Best Prop Firms With Weekly And Bi-Weekly Payouts

Best prop firm with weekly and bi-weekly payouts - FideIcrest

Prop firms with weekly and bi-weekly payouts are:

-

FideIcrest - Highly structured risk-managed trading environment

-

Topstep - Flexible trading strategies

-

FTMO - Rigorous path to prove trading abilities

-

Funded Next - Multiple funding models and profit-sharing

-

City Traders Imperium - Freedom to trade on own schedule

As a prop trader, early access to your hard-earned profits is crucial. Prop firms offering weekly and bi-weekly payouts cater to this need, providing faster access to capital and potentially greater control over your trading experience. This can be particularly beneficial for prop traders who rely on frequent portfolio adjustments or prefer the psychological comfort of knowing their earnings are readily available. However, choosing the right prop firm goes beyond just payout frequency. Let's delve into the key factors to consider when selecting a prop firm with fast and frequent payouts.

-

What are the advantages of receiving weekly payouts in prop firms?

Weekly payouts provide traders with consistent cash flow, reducing financial stress and allowing for quicker reinvestment of profits.

-

How do prop trading firms calculate trader payouts on a weekly basis?

Prop trading firms typically calculate trader payouts based on the trader's performance during the specified payout period, considering factors such as gains, risk management, and adherence to trading rules.

-

Are there specific performance metrics to receive weekly payouts?

Yes, prop trading firms often assess trader performance based on metrics like profitability, risk management, and compliance with trading guidelines to determine eligibility for weekly payouts.

-

Are there any requirements or qualifications to receive fast payouts in prop firms?

Some prop firms may require traders to meet minimum performance thresholds or maintain certain account balances to qualify for expedited payouts. Additionally, adherence to risk management policies and trading rules may be necessary.

Fastest payout prop firms

The following list features prop firms offering weekly and bi-weekly payouts. These firms provide traders with the opportunity to receive their earnings either every week or every two weeks, providing flexibility and regular income streams. Traders can choose the payout frequency that best suits their financial needs and trading preferences. This section will explore these prop firms and their payout structures, highlighting their benefits for traders seeking faster access to their profits.

FideIcrest

Fidelcrest is a proprietary trading company created by professional Forex market participants with more than 10 years of experience working for companies providing brokerage services. It was registered in 2018 in Cyprus but cooperates with traders from all over the world, including those residing in the USA. Fidelcrest offers Pro and Micro accounts for the MT4 terminal for trading currency pairs and CFDs on stocks, indices, metals, and commodity market assets. After passing the assessment and fulfilling the trading requirements, the trader gets the opportunity to trade using Fidelcrest funds. The minimum amount of funding is $10,000, and the maximum is $2 million.

-

Profit payouts are made automatically and in the currency that the trader used to pay the subscription fee

-

To withdraw funds, you can use bank transfers, PayPal, Skrill, Neteller, or Bitcoin transactions. Credit and debit cards can be used only for deposits

-

There is no minimum withdrawal amount

-

If a client withdraws profits to a bank account outside the SEPA zone, then a transaction fee of 50 euros is withheld. Fees from electronic payment systems are also possible. The company does not charge a withdrawal fee, regardless of the withdrawal method

Topstep

Topstep is an international proprietary trading company registered in the USA. The company has been providing financial services since 2012 and offers exclusive trading terms for clients from different countries. Topstep provides financing of real trading accounts of its clients if they prove the skill to make trades and manage risks on a simulation account. Traders can trade CME Group futures. Trading on real accounts is carried out through the ECN broker Equiti Capital.

Topstep offers three types of trading accounts: $50,000 ($50 monthly subscription), $100,000 ($99) and $150,000 ($149). Traders pay a one-time $149 Activation Fee, per Express Funded Account, upon passing. This fee is the same for all account sizes.

