Where to Buy Litecoin? Best Platforms With Low Fees

The best platform to buy Litecoin(LTC) is Bybit

Best platform to buy Litecoin(LTC) are:

-

ByBit - best for active Litecoin (LTC) traders

-

Binance US - Best to buy Litecoin in the US

-

Huobi Global - best for copy trading LTC

-

KuCoin - best platform to stake Litecoin

Cryptocurrencies like Litecoin were among the first to enter the market. In comparison to Bitcoin, Litecoin (LTC) is the digital silver to its gold. It’s true that Bitcoin (BTC) was the first to get there, but LTC followed very closely, improving on the original blockchain in a number of ways. In terms of adoption, Litecoin lags behind Bitcoin significantly. It does, however, offer a faster transaction rate and lower fees, hence, the term “lite”.

Aside from that, it's still a favorite among cryptocurrency enthusiasts due to its market capitalization ranking as one of the top coins in the sector.

You can use Litecoin to buy goods, services, and even invest in other crypto projects in the future.

Are you looking to buy Litecoin, but don’t know where to start? Not to worry. In this article, we list the top 5 exchanges where you can buy Litecoin (LTC) cryptocurrency with a credit card or debit card as well as other funding methods.

What is Litecoin (LTC)?

Litecoin is a modification of Bitcoin code that has many similar features. As a result, if you understand how Bitcoin works, you'll likely understand Litecoin as well.

LTC, the native digital currency of Litecoin, is protected with cryptography, and the amount of LTC that can ever be created is limited to 84 million using its software.

In the same way as Bitcoin, Litecoin uses proof-of-work mining to allow anyone with a computer to add new blocks to its blockchain and earn Litecoins.

A key difference between Litecoin and Bitcoin is that Litecoin uses a different mining algorithm in order to finalize transactions faster. The Litecoin blockchain is updated roughly every 2.5 minutes, versus 10 minutes for Bitcoin.

Litecoin was originally designed with the intention of reducing the effectiveness of specialized mining equipment, though this proved to be unsuccessful in the long run. While hobbyists can still mine Litecoin today, its market is dominated by large-scale miners.

Where Can You Buy Litecoin? Best Options with Low Fees

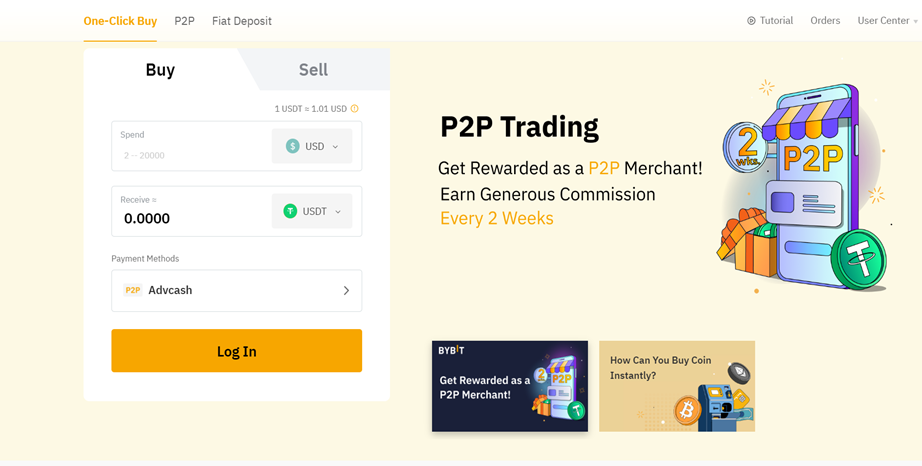

ByBit - Best international Platform to Buy Litecoin

The ByBit Exchange specializes in futures trading of cryptocurrencies. The Singapore-based derivatives exchange launched in 2018 offers leverage of up to 100:1 for crypto perpetual contracts.

