What Is XRP And Whether It’s Worth Buying?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

XRP is a digital asset used for fast, low-cost cross-border payments via RippleNet. Its key features include:

Created for bank transfers.

Faster than Bitcoin transactions.

Very low transaction fees.

Backed by Ripple Labs.

Used by real-world banks.

Volatile, like other cryptos.

Ripple (XRP) has gained recognition in the digital finance ecosystem for its unique role: it is both a digital asset (XRP) and a global payments platform (RippleNet) developed by Ripple Labs. Unlike traditional cryptocurrencies mainly designed for simple transfers or automated contracts, Ripple is built to improve cross-border payments for banks, financial institutions, and payment providers.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

What makes Ripple unique?

Ripple’s design addresses inefficiencies in traditional international payments — slow tRipple’s design aims to fix common problems in traditional international payments — slow transaction times, high fees, and the need for intermediary banking relationships. XRP, the native token of the XRP Ledger (XRPL), acts as a middle currency that helps manage liquidity during quick settlements. RippleNet is Ripple’s global payment network that includes over 300 financial institutions across 40+ countries. It uses modern messaging tools and payment processes, and integrates with ISO 20022 standards, which will become mandatory for global banking systems by 2025.

XRP by the numbers

Below is a snapshot of the essential metrics for XRP — one of the most recognized digital assets in the global crypto ecosystem. Known for its fast settlement times and minimal transaction fees, XRP is widely used in cross-border payments. This table offers a quick overview of its current supply, market value, performance, and technical characteristics.

| Metric | Value |

|---|---|

| Ticker | XRP |

| Max Supply | 100,000,000,000 |

| Circulating Supply | 58.55 billion |

| Market Capitalization | ~$151.44 billion |

| Price Range | $0.40 – $3.30 |

| 1-Year Return | +408% |

| Transaction Fee | 0.00001 XRP |

| Settlement Time | ~3-5 seconds |

XRP’s journey: A quick history

Here’s a quick and surprising look at XRP’s journey through the years.

2012: Ripple was born. Ripple Labs was founded by Chris Larsen and Jed McCaleb to build a faster, more scalable alternative to Bitcoin with XRP as the native token.

2013: XRP pre-mined all coins. Unlike Bitcoin, XRP launched with 100 billion coins already created, a move that still sparks debate over decentralization.

2015: Ripple signed first bank. Ripple struck a deal with Fidor Bank in Germany, quietly marking one of the first real bank tie-ups in crypto history.

2017: XRP outpaced Bitcoin in gains. While Bitcoin gained 1,318%, XRP exploded with over 36,000% growth, surprising even crypto veterans.

2020: SEC lawsuit shook Ripple. The U.S. SEC filed a lawsuit claiming XRP was a security. It led to massive delistings and price crashes but also sparked global discussion about crypto regulation.

2023: Ripple scored partial win. A U.S. court ruled that XRP was not a security when sold to retail traders, leading to a temporary spike in market confidence and price.

2024: Ripple expanded to CBDCs. Ripple signed multiple deals with countries like Palau and Montenegro to power their digital currencies using Ripple’s tech, not just XRP.

