deposit:

- $119

Trading platform:

- MT4

- MT5

- Three account types

- four balance options

- profit split is up to 80%

- minimum trading restrictions

- scaling is available for all accounts

- withdrawals are possible anytime

- training for traders

- Up to 1:100

Summary of FTUK Trading Company

FTUK is a moderate-risk prop trading firm with the TU Overall Score of 6.29 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by FTUK clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this firm as not all clients are satisfied with the company, according to reviews. FTUK ranks 9 among 41 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

FTUK provides favorable trading conditions, due to which it can successfully compete with the leaders of the segment. Several account types, including instant funding, a large selection of assets, and leverage of up to 1:100 with an almost complete absence of restrictions, allow traders to work in a comfortable, individually-adapted environment. Additional advantages are a mentoring system, internal training, and high-quality and prompt technical support. In addition, FTUK offers a partnership program that allows socially active traders to make good money.

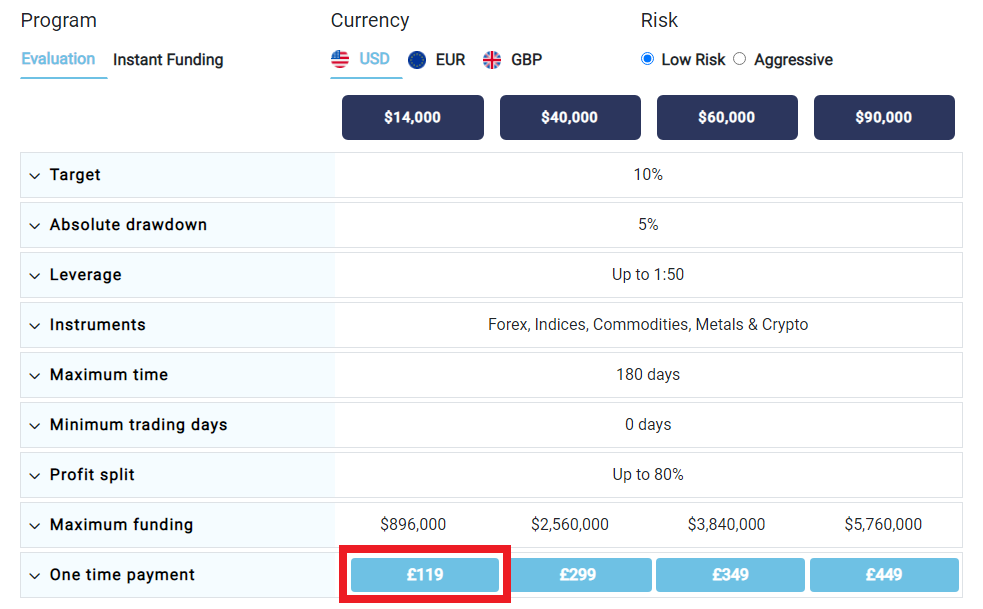

The British prop (proprietary) firm FTUK offers instant funding and standard accounts with a two-phase challenge to confirm the qualifications. The initial fee starts at £119 for a balance of $14,000. Initially, the maximum amount for a trader’s account is $90,000, but scaling up to $5,760,000 is possible for all accounts. There are no time limits at the funding stage. Traders can transfer positions overnight, trade news and during the weekends, use advisers, and copy trades. The only restriction is the total drawdown. FTUK works with the EightCap broker, which provides such trading instruments as currency pairs, cryptocurrencies, indices, commodities, and metals. The leverage is up to 1:50 on standard accounts and up to 1:100 on aggressive ones. Account currency is USD, EURO, or GBP. Trading is carried out through the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms and their mobile versions. This prop firm offers a referral program with payments of 10% of the initial fee of the invited user. As of the writing of this article, there is debate whether FTUK stands for “Federation of Trade Unions of Kyrgyzstan” or “Federation of Trade Unions Kawthoolei”. None of FTUK’s web content makes an effort to clarify the confusion. It is nonetheless interesting to note that FTUK is not listed among the 20 best brokers in Kyrgyzstan. And while Kawthoolei or Kaw Thoo Lei (meaning: “A Peaceful Land”) is located in Myanmar (Burma), FTUK is likewise not listed among the 20 best brokers in Myanmar. Thus, currently, it is unknown exactly what the acronym FTUK represents, only that it is registered in London.