-

To withdraw funds from a Funded Account, the broker offers two methods: bank transfer and ACH

-

Payments from a Funded Account are processed within 7-10 business days

-

There are no hidden commissions. Withdrawal fee is $50; if the amount exceeds $500, the fee is paid by the brokerage company.Commissions of payment systems are paid by the client separately.The Topstep broker offers several ways to pay for a monthly subscription to Trading Combine: by Visa, MasterCard, PayPal, American Express, and Discover

-

The company requests that you use a standard credit or debit card because but sometimes credit cards or gift certificates may not work

-

The term for crediting funds to Trading Combine depends on the deposit method. Bank card transactions are processed within 1-2 business days, e-payment systems usually process payments faster

-

To pay for the monthly subscription, there is no need to go through verification. To withdraw funds from a Funded Account, verify your identity by filling out the proper forms

FTMO

FTMO is an international proprietary trading company created in the Czech Republic in 2014. The platform brings traders into its fold and after traders successfully pass a two-step testing regime, FTMO transfers 400 thousand dollars to the trader’s account. Transactions are monitored by FTMO to grow the deposit. There is a payment of 80% at the first stage of real trading. The 90% Profit Split is available only to those FTMO Traders that have reached Scaling Plan. The company works in full accordance with European financial legislation and is under the local regulator.

-

The information presented on the site refers to FTMO only. The trader does not make any investment other than testing fees

-

Fee payment options include credit cards, bank transfers, Skrill, Confirmo, Nuvei, Discover, Unlimint, etc

-

Withdrawal of money from a real account after passing the test is possible under the following conditions: the first request is 14 days after the opening of the first trade; the profit allocation system includes a 60-day period during which a withdrawal can be requested 3 times. There is no commission for withdrawing money

-

The withdrawal request processing time is 1-2 business days. Cryptocurrency payments are possible

Funded Next

Proprietary trading firm Funded Next works with the Eightcap broker (was founded in 2009 and is licensed by the Australian Securities and Investments Commission - ASIC, 391441). The prop firm has offices in the UAE, USA, and Southeast Asia and works with residents of all countries. It provides up to $200,000 with a growth potential of up to $4 million. The maximum leverage is 1:100. Funded Next offers 2 account types with 5 plans in each, which allows traders to select the best options. A partner’s profit share is 60%-90%, depending on his performance. The challenges are quite easy. To confirm his qualification, a user trades on a demo account, but the platform pays him 15% of his earnings in real funds. After that, the limits are minimal: at least 10 trading pays per month, up to 5% daily drawdown, and up to 10% overall drawdown. Partners trade on MetaTrader 4 and can use the prop firm’s proprietary mobile app for account control.

-

a trader’s first profit is 15% of the funds earned from the challenge (even though challenges are taken on demo accounts)

-

when trading on real accounts, traders get 60-80% of the profit earned and can potentially raise the payouts to 90% (the rest goes to the prop firm)

-

at first, funds can be withdrawn only once in 30 days. Later, withdrawals become available on request once in 14 days

-

traders can withdraw funds to bank cards, electronic or cryptocurrency wallets, or via bank transfers

-

profit can be withdrawn in USD or popular cryptocurrencies like BTC or ETH. Automated conversion is available

-

withdrawal requests are processed within several days

City Traders Imperium

City Traders Imperium is an educational and prop (proprietary) firm established in 2018 in the UK by two professional traders. Clients who have completed the evaluation stage and are funded by City Traders Imperium can receive a profit split from 70% to 100% when they trade successfully. The firm gives its own capital only to active market participants who trade themselves and do not copy the trades of other traders. City Traders Imperium offers plans for intraday trading and long-term strategies. A direct funding program is also available.

-

Traders cannot withdraw money they used to pay the subscription fee. They can only withdraw profits earned after they complete the (i) evaluation and (ii) qualification stages and start trading with live funds provided by the firm

-

To submit a withdrawal request, send an email to funding@citytradersimperium.com stating your account number and the withdrawal amount. All positions must be closed

-

Withdrawal conditions depend on the financing plan. Withdrawal of profits under Standard and Classic Evaluation plans is possible only when a target profit of 50% is achieved. Money is credited in one payment to the card which was used to pay the subscription fee

-

Portfolio managers and traders who have chosen Direct Funding can withdraw money after the net profit exceeds the initial payment amount. Available withdrawal methods are bank transfers, Wise, Revolut, and PayPal

-

New participants of the Day Trading Challenge can withdraw profit after a month of trading on a live account, but if the target profit of 15% is achieved, the profit can be withdrawn earlier. Also, after achieving the target profit of 15%, withdrawal becomes available every two weeks, and not once a month. After 4 months of successful trading without violations of the requirements and submitting four withdrawals, a trader can withdraw profits every Friday

-

Withdrawal in USDC cryptocurrency is available on the Polygon/Matic network. Money is credited to the wallet within 24-48 hours from of the moment the withdrawal request is submitted

