Futures Contract: What is It and How to Trade it?

A futures contract is a popular exchange-traded derivative instrument. It benefits different classes of traders, both short-term private traders and large global ones, which is why the futures trading volume around the world is constantly growing.

Futures Contract

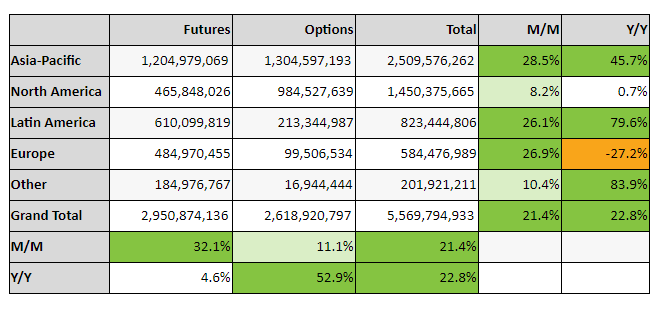

So, in total, almost 3 billion contracts were concluded on centralized exchanges in January 2023, which is 32.1% exceeding the previous month’s data and 4.6% in March 2020.

What is a futures contract? Definition

A futures contract is an agreement to buy or sell a specific basic asset or security at a predetermined price and at a specific time in the future.

Interested in Futures Trading? Open an Account-

The buyer of the contract shall buy and get the basic asset when the futures contract expires.

-

The seller of the futures contract shall provide and deliver the basic asset at the expiration date and at the agreed-upon price.

For example, suppose you bought a futures contract for the supply of oil. In this case, oil is the basic asset, and the futures contract is a derivative instrument from it.

Every futures contract has a delivery date (expiration date). At this period, the contract holders shall settle the contract. Therefore, volatility spikes occur in the futures markets on expiration days.

Every futures contract has a delivery date (expiration date)

Note

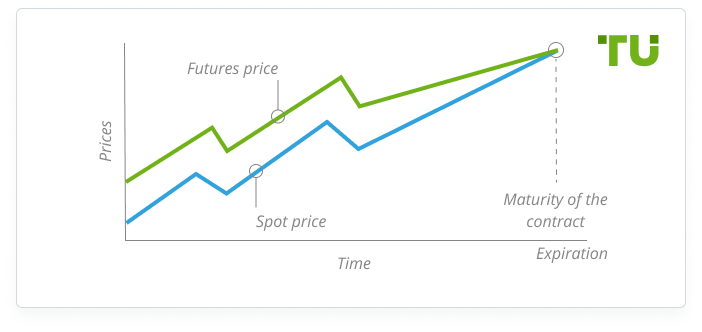

That the spot price may differ from the futures price, but the closer the expiration date, the smaller this potential difference will be.

How does a futures contract work?

Futures first appeared in Japan on the Osaka Stock Exchange in 1710, where farmers were selling their future rice harvest. They received money for the harvest at the time of the conclusion of the contract, and they were obliged to deliver the harvest by a certain date in the future. Hence the name = "future".

Dōjima Rice Exchange

In the 19th century, futures contracts for agricultural products were actively traded in Chicago. Since that time, the number of all kinds of futures has grown significantly.

Main functions of a futures contract

The first function of futures is to hedge risks. It is used by large market participants who have business in the real sector. For example, a Japanese car manufacturer supplying products to the United States and other countries can reduce the risk of yen fluctuations by opening a position in the foreign exchange market.

The second function of futures is to increase the liquidity and stability of the markets. Since the derivatives markets attract a large number of participants, including speculators, this helps to make financial markets more efficient.

How a futures contract is created?

The section of the exchange where futures are traded is called the derivatives market. The largest futures market is created by the CME Group, which includes:

-

Chicago Board of Trade (CBOT), founded in 1848.

-

Chicago Mercantile Exchange (CME), founded in 1874.

-

New York Mercantile Exchange NYMEX, founded in 1882. Note that the NYMEX includes the COMEX exchange.

