Your capital is at risk.

Nordnet Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Mobile application

- Infront Web Trader

- Infront Active Trader

- Nordnet Autotrader

- Nordnet API

- Finansinspektionen

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Mobile application

- Infront Web Trader

- Infront Active Trader

- Nordnet Autotrader

- Nordnet API

- Finansinspektionen

Our Evaluation of Nordnet

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Nordnet is a broker with higher-than-average risk and the TU Overall Score of 3.33 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Nordnet clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Nordnet offers a wide range of investment products and instruments for individual investors, including access to global stock markets, real-time trading, educational resources, and analytics. Its clients can use the Nordnet mobile platform to manage their investments and to get advice and support from financial experts.

Brief Look at Nordnet

Nordnet is a subsidiary of Nordnet Bank which was incorporated in 1996. The securities, savings, and capital management division was established in May 2022 and now provides its services to over 1.8 million clients from Sweden, Norway, Finland, and Denmark. Nordnet is headquartered in Stockholm and is regulated by Finansinspektionen (the Financial Supervisory Authority | Sweden). The company provides access to markets in Europe, the U.S., and Canada, offers proprietary trading platforms, and supports remote account opening.

- Universal conditions for investors from Sweden, Finland, Denmark, and Norway;

- Large choice of account types, including those with tax benefits and options for capital accumulation;

- Access to exchanges in Northern Europe, the EU, the U.S., and Canada;

- Wide range of trading platforms with unique parameters;

- Reliable regulation and client deposit protection ensured by the state;

- Free education in securities trading;

- Diverse passive income options.

- Minimum fees are charged for any trading volume;

- Use of electronic platforms is paid;

- No live chat on the website.

TU Expert Advice

Financial expert and analyst at Traders Union

Nordnet doesn’t limit itself to providing brokerage services on securities markets but also offers products and solutions for financial planning, including for children, savings, pension accruals, and life insurance. Nordnet’s accounts allow traders to invest in securities and to efficiently manage their profits. The broker is regulated by Sweden's state financial authority, therefore client funds are safe and protected by the compensation scheme.

The broker offers stocks and ETFs, and interest-bearing and non-listed securities. Its clients can trade on exchanges in Sweden, Denmark, Norway, Finland, the U.S., Canada, Germany, and the EU. Also, the broker provides for investing in mutual funds managed by experienced strategic managers. Nordnet claims that every tenth client uses collective investments in funds to receive passive income.

