Forex License Types - Best Forex Regulators

The Necessity of a Forex License

The Foreign Exchange Market does not have a centralized regulator. In other words, there is no single international authority or organization that controls the activities of all participants in the Forex market. Such a regulator does not exist because the transactions within the foreign exchange market are based on the independence of individual operators and their interdependence on other operators with whom they do business.

Do you prefer watching videos? Then watch the video summary of this article.

Below you will find all the information.

Nevertheless, the activities of individual Forex market players and brokers are carefully controlled. A broker's algorithms are constantly being tweaked and improved and they provide a lot of automatic, seamless control over market players. There are local regulators for individual countries and global regulators for multi-jurisdictional players in the Forex market.

Today, most legitimate brokers strive to obtain a license as a guarantee of their reliability to potential customers. Such licenses are issued by various financial authorities that verify the validity of the broker's operations, conduct audits, and regulate a broker’s activities after issuing them a license.

Forex brokers need a license to confirm that it is operating legitimately and to display the traders’ transactions on the interbank market.

How is the Forex Market Regulated and Who Regulates It?

A broker’s activities are controlled by Forex market regulators. The regulator can be local (competent public authorities) or international (independent financial commissions). Regulators perform three functions concerning the Forex broker. They are:

-

verify that the broker complies with the license requirements;

-

monitor compliance during trading and other transactions;

-

revoke the license when the broker severely violates the regulations.

The main task of the regulator issuing a license is to prevent a situation where the broker is not able to fulfill its obligations to traders. The regulator provides legal protection to traders and investors in the event of a dispute, investigates their complaints, and conducts inspections of brokers. Regulators also audit the activities of the broker to identify inconsistencies with its license requirements.

Where a regulator has issued the broker a license in a particular territory or country (i.e., local regulator), the regulator’s authority is limited to only traders and investors who are residents of that particular jurisdiction. For example, if a broker was licensed by the FCA (UK), the regulator controls the broker’s work only for citizens of the United Kingdom. Traders and investors from other countries cannot rely on being protected by this regulator.

Another important issue is that in some countries brokers are not required to have a license. Therefore, a broker can be registered as a legal entity providing some financial services and can work all over the world via the Internet. This, of course, does not mean that such a broker is unreliable or a fraud. It’s just that traders and investors have no guarantees when working with such a broker.

These are the advantages of working with a licensed broker:

-

the payment of funds lost as a result of bankruptcy by the broker is guaranteed to the trader/investor. To ensure this, the broker must create a compensation fund that is controlled by the regulator;

-

in the event of a legal or financial dispute between a trader/investor and a broker, the regulator — serving as an independent third party or arbitrator — will work to resolve the disputes;

-

regulators constantly audit the broker's work and immediately revokes the license and inform the competent authorities in case of substantial errors or fraudulent schemes;

-

the regulator that issued the license guarantees the transparency of the broker through the use of financial and tax audits.

The Most Popular Forex Regulators

Sometimes the regulators licensing the Forex brokers are divided into reputable and non-reputable groups. Such a classification is wrong. Actually, regulators differ in the requirements for the broker to be issued a license and the degree of control that the regulator exercises over the broker's activities. Consequently, the reliability of a licensed broker is often determined by the degree of control administered by the regulating authority.

-

For example, there are two major regulators in the USA — the Commodity Futures Trading Commission and the National Futures Association. Japan has its own counterpart which is the Financial Regulatory Authority. These organizations shall be referred to the first level as they are the most demanding of their brokers.

-

The UK Financial Regulatory Authority and the Australian Securities and Investments Commission make up the second level. It is also very difficult for a Forex broker to obtain a license with these organizations, and his activities are monitored comprehensively.

-

The Cyprus Securities and Exchange Commission and the Malta Financial Services Department also have serious requirements that must be met before a Forex broker’s license is issued. But their reporting and monitoring is generally simpler. Therefore, they are placed in the third level.

-

The Financial Services Commission BVO and the Belize International Financial Services Commission are regulators that comprise the fourth level. Their registration is much simpler and the audit is not very detailed.

