Your capital is at risk.

RCG Markets Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- ZAR 50

- MT4

- MT5

- FSCA

- 2022

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- ZAR 50

- MT4

- MT5

- FSCA

- 2022

Our Evaluation of RCG Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

RCG Markets is a high-risk broker with the TU Overall Score of 2.95 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by RCG Markets clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. RCG Markets ranks 317 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

RCG Markets is a regulated Forex and CFD broker with a wide choice of trading instruments and account types. Its services are available worldwide, excluding certain countries where there are restrictions on Forex trading.

Brief Look at RCG Markets

RCG Markets is an STP (straight-through processing) and ECN (Electronic Communication Network) broker headquartered in Johannesburg, South Africa. It was established in 2018 and has been operating under the supervision of the FSCA (Financial Sector Conduct Authority | South Africa) since 2021. RCG Markets offers four account types, such as classics MT4 and MT5, and accounts with near-zero spreads for trading on MT4. The broker supports margin trading with high leverage and yet provides negative balance protection. Automated strategies, hedging, and trading on a demo account are available to its clients. RCG Markets requires a small initial deposit and occasionally offers bonuses to new clients.

- The broker is licensed by the FSCA;

- MetaTrader 4 and MetaTrader 5 are available for trading;

- Minimum deposit is ZAR 50;

- Floating spreads for all asset types;

- Good range of currency pairs and stock indices;

- The broker doesn’t charge deposit or withdrawal fees.

- The broker doesn’t provide its services in all countries and regions;

- CFDs on cryptocurrencies are not available and stock markets are limited;

- PAMM and MAM accounts are not available.

TU Expert Advice

Financial expert and analyst at Traders Union

RCG Markets is a young Forex and CFD broker from South Africa. According to reviews, both experienced and novice traders use its services. The broker offers MetaTrader platforms popular among Forex market participants since these platforms provide convenient trade management and qualitative technical analysis.

The broker allows its clients to work with three order types — market, pending (buy limit, buy stop, sell limit, and sell stop), and trailing. Stop loss or take profit works on the broker’s server even if the platform is off, and can be added to pending orders. Trailing stop allows the broker’s clients to place stop loss on open positions and to fix profit when the market moves in the right direction. However, it works only when the platform is on.

The broker accepts cryptocurrencies, but it still doesn’t offer trading CFDs on them. RCG Markets offers trading over 60 CFDs on stocks, but most of them are U.S. and EU stocks. The Asian market is provided by stocks of Alibaba and South African stocks are not available. The choice of currency pairs is quite diverse and includes majors, over 25 cross-rates, and over 30 exotic pairs.

- You are seeking a broker that provides a diverse range of trading options, including Forex, CFDs, and stocks, all available with leverage up to 1:2000.

- You want a broker that uses ECN technology for order execution in the market. As per reviews, no major issues have been identified for this broker in terms of this process.

- You value user-friendly trading platforms. RCG Markets offers popular choices like MetaTrader 4 and 5, renowned for their ease of use and customizable features. Select a platform tailored to your trading preferences.

- Regulatory oversight is your top priority, especially from top-tier jurisdictions. RCG Markets is primarily regulated in South Africa, which may not adhere to the same stringent standards as some other financial authorities.

- You prefer brokers offering negative balance protection. RCG Markets does not provide this feature, meaning potential losses could surpass your initially deposited capital.

