Gold Analysis Today – XAU/USD Support and Resistance

The gold price forecast will be useful to those planning to work with this safe haven asset in the short or long term. An increased interest in gold is being observed against the global stagflation shock and instability, as the gold price has a negative correlation with traditional markets.

Traders Union analysts use methods and instruments of technical analysis to prepare gold price forecasts for today and the following days to save traders time and provide them with an opportunity to adjust their trading strategies accordingly.

Low volatility and smooth price movement without sudden ups or downs makes gold a suitable asset both for professionals and beginners. Short and long-term gold price forecasts will come in handy for those planning to trade in the gold spot market, gold futures, or CFDs. The asset can also be used for diversification of a trader’s investment portfolio to protect capital against inflation risks.

XAU/USD rises on U.S. CPI

16.05.2024

XAU/USD shows positive sentiment

15.05.2024

XAU/USD tests support at $2,335 per ounce

14.05.2024

XAU/USD is retreating from Friday's high

13.05.2024

XAU/USD is rising again

10.05.2024

XAU/USD remains in a relatively narrow range

09.05.2024

XAU/USD unable to break resistance at $2130 per ounce

08.05.2024

XAU/USD consolidates in a range

07.05.2024

XAU/USD still trades above $2,285 per ounce

03.05.2024

XAU/USD is under pressure after recovery

02.05.2024

XAU/USD continues to decline ahead of the FOMC

01.05.2024

XAU/USD continues consolidation within a range

30.04.2024

XAU/USD is under pressure again after the release of a strong U.S. Consumer Price Index (CPI)

29.04.2024

XAU/USD continues consolidation within range

26.04.2024

XAU/USD remains under pressure

25.04.2024

XAU/USD is recovering after decline

24.04.2024

XAU/USD is declining amid liquidation of long positions

23.04.2024

XAU/USD is facing pressure amidst profit-taking activities

22.04.2024

XAU/USD is consolidating at $2,395 resistance

19.04.2024

XAU/USD is moving away from $2,395 resistance

18.04.2024

XAU/USD is trying to return to highs

17.04.2024

XAU/USD bought back on the decline

16.04.2024

XAU/USD sold after another update of the highs

15.04.2024

XAU/USD renews its highs again

12.04.2024

USD/ZAR is in demand again

11.04.2024

XAU/USD under pressure after the release of US inflation data

11.04.2024

XAU/USD maintains a positive bias

10.04.2024

XAU/USD updates the high again

09.04.2024

XAU/USD moves higher, correction risks rise

08.04.2024

XAU/USD unable to break through 2305 dollars per ounce

05.04.2024

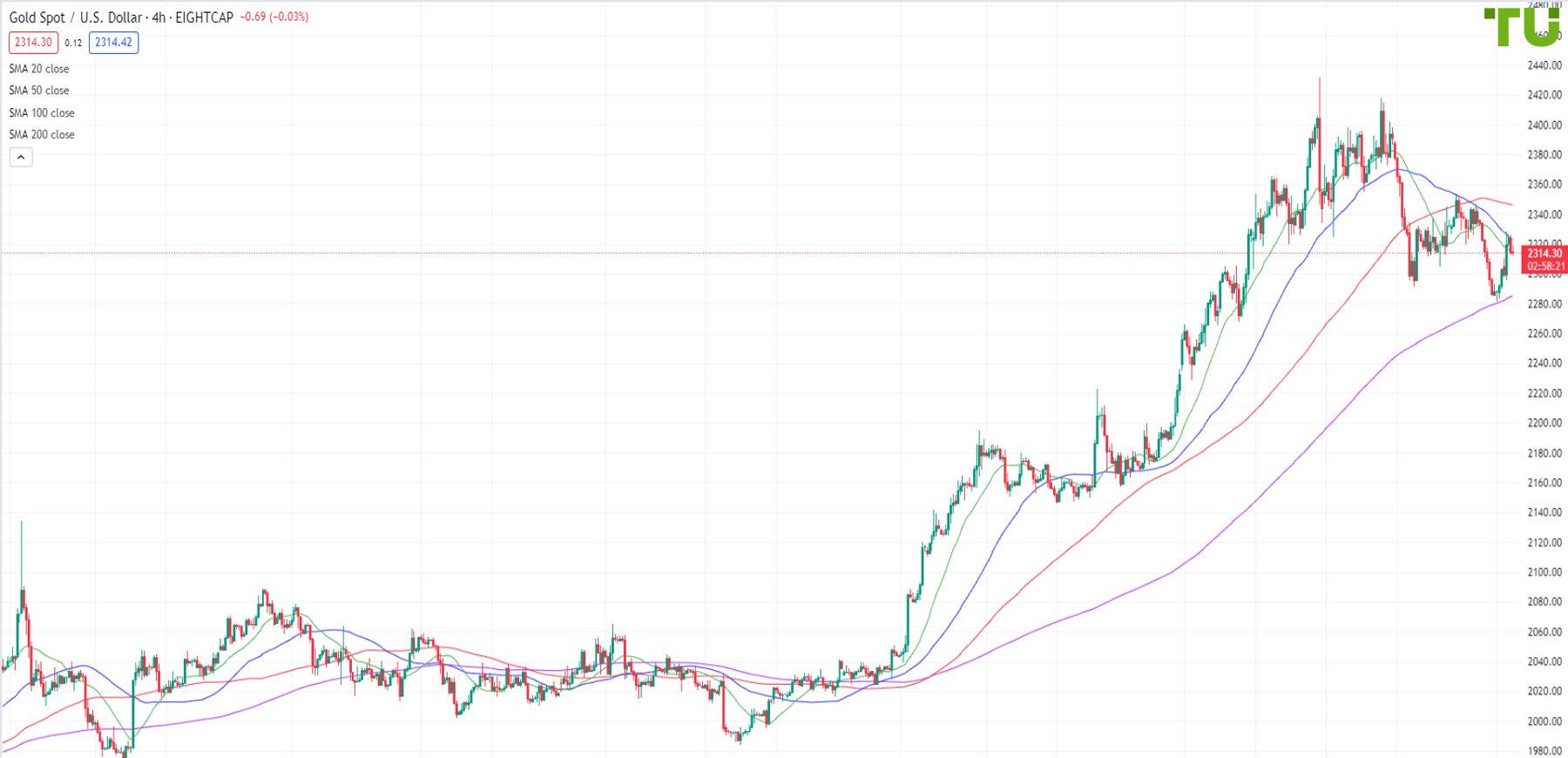

Gold price chart

Gold price forecast: how the price will change in the future

The live chart shows whether the gold price is rising or falling at the moment. But what will happen to the asset in the future: in one day, one week or one month? TU experts prepare the gold price forecast for one week and other periods based on the historical data and current situation in the market. In addition to the forecast based on technical analysis, also fundamental factors of influence need to be taken into account:

- Gold price growth is mostly observed in a tense geopolitical environment, when investors turn to this instrument to hedge risks;

- Toughening of the U.S. monetary policy and its impact on the global market;

- growth in consumer demand for the precious metal in India and China, which could cause the gold price to grow;

- rising inflation expectations, etc.

As a trading asset, gold carries a high significance for international currency markets. It also acts as a guarantor of stability of prices for most commodities, and is considered one of the most reliable forms of government, property and bank guarantees.