Tickeron Review: How To Analyze Stocks With AI

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Tickeron is a trading and investing platform that uses AI algorithms to analyze the market and provide trading signals. Advantages include automatic pattern recognition, trend forecasting, and access to educational resources. Disadvantages include high subscription costs and a possible complex interface for beginners.

Tickeron is an online trading and investment platform that offers algorithmic tools designed to enhance trading strategies. It provides a platform where financial experts and consultants offer their services. Tickeron supports stocks, cryptocurrencies, and Forex, offering unified tools for analysis. For instance, the screener allows users to apply filters across these asset classes. The platform offers a range of subscription plans, with some free test features available. This article provides an overview of Tickeron’s trading algorithms and guides you through the registration process.

What is Tickeron?

Tickeron is a platform developed by SAS Global, a company known for its solutions in the field of business analytics. SAS Global's clients are Fortune 500 companies. The platform combines algorithms based on artificial intelligence and the services of financial experts. It has been operating since 2013, and its headquarters are located in Nevada.

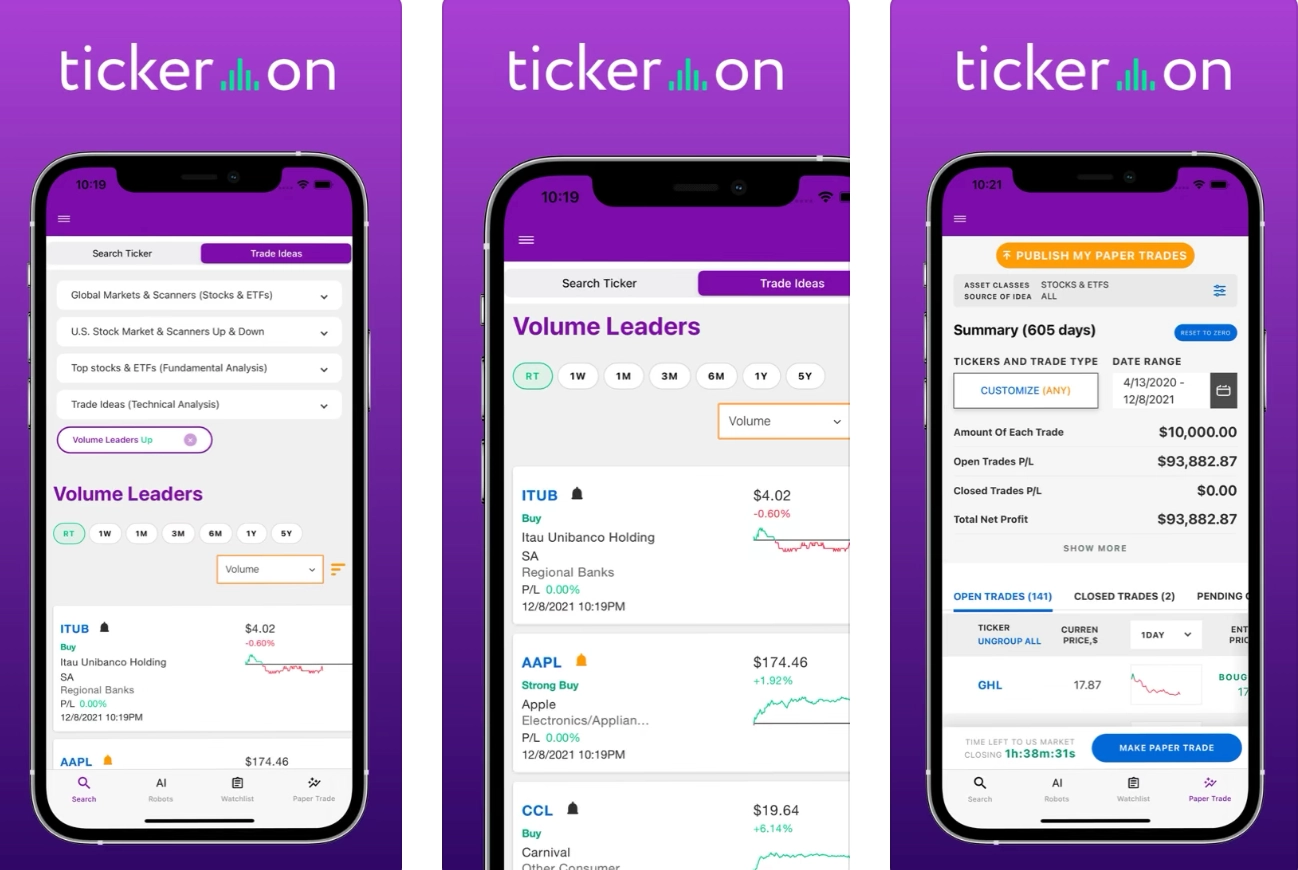

One of the key functions of Tickeron is the recognition of graphic patterns. The user sets the parameters, after which the system automatically finds figures on the asset charts that have previously shown high reliability. Artificial intelligence analyzes historical data and evaluates the success of past forecasts, which helps to determine the optimal entry points for trades. Access to the tools is provided both through the web platform and through mobile applications for iOS and Android.