RCG Markets Summary

Your capital is at risk. Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. RCG Markets and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MT4 (desktop and mobile) and MT5 (WebTrader, desktop, and mobile) |

|---|---|

| 📊 Accounts: | Demo MT4, Demo MT5, RCG Classic, RCG ECN, RCG RAW, and ROYAL 100 |

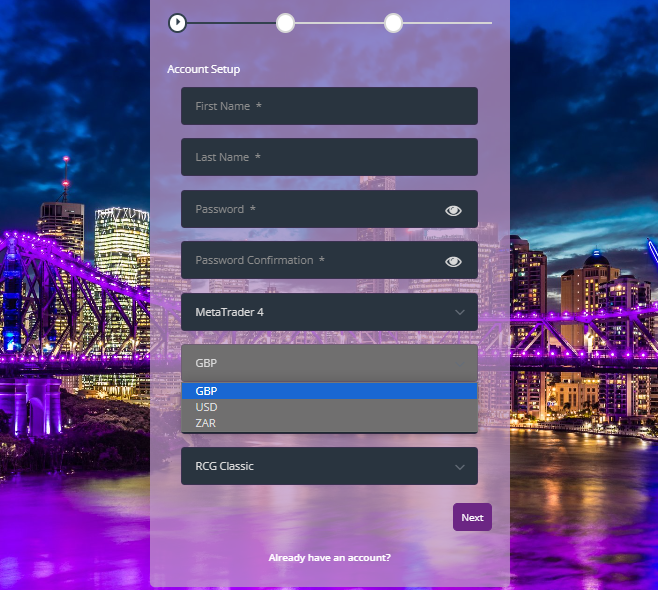

| 💰 Account currency: | ZAR, USD, and GBP |

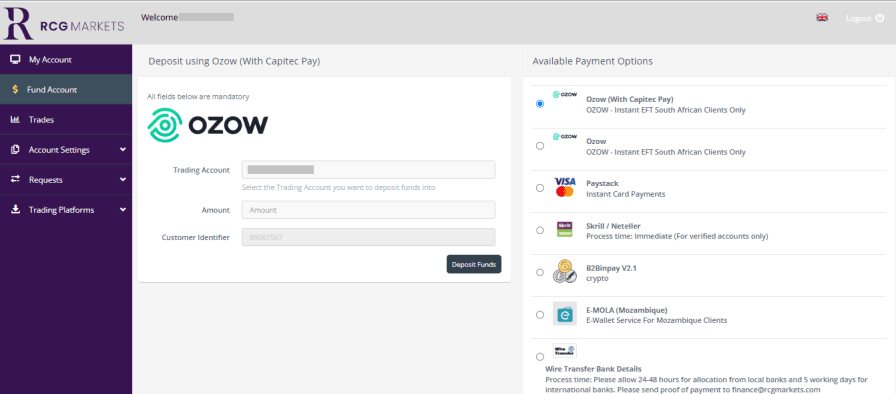

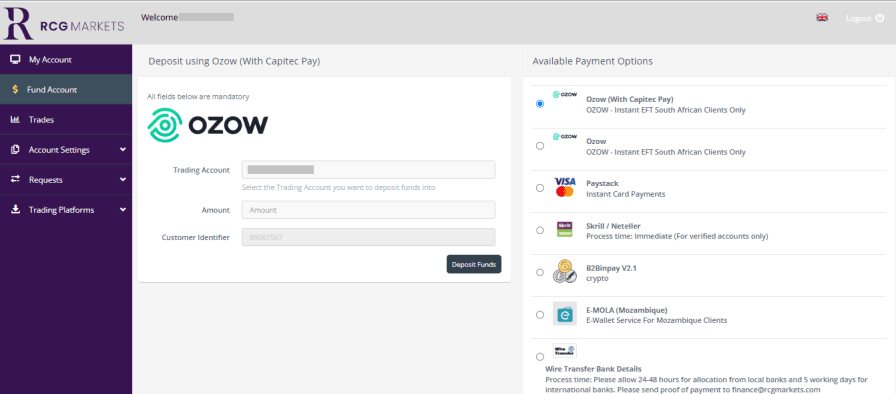

| 💵 Replenishment / Withdrawal: | Bank transfers, bank cards, Neteller, Skrill, Ozow (deposit), Paystack (deposit), Virtual Pay, B2BinPay (withdrawal), and crypto payments |

| 🚀 Minimum deposit: | ZAR 50 |

| ⚖️ Leverage: |

MT4 — up to 1:500-1:2,000; MT5 — up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: |