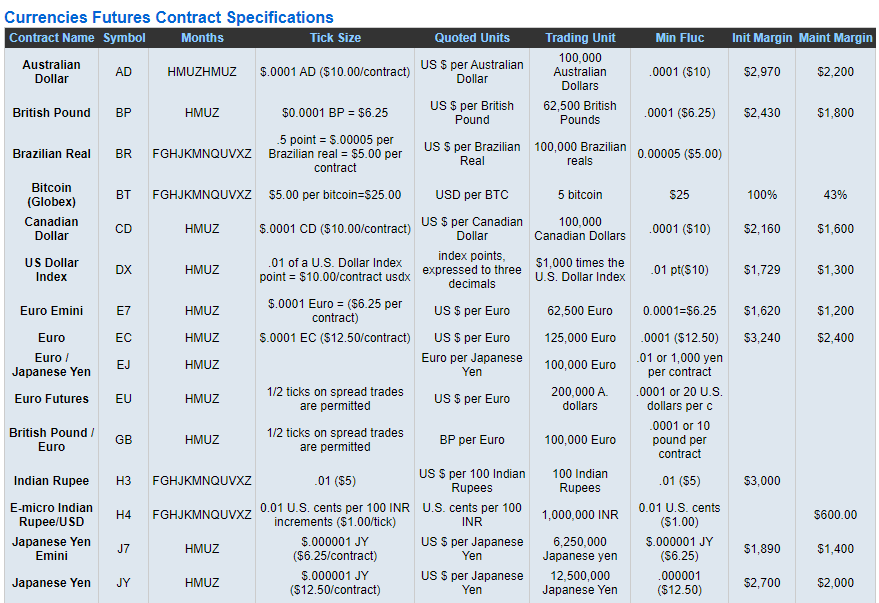

By launching futures contracts trading on its site, the exchange standardizes contracts in terms of quality and quantity to facilitate their trading. All details of the contract are written in the so-called specification. For example, in the screenshot below you can see a brief specification of currency futures on the CME.

Currencies Futures Contract Specifications

The contract specification contains:

-

Ticker to trade contract.

-

Expiry dates. Please understand that futures contracts for the same basic asset, but with a different expiration date, can be traded on the same exchange at the same time. For example, you can buy 1 futures for March delivery and 1 for September delivery.

-

The minimum step for changing the contract price.

-

The time at which futures are traded. As a rule, it is 5 days a week with a small stop of trading for 1 hour, when it is night in Europe and the USA.

-

The amount of the basic asset. For example, one oil contract on the Chicago Mercantile Exchange (CME) is estimated for 1,000 barrels of oil. Therefore, if you want to fix the price (sale or purchase) of 100,000 barrels of oil, buy/sell 100 contracts.

-

The amount of margin. This is the amount you need to have in your account to enter into a futures contract. For example, buying 1 gold futures, you don’t need to have the entire amount, which is equal to the cost of an ounce of gold in the spot market, but only a part of it.

For example, a standard EUR/USD futures contract contains €125,000. And if a large manufacturer is going to make a trade for 1 million euros and wants to fix the current profitable rate, he will open a position for 4 contracts. And the Euro Emini “contains” €62,500, which makes it more affordable for less capitalized retail traders. An “E-mini”, “e-mini”, or “emini” is an electronically traded futures contract that is a fraction of the value of a corresponding standard futures contract.

How to understand a futures ticker?

How to understand a futures ticker?

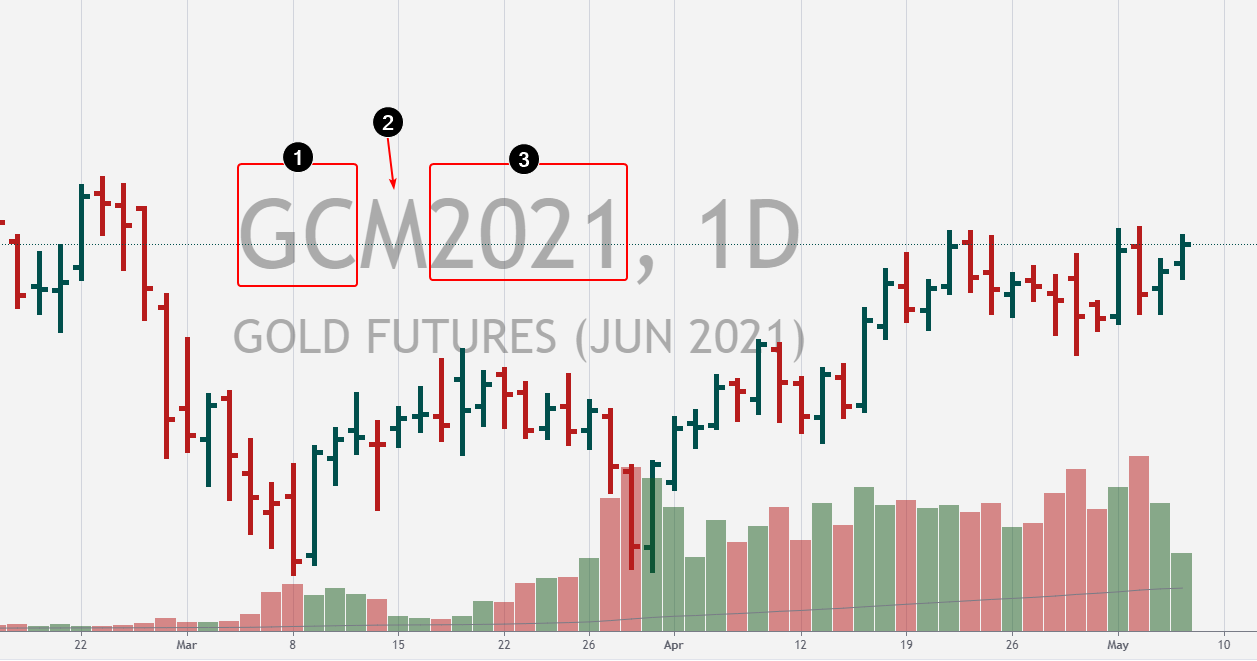

Each futures has a unique ticker. For example, GCM2024 means:

-

GC is a code that indicates that this is a gold futures contract;

-

M is the month when expiration will be performed. It usually happens in the middle of the month, but this is not a hard and fast rule.

