Your capital is at risk.

Erste Broker Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Erste Trader

- Erste NetBroker

- MNB

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Erste Trader

- Erste NetBroker

- MNB

Our Evaluation of Erste Broker

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Erste Broker is a broker with higher-than-average risk and the TU Overall Score of 3.49 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Erste Broker clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Erste Broker strives to provide a full range of financial services to satisfy the various needs of investors and traders.

Brief Look at Erste Broker

Erste Broker is one of the leading providers of investment services in the Hungarian market. It is a part of Erste Group which has over 15 million clients. The company is responsible for the provision of brokerage services for residents of Central and Eastern Europe. Erste Broker has been in the market since 1990, is regulated by the National Bank of Hungary (Magyar Nemzeti Bank), and is a member of the Budapest Stock Exchange. It offers access to 24 global exchanges and commodities markets, currencies, and CFDs. The broker’s clients can use leverage in spot, futures, and forward trades, as well as conduct foreign exchange on the interbank market.

- Supervision by the National Bank of Hungary;

- Participation in the Investor Protection Fund (BEVA | Befektető Védelmi Alap) with coverage up to €100,000 per client;

- No minimum investment requirements;

- Various assets and multiple markets, including currency and commodities;

- Advanced trading platforms that ensure fast and convenient access to markets;

- Demo mode for practicing and the Securities account for trading and investing in real markets;

- Client support in Hungarian is available by phone and email.

- Additional trading fees are charged for small trading volumes;

- Popular platforms such as MetaTrader or cTrader are not available;

- Deposits and withdrawals are made only by bank transfers that are slow and expensive.

TU Expert Advice

Financial expert and analyst at Traders Union

Erste Broker provides access to different asset types, which allows traders to diversify their portfolios and choose from a wide range of trading opportunities. Hungarian brokers must comply with the rules of ESMA (European Securities and Markets Authority). For example, the amount available for lending is stated there. Also, the regulator limits leverage up to 1:30 for retail traders.

Instead of attracting clients with temporary bonus offers or promotions, the broker focuses on providing a high level of service and competitive trading conditions. The Erste Broker platform has a demo mode to virtually enter currency and CFD markets. The broker provides virtual funds that can be used for trading. This allows traders to practice their strategies and improve their skills without the risk of losing real money.

Being a regulated broker, Erste Broker is obliged to comply with strict rules and regulations that can negatively affect the flexibility of its conditions. For example, Erste Broker doesn’t allow its clients to trade CFDs on cryptocurrencies. Traders can't use electronic payment systems for deposits and withdrawals either.

Erste Broker Summary

Your capital is at risk. Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Erste Broker and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | Erste Trader and Erste NetBroker |

|---|---|

| 📊 Accounts: | Demo and Securities account |

| 💰 Account currency: | HUF, EUR, USD, CHF, and GBP |

| 💵 Replenishment / Withdrawal: | Bank transfers |

| 🚀 Minimum deposit: | No restrictions |

| ⚖️ Leverage: | Up to 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 (Forex) |

| 💱 Spread: | From 0.4 pips for EUR/USD |

| 🔧 Instruments: | Forex and currency options; CFDs on stocks, indices, commodities, and precious metals; stocks, ETFs, ETCs, futures, bonds, and stock options |

| 💹 Margin Call / Stop Out: | 3% of the exchange rate in HUF/2% of the exchange rate in HUF |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Market |

| ⭐ Trading features: |

Trading fees are charged for a small trading volume; Hedging is allowed. |

| 🎁 Contests and bonuses: | No |

Erste Broker offers two platforms: Erste NetBroker for trading securities and Erste Trader for trading currencies and CFDs with leverage. Major currency pairs are traded with leverage up to 1:30, and other currencies and CFDs, up to 1:20. Spreads are variable and trading fees are subject to the client’s trading volume.

