Trading platform:

- Mobile Apps

- Web-Plattform

SoFi Bank Review 2024

- USA

Currencies:

- USD

- 0.90%-1.50%

- $250,000-$500,000

Summary of SoFi Bank

SoFi is a digital bank that was founded in 2011. It is headquartered in San Francisco, California. The bank is regulated by the U.S. SEC and FINRA. The deposits are protected with SIPC and FDIC compensation mechanisms. SoFi offers checking, savings, retirement and investment accounts and also debit and credit cards. The bank offers the services of lending, insurance and financial planning, as a possibility to earn income on deposits. All transactions and payments can be performed in the mobile app; there is no need to visit a bank branch. Account opening in SoFi is absolutely free, but you need to have a U.S. taxpayer identification number.

| 💼 Main types of accounts: | SoFi Checking and Savings (Individual, Joint), SoFi Money, SoFi Invest, IRA, SoFi at Work |

|---|---|

| 💱 Multi-currency account: | No (only US dollars, conversion at the MasterCard exchange rate) |

| ☂ Deposit insurance: | Yes ($250,000 for individuals, $500,000 for joint accounts) |

| 👛️ Savings options: | Savings accounts, including retirement accounts |

| ➕ Additional features: | Direct Deposit, insurance services, transfer of salary to the card, up to 15% cash back on purchases |

👍 Advantages of trading with SoFi Bank:

- Regulation by the U.S. state regulatory authorities and membership in the compensation funds.

- A possibility to open an account and register a card remotely, without visiting the company office.

- Wide selection of lending programs for individuals and representatives of small businesses.

- Higher interest rate on deposits than that offered by the competitors offering banking services in the U.S.

- User-friendly mobile app that you can use to manage funds, make payments and receive detailed statistics on active accounts and cards.

- Free cash withdrawal at over 55,000 ATMs all across the world.

- Cash back not only on debit, but also credit cards.

👎 Disadvantages of SoFi Bank:

- SoFi banking services are available only for the U.S. tax residents.

- Multicurrency accounts are not available, only USD.

- The company does not offer zero-interest loans.

Evaluation of the most influential parameters of SoFi Bank

Table of Contents

- Geographic Distribution

- Video Review

- Latest Comments

- Expert Review

- Latest SoFi Bank News

- Analysis of SoFi Bank

- Dynamics of the Popularity

- Investment Programs

- Terms for Cooperation

- Detailed Review

- Banking features

- Technical Support

- Social programs

- How to open an account?

- User Reviews of SoFi Bank

- FAQs

- TU Recommends

Geographic Distribution of SoFi Bank Traders

Popularity in

Video Review of SoFi Bank i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of SoFi Bank

SoFi is a digital bank that allows you to perform banking transactions on your smartphone without having to visit a bank branch. However, the remote nature of service provision does not affect the bank’s reliability and functionality. SoFi operates under the supervision of the U.S. regulators and participates in the compensation mechanisms, which means that clients’ funds are protected at the state level. At the same time, a high level of security does not impact the cost of the services. Quite on the contrary, SoFi aims to minimize the expenses of the clients and does not charge fees for servicing the cards and accounts and also partially covers the overdraft fees.

SoFi has certain peculiarities that need to be taken into account before you open a bank account. First, this bank works only with citizens or permanent residents of the U.S. Second, all accounts are opened only in USD and there is a fee on conversion into other currencies. There is one more nuance: SoFi debit/credit cards support only the MasterCard system. Therefore, you won’t be able to use the Visa system.

During the analysis of SoFi conditions, we discovered another unique option. Cash back credited to the credit card can be exchanged for cryptocurrency. However, this option is available only to the clients of the bank with the SoFi Invest account. As for the cash back amount, it varies depending on the type of the card: for Debit Cards it can be as high as 15%, and for Credit Cards – up to 3%.

SoFi offers loans to individuals and small businesses at average rates in the U.S. Jumbo Loans is a home mortgage loan for USD 500,000 – USD 3 million. At that, the loans for a large amount are provided under beneficial conditions: 4.5% maximum interest rate and 10% minimum down payment.