-

The fifth and sixth include all other offshore commissions. They also control and monitor Forex brokers, but they do not issue licenses and one is not required. The Seychelles Financial Services Department and the Saint Vincent and the Grenadines Islands Financial Regulatory Authority are members of these levels.

Over the last one to two years, many novice brokers became registered in Latvia, as this country is a member of the European Union with a stable financial system. This is also an offshore-type of the fifth or sixth level. It is important to understand that a regulator at any level is still an official organization. It controls Forex brokerages and protects the interests of traders and investors. It also makes sense to consider the following aspects:

-

95% of novice Forex brokers are licensed by the fifth or sixth level regulators;

-

Forex brokers who have been working for several years strive to obtain licenses with a regulator of the fourth level or above;

-

the regulators’ requirements at the fourth level or above are extensive. The cost of such a license is also 5-6 times more expensive, respectively than offshore regulators;

-

the application process and the investigation period to obtain a license within the 1-4 levels may take from 6 to12 months, while the same process by regulators that make up the 5-6 levels may take only a few weeks.

The principal difference between the regulators of levels 1-4 is that they require the Forex broker to have a local (i.e., physical) representative office, as well as reserve funds (excluding traders’ and investors’ funds) in its account. Twenty million dollars are required for the first level, but only $100 thousand are required for the second level.

During the licensing process that may take up to one year, there will be additional associated costs of $30-50 thousand. Also, an annual membership fee of $125 thousand is required by first-level regulators.

Regulators within the 3-4 levels have less stringent requirements, but they also require brokers to have a local representative office, capital reserves, and annual membership fees to get and maintain a current license.

Regulators of the 5-6 levels offer the most simplified registration system, for example, they don’t require a local representative office.

Top Forex Regulators

| Regulator | Jurisdiction level | Country |

|---|---|---|

| Commodity Futures Trading Commission of the USA (CFTC) | 1 | USA |

| National Futures Association of the USA (NFA) | 1 | USA |

| UK Financial Regulatory Authority (FCA) | 2 | Great Britain |

| Australian Securities and Investments Commission (ASIC) | 2 | Australia |

| Cyprus Securities and Exchange Commission (CySEC) | 3 | Cyprus |

| Malta Financial Services Department (MFSA) | 3 | Malta |

| Financial Services Commission BVO (FSC BVI) | 4 | Virgin Islands (Great Britain) |

| Belize International Financial Services Commission (IFSC) | 4 | Belize |

| Seychelles Financial Services Department (SFSA) | 5-6 | Seychelles |

| Saint Vincent and the Grenadines Islands Financial Regulatory Authority (SVG FSA) | 5-6 | Saint Vincent and the Grenadines Islands |

| Financial and Capital Markets Commission of Latvia (FCMC) | 5-6 | Latvia |

European Forex Regulators

The following regulators are the most popular among European regulators:

-

the UK Financial Regulatory Authority (FCA) is one of the earliest world-class regulators. It was created in 2001 and is characterized by having the most stringent requirements for brokerage organizations;

-

the Cyprus Securities and Exchange Commission (CySEC) is a European regulator that was founded in 1934, and has been operating as a Forex brokers regulator since 2001;

-

the Malta Financial Services Department (MFSA) is frequently compared to the Cyprus Commission in terms of its level of requirements and organizational structure. The MFSA has been operating since 2002;

-

The Financial Services Commission BVO (FSC BVI) has been operating since 2001. It belongs to the fourth level of regulators.

Offshore Forex Regulators

The concept of “offshore regulators” is well established. Some experts in the foreign exchange market are also classified as offshore regulators of the 4th level. According to the overall characteristics, international organizations are usually referred to as being in this group. They allow the Forex broker to be licensed with minimum requirements. The most popular regulators of the 5-6th levels are:

-

Seychelles Financial Services Department (SFSA). It is a relatively young regulator operating since 2013. Notwithstanding, its license is considered sufficiently credible and it gives traders and investors guarantees of protection;

-

Saint Vincent and the Grenadines Islands Financial Regulatory Authority (SVG FSA) is also a young but popular regulator. It was created in 2012 and has proven itself to be a reliable organization with a high level of professional competence;

-

Financial and Capital Markets Commission of Latvia (FCMC) was founded in 1997 and operates based on Latvian legislation and the legislation of the European Union.

