EUR/CAD forecast for today by Traders Union analysts

The EUR/CAD currency pair is primarily recommended for traders trading the news. Its price correlates with the commodity prices (in particular, oil and petroleum products prices). The quote shows the price of one euro in Canadian dollars. Euro is the base currency in the pair, and Canadian dollar (Loonie) is the quoted currency.

Traders Union experts conduct daily analysis using instruments of technical analysis and making the EUR/CAD forecast. You can monitor the price chart online and make informed trading decisions to earn profit.

EUR/CAD is moving higher

16.05.2024

EUR/CAD is trading unchanged

15.05.2024

EUR/CAD remains in range

14.05.2024

EUR/CAD is sold from resistance at 1.4755

13.05.2024

EUR/CAD is in demand on pullbacks

10.05.2024

EUR/CAD returned to 1.3734 support

09.05.2024

EUR/CAD tests strong resistance

08.05.2024

EUR/CAD declines after growth

07.05.2024

EUR/CAD retreated to 1.4645 support

03.05.2024

EUR/CAD storms 1.4725 resistance

02.05.2024

EUR/CAD rose to 1.4726

01.05.2024

EUR/CAD attempts to resume growth

30.04.2024

EUR/CAD declines after a rise

29.04.2024

EUR/CAD sold from 1.4690 resistance

26.04.2024

EUR/CAD moves higher

25.04.2024

EUR/CAD unable to continue rising on German PMI

24.04.2024

EUR/CAD rises on German PMI

23.04.2024

EUR/CAD sold on the rise

22.04.2024

EUR/CAD is under pressure

19.04.2024

