- 170 countries

- No

Currencies:

- Most currencies

cryptocurrencies:

- No

Summary of Paysend

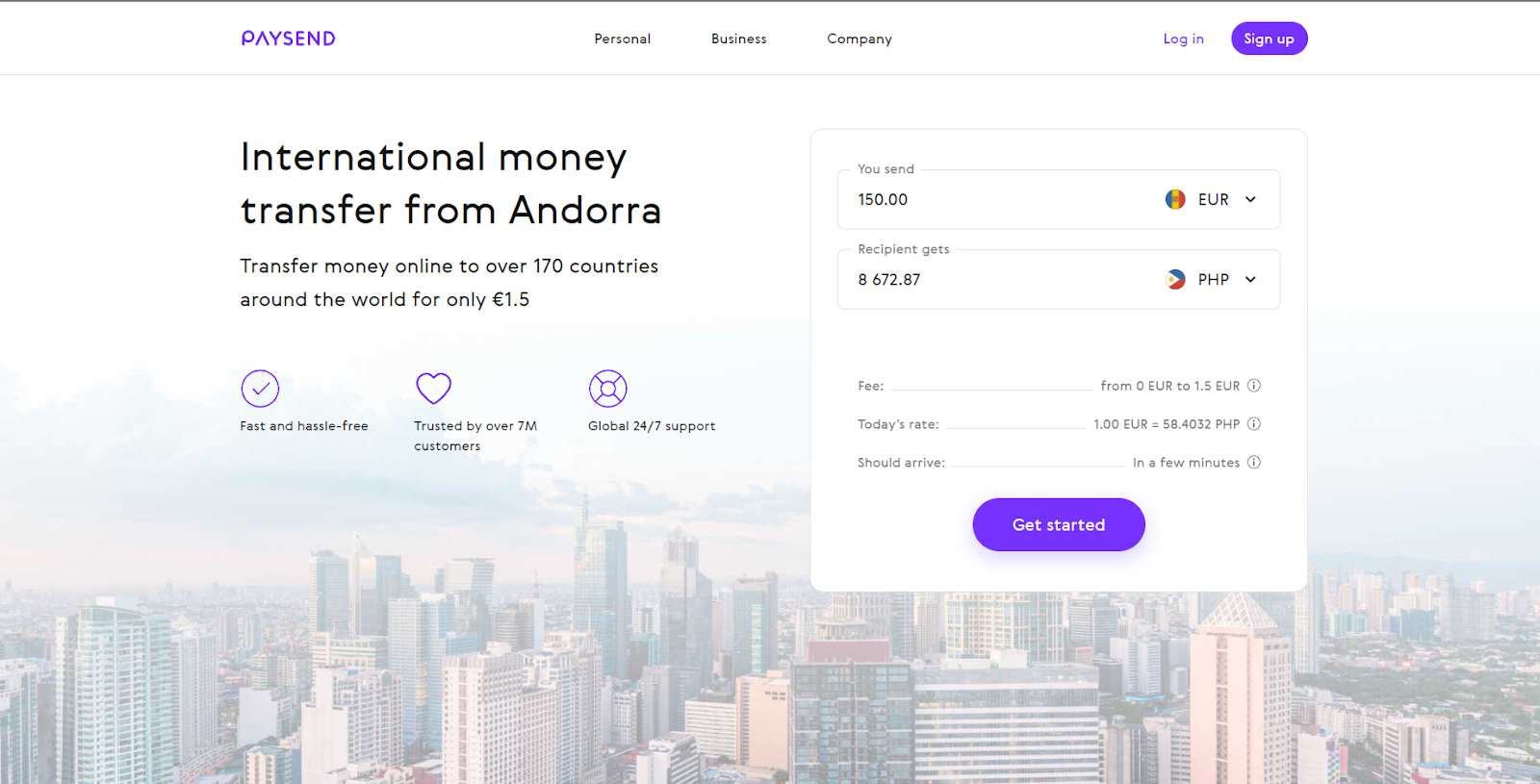

Paysend is a global money transfer service launched in 2017. It is a relatively young UK-based fintech company working to actively expand its coverage. The company operates in 170 countries. Paysend review shows that the fixed fee is the key feature of the service. Regardless of the amount of your transfer and the country of the recipient, the fee is always EUR 1.5, GBP 1, USD 2 or CAD 3 depending on the region. Currency is automatically converted at the rate that is closest to the market.

