capital. To do so, use the following channels:

-

Phone number;

-

Second phone number;

-

Fax;

-

email;

-

LiveChat on the website and in the user account.

Traders can also submit a ticket on the contact page. The Trust Capital broker has official profiles on the following social platforms: YouTube, Instagram, Twitter, Facebook, and LinkedIn. It is worth subscribing to the company's active page to stay updated with its latest news.

Contacts

| Foundation date | 2019 |

| Registration address | 23 Olympion Street | Libra Tower Office: 202 | 3035 Limassol | Cyprus |

| Regulation |

CySEC Licence number: 369/18 |

| Official site | trustcapitaltc.eu |

| Contacts |

Email:

cs@trustcapitaltc.eu,

Phone: +35725378899, +97145785767 |

Review of the Personal Cabinet of Trust Capital

To start collaborating with the broker, create a user account on their official website. Then, verify your account information and make a deposit. After that, by downloading the MT4 trading platform, traders can start trading. The experts at TU have prepared a step-by-step guide on the registration process and the features of the Trust Capital user account.

Go to the broker's website. In the upper right corner, select the interface language, which is monitored by Google Translate. Click on “Open Live Account”.

Provide your contact information. Enter your name, surname, email address, phone number, and your country of residence. Agree to the terms of cooperation and complete the anti-bot verification by checking the boxes. Click on “Begin”.

Enter your registration address with the postal code. Click on “Save and Continue”.

Enter your date and place of birth, nationality, and occupation. Choose the account type - Solo or Together. Specify the base currency for the account – USD or EUR. Agree to the data processing conditions. Answer a couple of questions. Click on “Confirm”.

Answer a few more questions regarding your financial status, trading experience, and preferences.

After providing all the answers, you will receive an email to the provided email address. This email will contain instructions for verification. Following the instructions, send the required photos/scans to the broker's email. Once the specialists verify them, you will receive a notification with your registration details. These details are required for logging into the user account. After that, deposit funds, download the MT4 trading platform, and start trading.

Your Trust Capital user account also provides access to:

Traders can track information about active accounts, detailing each parameter. They can also open or close accounts, including demo accounts.

Deposits and profit withdrawals are carried out through the corresponding features of the user account. There is also a LiveChat for contacting technical support.

The user account provides access to the educational section and the affiliate program menu, where a list of referrals and the bonuses received for them are indicated.

Traders have access to typical technical analysis tools and a link to newsfeeds. In the corresponding section, users can download the MT4 trading platform.

Disclaimer:

Your capital is at risk. 88.57% of retail investor accounts lose money when trading CFDs with this provider. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

See related articles in our country selection:

Articles that may help you

FAQs

Do reviews by traders influence the Trust Capital rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Trust Capital you need to go to the broker's profile.

How to leave a review about Trust Capital on the Traders Union website?

To leave a review about Trust Capital, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Trust Capital on a non-Traders Union client?

Anyone can leave feedback about Trust Capital on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.