Betaalbare aandelen onder $5 om te kopen

Ontdek investeringsmogelijkheden op het gebied van centen aandelen met onze gids "10 goedkope centen aandelen onder $5 om nu te kopen". TU-experts verdiepen zich in de specifieke kenmerken van penny stocks, onderzoeken de belangrijkste spelers en analyseren financiële prestaties, strategische samenwerkingen en markttrends, waarbij ze inzichten bieden om uw investeringsbeslissingen te begeleiden. Experts bieden analyses met technische voorspellingen en grafieken, zodat onze lezers een beter inzicht krijgen in het traject van elk aandeel.

Top 10 Goedkope penny aandelen om in te beleggen zijn:

-

Taboola.com Ltd (TBLA) - Dynamisch advertentiebedrijf met sterke financiële cijfers.

-

Enel Chile SA (ENIC)- Diverse hernieuwbare energie, sterke financiële resultaten, stijgende trend.

-

CorMedix Inc. (CRMD) - FDA-goedgekeurde katheteroplossing, strategische partnerschappen.

-

Heron Therapeutics Inc. (HRTX) - Robuuste financiële resultaten, pijn- en kankerbehandelingen.

-

Mama's Creations Inc. (MAMA) - Indrukwekkende financiële groei, kant-en-klaarmaaltijden.

-

Overseas Shipholding Group (OSG) - Robuuste resultaten voor het derde kwartaal, milieuvriendelijke vlootaanpak.

-

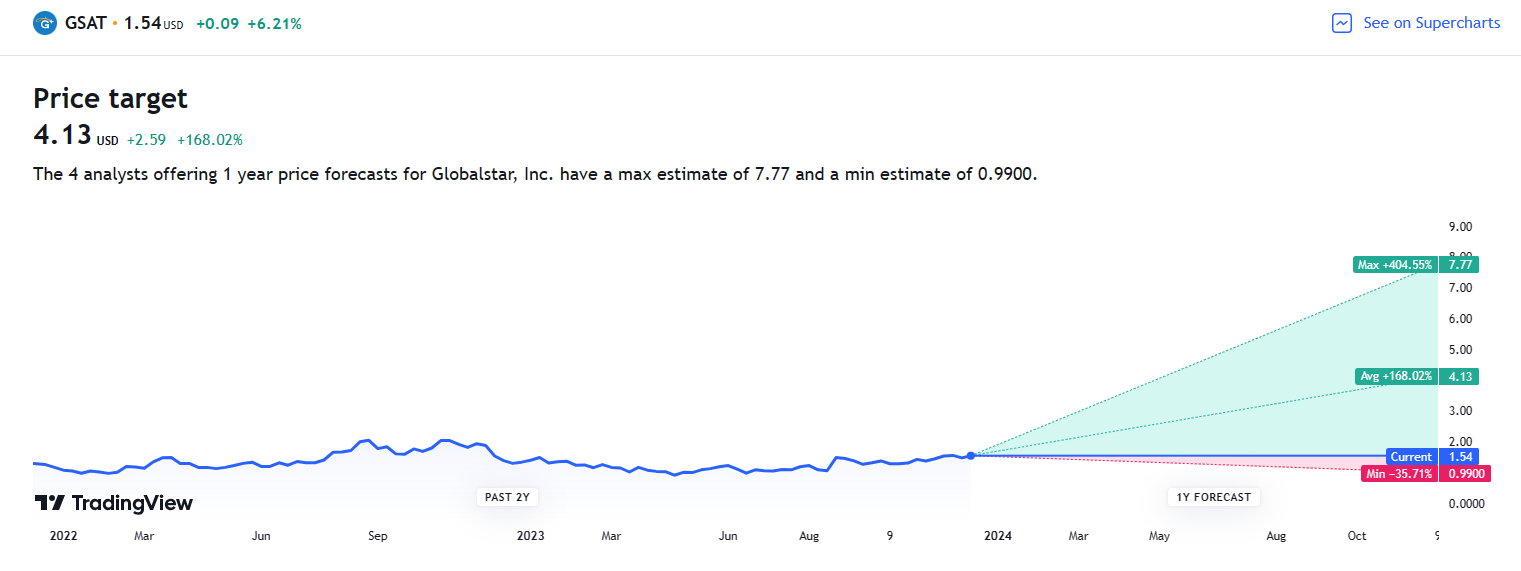

Globalstar Inc (GSAT) - 53% omzetstijging, sterke strategische initiatieven.

