EUR/NZD forecast for today by Traders Union analysts

EUR/NZD is a pair that belongs to the category of crosses (in respect of the U.S. dollar) or minors in the Forex market. Euro acts as the base currency of the pair, and the New Zealand dollar is the quoted currency. Although the U.S. dollar is not a part of the pair, it has a significant impact on the quote.

Notably, the EUR/NZD pair is not a major currency pair in the Forex market. The situation in the Forex market, commodity, and food prices set the general trend for the exchange rate.

The liquidity of the pair is rather small, and the spreads are high for the existing volatility (usually up to 20 points), which should be considered by traders. It will be difficult for those who prefer scalping on short time frames to make a profit.

TU experts use various methods of technical analysis, including support/resistance levels, indicators, chart figures, and patterns, to make the EUR/NZD forecast. This helps traders determine the approximate price movement in the near future.

EUR/NZD continued its decline

16.05.2024

EUR/NZD continued its decline

15.05.2024

EUR/NZD retreated to 1.7890

14.05.2024

EUR/NZD is under pressure from the 1.7940 level

13.05.2024

EUR/NZD bought on the dip

10.05.2024

EUR/NZD risks further decline

09.05.2024

EUR/NZD may continue to decline

08.05.2024

EUR/NZD remains under pressure

07.05.2024

EUR/NZD is under steady selling pressure

03.05.2024

EUR/NZD bought from 1.8025

02.05.2024

EUR/NZD tested 1.8150

01.05.2024

EUR/NZD is clawing back losses

30.04.2024

EUR/NZD continues decline

29.04.2024

EUR/NZD continue to be bought from 1.7980 support

26.04.2024

EUR/NZD may break current support

25.04.2024

EUR/NZD returns to support at 1.7995

24.04.2024

EUR/NZD under pressure after the rise

23.04.2024

EUR/NZD persists in its decline

22.04.2024

EUR/NZD declines after rising

19.04.2024

Euro/New Zealand dollar consolidates within a range

18.04.2024

Euro/New Zealand dollar collapsed toward 1.7965 support

17.04.2024

Euro/Kiwi back to strong resistance

16.04.2024

Euro/Kiwi rebounded to 1.7930

15.04.2024

Euro/Kiwi testing support at 1.7850

12.04.2024

Euro/Kiwi under pressure after rebounding upwards

11.04.2024

Euro/Kiwi declined to 1.7860

10.04.2024

Euro/Kiwi remains under pressure

09.04.2024

Euro/Kiwi is trying to continue its recovery

08.04.2024

Euro/Kiwi remains under pressure

05.04.2024

Euro/Kiwi broke the support and continues to decline

04.04.2024

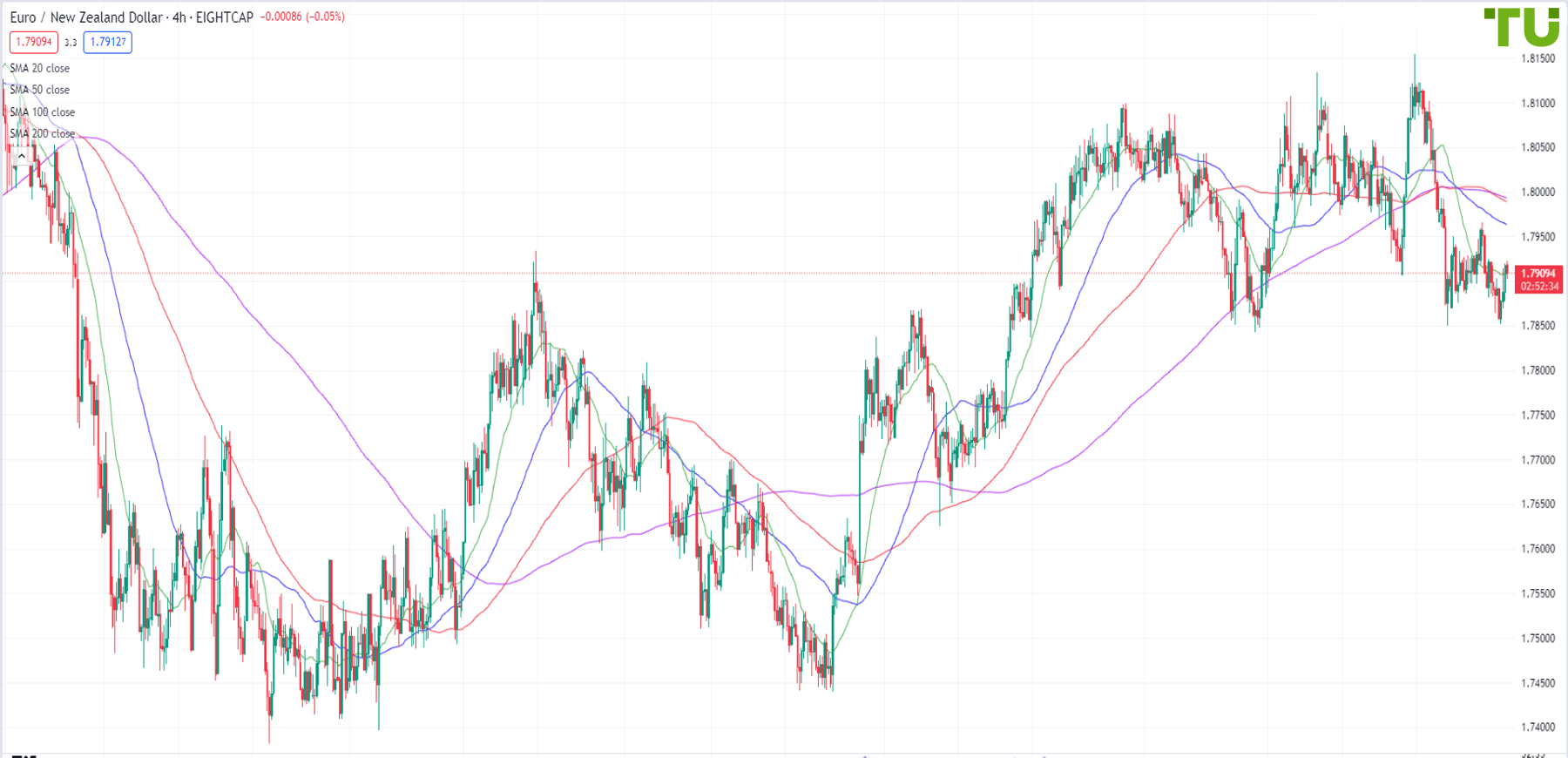

EUR NZD Chart

What is the purpose of the EUR/NZD forecast?

EUR/NZD is a cross pair. It is necessary to take into account the influence of the U.S. dollar, as it is involved in currency conversion for buy/sell transactions. It is important for inexperienced traders not only to find the forecast but also correctly read it. The pair will grow when the euro strengthens, and if the New Zealand dollar strengthens, the price will drop.

The peak of trading activity for the EUR/NZD pair falls on Friday, and Tuesday is the quietest day. Trading is active both during the Pacific and European sessions. Trading is quieter during the U.S. session, but you also shouldn’t expect a flat. Some days show significant volatility. The EUR/NZD pair has a reversion correlation with NZD/CHF, GBP/USD, and NZD/USD.

Technical analysis by TU experts will help you make the right trading decision. In addition, the following factors capable of impacting the price performance, need to be taken into account:

- Monetary policy in the eurozone and New Zealand;

- Economic indicators of the countries and their trade balances;

- The prices of agricultural and commodity products (they influence the NZD price).