FBS Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $5

- MetaTrader4

- MetaTrader5

- FBS app

- CySEC

- FSC (Belize)

- 2009

Our Evaluation of FBS

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Brief Look at FBS

FBS is an international broker with a strong presence in Asia, offering a wide range of trading instruments including Forex, stocks, indices, energies, and metals. With over 90 international awards and 27 million clients across 150 countries, FBS boasts a strong global reputation.

The company provides flexible trading conditions: leverage up to 1:3000, floating spreads from 0.7 pips, commission-free trading, and fast execution speeds starting at 0.01 seconds. FBS ensures client security with negative balance protection and offers a user-friendly experience on familiar trading platforms.

While FBS doesn't currently offer cryptocurrency trading or passive income options like PAMM accounts and copy trading, its competitive conditions and extensive educational resources make it a compelling choice for traders seeking a comprehensive and accessible experience.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- negative balance protection;

- a large selection of trading instruments;

- the support service works 24/7.

- auto copying is not available;

- no PAMM accounts;

- not suitable for short-term trading, such as scalping;

- the support service works in a limited number of languages;

- only two real accounts.

Ang FBS ay isang internasyonal na brokerage firm, na nag-aalok ng pangangalakal ng Forex, mga indeks, metal, at futures sa MetaTrader 4 at 5 na mga platform, kasama ang pagmamay-ari nitong FBS app. Maaaring makinabang ang mga mangangalakal mula sa mga kapaki-pakinabang na kondisyon na may minimum na deposito na $5, leverage hanggang 1:3000, walang bayad na kalakalan, at mga spread na nagsisimula sa 0.7 pips. Tinitiyak ng FBS ang seguridad ng kliyente na may proteksyon sa negatibong balanse at sinusuportahan ang mabilis na pagpapatupad ng order. Nag-aalok din ang broker ng magkakaibang mga mapagkukunang pang-edukasyon at isang opsyon sa demo account, na tumutugon sa parehong baguhan at may karanasan na mga mangangalakal. Gayunpaman, ang FBS ay may ilang partikular na disbentaha, tulad ng kawalan ng cryptocurrency trading, PAMM account, at mga opsyon sa passive income tulad ng copy trading. Limitado ang serbisyo ng suporta ng broker sa mga opsyon sa wika, at hindi ito tumutugon sa mga mangangalakal na nakatuon sa mga panandaliang diskarte, tulad ng scalping. Dahil dito, maaaring mas angkop ang FBS para sa mga mangangalakal na mas inuuna ang leverage at mga mapagkukunang pang-edukasyon kaysa sa mga pagkakataon sa passive income.

- You value the flexibility to deposit and withdraw funds through a wide range of methods. FBS currently supports over 200 options for deposit and withdrawal, including bank transfers, credit and debit cards, cryptocurrency wallets, and various online payment systems.

- You wish to thoroughly explore the trading platform. To facilitate this, FBS provides multiple avenues for traders. Firstly, you can open a free demo account. Additionally, you can start trading with a deposit of just $5, enjoying fee-free trading with leverage up to 1:3000.

- Your interest lies in passive income opportunities. FBS does not offer copy trading or joint accounts. While the company does have a partnership program, it may not be as financially rewarding as those of its competitors, and the income generated is not passive.

We checked the office of the FBS brokerage company in Cyprus, which is located at the following address according to the information on the company’s website:

Vasileos Georgiou A 89, Office 101, Potamos Germasogeias 4048, Limassol, Cyprus

-

The company is located at the stated address

-

We were able to speak to a company representative

-

We were able to visit the office as clients

-

-

Video of the company’s office

-

FBS Trading Conditions

| 💻 Trading platform: | FBS app, MetaTrader 5, MetaTrader 4 |

|---|---|

| 📊 Accounts: | Standard account, demo account |

| 💰 Account currency: | USD, EUR |

| 💵 Deposit / Withdrawal: | Cards: Visa, MasterCard; e-wallets: Skrill, Neteller, Wire Transfer, Rapid Transfer |

| 🚀 Minimum deposit: | $5 |

| ⚖️ Leverage: | 1:3000 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 lots |

