FairMarkets Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MT4

- MT5

- WebTrader

- FSC

- ASIC

- 2020

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MT4

- MT5

- WebTrader

- FSC

- ASIC

- 2020

Our Evaluation of FairMarkets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

FairMarkets is a high-risk broker with the TU Overall Score of 2.93 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by FairMarkets clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. FairMarkets ranks 319 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

FairMarkets represents a typical broker specializing in currency pairs and CFDs. Its main advantages include a choice of several accounts, no minimum deposit requirements on most accounts, narrow spreads, and either no commissions or commissions on par with market averages. The leverage is sufficient but slightly lower than that of most competitors. Its main drawback is a lack of transparency. This broker offers minimal alternative earning options, with only a partnership program available. This company is officially registered and licensed by FSC (Mauritius Financial Services Commission) and ASIC (Australian Securities and Investments Commission), making it recommendable for consideration.

Brief Look at FairMarkets

FairMarkets is a Forex and CFD broker. Contracts for Difference (CFDs) are offered on stocks, indices, commodities, and cryptocurrencies. They provide a free Demo account and four real accounts. Spreads are floating, starting from 0 pips, and it's possible to open an account with raw spreads. There is only a commission on the RAW ZERO account, which amounts to $10 per lot. The leverage is flexible, up to 1:400. This company’s clients use MetaTrader 4, MetaTrader 5, and WebTrader trading platforms. There is no minimum deposit requirement for three out of four account types, and a minimum deposit of at least $5,000 is needed for the VIP VARIABLE account. Swaps are excluded if the trader's account balance is $10,000 or more. This broker offers a partnership program for individuals and legal entities. A 100% deposit bonus and rewards are based on trading volume points. The platform offers numerous fundamental and technical analysis tools, a newsfeed, and calculators. Interactive education, a trader's glossary, and a FAQs section are also available.

- This broker's pool comprises 47 currency pairs and several dozen CFDs from different groups.

- Low entry barrier - most accounts have a low entry barrier starting at no minimum deposit, and the Demo account is free.

- The four real accounts offer different trading styles and methods.

- Trading costs are minimal because of narrow spreads and trading commissions attached only to one of the four accounts.

- High-profit potential is possible because this broker does not impose restrictions and allows trading with significant leverage.

- Additional earnings opportunities are presented via a standard referral program and an IB partnership for corporate clients.

- Client support operates 24/5, and the managers are proficient in 9 languages.

- This broker does not provide typical passive income options, such as joint accounts and copy trading.

- Client support is available even at night but only on weekdays, with no assistance on weekends.

- In some aspects, this broker lacks transparency; for instance, commission data for withdrawals is unavailable on their website.

TU Expert Advice

Financial expert and analyst at Traders Union

FairMarkets is a trading brand of Fairmarkets International Ltd, which, in turn, is owned by Trive Investment BV. This company holds licenses from FSC and ASIC, and there are no issues with regulation. A retrospective analysis has not revealed any breaches of this broker's obligations to its clients, and reviews are predominantly positive.

The first thing that surprises traders when they encounter this company is the absence of minimum deposit requirements on all accounts, except for VIP VARIABLE. Additionally, most accounts have no trading commissions, such commissions are only present on the RAW ZERO account, which offers raw spreads. The commission for this account is $10 per standard lot, which is an average market rate.

There are no complaints about the assets pool. This broker offers 47 currency pairs and several dozen CFDs on various assets, including stocks, indices, commodities, and cryptocurrencies. All assets come with flexible leverage, which can go up to 1:400. While many brokers offer higher leverage, it's not a substantial advantage. Yes, higher leverage increases profit potential, but it also amplifies trading risks.