-

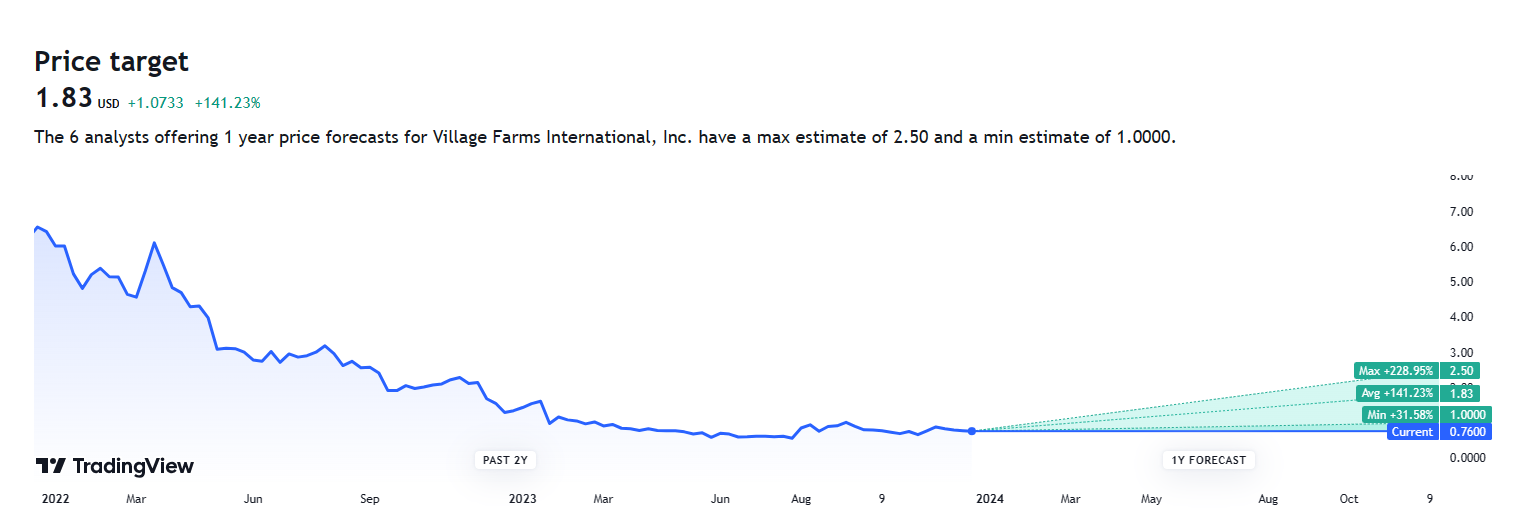

Village Farms International, Inc. (VFF) - Gediversifieerde activiteiten, positieve financiële resultaten, marktexpansie.

-

CareCloud, Inc. (CCLD) - IT-marktpotentieel voor de gezondheidszorg, sterk analistensentiment.

-

Baytex Energy Corp. (BTE) - 50% rendement in contanten, gestage productiegroei, gevarieerde portefeuille.

-

Zijn penny aandelen een goede investering voor beginners?

Penny aandelen kunnen risicovol zijn, dus beginners moeten zorgvuldig onderzoek doen en hun risicotolerantie overwegen voordat ze investeren.

-

Hoe kies ik de juiste penny stock om in te beleggen?

Zoek naar bedrijven met sterke financiële cijfers, strategische partnerschappen en een veelbelovende marktpositie voor potentiële groei.

-

Wat zijn de potentiële risico's van beleggen in penny stocks?

Penny aandelen kunnen volatiel zijn, met een lagere liquiditeit en een grotere kans op marktmanipulatie. Beleggers moeten voorzichtig en gediversifieerd zijn.

-

Is het mogelijk om aanzienlijke winsten te maken met penny stocks?

Hoewel het winstpotentieel bestaat, is het essentieel om bewust te zijn van de hogere risico's die gepaard gaan met penny stocks.

