Swing Trading: Main Strategies and Rules

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

How to succeed in binaries. Your success depends solely on your ability to predict, which comes with experience. Based on knowledge and intuition, you must be able to quickly determine the direction of price movement, be able to calculate the level of risk and instantly respond to any market changes.

Swing trading is one of the best techniques to earn profit from the market downswings and upswings ranging from one night to several weeks. You can use technical indicators to make sure if certain stocks have the right momentum and whether it’s the best time to sell or buy them. Moreover, in swing trading, you need to act quickly to increase your chances of earning more money in a short period of time.

In swing trading, the most important thing to earn a profit is to use a range of technical indicators. Not only will it allow you to identify the current market trends and patterns. But it'll also help you to determine the upcoming change in trends to make the informed decisions. If you're interested in swing trading, then you've come to the right place. This article contains everything you need to know about swing trading, such as respective rules and strategies. After reading this guide, you'll be able to create your own unique strategy as well to take your swing trading game to another level.

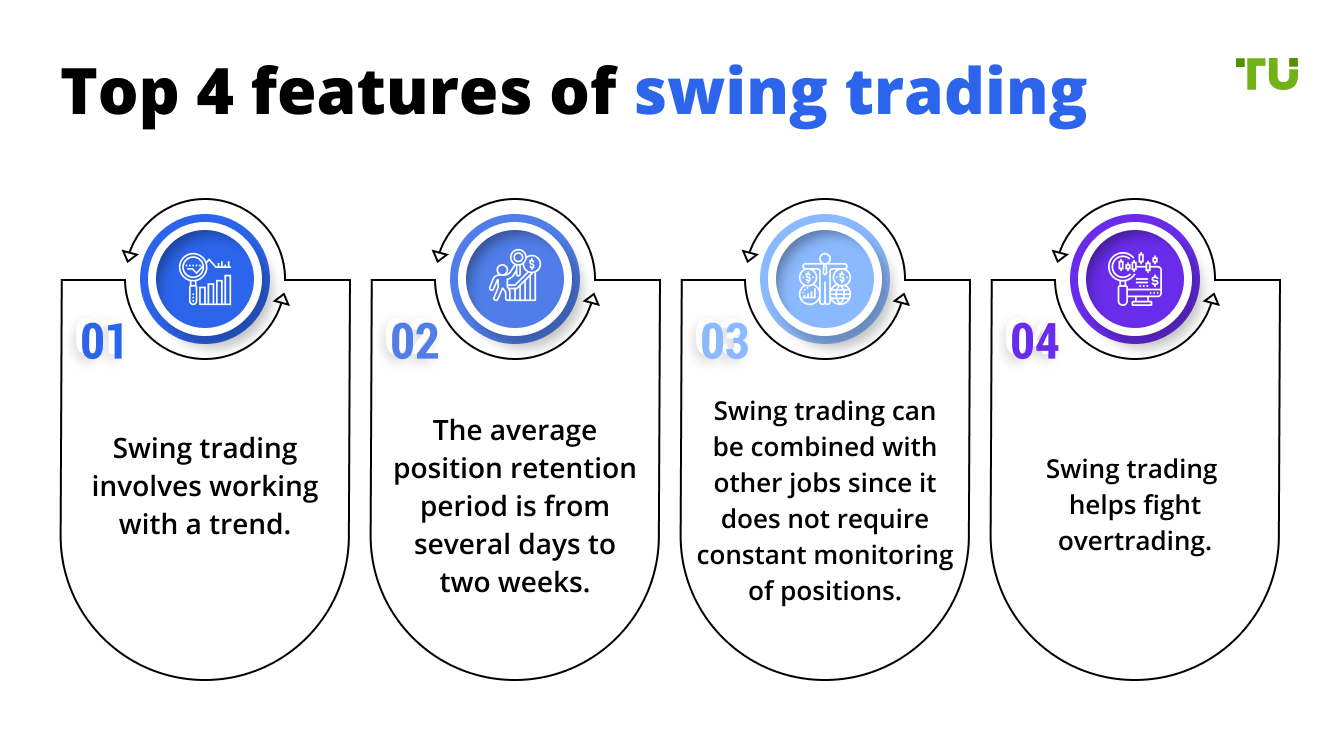

Top 4 features of swing trading

Top 4 features of swing tradingWhat is Swing Trading?