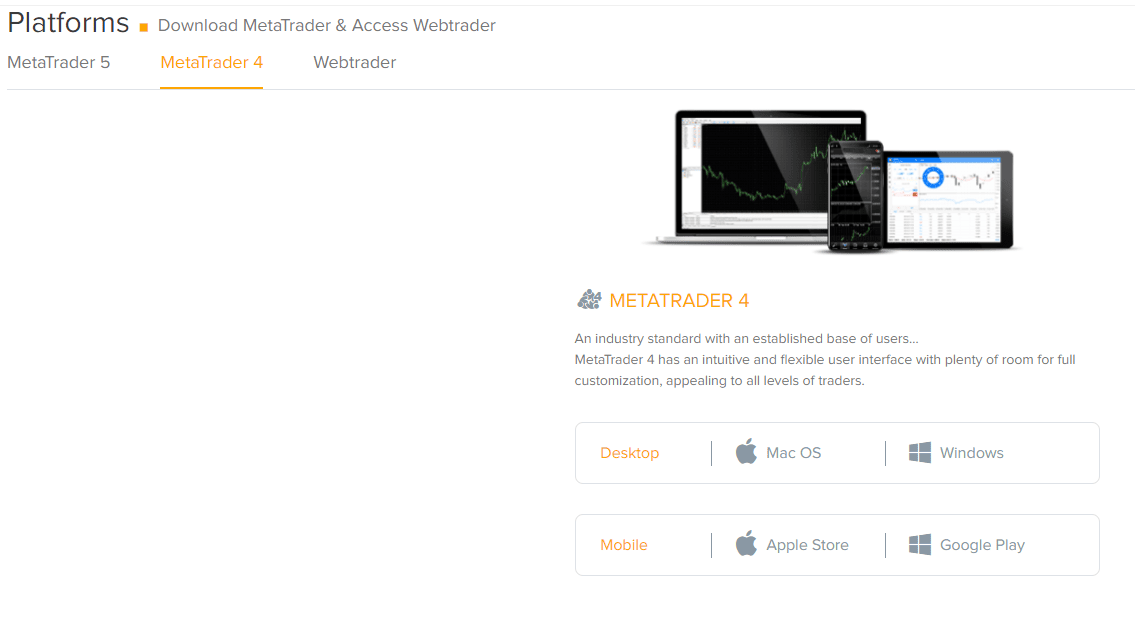

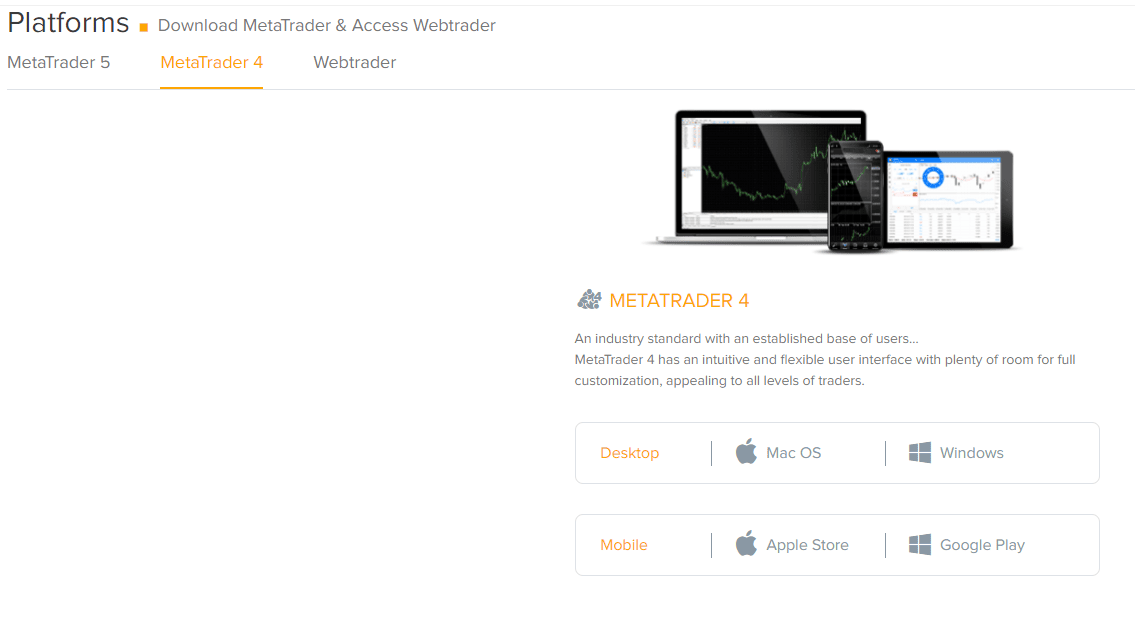

This broker provides a free Demo account, and the minimum trade size is 0.01 lots, with a maximum of 100 lots. In this regard, FairMarkets fully meets the standards of the leading competitors. The trading platforms offered to clients are worth mentioning as well. They include MT4, MT5 and WebTrader. Moreover, all versions, including mobile versions and different operating systems, are available. Considering the customization options of these platforms, traders can personalize their working conditions to the maximum extent.

This broker's website features an economic calendar, Trading Central, and market analysis. Interactive education even allows for earning. However, the only option for passive income is the partnership program, which may be insufficient for some users. Client support is not available on weekends, but this is not a unique trait of FairMarkets, as it is the case with most brokers. However, the lack of transparent information regarding withdrawal commissions is a point that requires attention.

FairMarkets Summary

| 💻 Trading platform: | МТ4, MT5, WebTrader |

|---|---|

| 📊 Accounts: | DEMO, STANDARD FIXED, STANDARD VARIABLE, VIP VARIABLE, RAW ZERO |

| 💰 Account currency: | USD, EUR, GBP |

| 💵 Replenishment / Withdrawal: | Bank transfers, Visa and Mastercard, Skrill and Neteller e-transfer systems |

| 🚀 Minimum deposit: | $1 |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0 pips |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, indices, commodities, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | 100%/20% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market |

| ⭐ Trading features: | Free Demo, there is no minimum deposit and trading commissions for most real accounts, narrow spreads, three trading platforms to choose from, interactive training, and many tools for analysis |

| 🎁 Contests and bonuses: | Yes |

For most brokers that offer multiple real accounts, the minimum deposit varies for each of them. FairMarkets' clients can open these account types: STANDARD FIXED, STANDARD VARIABLE, VIP VARIABLE, and RAW ZERO. All accounts, except VIP VARIABLE, do not have a mandatory deposit. This means traders can deposit any amount they consider sufficient to start active trading. To open a VIP VARIABLE account, a minimum of $5,000 is required. Leverage does not depend on the chosen account as it is determined by the asset only. The highest trading leverage for currency pairs is 1:400. Traders have the option to adjust the leverage size to what suits them best or trade without leverage. Technical support can be reached via phone, email, live chat, and support tickets on the website. The support operates 24/5, but only on weekdays.

