Qtrade Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €1,000

- MetaTrader4

- MetaTrader5

- ActivTrades

- TradingView

- FCA

- Amtsgericht München

- CSSF

- 2022

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €1,000

- MetaTrader4

- MetaTrader5

- ActivTrades

- TradingView

- FCA

- Amtsgericht München

- CSSF

- 2022

Our Evaluation of Qtrade-de

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Qtrade-de is a broker with higher-than-average risk and the TU Overall Score of 3.04 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Qtrade-de clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

QTrade is a regulated broker that offers a wide range of assets for both professional and retail clients. Also, a high initial deposit doesn’t allow novice traders with small free capital to test the broker’s conditions.

Brief Look at Qtrade-de

QTrade was incorporated in 2009 and has its head office in Munich. It is supervised by BaFin (The Federal Financial Supervisory Authority) and participates in the German compensation scheme for investors. QTrade partners with ActivTrades, an international broker regulated by FCA (Financial Conduct Authority | UK), SCB (Securities Commission of the Bahamas), and ESMA (European Securities and Markets Authority). Their accounts are integrated, which allows QTrade clients to use ActivTrader, the ActivTrades proprietary platform, along with MetaTrader 4, MetaTrader 5, and TradingView. QTrade focuses on active trading CFDs and Forex. Also, it offers leverage up to 1:30 (1:400 outside Germany) and proprietary signals. The broker provides its services to residents/citizens of Germany above age 18 and to residents of 70 more countries.

- BaFin ensures security and reliability;

- Account types for retail and professional trading;

- Negative balance protection;

- Over 1,000 CFDs on different assets, including currency pairs;

- Trading micro and mini lots;

- Technical and telephone support are available in German;

- Wide choice of trading platforms.

- To start retail trading CFDs, a minimum deposit of €1,000 is required;

- The broker’s website doesn’t contain educational materials for novice traders or information for developing the trading skills of more experienced traders;

- No live chat with technical support.

TU Expert Advice

Financial expert and analyst at Traders Union

QTrade’s executive broker is ActivTrades which has been on the market since 2001, is regulated in the EU, and provides its services to over 100,000 traders from 170 countries. QTrade and ActivTrades have been partners for over 14 years. ActivTrades provides Qtrade’s clients with its proprietary platform. Moreover, traders can also use MT4, MT5, and TradingView. QTrade refunds annual subscriptions to the TradingView data package for active traders with deposits over €5,000.

Accounts can be opened in four currencies. To reduce risks, traders can start trading micro lots. The broker doesn’t charge fees for opening and maintenance of accounts but earns only from spreads. QTrade is located in Germany, therefore it offers high-quality support in German, operates in compliance with all rules of BaFin, and participates in the generally accepted compensation scheme.

QTrade offers an extensive range of CFDs, especially on currency pairs and stocks. Yet, the broker doesn’t provide trading cryptocurrency derivatives. QTrade’s technical support is available only on weekdays. There is no live chat on the broker’s website, but many other communication channels are available.

Qtrade-de Summary

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5, ActivTrader, and TradingView |

|---|---|

| 📊 Accounts: | Demo and Live (Premiumkonto and Professionalkonto) |

| 💰 Account currency: | EUR, USD, GBP, and CHF |

| 💵 Replenishment / Withdrawal: | Bank transfers, bank cards, Neteller, Skrill, PayPal, and Sofort |

| 🚀 Minimum deposit: | €1,000 |

| ⚖️ Leverage: | Up to 1:30 /1:400 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.5 pips |

| 🔧 Instruments: | Forex (major, minor, and exotic currencies), futures contracts, and CFDs on indices, commodities, stocks, ETFs, and bonds |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | 10+ major banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Market |

| ⭐ Trading features: | EAs, scalping, and trading on news events are allowed |

| 🎁 Contests and bonuses: | Occasionally |

QTrade offers trading mini, micro, and standard lots. Trades can be executed on trading platforms or by phone without fees for the use of a dealing table. In addition to the main order types, traders can work with extended orders such as trailing stop, OCO (One Cancels Other), and OTO (One Triggers Other). Traders from Germany can’t use trading leverage over 1:30, however, traders from other jurisdictions can work with leverage up to 1:400.