Swing trading is a technique that you can use to achieve smaller gains by cutting losses quickly in short-term trends. The profit you earn in swing trading is usually small, but you can generate a handsome amount of annual returns if you do it correctly and consistently. As mentioned, the positions in swing trading are generally held for about one to several days. However, you can hold them for as long as several weeks as well, but it’s important to ensure that your trading experience remains profitable.

If you want to be a successful swing trader, then you must stick to its basic rules and strategies that we have discussed in this article. The overall price trends in swing trading are more important as compared to the intraday price fluctuations.

Why is Swing Trading Effective?

Swing trading is not only an effective way to maximize your profits, but you can also learn about the market trends in the least possible time. You can operate your swing strategy by spending as little as 30 minutes each day. Additionally, you don’t need to monitor the market constantly to get the signal to buy or sell stocks. That’s why swing trading is a feasible, effective as well and profitable trading style for many people. Being a swing trader, your overall profit will be determined by your trading strategy, opportunity, and position size. You can outperform the market if you get these parameters right to earn a substantial margin.

Swing Trading pros and cons

Just like any other trading style, swing trading also has its own advantages and disadvantages. Understanding these benefits and risks associated with swing trading will allow you to improve your trading strategy.

- Pros

- Cons

- You can achieve great returns about 5 to 10 percent and in the short term.

- Unlike conventional investing and trading methods, you don't need to be tied to your computer constantly. Because in swing trading, your trades can last for days or sometimes even weeks.

- It comes with less hassle compared to other trading styles because it doesn’t require much time and effort to perform research.

- It suitable for you even if you’re already doing a full-time job

- You need to implement the concepts (such as technical indicators, technical charts) correctly, and you'll need to put in a lot of effort and time if you don't understand them.

- It comes with overnight risk regardless of your experience and knowledge.

- You can ride trends, and swing trading can cost you're a lot of money, especially if your trade goes in the opposite direction.

Top 3 Best Swing Trading Strategies

Whether you’re interested in stocks, futures, or forex swing trading, you need to choose a strategy to become a successful swing trader. Not only will it help you to make the right decisions, but it'll also help you to make the best out of your swing trading.

Entry Point

Stop Loss

Profit Taking

Strategy 1: Price Action

You need a precise event (trigger) to identify the right time in order to perform a trade. In the following image, you can see different triggers taking place while the stock is in an uptrend.

Entry Point

You need to make sure that the trade you’re interested in is worth taking before going for it. With the help of your trade trigger, you can identify your entry point. For instance, in the above image, you can understand that above the downtrend line is a good point for long. Having sufficient as well as right conditions for the entry point is important to produce a good and profitable trade.

Stop Loss

You must also manage the risk associated with your trade with the help of a stop-loss order. You can place a stop loss by using multiple ways such as ATR (Average True Range). In this method, you need to place a stop-loss order based on volatility at a specific distance from the entry price.

Profit Taking

Once you have determined that the conditions for the trade are favorable, along with the knowledge of stop loss and entry point, the next thing you need to consider is the profit potential. Keep in mind that it’s not just randomly chosen as it’s based on real-time market trends and measurements such as chart patterns, trend channels, etcetera. You'll need to establish the point where the potential profit of your trade will be based depending upon the market tendencies you're trading.

Strategy 2: Fibonacci Retracement

You can identify resistance and support levels by using the Fibonacci retracement patterns. Eventually, it also helps you to identify the reversal levels as well on the stock charts. Bear in mind that before reversing again, stocks within a trend usually retrace a specific percentage. You can explore the potential reversal levels by creating horizontal lines on a stock chart with the help of Fibonacci ratios (23.6 percent, 38.2 percent, and 61.8 percent). You can also use a 50 percent level as well (however, it's not a Fibonacci ratio) because after reaching half of the previous point, stocks also tend to reverse.

You can understand the above image with the help of the following points:

A: Trade entry point

B: Stop Loss

C: Potential profit

D: Technical analysis (Fibonacci)

Strategy 3: Trend Channel Trading

The trend channel trading strategy is highly visual and effective that occurs when the price of a certain stock bounces at least three times off a rising trendline. Moreover, once the price has hit the upper trendline, it also falls, and a buying opportunity takes place on the lower trendline's fourth touchpoint. Maybe, you also can be interested in information about types of channel trading strategies in Forex.