| 💱 EUR/USD spread: | 0,7-1,3 pips |

| 🔧 Instruments: | Forex, indices, metals, futures contracts |

| 💹 Margin Call / Stop Out: | 40% / 20% |

| 🏛 Liquidity provider: | Currenex |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market Execution |

| ⭐ Trading features: | Advisors; Hedging; Protection against a gap. |

| 🎁 Contests and bonuses: | No |

The FBS brokerage company offers very attractive trading conditions for traders living all over the world. The minimum trade volume is 0.01 lot for all trading accounts. The minimum deposit is USD 5 and the spread from 0.7 pips. Traders can connect swap-free (an Islamic account) option to all live accounts, allowing them to trade according to Sharia law. Popular and exotic currency pairs, indices, futures, and metals are offered as trading instruments.

FBS Key Parameters Evaluation

Share your experience

No entries yet.

Trading Account Opening

To make it easier for you to start cooperation with the FBS broker, Traders Union suggests that you note the following information:

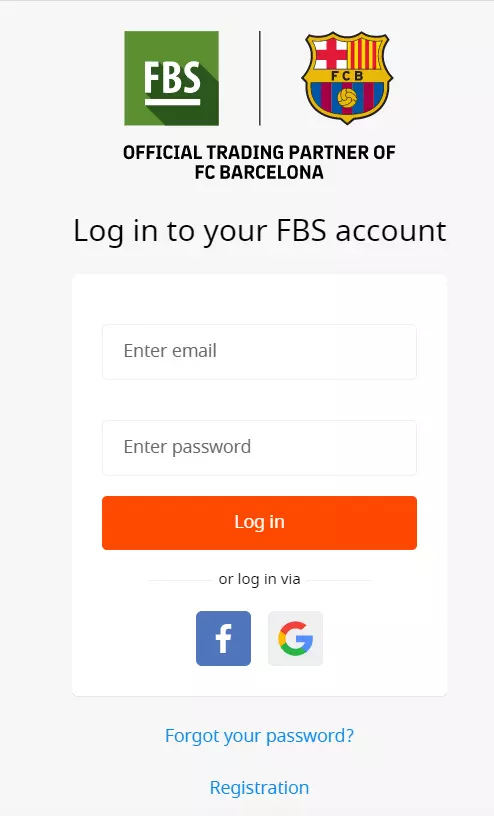

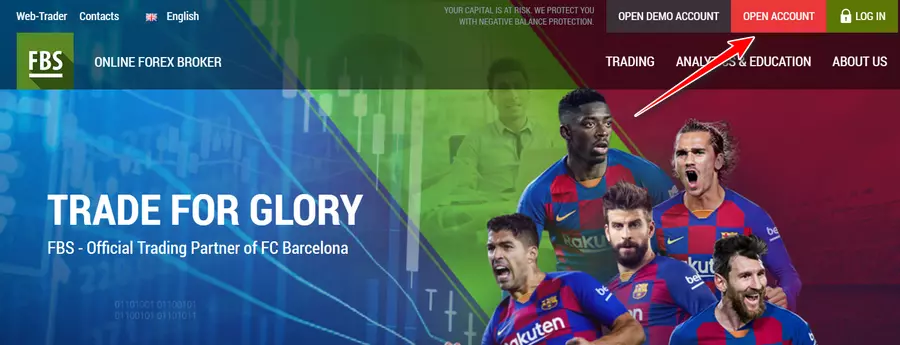

You can enter your FBS personal account from the main page of the company's website. To do this, click "Log in".

To log in, you need to enter your email address and password. You can also go through authorization using your Google or Facebook account.

If you have not opened an account yet, click on "Open Account" and go through the registration procedure. Indicate the country of residence and enter all the requested data in the appropriate fields. You will also need to go through verification of your personal information such as your passport data, etc.

After you register or log in, your personal account will become available. There you can replenish your account, download, and launch a trading platform convenient for you.

In your personal account, you can choose a financial instrument, replenish a deposit and withdraw funds.

Your personal account will also contain:

-

up-to-date analytics and quotes;

-

statistics on the effectiveness and profitability of affiliate programs;

-

useful information about the foreign exchange market, video tutorials, and webinar schedules;

-

service window for professional advice.