Dynamics of SoFi Bank’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of SoFi Bank

SoFi offers several investment solutions. One of them is active investing that allows you to trade stocks and ETFs with no commissions. Investing in fractional shares with as little as $5 is available. If a client wants to earn fully passive income, i.e. he doesn’t want to trade, he can turn on the automated investing option. In this case, a program and not a person will build a portfolio and rebalance it on a quarterly basis. The minimum investment amount for automated investing is USD 1. SoFi also offers three types of IRA: Traditional, Roth and SEP. They are savings accounts that bring passive income once an investor reaches a certain age.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Terms for Cooperation with SoFi Bank

SoFi services are available only to U.S. tax residents, including those living outside the country. The company has no requirements for the account balance. A client can deposit any amount to a checking or savings account. The US Dollar is the account currency. The bank issues debit and credit cards. They work through the MasterCard payment system and can be linked to Google Pay and Apple Pay.

| 💼 Main types of accounts: | SoFi Checking and Savings (Individual, Joint), SoFi Money, SoFi Invest, IRA, SoFi at Work |

|---|---|

| 💱 Multi-currency account: | No (only US dollars, conversion at the MasterCard exchange rate) |

| 💵 Deposit terms and conditions: | From $1, from 12 months, 0.90$ annual interest without the direct deposit, 1.50% with the direct deposit |

| 💳 Loan terms and conditions: | No-fee overdraft with the monthly direct deposit from USD 1,000, personal loans from USD 5,000 to USD 100,000 at 1.89% - 22.23% |

| ☂ Deposit insurance: | Yes ($250,000 for individuals, $500,000 for joint accounts) |

| 👛️ Savings options: | Savings accounts, including retirement accounts |

| 📋 Types of payment: | Debit/credit cards, ACH, Western Union, MoneyGram, bank transfer, Apple Pay, Google Pay |

| ➕ Additional features: | Direct Deposit, insurance services, transfer of salary to the card, up to 15% cash back on purchases |

Comparison of SoFi Bank with other Brokers

| SoFi Bank | Wise | Bunq | Curve Bank | Revolut | Aspiration Bank | |

| Supported Countries | USA | Globally | Netherlands, Germany, Austria, Italy, Spain, France, Belgium, Ireland, Bulgaria, Croatia, Slovenia, Republic of Cyprus, Finland, Greece, Hungary, Latvia, Lithuania, Luxembourg, Malta, Norway, Poland, | UK and EEA | Globally | US |

| Supported Currencies | USD | 54 currencies | Euro (16 European currencies in the Easy Money plan) | 26 currencies | 30 currencies | USD |

| Deposit insurance | $250,000-$500,000 | No | EUR 100,000 | No | Yes | Yes |

| Minimum deposit | $1 | No | No | No | No | $10 |

| Deposit rate | 0.90%-1.50% | No | 0.09% APY | No | 6.45% | No |

| Loan Rate | 1.89%-22.23% | No | The bank does not issue loans | No | 0.65%-0.7% | 3%-5% |

SoFi Bank Commissions & Fees

SoFi does not charge a fee for opening checking and savings accounts. Debit and credit cards are issued for free. Also, the digital bank does not charge a service fee (monthly or annual). Withdrawal at Allpoint and Star ATMs is free. If an ATM does not belong to a partner, the fee may range from $2.5 to $5 per transaction. For withdrawals from a foreign ATM, a fee of 1% to 3% may be charged.

The rates on personal loans (travel, wedding, home improvement loans) is 6.99% - 22.23%, home mortgage – 4.74%-5.46%. The flexible rate on student loans is 1.89%-11.98%, fixed rate – 3.75%-13.3%. The interest rate on Jumbo loans (large mortgage loans of up to USD 3 million) is 4.13%-4.5% depending on the chosen period of 15 or 30 years.

SoFi clients can practically instantly transfer money using a P2P system directly from the app and for free. The fee for international exchange depends on the currencies and varies from 0.2% to 0.9%.

The table below shows the fees and commissions charged by SoFi and other digital banks.

| Broker | Overdraft fee | ATM Withdrawal Fee | International transfer fee | International exchange fee |

| Revolut | No | Up to $350 - free - beyond $350 - 2% | 0.3% (min. $0.30, max. $6) | From 0% to 1% |

| Chime Bank | No | No | No | 3% (max.$5) |

| SoFi Bank | 0% | $0-5 | 0% (P2P payments) | 0.2%-0.9% |

SoFi aims to minimize the expenses of its customers. The digital bank does not charge commission for providing the mobile app, or a fee for opening and servicing the accounts of all types. SoFi clients can transfer money to each other for free and they don’t have to pay the overdraft fee provided they repay the debt within the stated deadline. Clients can also withdraw money from partner ATMs for free and exchange currencies at a good rate. The minimum rate on personal loans is 6.99%, which is an average level in the U.S. banking services market.

