AUD/USD forecast for today by Traders Union analysts

The AUD/USD currency pair is one of the major pairs for trading in the Forex market. This is due to it being popular among investors and traders. Traders Union analysts prepare the AUD/USD price prediction for today and each trading day so that you could monitor the AUD/USD price chart online. The price prediction is based on the technical analysis of the Forex market.

AUD/USD may continue to rise

16.05.2024

AUD/USD maintains a positive outlook

15.05.2024

AUD/USD is still in demand

14.05.2024

AUD/USD remains below 0.6620

13.05.2024

AUD/USD is bought from support

10.05.2024

AUD/USD continues decline

09.05.2024

AUD/USD retreats to 0.6590 support

08.05.2024

AUD/USD tries to return to Friday's high

07.05.2024

AUD/USD approaches 0.6600

03.05.2024

AUD/USD rises after decline

02.05.2024

AUD/USD is being sold off

01.05.2024

AUD/USD is moving higher

30.04.2024

AUD/USD concluded the week near 0.6550, risks of a resumption of decline persist

29.04.2024

AUD/USD is bought again from 0.6490 support

26.04.2024

AUD/USD is under moderate pressure after rise

25.04.2024

AUD/USD continued to recover

24.04.2024

AUD/USD is attempting to move higher

23.04.2024

AUD/USD returned to 0.6430 after falling

22.04.2024

AUD/USD is declining after a pullback

19.04.2024

Australian dollar/US dollar attempts recovery

18.04.2024

Australian dollar/US Dollar decline continues

17.04.2024

Aussie/dollar on its way to 0.6400?

16.04.2024

Aussie/dollar broke through the support at 0.6500

15.04.2024

Aussie/dollar remains under pressure

12.04.2024

Aussie/dollar back to 0.6500

11.04.2024

Aussie/dollar is in moderate demand

10.04.2024

Aussie/dollar continues to recover

09.04.2024

Aussie/dollar bought from 0.6550; downside risks persist

08.04.2024

Aussie/dollar moved higher but sold off from resistance at 0.6615

05.04.2024

Aussie/dollar recovers after the fall

04.04.2024

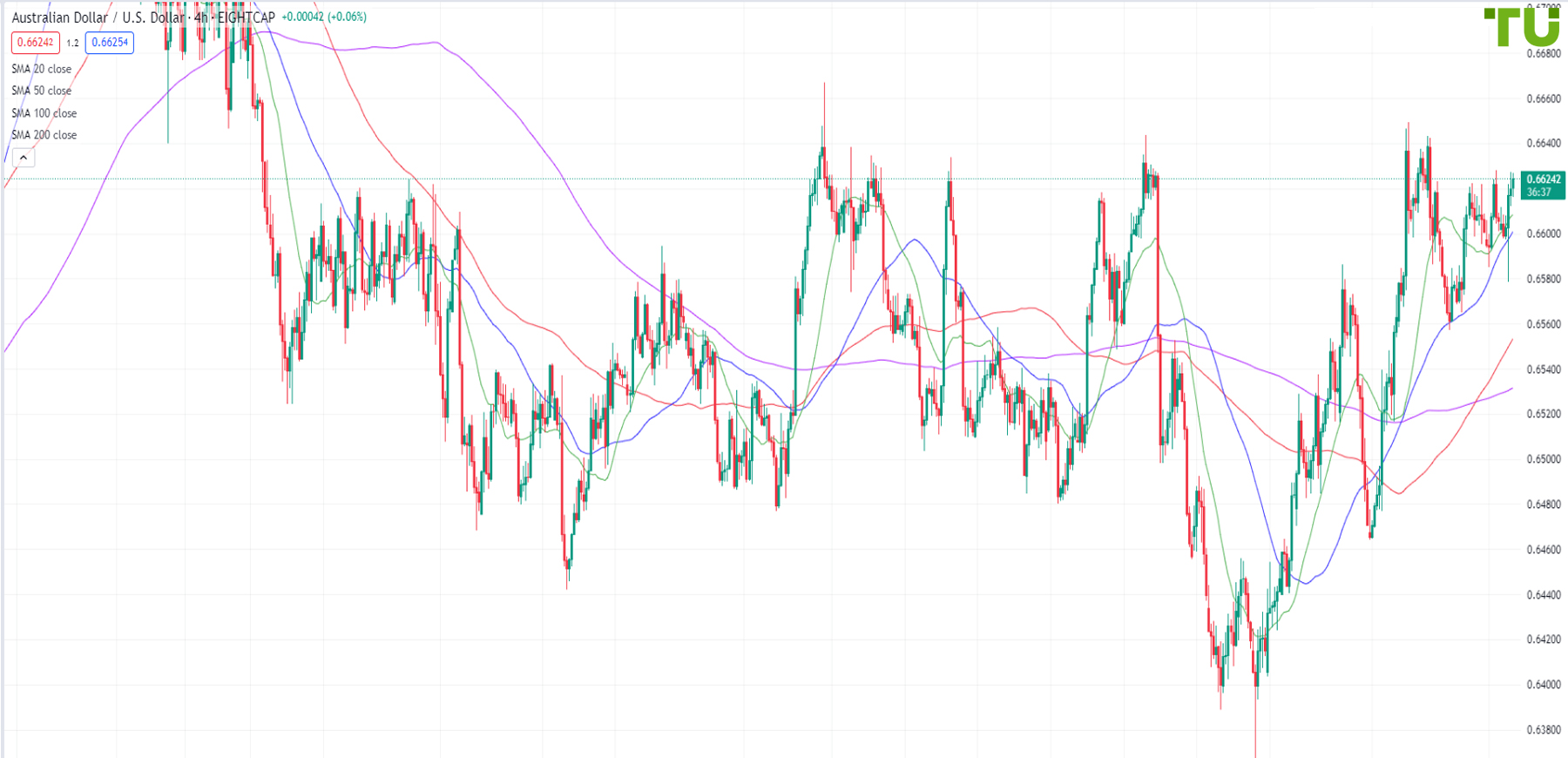

AUD/USD chart

Why is it important to know the AUD/USD price prediction?

Traders Union research determined that the AUD/USD is one of the most popular currency pairs among Forex traders and investors and it is in the group of major pairs. The Australian dollar is the base currency of the pair. It means that when the pair increases, the AUD strengthens and the USD weakens in it. When the pair declines, the Australian dollar weakens and the US dollar strengthens. The AUD/USD pair is suitable for novice traders, as it has an active, but not very high level of volatility, which provides you with time to make a trading decision. The peak of the AUD/USD volatility falls on the period from 19:00 to 04:30 (GMT) due to the trading schedule at the Australian exchange (ASX).

FAQ

What is the AUD/USD price prediction based on?

What is technical analysis in the Forex market?

Can the AUD/USD price prediction be trusted?

What impacts Australian dollar price against the US dollar

- Internal events at the Australian exchange (ASX);

- Policies of the central banks of Australia and the U.S.;

- Dynamics of export-import transactions of the countries;

- Inflation in the U.S. and Australia;

- Statements of the Australian and U.S. officials;

- General trends in the global financial markets and in the Forex market in particular.