| 💼 Main types of accounts: | Personal and Business |

|---|---|

| 💱 Multi-currency account: | Most currencies |

| ☂ Deposit insurance: | Fixed at EUR 1.5, GBP 1, USD 2 or CAD 3 |

| 👛️ Savings options: | Savings accounts |

| ➕ Additional features: | Partnership program, currency converter |

👍 Advantages of trading with Paysend:

- the service is well-known for its quick transfers. 95% of transfers are processed instantly, but transfers to accounts may take up to 5 days (due to the specific nature of banks’ operation);

- a fixed fee of EUR 1.5, GBP 1, USD 2 or CAD 3 makes large transfers very beneficial. Regardless of whether you transfer EUR 500, EUR 5,000 or EUR 15,000, you still pay the standard fee without any mark-up;

- Transfers can be made using various methods: to a bank card, bank account, electronic wallet, by phone number, or to a cash point. The method does not affect the fee or other conditions of transfer;

- Integrated conversion feature performs automatic currency exchange. You know the exchange rate in advance, before you make the transfer. The money is converted at a rate that is very close to the market price;

- Paysend review shows that the money transfer service meets international functionality and security standards. User data and funds are well protected;

- Paysend provides exclusive convenience of transfers thanks to simple functionality and excellent optimization of the app. You can understand how everything works within a couple of minutes.

👎 Disadvantages of Paysend:

- despite impressive coverage of 170 countries, transfers to some regions are either unavailable or limited;

- Paysend does not offer advanced features. For example the money transfer service does not provide investment programs or analytics for clients’ assets;

- the fixed fee of EUR 1.5, GBP 1, USD 2 or CAD 3 is not always beneficial. If you are transferring a small amount, the fee may turn out to be higher than the fee charged by other money transfer systems.

Analysis of the main features of Paysend

Table of Contents

Geographic Distribution of Paysend

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Paysend

There are quite many fintech companies in the market specializing in international money transfers. However, there has been interest towards Paysend since the very beginning. At the moment, there are over 7 million people using the service. Paysend review showed that the company has colossal coverage, with clients in the U.S., Europe, Asia and Australia. There is no doubt that the list of countries will only grow longer.

User reviews are mostly focused on the fees. Paysend charges a fixed fee for any transfer: EUR 1.5, GBP 1, USD 2 or CAD 3. This is an extremely low indicator no other service offers. Naturally, large transfers benefit the most from such low fees.

Our expert commission checked automatic conversion of the service. It is a built-in feature that greatly helps people using the Paysend app to make transfers. A user chooses the direction of the conversion and enters the recipient’s card. Conversion is performed at a rate that is very close to the market rate.

The service’s partnership program is also quite good. In order to participate, you only need to distribute your referral code among your friends and acquaintances. You can get a bonus for each invited user. Of course, it is not much if you receive it only once, but we interviewed most active users and saw that they gain serious benefits by being active on social media. It is smart marketing, and many transfer services use it.

Latest Paysend News

Dynamics of Paysend’s popularity among

Traders Union’s traders, according to 2023 data

Investment programs, available markets, and products of Paysend

Paysend review shows that the money transfer service does not offer investment options. The only option users can use to make extra cash is the partnership program. Cash bonuses are paid for inviting new clients. The bonuses can be higher, if a user is active on social media, but they still won’t be a great contribution to a person's income.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Paysend Money Transfer Terms & Conditions

The company works continuously to improve its operation, expanding geographic coverage and adding transfer options, although almost all known options are already available. 95% of transfers to a card take a couple of seconds. Transfers to a bank account could take several days due to the specific nature of banking system operation. However, it is never longer than 5 days (excluding weekends). It is not something specific to Paysend; all money transfer services work longer with accounts than with cards or other payment options.