Tickeron offers solutions for traders of any skill level. Beginners can use AI forecasts, and experienced users can use ready-made investment models to optimize time and analyze trends. The answer to the question about the cost and advantages of the platform can be found in the section describing the tools.

Tickeron features

Tickeron robots offer 8 products, including various tools. For example, a screener using artificial intelligence analyzes charts to find patterns. The principle of operation is the same for all types of assets - stocks, cryptocurrencies and Forex - so there is no need to describe them separately.

The platform is focused on two categories of users: traders and investors, as well as service providers - consultants and experts. The latter work through the "Marketplace" section, where they post forecasts and offer services. The main focus will be on the platform's tools for traders and investors.

Robots with artificial intelligence

Tickeron robots are the most popular tool on the platform. They use more than 100 algorithms to offer optimal strategies for specific assets. Each strategy includes data on the number of trades per day, the number of bets, the percentage profit and its monetary equivalent.

The user can set up filters: select the duration of the trade, the desired profitability, the trading style (for example, scalping or intraday trading) and the validity period of the strategy, for example, 30 days. Robots support working with stocks, cryptocurrencies, Forex and ETFs. The process is as simple as possible: in the robots section, you just need to set the parameters, select a strategy and activate it by clicking the "Subscribe" button.

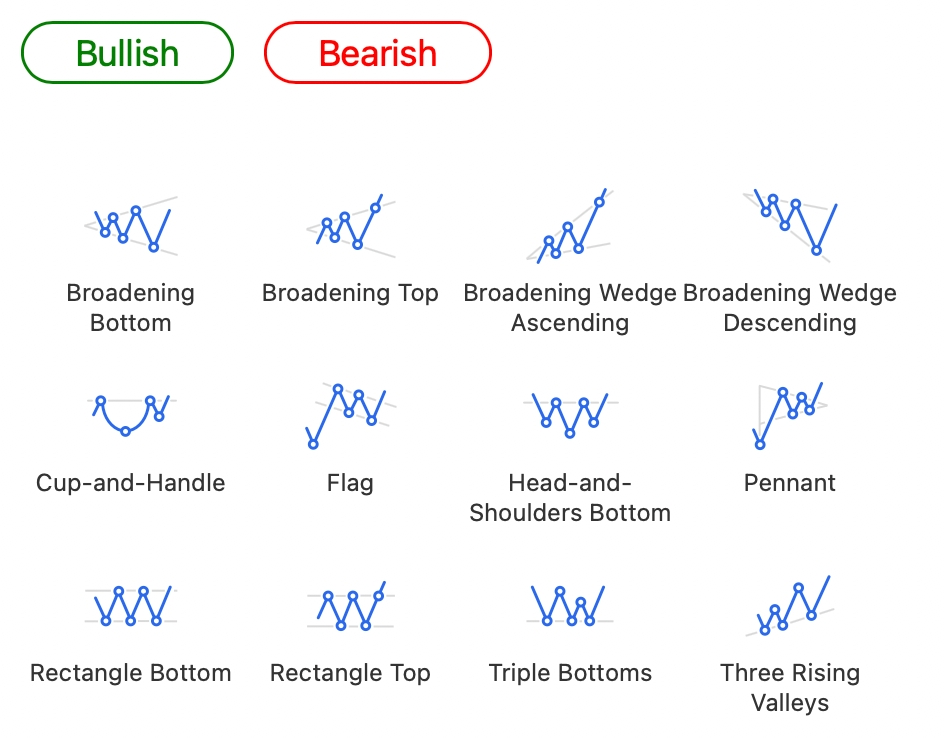

Pattern Search Engine (PSE)

The pattern search feature in Tickeron helps analyze asset charts by automatically identifying technical analysis figures. Artificial intelligence processes data in real time, providing the user with ready-made patterns without the need for deep knowledge of technical analysis.

In the PSE section, you can set the parameters: select a trend (Bullish or Bearish), pattern type, asset, price range, and confidence level. If a pattern is formed, the system displays it on the chart. If there is no selected pattern, the system notifies you when it begins to form. This tool supports 39 pattern types and helps determine the moment to buy or sell an asset.