Entry Point

The primary concept of the trend channel trading strategy is to buy the stocks you’re interested in near the trend channel’s bottom. But you need to keep in mind that you can lose a lot of money if you do it without considering the rest of the factors. One of the most important ones of those is the entry point that informs you about the right time to buy stocks. A great way to find the right entry point is to wait for the consolidation (when the price of the stock moves sideways for more than two days predominantly) slightly below or near the trend channel’s bottom.

Stop Loss

You also need to know the exit plan (Stop Loss) if your trade starts losing money in order to control risk. Selling the stock is always a good idea if the price of the stock reaches a certain point. For that matter, you can set the stop loss a few cents below the consolidation. This way, you'll know both levels even before taking the trade as the stop loss and entry points are determined on the basis of consolidation.

Profit Taking

You also need to determine whether you will exit the trade or not if it moves towards the channel’s top as planned. You can place your target at the channel’s top while placing the trade. In simple words, it means you’ll need to look at the price at which the upper trendline will intersect directly above your entry point.

How to Build Your Own Swing Trading Strategy?

Creating your own swing trading strategy sounds simple, but in reality, it's a little challenging process. That's why we have compiled a list of the most important factors that can help you to create a successful swing trading strategy. Keep in mind that the following points will serve you as a starting point, and you must not consider it a holy grail.

Signals

The primary goal of creating a swing trading strategy is to improve your chances of earning more profit. One of the most important things that you need to incorporate while creating a swing trading strategy is to understand reversal signals.

NRDs (Narrow Range Days)

NRD is a session that has exceptionally little space between closing and opening price. It usually takes place at the end of a trend, and it usually indicates a reversal. It’s known as a Doji (a Japanese word) among candlestick chartists, which literally means a mistake. In its extreme form, an NRD opens and closes at the same price, and instead of creating a rectangle, it creates a horizontal line on a candlestick chart. It’s one of the strongest reversal signals that indicate that the momentum has shifted in a downtrend from sellers to buyers or in the uptrend from buyers to sellers.

Volume Spike

Volume Spike is a session in which the volume is higher than the past days considerably, and it must not be ignored. If you find both of these signals together, then the chances of reversal are very high. It's not a wise decision to suddenly act on a solitary reversal signal, but you should always consider them and rely on both the indicator and confirmation.

Candlestick Reversal

One of the most important technical tools in swing trading is the candlestick chart that you must utilize. Tens of reversal signals that involve three, two, or even a single session can help you to identify the best timing for both entry and exit. Not only will it help you to improve your swing trading experience, but it'll also help you to increase profits and mitigate risks.

Position Sizing

If you want to become a successful swing trader, then you need to make sure your losses remain small. For example, at a given time, if you have a maximum risk of four percent and you want to minimize your portfolio risk to 0.5 percent or even less, then a 12.5 percent of the position will take you there.

0.5 percent / 4 percent = 12.5 percent.

If you’re in a market and hit the low-hanging fruit on reversals, then you’ll risk way less to ensure you keep your gains. Moreover, if you shift down your portfolio risk to 0.36 percent by keeping your trade risk at the same level, your position size will decrease to 9 percent. Of course, these numbers will vary depending upon the progression of the trade. But the main point is that you need to manage your portfolio constantly by adjusting it according to the market conditions. Moreover, position sizing serves you as one of the layers of the success equation. However, it's still one of the important ones, and you need to get it right.

Stop Loss

Not only stop loss helps you to minimize your losses, but it also allows you to determine your position size. If you're planning to go long, then the best place to put your stop-loss is just below the market price. On the other hand, if you want to go shot, then you should place the stop loss above the market price. Moreover, you should also get out of the trade if the current price of your selected stock is close to stopping loss.

For example, if you buy a stock share at 20 US dollars and its prices increase to five US dollars subsequently, you want to put your stop loss at 3 US dollars. This way, you'll lock in the profit of 1 US dollar if the price of the share decreases and reaches 3 US dollars.