| 💰 Account currency: | USD, EUR, and GBP |

|---|---|

| 🚀 Minimum deposit: | $119 |

| ⚖️ Leverage: | Up to 1:100 |

| 💱 Spread: | No |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, indices, commodities, and metals |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with FTUK:

- Balance for a standard account is up to $90,000 without restrictions on trading strategies;

- Accounts with instant funding allow you to get the required balance without a challenge;

- Initial fees start from £119. There is no subscription fee or other fees;

- Traders’ profit split is up to 80%. It increases as the balance is scaled;

- Withdrawal of funds is possible upon positive balance at any moment without time limits;

- Specialists of the prop firm provide its partners with expert consultations and improved trading skills;

- Technical support is represented by a call center, live chat, and email.

👎 Disadvantages of FTUK:

- There are large, non-standard gaps between balance steps. A trader can get only $14,000, $40,000, $60,000, or $90,000 in funding;

- Trading is carried out through MetaTrader platforms only; therefore, other platforms are not offered;

- Technical support responds promptly, but it works only on weekdays and at certain times.

Evaluation of the most influential parameters of FTUK

Geographic Distribution of FTUK Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of FTUK

FTUK is headquartered in London. The firm is officially registered and it is subject to financial legislation. It is partnered with Eightcap. Many other prop firms work with this broker. It is highly reliable and regulated. The broker offers a lot of assets, leverage, and tight spreads.

FTUK allows its partners to work with currencies, cryptocurrencies, indices, metals, and commodities. Leverage depends on both the asset and the level of the trader. A trader’s level is defined by scaling. Scaling is not mandatory, but it is necessary to increase the balance and profit split of a partner, as well as to increase the leverage. The initial profit split is 50%, but it can be increased up to 80%.

The scaling process itself is quite simple. All you need is to achieve a 10% profit and send a request to technical support. First, the balance is increased by 400%, then it doubles up to the limit. The limit is defined by the initial balance. The maximum is $5,760,000. No other prop firm provides its partners with such a maximum. The system is simple and transparent, and it is suitable for traders of any level. TU notes that the prop firm provides free materials and free consultations for its partners.

In terms of trading processes, FTUK fully justifies its claims of minimal restrictions. Traders can really use any trading strategy, transfer positions overnight, and trade news daily, including weekends. Advisers and copy trading are available. However, today many prop trading firms offer similar conditions to compete successfully. When trading with FTUK, you need to monitor only the total drawdown, which is 5% for all account types. It is also necessary to place a stop loss. It has its own indicator and depends on the scaling level.

The referral program is standard. Trading is carried out through MT platforms. They are the most popular and the majority of traders work with them. The prop firm has a good training system, although professionals are unlikely to find anything interesting. Finally, although technical support is highly rated, it does not operate 24/7. As a disadvantage, some experts note the variability of the balance and the dependence of leverage on scaling. However, there are many more advantages of this proprietary firm. Therefore, Traders Union recommends the platform for cooperation.

Dynamics of FTUK’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Prop trading firms do not offer traditional investment solutions. That is, traders cannot, for example, buy dividend stocks or invest in cryptocurrency staking. Some reviews consider referral programs, which are also called partnership programs, as an option for passive income. In fact, to make a significant profit with such options, you need to be socially active, and best of all, have a popular blog. However, this can really be a nice bonus.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Referral program from FTUK:

A trader can fill out a special form on the website and receive a personal link. It can be placed on any platform. Users who follow the link will become referrals of its owner. As soon as a referral pays the initial fee, 10% of that amount will go to the owner of the link. Traders have the opportunity to invite any number of referrals to the prop firm’s website and receive bonuses for each of them who join. Funds are credited to the partner's main account as soon as the referral's payment is accepted and processed. Also, funds can be immediately transferred to an external wallet. Peculiarities of partnership are discussed individually through technical support.