-

2023 is the expiration year. It can be abbreviated to one GCM1 digit.

Futures contracts classification

By the type of basic asset, futures are:

-

for agricultural products (wheat, corn, coffee, cattle, etc.);

-

for energy assets (oil, gas, fuel oil, etc.);

-

currency and cryptocurrency futures;

-

futures on stock indices;

-

stock futures;

-

other types.

Delivery method:

-

With delivery. This means the seller shall actually deliver the real amount of the basic asset by the expiration day.

-

No delivery (settlement futures). Mutual settlement at the prices of the basic asset operating on the spot market takes place on the day of expiration between holders of the futures contract.

By expiration date. For example, December futures is a contract with an expiration date in December.

Also, here we should mention the Continuous futures or Perpetual futures. This is an “endless” future when a contract with the next expiration date is substituted in place of the contract for which the expiration date has come.

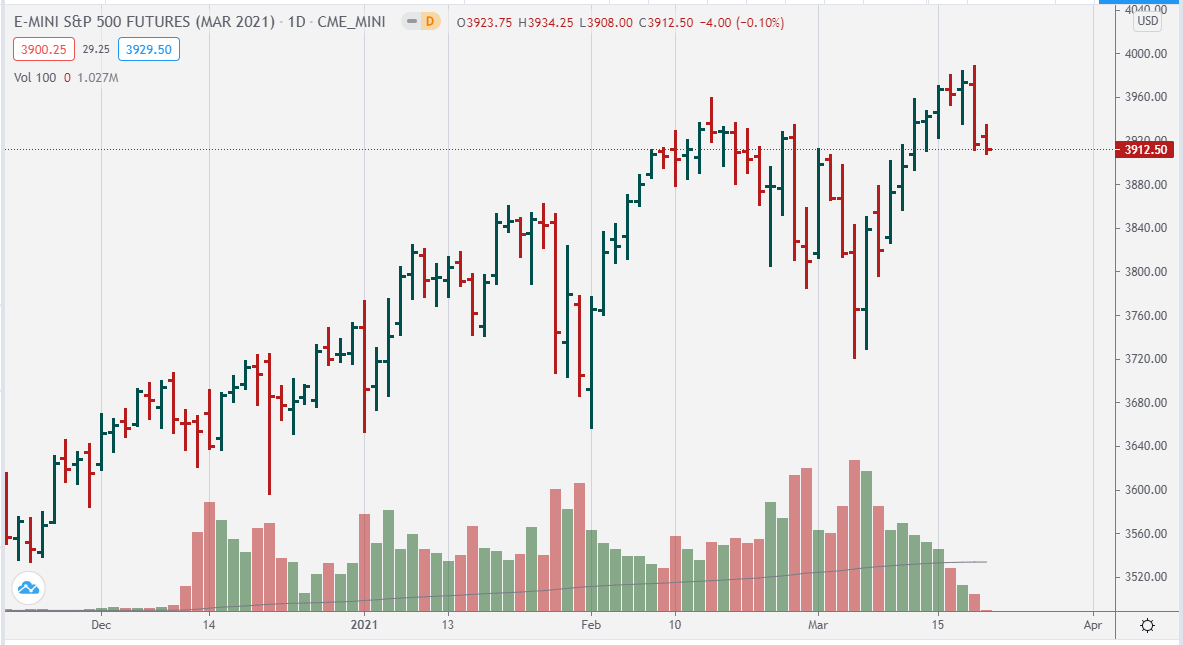

For example, in the picture below you can see a chart of the E-mini S&P-500 futures with an expiration date in January 2023.

A chart of the E-mini S&P-500 futures with an expiration date in January 2023

Please note that the contract began to be actively traded in mid-December 2020. It was then that the "previous" December futures expired.

The chart provided “truncates” in the middle of March, just then the expiration happened. Note that as the expiration date approaches, the trading volume decreases, which means that traders "switch" from trading the March contract to trading the "next" (June) contract.

There are no prices truncated with Continuous futures, and the dynamics of trading volumes here are smoother, which can be important and convenient for market analysis over a long period.

Futures market regulation

The US futures market is regulated by such official organizations as:

-

SEC - Securities and Exchange Commission. The main government body monitoring and regulating the American exchange market. Created in 1934. The head of the SEC is appointed by the President and confirmed by the Senate.