There are only 5 crypto assets to margin trade on the exchange, and you can only fund your account with digital currency, not fiat currency. As a result, ByBit is more suitable for experienced crypto traders and speculators due to its focus on futures trading and cryptocurrency-only funding. However, it’s less suitable for crypto newcomers or those seeking to trade and buy a variety of assets.

ByBit features a user-friendly interface that simplifies the Litecoin (LTC) purchasing process. In order to help you access LTC securely, ByBit has partnered with payment providers who share our security and reliability values. The Bybit platform offers several quick ways to get LTC: via credit/debit card, peer-to-peer (P2P) trading, or by trading other cryptocurrencies.

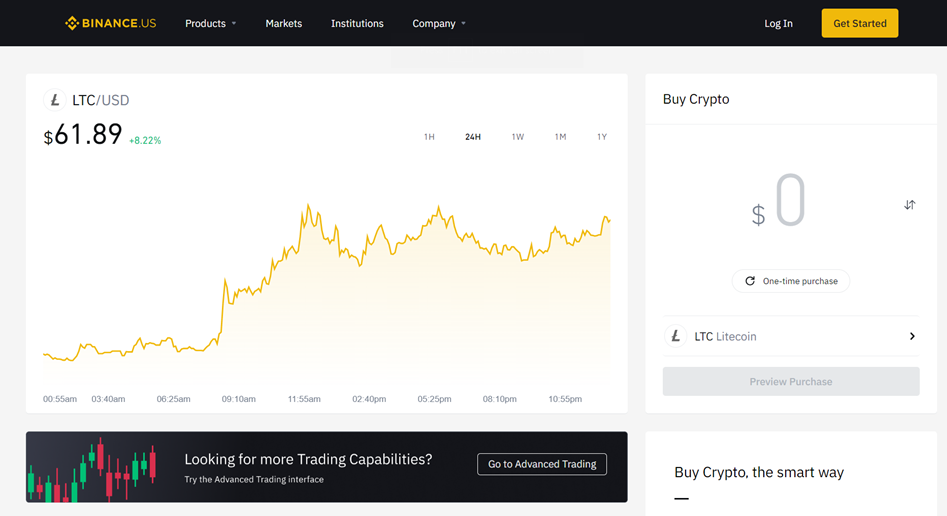

Binance US - Best Place to Buy LTC in the US

As one of the largest and most popular cryptocurrency exchanges, Binance allows users to buy Litecoin as well as a wide range of other virtual currencies. Litecoin can be traded with seven different pairs on the platform, from Tether (USDT) to Bitcoin (BTC). Trading volume for Litecoin on Binance exceeds 5%.

Users can also choose from the basic or advanced trading platform of this cryptocurrency exchange, depending on their specific needs. The large number of trading pairs on this exchange make it a very useful exchange for Litecoin and other altcoin traders.

After purchasing a virtual currency like Litcoin, clients can withdraw it from their wallets for a small fee.

Binance vs Binance US - What Are the Differences?Huobi Global - Best LTCUSDT Futures Contracts

Huobi Global is a leading crypto exchange and a great platform for trading Litecoin futures. The exchange offers a wide range of futures trading products. Huobi Global also provides traders with high leverage, which can be as much as 100x for LTCUSDT futures.

One of the key benefits of trading Litecoin futures on Huobi Global is the low trading fees. The platform charges a 0.04% taker fee and a 0.02% maker fee for opening and closing positions for futures contracts, which is significantly lower compared to most other exchanges. Additionally, Huobi Global offers a range of LTCUSDT trading pairs.

Huobi Global also provides an option for traders to stake their Litecoin and earn interest on their holdings. Lastly, Huobi Global also has a copy trading option, which allows traders to copy the trades of successful traders on the platform.

Crypto Broker or a Crypto Exchange – Which One do I Choose?KuCoin - Best Platform to Stake Litecoin

KuCoin is a popular cryptocurrency exchange that offers traders the ability to stake their Litecoin and earn interest on their holdings. Staking Litecoin on KuCoin is easy, and traders can earn up to 10% annually on their staked coins.