Trading Conditions for FTUK Users

For most prop firms, the initial fee depends on the type of account and the balance. In the case of FTUK, the account does not matter, but it is the balance that is important. The larger the balance, the higher is the initial fee. For example, to get $14,000, you need to pay £119. But if you want $90,000, the fee will be £449. From the very beginning, all groups of assets are available to traders, but the leverage depends on scaling. Initially, the leverage cannot exceed 1:10. At the maximum level, it is 1:50 or 1:100 for an Aggressive account. Technical support is represented by all communication channels, namely a call center, live chat, and email. But managers only work Monday through Friday from 09:00 to 18:00 GMT.

$119

Minimum

deposit

1:100

Leverage

8/5

Support

| 💻 Trading platform: | MT4, MT5 |

|---|---|

| 📊 Accounts: | Standard Low Risk, Standard Aggressive, and Instant Funding |

| 💰 Account currency: | USD, EUR, and GBP |

| 💵 Replenishment / Withdrawal: | Bank cards and e-wallets |

| 🚀 Minimum deposit: | $119 |

| ⚖️ Leverage: | Up to 1:100 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 Spread: | No |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, indices, commodities, and metals |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: |

Three account types; four balance options; profit split is up to 80%; minimum trading restrictions; scaling is available for all accounts; withdrawals are possible anytime; training for traders |

| 🎁 Contests and bonuses: | No |

Comparison of FTUK to other prop firms

| FTUK | Topstep | FTMO | Funded Trading Plus | SurgeTrader | E8 Funding | |

| Trading platform |

MT4, MT5 | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | EightCap M4, EightCap M5 | MT4, MT5 |

| Min deposit | $119 | $1 | $155 | $119 | $250 | $138 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:10 |

From 1:1 to 1:100 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0 points | From 0.1 points | From 0 points |

| Level of margin call / stop out |

No | 1% / 1% | 50% / 50% | No | 50% / 50% | No |

| Execution of orders | No | ECN | Instant Execution | Market Execution | Market Execution | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| FTUK | Topstep | FTMO | Funded Trading Plus | SurgeTrader | E8 Funding | |

| Forex | Yes | No | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | No | No | Yes | Yes | Yes | Yes |

| Indexes | Yes | No | Yes | Yes | Yes | Yes |

| Stock | No | Yes | Yes | No | Yes | Yes |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | No |

FTUK Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard Low Risk | From $1 | No |

| Standard Aggressive | From $1 | No |

| Instant Funding | From $1 | No |

This type of account and the balance influence the amount of the initial fee, but not the profit split. Immediately after completing the challenge on standard accounts, the partners’ profit split is 50%. They get the same amount if they choose an Instant Funding account. The profit split increases are the same for all accounts. However, the scaling limit is different. For example, for a standard account with an initial balance of $14,000, a trader can receive a maximum of $896,000 in the future. And for the balance of $60,000, the maximum scaling is $3,840,000. Therefore, if traders are aimed at progressive trading, they need to carefully consider which initial fee is best for them.

Detailed review of FTUK

FTUK does not implement any unique mechanisms. It is a standard prop firm. But it has some points that are rarely found at its competitors. For example, it is a non-refundable initial fee. Also, not all firms provide their partners with instant funding without completing a challenge. Leverage rarely reaches 1:50, while FTUK offers it at 1:100 for currency pairs at maximum scaling on Aggressive accounts. Many of the advantages of this prop firm are the result of its partnership with Eightcap. This applies to the already mentioned high leverage, as well as to a large selection of assets. For its part, the firm is doing everything to provide its partners with comfortable working conditions. First, there is the absence of restrictions on trading styles and strategies, as well as the ability to withdraw profits at any time.