Erste Broker Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

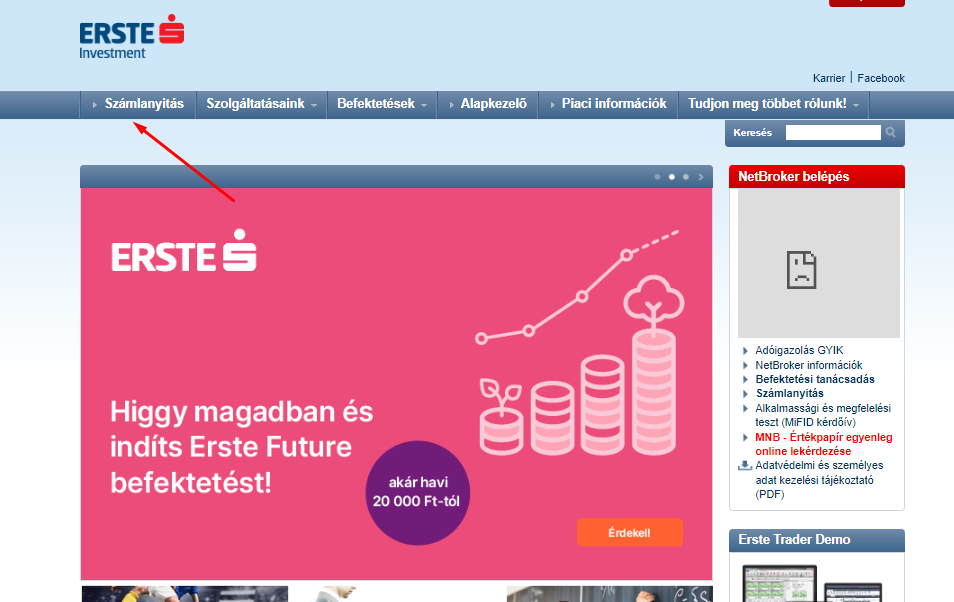

To start trading with Erste Broker, follow the instructions below:

Go to the broker’s website and click the “Open account” button at the top of the screen.

Provide information necessary for registration, including personal data and contact details. Choose a trading platform and confirm the opening of the Securities account by following the instructions on the website. Upon completion of registration, upload documents that confirm your identity and residence.

Wait until Erste Broker approves your registration. It may take some time since the company has to check the provided data. Upon successful registration and verification of your account, you can make a deposit and start trading on the Erste Broker platform.

Regulation and safety

Erste Broker is a part of Erste Group. Erste Bank, which is the oldest Austrian bank, is a subsidiary of the group. Erste Broker participates in BEVA: if the company fails to fulfill its obligations to hold deposits and securities, its clients receive compensation of up to €100,000 each.

The broker is licensed by the National Bank of Hungary under numbers III/75.005-19/2002, E-III/324/2008, and EN-III/M-947/2009. The National Bank is responsible for the formulation and implementation of the country’s monetary policy, issuance of the national currency, management of its foreign exchange reserves, and ensuring the stability and reliability of the financial system.

Advantages

- Compensation for the broker’s clients

- The Erste Broker website has annual reports with its financial performance

- Negative balance protection when trading on the Forex market

Disadvantages

- Limited range of payment methods

- Leverage is up to 1:30

- No bonuses or partnership programs

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Securities account | $4 | HUF 0-HUF 15,000 |

Opening an account with Erste Broker is free. However, there is a maintenance fee of HUF 350 a month.

TU experts have compared the average trading fees of Erste Broker, RoboForex, and Pocket Option, and the results are provided in the table below.

| Broker | Average commission | Level |

|---|---|---|

|

$4 | |

|

$1 | |

|

$8.5 |

Account types

Fill in the application to open a trading account with Erste Broker and provide the documents necessary for identity verification. Upon account verification, make a deposit and install the trading platform.

Account type:

Erste Trader supports a demo mode. This option is very useful for novice and experienced traders since it allows them to try trading with Erste Broker without depositing their funds. The virtual deposit available on a demo account is HUF 10,000,000.

Erste Broker doesn’t limit itself to one asset type or certain markets. It offers a wide range of financial services and investment instruments.

Deposit and Withdrawal

-

Traders can withdraw not only HUF, but also EUR, USD, GBP, or CHF.

-

HUF and foreign currencies are transferred to accounts of Erste Befektetési Zrt free of charge. Withdrawals to accounts with other banks cost 0.45% of the transaction amount. The minimum fee is HUF 500, the maximum — HUF 15,000.

-

Withdrawals through Viber cost HUF 15,000.

-

Cash withdrawals from the Securities account cost 1.25% + HUF 800 / EUR 2 / GBP 2 / $2 / CHF 2 subject to the currency.

Investment Options

Investment services are one of Erste Broker’s specializations. The broker provides access to stock market products for mid- and long-term investment. Passive income options are not available when trading Forex and CFDs. For example, Erste Broker doesn’t offer PAMM or MAM accounts and its platforms don’t support social or algorithmic trading.

Current offers for investors

One of the easiest investment solutions is the TBSZ (Tartós Befektetési Számla | Permanent Investment) account. It offers beneficial income tax conditions: 10% is withheld if funds are invested for 3 years; and 0% for 5 years. The minimum investment amount is HUF 25,000 (~ 68 USD).

Moreover, the broker offers Erste Future investment packages that differ in:

-

Risk level. Packages with low-, middle-, and high-risk levels are available.