Qtrade-de Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

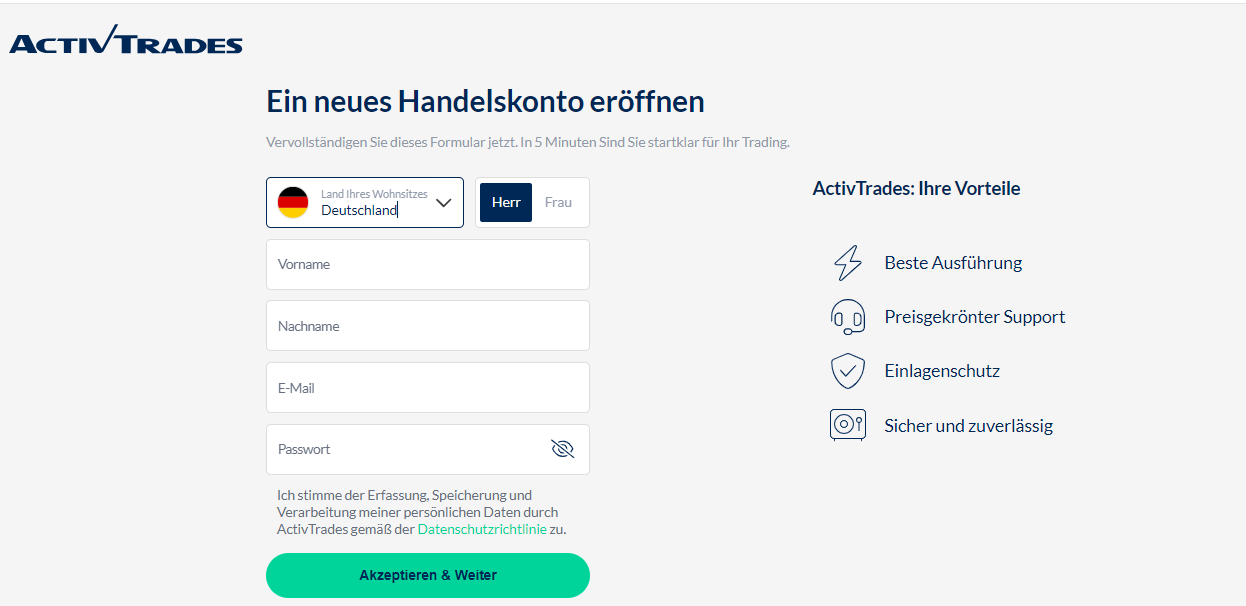

Creating a user account involves opening a trading account with the broker. Follow the brief instructions below.

Click the “Livekonto” button on the QTrade website. This launches the process to open a live account.

Next, the system redirects you to the website of ActivTrades, which is the broker’s partner. In the on-screen form, choose your country, and enter your first and last names, and email. Also, make a reliable password.