FTUK by the numbers:

-

Minimum initial fee is £119;

-

Scaling limit is $5,760,000;

-

Profit split is up to 80%;

-

Maximum allowable drawdown is 5%.

FTUK is a prop trading firm for trading on favorable conditions

Many platforms provide their partners with a strictly limited set of assets. Most often these are currency pairs and sometimes stocks and indices, but cryptocurrencies are gaining in popularity. FTUK allows you to trade all financial instruments that are in the Eightcap’s pool. These are currencies, cryptocurrencies, indices, commodities, and precious metals. There are hundreds of instruments in total. This diversity is a conceptual advantage because traders do not need to limit themselves in their choice. Also, trading different assets is a good opportunity to diversify your risks. Considering that FTUK offers leverage of up to 1:100, partners of the platform should definitely reinsure by any means. After all, a large leverage increases the potential profit, but at the same time, the risk increases proportionally.

Useful features of FTUK:

-

Standard accounts are presented by two subtypes, namely Low Risk and Aggressive. They differ in profit target, available leverage, and some other parameters;

-

Professional traders do not need to complete the challenge. They can choose Instant Funding accounts and immediately receive the required balance;

-

To trigger scaling, traders need to make a profit of 10% regardless of the type of account. The first time you scale, the balance is increased by 400%, then it is doubled.

Advantages:

Three account types and four balance options allow traders to choose an account that best fits their goals and skills;

Traders pay the initial fee and give a share of their profit to the firm. There are no other fees;

Initially, the partner's profit split is 50%, but in the process of scaling it can be increased up to 80%;

Scaling is available on accounts of all types.

Clients of the firm trade without restrictions. All they need is to place a stop loss and monitor the drawdown;

Hundreds of financial instruments are available for trading. Leverage is up to 1:100;

Traders can receive additional income through the partnership program.

Guide on how traders can start earning profits

Traders’ opportunities are greatly determined by the type of account and the balance, so it is important to make the right choice. FTUK offers two standard accounts, namely Low Risk and Aggressive. The first option is distinguished by a time limit of 180 days for completing the challenge and by a reduced 10% profit target. Also, Low Risk accounts offer the maximum leverage for currency pairs, which is 1:50. If traders choose the Aggressive option, the maximum leverage will be 1:100, but the time limit to complete the challenge will be 90 days, and the profit target will increase to 25%. As for the Instant Funding account, it is intended for professional market participants who are ready to pay the risk to the prop firm. It means they have to deposit 10% of the maximum available drawdown to immediately receive up to $90,000 on their accounts.

Account types:

Investment Education Online

It is profitable for the prop firm that its partners improve their skills. Because the more proficiently traders work, the more they earn and, accordingly, the more the platform earns. Many firms buy specialized materials, host webinars, and even run their own training courses. FTUK also offers to raise the level of its partners, so the firm’s blog contains useful articles on the theory and practice of trading, which are conveniently structured by thematic groups.

FTUK offers a wide range of materials on trading psychology and money management. It is difficult to say how useful they will be for professionals, but novice traders will definitely find a lot of important and necessary information in the blog.

Security (Protection for Investors)

FTUK is officially registered in the UK, but it does not need a license from an international regulator, because it does not bring its traders' transactions to the interbank market. This is done by Eightcap. The broker is regulated and its official website contains a complete package of documents indicating the current licenses. Thus, the partners of the prop firm can have no doubt that their transactions quickly enter the international markets and are executed in accordance with the regulations.

