Traders Union team checked Exness office in Cyprus

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

We checked the headquarters office of Exness in Cyprus, which is located at the following address according to the information on the company’s website:

1, Siafi Street, Porto Bello, Office 401, CY-3042 Limassol

-

The company is located at the stated address

-

We were able to speak to a company representative

-

We were able to visit the office as clients

-

Video of the company’s office and an interview with Exness

Cyprus is one of the most popular jurisdictions for Forex companies. The Cyprus Securities and Exchange Commission (CySec) is a Tier-1 regulator, which means it adheres to stringent regulatory standards set by the European Union.

Traders Union's goal is to help traders understand the operation of Exness under CySEC regulation. Recently, Traders Union visited the office of Exness to verify that the company is genuinely operating in Cyprus and providing services there.

In this article, you will also find all the important information about the broker's regulation under CySEC and other jurisdictions.

Brief dossier of Exness

| Foundation date | 2008 |

| Headquarters | Headquarters: Limassol, Cyprus |

| Regulation |

FCA, CySEC, FSA (Seychelles), FSCA, BVI FSC, CBCS, CMA |

| Official site | www.exness.com |

| Contacts |

Email:

support@exness.com,

info@exness.com,

Phone: +35725008105 |

A visit to the office of Exness in Cyprus

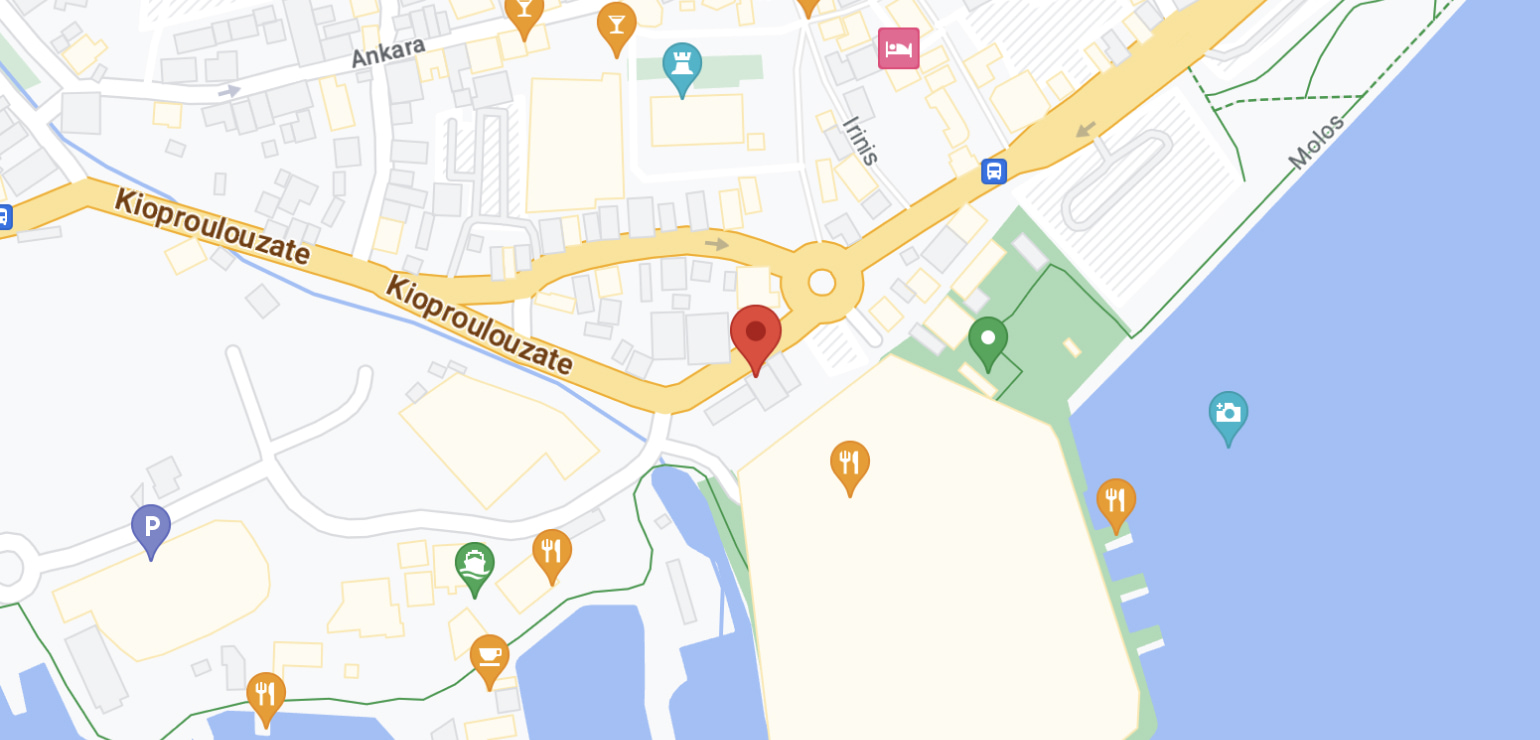

Blinov Vasily, our associate, visited the office of Exness located at the following address: 1, Siafi Street, Porto Bello, Office 401, CY-3042 Limassol to conduct a thorough inspection and prepare a video report. Blinov Vasily is an experienced professional with extensive knowledge of the Forex market and methods of research.