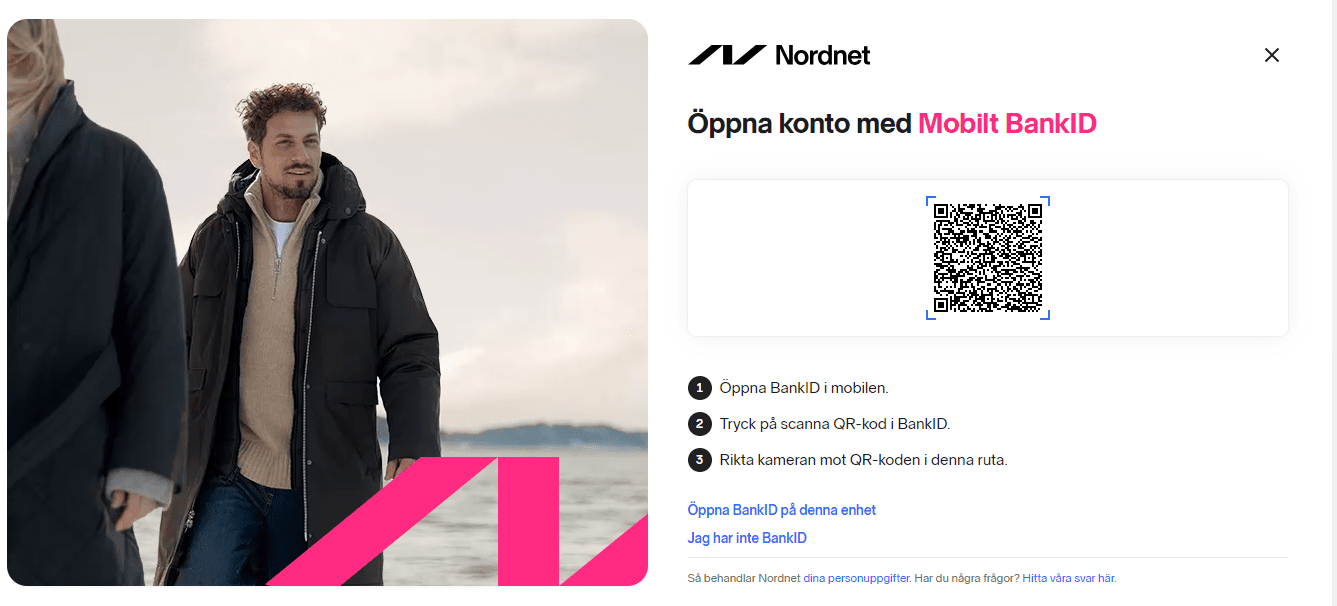

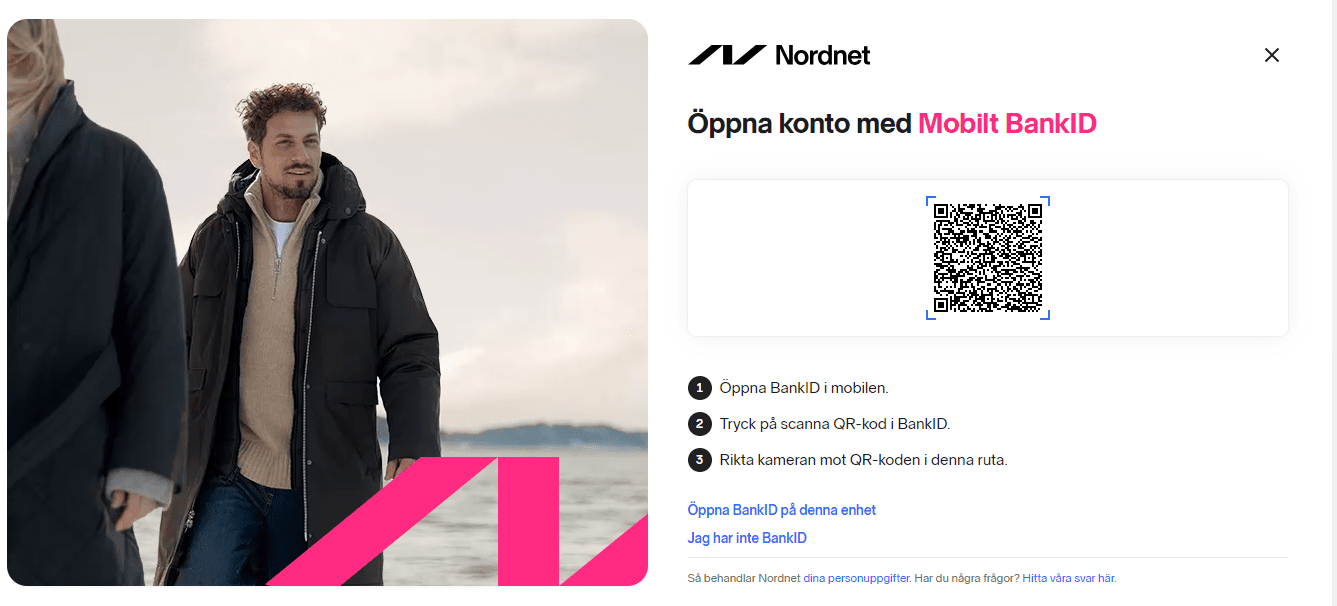

Nordnet strives to digitize all processes and settlements, and to maximize security. User accounts are first accessed with BankID, and then two-factor authentication can be used. The broker has developed convenient mobile apps for basic trading, as well as advanced web platforms with extended analytical capabilities.

Nordnet Summary

Your capital is at risk. Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Nordnet and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | Infront Web Trader, Infront Active Trader, Nordnet Autotrader, Nordnet API, and Mobile App for Android and iOS |

|---|---|

| 📊 Accounts: |

ISK (Investeringssparkonto | Investment Savings account); KF (Kapitalförsäkring | Capital Insurance); AF (Aktie-och fonddepå | Stocks and Funds Deposit); and Sparkonto (Savings account) |

| 💰 Account currency: | EUR, USD, SEK, NOK, DKK, and CAD |

| 💵 Replenishment / Withdrawal: | Bank transfers, online banking, Swish, and Trustly |

| 🚀 Minimum deposit: | No requirements |

| ⚖️ Leverage: | Up to 1:20 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | SEK 1 |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, indices, commodities, warrants, investment funds, ETFs, and ETCs; options on stocks and indices; futures on stocks; crypto indices, interest-bearing and non-listed securities |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Exchange |