10 Profitable penny stocks for Your investment

| Stock name | Stock Ticker | Market Cap | Forward P/E | EPS Next 5Y |

|---|---|---|---|---|

Enel Chile S.A. |

ENIC |

$4.74B |

7.48 |

- |

CorMedix Inc. |

CRMD |

$200.343M |

- |

- |

Heron Therapeutics, Inc. |

HRTX |

$253.62M |

- |

47.50% |

Mama's Creations Inc. |

MAMA |

$173.80M |

19.52 |

- |

Overseas Shipholding Group |

OSG |

$374.52M |

- |

- |

Globalstar, Inc. |

GSAT |

$3.17B |

- |

15.00% |

Village Farms International |

VFF |

$79.95M |

- |

- |

CareCloud Inc |

CCLD |

$18.10M |

- |

- |

Baytex Energy Corp. |

BTE |

$3.84B |

4.89 |

18.20% |

Taboola.com Ltd |

TBLA |

$1.20B |

75.05 |

- |

Taboola.com Ltd (TBLA)

Taboola (NASDAQ: TBLA) is a dynamic online advertising company that connects advertisers with a vast network of publishers, driving engagement and revenue through strategic partnerships and innovative technologies. With a focus on financial strength, strategic alliances, and a diverse business approach, Taboola presents a compelling investment opportunity in the digital advertising landscape.

| Reasons to Invest in Taboola (TBLA) in 2024 | Explanation |

|---|---|

Strong Financial Performance |

Taboola has been performing well financially, surpassing its own expectations. Q3 2023 earnings exceeded guidance, indicating a healthy and growing company. |

Strategic Partnerships |

Secured significant partnerships, like with NBCUniversal News Group. Such partnerships open up new growth opportunities and potential revenue streams. |

Yahoo Integration |

Successful integration with Yahoo, the fifth largest media property in the U.S. Taboola now has exclusive access to Yahoo's global native supply, attracting more advertisers and revenue. |

Diversification of Business |

Engages in various segments, including partnerships with publishers, reaching consumers through Taboola News, and advancing bidding technology. Diversification contributes to stability and sustained growth. |

Positive Outlook |

Optimistic about the future with raised guidance for 2023 and clear goals for 2024, such as achieving over $200 million in adjusted EBITDA and over $100 million in free cash flow. |

Chart reading for TBLA

Taboola.com Ltd. (TBLA) has experienced a bullish trend over the past year, with a consistent increase in stock prices. The chart indicates a positive trajectory, supported by the 50-day Exponential Moving Average (EMA) being above the 200-day EMA, signaling a strong likelihood of continued upward movement. Currently, the stock price is positioned above both EMAs, reinforcing the bullish outlook.

Enel Chile SA (ENIC)

Enel Chile SA (ENIC) emerges as a promising investment opportunity for the year 2024, driven by its strategic positioning and robust financial performance. The company, a major player in the Chilean electric utility sector, stands out for its commitment to renewable energy sources, diverse generation methods, and its potential for profitability.

Key Investment Highlights by Experts for 2024

Diverse Power Generation

Enel Chile employs various methods such as hydroelectric, wind, solar, and geothermal for power generation.

Renewable Energy Opportunities in Chile

The geographical advantage of high solar intensity in Northern Chile positions the company favourably for grid-scale solar power generation.

Path to Carbon Neutrality

Enel Chile is actively working towards achieving carbon neutrality, aligning with global sustainability trends.

Profitability

Trading at just three times earnings, indicating that the company's green ambitions are financially viable.

Attractive Dividend Yield

Follows a variable dividend policy, currently offering an impressive 10.3% dividend yield.

Financial Overview (Last 12 Months)

