deposit:

- $1

Trading platform:

- MT4

- MT5

- CySEC

- FSC (Mauritius)

- FSA

- FSCA

- 120%

deposit:

- $1

Trading platform:

- MT4

- MT5

- CySEC

- FSC (Mauritius)

- FSA

- FSCA

- 120%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of JustMarkets Trading Company

JustMarkets is a moderate-risk broker with the TU Overall Score of 6.33 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by JustMarkets clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. JustMarkets ranks 53 among 409 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

JustMarkets is a multi-asset broker with reliable regulation, providing services globally through its network of offices.

JustMarkets is a Forex and CFD broker using ECN and STP technologies, offering over 260 trading instruments and leverage up to 1:300 (depending on the trader's country). In over 10 years of operation, the company has attracted approximately a million traders from 190+ countries and has established four offices in different regions. JustMarkets holds licenses from CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), and FSC (Mauritius), and has received numerous international awards, including Best Broker in Asia and Africa. The company's services are unavailable to traders from the U.S., and each JustMarkets subsidiary has regional restrictions.

| 💰 Account currency: |

USD, EUR, GBP – all countries PLN – EU countries JPY, VND, MYR, ZAR, THB, IDR, KWD, CNY – countries outside the EU |

|---|---|

| 🚀 Minimum deposit: | $10 or $100 (depending on the country) |

| ⚖️ Leverage: | Up to 1:30, up to 1:300, up to 1:3000 (depending on the country and trader qualification) |

| 💱 Spread: |

Standard and Standard Cent – from 0.3 pips Pro – from 0.1 pips Raw Spread – from 0.0 pips |

| 🔧 Instruments: | Forex, indices, metals, energy, stocks, cryptocurrency pairs (not available in the EU) |

| 💹 Margin Call / Stop Out: |

CySEC: 80%/50% Other regulators: 40%/20% |

👍 Advantages of trading with JustMarkets:

- Regulation in four jurisdictions, including within the EU;

- A diverse range of trading assets, particularly currency pairs and CFDs on stocks;

- Low spreads and competitive lot fees on ECN accounts;

- High-quality and comprehensive education for beginners;

- Provision of classic MetaTrader platforms;

- Services for generating passive income;

- Partner and bonus programs with favorable conditions.

👎 Disadvantages of JustMarkets:

- Cent accounts and trading on MT4 platforms are unavailable to traders from the European Economic Area (EEA);

- Instant card deposits are not supported but funds are credited to the wallet balance within 30 minutes;

- Payouts from the investor compensation fund are exclusively available to clients from EU countries.

Evaluation of the most influential parameters of JustMarkets

Table of Contents

Geographic Distribution of JustMarkets Traders

Popularity in

Video Review of JustMarkets i

JustMarkets Latest Comments for 2024 i

Share your experience

- Best

- Last

- Oldest

Expert Review of JustMarkets

JustMarkets is a Forex and CFD broker with multiple branches and an impressive client base. The technological aspect of this company is at the highest level. To protect user data, the website employs a secure SSL connection with all transferred information encrypted. The company uses a multi-level server system with a complex data backup scheme to ensure protection against leaks and losses.

JustMarkets allows clients to employ many trading styles and does not set restrictions on the number of simultaneously open trades. Swift order execution (speed from 0.01 seconds) enables traders to efficiently use short-term strategies, such as scalping. Trading directly with liquidity providers without the involvement of dealing centers is done with the narrowest spreads and honest quotes.

The broker offers services for generating passive income, allowing even novice traders without trading experience to earn. JustMarkets has developed a comprehensive educational center with valuable information for beginners and provides access to demo and cent accounts on the MetaTrader 4 platform. The support service is available 24/7 in various languages, and you can request a callback and chat with a JustMarkets representative online.