Regulation and safety

FBS has a safety score of 9.2/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record over 16 years

- Strict requirements and extensive documentation to open an account

FBS Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

FSC (Belize) FSC (Belize) |

Financial Services Commission of Belize | Belize | No specific fund | Tier-3 |

FBS Security Factors

| Foundation date | 2009 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

Ang mga trading at non-trading na komisyon ng broker na FBS ay nasuri at na-rate bilang Medium na may score ng bayarin na 5/10. Bukod pa rito, ang mga komisyon na ito ay ikinumpara sa mga nangungunang dalawang kakumpitensya, Pepperstone at IG Markets, upang magbigay ng pinaka-komprehensibong impormasyon.

- Walang bayarin sa kawalan ng aktibidad

- Walang bayarin sa deposito

- Walang bayarin sa pag-withdraw

- Higit sa karaniwang bayarin sa Forex trading

- Walang ECN/Raw Spread na account

Mga Bayarin sa Pag-trade at Spread

Sa ibaba, sinuri at ikinumpara namin ang mga komisyon sa pag-trade ng FBS sa dalawang kakumpitensya. Nakatuon kami sa mga spread at iba pang bayarin sa transaksyon na direktang nauugnay sa pagsasagawa ng mga trade (hal. komisyon kada lot sa isang ECN account). Ang paghahambing na ito ay naglalayong magbigay ng malinaw na pag-unawa sa kahusayan ng gastos ng bawat broker.

Karaniwang Spread ng Account

Para sa mga Standard na account, ang mga komisyon ng FBS ay bahagi ng floating spread, na nag-iiba ayon sa kondisyon ng merkado. Ang mga karaniwang halaga ay ibinibigay, ngunit sa panahon ng mataas na volatility, ang spread ay maaaring lumampas sa mga ito.

FBS Mga karaniwang spread

| FBS | Pepperstone | IG Markets | |

| EUR/USD min, pips | 0,7 | 0,5 | 0,6 |

| EUR/USD max, pips | 1,3 | 1,5 | 1,2 |

| GPB/USD min, pips | 0,7 | 0,4 | 0,6 |

| GPB/USD max, pips | 1,0 | 1,4 | 1,5 |

Sinusuportahan ba ng FBS ang RAW/ECN na mga account?

Ayon sa aming natuklasan, ang FBS ay hindi nag-aalok ng RAW/ECN na mga account, na maaaring maging isang kawalan para sa transparency at liquidity. Gayunpaman, hindi nito ginagawang hindi kompetitibo ang broker. Isaalang-alang ang mga salik tulad ng antas ng spread, bilis ng pag-execute, regulasyon, kalidad ng suporta, at mga kasangkapan sa pag-trade kapag pumipili ng maaasahang broker.

Mga Bayarin sa Hindi Pag-trade

Nagsagawa kami ng detalyadong pagsusuri ng mga bayarin sa hindi pag-trade na nauugnay sa FBS. Ang pagsusuring ito ay nag-aalok ng komprehensibong pangkalahatang-ideya ng mga karagdagang gastos na maaaring makaapekto sa mga mangangalakal lampas sa regular na mga aktibidad sa pag-trade.

Mga Bayarin sa Hindi Pag-trade ng FBS

| FBS | Pepperstone | IG Markets | |

| Bayad sa Deposito, % | 0 | 0 | 0 |

| Bayad sa Pag-withdraw, % | 0 | 0 | 0 |

| Bayad sa Pag-withdraw, USD | 0 | 0 | 0 |

| Bayad sa Kawalan ng Aktibidad ($, bawat buwan) | 0 | 0 | 0 |

Account types

FBS offers its clients one type of accounts. The US dollar is used as the currency for replenishment. The company provides an opportunity to open a demo account that replicates real market conditions. This makes it possible to test your strategies without risking any or very much capital.

Account types:

For trading, FBS provides both MT4, MT5 and FBS trading platforms for computers, and a mobile terminal. There is also a web version of these trading terminals.

FBS - How to open, deposit and verify a trading account | Firsthand experience of Traders Union

Deposit and withdrawal

Nakakuha ang FBS ng Medium na marka para sa kahusayan at kaginhawaan ng mga proseso ng deposito at pag-withdraw nito.

Nagbibigay ang FBS ng makatwirang hanay ng mga opsyon sa deposito at pag-withdraw na may katamtamang bayarin, alinsunod sa mga pamantayan ng industriya.