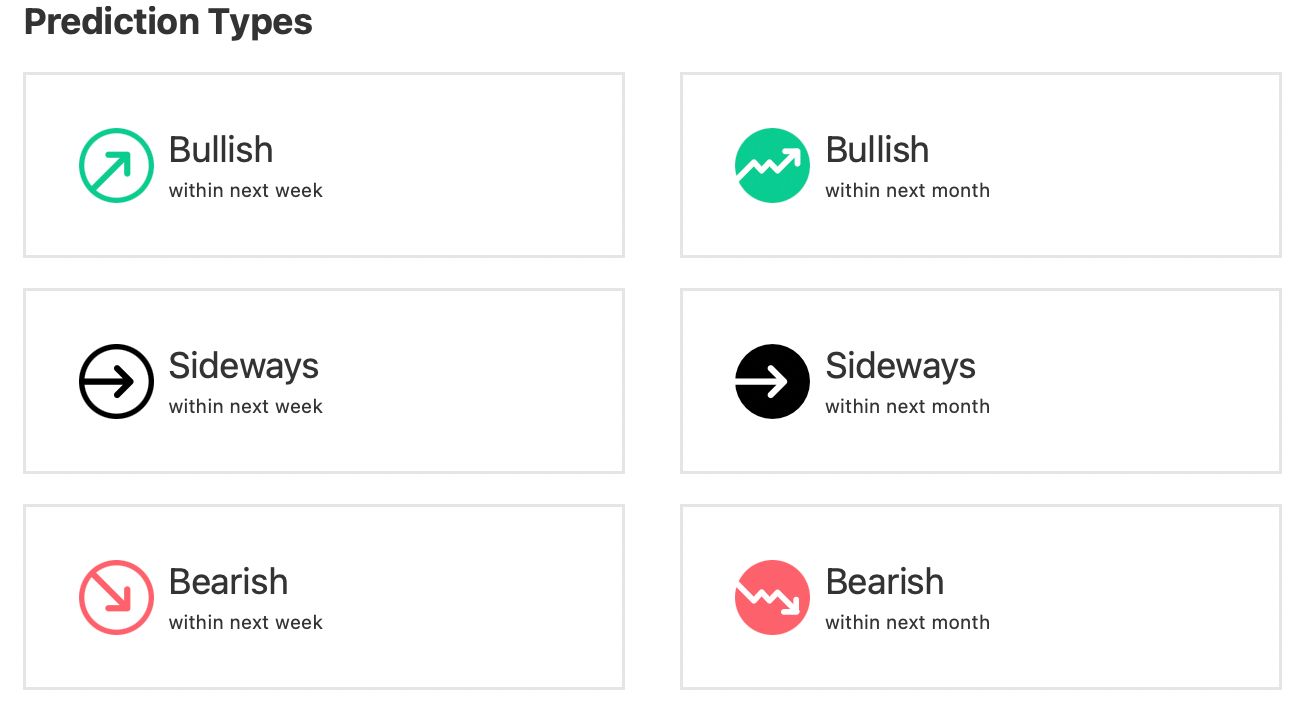

Trend Prediction Engine (TPE)

Trend trading is an effective strategy, but difficult in high volatility. Tickeron's AI-powered trend prediction tool analyzes the market and makes predictions based on user-defined parameters.

The basic version includes asset group and trend type settings. The paid plan allows for advanced criteria: price range, transaction volume, AI confidence level, trend duration, and other parameters. This tool helps you more accurately determine market directions and make informed trading decisions.

Real-time stock patterns (RTP)

The RTP function analyzes charts using artificial intelligence, identifying the formation of selected patterns in real time. It is a tool for traders looking for an entry point for immediate trades.

The function supports three asset groups: stocks, cryptocurrencies and Forex. The user selects the type of trend, figure and time interval: 5, 15 or 30 minutes, 1 hour or 1 day. RTP provides up-to-date data for short-term trades, as opposed to long-term forecasts suitable, for example, for ETFs.