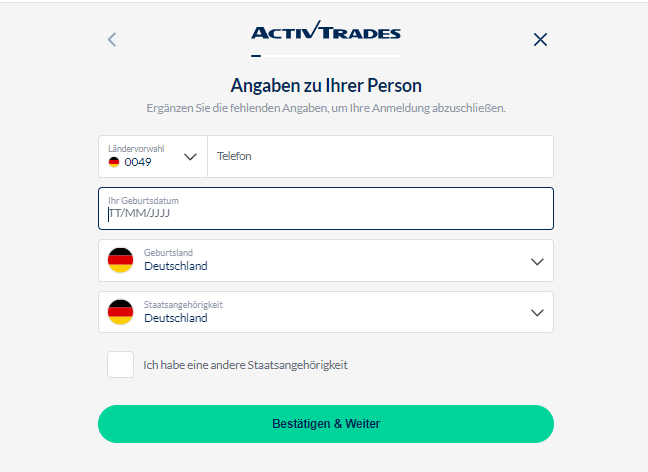

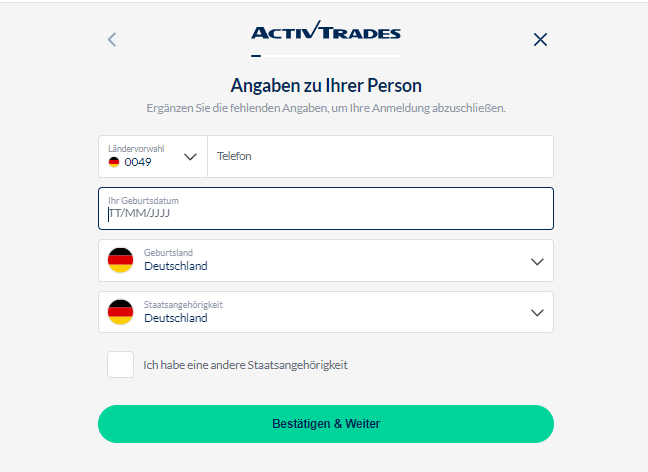

Next, choose your country of citizenship and residence, and provide your date of birth and phone number.

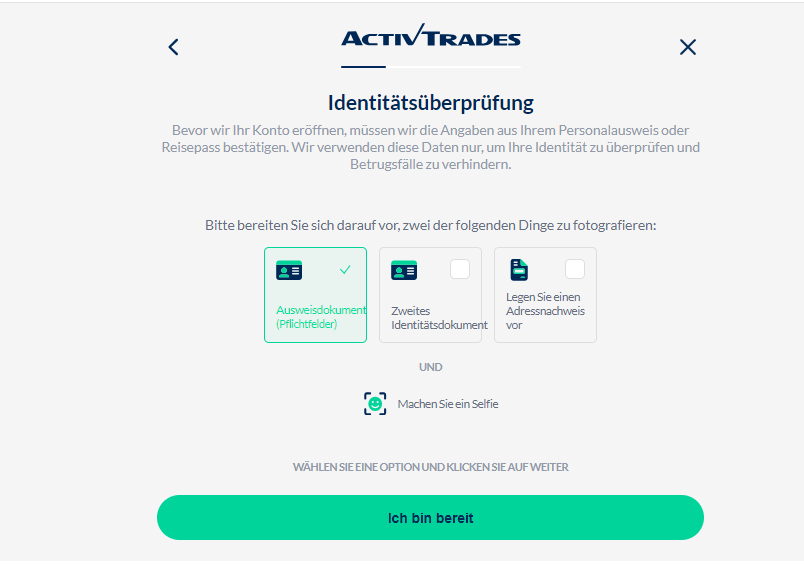

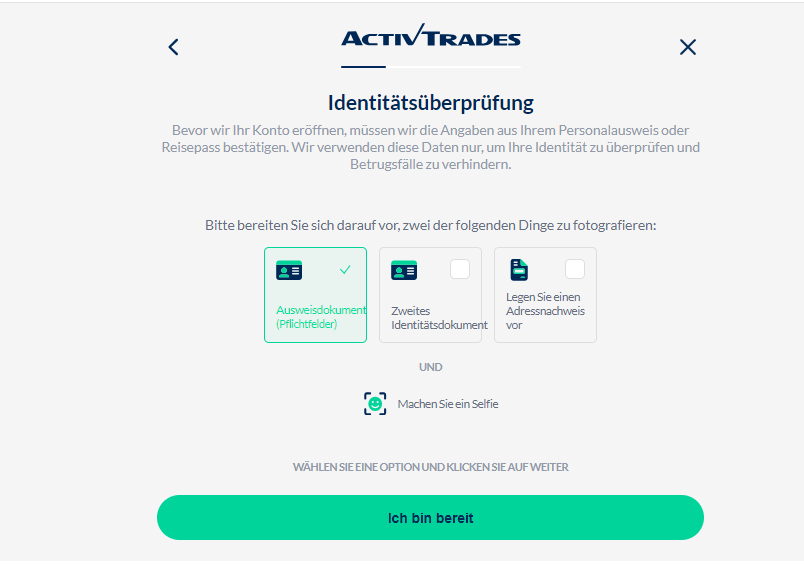

The last stage of registration is uploading documents to verify your identity and place of residence.