FairMarkets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

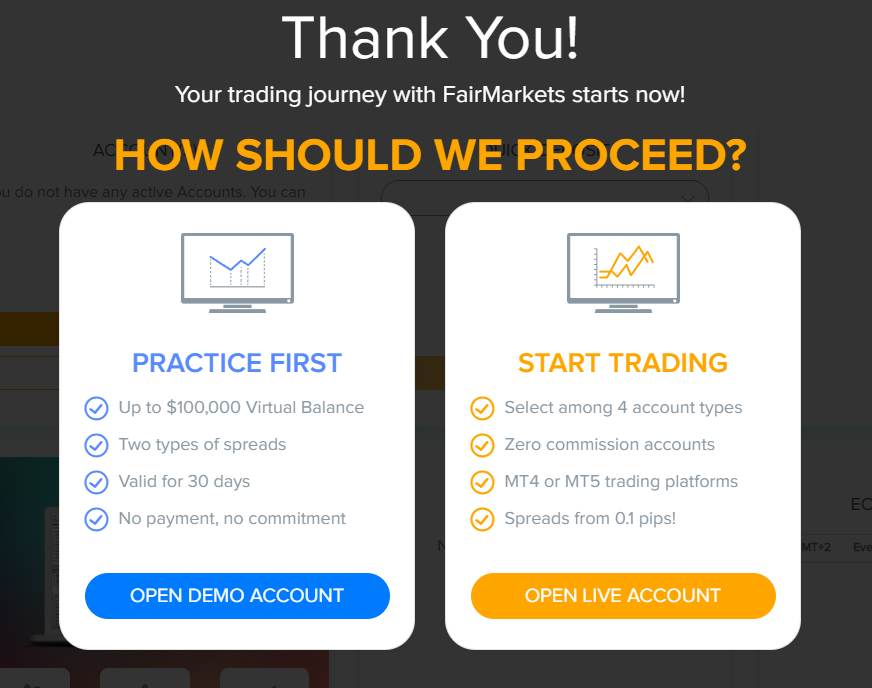

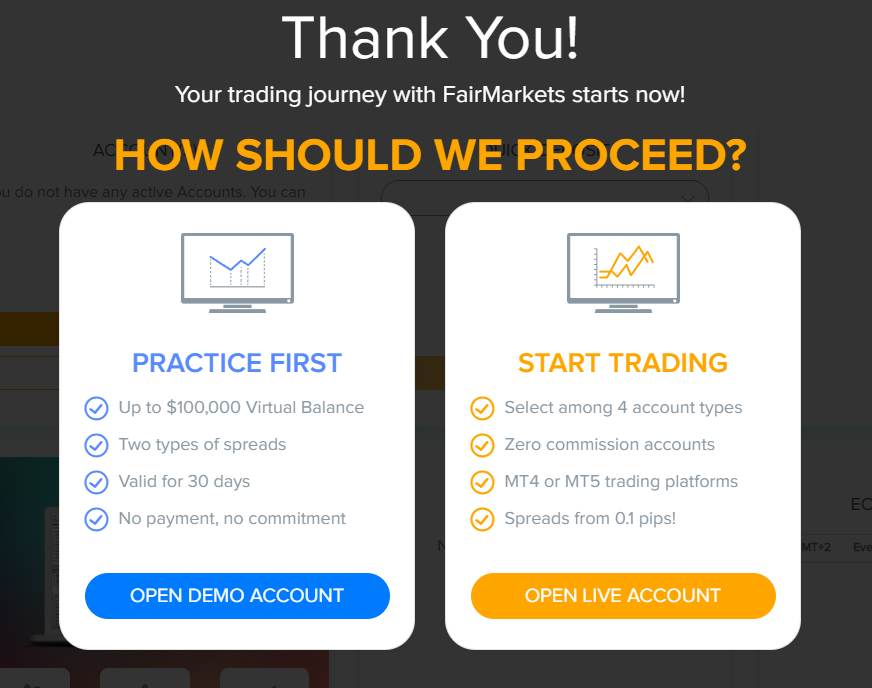

Trading Account Opening

To begin cooperation with this broker, you need to register, then verify your personal information (go through verification), open a real account, deposit funds, and download the trading platform software. After installing the platform, the trader launches it, enters the registration data, and gains access to the financial markets. Experts at TU have prepared the below step-by-step guide on registration and the features of the FairMarkets user account.

Go to this broker's website. In the top right corner, choose the language of the interface. Click the "Open Account" button.

Choose an honorific. Enter your first name, last name, and country of residence. Provide your phone number and email address and create a password, and indicate whether you are a resident of the U.S. Agree to the terms of cooperation by checking the box. Click "Confirm."

You can choose between a Demo or a real account. In this example, select a real account.

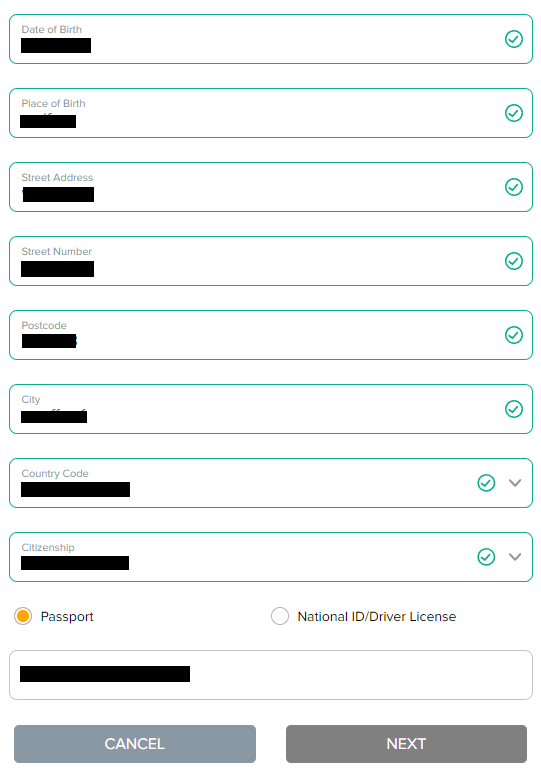

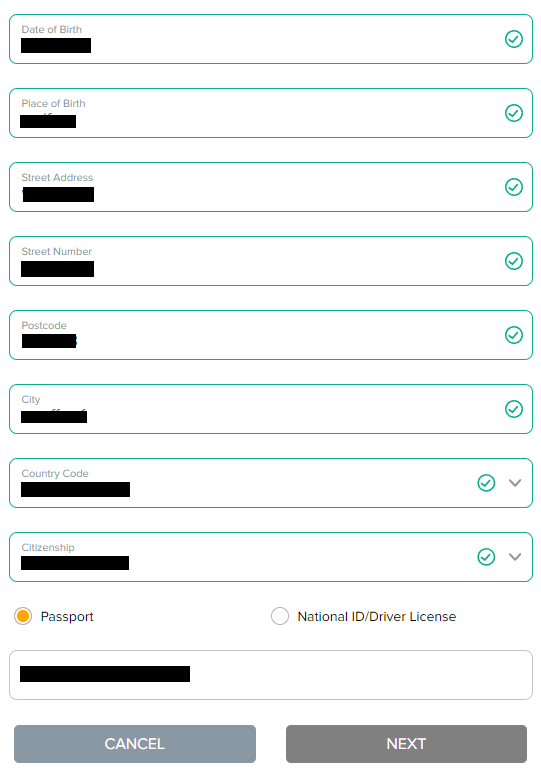

Enter your date and place of birth. Specify your residential address with the postal code. Select your residency and nationality. Indicate the document you can use to confirm your identity and enter its number. Click "Next".