Latest JustMarkets News

Dynamics of JustMarkets’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

JustMarkets does not specialize in investing, but it provides its clients with ways to automate trading processes and allocate funds for management. Trust management services are implemented through the MAM system, allowing experienced MT4 account managers to execute trades using the funds of connected investors. For investors, MAM investments represent a form of passive income, as they do not need to trade financial instruments themselves.

Copy trading is a service for earning income through trading signals

If a JustMarkets client successfully trades assets, they can increase their profit by using copy trading. To do this, one needs to open a new or connect an existing Standard or Pro account to the trading signals service and execute trades in their preferred mode. If a trade yields profit, the copying traders will be charged a commission, which will be credited to the signal provider's account. Features of copy trading for subscribers (investors):

-

Signal provider's trades are automatically copied to the investment account;

-

Fees are charged only for profitable trades;

-

Order copying speed is less than 1 second;

-

Compensation calculation for signal providers is done weekly and deducted from investors' accounts on Saturdays;

-

Investors can set the proportion of copied orders and unsubscribe from the trader at any time, which suspends the duplication of trades. Detailed statistics on fees and performance are available for each signal provider. The trader's profile also includes the profit coefficient, number of subscribers, and order directions.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership programsof JustMarkets:

-

IB (Introducing Broker) receives a portion of JustMarkets' trading fee withheld from the trades of attracted traders. For the 1st level, the reward is $10 for each closed lot on major currency pairs, $12 on minors and gold, and $25 on other instruments. IB also earns 10% of sub-partners' earnings, and the most successful ones additionally receive $2,000 at the end of the month;

-

Partnership programs are implemented in two ways. The first is the Revenue Share plan, where participants receive up to 65% of the broker's profit from the trading of referrals. The second type of reward is a one-time CPA commission payment, with a maximum amount of $1,500 for each attracted trader.

JustMarkets also offers other types of partnerships, including Regional Representative, Payment Agent, and White Label. These programs are more oriented toward companies rather than individuals. Experienced traders can become partners as Multi-Account Managers (MAMs), but after registration, they need to deposit a minimum of $5,000 and involve an equal amount of funds from two or more investors.

Trading Conditions for JustMarkets Users

JustMarkets offers ECN and STP accounts, over 260 trading instruments, and MetaTrader platforms. The minimum deposit amount depends on the trader's country and account type: for EU residents, it is $100 (for any account); for residents of other regions, it is $10 for Standard and Cent accounts; and $100 for Pro and Raw Spread accounts. The maximum leverage for retail traders from the EU is 1:30; for professional traders, it is 1:300. Clients from other countries can trade with leverage up to 1:3000 on any available account type.

$1

Minimum

deposit

1:3000

Leverage

24/7

Support

| 💻 Trading platform: | MT5 (all countries), MT4 (outside the EU) |

|---|---|

| 📊 Accounts: | Demo, Pro, and Raw Spread (in all countries), Standard Cent and Standard (outside the EU), Islamic |

| 💰 Account currency: |

USD, EUR, GBP – all countries PLN – EU countries JPY, VND, MYR, ZAR, THB, IDR, KWD, CNY – countries outside the EU |

| 💵 Replenishment / Withdrawal: |

Primary methods: credit/debit cards, bank transfer, Neteller, Skrill – all countries Additional: PayPal – EU Perfect Money, FasaPay, Sticpay, cryptocurrencies, local payment systems, wallets, and cards – other countries |

| 🚀 Minimum deposit: | $10 or $100 (depending on the country) |

| ⚖️ Leverage: | Up to 1:30, up to 1:300, up to 1:3000 (depending on the country and trader qualification) |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: |