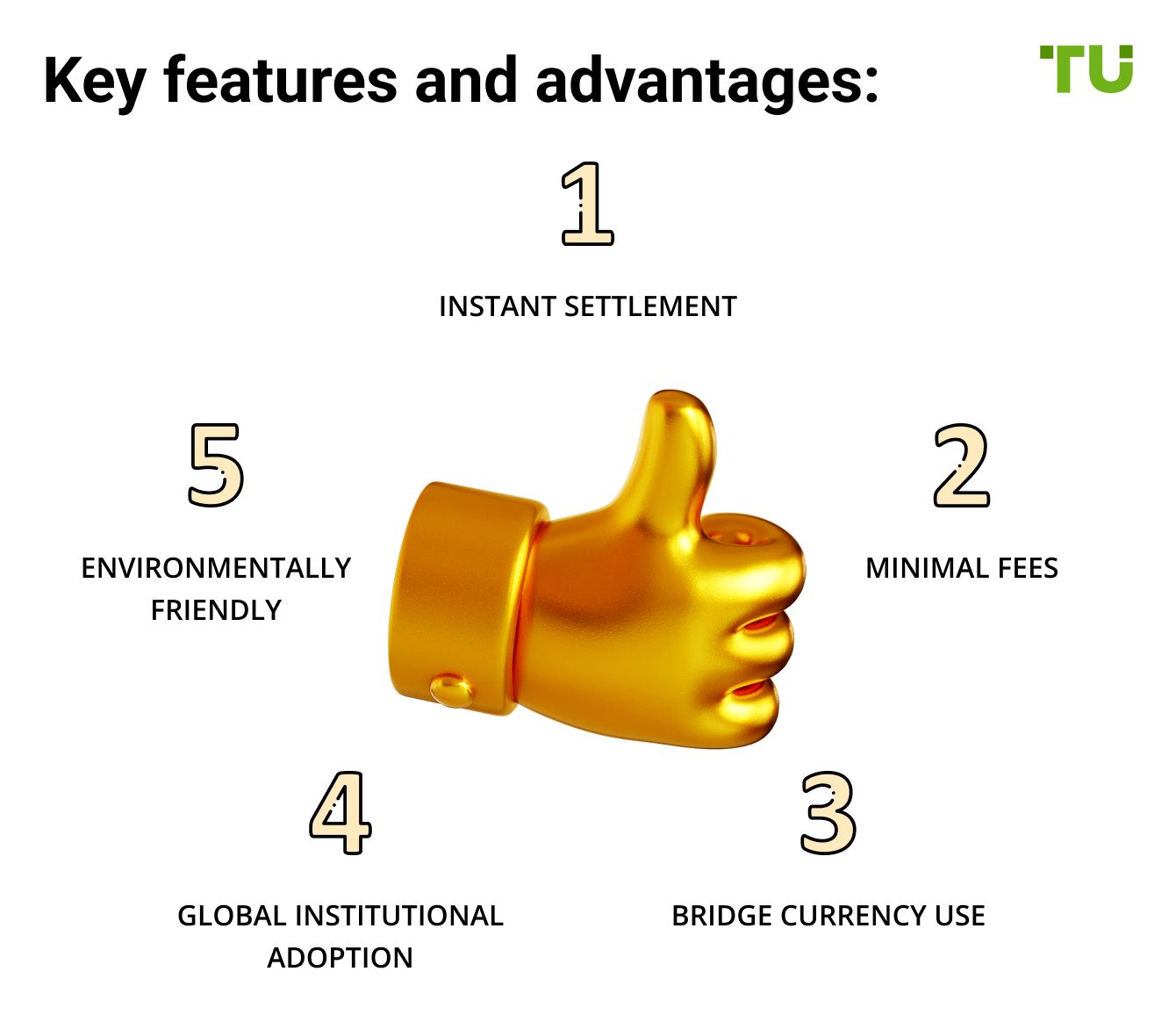

Key features and advantages

Instant settlement

Transactions on the XRP Ledger confirm in about 3 to 5 seconds. Traditional wire transfers can take days. Ripple’s consensus protocol replaces energy-intensive mining, making it much quicker and smoother.

Minimal fees

Transaction costs are as low as 0.00001 XRP, which is less than a cent, making microtransactions practical and large international transfers highly economical.

Bridge currency use

XRP serves as a neutral bridge asset between any two currencies, helping overcome liquidity gaps in corridors where direct trading pairs aren’t available.

Global institutional adoption

Ripple has partnered with major financial institutions, including Santander, PNC, SBI Holdings, and American Express, boosting the credibility and usefulness of RippleNet and XRP.

Environmentally friendly

XRP Ledger uses a consensus algorithm instead of Proof-of-Work (PoW), using very little energy compared to Bitcoin and Ethereum before the Merge.

RippleNet and ISO 20022

RippleNet is Ripple’s enterprise blockchain network that supports instant, low-cost cross-border payments. It’s built to align with ISO 20022 standards, the global format for financial data exchange.

This makes Ripple a likely fit for future integration into central bank digital currency (CBDC) systems and conventional banking networks.