Comparison of Forex Regulators

The first-level regulators are the most expensive regulators for licensing. No novice broker can afford such a license, but a lot of brokers obtain it after several years of brokerage. Offshore regulators are the cheapest. To learn more about low commission brokers, check out Traders Union's best offshore Forex brokers rating.

Generally speaking, the licenses by regulators within all six levels are ranked and valid on the international market, but it is obvious that the higher the level of the regulator, the more prestigious the license and reliable the broker. However, novice brokers can also be reliable with high potential and and have favorable terms, but may not have capital reserves of $20 million.

Just having a license, no matter what type, shows that the company aims to work transparently and officially. On the other hand, when working with brokers without a license you are acting at your own peril and risk. Their guarantees and promises are unwarranted and have no legal effect. Therefore, the Traders Union recommends associating only with brokers licensed by any of the regulators within levels 1-6.

TOP 10 Most Popular Licensed Brokers

Regulators constantly monitor Forex brokers. Therefore, every year several brokers have their licenses revoked. In contrast, each year several brokers obtain licenses from higher-level regulators. Therefore, when choosing a broker, the relevance of the data is very important. Here is our latest list of the most reliable Forex brokers, which is regularly adjusted by our experts.

| Broker | Regulator | Country of regulator | Minimum deposit |

|---|---|---|---|

| RoboForex | IFSC | Belize | $10 |

| Exness | CySEC | Cyprus | $1 |

| IC Markets | AFSL, FCA | Australia, Seychelles | $200 |

| InstaForex | FSC / FSC BVI | Virgin Islands (Great Britain) | $1 |

| XM Group | IFSC | XM Group | $5 |

| FXCM | FCA | Great Britain (EU and UK FXCM clients are excluded from the rebate program) |

$1 |

| FxPro | FCA, CySEC, FSCA, SCB | Great Britain, Cyprus, RSA, Bahamas | $100 |

| FXTM | FSCA, FCA, FSC | South Africa, Great Britain, Republic of Mauritius | $5 |

| Admiral Markets UK | ASIC, CySEC, FCA | Australia, Cyprus, Great Britain | $200 |

Is It Worth Giving Up More Favorable Conditions for the Sake of a License? Expert’s Opinion

“Novice traders and investors sometimes favor unlicensed Forex brokers because they seemingly offer the most favorable conditions upon first glance. Indeed, an unlicensed broker can offer you anything, such as a 3000% return on a transaction or a 100% return on investment upon a failed transaction. But such guarantees by an unlicensed broker are worthless because its activities are not regulated and because it does not have a third-party controlled reserve account. That is, it can declare bankruptcy tomorrow, and the trader/investor will lose the deposit without the possibility of recovery.

Licensed Forex brokers stand in stark contrast. Regardless of the level of license, such a broker is financially and legally responsible to its customers. If the broker goes bankrupt or another adverse situation occurs, the regulator and the law protect the trader/investor and help return the lost deposits from the broker's reserve fund. Therefore, it is recommended that all traders and investors work with brokers who have valid licenses.”

Anton Kharitonov, Traders Union Analyst

All Forex Regulators Reviews

FAQs

What does a “licensed Forex broker” mean?

The term means that the brokerage organization has successfully completed the voluntary process of obtaining an official license to conduct financial activities in the Forex market. Such a broker is reliable because its work is transparent and controlled by competent organizations.

Is a licensed or unlicensed broker more profitable and more reliable to work with?

An unlicensed broker is also an officially registered organization, but its activities are not regulated by anyone. It can be a Forex bucket shop or a pyramid scheme. Therefore, experts recommend working only with licensed brokers.

What types of licenses are available?

According to the generally accepted classification, licenses of Forex brokers are divided into six levels, and the fifth and sixth levels are offshore. It is safe to work with a licensed broker regardless of the type of license.