MT4 — from 0-1.5 pips; MT5 — from 1.5 pips |

| 🔧 Instruments: |

Forex, futures, and CFDs on stock indices, precious metals, commodities, and stocks |

| 💹 Margin Call / Stop Out: | 120%/80% |

| 🏛 Liquidity provider: | RocketX |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market |

| ⭐ Trading features: |

Scalping is forbidden; EAs and copy trading are available. |

| 🎁 Contests and bonuses: | Yes |

RCG Markets clients can trade over 60 currency pairs, 10 stock indices, commodities, energies, and stocks of the U.S., the EU, and Asia. The broker offers account types with ECN and STP execution. Since October 2023, RCG Markets clients can trade not only on MT4 but on MT5, and use the demo modes of these platforms. Spreads for all instruments are floating and execution is market. The minimum deposit for all account types is ZAR 50.

RCG Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

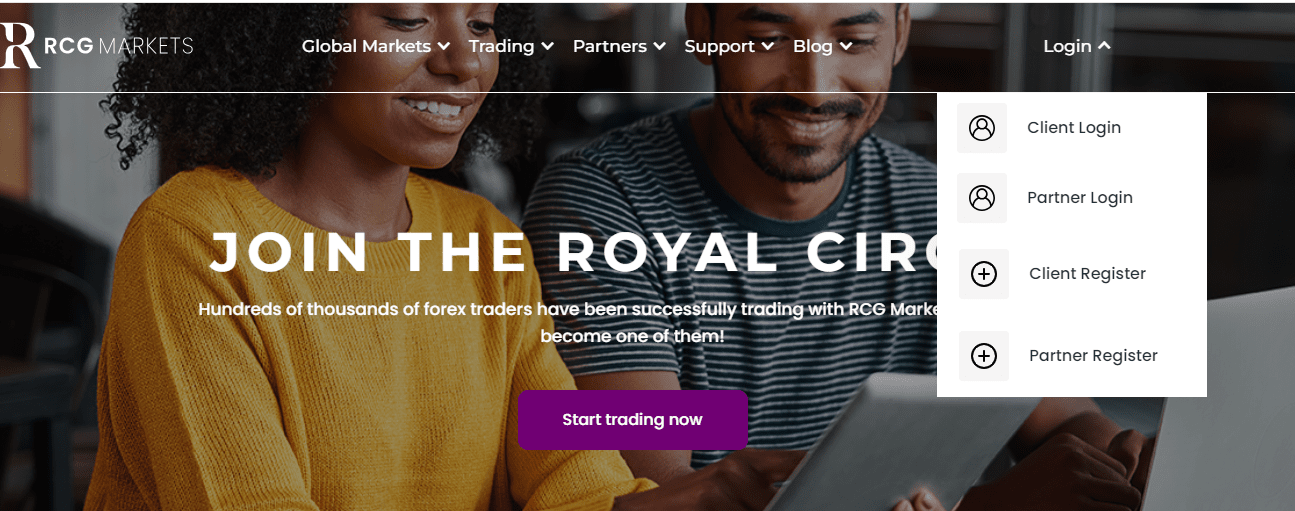

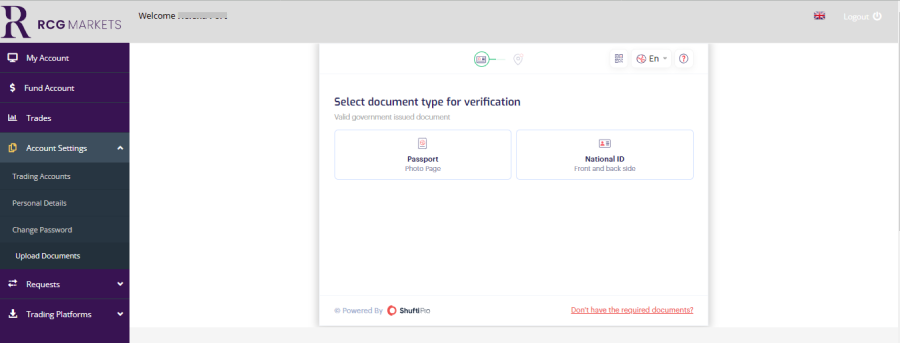

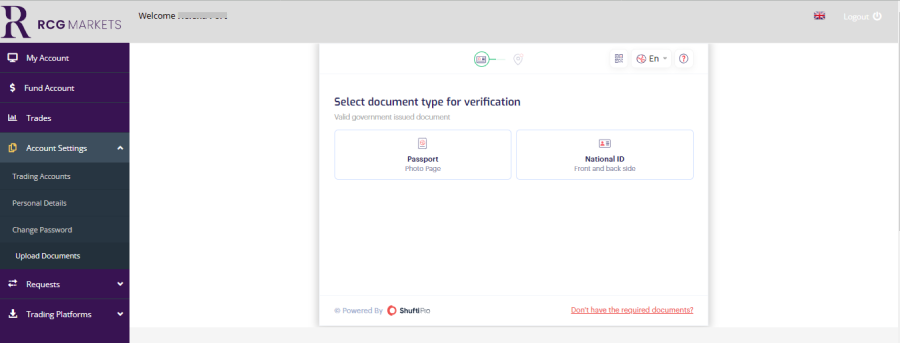

On the RCG Markets website, it is possible to register as a client or a partner. If you consider the broker for trading, create an account with it following the below instructions:

On the broker’s website, click the “Login” button to activate the menu for clients and partners. Choose the action that allows you to register a user account for trading.

Next, fill in the account opening form. Choose the account type, base currency, and trading platform. Also, the broker requests your personal data. Your email is necessary to link the user account.

The first steps after creating your user and trading accounts are:

Additional features of RCG Markets’ user account allow traders to:

-

View their trading history;

-

Add new live and demo accounts;

-

Change leverage;

-

Submit withdrawal requests;

-

Transfer funds between their accounts;

-

Go to the web version of MT5;