-

Commodity futures Trading Commission (CFTC). Created in 1974 to regulate the emerging futures trade.

-

FINRA (Financial Industry Regulatory Authority) is an independent regulatory body for anyone carrying out business in the United States financial markets. FINRA's mission is to protect investors by making sure the industry operates fairly and honestly.

Regulatory objectives:

-

Ensuring the pricing integrity.

-

Preventing fraud and abuse in futures trading

-

In addition to those mentioned, there is also the National Futures Association (NFA). It is a non-profit independent regulatory organization. It is funded by membership fees and membership is a must for many derivatives market participants. This ensures that everyone who transacts on the US futures exchanges and the retail foreign exchange market shall adhere to the same standards. The NFA doesn’t initially regulate markets but may do so on a contractual basis in a number of cases.

Derivatives markets in other countries are regulated by authorized government agencies.

Main futures markets

Main markets to trade futures:

-

stock index futures

-

currency

-

commodity futures

-

interest rate futures

Let's consider them in greater detail.

Index futures

Futures on individual stocks in the United States are not common, but futures on stock indices, where the values of the S&P-500, Dow Jones, Nasdaq, Russell indices act as basic assets, on the contrary, are very popular.

S&P futures

The S&P-500 stock index was developed by the reputable Standard & Poor rating agency.

The index is calculated based on the 500 shares of the largest companies listed on the stock exchanges in the United States. In its modern manifestation, it was formed in 1957, and today it is one of the most commonly used stock indices because it includes companies of different industries and thereby shows the state of the economy.

The S&P-500 futures index is designed. It uses the index value as the underlying asset. The CME is the main trading platform, although this futures is traded in other countries as well.

Several varieties of futures are presented on CME. The most popular among retail traders are:

-

E-mini S&P 500 Index (ES ticker)

-

Micro E-mini S&P 500 (MES ticker)

The list of companies on the S&P-500 list is regularly reviewed by the index committee. For example, in January 2023, Flowserve, SL Green Realty, Xerox, and Vontier were removed from the list due to a fall in the companies' capitalization. They were replaced by the more successful Caesars Entertainment, Generac Holdings, NXP Semiconductors, and Penn National Gaming. Thus, having bought futures on a stock index, you can expect that the best 500 companies will work in your favor.

Dow futures

There are about 5,000 stock indices (according to Bloomberg in 2017) in the United States alone! Imagine how many there are worldwide. While hardly every index has an active futures market, traders have the widest choice.

Dow futures

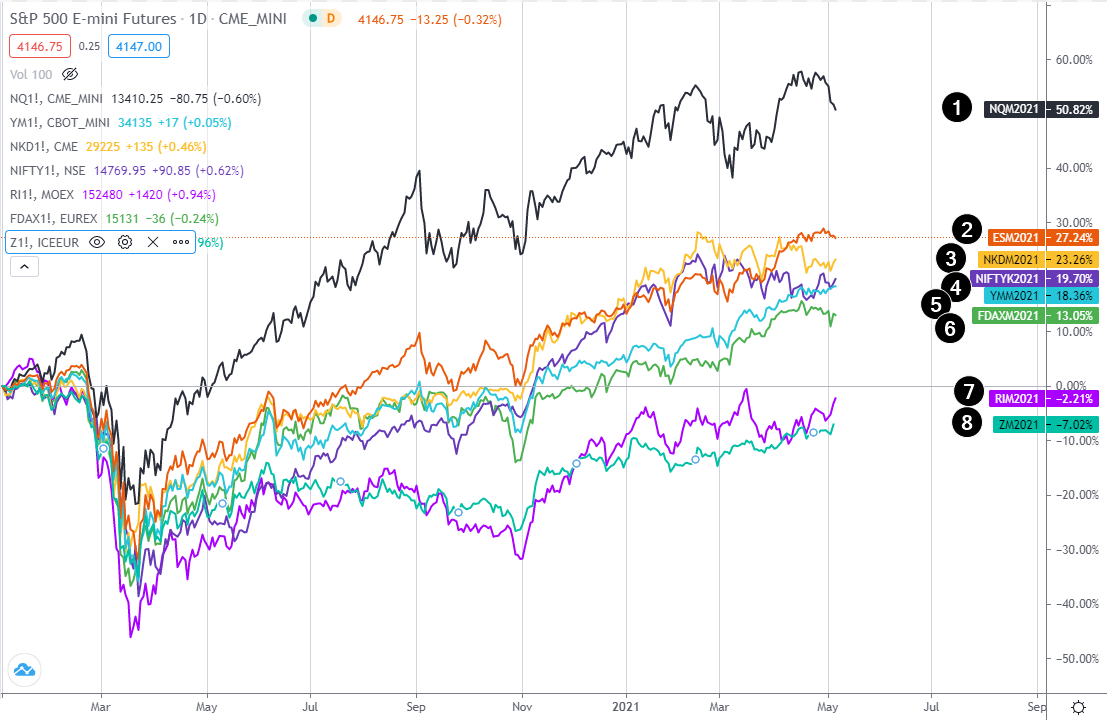

The chart above shows the price dynamics (as a percentage) of futures on various indices, starting in 2020:

-

1

Nasdaq Index futures. Futures ticker – NQ. The index tracks the performance of 100 tech companies listed on the Nasdaq. Since 2020, this index has shown the best progress, because AAPL, MSFT, AMZN, GOOG, FB, and other tech giants precede in the index.