| Metric | Amount (in billions) |

|---|---|

Market Capitalization |

$4.74 |

Enterprise Value |

$6.24 |

Revenue |

$5.83 |

Profits |

$1.47 |

Return on Equity (ROE) |

34.80% |

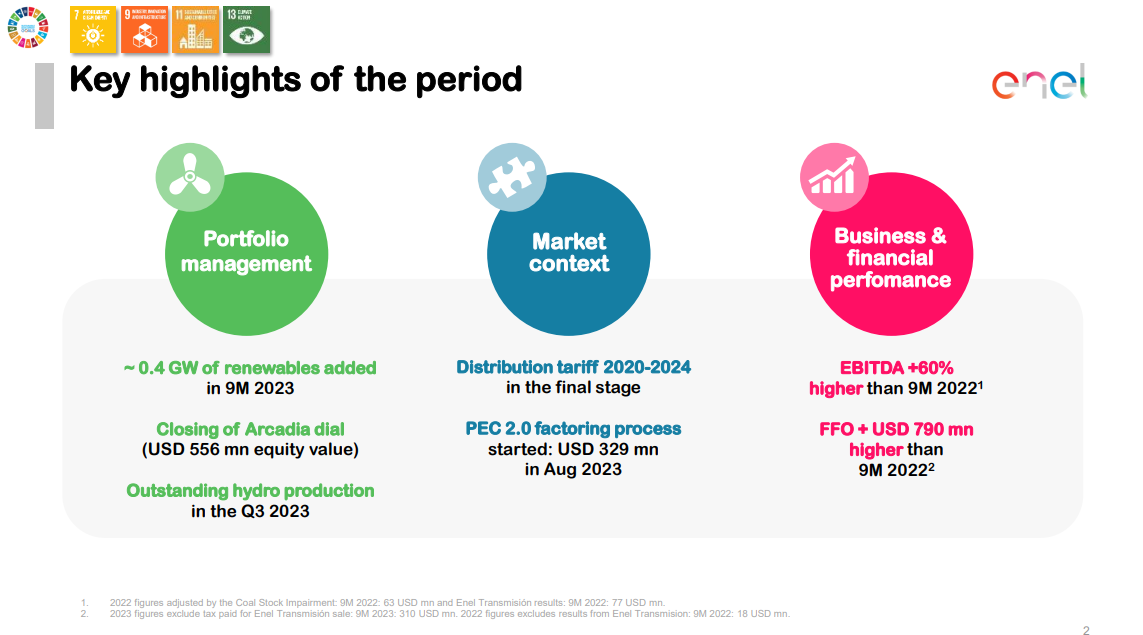

Key highlights for Q3 2023

Chart reading for ENIC

The stock is doing well. It recently broke out of a downtrend, signaling a positive shift. The overall trend has been upward since May 2023, showing a strong market with lots of buyers. The Relative Strength Index (RSI) is above 50, confirming the bullish trend. In simple terms, things are looking good, and the stock is on the rise.

CorMedix Inc. (CRMD)

CorMedix Inc. stands as a promising investment opportunity in 2024 due to its recent FDA approval for DefenCath, a groundbreaking antimicrobial catheter lock solution. With a strategic focus on preventing catheter-related bloodstream infections, especially in kidney failure patients undergoing hemodialysis, DefenCath enjoys a unique market position as the sole FDA-approved solution of its kind. The company's collaboration with The Leapfrog Group underscores its commitment to patient safety, while recent patent issuance ensures intellectual property protection until 2042, enhancing competitiveness.

Despite a reported net loss of $9.7 million in Q3 2023, CorMedix remains an attractive investment option. The higher loss is primarily due to increased operating expenses linked to pre-launch commercial activities for DefenCath, a groundbreaking antimicrobial solution. This spending reflects the company's strategic focus on preparing for the commercial launch of DefenCath, which received FDA approval.

Experts highlight key factors In the below table supporting an investment in CorMedix in 2024

| Factors | Description |

|---|---|

FDA Approval |

Recent approval for DefenCath, the first FDA-approved antimicrobial catheter lock solution. |

Unique Market Position |

Sole solution addressing catheter-related bloodstream infections in kidney failure patients. |

Strategic Partnerships |

Collaboration with The Leapfrog Group demonstrates commitment to patient safety. Such partnerships can enhance the company's visibility and influence in the healthcare sector. |

Intellectual Property |

Issuance of a patent by the USPTO reflects the proprietary nature of DefenCath, providing the company with intellectual property protection until April 15, 2042, enhancing its competitive edge. |

Market Potential |

Positioned in a sector with substantial growth potential, addressing life-threatening conditions. |

Financial Preparations |

Strategic hires and preparations for a successful commercial launch of DefenCath in Q1 2024. |

Heron Therapeutics Inc. (HRTX)

Heron Therapeutics Inc. presents a compelling investment opportunity in 2024, backed by robust financial performance, optimistic guidance, and strategic initiatives. The pharmaceutical company focuses on innovative treatments for pain and cancer, holding a diverse portfolio targeting acute care and oncology patients.

Financial Strength

-

Raised full-year 2023 net product sales guidance for the oncology care franchise to $104 million to $106 million, reflecting a positive revenue trajectory.

-

Anticipates full-year 2023 net product sales between $123 million and $125 million, with a projected increase in 2024 to between $138 million and $158 million.

Operational Efficiency and Cost Reduction

-

Implemented a comprehensive streamlining of financial processes, reducing operational expenses from $182 million in 2022 to $135 million in 2023.

-

Further cost reduction initiatives targeting an operational spend of $108 million to $116 million in 2024, contributing to improved gross margins.

Product Performance and Pipeline

-

Strong performance of the oncology care franchise, contributing to stable revenue and a raised guidance range.