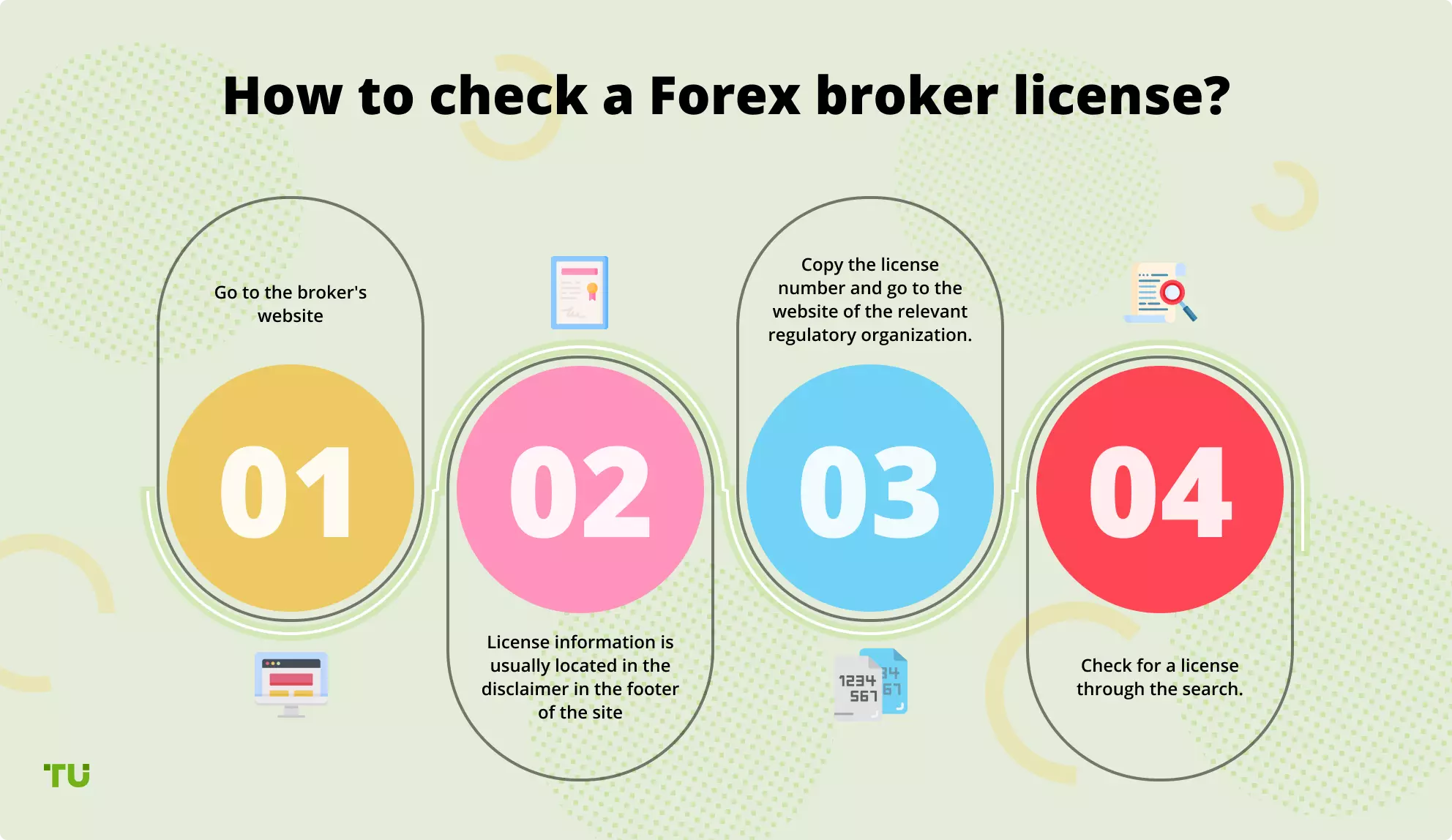

How can I tell the type of license of my broker?

Typically, brokers display their license number because it increases customer confidence. Also, the regulator and license number are indicated in the footer or in a special section of the broker’s website. You can verify the number on the official website by visiting the website of the regulator.