Paysend review showed that the service offers the same conditions to all users. The service does not have plans or additional options (both free and paid). This is a great advantage, as clients don’t have to consider which plan is most suitable or pay extra for certain features. On the other hand, Paysend does not have interesting features that could be connected for a fee. The company provides quick and convenient money transfers at minimum fees. Focusing on one task, Paysend service ensures its high quality.

As for the Paysend app, it is appreciated by experts and users. Constructive analysis along with stress testing showed no weaknesses or vulnerabilities. The app does not have glitches and does not lag. It can be installed on a mobile device running on any operating system. In the end, you get a stable transfer service you can use to send money to another country from card to card in just a few clicks. A stable app is a conceptual advantage of any service in the age of smartphones.

| 💼 Main types of accounts: | Personal and Business |

|---|---|

| 💱 Multi-currency account: | Most currencies |

| Deposit terms and conditions: | Card, account, electronic wallet, phone number |

| Loan terms and conditions: | Bank card, bank account, electronic wallet, phone number, cash point or personal delivery |

| ☂ Deposit insurance: | Fixed at EUR 1.5, GBP 1, USD 2 or CAD 3 |

| 👛️ Savings options: | Savings accounts |

| Types of payment: | No |

| ➕ Additional features: | Partnership program, currency converter |

Comparison of Paysend with other e-payment systems

| Paysend | Advcash | Payeer | Skrill | Neteller | FastSpring | |

| Supported Countries | 170 countries | 150 countries | 127 countries | 200 countries | 180 countries | 200 |

| Supported Currencies | Most currencies | 9 currencies (USD, EUR, GBP, RUB, BRL, TRY, UAH, KZT, VND) | 3 fiat currencies (USD, EUR, and RUB) and most cryptocurrencies | 40 currencies | 28 currencies | 20 |

| Support for cryptocurrencies | No | Yes | Yes | Yes (deposit) | Yes | No |

| Subscription fee | No | No, only transaction fees | No, transaction fees only | No, only transaction fees | 2.5% | 8.9% or 5.9% +95 cents per transaction |

| Payment acceptance equipment | EUR 1.5, GBP 1, USD 2 or CAD 3 | No, only software | No, online only | No, only online | Yes, Net+ Cards | No, only software in the form of SaaS |

Paysend Commissions & Fees

The Paysend money transfer service charges only one fee, the transfer fee. The fixed fee is EUR 1.5, GBP 1, USD 2 or CAD 3, depending on your area of residence. Note that the fee does not change under any circumstances. It does not matter which currency you want to make the transfer with and which currency you want to convert it into. The transfer amount also does not affect the fee, or the type of transfer, for example to a card or account.

At the moment, only a few services have the same fee schedule. Usually, the fee comprises two components: a certain fixed amount plus a percentage of the transfer amount. For example, €1.5 (or an equivalent) + 1% of the transfer amount. You don’t need an in-depth analysis to understand that Paysend’s conditions are much better. Many countries do not have another service like this in terms of the fee.

However, users need to consider that other parties to the transaction may charge additional fees. This primarily applies to banks. The money transfer service cannot influence the policy of banks. If your bank charges a fee for sending or receiving money in currency, you will have to pay it in addition to the Paysend fee. This fee is not specified in the service, because it is not related to the service. Paysend does not have any other charges, but the fixed fee. You can contact your bank for details about the transfer fees in order to avoid misunderstandings.