👍 Advantages

- Traders can contact the prop firm’s experts

- It is possible to address the broker’s technical support

👎 Disadvantages

- It is impossible to get help on the regional level

Withdrawal Options and Fees

-

Traders’ transactions are not brought to the interbank market when completing the challenge, so they do not earn profits;

-

At the funding stage, partners of the prop firm trade on the interbank market and can make a profit for successful transactions;

-

As soon as traders reach the profit target, they get the first level of scaling, which increases the balance by 400%;

-

Being at the first level or higher, a partner of the firm can at any time submit an application for withdrawal of funds;

-

Funds are withdrawn in the currency of the account. It can be USD, EURO, or GBP;

-

Withdrawals are possible to bank cards or e-wallets. Also, PayPal, Revolut, Wise, and other popular payment systems are available.

Customer Support Service

Despite the intuitive interface of the website and a detailed FAQs section, traders will in any case face emergency situations and issues that they cannot resolve on their own. It is important that the partners of the prop firm can use the help of professionals at any time. For this, FTUK offers a call center, live chat, and email. However, support is not available 24/7. Managers of the client support service are available Monday through Friday from 09:00 to 18:00 GMT.

👍 Advantages

- Non-registered users can contact technical support

- During working hours responses in the call center and live chat are prompt

👎 Disadvantages

- It is impossible to get help on weekends and non-working hours on weekdays

To contact technical support, use the following channels:

-

call center;

-

email;

-

live chat on the website and in the user account.

Note that the prop firm has official profiles on popular social networks, including Facebook, YouTube, Twitter, Instagram, etc. You can subscribe to them to keep up to date with the latest news.

Contacts

| Foundation date | 2021 |

| Registration address | Kemp House, 160 City Road, London, EC1V 2NX, United Kingdom |

| Official site | https://ftuk.com/ |

| Contacts |

Email:

support@ftuk.com,

Phone: +44 (20) 8798 2605 |

Review of the Personal Cabinet of FTUK

To start trading with the prop firm, you need to register, confirm your personal data, and pay the initial fee. Traders Union has provided the below step-by-step guide for you.

Go to the official FTUK website. In the main block click the "Get Funded Now" button.

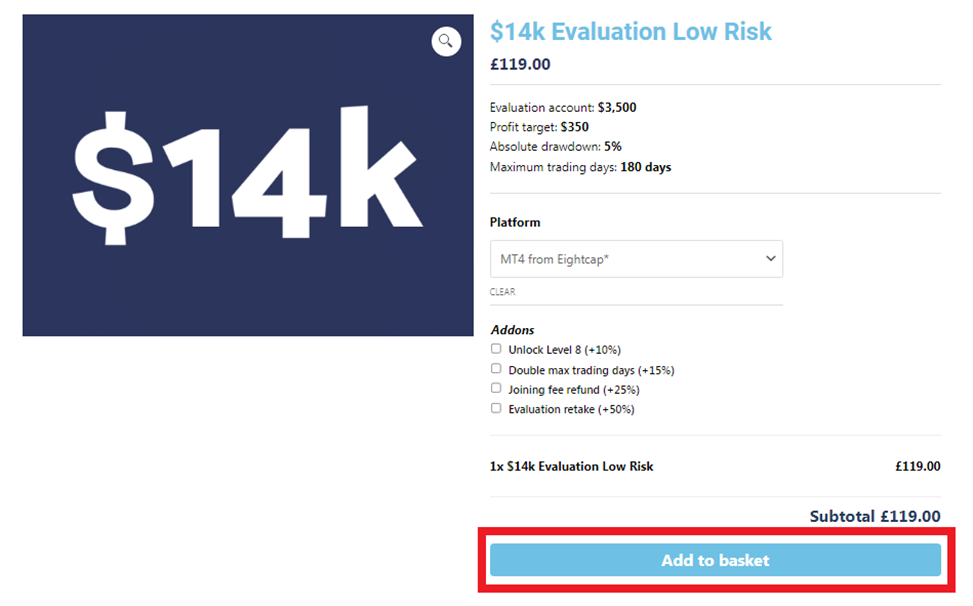

Select the type of account and currency. Read the trading conditions carefully. Then click on the initial fee corresponding to the required balance. For example, if you need the balance of $14,000, click the "£119" button.