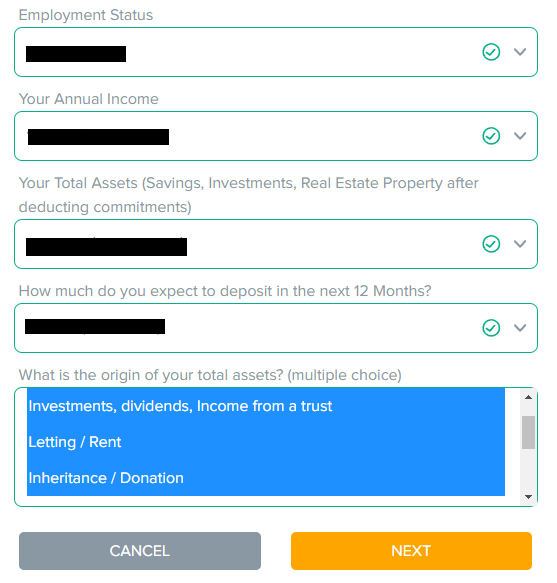

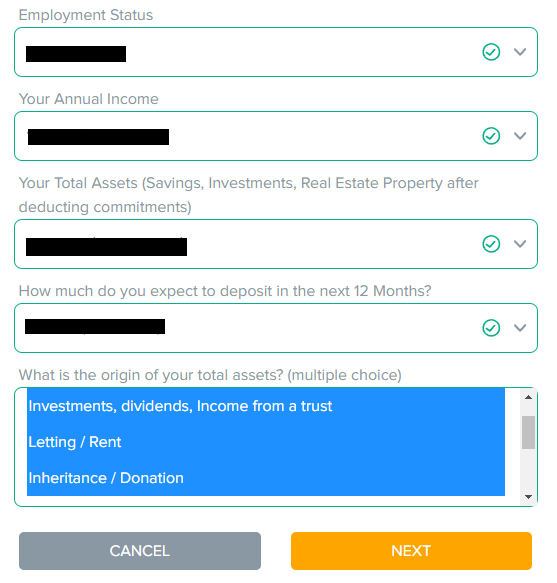

Answer several questions about your financial capabilities. Click "Next."

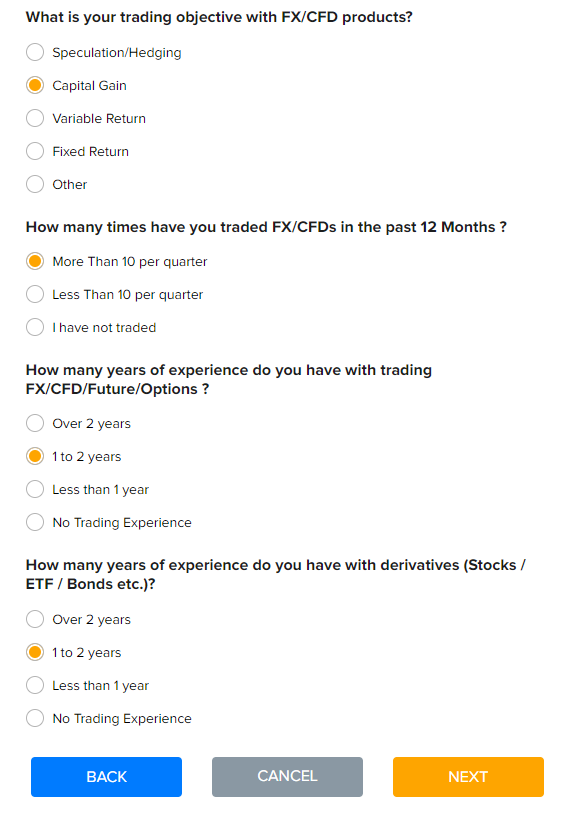

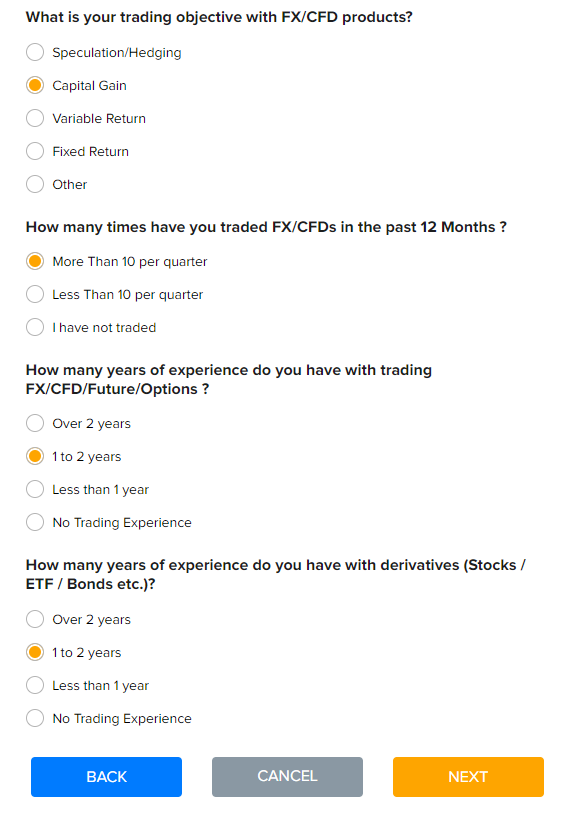

Answer several questions about your experience in trading Forex and CFDs. Click "Next".