Euro/Canadian dollar tries to hold above 1.4670

18.04.2024

Euro/Canadian dollar sold on growth

17.04.2024

Euro/Loonie remains under pressure

16.04.2024

Euro/loonie continues to decline

15.04.2024

Euro/Loonie declines after ECB comments

12.04.2024

Euro/Loonie under pressure ahead of ECB decision

11.04.2024

Euro/loonie under pressure after growth

10.04.2024

Euro/loonie moves higher

09.04.2024

Euro/loonie ended the week with growth

08.04.2024

Euro/loonie moves higher

05.04.2024

Euro/loonie continues to recover

04.04.2024

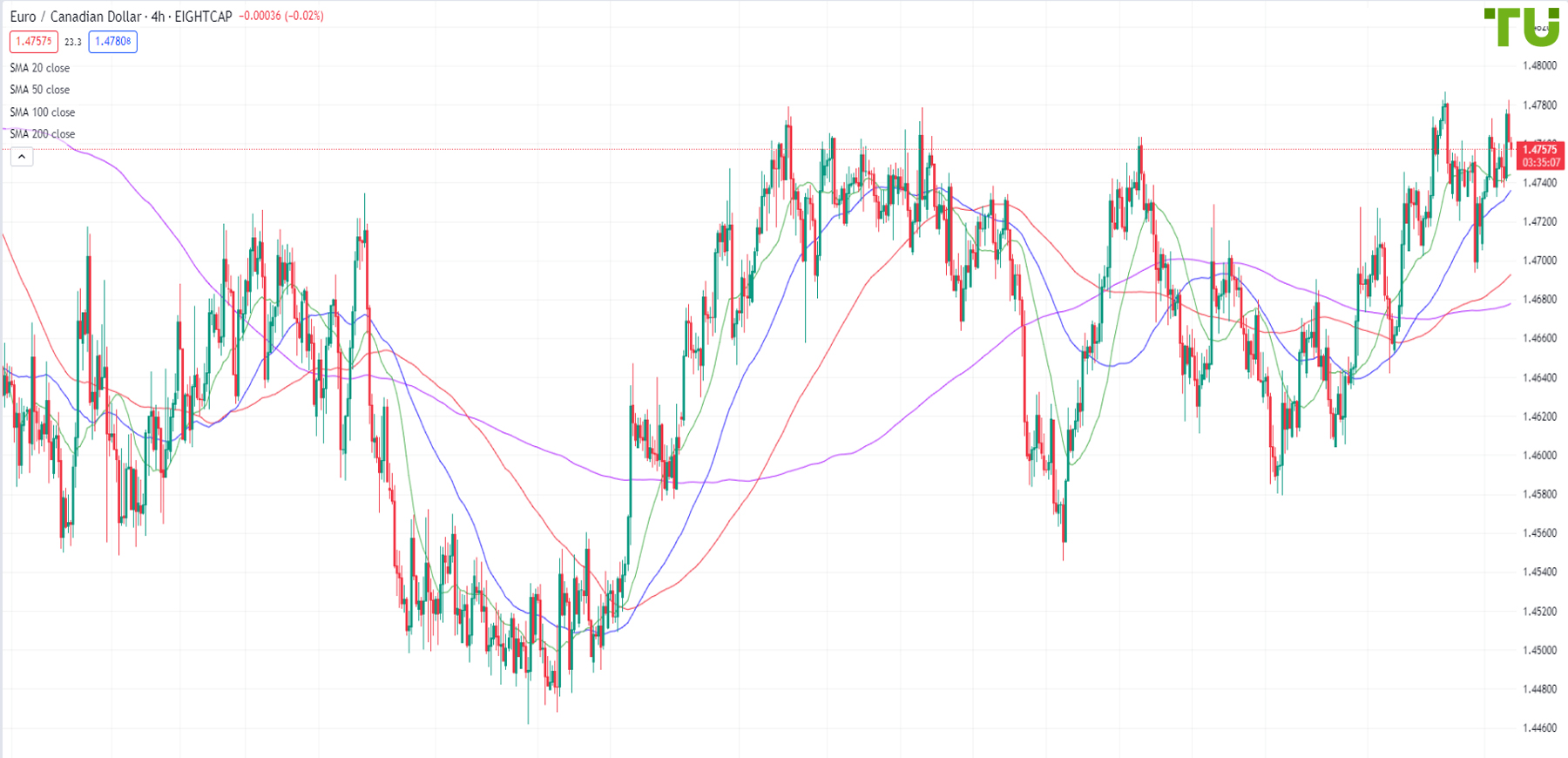

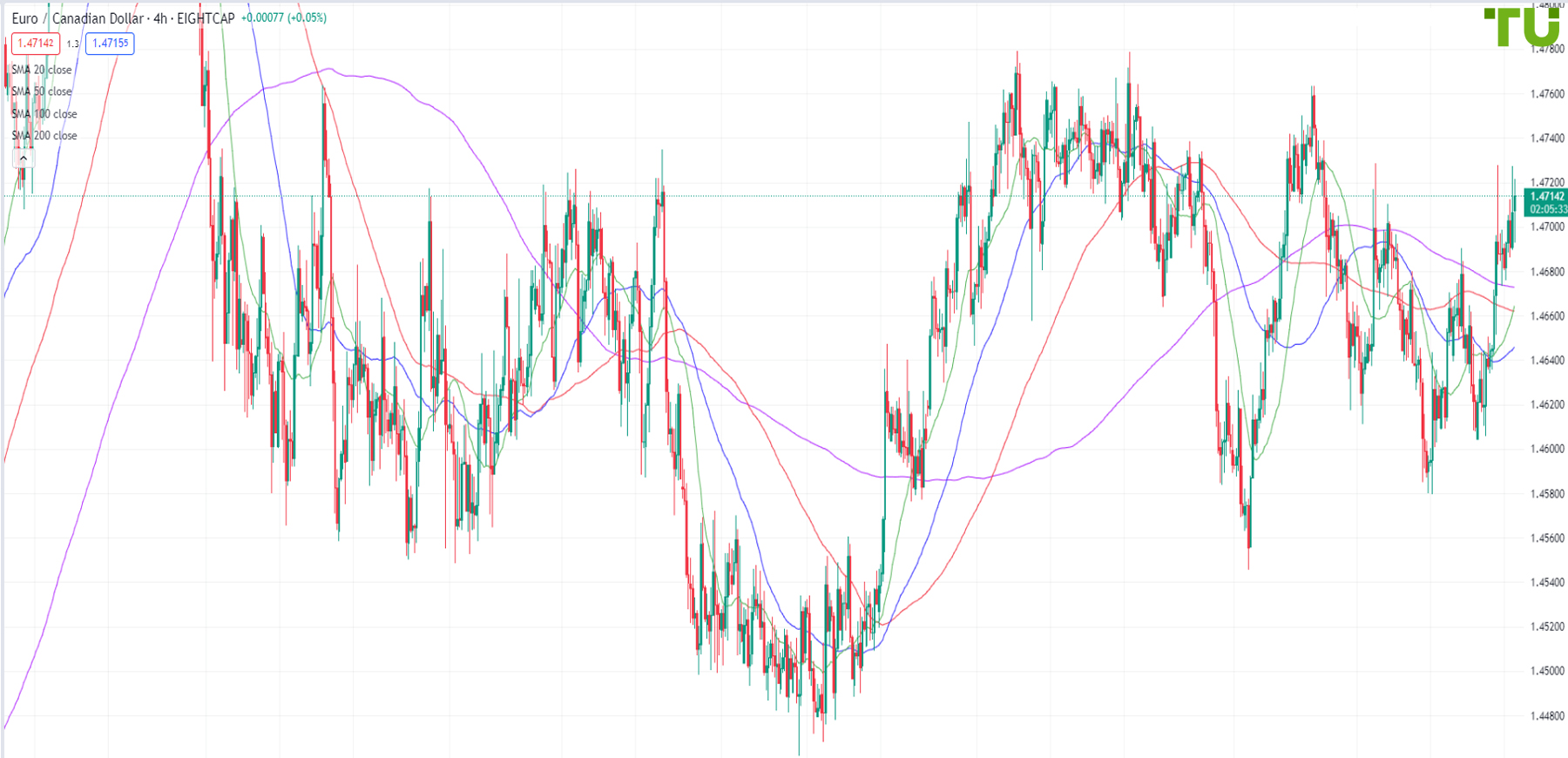

EUR CAD Chart

How will the euro price change against the Canadian dollar?

Technical analysis is of paramount importance in forecasting the EUR/CAD price performance both for the long and short term. TU experts use various methods of technical analysis (patterns, indicators, support and resistance levels, etc.) for making the forecast.

The EUR/CAD is considered a minor currency pair. Despite it not being as popular as some other pairs in the Forex market, it remains highly liquid. Because one of the currencies in the pair is actively traded during the U.S. trading session and the other during the European trading session, the period of increased volatility is rather extended.

The trading activity for this currency pair is usually observed at the London Stock Exchange (LSE) on working days from 8:00 am until 4:29 pm (GMT+1).