-

Acute care franchise showing positive momentum, with record unit volume for ZYNRELEF and APONVIE in the last eight weeks.

-

Anticipated label expansion and VAN launch for ZYNRELEF are expected to drive significant growth.

| Metric | Projection |

|---|---|

Revenue (2024) |

$138M - $158M |

Gross Margins (2024) |

68% - 70% |

Operating Spend (2024) |

$108M - $116M |

Mama's Creations Inc. (MAMA)

Mama's Creations Inc. (NASDAQ: MAMA) emerges as a compelling investment choice for 2024, marked by its impressive financial strides and strategic endeavors.

| Financial Highlights (Q3 Fiscal 2024) | |

|---|---|

Revenue (YoY Growth) |

$28.7 million (11.5%) |

Net Income (YoY Growth) |

$2.0 million (83.0%) |

Gross Profit Margin |

30.10% |

Cash and Cash Equivalents |

$5.6 million |

Under the expert leadership of Chairman and CEO Adam L. Michaels, the company prioritizes systematic operational execution and gross margin expansion. With a solid balance sheet boasting $5.6 million in cash and cash equivalents, Mama's Creations highlights its financial stability. Positioned in the burgeoning fresh, deli-prepared foods segment, the company aligns with evolving consumer preferences, promising potential market share gains.

Furthermore, accolades from QVC customers and strategic leadership appointments underscore Mama's Creations' commitment to excellence. The invitation to prominent investor conferences signifies investor opportunities. Overall, Mama's Creations Inc. stands as a promising investment prospect, poised for continued success and shareholder value appreciation in 2024 and beyond.

Technical Analysis prediction for Mama’s Creations Inc.

Overseas Shipholding Group (OSG)

Investing in Overseas Shipholding Group (NYSE: OSG) in 2024 presents a promising opportunity backed by their robust Q3 2023 results. With a net income of $17.6 million and a noteworthy 13.7% increase in adjusted EBITDA, OSG is steering toward success. The company exhibited financial prowess by strategically managing cash, executing share buybacks, and settling debts, showcasing a commitment to fiscal strength.

In a surprising twist, OSG acquired the Alaskan Frontier, displaying a forward-thinking approach. This tanker's eco-friendly makeover, with updated engines, aligns with sustainable practices, reducing fuel consumption and carbon emissions. The $50 million investment not only secures a ship but contributes to a green, high-performance fleet.

Analyzing OSG's performance over the last five years reveals a substantial 10% growth in returns on capital employed, indicating ample opportunities for internal capital investment. The simultaneous increase in capital employed by 107% further supports the potential for lucrative returns. Notably, OSG's reduction of current liabilities to 15% of total assets signifies prudent financial management, contributing to improved Return on Capital Employed (ROCE).

The stock price has been in a bullish trend over the past year, meaning it has been generally increasing. This is indicated by the upward slope of the blue channel in the below chart.

Chart reading for OSG

Globalstar Inc (GSAT)

Globalstar Inc (GSAT) presents a compelling investment opportunity driven by robust financial performance and strategic initiatives. The company reported a remarkable 53% increase in total revenue for Q3 2023, accompanied by a substantial 125% rise in Adjusted EBITDA, showcasing improved profitability. The upward revision of the 2023 total revenue guidance to a range between $215 million and $230 million reflects management's confidence in sustained growth, representing a 45% to 55% increase over the previous year.

Financial Performance Highlights (Q3 2023)

| Metric | Amount (in millions) | Growth/Change |

|---|---|---|

Total Revenue |

$57.7 |

53% Increase |

Service Revenue |

$20.3 |

61% Increase |

Subscriber Equipment Sales |

-$0.3 |

7% Decrease |

Income from Operations |

$2.0 |

Positive |

Net Loss |

-$6.2 |

Improved |

The financial outlook is optimistic, with an anticipated Adjusted EBITDA margin of approximately 55%, up from 39% in 2022. Globalstar's strategic focus on wholesale satellite capacity, terrestrial spectrum, IoT, and legacy services positions it for sustained growth.

Strategic Initiatives and Collaborations

Leadership Revamp

Dr. Paul Jacobs, a renowned figure in the technology industry, has been appointed as CEO, bringing valuable experience to drive innovation.

Exclusive Agreements

Globalstar secured an exclusive IP licensing agreement with XCOM Labs, enhancing technological capabilities for improved services and market expansion.

Collaboration with SpaceX

A $64 million agreement with SpaceX for satellite launches in 2025, supported by Apple's investment, signifies strong partnerships.