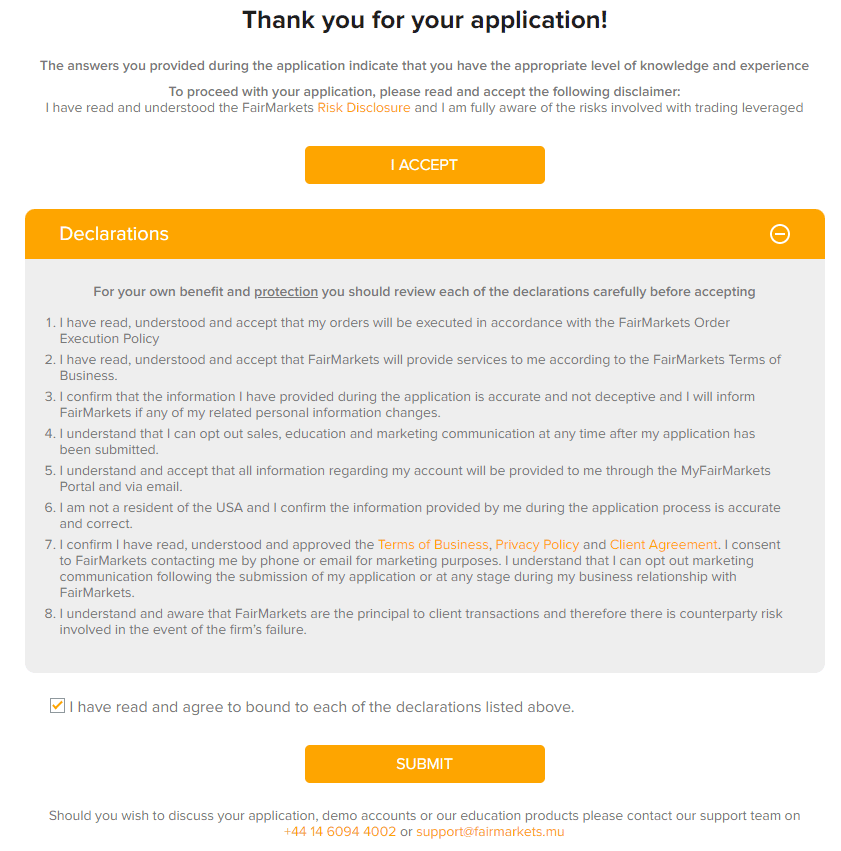

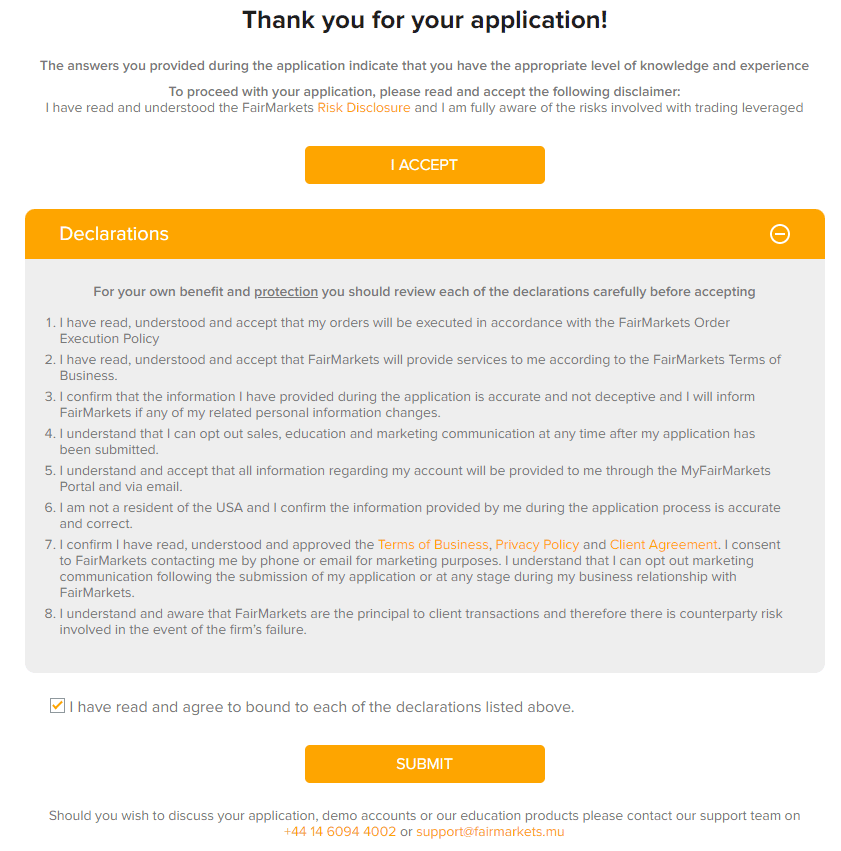

Read the disclaimer and agree to its terms by checking the box. Click "Confirm".

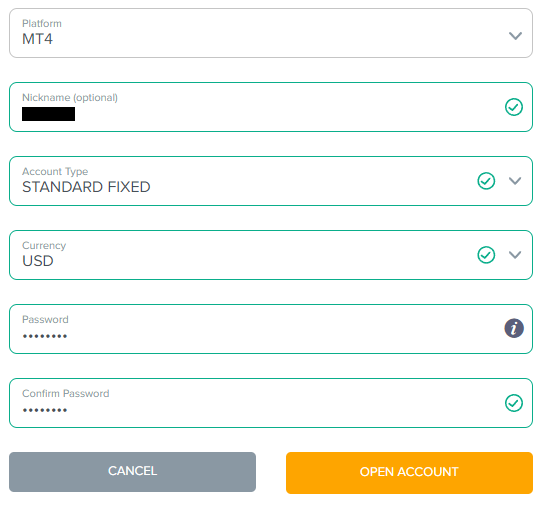

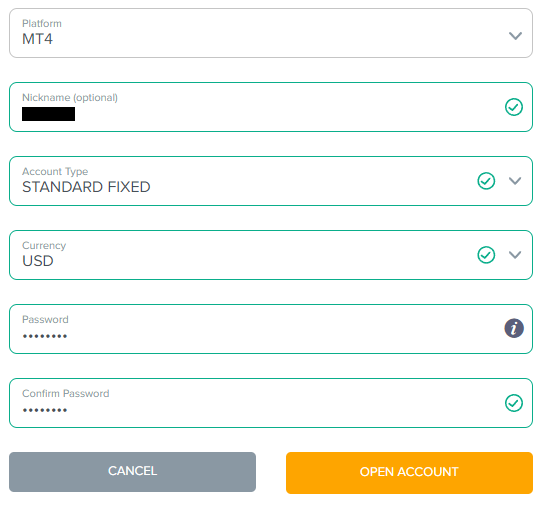

Choose a trading platform and specify a nickname (optional). Select the account type and base currency. Create a password for the account and enter it twice. Click "Open Account".