Review the trading conditions again. Select the platform to work with. Optionally, specify additional account options, and then click the "Add to Basket" button.

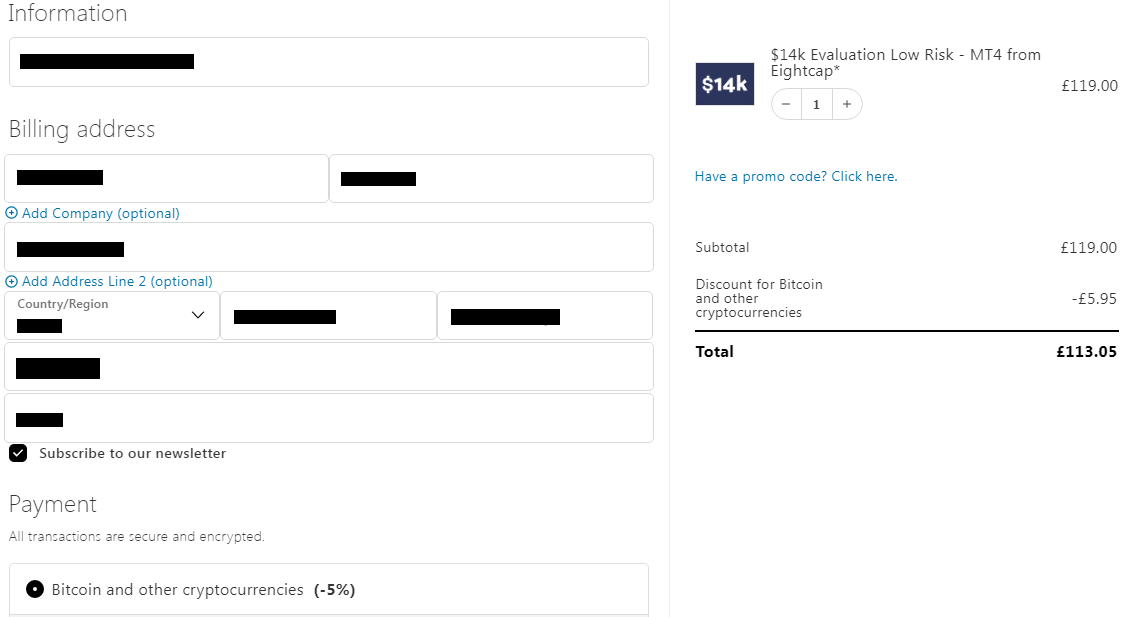

Enter your email address, first and last names, registration address, and phone number. Then select the appropriate payment method and enter the required details. Click the "Go to ..." button. The name of the system through which you will make the payment will be indicated here. Follow the instructions on the screen. As soon as the payment is credited to the account of the prop firm, you will have full access to your user account and will be able to start the challenge, or immediately trade if you have chosen Instant funding.

More features of FTUK’s user account:

-

The dashboard contains aggregated data on active accounts. A trader can get detailed information about the progress in the challenge, open and closed positions, and other transactions;

-

There are profile settings in the user account, where a partner of the prop firm has the opportunity to change personal data, including billing address, as well as set security parameters, such as password, confirmation, etc.;

-

An application for withdrawal of funds is also submitted through the user account. Traders see all their applications and their statuses. The information is updated in real-time, as the prop firm works 100% transparently;

-

The corresponding section of the user account contains information about the user's referrals. Here a list of referrals, their statuses, and payments are displayed. Money can be withdrawn to an external wallet.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

How do client reviews impact FTUK rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about FTUK you need to go to the company's profile.

How can I leave a review about FTUK on the Traders Union website?

To leave a review about FTUK , you need to register on the Traders Union website.

Can I leave a comment about FTUK if I am not a Traders Union client?

Anyone can post a comment about FTUK in any review about the company.

Traders Union Recommends: Choose the Best!