FTUK

The British prop (proprietary) firm FTUK offers instant funding and standard accounts with a two-phase challenge to confirm the qualifications. The initial fee starts at £119 for a balance of $14,000. Initially, the maximum amount for a trader’s account is $90,000, but scaling up to $5,760,000 is possible for all accounts. There are no time limits at the funding stage. Traders can transfer positions overnight, trade news and during the weekends, use advisers, and copy trades. The only restriction is the total drawdown. FTUK works with the EightCap broker, which provides such trading instruments as currency pairs, cryptocurrencies, indices, commodities, and metals. The leverage is up to 1:50 on standard accounts and up to 1:100 on aggressive ones.The maximum allowed drawdown is 5% of the balance. Account currency is USD, EURO, or GBP. Trading is carried out through the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms and their mobile versions. This prop firm offers a referral program with payments of 10% of the initial fee of the invited user.

-

Traders’ transactions are not brought to the interbank market when completing the challenge, so they do not earn profits

-

At the funding stage, partners of the prop firm trade on the interbank market and can make a profit for successful transactions

-

As soon as traders reach the profit target, they get the first level of scaling, which increases the balance by 400%

-

Being at the first level or higher, a partner of the firm can at any time submit an application for withdrawal of funds

-

Funds are withdrawn in the currency of the account. It can be USD, EURO, or GBP

-

FTUK has no additional fees or commissions.Withdrawals are possible to bank cards or e-wallets. Also, PayPal, Revolut, Wise, and other popular payment systems are available

The5ers

The5ers is a prop trading company. The5ers was registered in Israel in 2016 and has several representative offices globally, the largest of which is located in the United Kingdom. It uses the MT5 trading platform, which allows for the trading of currencies, stocks, precious metals, and indexes. Registration is paid, and the price starts at $235 ($85 of which is for the education program). Platform fees are below the market average. Its distinguishing feature is that it provides funding to traders by making free deposits into their accounts ranging from $6,000 to $4 million. This money cannot be withdrawn, but it is possible to withdraw profits from their use in the proportion of 50/50 (that is, half of the profit goes to the company). The leverage is up to 1:30. The5ers describes itself not as a broker, but as a platform for active trading with funding opportunities.

-

The company has not set a minimum withdrawal amount. This means that a trader can withdraw funds at any time and in any amount

-

The trader has several withdrawal options, the most common of which are transfers to a bank account and electronic payment systems

-

The5ers does not charge a withdrawal fee, but it is taken by third-party services (for example, payment systems)

-

Withdrawals are available in the following currencies: EUR, USD, GBP, JPY, CAD, AUD, NZD, and CHF

-

Keep in mind that if your account is blocked, you will be unable to withdraw funds (for example, if you have been inactive for 21 days)

Lux Trading Firm

The British proprietary trader (prop trader) Lux Trading Firm cooperates with Barclays, the country’s largest financial conglomerate. Lux Trading Firm’s official partners are Credit Suisse and Goldman Sachs banks. The company’s liquidity provider is an Australian internationally regulated broker Global Prime. Lux Trading Firm offers 4 account types. The minimum enrollment fee is 149 GBP (after evaluation, enrollment fees are fully refunded). Clients can get $25,000-$200,000 under management and grow their balances up to $10 million using TradingView, TraderEvolution, or MetaTrader 4.

-

A trader’s balance is displayed on Lux Trading Firm’s dashboard, and his funds are held in his Global Prime account. Nobody has access to that account

-

A trader can withdraw all or part of his funds at any moment. The prop firm and the broker do not set a minimum withdrawal amount

-

The following withdrawal channels are available: bank accounts and cards, online transfers, and electronic wallets

-

Lux Trading does not charge withdrawal fees. Spread and trading fees are calculated before withdrawal, taking into account the channels used. Traders pay the commissions of payment systems on their own

Audacity capital

The prop (proprietary) trading firm Audacity Capital is unique in that it does not work with retail brokers. It cooperates with an institutional liquidity provider, which allows it to receive the tightest spreads. Professional traders can open an account with a balance of $15,000 without taking an entry test. For beginners, the company offers a two-stage challenge, which takes place on a demo account. In the future, partners of the prop trader will receive 50% or 75% of the net profit depending on the account selected. The maximum possible drawdown is 10%. At the same time, whenever clients reach a profit of 10%, their account balance doubles. The maximum balance is $480,000. There are no restrictions on trading strategies. Trading is possible only via the MetaTrader 4 platform.