The Traders Union also compared Paysend’s fees with similar types of fees on other e-payment systems.

| PayPal | Remitly | Paysend | |

| Payment commission | $0.49 | $2.99 | €1.5 |

| Deposit commission | No fee | No fee | No fee |

| Withdrawal commission | 1.5% | $2.99 + 0.5% of the amount for Economy or 1.5% of the amount for the Express option | Fixed at EUR 1.5, GBP 1, USD 2 or CAD 3 |

| Commission for international transfers | Depend on the transaction type and region | Depends on the transaction type and region | Depends on the transaction type and region |

However, users need to consider that other parties to the transaction may charge additional fees. This primarily applies to banks. The money transfer service cannot influence the policy of banks. If your bank charges a fee for sending or receiving money in currency, you will have to pay it in addition to the Paysend fee. This fee is not specified in the service, because it is not related to the service. Paysend does not have any other charges, but the fixed fee. You can contact your bank for details about the transfer fees in order to avoid misunderstandings.

Paysend review performed by TU experts confirms what most user feedback says. It is a simple and easy-to-use international money transfer service that offers unique conditions: only one fixed fee. Each transfer is charged with EUR 1.5, GBP 1, USD 2 or CAD 3. Transfers are mostly instant or take mere seconds, with the exception of transfers to a bank account, which takes longer to process. There is also a partnership program that could bring a good amount of extra income provided you are quite active on social media.

Detailed review of Paysend

Since the Paysend app is not available, limited or replaced with an alternative in some countries, many people think they don’t need to know about the money transfer service. In truth, this year alone Paysend added more than two dozen new transfer “destinations” (for example, in some countries, users could only receive transfers, but now they can also send money). This means that if the service allows users in your country to only accept or only send money, it is likely that the situation will soon change for the better.

Any Paysend review names the fixed fee as a conceptual advantage of the service. TU experts analyzed the service’s conditions in detail and did not discover any pitfalls. This is important not only for the financial aspect. If a company does not hide anything from clients and provides fully client-oriented services, this concept applies to all its services. Reliable app, quick transfers, and quality customer support are the results of an honest and open approach.

By the way, customer support is also often mentioned in Paysend reviews. It is provided by the Help Center that features detailed instructions for working with the app. The Help Center is translated into English and Russian. There is also a forum, where clients help each other and can ask service representatives for advice. Finally, you can contact support service operators through the app. It is actually the quickest option. The operators provide clear answers and expert advice on all issues.

Paysend in figures:

-

7 million users;

-

170 countries – current coverage;

-

$0 – subscription fee;

-

EUR 1.5, GBP 1, USD 2 or CAD 3 – fixed fee.

Many Paysend reviews focus on simple registration. We will describe this process in detail below. Registration is indeed simple and doesn’t take much time. It is an important advantage when a money transfer service is easy and understandable and users have no issues during registration or later on. The money transfer process is also very simple: a client needs to specify the source of the transfer, the amount and recipient details. Conversion and transfer are performed automatically once the client confirms the transaction.

Paysend features:

-

transfers inside the country and abroad (170 countries);

-

transfers to bank cards and bank accounts;

-

transfers to an e-wallet or phone number;

-

option to receive the money transfer in cash (including via a delivery service);

-

a request for a money transfer can be sent to another user;

-

automatic currency conversion at a good rate;

-

program with bonuses for invited clients;

-

quick customer support in the app.

Paysend offers partnership to large companies. Partnership opens an opportunity to use the service for corporate payments under loyal conditions. The offer is valid for companies registered anywhere in the world. Companies are not required to meet certain criteria to enter into a partnership; the agreements are negotiated individually.

Benefits of Paysend money transfer service:

-

To become a client of the service, you need to install the Paysend app and spend literally a couple of minutes to register. In-depth verification is not required.

-

All basic payment methods are available: money can be sent from a card, account, e-wallet, phone number, and received using the same methods or even have the transfer delivered in cash to your home.

-

At the moment, transfers between 170 countries are available, although in some countries you can only send money and in others – only receive (check the website for details).

-

The app is simple and easy-to-understand; there are no secondary features that can distract and clutter working space.

-

The Invite a Friend program provides bonuses for clients who registered using your referral code.