Staking Litecoin on KuCoin also attracts low fees. The platform charges a 5% commission fee on staking on Ziliqa, which is lower than many other staking platforms. Additionally, KuCoin offers a range of trading pairs for Litecoin, including LTC/BTC, LTC/USDT, and LTC/ETH.

KuCoin also provides traders with the ability to trade Litecoin futures. The platform charges a 0.02% taker fee and a 0.01% maker fee for futures trading, which is lower compared to other exchanges.

How To Buy Litecoin With a Credit Card

To purchase Litecoin, log in to your verified account and open Fiat Gateway.

From the drop-down menu, select the preferred currency and enter the amount you plan to spend or buy in LTC.

Next, choose a service provider and a payment method. ByBit accepts electronic fund transfers, Visa/Mastercard credit and debit cards, and cash deposits.

Complete the transaction and wait for the cryptocurrency to arrive in your account. In most cases, it takes between 2 and 30 minutes to complete.

How To Buy Litecoin With a Credit Card

How to Buy Litecoin in the US

Sign up for a free Binance account on the website or app. The Binance app, your email, or your phone number can be used to register, or you can register via the Binance website.

Purchase Litecoin (LTC) using your preferred method.

To view the available options in your country, click the "Buy Crypto" link on the Binance website navigation.

Choose your preferred payment method. Bank deposits or credit/debit cards are both acceptable methods of payment. Binance's peer-to-peer trading service also allows you to buy LTC directly from other users. Third-party payment methods such as ADV Cash, Simplex, GEO Pay, and Bitfinity are also accepted by Binance.

How to Buy Litecoin in the US

Best Ways to Invest in Litecoin

Cryptocurrency Exchange

A cryptocurrency exchange is a digital platform that allows users to buy, sell, and trade cryptocurrencies like Litecoin. Some popular cryptocurrency exchanges that support Litecoin include Bybit, Binance, and Huobi Global. Here are the pros and cons of investing in Litecoin through a cryptocurrency exchange:

👍 Pros

•Convenience: Cryptocurrency exchanges offer a convenient way to buy and sell Litecoin, as users can easily trade Litecoin for other cryptocurrencies or fiat currencies.

•High liquidity: Cryptocurrency exchanges have high liquidity, which means that investors can easily buy and sell Litecoin without affecting the market price.

•Control: Investing in Litecoin through a cryptocurrency exchange gives investors complete control over their investments, as they can buy and sell Litecoin at any time.

👎 Cons

•Security risks: Cryptocurrency exchanges are vulnerable to hacks and cyber-attacks, which can result in the loss of investors' funds.

•Volatility: The cryptocurrency market is highly volatile, and Litecoin's price can fluctuate rapidly, which can result in significant gains or losses for investors.

Crypto CFD Contracts

Crypto Contracts for Difference (CFDs) allow investors to speculate on the price of Litecoin without actually owning the asset. CFDs are financial derivatives that enable investors to profit from the difference between the buying and selling price of Litecoin. Here are the pros and cons of investing in Litecoin through CFD contracts:

👍 Pros

•No ownership required: CFD contracts allow investors to speculate on Litecoin's price without owning the asset, which can be useful for investors who don't want to deal with the technical aspects of owning Litecoin.

•High leverage: CFDs allow investors to leverage their investments, which means they can potentially make higher returns with a smaller initial investment.

👎 Cons

•Risky: CFDs are a highly risky investment, as they are highly leveraged and can result in significant losses if the market goes against investors.

•Limited regulation: CFD contracts are not regulated in the same way as other financial products, which means investors may be vulnerable to scams or fraud.

Litecoin Futures

Litecoin futures are a financial instrument that allows investors to speculate on the future price of Litecoin. Futures contracts are agreements to buy or sell Litecoin at a predetermined price and date. Here are the pros and cons of investing in Litecoin through futures contracts:

👍 Pros

•Predictability: Futures contracts provide investors with a predictable way to invest in Litecoin, as they know the price and date of the contract in advance.