Fixing profit

You can use technical analysis for fixing profit in swing trading to determine the highs and lows of the stock prices that will be taking place in the next few days. For example, you can use the ATR (Average True Range) and the resistance channel’s upper bound as a starting base.

With experience and practice, you can always augment this basic approach by using the tools at your disposal. The best way to improve the chances of your profit, it's important to trade only where the potential of your profit is three times greater than the risk. For instance, you should be making at least 30 US dollars (if the target price is reached), and the loss must not be greater than 10 US dollars (if the stop-loss price is reached).

Patterns and Indicators Working Best in Swing Trading

As mentioned, you hold on to your stocks while swing trading for several days or even weeks. It can help you to earn more profits by properly focusing on the entry and exit points. Here are some of the technical instruments/indicators that are effective for building a strategy.

Moving Averages

Observing the moving averages means looking at the past closing prices’ calculated lines. Whether you’re swing trading stocks or forex, it’s important to understand this indicator. You’ll need to calculate and compare different time periods on the chart. It will allow you to understand the average changes taking place in the market over time. We recommend you use an 4hchart with moving average settings of 30 and 50.

Identify the reversals of trends

Determine the strengths of a particular trend

Relative Strength Index

For swing trading, RSI (Relative Strength Index) is one of the most powerful technical indicators. You can use this indicator to determine the ideal entry point, and it also helps you to understand short signals as well. Whether the market is flat, range-bound, oversold, or overbought, you can identify all of it using RSI. Discover the best RSI settings for swing trading.

You can determine RDI using the range from 1 to 100, where 70 might mean that the market is overbought or overvalued, and 30 could indicate that the market is oversold or undervalue.

Volume

It's one of the technical instruments that people commonly ignore, yet it's easy to use. If you're considering trends, then looking for volume is critical because market trends must be supported by volume. When a trend is going in a particular direction, you'll need to ensure that there is more significant volume taking place. If you can't see the volume, it could mean that the market is in undersold or oversold conditions.

Visual Analysis

For both experienced and new traders, it's important to look at visual patterns as well. It allows you to observe the events taking place in the market just by looking at the chart, which can help you a great deal to make an informed decision.

Swing Trading vs. Day Trading: What to Choose?

Unlike swing trading, day trading closes at the end of the day (as the name suggests). Both of the trading styles have their own strengths and weaknesses, and we recommend you choose the one that suits you the best. If you're passionate about the changing market trends and can spend more time in front of your monitor, then day trading can serve you well. On the other hand, if you don't have much spare time to spend then, swing trading could be your best choice.

You need to utilize the price discrepancy to make money

You need to land into positions depending upon fundamental, quantities, and technical reasons

You’ll need to use trading securities to make a living

You don’t need to hold your positions overnight

It consists of buying or shorting securities

You’ll need to hold them for several days (even weeks)

You don’t need to spend more time monitoring market trends

Best for the people who aren’t planning to make trading their full-time job

| Attributes | Swing Trading | Day Trading |

|---|---|---|

| Frequency of trades | Several days to weeks | 24 hours at max |

| Time | 15-30 minutes | 2-5 hours |

| The ability to combine with the main job | Yes | No |

| Number of Trades within a certain timeframe | Several trades per week | Multiple trades per day |

| Technical indicators | Uses trends and momentum indicators | Uses short-term buy and sell signals |

| Platform requirements | Standard brokerage account | State-of-the-art trading tools and platforms |

| Profit and risk | Fewer yet substantial gains or losses | Multiple, smaller gains or losses |

Swing Trading Stocks

Trading stocks is a practice where a person tries to earn profit by buying and selling the securities like stock shares. If you do it according to the rules of swing trading, then collectively, it's called swing trading stocks.

If you want to swing trade stocks, then by accessing the stock market, you can find the list of shares of different companies. You can buy shares of any company that suits you the best to make money on the basis of swing trading rules that we have mentioned above.

Forex Swing Trading

Forex swing trading, on the other hand, takes place on the Forex market, which is far more volatile as compared to the stock market. You can make more profit by forex swing trading, but because of the high fluctuation rate, you need to have the right skills and experience and find the right swing trading broker.

Another important thing that you need to know about Forex swing trading is that it comes with a higher leverage level. It makes it riskier than swing trading stocks, and it can also generate adverse effects.