-

2

S&P-500 Index futures.

-

3

Futures on the NIKKEI index, reflecting the overall exchange rate of the 225 most actively traded companies on the Tokyo Stock Exchange.

-

4

NIFTY Index futures. An instrument representing the Indian stock market is calculated based on the prices of 50 shares.

-

5

Dow Jones Index Futures. The longest-standing US index is based on 30 public companies, mostly industrial, representing the real manufacturing sector. Futures ticker – YM.

-

6

German stock market DAX futures demonstrating the German stock market.

-

7

Futures on the RTS index, demonstrating the Russian stock market

-

8

Futures on the FTSE index, demonstrating the UK stock market

In general, stock indices move synchronously, since, in the context of globalization of economic processes, they are closely interconnected. But by comparing indices, you can identify leaders to buy their futures, thereby increasing your chances of profit-making.

Currency futures

Currency futures quotes closely follow the Forex market currencies rates. The Globex system on the CME exchange is the main platform for trading currency futures. Only dollar futures are traded on the ICE (Intercontinental Exchange) exchange.

| Name | Symbol | Exchange | Contract Size | Tick / $ Value |

|---|---|---|---|---|

| Name Australian Dollar |

Symbol 6A |

Exchange CME/Globex |

Contract Size 100K AUD |

Tick / $ Value 0.0001 / $10.00 |

| Name British Pound |

Symbol 6B |

Exchange CME/Globex |

Contract Size 62.5K £ |

Tick / $ Value 0.0001 / $6.25 |

| Name Canadian Dollar |

Symbol 6C |

Exchange CME/Globex |

Contract Size 100K $ |

Tick / $ Value 0.00005 / $5.00 |

| Name EuroFX |

Symbol 6E |

Exchange CME/Globex |

Contract Size 125K € |

Tick / $ Value 0.00005 / $6.25 |

| Name Japanese Yen |

Symbol 6J |

Exchange CME/Globex |

Contract Size 12.5 mil ¥ |

Tick / $ Value 0.0000005 / $6.25 |

| Name Mexican Peso |

Symbol 6M |

Exchange CME/Globex |

Contract Size 500K AUD |

Tick / $ Value 0.00001 / $5.00 |

| Name New Zealand Dollar |

Symbol 6N |

Exchange CME/Globex |

Contract Size 100K NZD |

Tick / $ Value 0.0001 / $10.00 |

| Name Swiss Franc |

Symbol 6S |

Exchange CME/Globex |

Contract Size 125K CHF |

Tick / $ Value 0.0001 / $12.50 |

| Name E-mini EuroFX |

Symbol E7 |

Exchange CME/Globex |

Contract Size 62.5K € |

Tick / $ Value 0.0001 / $6.25 |

| Name E-mini Japanese Yen |

Symbol J7 |

Exchange CME/Globex |

Contract Size 6.25 mil ¥ |

Tick / $ Value 0.000001 / $6.25 |

| Name E-micro AUD/USD |

Symbol M6A |

Exchange CME/Globex |

Contract Size 10K AUD |

Tick / $ Value 0.0001 / $1.00 |

| Name E-micro GBP/USD |

Symbol M6B |

Exchange CME/Globex |

Contract Size £6,250 |

Tick / $ Value 0.0001 / $0.625 |

| Name E-micro CAD/USD |

Symbol MCD |

Exchange CME/Globex |

Contract Size 10,000 CAD |

Tick / $ Value 0.0001/ $1.00 |

| Name E-micro EUR/USD |

Symbol M6E |

Exchange CME/Globex |

Contract Size 12,500 € |

Tick / $ Value 0.0001 / $1.25 |

| Name E-micro JPY/USD |

Symbol MJY |

Exchange CME/Globex |

Contract Size 1.25 mil ¥ |

Tick / $ Value 0.000001 / $1.25 |

| Name E-micro CHF/USD |

Symbol MSF |

Exchange CME/Globex |

Contract Size 12,500 CHF |

Tick / $ Value 0.0001 / $1.25 |

| Name Dollar Index |

Symbol DX |

Exchange ICE futures U.S. |

Contract Size $1000 X Index Value |

Tick / $ Value 0.005 / $5.00 |

Unfortunately, sophisticated foreign exchange traders will feel a lack of tools to trade cross rates (e.g., EUR/GBP, EUR/JPY). But the official data will be an advantage. Since CME/Globex broadcasts the market depth, data on Bid/Ask volumes. You can build market profiles and get more facts for decision-making with a professional platform.