•Hedging: Futures contracts can be used for hedging purposes, which means investors can protect their investments against market volatility.

👎 Cons

•Limited liquidity: Futures contracts may have limited liquidity, which means that investors may have

Litecoin ETFs

A Litecoin ETF (Exchange-Traded Fund) is a type of investment fund that tracks the performance of Litecoin. The ETF trades on stock exchanges and can be bought and sold like a stock. Investing in a Litecoin ETF provides investors with exposure to Litecoin without the need to own or store the digital currency.

👍 Pros

•Diversification: Investing in a Litecoin ETF provides diversification as investors are not exposed to a single asset but a basket of cryptocurrencies.

•Low fees: Litecoin ETFs have lower fees compared to actively managed funds, making them a cost-effective way to invest in Litecoin.

👎 Cons

•Market volatility: Like all investments, Litecoin ETFs are subject to market volatility, which can result in significant losses.

•Market manipulation: The cryptocurrency market is not regulated, and market manipulation is a concern for investors.

Litecoin Price Predictions 2024, 2025, 2030

Traders Union, one of the top financial analysis websites, has made Litecoin price predictions based on its own price analysis model. These predictions are meant to provide insight into the potential future price of Litecoin.

Litecoin Price Prediction 2024

| Month | Minimum Price | Maximum Price | Average Price |

|---|---|---|---|

| March 2024 | $61,3 | $74,92 | $68,11 |

| April 2024 | $61,67 | $75,37 | $68,52 |

| May 2024 | $62,04 | $75,82 | $68,93 |

| June 2024 | $62,41 | $76,27 | $69,34 |

| July 2024 | $62,78 | $76,74 | $69,76 |

| August 2024 | $63,16 | $77,2 | $70,18 |

| September 2024 | $63,54 | $77,66 | $70,6 |

| October 2024 | $63,92 | $78,12 | $71,02 |

| November 2024 | $64,3 | $78,6 | $71,45 |

| December 2024 | $64,69 | $79,07 | $71,88 |

Long-term Litecoin Price Prediction

| Year | Price in the middle of the year | Price at the end of the year |

|---|---|---|

| 2023 | $120.41 | $160.55 |

| 2024 | $199.54 | $266.05 |

| 2025 | $227.06 | $302.74 |

| 2026 | $344.03 | $458.7 |

| 2027 | $550.44 | $733.92 |

| 2028 | $681.17 | $908.23 |

| 2029 | $894.47 | $1192.62 |

| 2030 | $1160.06 | $1546.74 |

| 2031 | $1341.7 | $1788.93 |

| 2032 | $1603.16 | $2137.54 |

| 2033 | $1850.86 | $2467.81 |

| 2034 | $1995.35 | $2660.46 |

How to Store Litecoin

A program can help you manage your Litecoins in a safe and secure manner so that you don't lose your crypto assets.

In addition to keeping your private keys, crypto wallets allow you to send, receive, and exchange cryptocurrency. By using these programs, you can manage and control your funds. There are different types of wallets you can use to store your Litecoins.

Best Crypto Wallets Security & Fees ComparisonHot Wallet

You can store your Litecoins in a hot wallet to manage and keep your assets safe. Hot wallets can be web-based, on mobile, or on desktop. Even though all crypto hot wallets are vulnerable to online attacks, web wallets have the lowest level of security.

Hot wallets are easy to use. To make a cryptocurrency transaction, you don't need to transition from offline to online.

For example, people often trade or purchase cryptocurrencies using mobile hot wallets. The process would be inconvenient if you used a cold wallet. To purchase cryptocurrency, you must plug your cold wallet into a device (usually a computer), transfer the necessary cryptocurrency to a hot wallet, and then make the payment.

In general, users who hold a large amount of cryptocurrency won't keep their crypto in hot wallets. It's generally not a good idea to keep a lot of money on your person, even with a hot mobile wallet. You can add more crypto to your hot wallet when the balance gets low, just like you can withdraw cash from an ATM.