- Ang minimum na deposito ay mas mababa sa karaniwang antas ng industriya

- Walang bayad sa deposito

- Walang bayad sa pag-withdraw

- Available ang mga bank wire transfer

- Limitadong kakayahang umangkop sa deposito at pag-withdraw, na nagreresulta sa mas mataas na gastos

- BTC ay hindi magagamit bilang pangunahing account na pera

- PayPal hindi suportado

Ano ang mga opsyon sa pagdeposito at pag-withdraw ng FBS?

Nagbibigay ang FBS ng pangunahing hanay ng mga opsyon sa pagdeposito at pag-withdraw, na sumasaklaw sa mga mahahalagang pamamaraan alinsunod sa mga pamantayan ng industriya. Ang set ng mga opsyon na ito ay sapat para sa karamihan ng mga mangangalakal, na may mga magagamit na pamamaraan Bank Card, Bank Wire, Skrill, Neteller.

Mga Paraan ng Deposito at Pag-withdraw ng FBS kumpara sa mga Kakumpitensya

| FBS | Pepperstone | IG Markets | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | Yes |

Ano ang mga pangunahing account na pera ng FBS?

Ang malawak na hanay ng mga pangunahing account na pera ay nagpapababa ng pangangailangan para sa conversion ng pera, na posibleng magpababa ng gastos sa transaksyon para sa mga kliyente sa buong mundo. Sinusuportahan ng FBS ang mga sumusunod na pangunahing account na pera:

Ano ang minimum na halaga ng deposito at pag-withdraw ng FBS?

Ang minimum na deposito sa FBS ay $5, habang ang minimum na halaga ng pag-withdraw ay $1. Ang mga minimum na ito ay maaaring magbago depende sa napiling uri ng account at paraan ng pagbabayad. Para sa mga tiyak na detalye, mangyaring makipag-ugnayan sa support team ng FBS.

Markets and tradable assets

FBS provides a standard range of trading assets in line with the market average. The platform includes 600 assets in total and 74 Forex currency pairs.

- Indices trading

- ETFs investing

- 600 assets for trading

- Bonds not available

- Copy trading not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by FBS with its competitors, making it easier for you to find the perfect fit.

| FBS | Pepperstone | IG Markets | |

| Currency pairs | 74 | 90 | 80 |

| Total tradable assets | 600 | 1200 | 20000 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | No | Yes |

Investment options

We also explored the trading assets and products FBS offers for beginner traders and investors who prefer not to engage in active trading.

| FBS | Pepperstone | IG Markets | |

| Bonds | No | No | Yes |

| ETFs | Yes | Yes | Yes |

| Copy trading | No | Yes | Yes |

| PAMM investing | No | Yes | No |

| Managed accounts | No | No | No |

Additional Trading Tools

-

Economic Calendar.

Economic Calendar is one of the essential tools for a trader, allowing you to familiarize yourself with current and upcoming critical financial events and analyze past events and their impact on the dynamics of the financial market as a whole and on specific trading instruments. The economic Calendar lists critical events that may affect the currency and stock markets. On the instrument page, each trader can select the time zone, date, and type of trading instrument he is interested in. The implemented filters allow you to obtain the most targeted information about the asset of interest to the trader.

-

Trader's calculator.

Using the Trader's calculator tool, you can calculate a given asset's main current trading parameters. The calculator lets you obtain data for retail and professional trading for any type of account available in the FBS company. By setting the necessary parameters for the trading instrument of interest in the Trader's calculator, trader will receive information about the required margin level, spread size, trading volume, the presence and value of a swap, and other trading indicators of the transaction.

-

Currency converter.

A currency converter allows a trader to study the current exchange rate of the currencies he is interested in and calculate his income when working with the selected currency pair. To do this, on the instrument page, you need to select the desired currencies and indicate the quantitative value of the base currency. The tool will provide the current exchange rate of the selected currencies against each other. It will also demonstrate the dynamics of the movement of this currency pair over the previous 30 days.

Customer support

The company's support service is ready to answer questions and advise traders 24 hours a day, 7 days a week.