-

Depending on the selected account type, a trader receives 50% or 75% of the net profit

-

Bonuses for the referral program are also credited to the user account of the platform’s partner

-

Traders can withdraw funds once a month by submitting an application in their user accounts

-

Withdrawal to a bank account, a bank card, or an e-wallet is possible, and other means are also available

-

Traders can find out about all commissions and related fees in their user accounts

-

There are no withdrawal fees. Spreads and commissions depend entirely on the broker or liquidity provider. There is a subscription fee of £99 per month. Paid training programmes are available (£649)

Comparison table

| Name | Payout Cycle (weekly/upon reaching the profit or bi-weekly) | Key features |

|---|---|---|

Bi-weekly |

Offers virtual accounts for trading currency and CFDs using the company’s funds |

|

Upon reaching profit |

Provides traders with capital and tools to navigate and profit from various market conditions |

|

Bi-weekly |

Offers a unique 2-step Evaluation Process for traders. Upon successful completion, traders are offered to trade on an FTMO Account with a balance of up to $200,000 |

|

|

Evaluation: Bi-weekly Express: Monthly One-step Stellar: Every 5 Days Two-step Stellar: Bi-weekly |

Offers two funding models and a total of ten plans, giving a trader up to 90% of his net profit |

|

Weekly |

Offers different trading programs with no time limits, balance-based drawdown, and rapid scaling plan |

|

Upon reaching profit |

Offers several account types, including instant funding, a large selection of assets, and leverage of up to 1:100 |

|

|

Instant Funding: Upon reaching the profit target High-stake Challenge: Bi-weekly Bootcamp Challenge: Upon reaching the profit target |

Offers traders access to funded accounts of up to $10,000,000 in just six stages |

|

Upon reaching the profit target |

Offers quick access to live environment accounts, substantial starting capital options, and fast scaling opportunities |

|

|

Funded Trader Program: Upon reaching the profit target Ability challenge: Monthly |

Offers two distinct funding programs: the Funded Trader Program and the Ability Challenge account |

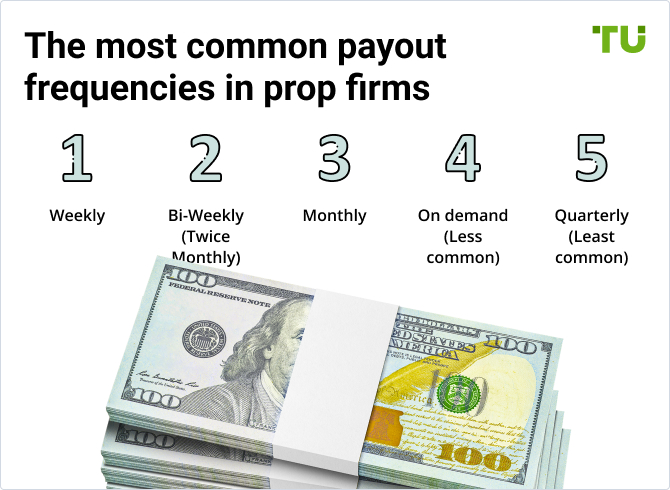

The most common payout frequencies in prop firms

The most common payout frequencies in prop firms vary, but here's a breakdown:

Weekly

This option provides the fastest access to your profits, typically every seven days.

Bi-Weekly (Twice Monthly)

Another popular choice, allowing earnings to be received every two weeks.

Monthly

A standard cycle for many prop firms, granting access to profits once a month.

On demand (Less common)

Some prop firms offer on-demand withdrawals, providing flexibility but may entail limitations or processing fees.

Quarterly (Least common)

Payouts occur every three months, making it the least frequent option due to potential cash flow challenges for prop firms.

Advantages of weekly and bi-weekly payments

👍 The advantages of weekly and bi-weekly payments in prop firms include several benefits:

• Increased liquidity

More frequent payments, like weekly or bi-weekly, can enhance cash flow and liquidity for traders. This is especially advantageous for those who depend on trading income for their daily expenses.

• Risk reduction

Smaller and more frequent payments help lessen the risk of significant losses stemming from market volatility. With payments occurring more often, traders can better manage their risk exposure and potentially keep away substantial downturns.

• Faster withdrawal of profits

Weekly or bi-weekly payments facilitate quicker profit withdrawals. Traders receive their earnings more frequently, enabling them to access their profits sooner and potentially reinvest them in other ventures.