Reputable exchanges store most of their customers' funds offline in a matrix of cold wallets, and keep a small amount needed for withdrawals in hot wallets. When storing cryptocurrency online, make sure you research the reputation of the exchange you're using.

Cold Wallet

Some consider Litecoin paper wallets the safest method of storing Litecoin (or any cryptocurrency) on the Internet. It's called a "cold wallet" because paper wallets are completely offline methods for storing coins.

With a paper wallet, both your public and private keys are printed on paper. Offline setup is also possible, so your private keys are never exposed.

In a paper wallet, coins are nearly impossible to steal when they’re stored properly and protected against loss, destruction, or theft.

LTC Staking

With staking, crypto holders can earn passive income without having to sell their digital assets.

Staking can be thought of as putting money in a high-yield savings account.

Your savings account is a bank account where you deposit money and the bank lends it out to others. You receive a portion of the interest earned from lending in exchange for locking up the money with the bank. The same thing happens when you stake your coins. This is why staking is such a great way to store your crypto coins.

In proof-of-stake (PoS) blockchain networks, investing in coins allows you to stake them, which helps the networks operate more efficiently and securely. However, since Litecoin isn’t a proof-of-stake blockchain, staking LTC isn’t available. But if Litecoin ever did move to a proof-of-stake consensus mechanism, you’d likely be able to stake LTC and earn rewards for holding your coins.

Should You Buy Litecoin in 2024?

Crypto has had a tough year in 2023, but the Litecoin market has shown that it can weather any storm multiple times since it was founded. Thus, once the low is reached, Litecoin can once again become a good investment for those willing to risk it.

But there’s one important thing to note: As with many other coins, Litecoin has plummeted over 80% over the last 12 months, making it part of "crypto winter."

Interestingly, we have seen this occur multiple times, but Litecoin has always recovered. Although you shouldn't jump in right away, investing in Litecoin isn’t a bad idea either. Compared to other financial assets, Litecoin may have a substantial risk-to-reward ratio.

But as with any other cryptocurrency (or trading instrument in general), it’s important to keep risk in mind. There’s a great deal of volatility in the crypto markets. It is important to be cautious about investing too much at once. Your investment strategy will dictate how much you put into the market at a given time. But always remember, only invest as much as you’re willing to risk.

Litecoin Price Prediction – LTC price in 2024, 2025, 2030Summary

You can get Litecoin in a number of easy, safe, and secure ways. For years, Litecoin has been a popular alternative to Bitcoin due to its cheap, fast transactions. Due to the similarities in the code, it shares many of the same positive characteristics.

Litecoin can be used to pay at progressive merchants worldwide with crypto, if you're interested in making payments in crypto. Check out one of the top exchanges mentioned in this post and start buying Litecoin today.

FAQs

What is Litecoin?

The Litecoin cryptocurrency facilitates peer-to-peer transactions through open-source software. Founded in 2011, it’s often referred to as the 'silver to Bitcoin's gold', since it was created not necessarily to compete with Bitcoin, but to complement it.

How does Litecoin work?

As a proof-of-work currency, Litecoin uses a 2.5 minute block cycle. Currently, each completed block generates 12.5 LTC, which is half every four years. The total number of LTC produced will never exceed 84 million.

Where do you buy Litecoin?

A variety of cryptocurrency exchanges allow you to buy Litecoin. Many of these platforms not only allow you to purchase the coin, but they also allow you to trade and sell Litecoin to other investors.

Is it better to buy Bitcoin or Litecoin?

As many crypto investors know, Bitcoin is the largest cryptocurrency by market capitalization. Litecoin is also one of the most popular cryptocurrencies, albeit not as well-known as Bitcoin. Litecoin was created to complement the Bitcoin blockchain and improve on it. Depending on your goals, the use of your coins, and your views on cryptocurrency, you'll find out which is better for you. Bitcoin is worth more than Litecoin, but Litecoin is faster to create. In general, Bitcoin offers more value per coin, while Litecoin offers more coins for less money.

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.