Standard and Standard Cent – from 0.3 pips Pro – from 0.1 pips Raw Spread – from 0.0 pips |

| 🔧 Instruments: | Forex, indices, metals, energy, stocks, cryptocurrency pairs (not available in the EU) |

| 💹 Margin Call / Stop Out: |

CySEC: 80%/50% Other regulators: 40%/20% |

| 🏛 Liquidity provider: | 18 major global banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market Execution |

| ⭐ Trading features: | Social trading, MAM service, EA advisors allowed |

| 🎁 Contests and bonuses: | Welcome bonus, deposit bonus, referral bonus |

Comparison of JustMarkets with other Brokers

| JustMarkets | RoboForex | Eightcap | Exness | AMarkets | Pepperstone | |

| Trading platform |

MT4, MobileTrading, MT5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, AMarkets App | MT4, MobileTrading, WebTrader, cTrader, MT5, TradingView |

| Min deposit | $1 | $10 | $100 | $10 | $100 | $1 |

| Leverage |

From 1:1 to 1:3000 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:3000 |

From 1:1 to 1:400 |

| Trust management | Yes | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

40% / 20% | 60% / 40% | 80% / 50% | No / 60% | 50% / 20% | 90% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Instant Execution |

| No deposit bonus | $30 | No | No | No | No | No |

| Cent accounts | Yes | Yes | No | No | No | No |

Broker comparison table of trading instruments

| JustMarkets | RoboForex | Eightcap | Exness | AMarkets | Pepperstone | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | No | Yes |

| Options | No | No | No | No | No | No |

JustMarkets Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Raw Spread | From $0 | Charged by the broker in case of trading inactivity |

| Pro | From $1 | Charged by the broker in case of trading inactivity |

| Standard | From $3 | Charged by the broker in case of trading inactivity |

| Standard Cent | From $0.3 | Charged by the broker in case of trading inactivity |

Swaps are charged for orders carried over to the next trading day. They can be negative, positive, or zero (for some currency pairs and metals).

The table below shows the average trading fee values for JustMarkets, RoboForex, and Pocket Option, along with a comparison of their levels.

| Broker | Average commission | Level |

| JustMarkets | $1.1 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed review of JustMarkets

JustMarkets sources liquidity from major global banks, keeps client funds in segregated accounts, and prioritizes data confidentiality. Clients have access to trades with virtually zero spreads, as well as the option to trade on demo and cent accounts. Specializing in CFD and Forex markets, JustMarkets does not provide direct access to stock exchanges.

JustMarkets by the numbers:

-

Holds 4 licenses;

-

Services available in 197 countries;

-

Over 1 million clients;

-

A new account is opened every 8 seconds;

-

85% of registered traders are repeat clients.

JustMarkets is a broker designed for active trading in currency and CFD markets.

The broker, regulated by multiple authorities, offers different trading conditions for traders from various countries. The CySEC-licensed division in Cyprus provides a more diverse selection of Forex assets (69 pairs) and CFDs on stocks (174). Other branches allow trading in 61 currency pairs and 165 CFDs on stocks, but also offer more indices (13 instead of 11) and metals (7 instead of 5) to their clients. The range of energy resources is the same across all branches such as gas, Brent, and WTI crude oil. The CySEC-regulated company does not support transactions with digital assets, while branches licensed by FSA (Seychelles) and FSC (Mauritius) offer trading with 14 cryptocurrency pairs.

Traders opening an account with the Cyprus-based JustMarkets can trade only on the MetaTrader 5 platform. Other company branches, besides MT5, also offer MetaTrader 4.

Useful Functions of JustMarkets:

-

MAM system provides income opportunities for both CFD market professionals and investors, including beginners;

-

Analytics offers daily forecasts and market reviews on the broker's website. Additionally, analysts cover upcoming events every Monday that could impact asset prices;

-

Market reports, sent to the user's email after subscription. This service is complimentary.

Advantages:

Retail traders cannot lose more funds than invested, thanks to the option of negative balance protection;

Social trading and algorithmic trading with the use of EA advisors are available;

Regular bonuses and fee discounts are offered to new and existing clients;

The company regularly provides comprehensive analytics and offers an economic calendar;

Advanced data encryption tools are applied;

The broker offers clients a wide range of assets and accounts, along with analytical data and quality technical support at any time.