As of September 30, 2023, GSAT held cash and equivalents of $64.1 million, demonstrating sound liquidity. The expectation of operating cash flows and funding from the 2023 Funding Agreement further supports the company's financial stability.

Technical Analysis Prediction for GSAT

Village Farms International, Inc. (VFF)

Village Farms International, Inc. is a North American company engaged in the production and sale of greenhouse-grown tomatoes, bell peppers, and cucumbers. It operates in four segments: Produce, Cannabis-Canada, Cannabis-U.S., and Energy.

Key Points for Investment highlighted by experts

Diversified Operations

The company is involved in both fresh produce and the cannabis market, offering a diversified portfolio.

Market Expansion

Village Farms has been making strategic moves in the Canadian cannabis industry, maintaining market share leadership and ranking among the top Licensed Producers nationally.

Financial Performance

Positive financial results for the third quarter of 2023 showcase the company's strength. Consolidated adjusted EBITDA improved, and positive cash flow was generated from each operating segment.

Additionally, Recent partnerships, such as supporting Military Makeover, highlight the company's commitment to social responsibility.

Financial Q3 Highlights

| Segment | Sales (in millions) | Gross Margin (%) | Net Income (Loss) (in millions) | Adjusted EBITDA (in millions) | Cash Flow (in millions) |

|---|---|---|---|---|---|

Canadian Cannabis |

$28.8 |

35% |

$2.9 |

$4.6 |

$3.8 (positive) |

U.S. Cannabis |

$5.0 |

64% |

$0.079 |

$0.2 |

$0.4 (positive) |

Village Farms Fresh |

$35.7 |

- |

($1.0) |

$0.8 |

$4.6 (positive) |

Experts have also highlighted in the below table some key strategic highlights and future outlook for this company.

| Strategic Highlights | |

|---|---|

Business Aspect |

Key Highlights |

Canadian Cannabis |

Maintained market share leadership, Launched new brands and products, Ranked among the top Licensed Producers nationally. |

U.S. Cannabis |

Balanced Health Botanicals showed improved net income and adjusted EBITDA. |

Village Farms Fresh (Produce) |

On track for profitability, Focus on managing virus challenges and technology investments. |

Future Outlook |

|

Outlook Factors |

Details |

Market Positioning |

Well-positioned for growth in 2024, leveraging expertise in controlled environmental agriculture and expanding market presence. |

Social Responsibility Initiatives |

Recent partnerships, such as supporting Military Makeover, showcase the commitment to social responsibility. |

Stock Price Forecast |

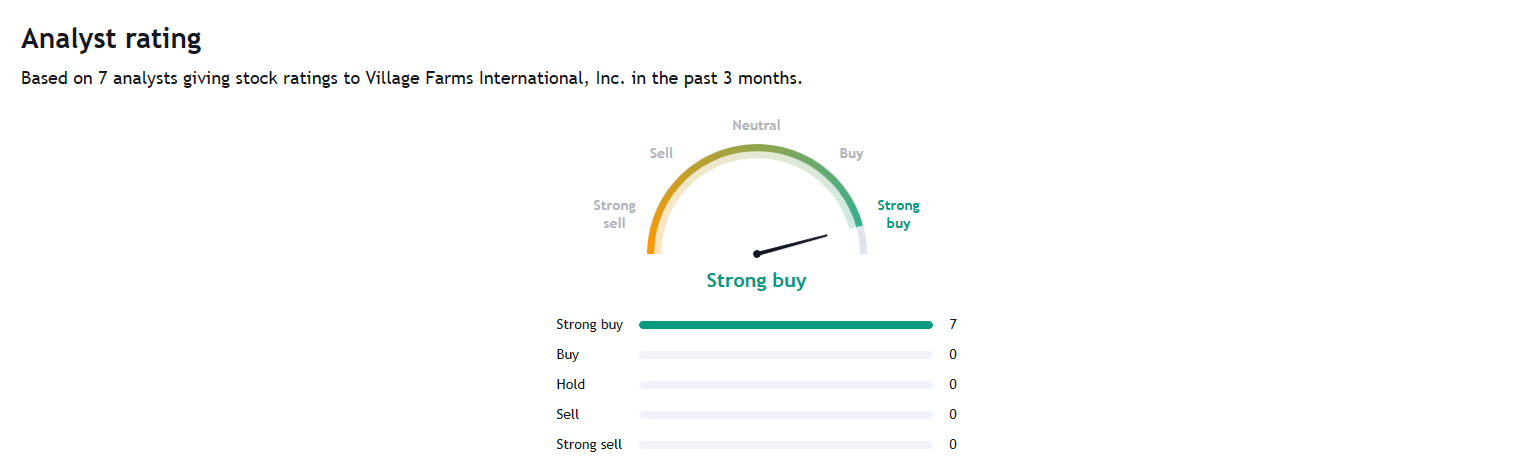

Analysts predict a positive stock price forecast for the next 12 months, indicating substantial growth potential. |

Technical Analysis prediction for Village Farms International, Inc.