XRP supply and escrow system

To avoid oversupplying the market, Ripple Labs locked 55 billion XRP into escrow in 2017. Each month, up to 1 billion XRP can be released, but unused XRP returns to escrow. This helps release XRP slowly over time and controls volatility.

Can you mine XRP?

No, you can’t mine XRP like Bitcoin or Ethereum, and that’s not just some technical detail, it’s intentional. All 100 billion XRP were created at the start by Ripple Labs, which held on to a big chunk for itself. Instead of mining, XRP relies on a consensus protocol to confirm transactions. What makes this stand out is that the XRP Ledger closes a block every 3 to 5 seconds and uses almost no energy at all. To give you an idea, confirming one XRP transaction uses less power than charging your phone. That’s something institutions care about, especially those focusing on sustainability.

Most people don’t realize that Ripple controls XRP supply using a smart escrow system that releases up to a billion tokens every month. It helps manage supply and also builds trust with big partners. Even though you can’t mine XRP, developers and investors are still drawn to the XRP Ledger because of what it can do. It has a built-in decentralized exchange and supports native tokens right out of the box. That’s not something you see every day. If you're looking to get involved without mining, running a validator or helping with liquidity could be where you start.

XRP legal status: SEC vs. Ripple

Ripple and the SEC wrapped up their long-running dispute in May 2025, a case that had kept the crypto world on edge. The SEC had accused Ripple of raising over $1.3 billion by selling XRP tokens without proper registration. Back in July 2023, Judge Analisa Torres ruled that while Ripple's direct sales to big investors broke the rules, its sales to everyday folks through exchanges didn't. Fast forward to the settlement: Ripple agreed to pay $50 million, a significant drop from the initial $125 million fine, and the SEC decided to drop its appeal, hinting at a change in how they might handle crypto cases moving forward.

This result could shake things up across the crypto space, especially when it comes to figuring out what counts as a security. The court's decision showed that the context of a token's sale matters a lot. It highlighted just how tricky it is to fit old-school securities laws into the new world of digital currencies. This might set the tone for how regulators look at other cryptocurrencies and push for rules that better fit this evolving market. For crypto companies, it's a sign to stay alert and be ready for a regulatory landscape that's still finding its footing.

Price history and volatility

In early 2025, XRP reached a high of $3.27 in January but faced a significant correction in February, dropping to $1.84. This decline was influenced by profit-taking and broader market adjustments. Since then, XRP has been on a gradual recovery path, with its price stabilizing in the $2.30 to $2.60 range.

The volatility in XRP's price can be attributed to several factors, including ongoing regulatory developments, market sentiment, and speculative trading. Analysts suggest that XRP's future performance will heavily depend on the resolution of its legal challenges and the broader adoption of Ripple's payment solutions.

Investors are advised to monitor these developments closely, as they could significantly impact XRP's price trajectory in the coming months.

XRP-based technologies: xCurrent and on-demand liquidity

xCurrent is Ripple’s tool designed for businesses that want to make instant, cross-border payments using secure messaging protocols.

On-demand liquidity (ODL) relies on XRP as a link between currencies and removes the need to maintain pre-funded accounts in foreign banks. This helps cut down on both expenses and the need for tied-up capital for financial institutions.

How to buy XRP (Step-by-step)

If you’re a beginner and want to buy XRP with a real edge, here are some lesser-known but powerful tips to guide you.

Use decentralized exchanges with XRP liquidity

Try using Sologenic DEX to buy XRP without relying on central platforms that might block or limit access in your country.

Check blockchain network status before buying

Use XRPScan to make sure there aren’t any issues slowing things down or that could mess with how fast your XRP shows up.

Leverage liquidity provider tokens on XRP-compatible platforms

You can add XRP to liquidity pools and get some extra crypto while you’re at it, instead of just letting it sit.

Avoid wallets with no native XRP support

Some wallets may list XRP but don’t give you full access to features like Trust Line creation, which limits what you can do later.

Buy XRP during low network usage times

Trading late at night in GMT hours often gets you better prices and lower spreads since the network is less crowded.

