EUR/AUD forecast for today by Traders Union analysts

EUR/AUD is the currency pair that shows the price of one euro in Australian dollars. It is considered a cross pair and has rather low volatility. Euro is the base currency in the pair and the Australian dollar is the quoted currency. TU analysts use various methods of technical analysis for making forecasts. This helps traders understand the market situation quicker and make the right trading decision.

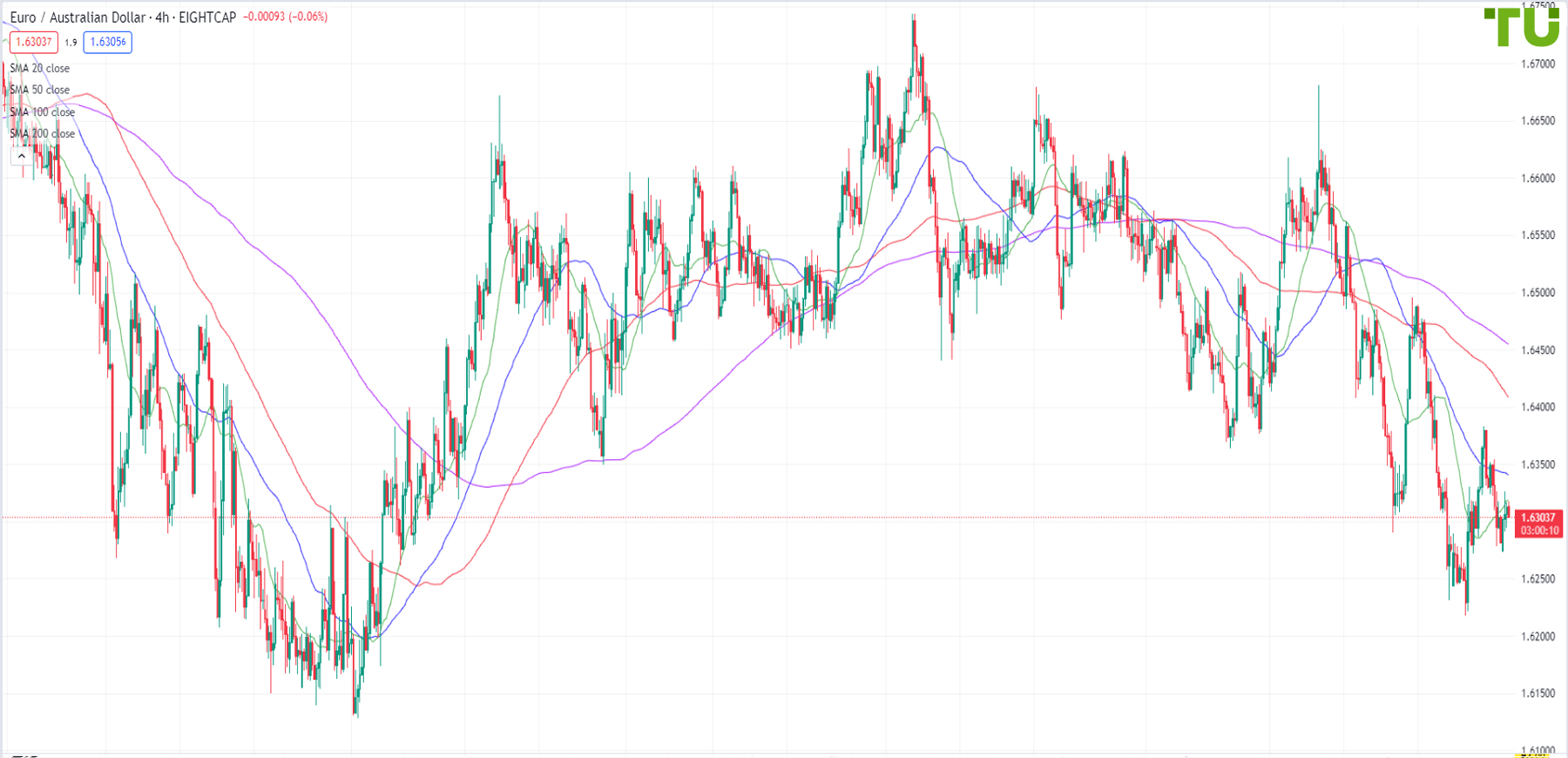

EUR/AUD tested strong support, risks of breakout increase

16.05.2024

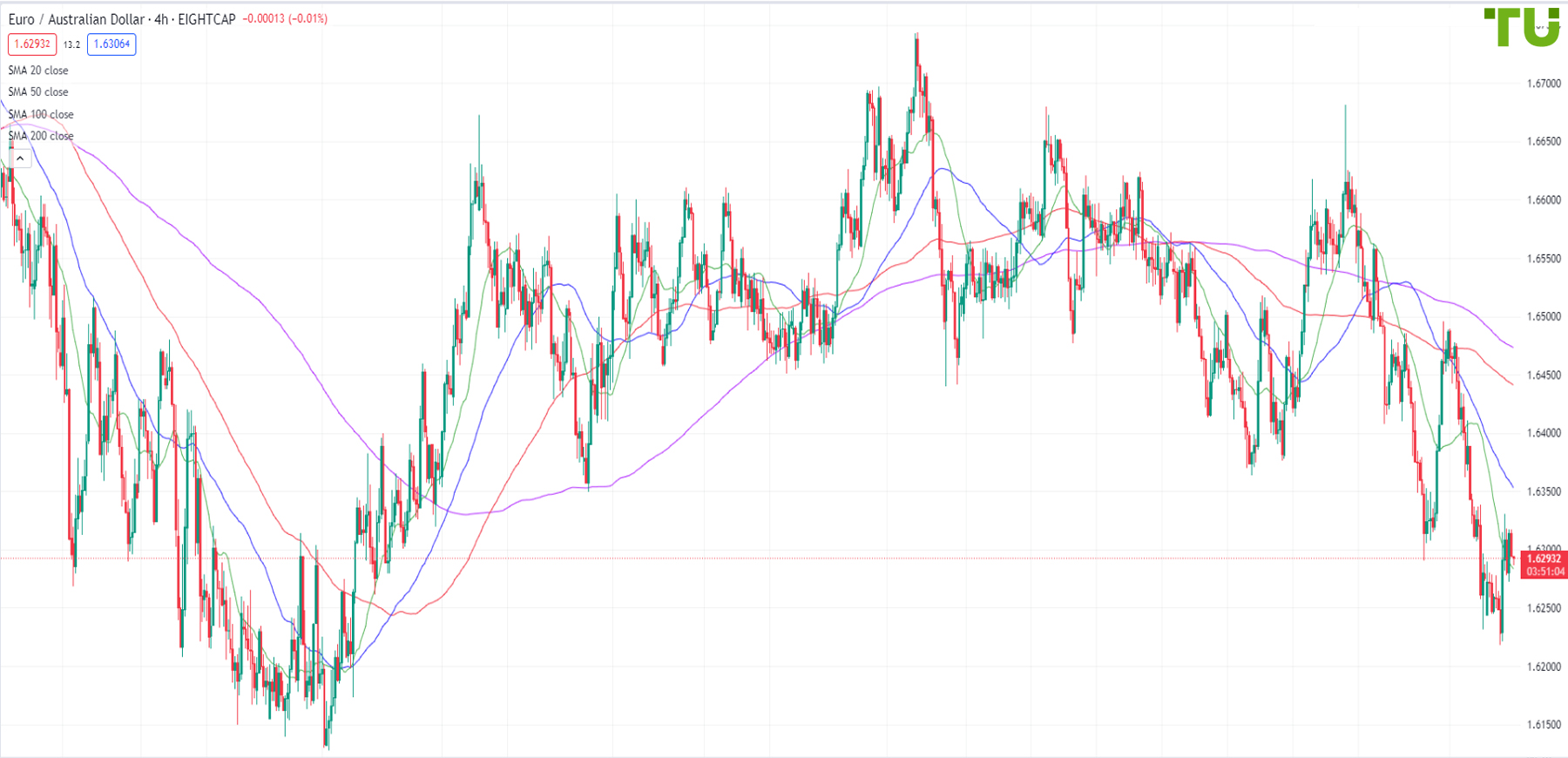

EUR/AUD declines

15.05.2024

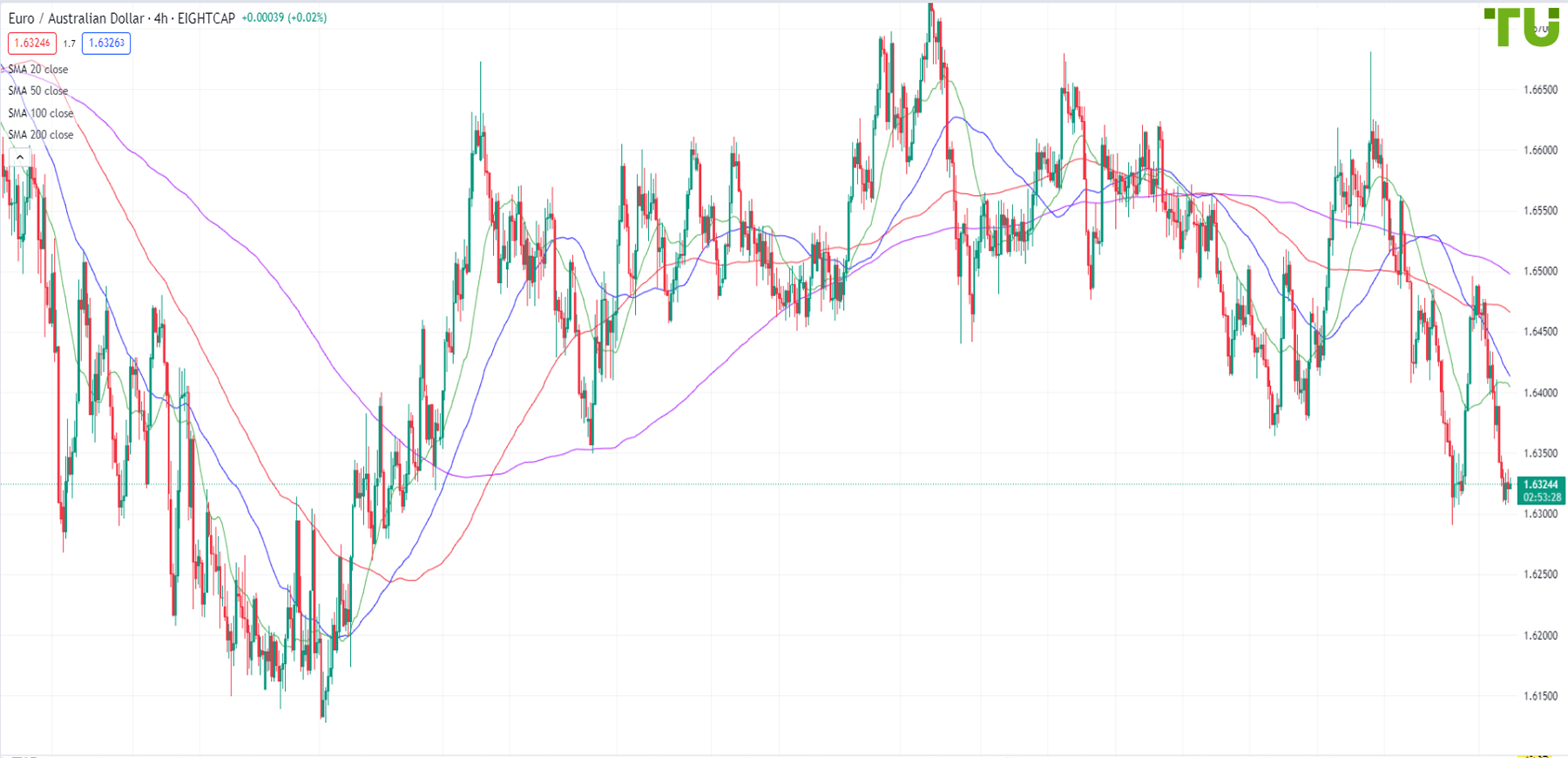

EUR/AUD attempts to break 1.6345 resistance

14.05.2024

EUR/AUD is under pressure after the rise

13.05.2024

EUR/AUD is under pressure

10.05.2024

EUR/AUD remains under pressure after the rise

09.05.2024

EUR/AUD remains under pressure after rise

08.05.2024

EUR/AUD recovers losses

07.05.2024

EUR/AUD returned to 1.6310 support

03.05.2024