Analysis reading for Village Farms International, Inc. by tradingview.com

CareCloud, Inc. (CCLD)

CareCloud, Inc. is a healthcare information technology (IT) company based in Somerset, NJ. Specializing in cloud-based solutions, it offers services like revenue cycle management, practice management, electronic health records, and more to medical providers. Formerly MTBC, the company rebranded in 2021.

While it's important to note that CareCloud faced challenges in its Q3 2023 financial results, including declining revenue and widening losses, the long-term potential of the healthcare IT market remains compelling. As CCLD navigates these challenges, a clear and effective turnaround strategy could pave the way for a resurgence, making it a stock worth considering for investors eyeing the healthcare IT sector in 2024.

| Factors | Details |

|---|---|

Healthcare IT Boom |

The global healthcare IT market is projected to reach $526.7 billion by 2027, with a CAGR of 9.1%. CCLD's cloud-based solutions are well-positioned for this growth. |

Strong Analyst Sentiment |

Analysts maintain a "Strong Buy" rating, anticipating substantial price appreciation. Predictions include revenue growth and a share price rebound in 2024. |

Insider Confidence |

Recent insider purchases by independent directors, even amid price slumps, indicate confidence in CCLD's future potential and belief in its strategic direction. |

Recurring Revenue Potential |

CCLD's subscription-based model ensures recurring revenue, offering financial stability and predictability, a significant advantage over traditional software sales. |

Strategic Partnerships |

Collaborations with key healthcare organizations provide opportunities to expand CCLD's market share, enhancing its long-term growth prospects. |

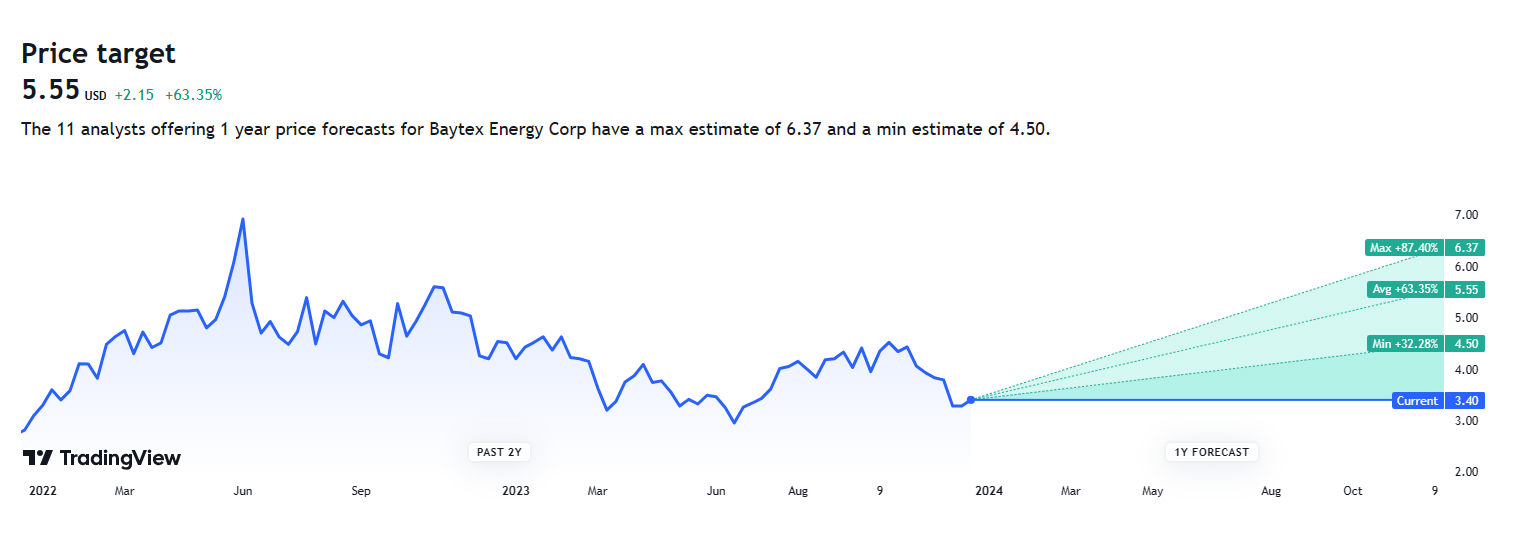

Baytex Energy Corp. (BTE)

