What Is The Best Time To Trade USD/INR?

The best time to trade USD/INR is from 9:00 AM to 12:00 PM (GMT), coinciding with activity in European financial markets, and 3:00 AM to 6:00 AM (GMT), aligning with activity in Indian financial markets. Trading during these hours can be effective, as the USD/INR pair is very volatile, as our research shows.

While the Forex market operates around the clock, this doesn't imply that every moment presents equally favorable trading opportunities.

In this article, we address the misconception that trading in the foreign exchange market is equally beneficial at all hours and aims to provide guidance on the best times to trade USD/INR, a popular currency pair.

Is USD/INR a good pair to trade?

Yes, USD/INR can be a good pair to trade for several reasons.

Firstly, the Indian economy's robust growth and the U.S. dollar's status as a global reserve currency contribute to its appeal.

Additionally, USD/INR can present opportunities due to price fluctuations driven by various factors such as economic data, geopolitical events, and market sentiment.

It also comprises potential drawbacks. The lack of substantial news and events on economic calendars can be a con for some traders, as it may result in less frequent trading opportunities and increased volatility when significant news does emerge.

The best times to trade USD/INR

When planning to trade USD/INR pair, you should pay special attention to what hours it is better to do it. Because unlike many other currency pairs, USD/INR trading is inactive when the U.S. financial markets are open.

European Session - This occurs from approximately 09:00 AM - 12:00 PM (GMT), when the European and London financial markets are open.

Asian Session - Trading hours are from 03:00 AM - 06:00 AM (GMT), when the Indian financial markets are open.

These trading hours are considered to be the best time to trade USD/INR.

However, it doesn't offer the guaranteed win-win situation. You always need to explore and experiment through Demo accounts to understand the market well.

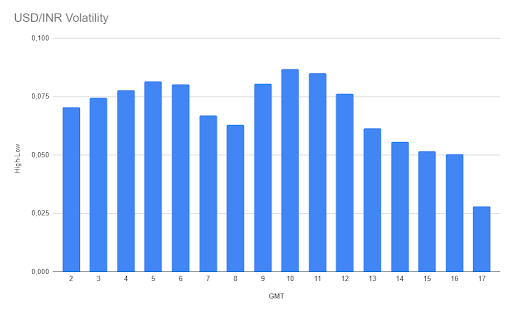

What is the daily volatility of the USD/INR?

The chart shown below represents the volatility based on the trade timings.

USD/INR Volatility - Source: TU’s research

Highest Volatility - The highest volatility of the USD/INR pair, as indicated by the chart, occurs between 10:00 AM and 11:00 AM (GMT). This can be with the release of significant economic news that directly affects the USD or Indian Rupee exchange rate.

Lowest Volatility - This usually occurs in the late evening hours in India. After 1:00 PM (GMT), the USD/INR market has very low volatility.

USD/INR trading hours

USD/INR trading is available 2AM to 5PM (GMT), five days a week.

The volatility of USD/INR during intraday trading can vary based on different market sessions and overlaps.

Asian Session

The Asian trading session, primarily centered around the Indian market, begins at approximately 9:00 AM IST (3:30 AM GMT). Volatility is driven by local economic news and events in the Asia-Pacific region.

European Session

The European trading session, which includes the London market, starts at around 8:00 AM GMT. Volatility is high during the overlap with the Asian session.

American Session

The American trading session, led by New York, begins at around 1:00 PM GMT (6:30 PM IST). For many currency pairs, the overlapping European and US trading sessions are the most volatile, but not for USD/INR.

How to trade USD/INR?

Here are some key considerations when trading USD/INR

-

Currency Pair Dynamics: Familiarize yourself with the USD/INR currency pair. Keep an eye on factors such as interest rates, inflation, and trade balances in both the U.S. and India.

-

Economic Data: Pay close attention to economic data releases for both the U.S. and India. Key reports, such as GDP figures, employment data, and central bank decisions, can significantly influence USD/INR.

-

News and Events: Stay updated with financial news and events, not only from the Reserve Bank of India (RBI) but also from major central banks like the Federal Reserve (Fed). Central bank decisions, monetary policy announcements, and political developments can be market-moving.

-

Technical Analysis: Utilize technical analysis tools to identify trends, support, and resistance levels, and potential entry and exit points.

-

Educational Resources: Continuously educate yourself about Forex trading and the specific nuances of USD/INR trading. For educational purpose, you can read our prediction in this article: US dollar to Indian Rupee Signals and Price Predictions

How to start trading the USD/INR currency pair

To start trading the USD/INR currency pair, follow these steps:

-

1

Choose a Reputable Broker: Select a reliable forex broker that offers USD/INR trading. Ensure the broker is regulated and provides a user-friendly trading platform. You can choose a broker that supports INR trading. Read the list of brokers that support INR trading here: Best Forex Brokers That Support Rupee Trading.

-

2

Account Setup: Open a trading account with your chosen broker. Consider choosing a demo account initially to practice trading without risking real money.

-

3

Market Analysis: Analyze the USD/INR currency pair. Study the factors that influence the exchange rate and use technical analysis tools.

-

4

Trading Strategy: Create a trading plan that outlines your strategy, including entry and exit criteria, position sizing, and risk management rules.

After having a trading strategy in your mind, you can start trading right away. It's important to trade to understand the real time market cycles. Experiment with your strategies to know what works the best for you.

Summary

While trading USD/INR, it's important to be aware of the risks associated with Forex trading, including market volatility, economic events, and the potential for losses.

Trading during specified hours, such as during the overlap of major trading sessions, can be more sensible for active traders as it offers increased liquidity and better trading opportunities. This approach helps reduce exhaustion and ensures traders are alert and focused during crucial market movements.

FAQs

Is currency trading 24 hours in India?

Currencies are traded on the international forex market, which is open 24/5. While in India, you can access forex through a broker and thus get the opportunity to trade currencies 24 hours a day.

What is USD INR trading?

USD/INR trading refers to the exchange of the U.S. dollar (USD) against the Indian rupee (INR) in the forex market. It allows traders to speculate on the exchange rate between these two currencies.

Which time to trade forex in India?

The best time to trade forex in India is during the European and American trading sessions, which are from 9:00 AM to 5:00 PM GMT+5:30. During these sessions, there is more liquidity and volatility, which can lead to more opportunities for profit.

What is the time of USD INR trading?

The USD/INR trading hours are from 9:00 AM to 5:00 PM Indian Standard Time (IST) from Monday to Friday.

Glossary for novice traders

-

1

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

2

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

3

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

-

4

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

-

5

Day trading

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).