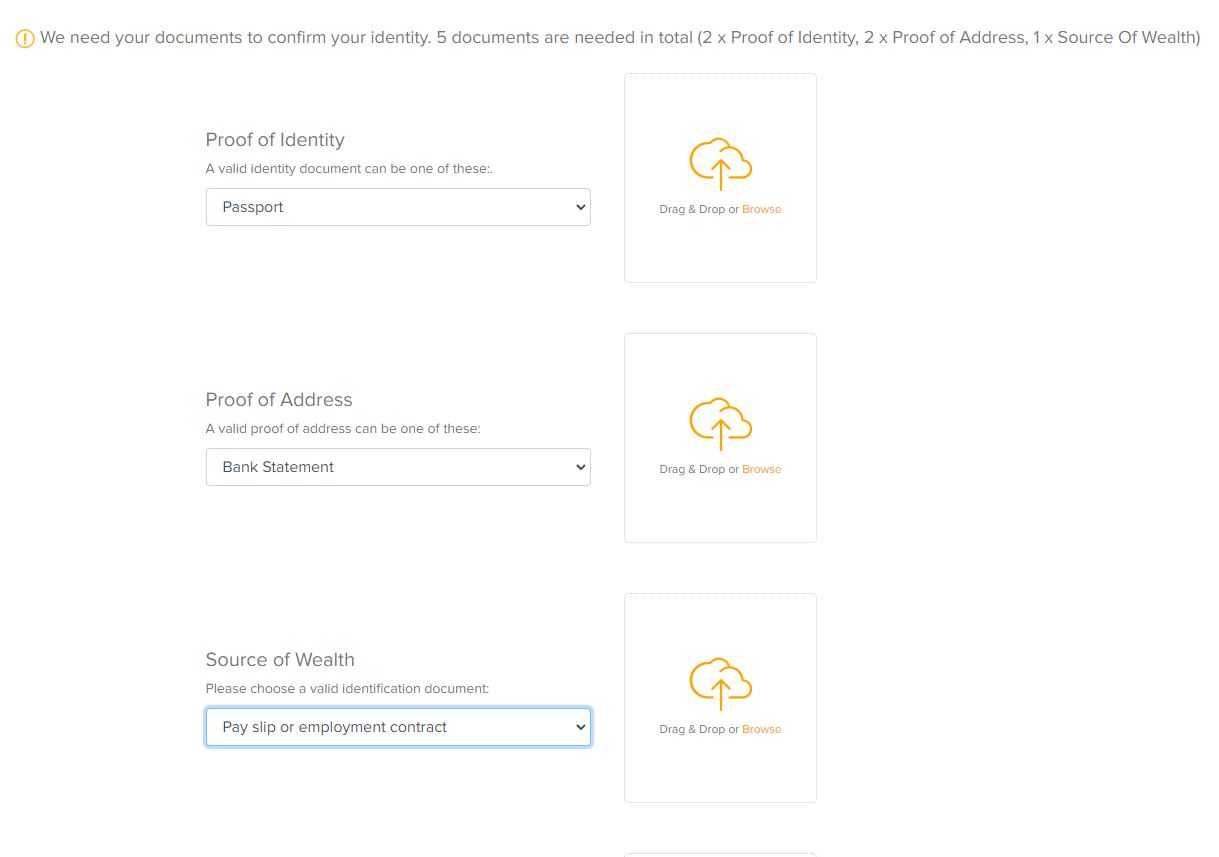

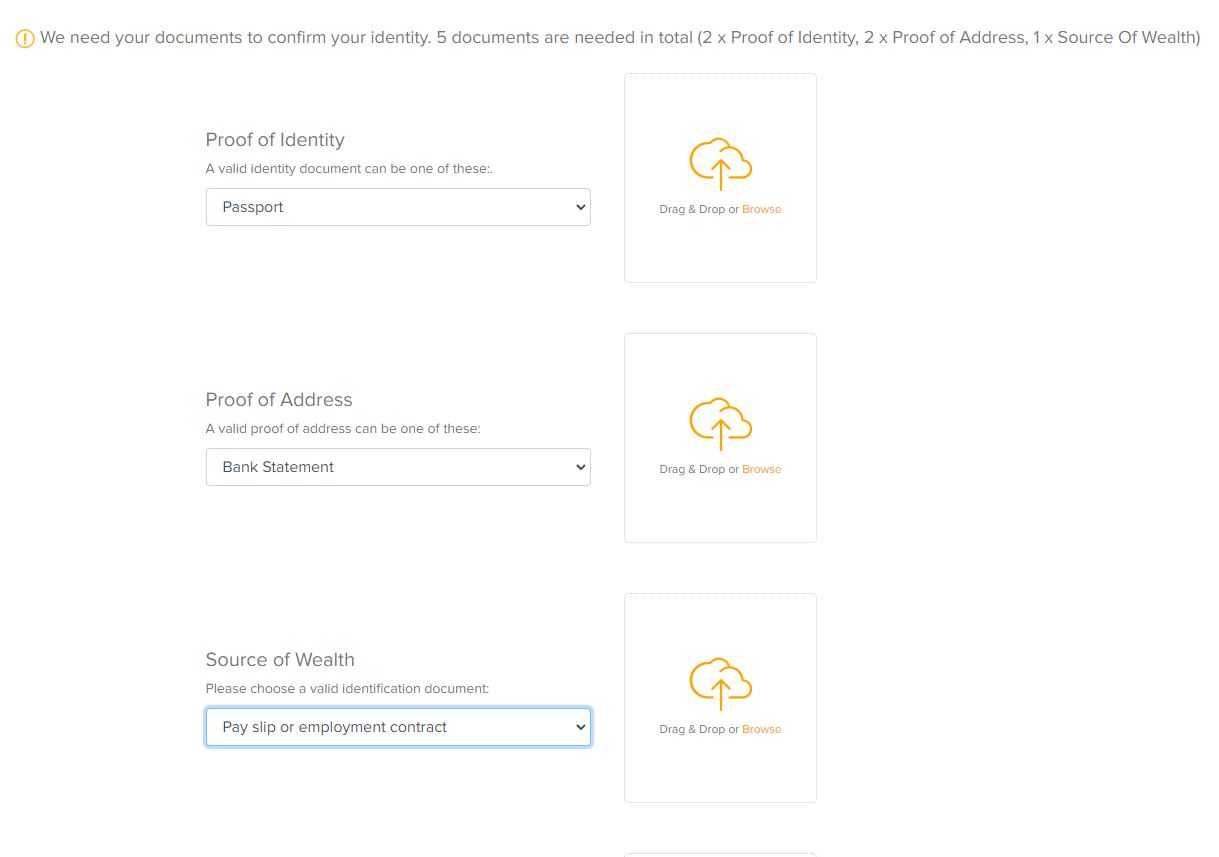

Confirm your identity through verification. For each block, choose the document type from the list and upload its scan/photo. Read the comments on the screen carefully. Click "Upload Documents" and wait for the verification to be completed.