Advantages

- Many options for communication

- Multilingual support: English, French, German, Italian, and Portuguese are available

- The site has a section with answers to the most popular questions (FAQs)

- You can contact support 24/7

- Support respond quickly

Disadvantages

- To communicate in the online chat, you must enter your email address

Available communication channels with customer support specialists include:

-

directly via phone numbers indicated on the website;

-

by email;

-

in the online chat on the website of the brokerage company;

-

in Facebook messenger.

Support is available from the FBS website and from your personal account.

Contacts

| Foundation date | 2009 |

|---|---|

| Registration address | Vasileos Georgiou A 89, Office 101, Potamos Germasogeias 4048, Limassol, Cyprus |

| Regulation |

CySEC, FSC (Belize)

Licence number: 000102/6 |

| Official site | www.fbs.com |

| Contacts |

Education

The FBS website has an impressive training section where everyone can get the information they need to trade successfully on Forex and beyond. The broker provides a quick guide to Forex, tips for traders, and video tutorials. The company also conducts webinars. The section is divided into levels for beginners, elementary, intermediate, and advanced levels.

To practice the knowledge gained on the FBS website, the specialists of the brokerage company recommend opening a demo account. You can practice on it without risking real money.

To support traders, a separate analytical section with an economic calendar, a currency converter, and calculators have been created on the site.

Comparison of FBS with other Brokers

| FBS | Eightcap | XM Group | RoboForex | Pocket Option | IC Markets | |

| Trading platform |

MT4, MobileTrading, MT5, FBS app | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | MT4, cTrader, MT5, TradingView |

| Min deposit | $5 | $100 | $5 | $10 | $5 | $200 |

| Leverage |

From 1:1 to 1:3000 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 1 point | From 0 points | From 0.8 points | From 0 points | From 1.2 point | From 0 points |

| Level of margin call / stop out |

40% / 20% | 80% / 50% | 100% / 50% | 60% / 40% | 30% / 50% | 100% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | No |

Detailed Review of FBS

FBS provides services in the Forex market globally. The company has been operating for a little over 10 years. The broker takes a responsible approach to performing the tasks assigned to it. FBS offers its trading clients optimal working conditions and popular financial instruments. The company is characterized by convenient trading terminals, including a mobile version of its own platform, and frequent innovations.

Because the regulators of FBS are the Cyprus Securities and Exchange Commission (CySEC) and Financial Services Commission of Belize (FSC), there is a guarantee of transparency and safety of the trader's funds.

FBS is the right broker for beginners and professional traders

FBS combines functionality, unique trading tools, and productivity. It also provides high-quality training materials that allow novice traders to quickly get used to trading in the foreign exchange market, as well as in the markets of stock indices and futures contracts. You can choose a demo account for training. It is free because trading is done with virtual funds. For those who want to try trading on the real market, but are not yet ready to risk even a hundred euros, you can choose a cent (micro) account. On it, the minimum deposit is USD 5.

The brokerage company is suitable for traders trading a wide variety of strategies. So, there is the possibility of trading robots, and you can make money on the news. The broker is also suitable for calm intraday trading, medium-term and long-term strategies. Orders are executed quickly and spreads are relatively low. In addition, it is possible to connect the swap-free account option. This will allow trading following Sharia law.

Traders cooperating with FBS trade through popular platforms such as MetaTrader 4 and MetaTrader 5. Both desktop versions for Windows and MAC are available, as well as mobile versions for devices running Android and iOS. Web versions of terminals are also available.

Analytical services of the FBS broker:

-

Forex News, Forex TV, and an economic calendar to track events that affect the volatility of trading instruments;

-

daily analytics are available to track fundamental and technical analysis of the market;

-

Forex calculators and currency converter is for comfortable trading and you can calculate how much money is needed, what is the expected spread, etc.

Advantages:

good liquidity;

the availability of a regulator;

quotes using 5 points after the decimal point;

good trading conditions: two types of real accounts, as well as two options for demo trading accounts, relatively low spreads starting from 1 pip;

a good set of financial instruments: you can trade currencies, contracts for differences, and metals;

plenty of materials for training - allows a beginner to quickly master the principles of Forex trading;

protection against a gap (negative balance) - will prevent the loss of the deposit;

you can trade robots - it makes it possible to conduct automated trading;

hedging is allowed - allows you to reduce risks.

Check out our reviews of other companies as well

User Satisfaction i