Guide on how traders can start earning profits

JustMarkets offers two types of accounts – trading and demo. The latter can only be used for transactions with virtual funds. For real-market trading, MT4 and MT5 accounts of different types are available, differing in the initial deposit amount, transaction fee, and assortment of tradable assets.

Account Types:

Traders using the CySEC-regulated broker receive one of two statuses – Retail or Professional – upon registration. The size of the provided leverage depends on the qualification. Trading conditions for JustMarkets clients vary as the broker operates in compliance with the requirements of different regulators.

JustMarkets’s bonuses

Welcome Bonus

It is $30 and is a no-deposit bonus credited to a special Welcome account. To transfer the profit to the trading account, the trader must close a minimum of 5 lots within 30 days and avoid exceeding the profit or loss indicators by 6 pips.

Deposit Bonus

The amount of this bonus depends on the deposited sum. For Cent accounts, the bonus is 50% for any replenishment. Pro and Standard account holders receive 100% on every deposit ranging from $100 to $499, and 120% for deposits of $500 and above.

Referral Bonus

According to the terms of the "Just Invite Friends" promotion, an existing JustMarkets client can receive rewards for the trading activities of the users they have invited. The bonus per lot ranges from $4.75 to $25, depending on the type of account on which the new trader executes transactions.

Investment Education Online

Training for beginners provided by JustMarkets serves as a high-quality introduction to the Forex market. Through this training, novice traders can not only familiarize themselves with the currency market but also understand important nuances for the development of their trading strategies.

The Demo account is designed for training beginners and refining strategies for experienced traders. JustMarkets offers demo accounts on both the MT4 and MT5 platforms and these demo accounts can be used for a period of 30 days.

Security (Protection for Investors)

JustMarkets is a multi-regulated brokerage company holding license SD088 from the Financial Services Authority of Seychelles (FSA) and license GB22200881 from the Financial Services Commission of Mauritius (FSC). It is also registered with the Financial Sector Conduct Authority of South Africa (FSCA) under the number FSP 51114. The mentioned regulatory bodies ensure that the broker operates under the legislation of the countries in which it is registered and adheres to the rules of the international financial markets. The FSA, FSC, and FSCA do not have compensation funds, meaning that clients' funds from their licensees are not protected from loss.

Traders from European Union countries (excluding France and Belgium) are served by the JustMarkets unit with license number 401/21 issued by CySEC, the Cyprus Securities and Exchange Commission. This regulator is not only among the most authoritative and stringent but also provides recourse through its Investor Compensation Fund (ICF). In case of the broker's bankruptcy or refusal to withdraw invested funds, each client under the supervision of CySEC can reclaim up to €20,000.

👍 Advantages

- Rights and obligations of both the company and its clients are clearly defined in the user agreement

- The trading account balance cannot go below zero even when using leverage

- The broker cannot use client deposits as they are held in bank accounts rather than within JustMarkets

👎 Disadvantages

- Compensation for losses is available only to traders from the EU

- CySEC prohibits transactions in cryptocurrencies

- Leverage for retail clients from the EU is limited to 1:30

Withdrawal Options and Fees

-

The company processes withdrawal requests from verified clients within 2 business days. After confirmation, funds are credited to the card or e-wallet within 2 hours, to the bank account within 6 days, and to local payment systems within 24 hours. Cryptocurrency transactions take up to 3 hours for crediting;

-

For all countries, withdrawal options include cards, bank transfers, Neteller, and Skrill. EU residents can also use PayPal, while residents of other countries can use cryptocurrency transactions, FasaPay, Perfect Money, STICPAY, and local payment systems;

-

The minimum withdrawal amount for the EU is EUR 50 for bank transfers and EUR 1 for other systems. Traders outside the EU, as well as those from France and Belgium, can withdraw a minimum of $500 via bank transfer and from $5/€5 using other methods;

-

JustMarkets does not charge a withdrawal fee, but it may deduct 3% of the total withdrawal amount or the full amount of fees incurred for processing the payment, but only from accounts used for trading. If no trading activity has occurred, the company may deduct 3% of the total withdrawal amount or the full amount of fees incurred for processing the payment.