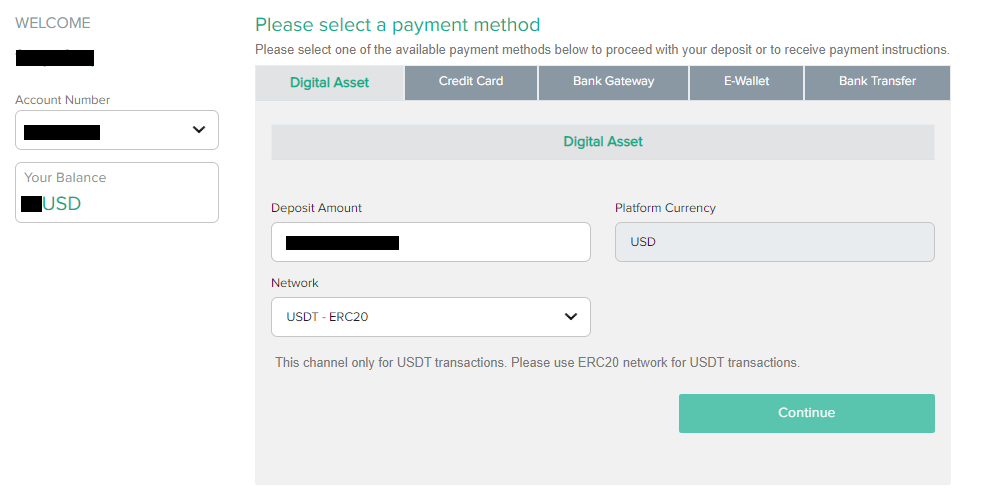

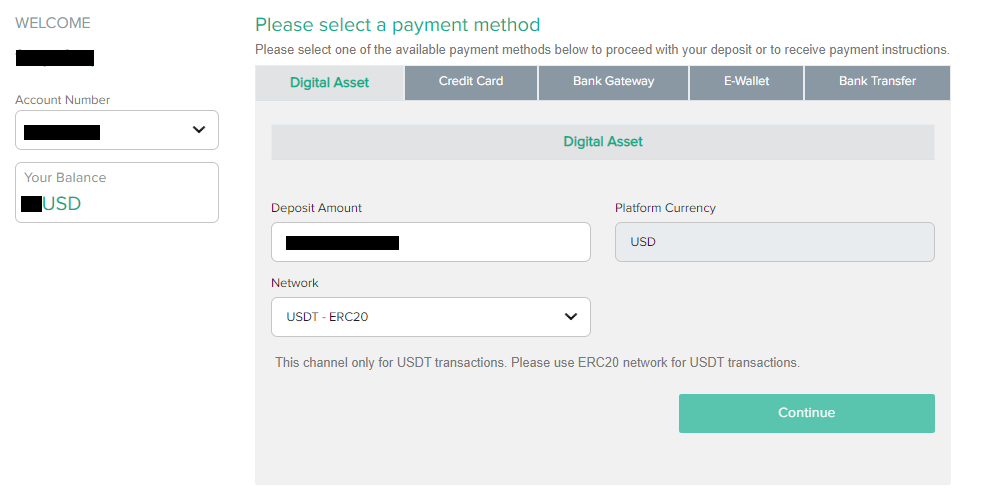

Click on the "Funds" button in the left menu. Select "Deposit." Follow the instructions on the screen. You can choose any available deposit method.

Click on the "Platforms" button in the left menu. Choose the suitable option for the trading platform. Download the software to your device and install it. Launch the platform, enter your registration data, and start trading.

Your FairMarkets user account also provides access to:

-

Tracking statistics on your accounts and accessing detailed information.

-

Open and close accounts (Demo and real), deposit and withdraw funds.

-

Make internal transfers and receive standard reports from the transaction archive.

-

Use the economic calendar, calculators, and other tools.

-

Download the trading platform software for MetaTrader 4, MetaTrader 5, or WebTrader.

-

Partner with this broker and track referral statistics.

-

Participate in the "Learn and Earn" quiz, which is regularly updated.

Regulation and safety

When it comes to a broker, the guarantee of security can only be provided through registration and regulation. A company that offers financial services must be officially registered, just like any other type of company. Otherwise, it would be operating illegally. Regulation, unlike registration, is voluntary. Having a regulator's license indicates the platform’s financial transparency. In case of a dispute, a trader can turn to the regulator and expect qualified protection of their interests. Trive Investment BV, which owns the FairMarkets brand, is officially registered in Mauritius. It is regulated by both the Mauritius Financial Services Commission (FSC) and the Australian Securities and Investments Commission (ASIC). Both licenses are confirmed and valid. This means that traders potentially have all the guarantees.

Pros

- This broker is officially registered and has two regulators

- In case of a conflict, a trader can appeal to FSC and/or ASIC

- No evidence of non-fulfillment of this broker's obligations have been recorded

Cons

- This company has no specialized protection mechanisms (e.g., user’s funds insurance)

- The trader will get nothing from appealing to the financial control authorities of his country

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| STANDARD FIXED | From $18, and without commission | Yes |

| STANDARD VARIABLE | From $12, and without commission | Yes |

| VIP VARIABLE | From $6, and without commission | Yes |

| RAW ZERO | From 0 points, the commission is $10 per lot | Yes |

As for the withdrawal commission, FairMarkets does not provide data about it on the website. Some companies have no such fee, while others have a limit on the number of free withdrawals per month. With FairMarkets, a trader will be informed about the exact commission amount when submitting a withdrawal request. All costs will be known in advance.

All the above indicators do not provide a clear idea of how profitable or unprofitable it is to work with this broker. To understand this, it is necessary to compare the offers of several platforms. The table below includes data for FairMarkets and two of its closest competitors.

| Broker | Average commission | Level |

|---|---|---|

|

$9 | |

|

$1 | |

|

$8.5 |

Account types

After reviewing this broker's general conditions and finding them suitable, the trader selects an account. FairMarkets offers four real account types, each with different conditions and purposes. STANDARD FIXED has the highest spread, no commission, and access to a large portion of this broker's asset pool. It is a universal account for beginners. STANDARD VARIABLE features reduced spreads, no commission, and standard leverage of up to 1:400. It is suitable for most active traders. VIP VARIABLE is a professional account. This is the only account with a minimum deposit requirement. It offers fairly low spreads and no commissions, with access to 47 currency pairs and all CFDs. RAW ZERO, on the other hand, offers a raw spread, making it the lowest, but it has a commission of $10 per lot. Thus, traders should orient themselves based on their trading preferences and available capital.

Account types:

FairMarkets is an ECN broker, that provides the highest order execution speed without delays. The service level is the same for all accounts, even the Demo account provides all the platform's capabilities. The difference is that the Demo account works with virtual currency but with real quotes.

Deposit and Withdrawal

If a trader is working on a Demo account, they are trading with virtual currency and are not earning any profits.

On each of the real accounts, this broker's clients can make a profit if their trades are successful.

Funds can be withdrawn from the account balance at any time through the corresponding option in the user account.