Detailed review of SoFi Bank

SoFi is a U.S. broker and a digital bank that was established in 2011. The bank offers a user-friendly app to its clients for managing personal finance and also bank products and solutions for saving and growing capital. The company is licensed by the U.S. Securities and Exchange Commission (SEC), the state regulatory authority of the U.S., and FINRA (Financial Industry Regulatory Authority). The bank is also a member of FDIC (Federal Deposit Insurance Corporation) and SIPC (Securities Investor Protection Corporation).

SoFi in figures:

-

Over 11 years of working with bank products;

-

Over 4 million people use the services of the digital bank;

-

Over USD 100 million in savings accounts;

-

Over USD 55 billion in issued loans;

-

SoFi clients repaid over USD 22 billion in loans.

SoFi can manage accounts and money from the mobile apps. The apps are available for Android and iOS smartphones. You can download them for free on Google Play and App Store. Also a web platform is available. It operates on all popular browsers and does not require installation. The apps offer the required features for convenient money management, quick money transfer, viewing information on loans and deposits.

SoFi’s useful features:

-

Mortgage calculator. This is an instrument for calculating your monthly payment based on the total value of property, down payment, interest rate and repayment period.

-

Personal Loan calculator. The calculator allows you to calculate the total debt on a loan as of now and ways to save on total interest.

-

SoFi Member Rewards. The participants of the program can earn points by taking various actions in the app or your personal account. Points can be turned into cash, used to repay the loan interest, invested in fractional shares or cryptocurrency.

-

Referral program. With a referral program, an existing client can earn money by attracting new users of banking and investment services offered by SoFi.

-

Free Financial Planning Advice. You can receive your advice during a personal conversation with a company’s financial expert, which takes place in the video chat format.

-

A discount on various types of planning. Thanks to the partnership with Trust & Will, a top online trust and estate planning platform, SoFi clients get a 25% discount on trust, will or guardianship estate plans.

-

Blog. The blog features a guide on smart investing for beginners, advice and long-term strategies, company and economy news.

Advantages:

SoFi Bank is a member of FDIC, which means that client funds in the checking and savings accounts are protected at the state level.

Any adult resident or citizen of the U.S. can open an account, regardless of their previous credit history.

In addition to debit cards, SoFi offers credit cards with a cash back.

There are no requirements for the account and card balance, no-commission overdraft is available.

The company joined the checking and savings accounts into a single account SoFi Checking and Savings, which made it easier to manage and monitor their money.

Mobile apps are protected with a two-factor authentication using a text message.

Opening and servicing of accounts and cards is absolutely free.

The company offers various types of loans, including large mortgage loans for up to USD 3 million.

Clients have access to insurance services, refinancing of previously issued loans, pension and student savings plans.

Types of accounts for individuals and businesses

Banking features

SoFi offers the most demanded banking services in digital format. The bank’s clients have access to various types of loans, mortgage, student loan and car loan refinancing, retirement and financial planning. SoFi provides car, life and property insurance, both private and rented.

Small business owners are offered various financing programs for buying commercial property, equipment and raw materials, for repairing and expanding production capacity, etc. The programs offer up to USD 2 million for a term of 7 years. SoFi At Work is another business solution. Hired employees can use the account at SoFi bank to receive salaries, bonuses and discounts on loans.

You can check your credit rating on the website and also read advice on how to improve it. It is possible to link different types of accounts (checking, savings, investment and retirement) with credit cards, loans and credits. This allows you to actively monitor the use of funds and, if necessary, redirect them from one account to another.

Technical Support

The SoFi website features Help Center and FAQ sections, where users can find information on bank and loan products, interest rates, commissions and fees. Customer support is available in a chat, by phone and email.

You can ask questions about the checking and savings account, personal loans and student loans from Monday to Thursday from 5am to 7pm, and from Friday to Sunday from 5am to 5pm PT. Contact phone is (855) 456-7634.

Specialists on home loans are available by phone (844) 763-4466 and homeloans@sofi.com from Monday to Friday, from 6am to 6pm PT. Credit card support is available 24/7 on this number: (844) 945-7634.