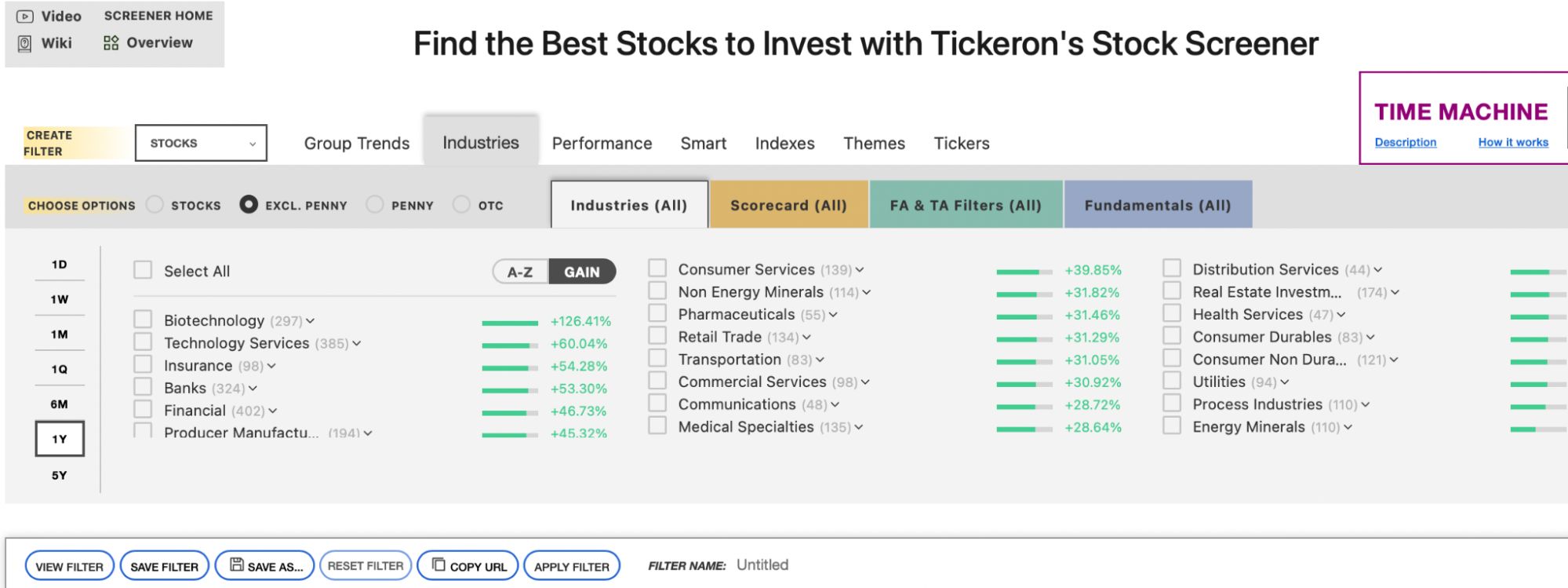

AI screener

The Tickeron screener is a tool for finding assets that match specified parameters. For example, it can find Nasdaq stocks with an upward trend and a projected return of 15% over 90 days.

The screener allows you to filter assets (stocks, ETFs, Forex, cryptocurrencies), set the analysis period (from real time to five years), set price ranges, transaction volumes and use more than 20 additional indicators. The function supports alerts, notifying the user about the assets found.

Filters can be saved, changed in real time and shared via links. The screener is suitable for both active trading and long-term investments, and the paid plan opens up additional settings and parameters.

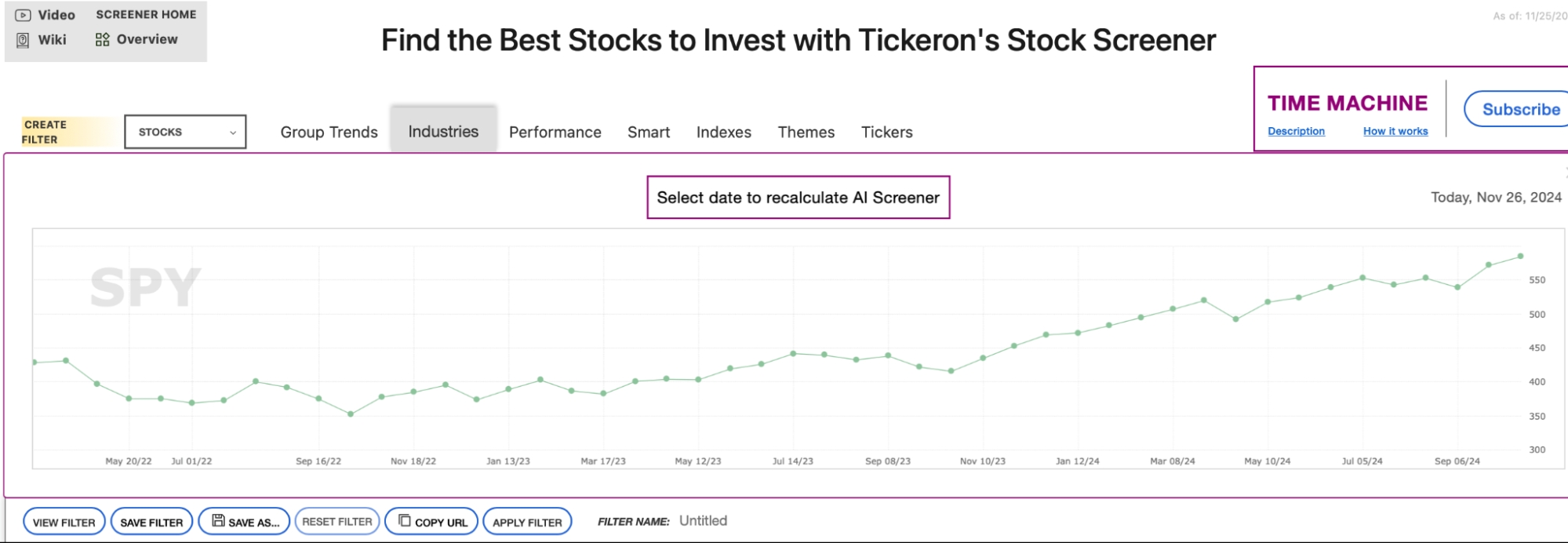

Time machine

The Time Machine feature allows you to select a chart of any asset and return to a specified point in time to assess the compliance of the selected pattern or forecast. This is useful for analyzing the accuracy of forecasts based on fundamental and technical analysis.

The feature covers data for the last four years and allows you to use indicators, AI strategies, patterns, and trend filters. Available for all assets, it allows you to compare indicators over different time intervals.