The current withdrawal methods include bank transfer, Visa and Mastercard cards, as well as Skrill and Neteller systems.

All information regarding the minimum withdrawal and fees is displayed when submitting the request.

This broker recommends withdrawing to a card as it is the fastest option available.

The platform processes withdrawal requests as quickly as possible, but the actual withdrawal may take several days.

Investment Options

Traders come to brokers to trade. However, if the platform offers alternative earning options, it can attract additional users. Today, the most common services are trade copying and joint accounts like MAM and PAMM. Some brokers also offer cryptocurrency staking and startup investments. However, FairMarkets doesn't have any of these as they only have a partnership program.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

FairMarkets partnership program

All a trader needs to do is go to the corresponding section of the website and apply for a partnership. If they are an individual, they can earn through typical referral conditions. This means that by using the link received in their user account, traders invite other users to the platform and receive bonus payments if the invited users become clients, i.e., register and start trading. Payments for one referral can reach $500, and there is no limit to the number of referrals. If a trader is a legal entity, this broker offers them an IBs (Introducing Brokers) type of partnership. This company's partner receives marketing materials and mechanisms for attracting users, as well as special trading conditions and transparent reporting.

Customer support

A trader may miss certain information or not understand something. For example, what are the options for depositing funds? Does this broker charge a fee for deposits? Is the trader obligated to set a stop-loss? Why was a trade forcibly closed, or why was a withdrawal request not processed? In any unclear situation, it is essential to contact competent client support. At FairMarkets, client support is provided through a call center, email, and live chat, available on the website and in the user account. Additionally, users can create a ticket on a separate page. All channels of support work promptly. Client support is available 24/5, meaning it operates on weekdays but not on weekends.

Pros

- There are several channels of communication

- Even unregistered users can contact support

- Works 24/5

- Support communicates in nine languages

Cons

- Managers are unavailable on weekends

Whether you are already working with FairMarkets or planning to become its client, whenever you have relevant questions or encounter a dispute, feel free to contact technical support using the following contact methods:

First phone number.

Second phone number.

Email.

Live chat on the website and in the user account.

Submit a ticket on the support page.

This broker is not present on social media platforms. Therefore, traders can only get the latest news, such as current promotions, from this company's website, as provided below.

Contacts

| Foundation date | 2020 |

|---|---|

| Registration address | The Cyberati Lounge, Ground Floor, Silicon Avenue 40, Cybercity, 72201 Ebene, Republic of Mauritius |

| Regulation | FSC, ASIC |

| Official site | https://www.fair.markets/ |

| Contacts |

+44 14 6094 4002, +230 460 8533

|

Education

Brokers understand the importance of knowledge for traders, especially those who are just starting to trade. That's why many of them offer educational programs to their clients. FairMarkets has also taken care of providing educational resources. They offer thematic video guides, a filtered article database, and electronic books. In addition, this broker regularly conducts quizzes in which every trader can participate. If a platform's client answers most of the questions correctly, they receive a monetary bonus. This is an excellent motivation for beginners to master the basics and advanced levels, and even experienced traders can benefit from revisiting the fundamentals, especially if they get paid for it.

FairMarkets' educational system is presented in various formats. This is a very good approach because some people prefer reading, while others prefer watching and listening. The fact that there is almost no information for experienced traders is not unique. The vast majority of brokers focus on educating beginners, and this is a normal practice.

Comparison of FairMarkets with other Brokers

| FairMarkets | RoboForex | Pocket Option | Exness | Eightcap | TeleTrade | |

| Trading platform |

MT4, MT5, WebTrader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MT4, MT5 |

| Min deposit | $5000 | $10 | $5 | $10 | $100 | $1 |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:10 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0.8 points |

| Level of margin call / stop out |

100% / 20% | 60% / 40% | 30% / 50% | No / 60% | 80% / 50% | 70% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed review of FairMarkets

Since this broker has been in the market for 15 years, there is a well-established opinion about it. Although FairMarkets may lag behind its competitors in some aspects, it offers services at a modern level without obvious drawbacks. The order execution is market-based, and no technical issues have been reported. This broker uses virtual servers and microservices architecture, which is a cutting-edge standard. FairMarkets does not stand still, they regularly update their stocks and expand their pool of assets. The infrastructure is well-established for its existing functions. For example, partners have a separate portal for their user accounts. Any disputes can be easily resolved through technical support, which meets the requirements for responsiveness and competence.

FairMarkets by the numbers:

There are 4 real accounts (plus a Demo).

Floating spreads starting from 0 pips.

The trading commission is either $0 or $10 per lot.

There are 3 trading platforms available.

There is a 100% welcome bonus on the first deposit.

FairMarkets is a comfortable broker for active trading

The comfort of the trader's work is ensured by several means. First, it's the trading platforms, which are MT4, MT5, and WebTrader. MT trading platforms are superbly customizable through plugins. Since they have mobile versions, the trader is not limited in terms of location and can trade from a smartphone almost anywhere. Second, the pool of assets has conceptual importance. The more assets available, the broader the trader's possibilities and the easier it is for him to diversify trading risks. FairMarkets offers 47 currency pairs and dozens of contracts for price difference (CFDs), represented in the following asset groups: stocks, indices, commodities, and cryptocurrencies. These instruments are more than enough to satisfy the trading needs of this company's clients. Moreover, this broker does not impose any restrictions, so traders can trade the news, scalp, hedge, and use advisors.

FairMarkets’ analytical services:

Trading Central. This tool is an analytical portal where the current market situation is assessed using machine algorithms and expert inputs.

Economic calendar. A typical service is provided in the form of a table displaying major economic and political events that can affect asset quotes. Quotes are shown in dynamics with forecasts.

Learn and Earn. This broker offers good training that can interest not only beginner users. Registered traders can participate in quizzes to test their knowledge, with winners receiving $100.

Advantages:

This company has been in the market for a long time, its activities are regulated by two regulators, making it a trustworthy and reliable broker.

Clients can start with a free Demo, and most real accounts do not have minimum deposit requirements.

A significant number of diverse assets are complemented by moderate leverage.

This broker offers good training, which is structured in various formats.

The website presents numerous special tools for technical and fundamental analyses.

Each trader can request a virtual private server (VPS). The service is paid, but if the balance is above $2,000 and the trader trades over 10 lots per month, it is provided for free. The delay is no more than 1 ms.

User Satisfaction