Regulation and Safety

QTrade’s activities are regulated by BaFin. Its registration number is 136084. Also, it is registered in Amtsgericht München (Munich District Court) under number HRB 183066. The broker’s VAT identification number is DE 270 03 73 88.

Client funds are held on accounts opened with Barclays included in the EuroStoxx index, which combines stocks of 50 major EEA companies. CSSF (Commission de Surveillance du Secteur Financier | Luxembourg) ensures trader funds protection. Also, all deposits on premium accounts are insured with Lloyd’s of London, a major association of insurers. The maximum coverage is GBP 1,000,000 or its equivalent in EUR.

Advantages

- Financial stability and ability to fulfill its obligations to its clients

- Compensation of up to €100,000 in cash and up to €20,000 in securities in case QTrade suspends its activities

- Segregation of client funds from the broker’s capital

Disadvantages

- Negative balance protection doesn’t apply to professional accounts

- Stock exchange fees for trading CFDs on stocks

- Traders can create user accounts only upon uploading documents

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Premiumkonto | $5 | 0%-1.5% |

| Professionalkonto | $6 | 0%-1.5% |

For transferring positions overnight, the swap commission may be positive or negative. TU experts have compared the average spreads of QTrade, RoboForex, and Pocket Option. The results are provided in the table below.

| Broker | Average commission | Level |

|---|---|---|

|

$5.5 | |

|

$1 | |

|

$8.5 |

Account Types

QTrade is integrated with ActivTrades, therefore when traders open accounts with QTrade, they automatically open accounts with ActivTrades. According to ESMA requirements, traders from Germany are divided into retail and professional. Each status triggers its respective trading conditions and available protection tools. Potential clients can open an Einzelkonto (Individual account), Gemeinschaftskonto (Joint account), or Gesellschaftskonto (Company account) accounts.

Account types:

Traders can open a demo account with a virtual deposit of €50,000 and use it within 30 days. After traders open live accounts, they can request a demo account with unlimited validity.

QTrade offers a clear pricing model, as well as modern and innovative platforms that provide a comfortable trading experience.

Deposit and Withdrawal

The broker withdraws money using different methods. Traders can use standard bank transfers, PayPal, Neteller, Skrill, or bank cards. Also, the Sofort instant transfer is available;

Fees depend on the trader’s status, country of residence, and the payment method. Most methods are free for retail clients. Professional traders pay fees for withdrawing profits by bank transfers;

Traders receive their money within time limits set by a certain payment system. Bank transfers take up to 5 business days.

Investment Options

QTrade focuses on active trading, however, it doesn’t forbid passive income strategies available on MetaTrader platforms. If traders choose the ActivTrader platform, automated trading, such as copy trading and expert advisors, is not available to them. QTrade neither provides fund management services nor builds investment portfolios for its clients.

Copy trading on MT4 and MT5

Automation of the trading process on MetaTrader platforms is carried out with a copying function known as trading signals. Investors can copy trades of signal providers after paying fees for subscribing to their strategies. If copied trades are profitable, investors give a part of their income to providers. The process for using trading signals on MT4 and MT5 is the following:

Choose a signal provider in the Signals section on the mql5.com website. Use the filters to help you quickly select a trader according to the attributes you want in a signal provider, and to select a trader that’s best for you.

Activate signals. Signals are activated automatically in the account on the platform upon registration on the mql5.com website and payment of the subscription fee for signals of the selected provider.

Manage your settings. Investors must set copying parameters, such as lot size, risk management strategy, etc.

Make a deposit. The minimum investment is $100 and the required amounts are provided in the profiles of each signal provider.

QTrade clients can trade using signals of its in-house analysts, but a minimum deposit of €3,000 is required for this. Subscription to the in-house signals is free and they are sent by email. Investors decide on the use of received signals themselves. Copy trading on the platform is made manually.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership programs from QTrade:

QTrade doesn’t provide the opportunity to earn fees and rewards for attracting new clients.