Real-time patterns (RTP) for cryptocurrencies

The Real-Time Patterns (RTP) function for cryptocurrencies analyzes the market in real time using machine learning algorithms and unique solutions of the company. It is placed in a separate block due to the specifics of the crypto market.

Available settings include a time interval from 1 minute to 1 day, selection of trend, pattern and asset. Advanced parameters are available only in paid plans, but the trial period allows you to evaluate the effectiveness of RTP for traders with different levels of experience.

Real-time Forex patterns

Tickeron provides a real-time pattern tracking feature for currency pairs. Hundreds of currencies and 39 templates with time intervals from 1 minute to 1 day are available. The user can customize the transaction volume, price fluctuation range, and other parameters.

Artificial intelligence not only records the formation of patterns, but also analyzes their previous occurrences in similar conditions, evaluating their results. Data on the number of transactions, traders' experience, and their success are taken into account, which allows for the formation of detailed analytics for a more accurate forecast.

The functions of the Tickeron platform are powered by artificial intelligence, which can solve tasks that several dozen top trading experts would find impossible. Moreover, the AI analyzes the data in a matter of minutes, as well as continuously, which allows you to get an immediate or delayed signal when the graph matches the preset filters.

Tickeron paid and free features

Tickeron provides a 14-day trial period for new users. During this period, all platform features are available, but with restrictions on settings. This time is enough to evaluate the service's capabilities for trading on Forex, the stock exchange, or the cryptocurrency market. There is also a free tariff with basic options.