| ⭐ Trading features: |

Active trading and use of long-term strategies are available; Certain trading instruments are available only to professional traders. |

| 🎁 Contests and bonuses: | Fee-free trading for new clients |

Nordnet specializes in stock exchanges of Northern Europe and offers access to trading on Nasdaq Stockholm, Oslo Børs, Nasdaq Copenhagen, Nasdaq Helsinki, First North, Nordic Growth Market, and Nordic MTF. Foreign markets offer stocks and ETFs listed on the Nasdaq, NYSE, Toronto Stock Exchange, London Stock Exchange, Xetra, and Euronext. Trading on the latter is available only by phone.

Nordnet Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

Nordnet’s user account is created by following the below procedures:

First, go to the broker’s official website and click the button at the top of the main page to start the account opening process.

Next, follow the on-screen instructions. If you don’t have BankID, contact technical support to open an account.

Upon installation of the Nordnet mobile app on your smartphone, open the account type that suits you best and fund it directly in your user account. Log into your user account with BankID first, then use a code generated in the mobile app.

Regulation and safety

The registered name is Nordnet Fonder AB, and it is supervised by Finansinspektionen. This authority has the power to ensure compliance with legislation and standards of financial regulation in the country. The registration number of Nordnet Fonder AB is 556541-9057.

Nordnet’s investment and savings accounts participate in the investor protection scheme of Sweden. If Nordnet fails to return funds or securities to its clients, the compensation fund covers traders’ losses. The maximum coverage is SEK 250,000 per client.

Moreover, according to the decision of Riksgälden, the Swedish government agency, client funds are protected by the state deposit guarantee. The standard coverage per client is up to SEK 1,050,000, however, some deposits may have coverage of up to SEK 5 million.

Advantages

- The broker participates in investor protection programs and deposit guarantees

- According to regulatory requirements, the broker capital and client funds are segregated

- The Swedish government guarantees compensation to the broker’s clients in case of bankruptcy

Disadvantages

- The broker provides its services only to residents and citizens of Scandinavian countries

- Regulatory rules may change over time, which affects service conditions or requirements for the broker’s clients

- Swedish regulation includes restrictions on leverage and the choice of investment products for non-professional traders

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Investeringssparkonto — ISK | $0.094 | DKK 0-DKK 499 |

Mobile trading apps are free. Use of other platforms costs DKK 125-DKK 1,000 a month. Also, there are fees for real-time quote broadcasting for Nordnet API platforms and Nasdaq.

Below is a comparative table with the fees of Nordnet and two international Forex brokers.

| Broker | Average commission | Level |

|---|---|---|

|

$4.8 | |

|

$1 | |

|

$8.5 |

Account types

Nordnet offers 4 account types that allow traders to conduct investment activities and wisely manage their capital. Each client can open up to 5 accounts of one type. Parents can manage the investment accounts of their children until they reach the age of maturity.

Account types:

Nordnet positions itself as a digital broker, which is why it offers remote creation of the user account in addition to opening it in the office.

The broker strives to provide products and solutions that allow traders to receive profits from their investment activities and to increase their capital in the long term.

Deposit and Withdrawal

-

Fees are not charged for withdrawing SEK to a verified bank account through Nordnet’s user account.

-

If withdrawal requests are submitted through a special form or by messages, DKK 200 is charged for such transactions, since these methods refer to manual withdrawals.

-

Also, Nordnet clients can make express transfers with a DKK 499 fee. If requests are submitted on a business day by 13:00 (GMT+1), money arrives in bank accounts the same day. If requests are submitted later, then it arrives the next business day.

-

If the withdrawal currency differs from the account currency, a conversion fee of 0.25% of the possible exchange rate is charged.

Investment Options

Nordnet offers various passive income options. Many of them are suitable for novice investors since they don’t require huge investments and deep knowledge of the stock market. However, they don’t guarantee profits, since the securities market is volatile.

Passive income options offered by Nordnet

Consider these main offers that provide for making income without the active participation by traders:

-

Shareville investment social network. The number of its participants is over 300,000. They can monitor each other’s trading activities, consult on investment products, give advice on the purchase/sale of assets, etc.

-

Purchase of shares in companies that pay dividends. The Nordnet website contains information on securities issuers that reward their shareholders. Holders of investment and savings account types don’t pay taxes for dividends of Swedish companies, which increases the total profitability of such investments.