Social programs of SoFi Bank

SoFi social programs are built on three principles – diversity, equality and inclusiveness. The company leaders believe that changes in society begin with changes within the team, so by 2023 they plan to completely reorganize their staff along gender and demographic lines.

SoFi holds training sessions for team members that aim to develop an open mind towards various groups, including LGBTQ+, veterans, and people with mental or physical disabilities. SoFi also actively works with military organizations and universities, as by 2023 its staff should consist of 20% students and military.

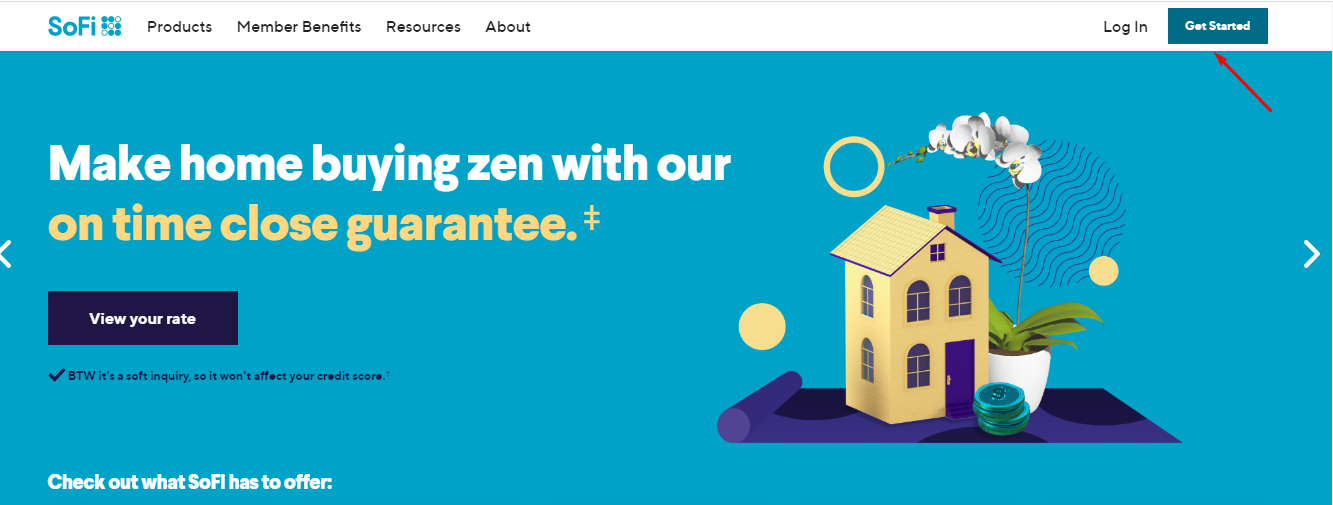

How to open an account at SoFi Bank

You can open an account at SoFi bank on its official website. You need to click Get Started and choose an account that you need. After that you will see the registration form. Provide your First Name, Last Name, State, Email and Password. There will be a button for downloading the SoFi app on the page of account opening. Click on it and select the store – Google Play or App Store.

In order to start using the bank’s services, you need to verify your identity. You will need to provide your Social Security Number and identity documents. Once SoFi verifies your information, you will be granted access to your Personal Account. You will be able to access it from the website and in the mobile app.

During registration you will be asked to provide your address, where the SoFi Mastercard debit card will be sent. Shipping is free to any US state. World Elite Mastercard credit card is issued additionally.

Only citizens or permanent residents of the U.S., who turned 18, can open an account at SoFi. The bank does not charge account opening or servicing fees. No fees are charged on cards as well. On the contrary, card holders can get cash back on the purchases at physical and online stores.

Disclaimer:

Your capital is at risk. Via SoFi Bank's secure website. Your capital is at risk.

Articles that may help you

FAQs

How does SoFi Bank earn money?

The main income of SoFi Bank is from commissions. You can learn the structure of commissions in detail on the bank's website.

How does SoFi Bank protect its customers?

SoFi Bank uses two-factor authentication, data encryption and other security methods.

Is it possible to check the statistics of expenses?

SoFi Bank provides clients with extended statistics. You can study the detailed information about revenue receipts, expenses, split into different periods of time, etc.

Is it possible to make international payments through SoFi Bank?

Yes. SoFi Bank allows you to make payments between customers in different countries.

Traders Union Recommends: Choose the Best!

Via Wise's secure website.

Via Bunq's secure website.

Via Curve's secure website.