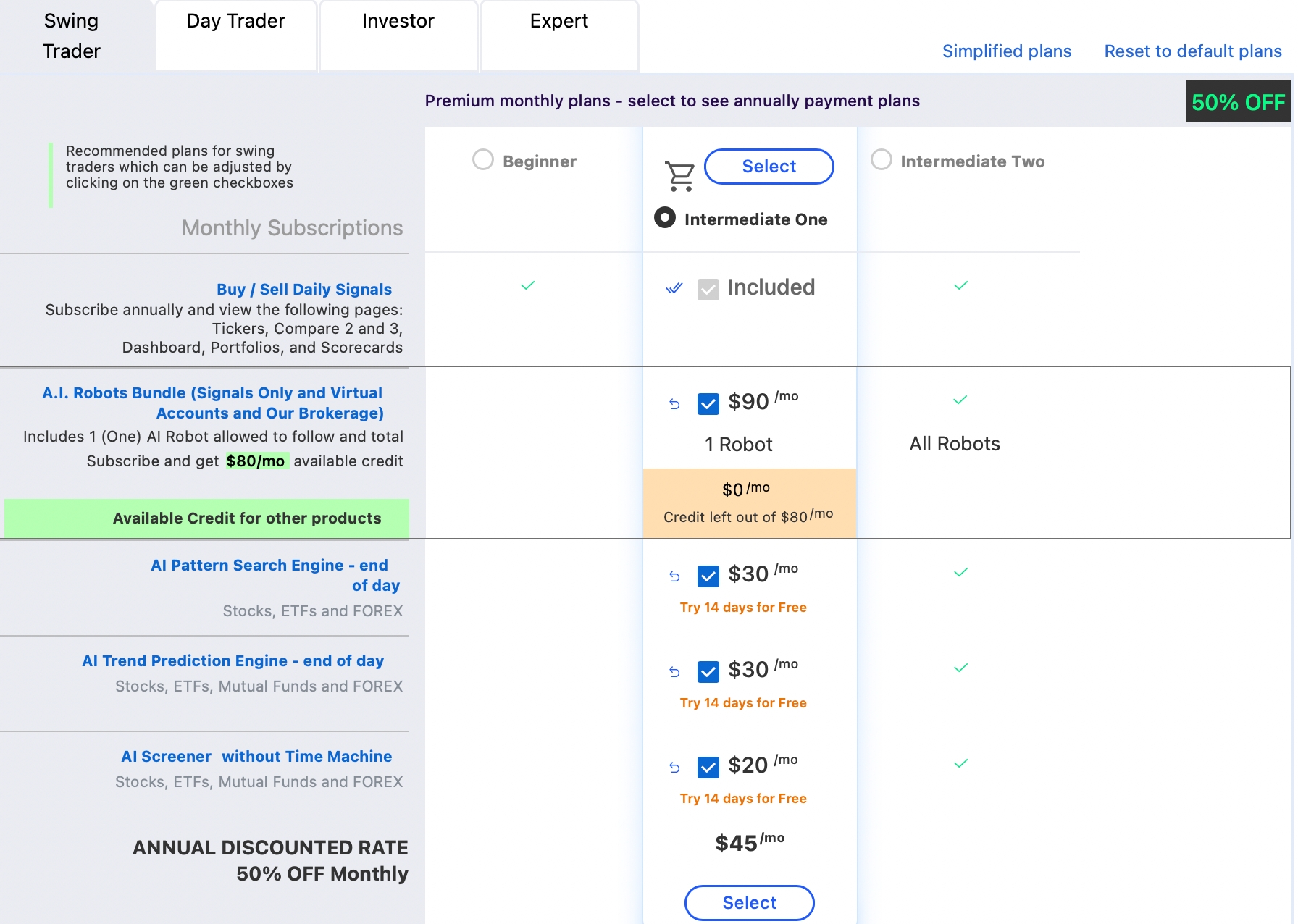

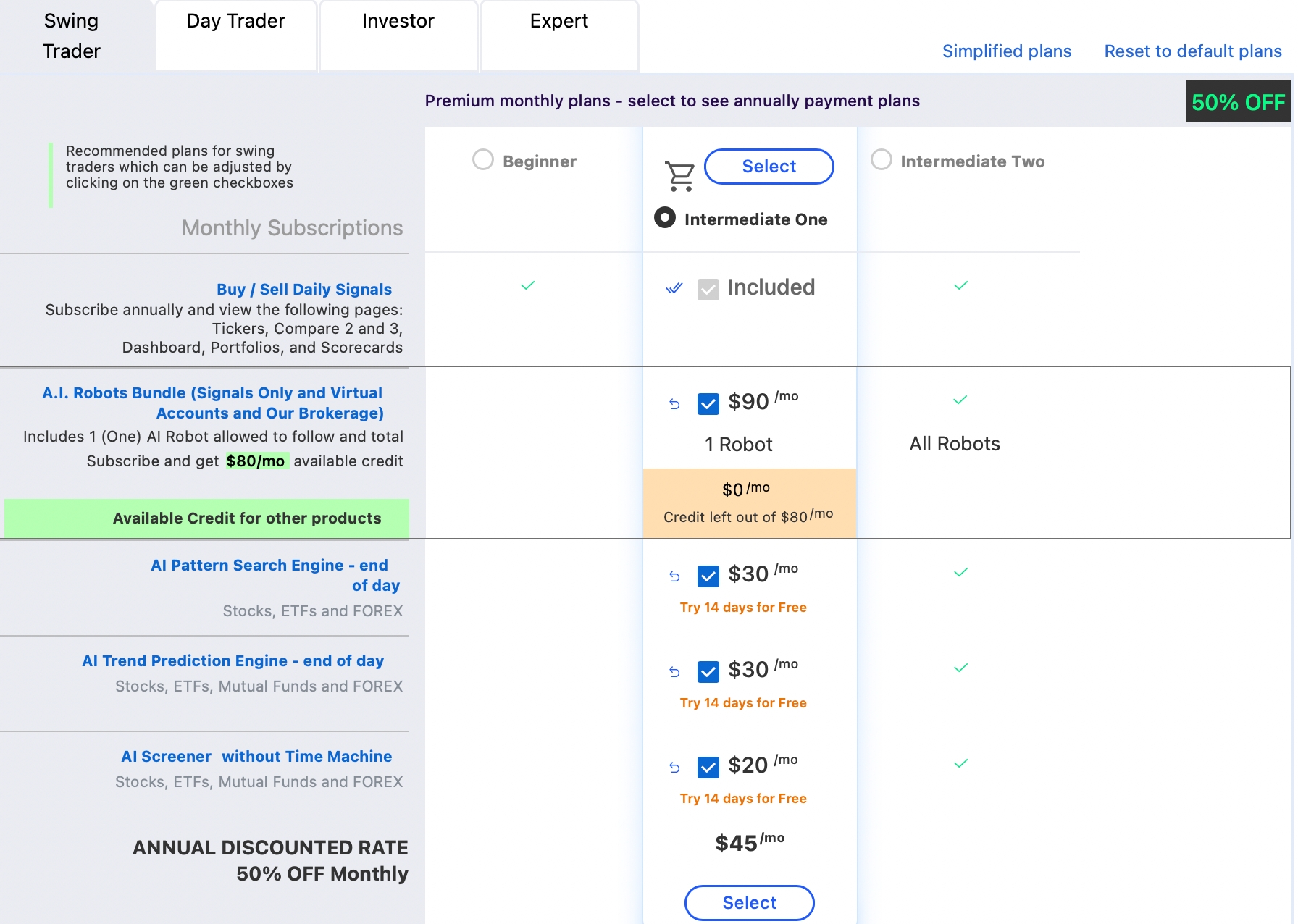

The tariff plan is selected depending on the strategy and the necessary tools. After the trial period, you can go to the "Prices" section, study the offers and choose the appropriate option. The company often provides discounts of up to 50% for new users.

Additionally, you can purchase individual services while remaining on the free tariff. For example, the purchase of two trading robots includes a monthly credit of $120, which can be used for other platform functions.

Tickeron reliability and security

Tickeron has been operating on the market for 9 years as a division of SAS Global, a company that complies with the requirements of EU Regulations No. 765/2008 and No. 339/93. Although there is no separate regulation for Tickeron, the parent company is responsible for its work.