-

Download desktop platforms and mobile apps.

Regulation and safety

Since 2021, RCG Markets (Pty) Ltd, which manages the RCG Markets brand, has been regulated by the Financial Sector Conduct Authority, established in 2018 following the reorganization of the Financial Services Board (FSB). Today, FSCA supervises the financial sector of South Africa.

FSCA monitors companies' licensing and regulation, client protection, investigation of regulation violations, etc. It ensures transparency, stability, and reliability of the South African financial sector. FSCA refers to regulators with a medium level of trader confidence. In terms of reliability, it is inferior to CFTC (Commodity Futures Trading Commission | the U.S.), NFA (National Futures Association | the U.S.), FCS (Financial Conduct Authority | the UK), and ASIC (Australian Securities and Investments Commission).

RCG Markets is registered as a Financial Service Provider (FSP) and is licensed by FSCA under number 49769, which allows the broker to provide legal online trading services in South Africa.

Advantages

- Negative balance protection for retail clients

- Client funds are segregated from the broker’s capital

- FSCA doesn’t forbid high leverage

Disadvantages

- RCG Markets is not a member of any compensation schemes for traders

- FSCA doesn’t process claims of South African non-residents

- Traders are obliged to use the same account for deposits and withdrawals

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| RCG Classic | $15 | Third-party fees |

| RCG ECN | $0 | Third-party fees |

| RCG RAW | $0 | Third-party fees |

| ROYAL 100 | $15 | Third-party fees |

The broker doesn’t charge maintenance fees for active accounts. If the account has been inactive for a year, a fixed fee of $50 is charged. If the balance is less, the broker writes off the remaining funds and archives the account.