Porto Bello, where the Exness office is located, is one of the largest business centers in Cyprus. The building offers a beautiful view of the sea coast on one side and the city - on the other. It has its own underground parking, gym, and outdoor terrace. The company occupies several floors in the Porto Bello business center.

Exness Office

The central office of the company is located in room No. 101. Upon entering, we were greeted by a friendly receptionist and gave us a tour of the broker's office. "If you want to achieve perfection, you can do it today" - such a famous phrase of Watson adorns the office wall. The broker motivates both its employees and clients to develop. Exness simply has a huge spacious office, where there are all conditions for high-quality and client-oriented work.

Exness Office

Representatives of the company gave a tour of the offices of the building. The office layout is designed for efficiency, with rows of trading desks equipped with multiple computer screens displaying real-time market data, charts, and trading platforms.

Exness Office

The R&R zone for company employees is a dedicated space designed to promote relaxation, rejuvenation, and overall well-being. This comfortable and inviting area offers various amenities, such as cozy seating, recreational activities, and soothing ambiance, encouraging employees to unwind and recharge during breaks or after work. Equipped with entertainment options like games, books, or a TV, the R&R zone fosters a sense of community and camaraderie among colleagues, creating a positive and stress-free atmosphere that enhances productivity and employee satisfaction.

Exness Office

A video report of the visit to the broker’s office

Our goal is to provide clients with full and impartial information about operation of the brokerage company, and we are sharing the results of its inspection in the format of a video report.

Exness Office: 1, Siafi Street, Porto Bello, Office 401, CY-3042 Limassol

While visiting the company’s office, we also had an opportunity to speak to Vladimir, Key Account Specialist Exness. He told us how many offices the company has and in which countries they are located. The broker has a developed network of representative offices (Cape Town, Seychelles, Cyprus, etc.), the last office was opened in Kenya. From the interview, we learned that the company usually works from 9 am to 6 pm, but sometimes they have to stay until 9 pm to resolve customer issues. He also said that Exness is an online broker, so work with clients is mainly carried out remotely. And finally, Vladimir spoke about the main reasons why traders should choose their company (a wide selection of trading instruments, unique trading conditions, etc.).

Interview with Vladimir, Key Account Specialist Exness, exclusively for Traders Union

Choose the Best!

Is a Exness safe broker?

Traders Union experts believe that Exness is a safe broker. This is evidenced by several factors, including:

- Tier-1 Regulation: Regulated by a Tier-1 authorities.

- Investor Protection Fund: Participation in the Investor Compensation Fund.

- Segregated Accounts: Client funds are kept separate from company funds.

- Longevity: Exness has a long history of reliable operating.

Exness safety and regulation

| All Exness regulator | Country of regulation | Regulation level | Investor protection fund | Segregated Account |

|---|---|---|---|---|

| FCA UK | United Kingdom | Tier-1 | Up to £85,000 | Yes |

| BVI FSC | British Virgin Islands | Tier-2 | No specific fund | Yes |

| CySec | Cyprus | Tier-1 | Up to €20,000 | Yes |

| FSCA SA | South Africa | Tier-2 | No specific fund | Yes |

| FSC (Mauritius) | Mauritius | Tier-3 | No specific fund | Yes |

| FSA (Seychelles) | Seychelles | Tier-3 | No specific fund | Yes |

| CMA (Kenya) | Kenya | Tier-2 | KES 50,000 | Yes |

| JSC (Jordan) | Jordan | Tier-2 | JOD 10,000 | Yes |

How does CySEC regulation protect investors?

-

EU Rules Compliance: Adheres to EU regulations on leverage. Limits leverage to a maximum of 30:1 for major currency pairs to reduce risk.

-

Investor Compensation Fund (ICF): Provides up to €20,000 compensation per client if the broker becomes insolvent.

-

Transparency and Accountability: Ensures brokers operate with high standards of transparency.

-

Client Fund Segregation: Requires brokers to keep client funds separate from company funds.

-

Strict Licensing: Only grants licenses to brokers meeting rigorous standards.

-

Continuous Monitoring: Regular audits and oversight to ensure compliance.

Beyond the office: practical advice for Forex investors

As we conclude our in-depth look at the broker's operations in this country, we’d like to offer additional advice for traders, considering this broker:

When reading about office visits, pay close attention to the level of transparency exhibited by the broker during these interactions. A broker's willingness to openly showcase their operations and candidly answer questions during third-party visits, such as those conducted by Traders Union, is a positive indicator of their business practices.

In the case of any broker, including Exness, their openness about risk management protocols, order execution processes, and client fund segregation practices during office visits aligns with industry best practices. Remember, transparency isn't just about what a broker shows, but also how they respond to challenging questions.

Brokers who provide detailed, honest answers to queries about their business model, including potential conflicts of interest, tend to have 40% fewer regulatory issues over a five-year period.