Best Brokers for Swing Trading

| Broker | Best for | Advantages | Regulation |

|---|---|---|---|

| Webull | Stocks | • No Inactivity fee charged • 0-dollar account minimum • Offers demo account • Time to open an account: 1 day • Products: Stock, ETF, Options | (SEC), (FINRA) |

| Fidelity | Futures and Options | • Offers demo account • base currencies supported: 16 • Products: Stock, ETF, Fund, Bond, Options, Robo-advisory | (SEC), (FINRA). |

| Forex.com | Forex | • Low forex fees • Offers demo account • Diverse technical research tools Products: Forex, CFD, Crypto | (FCA), (CFTC) |

| TD Ameritrade | For Professionals | • Free ETF and stock trading • Great customer support • Products: Stock, ETF, Forex, Fund, Bond, Options, Futures, Crypto | (SEC), (FINRA), (CFTC) |

| RobinHood | For Beginners | • Free ETF and US stock trading • Fully digital fast and account opening • Great researching and educational tools • Offers demo account • Products: Stock, ETF, Options, Crypto | (SEC), (FINRA) |

Webull - Best for Stock Swing Trading

Webull is one of the best online trading platforms that come with zero account minimum and zero inactivity fee. Moreover, it offers a commission-free ETF and US stocks trading environment, which makes it the best platform for stock swing trading.

No Inactivity fee charged

0-dollar account minimum

Zero commission

Fidelity - Best for Futures and Options

If you want to swing trade futures and options, then choosing fidelity can be a great option. You can test all the functionalities that this broker has to offer by accessing its demo account for free. Other than that, the commission and fee structure of this broker is also one of the best ones in the whole industry.

No Inactivity fee charged

0-dollar account minimum

Zero commission

Forex.com - Best for Forex Swing Trading

Forex.com, as the name suggests, is the best online brokerage for forex trading. It's one of the most successful and renowned trading platforms that offer great desktop, web, and mobile applications. Moreover, the tools and features of Forex.com also help you to take your trading experience to another level.

100 dollars account minimum

No withdrawal fees

1-dollar commission per 1,000,000 dollars

TD Ameritrade - Best for Professionals

TD Ameritrade is one of the biggest as well as oldest US stockbrokers, which was founded back in 1975. It also offers a dedicated desktop trading platform, "Thinkorswim," which is one of the most advanced and best ones in the whole market.

100 dollars account minimum

No withdrawal fees

Inactivity fee charged

Zero commission

Robinhood - Best for Beginners

If you're a beginner and interested in swing trading, then there is no better option for your other than Robinhood. It comes with a range of tools built on state-of-the-art technology that you can use to learn about swing trading in the best possible way.

100 dollars account minimum

No withdrawal fees

Inactivity fee charged

Zero commission

Summary

If you're currently doing a full-time job and also interested in trading, then swing trading is your best choice. Not only can you earn a handsome amount of money with it, but you can also identify the trading opportunities you're most interested in. We hope that this guide will help you to understand everything swing trading rules, strategies, and how to come up with your own.

FAQs

How much investment do you need for stock swing trading?

As a basic rule, you'll need at least 5000 US dollars to start swing trading, but there are platforms such as Webull that allow you to swing trade stocks with the net account value of 2000 US dollars.

How many stocks do you need to swing trade?

Theoretically, there is no limit but if you want to achieve optimal results having no more than ten stocks is enough.

Can you make a living with swing trading?

The one-word answer is yes because you can achieve 30 percent as an average annual return. However, it can take more time as you can double your capital no earlier than three years.

Is swing trading riskier than day trading?

No, as compared to swing trading, day trading is riskier. But it certainly doesn’t mean that the risks aren’t associated with swing trading.

Related Articles

Team that worked on the article

Bruce Powers is an expert trader and technical analyst with over 20 years of experience in Forex, commodities, ETFs, cryptocurrencies and other assets. He is an active trader, technical and fundamental analyst, media commentator, educator and a writer. As an author for Traders Union, he contributes his deep analytical skills, expertise and understanding of the global economy and financial markets to provide market analysis and insights. Powers is also a frequent guest on business TV news shows.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

A Robo-Advisor is a digital platform using automated algorithms to provide investment advice and manage portfolios on behalf of clients, often with lower fees than traditional advisors.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.