Customer Support

For assistance, visit the Kontakt & Hilfe section of the broker’s website. It contains all available communication channels and a ready-made form to request help by email or phone. The company works from 9:00 to 17:00 (GMT+1) Monday through Friday.

Advantages

- Multiple communication channels

- Support managers are available during business hours on weekdays without breaks (24/5)

Disadvantages

- No live chat on the broker’s website

- Support isn’t available on weekends

To get assistance from QTrade, traders can use:

Telephone;

Fax;

Email;

Feedback form;

The company’s postal address;

TeamViewer to solve technical issues;

Facebook and X.

To receive more prompt assistance by email or phone, select the topic of the request in the feedback form.

Contacts

| Foundation date | 2022 |

|---|---|

| Registration address | QTrade GmbH, Landsberger Straße 155, 80687 München, Deutschland |

| Regulation | FCA, Amtsgericht München, CSSF |

| Official site | https://qtrade.de/ |

| Contacts |

Education

QTrade holds educational webinars with professional traders and provides free materials to acquire necessary trading skills.

A demo account is suitable for exploring trading on financial markets. This account type is free and a virtual deposit is used for trading; therefore, there is no risk of losing real money.

Comparison of Qtrade-de with other Brokers

| Qtrade-de | RoboForex | Pocket Option | Exness | FBS | 4XC | |

| Trading platform |

ActivTrades, MetaTrader4, MetaTrader5, TradingView | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading | MT5, MT4, WebTrader |

| Min deposit | $1000 | $10 | $5 | $10 | $1 | $50 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.5 points | From 0 points | From 1.2 point | From 1 point | From 0.2 points | From 0 points |

| Level of margin call / stop out |

No | 60% / 40% | 30% / 50% | No / 60% | 40% / 20% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | $5 | $50 |

| Cent accounts | No | Yes | No | No | Yes | No |

Detailed review of Qtrade

QTrade proactively introduces new technologies and innovations to improve trading. It has an extensive client base that consists of traders worldwide. The broker offers competitive trading conditions with floating spreads and no fees for order processing and account maintenance. QTrade provides access to a wide range of financial instruments and supports trading on such popular platforms as MetaTrader 4 and MetaTrader 5.

QTrade by the numbers:

14+ years of brokerage services;

Over 1,000 CFDs including CFDs on 80 currency pairs;

Quotes from 10 major liquidity providers;

100+ educational articles for novice and professional traders.

QTrade is a broker with a wide choice of CFDs and currency pairs

Major currency pairs are traded with spreads from 0.5-2.8 pips for EUR/USD and GBP/CAD, and leverage up to 1:30. Spreads for minor pairs start at 0.8-5 pips and leverage is up to 1:20. Exotics are traded with spreads from 5.9-1,000 pips and leverage up to 1:20. Leverage for gold and indices is up to 1:20; for silver and commodities, it is up to 1:10; and for bonds, stocks, and ETFs, it is up to 1:5. The broker doesn’t offer cryptocurrency trading.

QTrade provides access to 24 stock markets. There are over 300 CFDs with leverage up to 1:5. Fees for providing real-time prices for CFDs on stocks are as follows. For European markets, it is €0 and for other markets, it is €1 a month. Margin requirements differ for deposits over and less than €25,000. The broker allows its clients to simultaneously open long and short positions, scalp, and trade on news events.

Useful services offered by QTrade:

Professional newsfeeds provided by Dow Jones and Newswires;

Real-time quotes without delays on a live account;

Free demo accounts on various platforms;

Educational and analytic webinars;

A blog with useful articles for traders of different levels.

Advantages:

Fast and simple account opening within 24 hours;

Ultra-fast execution without requotes;

No regional limitations — the broker provides its services worldwide;

Efficient technical support that helps to solve any technical problems through remote access as well;

Educational resources, analytics, and useful tools that help to gain and improve trading skills.

QTrade provides different deposit and withdrawal methods, ensures deposit protection, and complies with EU standards of limiting losses.

User Satisfaction