-

Investment periods. They range from 1 to 7 years.

-

Expected profitability. The range is from 0.81% to 6.44% subject to the investment period.

Erste Broker offers 8 packages with different settings, from investing cash to investing in stocks of eco-friendly companies. The broker’s clients can use only Hungarian forint (HUF), since Erste Broker doesn’t provide investing in foreign currencies.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership programs from Erste Broker:

Lack of partnership programs means that the broker doesn’t offer rewards to brokerage companies, investment consultants, or traders who could attract new clients to it.

Customer support

The broker’s clients can contact technical support from 8:00 to 22:00 (GMT+1) Monday through Friday. It is possible to place orders with U.S. stocks by phone on weekdays from 17:30 to 22:00 (GMT+1).

Advantages

- Technical support is available by phone

- The broker’s offices are located in over 20 cities of Hungary

Disadvantages

- No online communication channels

- Clients are serviced with breaks

The following communication methods are available:

-

Telephone;

-

Fax;

-

Email;

-

Personal meeting in one of its physical offices.

To get assistance with brokerage and investment services, traders can visit any department of Erste Broker or Erste Bank.

Contacts

| Registration address | Erste Befektetési Zrt, 1138 Budapest, Népfürdő u. 24-26 |

|---|---|

| Regulation | MNB |

| Official site | https://www.ersteinvestment.hu/hu/index.html |

| Contacts |

06 1 235 5100, 06 1 235 5190

|

Education

There is no separate education section on the Erste Broker website. However, each block that describes different groups of financial instruments has basic information that provides for understanding the main terms and concepts.

Traders can use a demo account for training. It provides access to real market conditions, which allows traders to get trading experience in a real market simulator.

Comparison of Erste Broker with other Brokers

| Erste Broker | RoboForex | Pocket Option | Exness | FreshForex | Deriv | |

| Trading platform |

Erste NetBroker, Erste Trader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading | Deriv bot, Deriv MT5, Derivix, Deriv Trader, SmartTrader |

| Min deposit | $1 | $10 | $5 | $10 | No | $5 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | 1.00% |

| Spread | From 0.4 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

3% / 2% | 60% / 40% | 30% / 50% | No / 60% | 40% / 20% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | $30 | No |

| Cent accounts | No | Yes | No | No | Yes | No |

Detailed review of Erste Broker

Erste Broker is a member of the Budapest Stock Exchange and the Association of Investment Service Providers (Befektetési Szolgáltatók Szövetsége). The broker provides access to 24 stock exchanges in the U.S. and Europe, currency and CFD markets, and 5 U.S. futures exchanges. There are over 10,700 available stocks, futures, ETFs [(currency) exchange-traded funds], and ETCs (exchange-traded commodities).

Erste Broker by the numbers:

-

80+ offices throughout Hungary;

-

The broker has been in the financial market over 34 years;

-

Access to 20+ major global exchanges;

-

Over 1,000 ETFs and ETCs.

Erste Broker is for those who care about the security, diversity, and convenience of the trading process

Overall, the broker offers trading on 40 currencies and over 180 pairs in different formats on Erste Trader. It provides for OTC forward currency trading that allows traders to protect their interests from currency risks in the long term. Moreover, almost all currency pairs are available as futures contracts. Also, Erste Trader provides trading options on 40+ currency pairs, gold, and silver with various expiration periods of up to 1 year.

Erste Broker clients can place short and long positions on metals: it is possible to buy/sell gold and silver for USD, EUR, AUD, JPY, and HKD; palladium and platinum can be bought for USD. Trades with 14 CFDs on indices, oil, and commodities and with over 5,100 CFDs on stocks are available. Also, traders can work with CFDs on popular currency pairs.

Useful services offered by Erste Broker:

-

Free real-time data;

-

Daily and historical charts for currencies and CFDs;

-

Latest news and analytics on different markets;

-

Real-time exchange rates and financial data;

-

Demo mode for trading currencies and CFDs;

-

Emails with current news.

Advantages:

The broker offers portfolio management services that help its clients develop their investment strategies and allocate their capital wisely;

Traders can use advanced electronic platforms for online trading. Also, they can trade by phone;

Erste Broker provides research reports, analytical data, and market forecasts to help its clients make informed trading decisions;

The company ensures high loss protection by insuring client deposits at the Investor Protection Fund with up to €100,000 per client;

Erste Broker’s software offers comprehensive functionality and ease of use on different devices, including PCs, laptops, smartphones, and tablets.

The broker provides a wide range of trading services, as well as investment advice, portfolio management, market research, and other financial solutions.

User Satisfaction