• Psychological comfort

Regular payments instill a sense of security and stability for traders. The assurance of consistent payments can alleviate financial stress and worry, allowing traders to concentrate on refining their trading strategies.

Can prop traders request expedited payouts?

Prop traders may have the option to request expedited payouts from select prop firms, which offer on-demand or accelerated payout features. These policies allow traders to withdraw their earnings more frequently, typically on a weekly or bi-weekly basis, instead of waiting for monthly or quarterly payouts.

On-demand payouts enable traders to submit withdrawal requests according to their preferred schedule, with the prop firm's accounting department processing these requests within a short timeframe, usually within three business days. Some firms offer on-demand payouts through various methods, such as bank transfers, cryptocurrency, or direct communication channels like email or Discord.

Accelerated payout cycles provide another avenue for traders to access their earnings more regularly. For example, some firms implement 14-day or bi-weekly payout cycles, allowing traders to receive their profits sooner and potentially reinvest them elsewhere.

However, it's important to note that expedited payouts may come with certain conditions:

-

Minimum withdrawal amount: Traders may be required to have earned a minimum amount before being eligible for expedited payouts

-

Fees: Expedited withdrawals could incur additional processing fees to cover the extra administrative work involved

-

Limited frequency: Some prop firms may limit how often traders can request expedited payouts to prevent misuse or abuse of the system

How to choose a prop firm with weekly or bi-weekly payouts

When selecting a prop firm with weekly or bi-weekly payouts, traders should consider several key factors:

Payout structure and frequency

Seek prop firms that provide weekly or bi-weekly payouts, like Funding Traders, where payouts occur every 7 days. This frequent payout schedule enhances cash flow and diminishes personal risk.

Trading strategies and support

Opt for a prop firm that aligns with your trading strategies and offers educational resources.

Risk management policies

Look into prop firms with adaptable trading rules and substantial autonomy. FundedNext, for example, emphasizes responsive client support and efficient risk management.

Performance measurement

Evaluate the firm's performance assessment methods, such as Fidelcrest, which analyze gains, risk management practices, and adherence to trading regulations.

On-demand and accelerated payouts

TU expert Rinat Gismatullin suggests considering prop firms that provide on-demand or accelerated payout options.

Drawdown limits

Understand the maximum allowable loss on your account before it gets closed. Choose a prop firm with drawdown limits that fit your risk tolerance.

Expert opinion

As an expert in the field of prop trading and financial markets, I firmly advocate for prop firms that offer bi-weekly or weekly payouts to traders. These payout frequencies provide numerous advantages that contribute to the overall success and satisfaction of traders.

Firstly, the ability to receive earnings on a bi-weekly or weekly basis significantly enhances traders' liquidity and cash flow. This regular influx of funds enables traders to better manage their financial obligations and capitalize on emerging opportunities in the market without being hindered by lengthy payout cycles.

Additionally, the psychological comfort provided by bi-weekly or weekly payouts cannot be overstated. Knowing that earnings will be deposited into their accounts on a regular basis alleviates stress and anxiety associated with financial uncertainty. This allows traders to focus their energy and attention on refining their trading strategies and maximizing their performance in the markets.

Conclusion

In conclusion, prop firms that provide weekly and bi-weekly payouts offer significant advantages to traders. These payout frequencies enhance liquidity, mitigate risks associated with market volatility, and provide psychological comfort by ensuring regular income streams. By considering factors such as payout structure, support for trading strategies, risk management policies, performance measurement, and payout options, traders can make informed decisions when choosing a prop firm. Overall, opting for a prop firm with weekly or bi-weekly payouts can contribute to a more stable and rewarding trading experience.

Methodology

Traders Union applies a rigorous methodology to evaluate prop companies using over 100 both quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

-

Trader Testimonials and Reviews. Collecting and analyzing feedback from existing and past traders to understand their experiences with the firm

-

Trading instruments. Companies are evaluated on the breadth and depth of assets/markets available to trade

-

Challenges and Evaluation Process. Analyzing the firm's challenge system, account types, evaluation criteria, and the process for granting funding

-

Profit Split. Reviewing the profit split structure and terms, scaling plans, and how the firm handles profit distributions

-

Trading Conditions. Examining the leverage, execution speeds, commissions, and other trading costs associated with the firm

-

Platform and Technology. Assessing the firm's proprietary trading platform or third-party platforms it supports, including ease of use, functionality, and stability

-

Education and Support. Quality and availability of training materials, webinars, and one-on-one coaching

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).