At the same time, Tickeron warns that AI and expert forecasts are hypothetical and do not guarantee success. Users are fully responsible for their decisions, and there is no insurance against losses. This is standard practice for trading on Forex or stock markets.

The average user rating of the platform is 4.2 out of 5 based on thousands of reviews. Users highly rate the functionality of the service, although sometimes they note the inconvenience of the interface and excessive advertising.

Marketplace features

Tickeron offers opportunities for both buyers and sellers. Sellers (financial experts and consultants) register on the platform and create profiles in the Marketplace section, where they offer four types of services:

Stock and securities exchange. Sellers integrate their brokerage profiles, and the system creates their local rating, including data on transactions, experience, and profitability. Buyers can subscribe to a seller and copy their actions.

Active investing. Short-term strategies are published here. Participants can be filtered by parameters; subscription to the service is paid.

Ready-made portfolios. Similar to Active Investing, but for long-term strategies. The buyer filters sellers by assets, period, and risk level. Subscription is also paid.

Wishlist exchange. Sellers create asset portfolios with forecasts and potential profitability. The service is free and unique to Tickeron.

Sellers can earn money on paid subscriptions, increasing their popularity by providing free services and publishing transaction statistics.

User clubs

The Marketplace section also features clubs, divided into three tabs:

Trader clubs. Communities where users share strategies and active trading experience.

Investor clubs. Focus on long-term strategies and publishing portfolios.

Best predictors. Ratings of users with the greatest forecast accuracy. Profiles are available for study and subscription.

Clubs promote user interaction, exchange of experience and development of the platform due to the growth of community activity.

Getting started with Tickeron

To use the platform, you need to register and choose a free plan or trial period for the desired service. You can then continue with the free version, sign up for a paid subscription, or add individual services, paying for them at the current price.

Sign up steps:

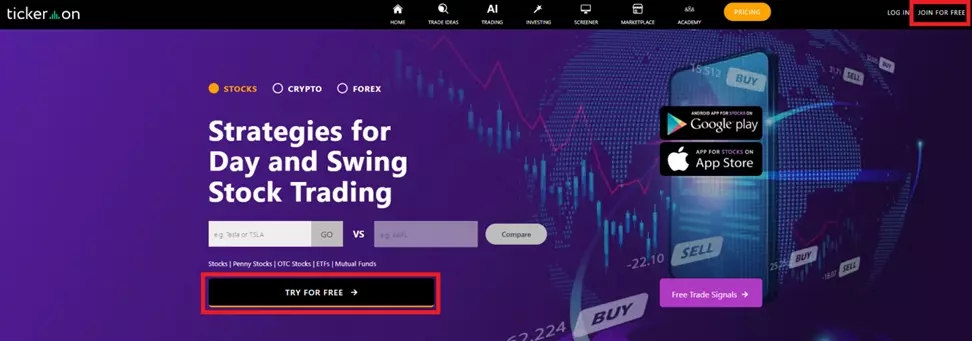

Go to the official Tickeron website and click "Join for Free" in the upper right corner or "Try for Free" in the center of the screen.