Commodity futures

Commodity futures include contracts with such basic assets as:

-

Energy resources – oil (WTI, Brent crude), fuel oil, natural gas, etc.;

-

Metals – gold, silver, copper, platinum, etc.;

-

Agricultural products – wheat, corn, soybeans, sugar, cotton, cattle meat, etc.;

To save your time, we won’t provide you with details on all these numerous contracts. Let's just say that the most popular basic assets (such as gold) have Mini and Micro versions to make them more affordable.

Interest rate futures

An Interest Rate futures is a futures contract with a basic asset that pays interest. The interest rate futures price moves in inverse proportion to the interest rates.

It is one of the types of futures, where debt obligations and other similar financial instruments are taken as the underlying asset. Contracts with the 30-year, 10-year, 5-year, and 2-year US Treasury bonds as assets are the most popular interest rate futures.

| Name | Symbol | Exchange | Contract Size | Tick / $ Value |

|---|---|---|---|---|

| Name US 10-Year Interest Rate Swap |

Symbol SR |

Exchange CBOT/Globex |

Contract Size $100K |

Tick / $ Value 1/32 / $15.625 |

| Name Ultra T-Bond |

Symbol UB |

Exchange CBOT/Globex |

Contract Size $100K bond |

Tick / $ Value 1/32 / $31.25 |

| Name Ultra 10-Year |

Symbol TN |

Exchange CBOT/Globex |

Contract Size $100K Note |

Tick / $ Value 1/32 / $15.625 |

| Name US 3-Year US Treasury Notes |

Symbol Z3N |

Exchange CBOT/Globex |

Contract Size $300K note |

Tick / $ Value 1/128 / $15.625 |

| Name US 30-Year Treasury Bond |

Symbol ZB |

Exchange CBOT/Globex |

Contract Size $100K bond |

Tick / $ Value 1/32 / $31.25 |

| Name US 5-Year Treasury Note |

Symbol ZF |

Exchange CBOT/Globex |

Contract Size $100K note |

Tick / $ Value 1/128 / $7.8125 |

| Name US 10-Year Treasury Note |

Symbol ZN |

Exchange CBOT/Globex |

Contract Size $100K note |

Tick / $ Value 1/64 / $15.625 |

| Name Fed Funds 30-Day Interest Rate |

Symbol ZQ |

Exchange CBOT/Globex |

Contract Size $5 mil |

Tick / $ Value 0.005 / $20.835 |

| Name US 2-Year Treasury Note |

Symbol ZT |

Exchange CBOT/Globex |

Contract Size $200K note |

Tick / $ Value 1/128 / $15.625 |

| Name Eurodollar |

Symbol GE |

Exchange CME/Globex |

Contract Size $1 mil |

Tick / $ Value 0.01 / $25.00 |

| Name LIBOR One Month |

Symbol GLB |

Exchange CME/Globex |

Contract Size $3 mil |

Tick / $ Value 0.005 / $12.50 |

| Name Euro-BTP futures |

Symbol FBTP |

Exchange Eurex |

Contract Size €100K |

Tick / $ Value 0.01 / €10.00 |

| Name Euro Bund 10-Year |

Symbol FGBL |

Exchange Eurex |

Contract Size €100K |

Tick / $ Value 0.01 / € 10.0 |

| Name Euro Bobl 5-Year |

Symbol FGBM |

Exchange Eurex |

Contract Size €100K |

Tick / $ Value 0.01 / € 10.00 |

| Name Euro Schatz 2-Year |

Symbol FGBS |

Exchange Eurex |

Contract Size €100K |

Tick / $ Value 0.005 / €5.00 |

| Name Euro-Buxl |

Symbol FGBX |

Exchange Eurex |

Contract Size €100K |

Tick / $ Value 0.02 / €20.00 |

| Name Euro-Oat |

Symbol FOAT |

Exchange Eurex |

Contract Size 1€00K |

Tick / $ Value 0.01 / €10.00 |

| Name Short Sterling 3-Month |

Symbol L |

Exchange LIFFE |

Contract Size £500,000 |

Tick / $ Value 0.005 / £6.25 |

| Name Long Gilt |

Symbol R |

Exchange LIFFE |

Contract Size £100K |

Tick / $ Value 0.01 / £10 |

| Name OSE Tokyo 10-Year (BIG) |

Symbol JGB |

Exchange Osaka - Japan (JPX) |

Contract Size ¥100,000,000 |

Tick / $ Value ¥0.01 / ¥10,000 |

| Name SGX Mini 10-Year JGB |

Symbol JB |

Exchange Singapore Exchange (SGX) |

Contract Size ¥10,000,000 |

Tick / $ Value ¥0.01/ ¥100 |

| Name 90-Day Bank Accept |

Symbol IR |

Exchange Sydney Futures Exchange (SFE) |

Contract Size A$1,000,000 |

Tick / $ Value 0.01 / $24.00 |

| Name 10-Year Aus Treasury Bond |

Symbol XT |

Exchange Sydney Futures Exchange (SFE) |

Contract Size A$100,000 |

Tick / $ Value 0.005 / $47.00 |

| Name 3-Year Aus Interest Rate Swap |

Symbol YT |

Exchange Sydney Futures Exchange (SFE) |

Contract Size A$100,000 |

Tick / $ Value 0.01 / $30.00 |

Note

Note that futures on financial instruments are a field for the activities of large players because here fluctuations are relatively small, respectively, opportunities for speculation are narrowed, and large amounts are required for trades.