EUR/AUD continued to decline

02.05.2024

EUR/AUD returned to the 1.6490 resistance

01.05.2024

EUR/AUD is recovering after a decline

30.04.2024

EUR/AUD refreshes current minimum

29.04.2024

EUR/AUD tested 1.6380 strong support

26.04.2024

EUR/AUD continues to sell on rallies

25.04.2024

EUR/AUD dipped to 1.6410

24.04.2024

EUR/AUD recovers losses after German PMI release

23.04.2024

EUR/AUD risks further decline

22.04.2024

EUR/AUD returns to support at 1.6580 after rising to 1.6680

19.04.2024

Euro/Australian dollar consolidates after growth

18.04.2024

Euro/Australian dollar declines following growth

17.04.2024

Euro/Aussie continues to grow

16.04.2024

Euro/Aussie redeemed again from 1.6380 support

15.04.2024

Euro/Aussie returned to the support at 1.6380

12.04.2024

Euro/Aussie soared towards resistance at 1.6515

11.04.2024

Euro/Aussie continues to decline

10.04.2024

Euro/Aussie returned to support at 1.6415

09.04.2024

Euro/Aussie trades below 1.6490

08.04.2024

Euro/Aussie selling on the upside

05.04.2024

Euro/Aussie resumed falling

04.04.2024

EUR/AUD Chart

How is the EUR/AUD forecast made?

If you look at the EUR/AUD chart, you will see that this pair has low volatility and therefore is considered a non-technical one. It is suitable for novice traders who prefer conservative or moderate Forex trading strategies.

The exchange rate is influenced not only by the general trend in the international Forex market but also by the difference in the discount rates of Australia and Europe, consumer and commodity prices. However, the European countries rely on the services sector and industry, while the Australian economy is developing thanks to agriculture and natural resources.

This trading pair correlates with GBR/JPY, USD/JPY, and EUR/JPY the most. TU experts have determined that the correlation is dynamic and could differ on different days or chart intervals. Therefore, when making trading decisions, you need to take into account the EUR/AUD forecast made by experts based on technical indicators, patterns, and support and resistance levels.