A comparison of different brokers’ fees shows how suitable the conditions of certain companies are for traders. TU experts have compared RCG Markets’ fees to the fees of brokers from the top 5 brokers list.

| Broker | Average commission | Level |

|---|---|---|

|

$7.5 | |

|

$1 | |

|

$8.5 |

Account types

To make trading through RCG Markets efficient and profitable, it is important to correctly choose the account type. The broker offers various options based on the needs of experienced market participants and Forex novice traders. Also, traders can choose the account type for trading on MT4 and MT5. Each client can have several account types in ZAR, USD, and GBP.

Account types:

Prior to opening a live account, traders can create a demo account with a virtual deposit. On MT4, virtual funds are $100,000; and on MT5, it’s $10,000. A demo account is valid for 30 days.

The broker offers a wide range of account types with different executions, which allows traders to switch to a more profitable strategy and, in general, permits them to react faster to market changes.

Deposit and Withdrawal

-

Withdrawal requests submitted in the user account by 17:00 (GMT+2) are processed the same day. Requests submitted later are processed the next business day.

-

Withdrawal methods are Neteller, Skrill, Virtual Pay, B2BinPay, bank transfers, and bank cards.

-

Minimum withdrawal amount is ZAR 100.

-

The broker doesn’t charge withdrawal fees for local transactions. However, fees are charged for international bank transfers.

-

Withdrawals to bank cards and by international transfers take 5-10 minutes. If traders use regular bank transfers, Skrill, or cryptocurrencies, they receive their money instantly upon processing their requests which takes 24-48 hours.

Investment Options

To receive passive income, choose a third-party service to automate the trading process. The broker doesn’t have proprietary tools that can be used for making income without active trading. For example, RCG Markets doesn’t offer MAM or PAMM accounts popular among Forex investors. Yet, the broker’s clients can receive additional income from a partnership program.

Passive income options available with RCG Markets

To start making passive income, choose the appropriate investment solution. The broker itself doesn’t give recommendations on efficient tools but doesn’t forbid their use.

Passive income options are:

-

Copy trading. This option is supported by desktop versions of MT4 and MT5. Investors choose traders whose trades they want to copy and make a monthly payment to activate the service. Ratings of the best traders are available on the MetaTrader website in the Signals section. If a copied trade brings profit to a subscriber, a part of the profit is given to a trader who executed this trade. Thus, experienced traders trade instead of investors, which is a type of social trading.

-

Algorithmic trading. It implies trading while using trading robots, special apps, and custom indicators. All these tools are available on MetaTrader websites. However, in this case, programs for different platforms vary, since they are written in different programming languages — MQL4 for MT4 and MQL5 for MT5. Trading apps for MetaTrader platforms are also known as expert advisors or EAs.

Copy and algorithmic trading are automated strategies since they completely exclude interference with investor trades if properly configured. However, RCG Markets offers another income option — trading according to signals posted on its Facebook portal. Signals aren’t copied automatically but are ready-made recommendations on the purchase/sale of assets, used by investors to place positions manually.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership programs from RCG Markets:

-

White Label. It is a program for legal entities and brokerage companies that wish to provide intermediary services using RCG Markets technologies under their own brand.

-

Referral program for retail traders. Partners, who attract new clients with their links, receive rewards from the broker. It is paid for every closed lot and is calculated based on the referral’s account type and the traded instrument. If referrals trade indices on the Classic account, the partner’s fee is $50; other assets are $10. Rewards for trading on ECN and RAW accounts are $5 for Forex, gold, silver, and energies; and $10 for indices.

Partners’ rewards are calculated according to positions left open for more than 5 minutes. The broker doesn’t pay rewards for trading CFDs on stocks. Rewards are accrued every day at 12:00 (GMT+2).

Customer support

RCG Markets’ technical support is available 24/5, excluding public holidays. The Johannesburg office operates from 9:00 to 17:00 Monday through Friday and from 9:00 to 14:00 on Saturday and Sunday.