Futures trading advantages

Marginality. You only need to have a fraction of the contract value (margin) on your account to start trading futures. This is beneficial for novice traders who want to gain experience in trading in the real market, but are not ready to risk large amounts. Particularly favorable terms are offered to intraday traders. The amount of the position provision (initial margin and maintenance margin) is set by exchanges, and your broker can also influence their value.

Markets are open longer. The futures markets may be open while the spot markets where the basic assets are traded are closed. For example, the Globex electronic system, introduced on the CME in 1992, allows you to find opportunities to trade in stock futures 23 hours a day, 5 days a week while the stock markets are open approximately 8 hours a day. Another advantage is that it reduces the impact of gaps, thereby reducing the risk of getting a large loss at the opening of the session.

Low fees. High competition among brokers and the growing popularity of futures trading provide low costs for the private trader. Thus, you will get low commissions (up to zero), which will not drastically affect your performance. It is often enough for the contract price to move one tick in your favor to cover the costs. Traders on cryptocurrency exchanges can only dream of it.

Multidirectional trade. Falling markets are as easy to trade as rising ones with futures contracts.

Wide range of sectors. You can benefit from price fluctuations for various types of assets with access to the futures market – stock indices, currencies, raw materials, agricultural products, and cryptocurrencies. Bitcoin and Ethereum futures are traded on CME.

More for analysis. As investors in stock markets analyze the company reports in detail, derivatives market participants have access to open interest data. This indicator is available for the futures markets and reflects the number of open positions. Thus, by analyzing the dynamics of prices and open interest, traders can assess the strength of the trend. Data on open interest is published on the exchange website at the end of trading, and in some cases, it is even broadcast in real-time.

Also, data on volumes and market depth are available for futures. And this is the information that Forex traders may lack.

How to trade futures

You need to act systematically (as is the case with other financial instruments), that is, consistently to succeed in futures trading. Otherwise, trading will become a gamble, in the "what if you're lucky" style. That is no different from Las Vegas.

What will be your trading strategy? It depends on your goals.

| Purpose | For whom |

|---|---|

| Purpose Speculation |

For whom For those who have free time to get new knowledge and apply it in the futures market |

| Purpose Diversification |

For whom For those looking to “put all eggs in several baskets” to achieve more even capital gains. |

| Purpose Hedging |

For whom For example, for professionals who want to insure their main stock portfolio against falling stock prices. |

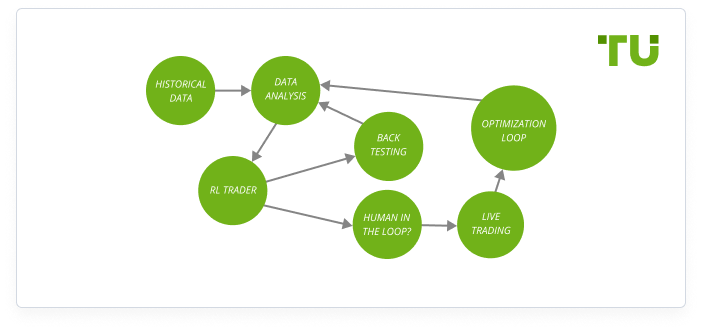

Treat futures trading as a business because that’s what it is. Develop a business plan, define your trading style and your advantages. Test your plan with historical data, make edits if necessary.

And then try to implement it in real-time.

Futures trading is a business

Find the strategy that works best for you.

Futures contract trading example

The screenshot below shows an example of buying a gold future after the release of statistics on the US economy. For a demonstration, we bought one contract near the support line of the ascending channel. The deal showed +$60 within 3 minutes. How did it happen?

An example of buying a gold future after the release of statistics on the US economy

This contract was purchased on the COMEX exchange (part of the CME Group). According to the specification, the price is 1 ounce of gold, the contract size is 100 ounces. The price step is 10 cents. Accordingly, when the quote increased by 60 cents (6 ticks), we made a profit = 60 cents x 100 ounces = $60.