-

Nordnet Autotrader platform. Its functionality provides for partial or full automation of trading. Users can create their own strategies, indicators, and trading robots, as well as compare them against historical data using the demo mode.

-

Investments in funds. The Nordnet platform provides over 1,600 funds with risk levels from 1 to 6 that refer to different industries. For example, investors can work with funds with sustainable growth indicators, small and average companies, developing markets, etc.

The easiest passive income option is a savings account. Once funds are credited, the accrual of the annual interest rate begins.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership programs from Nordnet:

The broker doesn’t offer partnership programs.

Customer support

Client service is provided from 8:30 to 19:00 Monday through Thursday and from 8:30 to 18:00 on Friday. The Trading Department is available from 8:30 to 17:45 Monday through Friday. Trading orders for U.S. markets are placed by phone from 15:30 to 22:00 (GMT+1).

Advantages

- Online support for registered clients is available

- It is possible to contact the broker by phone

Disadvantages

- The website guests can’t contact the broker in a live chat

- Support is available only on weekdays

Traders can contact technical support via the following communication channels:

-

Telephone numbers provided in the Contact us section;

-

Email;

-

User account.

The Nordnet website provides the address of the Stockholm office, where traders can visit to get assistance as well.

Contacts

| Registration address | Nordnet Fonder AB, Alströmergatan 39, 112 47 Stockholm, Sverige |

|---|---|

| Regulation | Finansinspektionen |

| Official site | https://www.nordnet.se/se |

| Contacts |

+4610-583 3000,

+4610-583 37 00 |

Education

To get access to education offered by Nordnet, go to the Nordnet Academy website. All educational materials are divided into topics, which simplifies the search for the required information.

To learn how to trade securities without the risk of losing funds, use the demo mode on trading platforms.

Comparison of Nordnet with other Brokers

| Nordnet | RoboForex | Pocket Option | Exness | FBS | Tickmill | |

| Trading platform |

Nordnet API, Nordnet Autotrader, Infront Active Trader, Infront Web Trader, Mobile application | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading | MT4, MT5, Tickmill Mobile App |

| Min deposit | No | $10 | $5 | $10 | $1 | $100 |

| Leverage |

From 1:1 to 1:20 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0.2 points | From 0 points |

| Level of margin call / stop out |

No | 60% / 40% | 30% / 50% | No / 60% | 40% / 20% | 100% / 30% |

| Execution of orders | Exchange execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | $5 | $30 |

| Cent accounts | No | Yes | No | No | Yes | No |

Detailed review of Nordnet

Nordnet is a stock broker that focuses on providing services to investors from Northern Europe. Its services range from trading financial instruments to lending and providing savings and pension accounts. Nordnet wants to become a digital platform for successful financial planning and capital accumulation for people of different ages.

Nordnet by the numbers:

-

Over 1,860,000 clients in 4 countries;

-

More than 12 million executed trades;

-

800+ employees;

-

Operating profit as of December 2023 is SEK 830 million.

Nordnet is a broker that aims to make investment easy and available for many people

Nordnet offers a wide choice of trading platforms. Infront Web Trader provides access to trading securities listed on the exchanges of the U.S., Sweden, Germany, Finland, Norway, Denmark, and Canada. Infront Active Trader also provides trading on 7 markets, but is designed for the most active traders. Nordnet Autotrader provides the widest choice of financial instruments and allows users to automate the trading process. Due to the API (Application Programming Interface) technology, traders can use their own software or third-party trading apps, which provides for creating a unique platform with personalized options and settings.

The demo version of Nordnet API is unavailable. Other platforms support a free demo mode, but not all of them are termless. For example, Infront Active Trader can be tested for free within 14 days.

Useful services offered by Nordnet:

-

Blog with useful articles and market data;

-

Videos on savings and investments;

-

Newsletters and daily market analysis;

-

Access to Shareville with investment ideas and the possibility to communicate with other participants;

-

Advice on choosing prospective stocks, ETFs, and mutual funds;

-

Demo mode for trading platforms to explore their functions and available markets.

Nordnet is a well-known digital platform for savings and investments that also provides three loan types and products for individual pension accruals.

Advantages:

Broad availability of trading instruments;

No requirements for the initial deposit;

Free opening of accounts;

Client investments and deposits are protected by the state;

Fast deposits and withdrawals through online banking systems;

Professional technical support.

User Satisfaction