Advantages

- Different communication channels are available

- Support in WhatsApp is almost instant

Disadvantages

- Technical support is provided with breaks

- Managers are not available in a live chat

RCG Markets provides the following communication channels:

-

Telephone;

-

Email;

-

WhatsApp;

-

Feedback form;

-

Instagram, X (formerly Twitter), and Facebook.

There is no live chat in the user account. Tickets are not available either.

Contacts

| Foundation date | 2022 |

|---|---|

| Registration address | RCG Markets (Pty) Ltd, 13th Floor, Green Park Corner, 3 Lower Road, Sandown, Gauteng, 2196, Johannesburg, Republic of South Africa |

| Regulation |

FSCA

Licence number: FSP49769 |

| Official site | https://www.rcgmarkets.com/ |

| Contacts |

+27 (10) 007 5974, WhatsApp number: +27 82 401 6338

|

Education

Providing educational content for novice traders isn’t RCG Markets’ priority. Nevertheless, the broker posts useful articles in its blog but doesn’t hold seminars, webinars, or individual educational courses.

Upon registration with RCG Markets, traders can open demo accounts. These accounts provide real market conditions and allow traders to open and close positions, use different trading strategies, and study features of trading platforms without depositing real funds. Overall, a demo account is one of the most efficient training tools.

Comparison of RCG Markets with other Brokers

| RCG Markets | RoboForex | Pocket Option | Exness | Forex4you | Tickmill | |

| Trading platform |

MT4, MT5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5 | MT4, MT5, Tickmill Mobile App |

| Min deposit | $50 | $10 | $5 | $10 | No | $100 |

| Leverage |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:10 to 1:2000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1.5 point | From 0 points | From 1.2 point | From 1 point | From 0.1 points | From 0 points |

| Level of margin call / stop out |

120% / 80% | 60% / 40% | 30% / 50% | No / 60% | 100% / 20% | 100% / 30% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $30 |

| Cent accounts | No | Yes | No | No | Yes | No |

Detailed review of RCG Markets

RCG Markets is an ECN and STP broker from South Africa that provides access to legal trading on over-the-counter markets. It offers MetaTrader platforms which are the most popular platforms among Forex traders, supports the use of leverage, and provides technical support and consulting services. The broker has introduced a wide range of account types for traders with different strategies and trading styles.

RCG Markets by the numbers:

-

The broker has been in the market for over 3 years;

-

Traders can open 4 account types in 3 currencies;

-

Withdrawal methods with a 24 to 48-hour processing period are available;

-

The company offers 2 types of partnership — for traders and companies;

-

The Johannesburg office provides its services 7 days a week.

RCG Markets is a broker that provides trading Forex and popular CFDs with leverage up to 1:2,000

RCG Markets is an intermediary of over-the-counter currency and CFD markets. It offers its clients leverage to buy assets with larger amounts than they actually have. Leverage depends on the trading instrument and the account type. The largest leverage up to 1:2,000 is available to traders who have a classic STP account type on MT4. On other MT4 account types, leverage is up to 1:500-1:1,000, and it is up to 1:500 on MT5 account types. The choice of trading instruments is similar on MT4 and MT5.

An important feature of MT4 account types is the opportunity to trade a reduced lot size of 10,000 units of the instrument-based currency as compared to the standard 100,000 units. Lower risks and contract size are available for trading currency pairs, indices, and metals.

Useful services offered by RCG Markets:

-

Newsletters. Clients and non-clients of the broker can receive market information by email.

-

Blog. Tips and recommendations for novice traders are posted here. In fact, it is an educational section of the website with materials necessary to start Forex trading.

-

List of documents. The broker’s website provides all the documents that regulate relations between the broker and its clients. These range from the user agreement to complaint forms.

Advantages:

Market execution implies no requotes;

There is an opportunity to receive additional income for attracting new clients;

EAs and custom indicators are allowed;

Various payment methods are available;

Switching between accounts within one user account is possible.

The broker provides access to global financial asset markets through convenient trading platforms and secure communication channels that allow its clients to focus on trading and not worry about the safety of their funds.

User Satisfaction