Baytex Energy Corp. (NYSE: BTE) is a Calgary-based energy company excelling in oil and gas production. With operations in Western Canada and the U.S. Eagle Ford region, BTE prioritizes shareholder value through 50% cash returns, robust production growth targeting 150,000-156,000 barrels daily, and a diverse oil portfolio. Their focus on cost efficiency and anticipation of potential oil price increases further positions BTE as an attractive investment in the dynamic energy market.

| Reasons to Invest in BTE in 2024 | Details |

|---|---|

Cash Returns to Shareholders |

BTE plans to allocate 50% of its earnings for share buybacks and dividends. This move is favorable for investors seeking income from their investments, as it enhances shareholder value and demonstrates a commitment to returning money to shareholders. |

Steady Production Growth |

BTE aims to achieve an average production of 150,000 to 156,000 barrels of oil equivalent per day in 2024. Consistent production levels provide a reliable income source for the company and contribute to revenue stability, which can be reassuring for investors. |

Diverse Oil Portfolio |

BTE operates in different regions, including Western Canada and Texas. This diversification strategy helps mitigate risks associated with the performance of a single area. If one region faces challenges, the others may still contribute to profitability, reducing overall risk. |

Cutting Costs |

BTE is actively working to reduce operational costs, aiming to spend less money to extract the same amount of oil. Successful cost-cutting measures can lead to increased profitability, which is generally positive for investors and may contribute to higher stock prices. |

Potential for Higher Oil Prices |

BTE stands to benefit if oil prices increase in 2024. Higher oil prices can result in increased revenue from selling oil, potentially leading to higher profits for the company and, consequently, more significant returns for investors. |

| Financials | Operational Highlights |

|---|---|

Revenue: $783 million |

Average production: 124,000 boe/d |

Net income: $127 million |

Cost control: Reduced drilling and completion costs 5% |

Free cash flow: $246 million |

Debt reduction: Paid off $188 million |

Dividend: $0.0225 per share |

Share repurchases: Bought back $34 million in shares |

Technical Analysis Prediction for Baytex Energy Corp.

Chart reading for BTE

The Relative Strength Index (RSI) is signaling that the stock could be oversold as it currently sits below the 50 mark. Additionally, there appears to be a level of support around the current price of approximately $2.90-3.00.

Woordenlijst voor beginnende handelaars

-

1

Index

Index in de handel is de maatstaf voor de prestaties van een groep aandelen, die de activa en effecten in de index kan omvatten.

-

2

Extra

Xetra is een Duits beurshandelssysteem dat wordt beheerd door de beurs van Frankfurt. Deutsche Börse is het moederbedrijf van de Frankfurt Stock Exchange.

-

3

Belegger

Een belegger is een individu dat geld investeert in een actief met de verwachting dat de waarde ervan in de toekomst zal stijgen. De activa kunnen van alles zijn, waaronder obligaties, schuldbrieven, beleggingsfondsen, aandelen, goud, zilver, exchange-traded funds (ETF's) en onroerend goed.

-

4

Diversificatie

Diversificatie is een beleggingsstrategie waarbij beleggingen worden gespreid over verschillende activaklassen, sectoren en geografische regio's om het algehele risico te verlagen.

Team dat op dit artikel heeft gewerkt

Oleg Tkachenko is een economisch analist en risicomanager met meer dan 14 jaar ervaring in het werken met systeembanken, investeringsbedrijven en analytische platforms. Sinds 2018 is hij analist bij Traders Union. Zijn belangrijkste specialiteiten zijn de analyse en voorspelling van prijstrends op de forex-, aandelen-, grondstoffen- en cryptocurrency markten, evenals de ontwikkeling van handelsstrategieën en individuele risicobeheersystemen. Hij analyseert ook niet-standaard beleggingsmarkten en bestudeert handelspsychologie.

Bovendien werd Oleg lid van de Nationale Unie van Journalisten van Oekraïne (lidmaatschapskaart nr. 4575, internationaal certificaat UKR4494).