Enable destination tag alerts when sending XRP

Always double-check or save the destination tag for exchange wallets so you don’t accidentally lose your XRP.

Explore XRP wrapped tokens on other chains

Wrapped XRP (wXRP) lets you move between blockchains like Ethereum or BNB Chain while still tracking XRP’s price.

Should you invest in XRP

- Pros

- Cons

Fast liquidity access. XRP is used by banks not just for quick transfers but to quickly unlock cash without delays in cross-border payments.

Built-in anti-spam mechanism. Each transaction burns a tiny amount of XRP, so spamming the network gets costly fast and keeps things running smoothly.

Choose who verifies your transactions. XRP Ledger doesn’t rely on miners but lets institutions pick a trusted list of validators, giving them more control.

Ripple made deals with banks in tricky regions. Ripple has strong partnerships in areas like Southeast Asia and the Middle East, where banking can be painfully slow.

Limited decentralization. XRP uses a handpicked list of validators, which gives Ripple some control and may bother people who prefer fully open systems.

Uncertain legal standing. The ongoing legal mess with the SEC keeps XRP in a risky spot, especially for U.S.-based investors.

Wallet compatibility issues. Some top wallets don’t support XRP features like trustlines or advanced security, which can be a headache for secure storage.

Ripple holds a huge chunk. Since Ripple owns a big part of the XRP supply, they can shake up prices when they sell big chunks into the market.

Verdict: XRP can be a solid addition to a diversified crypto portfolio, but only for investors with a medium-to-high risk tolerance.

XRP is reshaping cross-border payments in Southeast Asia and beyond

XRP isn’t just about charts or lawsuits anymore. What’s really moving the needle is how it’s being used behind the scenes in Southeast Asia. In places like the Philippines and Thailand, banks and money transfer companies are using XRP to power cross-border payments. It’s fast, cheap, and doesn’t require holding large amounts of foreign currency. Big names like SBI Remit and Tranglo are already using it daily. If you're new to XRP, start by tracking payment volumes in these countries. It gives you a real sense of adoption, not just price speculation.

Also, Ripple is quietly working with small countries testing out central bank digital currencies (CBDCs). Places like Bhutan and Palau are running pilot programs using Ripple’s private ledger. It’s a behind-the-scenes move that could turn XRP into part of the plumbing for digital government money. That’s way bigger than just being another token. If just a few governments start using Ripple tech at scale, this isn't just a crypto play, it’s a long-term investment in global financial rails.

Conclusion

XRP stands out as one of the most established cryptocurrencies with a clear utility in global payments and strong institutional backing. Its fast transaction speed, low fees, and integration with financial institutions through RippleNet make it a unique player in the blockchain space. However, ongoing regulatory challenges, particularly in the U.S., introduce a degree of uncertainty that investors should consider.

If you're looking for a crypto asset with real-world use cases and long-term potential, XRP deserves a place on your radar — but like any investment, it requires careful analysis, awareness of market risks, and a strategy aligned with your financial goals. As with all crypto investments: research thoroughly, diversify wisely, and invest responsibly.

FAQs

How can I earn passive income using XRP?

You can earn passive income by providing liquidity on decentralized XRP platforms like Sologenic DEX or by staking wrapped XRP (wXRP) on other blockchains. While XRP doesn’t have traditional staking, you can still explore DeFi options that offer rewards for helping with liquidity.

Can XRP be used for everyday purchases?

While not as widely accepted as Bitcoin, some platforms and cards let you spend XRP like cash. You convert it instantly at checkout, so while merchants may not take XRP directly, it's still usable in daily life with the right tools.

What wallets fully support XRP’s advanced features?

Trust Wallet and Xumm are two great options that support XRP features like Trust Lines and native tokens. Many wallets claim to support XRP, but they may lack functionality needed to interact fully with the XRP Ledger’s ecosystem.

Does XRP support smart contracts like Ethereum?

Not in the same way. XRP Ledger doesn’t have full smart contract capabilities like Ethereum. However, it allows limited programmability and is working on Hooks, an upgrade that will bring lightweight smart contract functionality without compromising speed or security.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.