-

Conversion during transfers is automatic (if required). The service uses the exchange rate that is close to the current market rate.

-

There is only one account type with no additional features. There is a fixed fee for all transfers, regardless of the amount, currency and the location of the recipient.

Full Paysend review shows that the money transfer service has many advantages. There are naturally some disadvantages, but they are mostly subjective. Throughout its entire operation, the company has been improving its work and expanding its presence.

Types of accounts in the Paysend payment system

A new user receives access to full features of the international money transfer service right away. There is no need to compare accounts to decide which one is the best or what features to use. A single account with transparent conditions is a clear advantage that attracts many clients.

Banking features

Banking features basically mean modern banking services, for example, transfers inside the country and abroad, loans and micro loans, investment instruments, savings accounts, automated analytics and reporting. Paysend only offers money transfers. Accordingly, the service cannot be considered a bank or a neobank. You have to seek other platforms for savings, investing and other financial opportunities.

Social programs of Paysend

Very few international money transfer services implement environmental or social programs. Launch of such programs or participation in them do not determine the quality of service. However, there are companies that are socially active or involved in charity, although their conditions leave a lot to be desired. Therefore, despite the fact that Paysend never launched any social programs, you shouldn’t treat this service with prejudice. What’s more important is that Paysend quickly transfers money at a low fee.

How to open an account at Paysend

The registration process on Paysend does not take much time. It is technically simple. Nonetheless, there are several nuances that need to be considered not to waste time. Below is a step-by-step guide on how to register on Paysend.

-

Step 1. Go to the official website of the Paysend money transfer service. Scroll down to the bottom. In the bottom left corner choose your language. Then return to the top of the homepage and click the Sign Up button in the top right corner.

-

Step 2. Type in your mobile phone number and click Continue. In the next window provide your first name, last name and date of birth.

-

Step 3. Next you need to type in your city, residential address and postcode. You need to provide your residential address in your registration country, not an actual address. This legal information is required for the service to provide you services on legal grounds. Third parties cannot access your personal information. After you fill out mandatory fields, click the Continue button.

-

Step 4. Specify your email (the one you regularly use). Notifications and letters from customer support will be sent to it. Click Continue and then enter the 4-digit code from the text message sent to your mobile phone. Note that by entering the code you agree to the terms of use (you can read the document by following the link under the code). If you didn’t receive the code, you can request for it to be resent.

-

Step 5. Now, the registration is complete. To gain access to your user account, click Log In. You can send money through a user account, but it is much easier to do it via the app. Note that you can change registration information (for example your phone number or email) by contacting customer support.

-

Step 6. Once again go to the website and scroll down to the Get the Paysend app Today! section. You will see links to digital app stores. Choose the one you need: App Store or Google Play, click on the link and follow the instructions on the screen. You can also download the app on your smartphone. Just type in Paysend in the search bar.

Technical support

The company does not have a call center. Clients can communicate with customer support by email or in the app. The app is better, as the responses are quicker and you can contact the support at any time. There is a Help Center on the website, which is available in most languages. The Help section features answers to frequently asked questions with detailed explanations. Also a lot of useful information is available on the forum, which can be accessed through the Help Center on the website.

Disclaimer:

Your capital is at risk. Via Paysend's secure website. Your capital is at risk.

FAQs

Does the Paysend payment system work officially?

Yes. The payment system is officially registered and licensed for financial activities.

Is it possible to withdraw money to a bank card from a Paysend account?

Paysend customers can withdraw money to debit and credit cards of any bank.

Can I buy cryptocurrency through Paysend?

By means of the Paysend wallet, you can replenish your account on a cryptocurrency exchange and buy cryptocurrency.

Does Paysend have a mobile app?

Yes. The Paysend payment system offers a convenient mobile application for money transfers.

Traders Union Recommends: Choose the Best!

Via Advcash's secure website.

Via Payeer's secure website.

Via Skrill's secure website.