Customer Support Service

JustMarkets supports over 10 communication methods, but the chat is the most accessible as it operates 24/7 in 11 languages.

👍 Advantages

- Any trader can request a callback

- Fast support through online communication channels

👎 Disadvantages

- There is no email communication form in the contact section

- Charges may apply for calls made through mobile operators

Traders can seek assistance through various communication channels, including:

-

Chat on the website and in the user account;

-

Email;

-

Phone call;

-

Callback request form;

-

Instagram;

-

Telegram;

-

Skype;

-

Messengers: Facebook, Viber, and Line.

Traders using iOS devices can also use iMessage for communicating with technical support.

Contacts

| Foundation date | 2012 |

| Registration address | JustMarkets Ltd, Grigori Afxentiou, 13&15, Ide Ioannou Court, Office 102, Mesa Geitonia, 4003, Limassol, Cyprus |

| Regulation |

CySEC, FSC (Mauritius), FSA, FSCA Licence number: 401/21, GB22200881, SD088, 51114 |

| Official site | https://justmarkets.com/ |

| Contacts |

Email:

support@justmarkets.com,

Phone: +371 67 881 045 |

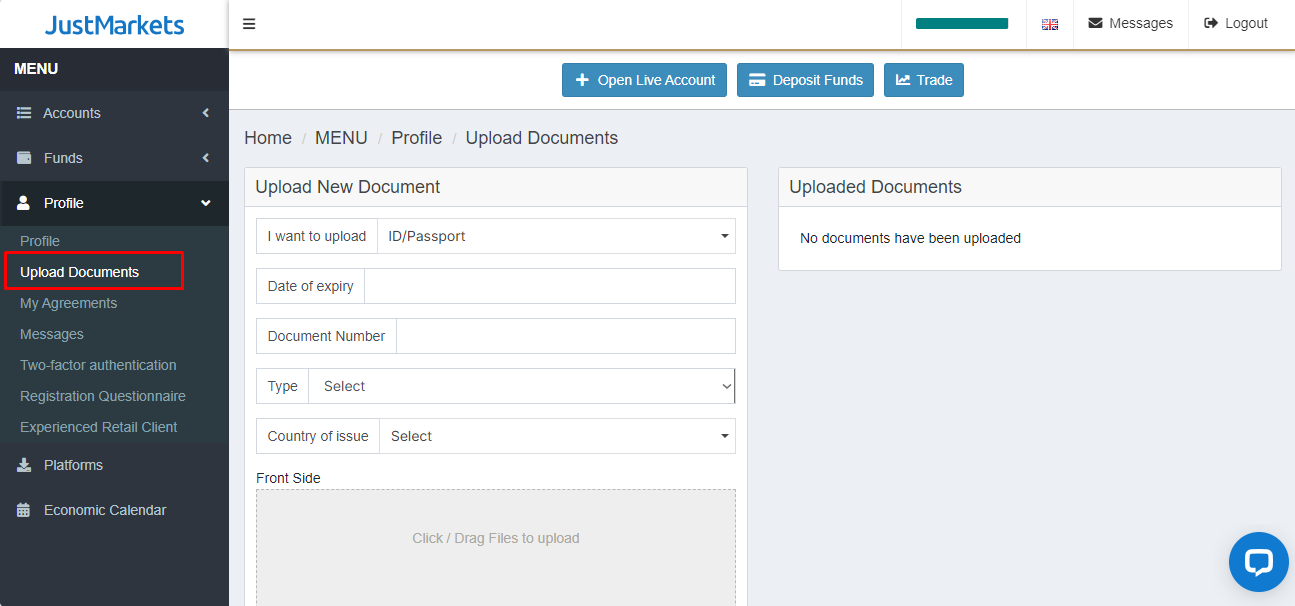

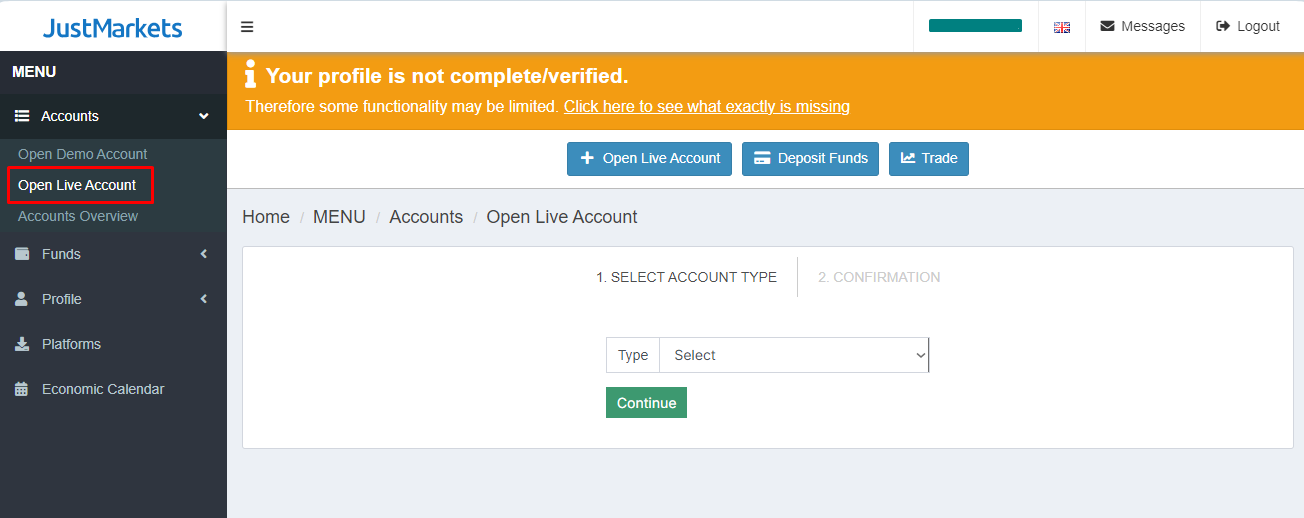

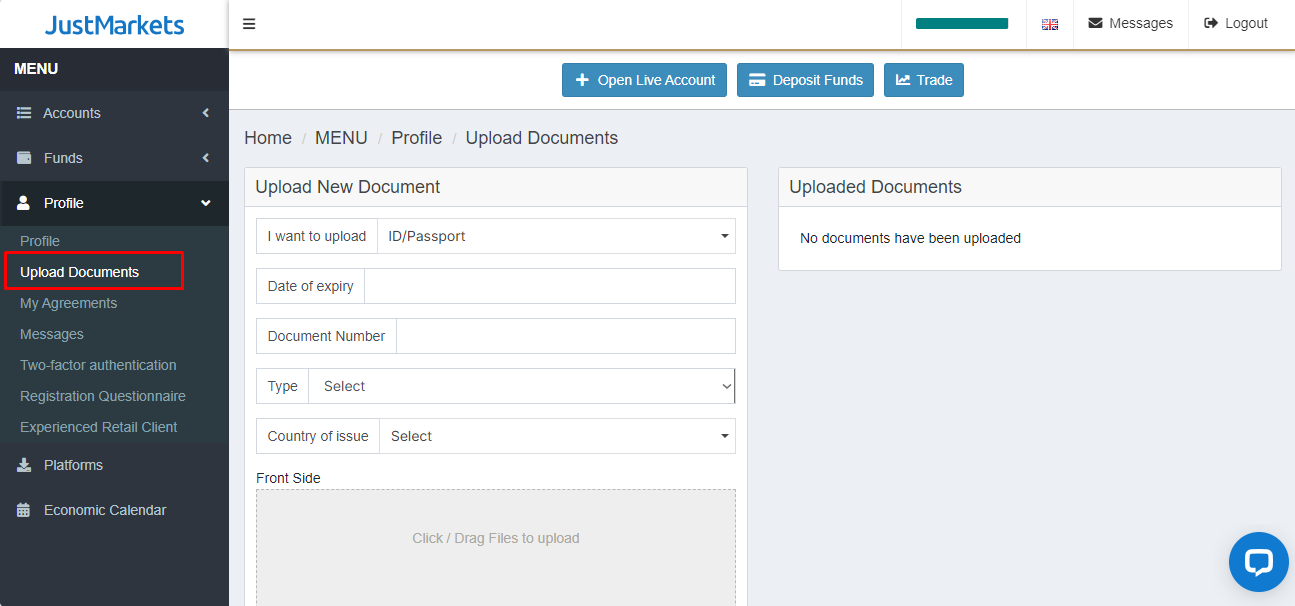

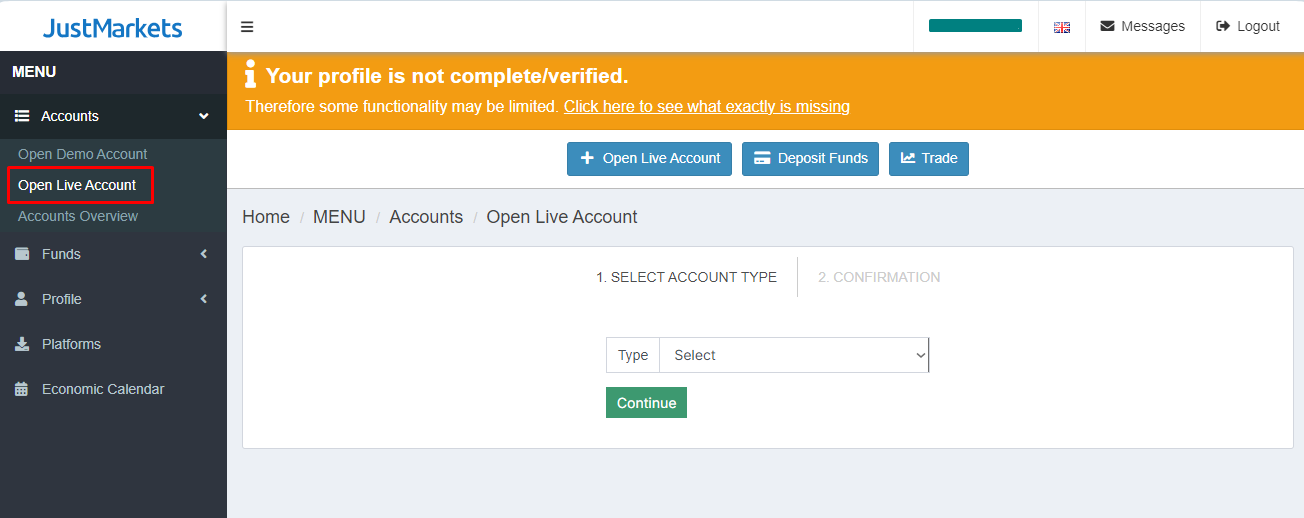

Review of JustMarkets’s user account

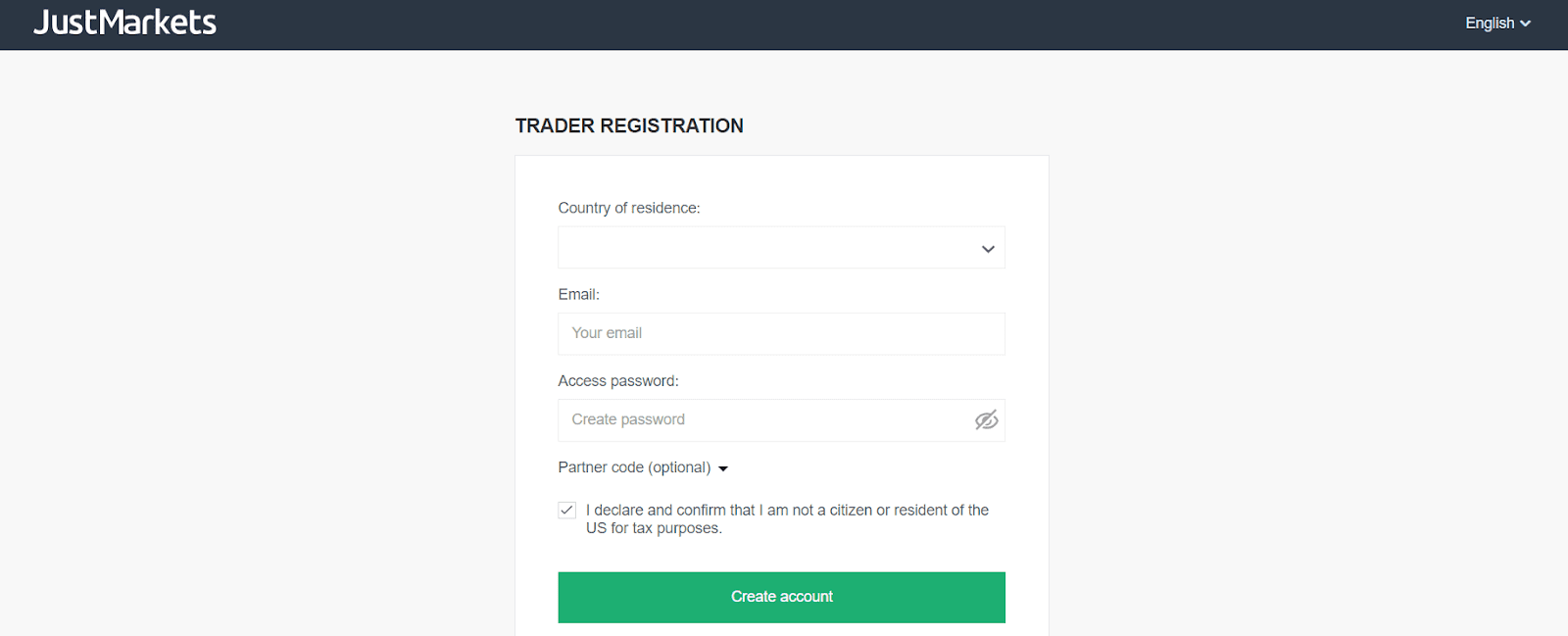

Below is a brief guide on registering on the JustMarkets website, along with an overview of the user account.

The first step in creating an account is to fill out the client's questionnaire. To display it on the screen, click on "Registration" or “Create Account.”

The broker requests the country, email, and a unique password (which must be created according to the specified rules). Also, at this stage of registration, a partner code is indicated if the account is opened upon the invitation of an active JustMarkets client. The next step is to confirm the email and complete the profile. For subsequent logins to the personal account, you should use the data (email and password) specified in the registration form.

Functions of the JustMarkets’ user account:

On the user account you can perform the following actions:

-

Fund trading accounts and withdraw profits earned on them;

-

Download trading platforms or access WebTrader;

-

Transfer funds between your accounts and view transaction history;

-

Create demo accounts and top up virtual deposits when needed;

-

Use the economic calendar and other analytical tools.

Disclaimer:

Your capital is at risk. Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

Do reviews by traders influence the JustMarkets rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about JustMarkets you need to go to the broker's profile.

How to leave a review about JustMarkets on the Traders Union website?

To leave a review about JustMarkets, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about JustMarkets on a non-Traders Union client?

Anyone can leave feedback about JustMarkets on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.