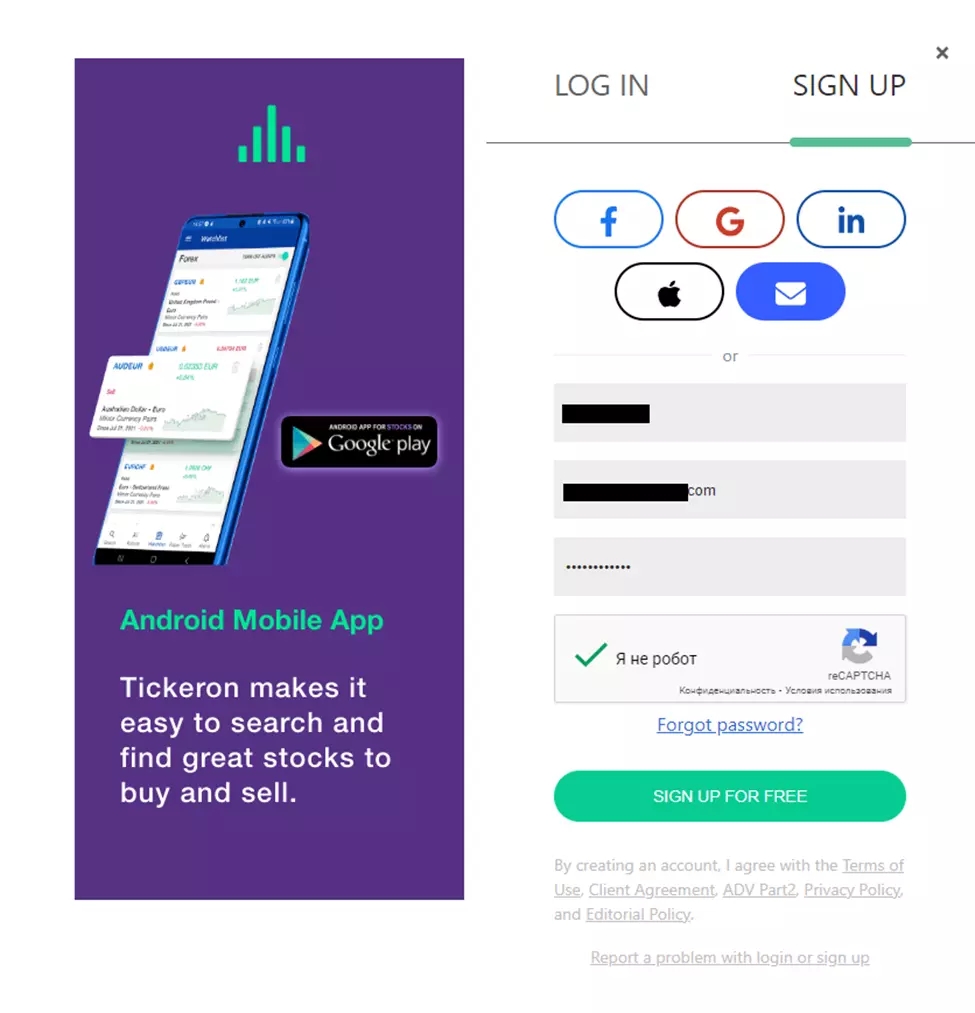

Enter your username, email address, and password, tick the "I am not a robot" box, then click on the "Sign up for free" button. You can also register using a Facebook, Google, Apple, etc. account. To do this, click on the icon of the relevant service.

To use all the functions of the platform (including the paid services), you must specify your personal information in your profile. Click on the username in the upper right corner of the screen and select the "Personal Profile" line. Specify all the requested data in your profile (the blocks are selected on the left).

Now you can use the basic services of the platform. The free plan is automatically activated for the applicable services. If you want to activate a paid service, go to its page. Take "Pattern Search" as an example. There is a "Try for free" button on the left side of the screen on the service page. By clicking on it, you will activate the function for 14 days. After that, you can pay for a plan in the "My Subscriptions" section of the profile menu.

You can also go to the "Pricing" section (in the footer of the website). Find the paid subscription plan you need and click on the "Select" button. Follow the on-screen instructions (you will need to link a card for payment if you didn't do it earlier when filling out your profile details).

You can work with the service through the mobile app. In the "Mobile apps" section, look for the version for your device. Click on the version name and the service will redirect you to the digital store. If your PC is synchronized with your smartphone, you have the option to activate the installation remotely. Otherwise, you will have to open the service's website on your smartphone to go to the store and start downloading.

Using Tickeron, double-check forecasts using your own analysis methods

Tickeron stands out from other platforms by using artificial intelligence to analyze stocks. This is a truly valuable tool for those who want to optimize their decision-making process. However, there are a few nuances to consider. The forecasts provided by the platform are based on historical data, and although the algorithms take into account many variables, the market is always subject to unexpected factors. Therefore, when using the platform, I recommend additionally checking the forecasts using your own analysis methods.

Another feature of Tickeron is the ability to customize filters and adapt the algorithms to your needs. Beginners should start with basic patterns and gradually add additional criteria, such as transaction volumes and trend duration. This will avoid redundant information that can complicate the decision-making process.

For those who already have experience in trading, I recommend paying attention to the historical accuracy of the selected patterns. In the "Time Machine" section, you can test how well similar strategies worked in the past. This will allow you to assess whether the current forecasts are suitable for your trading style. It is also useful to combine Tickeron data with information from other analytical services to form a more balanced strategy.

Conclusion

Tickeron demonstrates powerful capabilities for stock analysis using artificial intelligence, offering tools suitable for both beginners and experienced traders. The platform automates complex processes such as pattern identification and trend forecasting, helping users save time and make more informed decisions. Keep in mind that forecasts remain probabilistic and require additional verification. Flexible pricing allows you to tailor the platform to your individual needs, including free features and paid options. For maximum results, Tickeron is best used in combination with other analysis methods. Overall, the platform provides a modern and effective tool for improving investment strategies.

FAQs

How can AI be used to identify undervalued stocks?

AI analyzes fundamental and technical data such as P/E ratios, earnings growth, dividends, and chart trends. This helps to find undervalued stocks that have potential to grow, especially in volatile market conditions.

Can such platforms be used for long-term investing?

Yes, stock forecasting and analysis features help identify stable trends that can be useful for long-term strategies. Additionally, it is worth considering macroeconomic factors to select assets with high stability.

How to minimize risks when using AI recommendations?

Use AI forecasts as a supplement to your own research. Compare data with other analytical tools, follow market news, and diversify your portfolio to avoid over-reliance on one source of information.

What filter settings are suitable for active trading?

For active trading, it is better to use short time intervals, such as 5-15 minutes, with filters set for high volatility and trading volume. This allows you to quickly respond to changes and look for opportunities for short-term transactions.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Trend trading is a trading strategy where traders aim to profit from the directional movements of an asset's price over an extended period.