Types of XM.com accounts

Types of trading accounts in the XM Group

Traders cooperating with the XM Group broker can choose from several types of trading accounts with varying conditions. Novice clients of the company can start trading on a demo account to hone their skills and strategies, as well as get acquainted with all the trading functions of the broker. Classic (real) trading accounts allow more experienced traders to trade and make money on Forex.

- ● Demo account;

- ● Micro (cent);

- ● Standard;

- ● XM Ultra-Low;

- ● Shares.

| Tickmill | XM | Admirals | |

| Number of real accounts types | 3 | 4 | 5 |

| Cent accounts | No | Yes | Yes |

| Number of demo account types | 3 | 2 | 1 |

XM Group’s demo account

Seasoned traders know how important demo accounts are at the final stage of a trader's preparation and before starting to work using real money. Demo versions of trading accounts with virtual deposits are suitable both for beginners who are taking the baby steps in trading and for experienced traders who seek to test their strategies or check the work of advisors. Trading conditions on a demo account practically do not differ from working with real money, except that in the first case you risk nothing.

The XM Group broker offers the following demo account options, which are similar to real accounts:

- ● XM Standard;

- ● XM Ultra-Low Standard.

Before opening a demo account, a trader can choose the following options:

- ● Type of trading platform;

- ● Currency of the trading account;

- ● The size of the proposed investment;

- ● Account type;

- ● Leverage size.

| Standard | XM Ultra-Low Standard | |

| Minimum deposit | $0 | $0 |

| Account currencies | EUR, USD, GBP, AUD, ZAR, SGD, CHF, JPY, RUB, PLN, and HUF | EUR, USD, GBP, AUD, ZAR, and SGD |

| Maximum leverage | 1:888 | 1:888 |

| Instruments | Currency pairs, CFDs on precious metals, indices, stocks, and energies | Currency pairs, CFDs on precious metals, indices, stocks, and energies |

| Spread | From 1 pip | From 0.6 pips |

By opening a demo account with XM.com, you can test your trading strategy and roughly understand how much you can earn with this or that starting capital on Forex.

XM Group cent accounts

After a demo account, novice traders strive to try their hand at cent (aka micro) accounts, where the trader is risking only a small amount of capital. This is a great way to prepare for navigating a real account. Cent accounts are characterized by high leverage, which gives the trader a chance to significantly increase the trading potential and, accordingly, increase the probable profit.

The XM Group broker allows its clients to work on the micro type account. The leverage here, as in other types of accounts with this broker, is 1:888. The maximum number of positions is 200. It should be noted that this is not the best indicator. For example, the Forex4you broker allows you to open up to 500 orders at the same time, which is 2.5 times higher than the value at XM.com.

Classic accounts at XM.com

The XM Group broker offers traders the following types of live trading accounts:

-

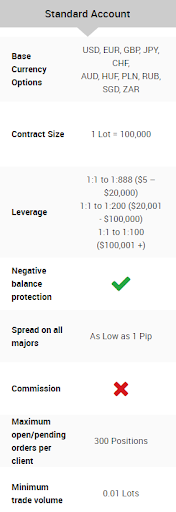

● Standard

All instruments that are in the broker's arsenal are available for trading (currency pairs, CFDs on indices, stocks, commodities). The minimum deposit is $5. The maximum leverage is up to 1 to 888. The minimum lot size is 0.01. Spreads are from 1 pip. This type of trading account is suitable for both beginners and professional currency speculators.

XM Group Account Types — Standard

-

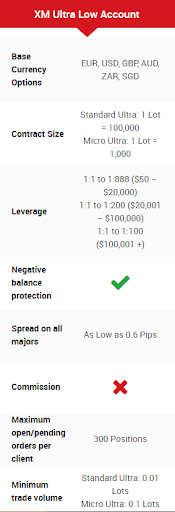

● XM Ultra Low

This type of trading account differs from others by low spreads, from 0.6 pips, suitable for intraday traders. The deposit starts from $50. The maximum number of open positions is 200. The maximum leverage is 1: 888.

XM Group Account Types — XM Ultra-Low

-

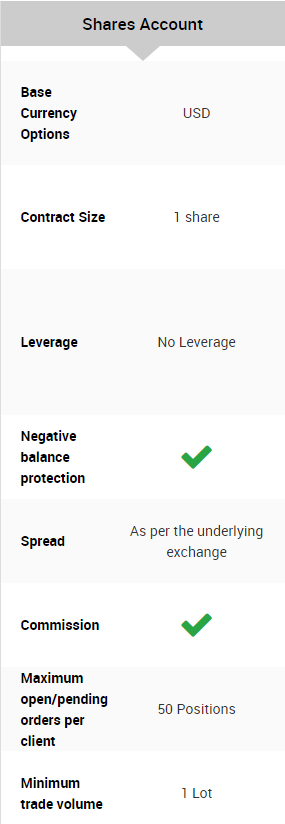

● Shares

This is a separate type of account for trading stocks. The minimum deposit is $10,000. The spread depends on the conditions of the specific exchanges on which the trader buys the shares. No leverage is provided on this type of trading account.

XM Group Account Types — Shares

FAQs regarding account types at XM.com

Is algorithmic trading possible with XM Group?

You can use trading advisors on all trading accounts of the XM Group broker without exception. The company offers fast order execution, which is a clear advantage when working with advisors.

Which XM.com accounts are best for newbie traders?

Beginners can practice on demo accounts from the beginning to prevent risking real money. After that, it is recommended to switch to a micro (cent) account to consolidate skills, as well as get the first real profit.

How much can you start trading with at XM Group?

The minimum deposit with XM.com broker is $5. This amount will be enough for beginner traders to take their first steps in Forex trading. Experienced Forex players are advised to make larger deposits in order to increase the potential profit.

How to open a trading account with XM Group?

To do this, just go to the XM Group broker's website and complete the registration process.

What are the advantages of opening a trading account using the Traders Union referral link?

By opening an account using the Traders Union referral link, the trader gets the opportunity to earn additional money without risks because a return of a part of the spread for each completed transaction.

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.