How to buy futures: 3-Step algorithm

To buy futures, follow three main steps from choosing a broker to making a deposit and analyzing the market. Please find a quick guide below.

Choosing the right broker

If you are interested in the US derivatives markets:

-

Make sure the broker provides a wide variety of derivatives markets. Not all brokers provide access to the derivatives market. For example, clients of Fidelity, Vanguard, Webull, and various Forex brokers cannot trade futures.

-

Make sure that the broker has no claims from official regulators and check the broker on the regulator's website - https://brokercheck.finra.org/.

-

Check out the trading platforms provided.

-

Explore extra services and customer support, tutorials, analytics, quality, and trustworthiness.

Having chosen a broker, proceed to the second step. For sure, in the process of studying candidates, you will need to go through several simple online registrations.

Funding the account

Typically, US-regulated brokers provide an identical set of deposit/withdrawal methods, so this will not be a broker choosing criteria.

Go through verification by submitting the required documents (as a rule, they are needed to identify the person and confirm the address of residence), and deposit the account. The broker may require at least $2,000 on the account or the leveraged trading service.

Market analysis

In search of attractive ideas, you can either independently apply any type of analysis – fundamental, technical, volumetric analysis, or market sentiment. Or rely on the experts’ opinions who usually work in the broker's staff. The choice is yours.

The main thing is to keep one’s wits. The futures markets are open 5 days a week and offer almost limitless possibilities. Don't try to use all of them. Choose the best 1-2 and open a position, and then - carefully try to preserve your capital.

Best futures brokers in 2024

Traders Union recommends you draw your attention to 2 brokers that provide access to futures trading:

| Broker | Advantages |

|---|---|

| Broker | Advantages

Low commission |

| Broker | Advantages

High level of analytics, advanced thinkorswim platform |

Interactive Brokers

Interactive Brokers (IBKR) is a top-tier US broker established in 1978 with 24 offices in 14 countries. Interactive Brokers features are:

-

low commissions. For example, E-mini S&P-500 futures traders will pay just $0.85 per 1 contract trade.

-

the widest range of markets available. The broker's clients can buy securities on 135 exchanges worldwide. Forex, cryptocurrencies, and derivative financial instruments are available.

Clients' capital is protected up to $500 thousand (depending on the jurisdiction), and the broker itself is regulated by reputable bodies such as the SEC (USA), FCA (UK), Investment Industry Regulatory Organization of Canada, and others. The IBKR is listed on the Nasdaq.

TD Ameritrade

TD Ameritrade is a broker established in 1971. In 2020, it became part of broker Charles Schwab, and in 2023, their services and accounts will be synchronized, creating a wide choice for clients. The TD Ameritrade advantages are:

-

powerful thinkorswim platform, which implements professional solutions for the analysis of the futures market

-

a high level of daily analytics available to clients, including for the derivatives market.

This broker's reliability is the highest because Toronto-Dominion Bank is among TD Ameritrade's partners, and Charles Schwab shares are traded on the New York Stock Exchange. It is a member of FINRA and SIPC (Organization for the Protection of Customer Accounts), regulated by the SEC.

Summary

A futures contract is a universal instrument for trading in the financial market. It is perfect for novice traders because:

futures trading is regulated by the government and regulatory agencies. Therefore, it is a reliable business;

there is a wide range of basic assets;

low commissions and low requirements for initial capital.

Learn how to trade futures effectively, and you will always have a high income from speculation. You can also use derivatives markets for medium-term investments.

FAQs

What is futures?

It is a financial derivative traded on an exchange. The price of a futures contract is based on the price of the basic asset. Each futures has a limited expiration date.

How to start trading futures?

Open an account with a licensed broker providing access to the derivatives markets. Practice a demo account before entering into real trades.

Is it profitable to trade futures?

Yes. Commissions are low due to high competition and great popularity, and buyers and sellers are always in abundance. You increase the potential for high returns per dollar invested by leveraged trading.

What are the risks of futures trading?

Risks are comparable to benefits. Trading with leverage incurs the possibility of quickly losing your initial capital. Therefore, use stop-loss orders to protect yourself from the worst-case scenario.

Is it safe to trade futures?

Yes, derivatives markets are highly regulated. Organizations such as the SEC and NFA (USA) closely monitor fair and transparent trading. There are no fraudsters here. The main risk is trading, due to incorrect decisions.

Team that worked on the article

Winnifred Emmanuel is a freelance financial analyst and writer with years of experience in working with financial websites and businesses. Her expertise spans various areas, including commodities, Forex, stocks, and cryptocurrency. Winnifred tailors her writing to various audiences, including beginners, while also providing useful insights for those who are already familiar with financial markets.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.